|

|

市場調査レポート

商品コード

1615494

リチウムイオンキャパシタおよびその他のバッテリースーパーキャパシタハイブリッド:市場・技術 (2025-2045年)Lithium-ion Capacitors and Other Battery Supercapacitor Hybrids: Markets, Technology, 2025-2045 |

||||||

|

|||||||

| リチウムイオンキャパシタおよびその他のバッテリースーパーキャパシタハイブリッド:市場・技術 (2025-2045年) |

|

出版日: 2024年11月30日

発行: Zhar Research

ページ情報: 英文 476 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

熱核反応炉、電磁兵器、土木機械、スマートメーターに共通するものは何でしょうか?これらはすべてリチウムイオンキャパシタ (LIC) を使用しています。これらはスーパーキャパシタとバッテリーの中間のようなもので、しばしば両方の長所を兼ね備えています。

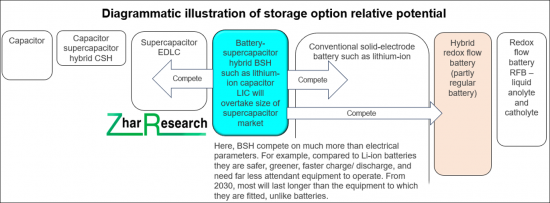

この重要性は、ハイブリッドスーパーキャパシタやスーパーバッテリーといった紛らわしい用語によって見過ごされがちですが、世界はLICの方向に進んでおり、その例としてはAIデータセンターが電力と信頼性を重視するようになっていることが挙げられます。ここでLICは、より安全で、より長寿命で、より高速に動作・回復する無停電電源装置として使用されています。金属イオン電池の市場規模には及ばない見通しであるものの、LICはスーパーキャパシタを追い越すと考えられています。その他のバッテリースーパーキャパシタハイブリッド (BSH) も含めると、売上は20年以内に年間100億米ドルを超えると予測されています。

当レポートでは、リチウムイオンキャパシタ (LIC) およびその他のバッテリースーパーキャパシタハイブリッド (BSH) の市場および技術を調査し、技術の種類と概要、市場ニーズとその変化、市場影響因子の分析、技術ロードマップ・研究開発動向、用途別の展望、用途・技術別の市場予測、主要企業の分析などをまとめています。

