|

|

市場調査レポート

商品コード

1127232

クラフトビールの世界市場 (2022~2030年):成長・将来の展望・競合分析Craft Beer Market - Growth, Future Prospects and Competitive Analysis, 2022 - 2030 |

||||||

| クラフトビールの世界市場 (2022~2030年):成長・将来の展望・競合分析 |

|

出版日: 2022年06月20日

発行: Acute Market Reports

ページ情報: 英文 120 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

2020年、世界のクラフトビールの市場規模は95兆ドルを超える規模を示し、2022年から2030年にかけては8%超のCAGRで成長すると予測されています。

ビールは世界で最も古く、最も人気のあるアルコール飲料です。常に味覚の修正と改良が行われ、また多くの風味豊かなオプションが利用できるため、市場は世界中で安定した成長を遂げています。

当レポートでは、世界のクラフトビールの市場を調査し、市場概要、市場成長への各種影響因子の分析、市場規模の推移・予測、各種区分・地域/主要国別の内訳、主要企業のプロファイルなどをまとめています。

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 クラフトビール市場:事業の見通し・市場力学

- 市場規模:2020年~2030年

- 市場力学

- 市場促進要因

- 市場抑制要因

- 主な課題

- 主な機会

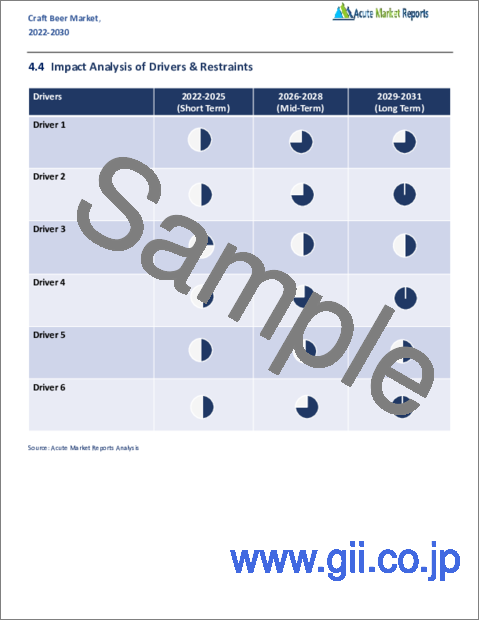

- 促進要因・抑制要因の影響分析

- シーソー分析

- ポーターのファイブフォースモデル

- PESTEL分析

第4章 クラフトビール市場:製品別

- 市場概要

- 成長・収益分析:2021年・2030年

- 市場の分類

- ブラウンエールクラフトビール

- ペールエールクラフトビール

- ポータークラフトビール

- スタウトクラフトビール

- ペールラガークラフトビール

- ピルスナークラフトビール

- マルザンクラフトビール

- ボックスクラフトビール

- その他

第5章 クラフトビール市場:醸造者別

- 市場概要

- 成長・収益分析:2021年・2030年

- 市場の分類

- アメリカンサワークラフトビール

- ノンアルコールクラフトビール

- ベルギーフルーツランビッククラフトビール

- フランダースレッドエールクラフトビール

- ベルギーグーズクラフトビール

第6章 クラフトビール市場:販売チャネル別

- 市場概要

- 成長・収益分析:2021年・2030年

- 市場の分類

- マイクロブルワリー

- ブルーパブ

- 契約醸造企業

- 独立系企業

- 地域のクラフト醸造企業

第7章 クラフトビール市場:年齢別

- 市場概要

- 成長・収益分析:2021年・2030年

- 市場の分類

- 21-35歳

- 42-54歳

- 55歳以上

第8章 北米のクラフトビール市場

- 市場概要

- クラフトビール市場:製品別

- クラフトビール市場:醸造者別

- クラフトビール市場:販売チャネル別

- クラフトビール市場:年齢別

- クラフトビール市場:地域別

第9章 英国およびEUのクラフトビール市場

- 市場概要

- クラフトビール市場:製品別

- クラフトビール市場:醸造者別

- クラフトビール市場:販売チャネル別

- クラフトビール市場:年齢別

- クラフトビール市場:地域別

第10章 アジア太平洋のクラフトビール市場

- 市場概要

- クラフトビール市場:製品別

- クラフトビール市場:醸造者別

- クラフトビール市場:販売チャネル別

- クラフトビール市場:年齢別

- クラフトビール市場:地域別

第11章 ラテンアメリカのクラフトビール市場

- 市場概要

- クラフトビール市場:製品別

- クラフトビール市場:醸造者別

- クラフトビール市場:販売チャネル別

- クラフトビール市場:年齢別

- クラフトビール市場:地域別

第12章 中東およびアフリカのクラフトビール市場

- 市場概要

- クラフトビール市場:製品別

- クラフトビール市場:醸造者別

- クラフトビール市場:販売チャネル別

- クラフトビール市場:年齢別

- クラフトビール市場:地域別

第13章 企業プロファイル

- Anheuser-Busch InBev

- Beijing Enterprises Holdings Limited(Beijing Yanjing Brewery Co., Ltd.)

- Carlsberg Group

- Diageo PLC

- Dogfish Head Craft Brewery, Inc.

- Heineken Holding NV.

- Squatters Pub and Beers

- Sierra Nevada Brewing Co.

- The Boston Beer Company, Inc.

- United Breweries Limited

List of Tables

- TABLE 1 Global Craft Beer Market By Product , 2020-2030, USD (Million)

- TABLE 2 Global Craft Beer Market By Brewer , 2020-2030, USD (Million)

- TABLE 3 Global Craft Beer Market By Sales Channel , 2020-2030, USD (Million)

- TABLE 4 Global Craft Beer Market By Age , 2020-2030, USD (Million)

- TABLE 5 North America Craft Beer Market By Product , 2020-2030, USD (Million)

- TABLE 6 North America Craft Beer Market By Brewer , 2020-2030, USD (Million)

- TABLE 7 North America Craft Beer Market By Sales Channel , 2020-2030, USD (Million)

- TABLE 8 North America Craft Beer Market By Age , 2020-2030, USD (Million)

- TABLE 9 UK and European Union Craft Beer Market By Product , 2020-2030, USD (Million)

- TABLE 10 UK and European Union Craft Beer Market By Brewer , 2020-2030, USD (Million)

- TABLE 11 UK and European Union Craft Beer Market By Sales Channel , 2020-2030, USD (Million)

