|

|

市場調査レポート

商品コード

1692589

再構成される水素経済:材料およびハードウェア市場・技術 (2025-2045年)The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045 |

||||||

|

|||||||

| 再構成される水素経済:材料およびハードウェア市場・技術 (2025-2045年) |

|

出版日: 2025年03月31日

発行: Zhar Research

ページ情報: 英文 340 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

打ち負かすことができないなら、仲間にしよう

電化を台無しにする無駄な試みではなく、電化を強化するために方向転換されたとき、水素は大きな新市場を持つことになります。例えば、電力網のための核融合発電として成功する可能性があります。実際、設計によっては直接電力を生産することもできます。大型船舶の電気駆動装置の動力源になるかもしれません。核融合発電への投資は急増しており、2035年以降の商業化に向けて毎年100億米ドル以上の投資が見込まれています。一方、発電コストの低さでは太陽光発電に軍配が上がりますが、塩の洞窟での通常の水素貯蔵は、季節ごとに発生する貯蔵のニーズに対してトップランナーです。実際、現代の戦略的石油備蓄に相当するものは、地下の洞窟にずっと長く貯蔵されるグリーン水素かもしれません。さらに、化学原料としてのグリーン水素の利用を拡大する可能性もかなりあり、これらの選択肢はいずれも、水素を家庭や自動車にパイプで供給するという、以前の破滅的な試みよりもはるかに現実的です。

当レポートでは、再構成される水素経済の動向を調査し、水素経済のこれまでの経緯と課題、水素の製造・貯蔵技術、材料開発の動向、LDES (長期エネルギー貯蔵) と水素、水素核融合、化学原料としての水素など、水素経済の新しい機会の分析、将来の展望などをまとめています。

目次

第1章 エグゼクティブサマリー・総論

- 本レポートの目的

- 調査手法

- 産業用水素に関する一般的な総論とSWOT評価

- 総論:電力網向け水素:SWOT評価・核融合発電

- 総論:電力網向け水素:長期エネルギー貯蔵 (LDES)・SWOT評価

- 総論:化学原料としてのグリーン水素

- 総論:陸上、水上、空中の水素ビークル

- 電力網サポート (核融合、LDES)、化学原料、ニッチ燃料のラインを含む水素経済改革ロードマップ

- 2025年から2045年までの市場予測:27項目

- 水素市場

- 水素ハードウェア市場

- LDES市場:技術カテゴリー別

- LDES市場

- 2025-2045年のLDES市場

第2章 水素の概要:事業機会と関連する材料

- 概要

- 本章の内容

- 水素経済の目標と優先順位の変化

- 水素経済の再構築を支援する取り組みの例

- 事業機会としての水素の基礎

- 水素経済の最初のコンセプトが失敗している理由

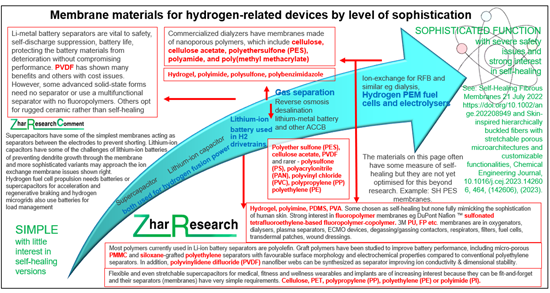

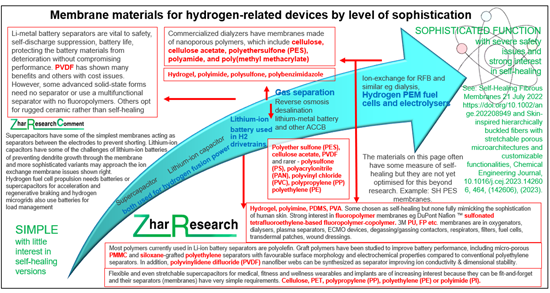

- 膜材料の高度化レベル

第3章 水素製造・貯蔵技術と材料の革新

- 概要

- 水素製造

- 水素の輸送と貯蔵の方法と材料

第4章 電力網:水素長期エネルギー貯蔵 (LDES)