目次

第1章 エグゼクティブサマリー・結論

- このレポートの目的

- この分析の調査手法

- 定義

- エネルギー貯蔵ツールキット

- 13の主な結論:LICを含むBSH市場

- インフォグラム:もっとも影響力のある市場ニーズ

- インフォグラム:BSHと疑似コンデンサの相対的な商業的重要性

- LICを含むEDLCとBSHの提供価値と用途

- EDLCとBSHの技術の使用例:応用分野

- 大型機器向けLICとEDLCの供給と潜在力の分析

- 18の主な結論:技術とメーカー

- インフォグラム:エネルギー密度、電力密度、寿命、サイズ、重量の妥協

- 貯蔵容量を少なくする戦略により、BSHの採用可能性が高まる

- 研究の方向転換の必要性:5コラム・7ライン

- 2024年のBSHとEDLCの研究活動:国別・技術別

- SWOT評価・ロードマップ

- 市場を動かすBSHイベントのロードマップ:技術、産業、市場

- バッテリースーパーキャパシタハイブリッド:30ライン別予測

第2章 バッテリースーパーキャパシタハイブリッド (BSH):ニーズ、ツールキット、製造の概要

- エネルギー貯蔵ツールキット

- エネルギー貯蔵市場

- 技術の最適化と技術の競合問題:イントロダクション

- LIC、リチウムイオン電池、スーパーキャパシタ:34パラメータを比較

- LICフォーマットと隣接技術の比較

- さらに読む

第3章 将来のリチウムイオンコンデンサの設計と競争上の位置付け

- 概要

- 設計上の問題

- 研究の進歩の分析

- 特許の例

- さらに読む

第4章 その他の金属イオンコンデンサの設計と進歩:鉛イオン、ニッケルイオン、カリウムイオン、ナトリウムイオン、亜鉛イオンコンデンサ

- 概要

- 鉛イオンコンデンサ:歴史、原理、研究

- ニッケルイオンコンデンサ:2024年の進歩

- カリウムイオンコンデンサ:2024年の進歩

- ナトリウムイオンコンデンサ:2024年の進歩

- 亜鉛イオンコンデンサ:2024年の進歩

第5章 バッテリースーパーキャパシタハイブリッドストレージ向けのその他の新しい化学物質

- 概要

- 根拠

- 研究パイプライン

第6章 研究パイプライン分析で使用されている新興材料

- 概要

- 売上を牽引するスーパーキャパシタの主要なパラメータに影響を与える要因

- 一般的な材料の選択

- スーパーキャパシタの改善戦略

- スーパーキャパシタとその変種におけるグラフェンの重要性

- スーパーキャパシタのその他の2Dおよび関連材料と研究例

- スーパーキャパシタ電極材料と構造の研究

- 以前の重要な例

- スーパーキャパシタ用電解質およびその変種

- 膜の難易度と使用および提案された材料

- 自己放電の削減:大きな必要性があるが、研究は少ない

第7章 新興BSH市場:エネルギー、自動車、航空宇宙、軍事、電子機器、その他の分野における基本的動向と最良の見通しの比較

- 市場への影響

- 概要

- スーパーキャパシタの相対的な商業的重要性

- もっとも有望なスーパーキャパシタファミリーの提供価値

- 市場の潜在力と製造規模の不一致

- 大型デバイスの供給と可能性の分析

第8章 エネルギー分野の新興BSH市場

- 概要:2024~2044年の見通し

- 核融合発電

- 断続性の少ないグリッド発電:波力、潮流、高高度風力

- 送電網外のスーパーキャパシタ:新たな大きな機会

- 水力発電

第9章 陸上車両および海洋用途の台頭:自動車、バス、トラックトレイン、オフロード建設、農業、鉱業、林業、マテリアルハンドリング、ボート、船舶

- 陸上輸送におけるスーパーキャパシタの使用の概要

- オンロード用途は減少傾向にあるが、オフロード用途は活況

- 陸上車両におけるスーパーキャパシタとその派生製品:オンロードからオフロードへの移行

- 大型スーパーキャパシタを搭載した新しい車両および関連設計

- 路面電車とトロリーバスの再生と架線ギャップへの対処

- マテリアルハンドリング (イントラロジスティクス) スーパーキャパシタ

- 大型スーパーキャパシタの鉱業および採石業での使用

- 車両用大型スーパーキャパシタに関する研究

- 列車用大型スーパーキャパシタと線路側回生

- 大型スーパーキャパシタの海洋利用と研究パイプライン

第10章 6G通信、エレクトロニクス、小型電気機器における新たな用途

- 概要

- 小型BSHとスーパーキャパシタの用途の大幅な拡大

- ウェアラブル、スマートウォッチ、スマートフォン、ラップトップなどのデバイスにおけるBSHとスーパーキャパシタ

- 6G通信:2030年からの新たなBSH市場

- 資産追跡成長市場

- バッテリーサポートとバックアップ電源スーパーキャパシタ

- ハンドヘルド端末BSHとスーパーキャパシタ

- IoTノード、ワイヤレスセンサー、BSHとスーパーキャパシタを使用したエネルギー収集モード

- データトランスミッション、ロック、ソレノイドの起動、電子インクの更新、LEDフラッシュ用のピーク電力

- スマートメーター

- スポット溶接

第11章 新たな軍事および航空宇宙用途

- 概要

- 軍事用途:電気力学兵器と電磁兵器が大きな焦点に

- 軍事用途:無人航空機、通信機器、レーダー、飛行機、船舶、戦車、衛星、誘導ミサイル、弾薬点火装置、電磁装甲

- 航空宇宙:衛星、航空機電動化 (MEA)、その他の成長機会

第12章 BSH (LICを含む)、スーパーキャパシタ、擬似キャパシタ、CSH116社の評価

- 116社の比較から得た指標の分析

- 116社のスーパーキャパシタ、擬似キャパシタ、BSH (LICを含む) メーカー

Summary

What do thermonuclear reactors, electromagnetic weapons, earthmoving machines and smart meters have in common? They all use lithium-ion capacitors LIC, something between a supercapacitor and a battery and often the best of both worlds. The new Zhar Research 476-page report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045" explains.

