|

|

市場調査レポート

商品コード

1349506

センサーの市場・技術・企業 (2024-2044年):インプット・モード・用途・特許・製造業者・研究・ロードマップ・予測Sensor Markets, Technologies, Companies 2024-2044: by Inputs, Modes, Applications, Patents, Manufacturers, Research, Roadmaps, Forecasts |

||||||

|

|||||||

| センサーの市場・技術・企業 (2024-2044年):インプット・モード・用途・特許・製造業者・研究・ロードマップ・予測 |

|

出版日: 2023年09月21日

発行: Zhar Research

ページ情報: 英文 417 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

Zhar ResearchのCEOであるPeter Harrop博士は次のように述べています。「製造業者、インテグレーター、ユーザーのいずれの立場であれ、成長の機会は考えている以上に大きいでしょう。 (中略) 当社では、センサーハードウェア市場全体が20年後には2,500億米ドルの規模に近づくと予測していますが、その中では、2023年の多くの目覚ましい研究の進歩に支えられ、ある分野は非常に急速に成長し、ある分野は衰退するといった変化がますます激しくなるでしょう。例えば、従来型の自動車、従来型の発電、燃料サプライチェーン用のセンサーは、20年間でそのほとんどが減少する見通しです。」

当レポートでは、世界のセンサー市場を包括的に調査し、市場の定義と概要、市場影響因子の分析、センサータイプ・オペレーションモード・産業・用途など各種区分別の最新技術動向、業界リーダー、成功事例、研究パイプラインの分析、市場成長予測、主要企業の分析・比較などをまとめています。

目次

第1章 エグゼクティブサマリー・総論・センサー企業の順位表・ロードマップ・予測

第2章 イントロダクション

第3章 センサー設計・価格設定・採用に影響を与える主な要因

- 定義・インプット・構造・アウトプット

- スマートセンサーの構造と目的

- 重要なセンサーパラメーター

- 光センシングが2024年から2044年に主流になる理由

- 370万件の特許検索から得たセンサーのトレンド

- 氷山の一角・それ以上の展望

- エネルギーハーベスティングの規模の課題と重要性

- 複数センサーのトレンド:スマートフォン、医療予測分析に関する12の例

- バイオミメティクス:皮膚センサー・自己修復センサー・センサーフュージョン

- オンボード電源としてのエナジーハーベスティングの重要性とセンサーの形態

- センサーホストシステム市場の縮小とと車両の簡素化

第4章 パラメーター別分析 (31カテゴリー):技術・製造業者・成功・展望・特許リーダーとトレンド・研究パイプライン・Patsnap予測

- 概要

- 音響 (音) センサー

- アルコールセンサー

- 高度センサー

- 迎え角センサー

- 姿勢センサー

- 血糖センサー

- 血中酸素センサー

- CGM連続血糖モニタリングセンサー

- 化学センサー

- カラーセンサー

- 距離センサー

- フローセンサー

- 力センサー

- 燃料噴射センサー

- 湿度センサー

- 失禁センサー

- イメージセンサー

- レベルセンサー

- 光センサー

- 計測センサー

- 金属センサー

- 湿気センサー

- モーションセンサー

- 位置センサー

- 圧力センサーとひずみセンサー

- 近接センサー

- 温度センサー

- 傾斜センサー

- タッチセンサー

- 振動センサー

- 重量センサー

第5章 オペレーションモード別分析 (31カテゴリー):技術・製造業者・成功・展望・特許リーダーとトレンド・研究パイプライン・Patsnap予測の分析

- 概要

- 加速度センサーと加速度センサー

- 気圧センサー

- バイオセンサー

- カメラセンサー

- 静電容量センサー

- CMOSおよびMOSセンサー

- 電気化学センサー

- 電気力学センサー

- 電気光学センサー

- 静電気センサー

- 光ファイバーおよびTHz導波管センサー

- ジャイロスコープセンサー

- ホール効果センサー

- 誘導センサー

- 赤外線センサー

- インフラサウンドセンサー

- LIDARセンサー

- 磁力計センサー

- MEMSセンサー

- 光学センサー (生体認証光電子メモリトランジスタを含む)