- 概要

- 化学中間体LDESのスイートスポット

- LDESにおける水素とメタンおよびアンモニアの比較

- 水素LDESリーダー:Calistoga Resiliency Centre USA

- 計算によると、最長期のLDESでは水素が勝利することが判明

- 鉱業大手は慎重に多くの選択肢を進めている

- 建物・その他の小さな場所

- LDES水素貯蔵技術

- LDESの水素貯蔵パラメータ評価

- LDESにおける水素、メタン、アンモニアのSWOT評価

第5章 電力網:水素からの核融合発電

- 核融合の基礎:候補反応と特殊材料の可能性

- 核融合グリッド電力の可能性に関するSWOT評価

- 実際の核分裂発電システムと計画中の核融合発電システムの比較

- 核融合炉の動作原理と材料の放射線損傷

- 慣性閉じ込め核融合

- 核融合発電のための磁気閉じ込めオプション

- 関心と投資の急増:選ばれる技術とその理由

- 水素核融合発電装置の製造を競う民間核融合企業の分析

- 主要な核融合発電企業:国別・さまざまなパフォーマンス基準・資金調達

- 核融合発電の最も早い供給日

第6章 化学、鉄鋼、食品製造における水素原料反応物および中間体

- 概要:化学品用水素:肥料・セメント、燃料、食品、カーボンナノチューブ

- セメントとコンクリートの脱炭素化

- 石油精製と化学工学における水素

- 肥料生産における水素利用:アンモニアルートと展望

- 水素による鉄鋼製造の脱炭素化と2025年の調査と展望

- 持続可能な燃料と化学品の生産のための二酸化炭素の水素化

第7章 完全な電化が不十分または実行不可能なニッチ燃料:一部の航空宇宙、船舶、列車、オンロード、オフロード車両、マイクログリッド

- 概要

- 水素バスと路面電車:小さいシェアと展望

- 水素トラック

- フォークリフトを含むマテリアルハンドリングおよび建設車両

- 採掘車両

- 農業用車両

- 軍用車両

- 列車

- ボート・船舶

- 航空機用水素:SAFと純水素の取り組み、調査、2025年までの評価

- 水素マイクログリッドと2025年の調査

- 水素熱電併給発電の新たな発明

Summary

The hydrogen economy reinvented will call for many new high-added-value materials and devices. A report is now available on just this. It is Zhar Research, "The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045".

If you cannot beat them then join them

It is now realised that hydrogen will have large new markets when it is redirected to enhance electrification, not pitched as a futile attempt to destroy electrification. For instance, it can succeed as fusion power for electricity grids. Indeed, it some designs, it will directly produce electricity. That may power the electric drives of large ships. Investment in fusion power is rocketing, with over $10 billion yearly in prospect for commercialisation, mostly 2035 and beyond, and much of this spent on specialist materials. Meanwhile, as solar wins for lowest cost electricity generation, regular hydrogen in salt caverns is front-runner for seasonal storage needs arising. Indeed, the modern equivalent of strategic oil reserves may be green hydrogen stored in underground caverns for much longer. In addition, there is considerable potential to grow the use of green hydrogen as a chemical feedstock, all of these options being far more realistic than the earlier doomed attempts to pipe hydrogen into our homes and cars.

Big reversals: different opportunities

Learn how there are big reversals here. Fusion power will need tiny amounts of hydrogen but at massively high prices for the deuterium and tritium isotopes. It will need highly sophisticated, high-priced materials, mostly inorganic. The volume demand for regular hydrogen will heavily involve chemical intermediary and fuel blends rather than the original idea of pure hydrogen everywhere. Because of its fundamental properties, we shall minimise the distribution of hydrogen, not maximise it.