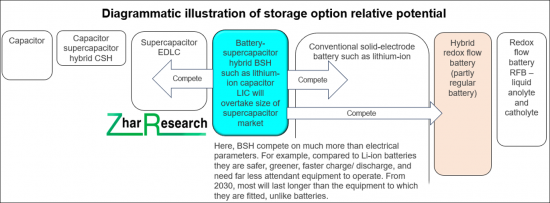

Their importance is often missed by confusing terms like hybrid supercapacitor and superbattery, but the world is going their way, an example being artificial intelligence data centers becoming power and reliability-oriented. Consequently, they appear there as safer, longer lived, uninterrupted power supplies that act and recover faster. While they will not match the market size of metal ion batteries, they will overtake supercapacitors. Include other battery-supercapacitor hybrids BSH and the analysis predicts over $10 billion yearly sales within 20 years.

Here are some of the questions answered:

- Gaps in the market?

- Next winners and losers?

- Full list of technology options?

- SWOT appraisals by technology?

- Evolving market needs 2025-2045?

- Where should research be redirected?

- Market forecasts by technology 2025-2045?

- Deep analysis of research advances in 2024?

- What follows LIC of the BSH choices and why?

- Technology readiness and potential improvement?

- Market drivers and forecasts of background parameters?

- Potential winners and losers by company and technology?

- Detailed technology parameter comparisons with comment?

- Detailed appraisal of all the leading proponents and their strategies?

- New applications and technology milestones in roadmaps by year 2025-2045?

This commercially-oriented report is both lucid and thorough, involving:

6 SWOT appraisals, 12 Chapters, 30 Forecast lines 2025-2045, 30 Key conclusions, 107 New infograms, over 116 Companies and 153 best research papers from 2023/4 reviewed.

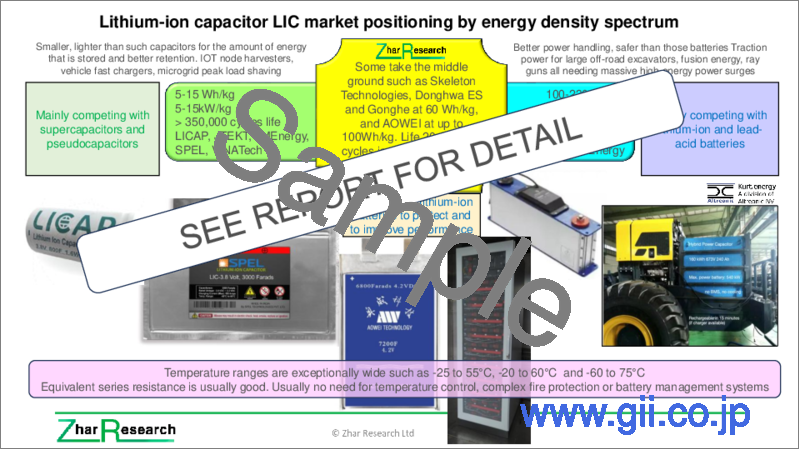

The Executive summary and conclusions (38 pages) is sufficient in itself including roadmaps and those 30 forecasts. Chapter 2. Covers "Battery supercapacitor hybrids BSH: introduction to need, toolkit and manufacture" in 25 pages putting them in context of all evolving storage with many examples including e-bikes, wind turbines, trains, trams. Learn the chemistry and structure involved in tailoring them to be supercapacitor-like, battery-like or something in-between because there are commercial successes beginning for all of those options.

Chapter 3. "Future lithium-ion capacitor design and competitive position" takes 25 information-packed pages to reveal these specific constructions from the smallest electronics components to heavy engineering. Here are the issues and new market to be addressed. Chapter 4. "Other metal-ion capacitors design and progress: Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors" , in 20 pages clarifies the best research and targetted markets for these with much advance in 2024. Why most work on sodium-ion capacitors? Why is nickel-ion capacitor NIC, particularly with cobalt receiving equal attention? Why considerable work on potassium-ion and zinc-ion capacitors? Involvement of graphene?