- TABLE 12 UK and European Union Craft Beer Market By Age , 2020-2030, USD (Million)

- TABLE 13 Asia Pacific Craft Beer Market By Product , 2020-2030, USD (Million)

- TABLE 14 Asia Pacific Craft Beer Market By Brewer , 2020-2030, USD (Million)

- TABLE 15 Asia Pacific Craft Beer Market By Sales Channel , 2020-2030, USD (Million)

- TABLE 16 Asia Pacific Craft Beer Market By Age , 2020-2030, USD (Million)

- TABLE 17 Latin America Craft Beer Market By Product , 2020-2030, USD (Million)

- TABLE 18 Latin America Craft Beer Market By Brewer , 2020-2030, USD (Million)

- TABLE 19 Latin America Craft Beer Market By Sales Channel , 2020-2030, USD (Million)

- TABLE 20 Latin America Craft Beer Market By Age , 2020-2030, USD (Million)

- TABLE 21 Middle East and Africa Craft Beer Market By Product , 2020-2030, USD (Million)

- TABLE 22 Middle East and Africa Craft Beer Market By Brewer , 2020-2030, USD (Million)

- TABLE 23 Middle East and Africa Craft Beer Market By Sales Channel , 2020-2030, USD (Million)

- TABLE 24 Middle East and Africa Craft Beer Market By Age , 2020-2030, USD (Million)

List of Figures

- FIG. 1 Global Craft Beer Market: Market Coverage

- FIG. 2 Research Methodology and Data Sources

- FIG. 3 Market Size Estimation - Top Down & Bottom-Up Approach

- FIG. 4 Global Craft Beer Market: Quality Assurance

- FIG. 5 Global Craft Beer Market, By Product , 2021

- FIG. 6 Global Craft Beer Market, By Brewer , 2021

- FIG. 7 Global Craft Beer Market, By Sales Channel , 2021

- FIG. 8 Global Craft Beer Market, By Age , 2021

- FIG. 9 Global Craft Beer Market, By Geography, 2021

- FIG. 10 Global Craft Beer Market, By Product , 2021 Vs 2030, %

- FIG. 11 Global Craft Beer Market, By Brewer , 2021 Vs 2030, %

- FIG. 12 Global Craft Beer Market, By Sales Channel , 2021 Vs 2030, %

- FIG. 13 Global Craft Beer Market, By Age , 2021 Vs 2030, %

- FIG. 14 U.S. Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 15 Canada Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 16 Rest of North America Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 17 UK Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 18 Germany Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 19 Spain Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 20 Italy Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 21 France Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 22 Rest of Europe Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 23 China Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 24 Japan Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 25 India Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 26 Australia Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 27 South Korea Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 28 Rest of Asia Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 29 Brazil Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 30 Mexico Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 31 Rest of Latin America Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 32 GCC Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 33 Africa Craft Beer Market (US$ Million), 2020 - 2030