Your new addressable markets

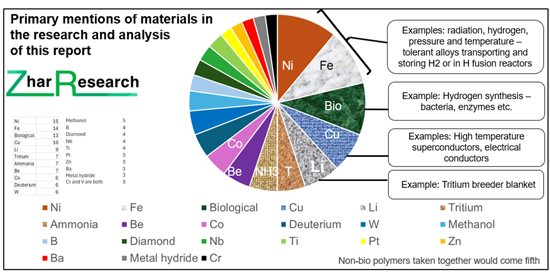

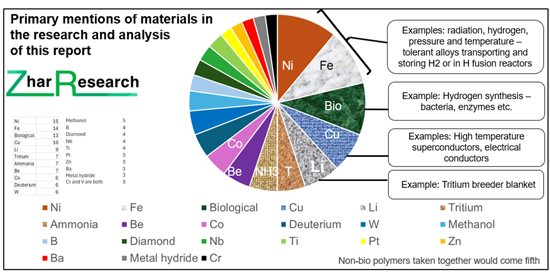

The commercially-oriented, 340-page report starts with a 50-page Executive Summary and Conclusions sufficient in itself for those in a hurry. Here are 51 key conclusions, 27 forecast lines, roadmap in three lines by year 2025-2045, three SWOT appraisals and many lucid new infographics making it easy to grasp your new opportunities. Among the new needs, learn why nickel, iron, copper and lithium-based materials are so prominent alongside biological materials. What are the many types of sophisticated membranes now needed?

Which chemistries?

Why are chemistries of B, Ba, Be, Co, Nb, Pt, V, Zn and, to a lesser extent, Ir, La, Mn, Zr important? Which organics and why, including many membrane composites emerging? Many 2025 research papers and latest industrial advances are analysed throughout the report.

Chapter 2. "Introduction to hydrogen: business opportunities and materials involved" takes 44 pages to cover actual and potential uses of green hydrogen, hydrogen isotopes and their primary uses, actual and targetted, and evidence that the industry is starting to pivot towards different objectives. Many of the resulting, different, hardware needs are introduced here.

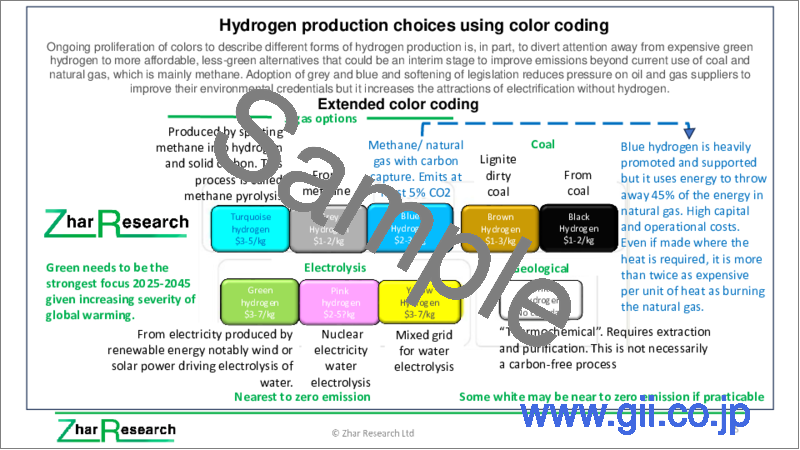

Production is changing

The 46 pages of Chapter 3. "Hydrogen production and storage technologies and materials reinvented" concern regular hydrogen, particularly green hydrogen, reasons for current strong investment in hydrogen production and hydrogen hubs, ten hydrogen production methods and their materials then specifically electrolyser technologies compared, materials opportunities emerging. See new focus on geologic "natural" hydrogen, solar hydrogen panels, bio-fermentation and hydrogen made where it is needed. Will there be over-production of green hydrogen due to cost and other factors? Understand hydrogen storage materials: addressing life, size, weight, leakage and safety issues. What hydrogen transport and storage methods, materials, challenges are your opportunities? One particularly important aspect then gets its own chapter.

Electricity grids come center stage

Chapter 4. "Electricity grids: Hydrogen Long Duration Energy Storage LDES" (54 pages). Mostly underground in salt caverns, this will mainly involve massive surplus wind and solar power making green hydrogen with storage then subsequent discharge (GWh divided by GW) of three months or more. Again the coverage is both up-to-date and critical with 2025 research and honest, numerate presentation of the serious conversion efficiency, leakage and other issues for you to solve.

Hydrogen fusion power

It is deeply significant that proof of principle has recently been repeatedly demonstrated with generation of electricity by hydrogen fusion and many amply-funded private companies are promising to demonstrate it providing grid electricity well within the 2025-2045 timeframe. Chapter 5. "Electricity grids: Nuclear fusion power from hydrogen" (57 pages) critically inspects a profusion of 2025 research and industrial advances in this, particularly surfacing your exciting equipment and materials opportunities. Specialist steels, lithium breeder blankets, diamond hydrogen targets, high temperature superconductors pinching hydrogen plasma, deuterium, tritium and helium3 and are examples that are potentially highly profitable.