15 pages of Chapter 5. "Other emerging chemistries for battery-supercapacitor hybrid storage" concerns wild cards such as Zeolite Ionic Frameworks, MXene and MOFs composites for BSH and the relevance of metal alloys and manganese compounds. After these simpler chapters, you are ready for the dep dive of Chapter 6. "Emerging materials employed with 2024, 2023 research pipeline analysis" going closely into electrodes, electrolytes and membranes in 50 pages with a flood of new research analysed and many infograms clarifying choices and trends.

Because BSH can be tailored to such a wide range of size and performance, the emerging applications and competitive positioning needs careful investigation and that is provided in Chapter 7. Emerging BSH markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other. This is 11 pages because many applications have already been covered and more lie ahead.

Chapter 8. Energy sector emerging BSH markets (49 pages) reveals an extraordinary breadth of opportunity from recent adoption for the Japan Tokamak thermonuclear reactor, wind turbines and many uses in grids and microgrids, even electric vehicle fast chargers. This survey also includes supercapacitor applications likely to switch to BSH, initially LIC. Chapter 9. "Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships" (50 pages) is equally broad in reach. Chapter 10. Emerging applications in 6G Communications, electronics and small electrics (29 pages) is mainly revealing opportunities for small LIC. Chapter 11, "Emerging military and aerospace applications" (20 pages) often involves hand-held to very large equipment, even aircraft.

Chapter 12. "116 BSH (including LIC), supercapacitor, pseudocapacitor, CSH companies assessed in 10 columns and 112 pages" looks at most supercapacitor manufacturers because they are either making LIC or eyeing that opportunity. With many pictures, parameters and news items, you can see the commercial activities and objectives in detail.

Whether you wish to supply materials, devices or systems incorporating BSH, the report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045" is your essential reading.

CAPTION: Diagrammatic illustration of storage option relative potential. Source Zhar Research report, "Lithium-ion capacitors and other battery supercapacitor hybrids: markets, technology, 2025-2045".

Table of Contents

1. Executive summary and conclusions

- 1.1. Purpose of this report

- 1.2. Methodology of this analysis

- 1.3. Definitions

- 1.4. Energy storage toolkit

- 1.4.1. The basic options

- 1.4.2. BSH have some of superlatives of a supercapacitor combined with those of a battery

- 1.4.3. BSH and in particular LIC create some valuable tipping points

- 1.4.4. The many advantages of lithium-ion capacitors LIC and the energy density choices

- 1.4.5. How strategies for improving supercapacitors will benefit BSH including LIC

- 1.4.6. Prioritisation of active electrode-electrolyte pairings

- 1.5 13 Primary conclusions: BSH markets including LIC

- 1.6. Infogram: the most impactful market needs

- 1.7. Infogram: relative commercial significance of BSH and pseudocapacitors 2024-2044

- 1.8. Some market propositions and uses of EDLC and BSH including LIC 2024-2044

- 1.9. Technology uses by applicational sector for EDLC vs BSH - examples

- 1.10. Analysis of supply and potential of LIC and EDLC for large devices

- 1.11 18 primary conclusions: technologies and manufacturers

- 1.12. Infogram: the energy density-power density, life, size and weight compromise

- 1.13. How strategies to require less storage make BSH more adoptable

- 1.14. How research needs redirecting: 5 columns, 7 lines

- 1.17. BSH and EDLC research activity by country and technology 2024

- 1.18. SWOT appraisals and roadmap 2025-2045

- 1.18.1. SWOT appraisal of supercapacitors and BSH

- 1.18.2. SWOT appraisal of LIC and other BSH

- 1.18.3. SWOT appraisal of graphene LIC

- 1.18.4. SWOT appraisal of batteryless storage technologies generally

- 1.19. Roadmap of market-moving BSH events - technologies, industry and markets 2025-2045

- 1.20. Battery supercapacitor hybrids: forecasts by 30 lines 2025-2045

- 1.20.1. Competitors RFB beyond grid, EDLC, Pseudocapacitor and BSH $ billion 2025-2045

- 1.20.2. Battery supercapacitor hybrid storage BSH by type: BSH, Non-lithium, LIC, banks $ billion 2025-2045

- 1.20.3. Battery supercapacitor hybrids BSH value market percent by four regions 2025-2045

