|

|

市場調査レポート

商品コード

1880930

データセンター、マイクログリッド、住宅向けLDES (長期間エネルギー貯蔵):技術動向・市場の展望 (2026-2036年)Long Duration Energy Storage for Datacenters, Microgrids, Houses: Technologies, Markets 2026-2036 |

||||||

|

|||||||

| データセンター、マイクログリッド、住宅向けLDES (長期間エネルギー貯蔵):技術動向・市場の展望 (2026-2036年) |

|

出版日: 2025年11月28日

発行: Zhar Research

ページ情報: 英文 394 Pages

納期: 即日から翌営業日

|

概要

遅延電力は送電網以外にも非常に多くの用途で必要とされています。当レポートでは、2046年までにこの分野の市場規模が970億米ドルに達し、新興LDES (長期間エネルギー貯蔵) 市場全体の36%を占めると予測しています。 ここで対象となる世界は、オフグリッドや“フリンジ・オブ・グリッド” (まれにバックアップとしてのみグリッドを使うような系統周縁部) を含んでおり、要求仕様は送電網用とは大きく異なります。送電網向けよりも100倍のユニット数が必要になる一方で、それぞれは小型で設置スペースに制約があり、建物内でも安全で、小さなフットプリントで積み重ね可能、遠隔地向けに長寿命かつ高信頼性が求められます。2046年より前に多くのソーラーハウスでLDESが大量採用され、その多くがオフグリッドになると本レポートでは予測しています。本レポートは非常に精査されており、全10章構成、17件のSWOT評価、2026-2046年の24本の予測ラインを収録し、100社以上の企業と、2025年までの研究動向を調査対象としています。

目次

第1章 エグゼクティブサマリーと結論

- 本レポートの目的と独自の範囲

- 本分析の調査手法

- 現在のグリッド外のLDESおよび類似の例

- 技術の基礎

- 電化とLDESの定義、ニーズ、候補者に関する18の主要な結論

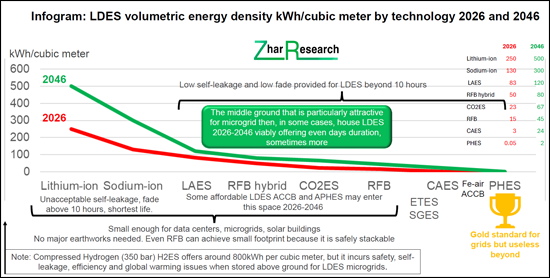

- インフォグラム:LDES体積エネルギー密度:技術別 (2026年・2046年)

- インフォグラム:マイクログリッドおよび類似のLDESの代替案 (2026-2046年)

- インフォグラム:2036~46年におけるオフグリッド太陽光住宅+LDESのオール電化イメージ

- LDESの顧客タイプと潜在的なエネルギーサービス

- 19列・10技術別の潜在的なLDES性能

- LDESの3サイズ区分それぞれの2026-2046年の技術優位性 (現時点のエビデンスに基づく)

- 技術別に見た設置可能サイト数 (2026-2046年) :マイクログリッドの機会を示すもの

- 技術別のLDES必要量の計算とその意味

- 現在および将来のLDESの持続時間と供給可能電力

- 広義のマイクログリッドLDES技術に関する9件のSWOT評価

- LDESロードマップ(2026-2046年)

- 2026-2046年の市場予測 (24本の予測ライン、グラフ、解説)

第2章 LDESの必要性と設計原則

- エネルギーの基礎

- 定置型エネルギー貯蔵とLDESの基礎

- 2025-2026年のLDESプロジェクト (主要技術サブセットを示す)

- 科学的カテゴリー別LDES:8パラメーターで比較

- 電気化学的LDESオプションの説明

- 多くの電池は10時間以上の持続時間では競争力を失う

- 2026年から2046年までのLDES全体に関する概要レポート

第3章 マイクログリッドLDESの代替案

- 概況

- インフォグラム:LDESからの13の代替案 (2026-2046年)

- 世界の事例:デンマーク、シンガポール、中国、米国

- 風力、太陽光、LDESをほとんど/全く必要としないオプションの設備利用率

- LDES代替案に関する2025年の広範な研究

- 2025年の断続的電力供給に対応する家庭用エネルギーマネジメント (HEMS) の研究

第4章 先進揚水発電 (APHES)

- 概要

- 概要

- 鉱山跡地の利用

- 加圧地下:Quidnet Energy USA

- 重い流体を使い丘陵を活用:RheEnergise UK

- 海水や塩水の利用

- Sizeable Energy (イタリア) 、StEnSea (ドイツ) 、Ocean Grazer (オランダ)

- ハイブリッド技術:2024年と2025年の研究の進歩

- 2024年と2025年の研究の進歩

- APHESのSWOT評価

第5章 マイクログリッドLDESのためのH2ESとCAES

- 水素エネルギー貯蔵 (H2ES)

- マイクログリッド向け圧縮空気エネルギー貯蔵 (CAES)

第6章 レドックスフロー電池 (RFB)

- 概要

- LDES向けに研究がシフト

- 2026-2046年におけるLDES向けRFBの成功

- SWOT分析とパラメーター比較 (RFB for LDES)

- 45社のRFB企業を8項目で比較 (名称、ブランド、技術、成熟度、非グリッド焦点、LDES焦点、コメント)

- RFB技術 (2025年までの研究含む)

- 材料別の具体的な設計:バナジウム、鉄およびその変種、その他の金属配位子、ハロゲンベース、有機、マンガン、2025年の研究、3つのSWOT評価

- RFBメーカープロファイル

- 2025年のさらなる研究

第7章 固体重力エネルギー貯蔵 (SGES)

- 概要 (2025年研究含む)

- ARES USA

- Energy Vault スイス、米国、中国、インドのライセンシー

- Gravitricity

- Green Gravity Australia

- SinkFloatSolutions France

第8章 高度従来型建設電池 (ACCB)

- 概要

- 8社のACCBメーカーを8項目で比較

- パラメーター評価とSWOT (ACCB for LDES)

- 金属空気電池

- 高温電池

- Inlyte、Altris、HiNa、Tiamat、Natron、Faradionなどの金属イオン電池

- ニッケル水素電池:EnerVenue USAのSWOT

第9章 液化ガスエネルギー貯蔵 (LGES):液体空気 (LAES) またはCO2

- 概要

- LAES LDES

- 液体および圧縮二酸化炭素LDES

第10章 遅延電力のための熱エネルギー貯蔵 (ETES)

- 2025年の概要と研究の進展

- 2025年と2024年の研究の進歩

- 失敗の教訓:Siemens Gamesa, Azelio, Steisdal, Lumenion

- 熱機関アプローチの進展:Echogen USA

- 極端な温度と光電変換の利用

- 一つのプラントから遅延熱と電力を販売