- FIG. 34 Rest of Middle East and Africa Craft Beer Market (US$ Million), 2020 - 2030

Introduction

In 2020, the global craft beer market was worth over $ 95 trillion. Globally, the impact of COVID-19 was unprecedented. The market evidenced a decrease in demand across all regions due to the pandemic. The market is projected to grow at a CAGR exceeding 8% between 2022-2030. Beer is the oldest and most popular alcoholic beverage in the world. Due to constant taste modification and improvements, as well as the availability of many flavorful options, the market is experiencing steady growth across the globe. Consumers are constantly looking for new and innovative beverages, which has led to an increase in the demand for flavorful options.

COVID-19 Impact: Market Bounced Strongly Post COVID-19 Leading to the Change in Coping Strategies

Beer is considered as a relaxing beverage by many consumers. To maintain social distancing, governments closed many bars, restaurants, taprooms, and pubs during the global COVID-19 pandemic. This led to a negative impact on the global market. According to the Brewers Association's May study, total brewery sales in the U.S. fell by 30% in May compared to the previous year. Nearly 90% of the brewing firms had either stopped or slowed their production as their YoY sales declined in April. Due to lockdown enforcement S. and cancellation of orders by distributors, over 85% of craft breweries were forced to close their brew pubs in the U.S. This adversely affected most of the local craft breweries. The market has recovered immensely due to the opening of taprooms and the ease of production. This revival has led to significant changes in the market trends and our report contains a detailed analysis of the same.

Go green Technology, Change in Customer Preferences, and Increasing Socialization are all Contributing to the Market Growth

The rise in socializing, especially among millennials has increased their visits to taprooms and brewpubs. The rise in independent and small breweries has also contributed to this increase. Breweries are working to improve their beer production in order to meet increasing consumer demand. According to the Brewers Association, the United States' small and independent brewers produced around 26.3 million barrels of beer in 2019, a 4 percent increase over the previous year. Craft production was responsible for 25.2% of the total U.S. product retail market in 2021, which has contributed to overall market growth. However, the impact of COVID-19 led to a significant loss in 2020.

Go-green technology, which is a result of recent developments in craft beer development, is being integrated into beer production to increase market growth and reduce waste. Canning has been a major factor in the development of craft beer over the past few years. The demand for craft beer is increasing due to the rise in restaurants, bars, and pubs in cities. The market has seen a rise in demand for craft breweries due to the proliferation of social trends among millennials.

Non-alcoholic craft beer sales have increased due to growing health awareness and awareness among millennials about all the benefits of non-alcoholic beer. With a rising preference for low alcohol volume beverages, sales of low-alcohol and no-alcohol beers are increasing. This is due to the growing demand from health-conscious customers and an increased variety of options with better taste. Low-alcohol ciders and beers are on the rise due to increasing awareness about alcohol consumption and customers' willingness to try new drinks. Anheuser-Busch InBev, for instance, launched four low- and no-alcohol beers in 2020 to expand its product range. These beers contain less than 4% alcohol. This shift is evident in the volume of low-alcohol drinks in the United Kingdom. Off-licences and supermarket sales have reached a new record. Low-alcohol beers, which are those with 2.8% ABV or less, are more affordable than their higher-alcohol alternatives. This is to increase the demand for low-alcohol beer, such as craft beer.

Innovations in Alcoholic Drinks is Impeding the Market Growth

Although alcoholic beverages are popular worldwide, there are many other alcohol craft beverages like gin and whiskey that are hindering market growth. Due to consumers' willingness to experiment with new types of craft spirits, there is a growing preference for such spirits. The other alcoholic craft drinks are also more varied than the alcoholic beverage, and undergo several distillation methods to produce high-quality liquor. The market is also restrained by the availability of many flavors in alcoholic craft drinks such as grapefruit and raspberry, lemon, and other.