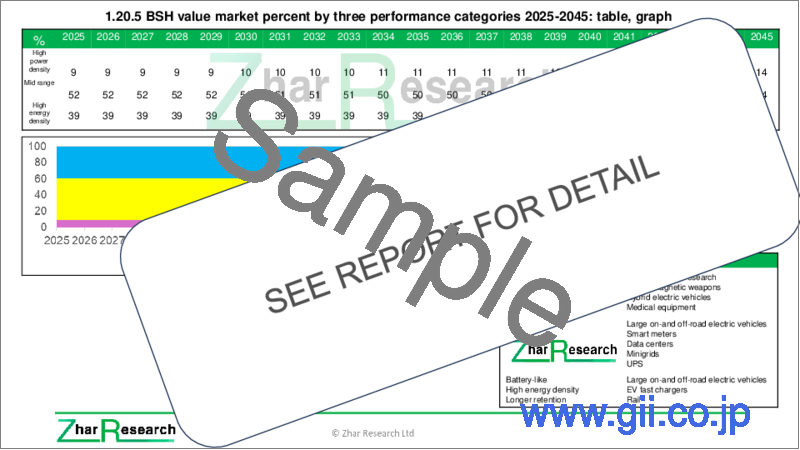

- 1.20.4. BSH value market percent by three performance categories 2025-2045

- 1.20.5. Battery supercapacitor hybrid BSH value market % by two Wh categories 2025-2045

- 1.20.6. BSH value market % by three electrode morphologies 2025-2045

- 1.20.7. BSH product life years and life of equipment to which it is fitted years 2014-2045

- 1.20.8. Market for seven types of equipment fitting BSH $ billion 2025-2045

- 1.20.9. Energy storage device market battery vs batteryless $ billion 2025-2045

2. Battery supercapacitor hybrids BSH: introduction to need, toolkit and manufacture

- 2.1. Energy storage toolkit

- 2.1.1. The basic options

- 2.1.2. How BSH will compete with other technologies

- 2.1.3. Electrochemical vs electrostatic storage

- 2.1.4. Examples of competition between capacitor, supercapacitor and battery technologies

- 2.1.5. Supercapacitors and BSH replacing batteries in ebikes

- 2.2. Energy storage market

- 2.2.1. Overview

- 2.2.2. Energy harvesting creates markets for BSH storage

- 2.2.3. The beyond-grid opportunity for large BSH

- 2.2.4. Need for conventional BSH formats but also structural electrics and electronics

- 2.3. Introduction to technology optimisation and technology competition issues

- 2.3.1. Overview

- 2.3.2. BSH internal design compared to others

- 2.3.3. Hot topics include LIB and graphene

- 2.3.4. BSH voltage, charge retention and ageing issues compared to competition

- 2.3.5. BSH competitive position on energy density vs power density

- 2.3.6. Days storage vs rated power return MW for storage technologies

- 2.4. 34 parameters for LIC, Li-ion battery and supercapacitor compared

- 2.5. LIC formats compared with adjacent technologies

- 2.6. Further reading

3. Future lithium-ion capacitor design and competitive position

- 3.1. Overview

- 3.2. Design issues

- 3.2.1. Basic structure

- 3.2.2. Current applications to optimise

- 3.2.3. Future applications to optimise

- 3.2.4. Performance issues being addressed

- 3.2.5. Lithium-ion capacitor LIC market positioning by energy density spectrum

- 3.3. Analysis of research advances through 2024

- 3.4. Examples of patents

- 3.5. Further reading -Zhar Research report putting LIB in supercapacitor context