Growth in use as chemical reactant

Chapter 6. "Hydrogen feedstock reactant and intermediary in chemical, steel, food manufacture" (28 pages) sees growth in this substantial existing use of hydrogen as a chemical feedstock but this situation is complex. For example, there will be more green hydrogen use to make ammonia notably to make fertilizer. However, on a 20-year timeframe, farming is increasingly going indoors with aquaponics, hydroponics and cell culture needing little fertilizer -sometimes 95% less. Use in steelmaking is likely to be a largely new market and more hydrogen will be used in oil refineries until they are hit by a decline in number due to electrification of homes and vehicles. Over-arching all this is adoption of green hydrogen in place of dirtier forms and to make higher value materials such as carbon nanotubes. All is explained and predicted in this chapter, including relevance of hydrogen to cement decarbonisation.

Hydrogen as a niche fuel

Chapter 7. "Niche fuel where full electrification is inadequate or impracticable:

some aerospace, ships, trains, on-road, off-road vehicles, microgrids" in 40 pages addresses what remains after the original dream is abandoned - battery-electric vehicles and electricity equipment in our homes being much simpler, safer, more affordable and longer-lived. We find that industrial heating, off-road vehicles, trains and ships are among the niches that may adopt some hydrogen solutions but affordable MW-level mining vehicle and ship batteries and faster improvement of battery-electric powertrains are a threat, including very fast charging. Hydrogen adoption niches will sometimes be aided by being a marginally costed part of a hydrogen ecosystem because total cost of ownership is a major impediment in stand-alone transport and microgrid systems.

CAPTION: Primary mentions of valuable materials in the Zhar Research report, "The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045". Elements named refer to use as metal, alloy or compound.

CAPTION: Membrane materials for hydrogen-related devices by level of sophistication

Source: Zhar Research report, "The Hydrogen Economy Reinvented: Materials and Hardware Markets, Technology 2025-2045" .

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3 25 General conclusions and SWOT appraisal of industrial hydrogen

- 1.4. Conclusions: hydrogen for electricity grids: fusion power with SWOT appraisal

- 1.5. Conclusions: hydrogen for electricity grids: Long Duration Energy Storage LDES with SWOT appraisal

- 1.6. Conclusions: green hydrogen as a chemical feedstock

- 1.7. Conclusions: hydrogen vehicles by land, water and air

- 1.8. Roadmap for reinvented hydrogen economy 2025-2045 with lines for electricity grid support (fusion, LDES), chemical feedstock and niche fuel

- 1.9. Market forecasts 2025-2045 in 27 lines

- 1.9.1. Hydrogen market million tonnes 2025-2045 in seven lines, table, graphs

- 1.9.2. Hydrogen hardware market $ billion 2025-2045 in 8 lines, table, graphs

- 1.9.3. LDES market in 9 technology categories $ billion 2025-2045, 9 lines table, graphs

- 1.9.4. LDES total value market showing beyond-grid gaining share 2025-2045

- 1.9.5. Total LDES value market percent in three size categories 2025-2045 table, graphs

2. Introduction to hydrogen: business opportunities and materials involved

- 2.1. Overview

- 2.2. Coverage in this chapter

- 2.3. The hydrogen economy objectives and how priorities are changing

- 2.3.1. Many actual and potential uses of green hydrogen

- 2.3.2. Lessons of history and new objectives for 2025-2045

- 2.3.3. How the hydrogen economy idea is being reinvented to reflect new realities

- 2.3.4. Reinvention to leverage strengths leads to different beneficiaries

- 2.3.5. New realities: how the hydrogen economy objective is being reinvented

- 2.3.6. The most promising uses of green hydrogen 2025-2045

- 2.3.7 2024-5 research advances

- 2.4. Examples of initiatives supporting the reinvented hydrogen economy

- 2.4.1. Steel, ammonia, hydrogen hubs not based on everyday fuel making, fusion power

- 2.4.2. Private fusion companies and governments race into hydrogen fusion power