Customers to Prefer Low Alcohol Beer Alternatives During the Forecast Period

As consumers become more health conscious, they are drawn to low-alcohol beverages. Sales of no-alcohol and lower-alcohol beers are on the rise due to increased competition from new, better-tasting products. Ciders and beers with low alcohol levels have enjoyed increasing popularity due to increased awareness about alcohol consumption and the desire to try new drinks. This trend can be seen in the volume of low-alcohol drinks in the United Kingdom, which has seen record sales at the supermarket and off-license levels. Low-alcohol beers, those with less than 2.8% ABV, are also cheaper. Low-alcohol beer could be more popular in craft beer and provide a significant opportunity for growth.

Craft Lager to Evidence Significant Growth While Off Trade Channels are Being Preferred and Millennials are the Key Target

Craft lager is experiencing significant growth due to brewers adding new varieties such as pales and light lager to their product ranges in an effort to attract consumers' attention away from the main brands. Craft lagers are becoming more popular due to their light, malty flavor. Brewers are now looking for products with longer shelf life and lower-cost ingredients. This has led to an increase in craft lager production. Ale is the second most popular alcoholic beverage on the market, followed closely by lager.

Due to the wide variety of beer types and flavors, off-trade channels have seen an increase in craft beer sales in recent years. Off-trade channels like convenience stores and supermarkets are preferred by consumers as they offer convenient cans or pre-chilled bottles. Consumers are inclined towards purchasing alcoholic beverages from off-trade sources. Consumers prefer to drink at home over in pubs, which is more comfortable, relaxing, and cost-effective.

On-trade markets have a completely different approach to product distribution and sales than the off-trade. The on-trade market is dominated by the bar/restaurant manager and any trade professionals (bartenders, waiters) who play a crucial role in the sales process. On-trade establishments that offer tasting rooms, brewpubs and tiki bars provide a more luxurious and comfortable experience for customers. This has led to the increase in millennials adopting pub and bar culture in turn driving the growth in the craft beer market.

North America to Lead the Revenues While APAC Leads the Growth

North America accounts for a significant share of the craft beer industry. Craft beer has seen a rise in popularity due to the increasing number of microbreweries. The demand for craft beer has increased exponentially due to the increase in American breweries. According to the Brewers Association in the United States, the number of craft breweries has increased from 8391 in 2019, to 8764 by 2020. Social media, local events and promotions are key drivers of the craft movement. Because of its rich, vibrant taste, millennials in the region are more inclined to drink craft beer than regular beer. The market players have created many product innovations due to rising demand for craft beer among young people and the growing demand for low-alcohol craft beers in the region. Stella Artois, an Anheuser-Busch brand, introduced Liberte in the United States in 2021.U.S. beer volume sales increased by 1% in 2021. Craft brewer volume sales rose over 7.5%, increasing small- and independent brewers' share of the U.S. beer industry volume to 13%.

Craft beer's success in America has been largely due to the large number of microbreweries that exist and the high volume of beer produced. The market for craft beer has been boosted by the growth of independent breweries as well as the support of small-scale businesses. They have played a significant role in the growth of this market. As per our report from Acute Market Reports, North America contributed to over 35% of revenues in the craft beer market.

Over the past five years, Europe has evidenced rapid growth in craft breweries. The support for craft beer can be viewed as the increased growth of active breweries on the European market. Premium beers are a big trend in Europe. This has supported the growth of the craft beer market in these regions. The recent growth in craft beer production is due to an increase in craft ale consumption. This has resulted in a positive outlook for the future of craft beer.

Consumption growth in Asia Pacific has been positively affected by the growing demand for unique flavors and the rapid urbanization. The Asia Pacific market is expected at the fastest pace with a CAGR of 11% during the forecast period 2022-2030. The market has seen significant growth in recent years due to a large demand, which was supplanted with rising incomes, rapid urbanization, as well as the growth of beer companies. Major sales will likely be from India and China. China's craft beer market has grown over 250%. There are more than a thousand craft breweries in China, which contributes to the region's growth.

Market Consolidation to Toughen the Competition During the Forecast Period

Global market is largely dominated by key players that includes The Boston Beer Company, Heineken NV, Constellation Brands, Inc., Anheuser-Busch Inc., and Constellation Brands, Inc. These companies are all actively focusing on new product launches, incorporating novel ingredients, and improvising the process. Strategic mergers is also a notable strategy adopted by the major players to strengthen their businesses and increase their market presence. To diversify its product range, Anheuser-Busch InBev purchased the remaining 68.8% of Craft Brew Alliance in June 2020.