4. Other metal-ion capacitors design and progress: Lead-ion, nickel-ion, potassium-ion, sodium-ion, zinc-ion capacitors

- 4.1. Overview

- 4.2. Lead ion capacitors: history, rationale , research

- 4.3. Nickel-ion capacitors: advances in 2024

- 4.4. Potassium-ion capacitors: advances in 2024

- 4.5. Sodium-ion capacitors: advances in 2024

- 4.5. Zinc-ion capacitors: advances in 2024

5. Other emerging chemistries for battery-supercapacitor hybrid storage

- 5.1. Overview

- 5.2. Rationale

- 5.3. Research pipeline

- 5.3.1. Zeolite Ionic Frameworks for BSH

- 5.3.2. MXene and MOFs composites for BSH

- 5.3.2. Metal alloys and manganese compounds in BSH

6. Emerging materials employed with 2024, 2023 research pipeline analysis

- 6.1. Overview

- 6.2. Factors influencing key supercapacitor parameters driving sales

- 6.3. Materials choices in general

- 6.4. Strategies for improving supercapacitors

- 6.4.1. General

- 6.4.2. Prioritisation of active electrode-electrolyte pairings

- 6.5. Significance of graphene in supercapacitors and variants

- 6.5.1. Overview

- 6.5.2. Graphene supercapacitor SWOT appraisal

- 6.5.3. Vertically-aligned graphene for ac and improved cycle life

- 6.5.4. Frequency performance improvement with graphene

- 6.5.5. Graphene textile for supercapacitors and sensors

- 6.5.6. Eleven graphene supercapacitor material and device developers and manufacturers compared in five columns

- 6.6. Other 2D and allied materials for supercapacitors with examples of research

- 6.6.1. MOF and MXene and combinations are the focus

- 6.6.2. Tantalum carbide MXene hybrid as a biocompatible supercapacitor electrodes

- 6.6.3. CNT

- 6.7. Research on supercapacitor electrode materials and structures in 2024

- 6.8. Research on supercapacitor electrode materials and structures in 2023

- 6.9. Important examples from earlier

- 6.10. Electrolytes for supercapacitors and variants

- 6.10.1. General considerations including organic electrolytes

- 6.10.2. Supercapacitor electrolyte choices

- 6.10.3. Focus on aqueous supercapacitor electrolytes

- 6.10.4. Ionic liquid electrolytes in supercapacitor research

- 6.10.5. Focus on solid state, semi-solid-state and flexible electrolytes

- 6.10.6. Hydrogels as electrolytes for semi-solid supercapacitors

- 6.10.7. Supercapacitor concrete and bricks

- 6.11. Membrane difficulty levels and materials used and proposed

- 6.12. Reducing self-discharge: great need, little research

7. Emerging BSH markets : basic trends and best prospects compared between energy, vehicles, aerospace, military, electronics, other

- 7.1. Implications for the market 2025-2045

- 7.2. Overview

- 7.3. Relative commercial significance of supercapacitor variants 2025-2045

- 7.4. Market propositions of the most-promising supercapacitor families 2025-2045

- 7.5. Mismatch between market potential and sizes made

- 7.6. Analysis of supply and potential for large devices

- 7.6.1. Overview

- 7.6.2. Largest lithium-ion capacitors offered by manufacturer with parameters and uses

- 7.6.3. Markets for the largest BSH

- 7.6.4. Market analysis for the six most important applicational sectors

8. Energy sector emerging BSH markets

- 8.1. Overview: poor, modest and strong prospects 2024-2044

- 8.2. Thermonuclear power

- 8.2.1. Overview

- 8.3.2. Applications of supercapacitors in fusion research

- 8.3.3. Other thermonuclear supercapacitors

- 8.3.4. Hybrid supercapacitor banks for thermonuclear power: Tokyo Tokamak

- 8.3.5. Helion USA supercapacitor bank

- 8.3.6. First Light UK supercapacitor bank

- 8.3. Less-intermittent grid electricity generation: wave, tidal stream, elevated wind

- 8.3.1. Supercapacitors in utility energy storage for grids and large UPS

- 8.3.2. 5MW grid measurement supercapacitor

- 8.3.3. Tidal stream power applications

- 8.3.4. Wave power applications

- 8.3.5. Airborne Wind Energy AWE applications

- 8.3.6. Taller wind turbines tapping less-intermittent wind: protection, smoothing

- 8.4. Beyond-grid supercapacitors: large emerging opportunity

- 8.4.1. Overview

- 8.4.2. Beyond-grid buildings, industrial processes, minigrids, microgrids, other

- 8.4.3. Beyond-grid electricity production and management

- 8.4.4. The off-grid megatrend

- 8.4.5. The solar megatrend

- 8.4.6. Hydrogen-supercapacitor rural microgrid Tapah, Malaysia

- 8.4.7. Supercapacitors in other microgrids, solar buildings

- 8.4.8. Fast charging of electric vehicles including buses and autonomous shuttles