- 2.5. Basics of hydrogen as your business opportunity

- 2.5.1. SWOT appraisal of hydrogen

- 2.5.2. Hydrogen isotopes and their primary uses actual and targetted

- 2.5.3. Comparison of regular hydrogen (protium) with other fuels and with deuterium and tritium forms of hydrogen

- 2.5.4. Parameters for on-board hydrogen storage vs gasoline

- 2.6. Why the first concept of a hydrogen economy is failing

- 2.6.1. Some emerging realities driving reinvention of the hydrogen economy idea

- 2.6.2. How hydrogen is not the leading prospect for decarbonisation

- 2.6.3. How a battery competes with hydrogen tank + fuel cell

- 2.6.4. Why hydrogen for mainstream heating is fundamentally more complex and expensive than electrification

- 2.6.5. Why hydrogen is not "the new mainstream oil or gas fuel" 2025-2045 but niches remain

- 2.7. Membrane materials by level of sophistication

3. Hydrogen production and storage technologies and materials reinvented

- 3.1. Overview

- 3.2 Hydrogen production

- 3.2.1. Strong investment in hydrogen production and hydrogen hubs

- 3.2.2. Hydrogen production choices using color coding

- 3.2.3. Eleven hydrogen production methods and their materials compared

- 3.2.4. Electrolyser technologies compared

- 3.2.5. Materials opportunities emerging

- 3.2.6. New focus on - geologic "natural" hydrogen, solar hydrogen panels, bio-fermentation

- 3.2.7. Examples of hydrogen made where it is needed - a new emphasis

- 3.2.8. Will there be over-production of green hydrogen due to cost and other factors?

- 3.3. Hydrogen transport and storage methods and materials

- 3.3.1. The challenges

- 3.3.2. Five types of hydrogen and intermediary for storage compared

- 3.3.3. Hydrogen storage materials: addressing life, size, weight, leakage and safety issues

4. Electricity grids: Hydrogen Long Duration Energy Storage LDES

- 4.1. Overview

- 4.1.1. Approach

- 4.1.2. Optimisation and priorities

- 4.1.3. Hydrogen grid storage: the UK as an example of contention

- 4.1.4. Wide spread of parameters means interpretation should be cautious

- 4.2. Sweet spot for chemical intermediary LDES

- 4.2.1. Best applications

- 4.3.2. New research on salt caverns, subsea and other options for large scale hydrogen storage

- 4.3.3. New research on complex mechanisms for hydrogen loss

- 4.3.4. N4w research on hydrogen leakage causing global warming

- 4.3.5. New research combining grid hydrogen storage with other storage: hybrid systems

- 4.4. Hydrogen compared to methane and ammonia for LDES

- 4.5. Hydrogen LDES leader: Calistoga Resiliency Centre USA 48-hour hydrogen LDES

- 4.6. Calculations finding that hydrogen will win for longest term LDES

- 4.7. Mining giants prudently progress many options

- 4.8. Buildings and other small locations

- 4.8.1. Rationale

- 4.8.2. Hydrogen storage offered for houses in Italy and Germany

- 4.9. Technologies for LDES hydrogen storage

- 4.9.1. Overview

- 4.9.2. Choices of underground storage for LDES hydrogen

- 4.9.3. Hydrogen interconnectors for electrical energy transmission and storage

- 4.9.4. Review of 15 projects that use hydrogen as energy storage in a power system

- 4.10. Parameter appraisal of hydrogen storage for LDES

- 4.11. SWOT appraisal of hydrogen, methane, ammonia for LDES

5. Electricity grids: Nuclear fusion power from hydrogen

- 5.1. Fusion basics: candidate reactions and specialist materials opportunities

- 5.1.1. Candidate hydrogen fusion reactions

- 5.1.2. Development objectives are fusion ignition then net power gain

- 5.1.3. Materials opportunities: liquids, solids, gases and plasma

- 5.3. SWOT appraisal of the potential of fusion grid power

- 5.4. Comparison of actual fission and planned fusion power systems

- 5.5. Operating principles of fusion reactors and radiation damage of the materials

- 5.5.1. Candidate designs

- 5.5.2. Radiation and plasma damage of the materials: research in 2025 and future needs