Historical & Forecast Period

This study report represents analysis of each segment from 2020 to 2030 considering 2021 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2022 to 2030.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Craft Beer market are as follows:

- Research and development budgets of manufacturers and government spending

- Revenues of key companies in the market segment

- Number of end users and consumption volume, price and value.

Geographical revenues generate by countries considered in the report:

Micro and macro environment factors that are currently influencing the Craft Beer market and their expected impact during the forecast period.

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

ATTRIBUTE DETAILS

- Research Period: 2020-2030

- Base Year: 2021

- Forecast Period: 2022-2030

- Historical Year: 2020

- Unit: USD Million

Segmentation

Product

- Brown Ale Craft Beer

- Pale Ale Craft Beer

- Porter Craft Beer

- Stout Craft Beer

- Pale Lager Craft Beer

- Pilsner Craft Beer

- Marzens Craft Beer

- Bocks Craft Beer

- Other Craft Beer Products

Brewer

- American Sour Craft Beer

- Non-Alcoholic Craft Beer

- Belgian Fruit Lambic Craft Beer

- Flanders Red Ale Craft Beer

- Belgian Gueuze Craft Beer

Sales Channel

- Craft Beer Sales via Microbreweries

- Craft Beer Sales via Brewpubs

- Craft Beer Sales via Contract Brewing Companies

- Craft Beer Sales via Independent

- Regional Craft Brewing Companies

Age

- 21-35

- 42-54 institutions

- Above 55

Region Segment (2020-2030; US$ Million)

- North America

- U.S.

- Canada

- Rest of North America

- UK and European Union

- UK

- Germany

- Spain

- Italy

- France

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC

- Africa

- Rest of Middle East and Africa

Global Impact of COVID-19 Segment (2020-2021; US$ Million )

- Pre COVID-19 situation

- Post COVID-19 situation

Key questions answered in this report:

- What are the key micro and macro environmental factors that are impacting the growth of Craft Beer market?

- What are the key investment pockets with respect to product segments and geographies currently and during the forecast period?

- Estimated forecast and market projections up to 2030.

- Which segment accounts for the fastest CAGR during the forecast period?

- Which market segment holds a larger market share and why?

- Are low and middle-income economies investing in the Craft Beer market?

- Which is the largest regional market for Craft Beer market?

- What are the market trends and dynamics in emerging markets such as Asia Pacific, Latin America, and Middle East & Africa?

- Which are the key trends driving Craft Beer market growth?

- Who are the key competitors and what are their key strategies to enhance their market presence in the Craft Beer market worldwide?

Table of Contents

1. Preface

- 1.1. Report Description

- 1.1.1. Purpose of the Report

- 1.1.2. Target Audience

- 1.1.3. Key Offerings

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.3.1. Phase I - Secondary Research

- 1.3.2. Phase II - Primary Research

- 1.3.3. Phase III - Expert Panel Review

- 1.3.4. Assumptions

- 1.3.5. Approach Adopted

2. Executive Summary

- 2.1. Market Snapshot: Global Craft Beer Market

- 2.2. Global Craft Beer Market, By Product , 2021 (US$ Million)

- 2.3. Global Craft Beer Market, By Brewer , 2021 (US$ Million)

- 2.4. Global Craft Beer Market, By Sales Channel , 2021 (US$ Million)

- 2.5. Global Craft Beer Market, By Age , 2021 (US$ Million)

- 2.6. Global Craft Beer Market, By Geography, 2021 (US$ Million)

- 2.7. Impact of Covid 19

- 2.8. Attractive Investment Proposition by Geography, 2021

- 2.9. Competitive Analysis

- 2.9.1. Market Positioning of Key Craft Beer Market Vendors

- 2.9.2. Strategies Adopted by Craft Beer Market Vendors

- 2.9.3. Key Industry Strategies

3. Craft Beer Market: Business Outlook & Market Dynamics

- 3.1. Introduction

- 3.2. Global Craft Beer Market Value, 2020 - 2030, (US$ Million)