- 8.5. Hydro power

9. Emerging land vehicle and marine applications: automotive, bus, truck train, off-road construction, agriculture, mining, forestry, material handling, boats, ships

- 9.1. Overview of supercapacitor use in land transport

- 9.2. On-road applications face decline but off-road vibrant

- 9.3. How the value market for supercapacitors and their variants in land vehicles will move from largely on-road to largely off-road

- 9.4. Emerging vehicle and allied designs with large supercapacitors

- 9.4.1. Industrial vehicles: Rutronik HESS

- 9.4.2. Heavy duty powertrains and active suspension

- 9.5. Tram and trolleybus regeneration and coping with gaps in catenary

- 9.6. Material handling (intralogistics) supercapacitors

- 9.7. Mining and quarrying uses for large supercapacitors

- 9.7.1. Overview and future open pit mine and quarry

- 9.7.2. Mining and quarrying vehicles go electric

- 9.7.3. Supercapacitors for electric mining and construction

- 9.8. Research relevant to large supercapacitors in vehicles

- 9.9. Large supercapacitors for trains and their trackside regeneration

- 9.9.1. Overview

- 9.9.2. Supercapacitor diesel hybrid and hydrogen trains

- 9.9.3. Supercapacitor regeneration for trains on-board and trackside

- 9.9.4. Research pipeline relevant to supercapacitors for trains

- 9.10. Marine use of large supercapacitors and the research pipeline

10. Emerging applications in 6G Communications, electronics and small electrics

- 10.1. Overview

- 10.2. Substantial growing applications for small BSH and supercapacitors

- 10.3. BSH and supercapacitors in wearables, smart watches, smartphones, laptops and similar devices

- 10.3.1. General

- 10.3.2. Wearables needing BSH and supercapacitors

- 10.4. 6G Communications: new BSH market from 2030

- 10.4.1. Overview with needs

- 10.4.2. New needs and 5G inadequacies

- 10.4.3. 6G massive hardware deployment: proliferation but many compromises

- 10.4.4. Objectives of NTTDoCoMo, Huawei, Samsung and others

- 10.4.5. Progress from 1G-6G rollouts 1980-2044

- 10.4.6. 6G underwater and underground

- 10.5. Asset tracking growth market

- 10.6. Battery support and back-up power supercapacitors

- 10.7. Hand-held terminals BSH and supercapacitors

- 10.8. Internet of Things nodes, wireless sensors and their energy harvesting modes with BSH and supercapacitors

- 10.8.1. Overview

- 10.8.2. Sensor inputs and outputs

- 10.8.3. Ten forms of energy harvesting for sensing and power for sensors

- 10.8.4. Supercapacitor transpiration electrokinetic harvesting for battery-free sensor power supply

- 10.9. Peak power for data transmission, locks, solenoid activation, e-ink update, LED flash

- 10.10. Smart meters

- 10.11. Spot welding

11. Emerging military and aerospace applications

- 11.1. Overview

- 11.2. Military applications: electrodynamic and electromagnetic weapons now a strong focus

- 11.2.1. Overview: laser weapons, beam energy weapons, microwave weapons, electromagnetic guns

- 11.2.2. Electrodynamic weapons: coil and rail guns

- 11.2.3. Electromagnetic weapons disabling electronics or acting as ordnance

- 11.2.4. Pulsed linear accelerator weapon

- 11.3. Military applications: unmanned aircraft, communication equipment, radar, plane, ship, tank, satellite, guided missile, munition ignition, electromagnetic armour

- 11.3.1. CSH sales increasing

- 11.3.2. Force Field protection

- 11.3.3. Supercapacitor- diesel hybrid heavy mobility army truck

- 11.3.4 17 other military applications now emerging

- 11.4. Aerospace: satellites, More Electric Aircraft MEA and other growth opportunities

- 11.4.1. Overview: supercapacitor numbers and variety increase

- 11.4.2. More Electric Aircraft MEA

- 11.4.3. Better capacitors sought for aircraft

12. 116 BSH (including LIC), supercapacitor, pseudocapacitor, CSH companies assessed in 10 columns and 112 pages

- 12.1. Analysis of metrics from the comparison of 116 companies

- 12.2. 116 supercapacitor, pseudocapacitor and BSH (including LIC) manufacturers assessed in 10 columns across 108 pages