- 5.6. Inertial Confinement Fusion

- 5.6.1. Laser-based inertial confinement fusion (LICF) laser designs

- 5.6.2. Fusion target opportunities

- 5.6.3. Lawrence Livermore National Laboratories LLNL National Ignition Facility NIF

- 5.6.4. Other inertial confinement developers and the special case of Helion

- 5.7. Magnetic confinement options for fusion power

- 5.7.1. General

- 5.7.2. Heating

- 5.7.3. Electricity production

- 5.7.4. Tokamak and Z-Pinch: JET, ITER and others

- 5.7.5. Toroidal magnetic confinement machine material opportunities

- 5.7.6. Research in 2025 on toroidal and allied fusion power hardware

- 5.7.7. Stellarators and their research in 2025

- 5.7.8. Inside-out magnetic confinement: OpenStar levitated dipole fusion reactor

- 5.8. Sudden surge in interest and investment: which technology and why

- 5.9. Analysis of private fusion companies racing to make hydrogen fusion electricity generators

- 5.10. Winning fusion power companies by country, various performance criteria, funding

- 5.10.1. Analysis by location, operating principles, funding of private companies

- 5.10.2. Winning technologies in approaching or achieving fusion ignition

- 5.11. Earliest dates for fusion electricity being delivered

6. Hydrogen feedstock reactant and intermediary in chemical, steel, food manufacture

- 6.1. Overview: hydrogen for chemicals from fertiliser and cement, fuels, foods, carbon nanotubes

- 6.1.1. Current situation

- 6.1.2. Growth ahead making higher value materials such as carbon nanotubes

- 6.1.3. Europe takes the lead in decarbonising industrial hydrogen: 2025 initiatives

- 6.2. Cement and concrete decarbonisation

- 6.2.1. The challenge and the place of hydrogen

- 6.2.2. First net zero concrete placement using synthetic limestone aggregate

- 6.2.3. Use of hydrogen for cement and concrete decarbonisation

- 6.2.4. Appraisal of examples, latest research and intentions for hydrogen in cement manufacture

- 6.2.5 24 of the companies and primary countries involved

- 6.3. Hydrogen in oil refineries and chemical engineering

- 6.3.1. Rationale

- 6.3.2. Current examples of hydrogen in the oil and gas industry

- 6.3.3. Key applications and prospects

- 6.4. Hydrogen use in fertiliser production 2025-2045, the ammonia route and prospects

- 6.5. Decarbonising steel making with hydrogen and its 2025 research and prospects

- 6.6. Hydrogenation of carbon dioxide for sustainable fuel and chemical production: 2025 research

7. Niche fuel where full electrification is inadequate or impracticable: some aerospace, ships, trains, on-road, off-road vehicles, microgrids

- 7.1. Overview:

- 7.1.1. General situation through 2025 and coverage in this chapter

- 7.1.2. Why hydrogen prospects are greater for very large vehicles

- 7.1.3. Hydrogen as a hybrid solution for vehicles land, water and air

- 7.2. Hydrogen bus and tram minority share and prospects

- 7.3. Hydrogen trucks

- 7.4. Material handling and construction vehicles including forklift trucks

- 7.5. Mining vehicles

- 7.6. Agricultural vehicles

- 7.7. Military vehicles

- 7.8. Trains

- 7.9. Boats and ships

- 7.9.1. Overview

- 7.9.2. Progress towards energy independent ships without hydrogen

- 7.9.3. Hydrogen options as ship fuel loaded or made on-board including planned Energy Observer 2 ship

- 7.9.4. International Maritime Organisation forecasts, actions, view of hydrogen as ship fuel

- 7.9.5. Hydrogen ships and boats: practical experience through 2025

- 7.9.6. Research progress in 2025

- 7.10. Hydrogen for aircraft: SAF and pure hydrogen initiative, research, appraisal through 2025

- 7.10.1. Current situation

- 7.10.2. Sustainable Aviation Fuel SAF involving hydrogen

- 7.10.3. Pure hydrogen aviation

- 7.10.4. Research in 2025 on hydrogen aviation materials and issues

- 7.10.5. Enthusiasm meets decline in interest

- 7.11. Hydrogen microgrids and their 2025 research

- 7.12. Hydrogen combined heat and power reinvented