- 光電センサー

- フォトニックセンサー

- 太陽光発電センサー

- 圧電センサー

- ピエゾ抵抗センサー

- 圧電センサー

- 量子センサー

- レーダーセンサー

- サーミスタセンサー

- 熱電センサー

- 摩擦電気センサー

- 超音波センサー

第6章 用途・事業部門別分析 (20カテゴリー):技術・製造業者・成功・展望・特許リーダーとトレンド・研究パイプライン・Patsnap予測の分析

- 概要

- 自動車 (エンジンおよびトラクションモーターセンサーを含む)

- 車載センサー

- エンジンセンサー

- トラクションモーターセンサー

- 環境、鉱山、病原体、ガスセンサー

- 環境

- 病原体センサー

- 鉱業

- ガスセンサー

- 産業用 (IoTセンサーを含む)

- 産業用センサー

- IoTセンサー

- 物流センサー

- 医療、フィットネス、ウェルネスセンサー

- 医療用センサー

- 心臓センサー

- 神経センサー

- ヘルスケアセンサー

- フィットネスセンサー

- 運動センサー

- 通信およびパーソナルエレクトロニクス

- 6G通信センサー

- スマートフォンセンサー

- スマートウォッチセンサー

- ウェアラブルセンサー

第7章 センサー企業トップ16社:プロファイル・特許活動・SWOT分析

- 概要

- Apple:戦略・特許動向・予測・SWOT

- Canon:戦略・特許動向・予測・SWOT

- Denso:戦略・特許動向・予測・SWOT

- F. Hoffmann La Roche:戦略・特許動向・予測・SWOT

- Medtronic:戦略・特許動向・予測・SWOT

- Mitsubishi:戦略・特許動向・予測・SWOT

- Panasonic:戦略・特許動向・予測・SWOT

- Qualcomm:戦略・特許動向・予測・SWOT

- Robert Bosch:戦略・特許動向・予測・SWOT

- Samsung:戦略・特許動向・予測・SWOT

- Sensata Technologies:戦略・特許動向・予測・SWOT

- Sony:戦略・特許動向・予測・SWOT

- TE Connectivity:戦略・特許動向・予測・SWOT

- Teledyne Technologies:戦略・特許動向・予測・SWOT

- Toshiba:戦略・特許動向・予測・SWOT

- Toyota:戦略・特許動向・予測・SWOT

第8章 センサー企業130社の比較:国・能力・Zhar Research戦略スコア

Report Features:

- 8 chapters

- 17 SWOT appraisals

- 20 analyses by business

- 31 analyses by parameter

- 36 analyses by operation mode

- 48 forecast lines 2024-2044

- 97 PatSnap ® engine analyses

- 3.7 million patents searched for trends

- 200+ companies mentioned, most compared

- 417 pages

New Sensor Report Reflects New Realities

It is uniquely affordable, comprehensive and up-to-date. The new, 417-page Zhar Research report, "Sensor markets, technologies, leaders 2024-2044: by inputs, modes, applications, patents, manufacturers, research, roadmaps, forecasts" is now available. Its focus is commercial opportunities and potential partners, acquisitions and competitors. It even identifies several, totally new, large sensor markets ahead.