- 3.3. Market Dynamics

- 3.3.1. Market Drivers

- 3.3.2. Market Restraints

- 3.3.3. Key Challenges

- 3.3.4. Key Opportunities

- 3.4. Impact Analysis of Drivers and Restraints

- 3.5. See-Saw Analysis

- 3.6. Porter's Five Force Model

- 3.6.1. Supplier Power

- 3.6.2. Buyer Power

- 3.6.3. Threat Of Substitutes

- 3.6.4. Threat Of New Entrants

- 3.6.5. Competitive Rivalry

- 3.7. PESTEL Analysis

- 3.7.1. Political Landscape

- 3.7.2. Economic Landscape

- 3.7.3. Technology Landscape

- 3.7.4. Legal Landscape

- 3.7.5. Social Landscape

4. Craft Beer Market: By Product , 2020-2030, USD (Million)

- 4.1. Market Overview

- 4.2. Growth & Revenue Analysis: 2021 Versus 2030

- 4.3. Market Segmentation

- 4.3.1. Brown Ale Craft Beer

- 4.3.2. Pale Ale Craft Beer

- 4.3.3. Porter Craft Beer

- 4.3.4. Stout Craft Beer

- 4.3.5. Pale Lager Craft Beer

- 4.3.6. Pilsner Craft Beer

- 4.3.7. Marzens Craft Beer

- 4.3.8. Bocks Craft Beer

- 4.3.9. Other Craft Beer Products

5. Craft Beer Market: By Brewer , 2020-2030, USD (Million)

- 5.1. Market Overview

- 5.2. Growth & Revenue Analysis: 2021 Versus 2030

- 5.3. Market Segmentation

- 5.3.1. American Sour Craft Beer

- 5.3.2. Non-Alcoholic Craft Beer

- 5.3.3. Belgian Fruit Lambic Craft Beer

- 5.3.4. Flanders Red Ale Craft Beer

- 5.3.5. Belgian Gueuze Craft Beer

6. Craft Beer Market: By Sales Channel , 2020-2030, USD (Million)

- 6.1. Market Overview

- 6.2. Growth & Revenue Analysis: 2021 Versus 2030

- 6.3. Market Segmentation

- 6.3.1. Craft Beer Sales via Microbreweries

- 6.3.2. Craft Beer Sales via Brewpubs

- 6.3.3. Craft Beer Sales via Contract Brewing Companies

- 6.3.4. Craft Beer Sales via Independent

- 6.3.5. Regional Craft Brewing Companies

7. Craft Beer Market: By Age , 2020-2030, USD (Million)

- 7.1. Market Overview

- 7.2. Growth & Revenue Analysis: 2021 Versus 2030

- 7.3. Market Segmentation

- 7.3.1. 21-35

- 7.3.2. 42-54 institutions

- 7.3.3. Above 55

8. North America Craft Beer Market, 2020-2030, USD (Million)

- 8.1. Market Overview

- 8.2. Craft Beer Market: By Product , 2020-2030, USD (Million)

- 8.3. Craft Beer Market: By Brewer , 2020-2030, USD (Million)

- 8.4. Craft Beer Market: By Sales Channel , 2020-2030, USD (Million)

- 8.5. Craft Beer Market: By Age , 2020-2030, USD (Million)

- 8.6.Craft Beer Market: By Region, 2020-2030, USD (Million)

- 8.6.1.North America

- 8.6.1.1. U.S.

- 8.6.1.2. Canada

- 8.6.1.3. Rest of North America

- 8.6.1.North America

9. UK and European Union Craft Beer Market, 2020-2030, USD (Million)

- 9.1. Market Overview

- 9.2. Craft Beer Market: By Product , 2020-2030, USD (Million)

- 9.3. Craft Beer Market: By Brewer , 2020-2030, USD (Million)

- 9.4. Craft Beer Market: By Sales Channel , 2020-2030, USD (Million)

- 9.5. Craft Beer Market: By Age , 2020-2030, USD (Million)

- 9.6.Craft Beer Market: By Region, 2020-2030, USD (Million)

- 9.6.1.UK and European Union

- 9.6.1.1. UK

- 9.6.1.2. Germany

- 9.6.1.3. Spain

- 9.6.1.4. Italy

- 9.6.1.5. France

- 9.6.1.6. Rest of Europe

- 9.6.1.UK and European Union

10. Asia Pacific Craft Beer Market, 2020-2030, USD (Million)

- 10.1. Market Overview

- 10.2. Craft Beer Market: By Product , 2020-2030, USD (Million)

- 10.3. Craft Beer Market: By Brewer , 2020-2030, USD (Million)

- 10.4. Craft Beer Market: By Sales Channel , 2020-2030, USD (Million)

- 10.5. Craft Beer Market: By Age , 2020-2030, USD (Million)

- 10.6.Craft Beer Market: By Region, 2020-2030, USD (Million)

- 10.6.1.Asia Pacific

- 10.6.1.1. China

- 10.6.1.2. Japan

- 10.6.1.3. India

- 10.6.1.4. Australia

- 10.6.1.5. South Korea

- 10.6.1.6. Rest of Asia Pacific

- 10.6.1.Asia Pacific

11. Latin America Craft Beer Market, 2020-2030, USD (Million)

- 11.1. Market Overview

- 11.2. Craft Beer Market: By Product , 2020-2030, USD (Million)

- 11.3. Craft Beer Market: By Brewer , 2020-2030, USD (Million)

- 11.4. Craft Beer Market: By Sales Channel , 2020-2030, USD (Million)

- 11.5. Craft Beer Market: By Age , 2020-2030, USD (Million)

- 11.6.Craft Beer Market: By Region, 2020-2030, USD (Million)

- 11.6.1.Latin America

- 11.6.1.1. Brazil

- 11.6.1.2. Mexico

- 11.6.1.3. Rest of Latin America

- 11.6.1.Latin America

12. Middle East and Africa Craft Beer Market, 2020-2030, USD (Million)

- 12.1. Market Overview

- 12.2. Craft Beer Market: By Product , 2020-2030, USD (Million)

- 12.3. Craft Beer Market: By Brewer , 2020-2030, USD (Million)

- 12.4. Craft Beer Market: By Sales Channel , 2020-2030, USD (Million)

- 12.5. Craft Beer Market: By Age , 2020-2030, USD (Million)

- 12.6.Craft Beer Market: By Region, 2020-2030, USD (Million)

- 12.6.1.Middle East and Africa

- 12.6.1.1. GCC

- 12.6.1.2. Africa

- 12.6.1.3. Rest of Middle East and Africa

- 12.6.1.Middle East and Africa

13. Company Profile

- 13.1. Anheuser-Busch InBev

- 13.1.1. Company Overview

- 13.1.2. Financial Performance

- 13.1.3. Product Portfolio

- 13.1.4. Strategic Initiatives

- 13.2. Beijing Enterprises Holdings Limited (Beijing Yanjing Brewery Co., Ltd.)

- 13.2.1. Company Overview

- 13.2.2. Financial Performance

- 13.2.3. Product Portfolio

- 13.2.4. Strategic Initiatives

- 13.3. Carlsberg Group

- 13.3.1. Company Overview

- 13.3.2. Financial Performance

- 13.3.3. Product Portfolio

- 13.3.4. Strategic Initiatives

- 13.4. Diageo PLC

- 13.4.1. Company Overview

- 13.4.2. Financial Performance

- 13.4.3. Product Portfolio

- 13.4.4. Strategic Initiatives

- 13.5. Dogfish Head Craft Brewery, Inc.

- 13.5.1. Company Overview

- 13.5.2. Financial Performance

- 13.5.3. Product Portfolio

- 13.5.4. Strategic Initiatives

- 13.6. Heineken Holding NV.

- 13.6.1. Company Overview

- 13.6.2. Financial Performance

- 13.6.3. Product Portfolio

- 13.6.4. Strategic Initiatives

- 13.7. Squatters Pub and Beers

- 13.7.1. Company Overview

- 13.7.2. Financial Performance

- 13.7.3. Product Portfolio

- 13.7.4. Strategic Initiatives

- 13.8. Sierra Nevada Brewing Co.

- 13.8.1. Company Overview

- 13.8.2. Financial Performance

- 13.8.3. Product Portfolio

- 13.8.4. Strategic Initiatives

- 13.9. The Boston Beer Company, Inc.

- 13.9.1. Company Overview

- 13.9.2. Financial Performance

- 13.9.3. Product Portfolio

- 13.9.4. Strategic Initiatives

- 13.10. United Breweries Limited

- 13.10.1. Company Overview

- 13.10.2. Financial Performance

- 13.10.3. Product Portfolio

- 13.10.4. Strategic Initiatives