See the big picture - miss nothing

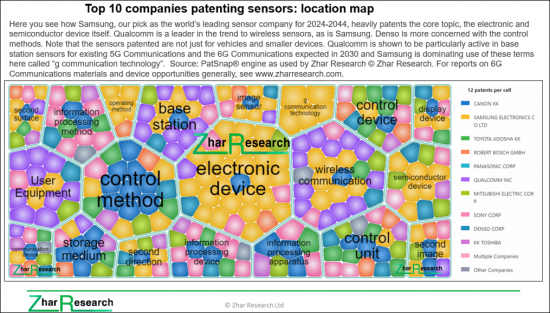

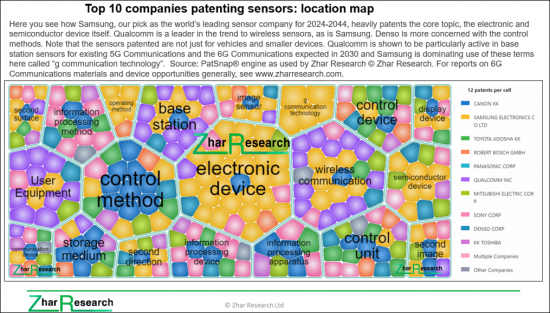

Dr. Peter Harrop, CEO of Zhar Research says, "Your opportunities are probably broader than you realise, whether your interest is as a manufacturer, integrator or user. We therefore recommend that you look at this full coverage before dipping into the many excellent reports on specifics. We see the total sensor hardware market approaching $250 billion in twenty years but within that there is an increasingly rapid change with some sectors declining and some growing very rapidly, supported by the many remarkable research advances in 2023. For example, sensors for conventional vehicles, conventional electricity production and fuel supply chains will mostly decline over twenty years."He adds, "The flood of patenting of LIDAR sensors was misleading because the biggest envisaged application in driverless cars is now doubtful as we warned years ago. Tesla is pulling ahead without it and, in 2023, Bosch exited LIDAR despite being a leading patentor at the time. In contrast, the advent of drone warfare, over 500 million diabetics, 6G Communications, cooling reinvented and massive, long duration grid storage are just some of the huge sensor growth opportunities that we analyse, many completely new. They kick in at various times over the coming twenty years. Looking at it another way, optical sensing, notably at infrared and visible wavelengths has a fabulous future across most applicational sectors for reasons we detail. They include the new THz far-infrared electronics, unmanned mining, factories and vehicles and much more."

Leading sensor companies beyond catalog sellers

Catalog sensor suppliers are the tip of the iceberg because most of the investment, patenting and value sale of sensors is by giant companies selling custom sensors both to others and to themselves. On multiple strategy and achievement criteria, the report identifies and examines the 2024-2044 sensor leader, 11 in the second division and 15 in the third division estimating their sensor sales. This is backed by detail and a strategy score for 130 companies for you to consider as acquisitions, partners or suppliers. Indeed, over 200 sensor manufacturers are mentioned throughout the report. A profusion of new infograms, comparison tables, graphs and images make the report both original and readable.

Chapter 1: Executive summary and conclusions is 45 pages sufficient in themselves. After purpose, scope and methodology you see 19 primary conclusions, based on the latest situation through 2023. There follows sensor basics, trend to multiple sensors with 12 examples for smartphones, a number set to double but already including medical predictive analysis. Learn the industry structure, with a new infogram. Sensor market drivers by sector 2024-2044 are presented, with why light sensing dominates and a new SWOT appraisal of the leader's sensor prospects 2024-2044. Market forecasts in are shown in 48 lines with tables, graphs and including valuation of important new markets for sensors that are emerging in these years. Then comes a detailed new 2024-2044 sensor roadmap.

Chapter 2 Introduction uses eight pages to explain basic sensor design, inputs, categories, pricing issues, and the megatrends now driving sensor adoption. See why more sensors per device will often be more important to you than any increase in device sales.

Chapter 3 concerns primary factors now influencing sensor design, pricing and adoption. Its 40 pages closely examine definitions, inputs, anatomy, outputs, biomimetic and smart sensing, important sensor parameters, which sensing input will dominate 2024-2044. Also see the latest sensor trend from a new search of 3.7 million patents, the 12 most-patented sensors in common parlance and the top patentors in each case. In this chapter you also learn the size challenge with many examples and how multiple sensors, increasingly in one device, serve predictive analysis and sensor fusion. See 14 smartphone sensor families and why the number per phone will double. Understand skin sensors and self-healing sensors. Realise the importance of energy harvesting as on-board power and in reverse as forms of self-powered sensor input with great detail. Electrification is covered in the dramatically simpler electricity production and vehicle design that will collapse demand for many sensors.

Chapters 4 through 6 interprets, by parameter, the latest technologies, manufacturers, successes, prospects, patenting leaders and trends plus the research pipeline with best further reading including much from 2023. There are many new illustrations and informed comments throughout.

Chapter 4 covers latest analysis by parameter measured in 31 categories over 86 information-packed pages with illustrated examples, implications of research papers, patenting, patentors, products on sale, market drivers. Which have collapsing metrics, which are bursting on the scene and why? It is all here in data-based analysis.

Chapter 5 is a new analysis by mode of operation in 36 categories over 87 pages. That includes the new THz waveguide, infrasound, optical memtransistor, piezotronic, quantum and triboelectric sensors and other innovations that can boost your business.

Chapter 6 has analysis by application and business sector in 20 categories and 42 pages. That includes newly important sectors such as sensors for 6G telecommunications, electric vehicle traction motors and Internet of Things nodes each with their sensor patent trends, including forecasts of patenting to 2024, analysis and business appraisal. Other aspects are examination of common-parlance terms medical, healthcare, heart, exercise and fitness sensors each revealed by listing leading patentors, future prospects and research.

Chapter 7 presents in detail what Zhar Research finds to be the top 16 sensor companies with their 17 SWOT analyses, financials, profiles, sensor patent emphasis maps etc.

Finally, Chapter 8. Is called "130 sensor companies compared by country, capability, Zhar Research strategy score". In 29 pages, it includes all the leaders identified earlier by both grouped multiple criteria, simply by patenting rate and it adds a deliberately varied mix of very small to very large other players to give a good understanding of the overall sensor business which runs to around 1000 companies. This chapter is structured as a two-page overview mentioning several other companies then a long table of the 130 chosen sensor companies with columns for company name, country, sensors examples with background and Zhar Research strategy score out of ten based on the scope of sensors made and used plus financial, market and technical positioning in the light of which markets we see growing and which collapsing 2024-2044.

With clarity the emphasis, Zhar Research report , "Sensor markets, technologies, leaders 2024-2044: by inputs, modes, applications, patents, manufacturers, research, roadmaps, forecasts" has a Glossary but also terms explained through the text. There are a large number of latest research papers recommended throughout for those wishing to dig deeper on specifics.

Table of Contents

1. Executive summary and conclusions, sensor company league table, roadmaps and forecasts 2023-2043

- 1.1. Purpose of this report

- 1.2. Scope of this report

- 1.3. Why precision is impossible

- 1.4. Methodology of this analysis

- 1.5. 19 primary conclusions

- 1.6. Sensor basics: biomimetics, inputs, outputs, smart sensors

- 1.7. Trend to multiple sensors: 12 examples for smartphones, medical predictive analysis

- 1.8. Look beyond the tip of the iceberg: catalog sensor vendors are only the tip

- 1.9. Sensor business infogram

- 1.10 Sensor market drivers by sector 2024-2044

- 1.11. Light sensing dominates

- 1.12. Establishing the leading sensor companies for 2024-2044 with leader SWOT

- 1.13. Market forecasts in 48 lines

- 1.13.1. Methodology and reality checks

- 1.13.2. Market growth rate

- 1.13.3. Sensor location hardware market $ billion 2024

- 1.13.4. Sensors global value market for seven application sectors $ billion 2023-2044: table

- 1.13.5. Sensors global value market for seven application sectors $ billion 2023-2044: line graphs with market drivers explained

- 1.13.6. Sensors global value market for seven application sectors $ billion 2023-2044: area graph

- 1.13.7. Global total sensor hardware market $ billion 2024 with linear average

- 1.13.8. Sensor value market % by 6 input media 2024, 2034, 2044: table with sub-categories and reasons

- 1.13.9. Sensor value market % by six input media 2024-2044: graphs

- 1.13.10. Smartphones and their sensor market units, unit price, value market $ billion 2023-2044

- 1.13.11. Rapidly emerging sensor market: Active cooling market forecasts in eight categories $ billion 2023-2043

- 1.13.12. New sensor market: Long Duration Energy Storage LDES market by 11 primary technology applications and new market needs 2023-2043

- 1.13.13. New sensor market: Terahertz electronics 2028-2044

- 1.14. Sensor roadmap 2024-2044

2. Introduction

- 2.1. Definition and design

- 2.2. Categories

- 2.3. Primary parameters measured each become multi-faced

- 2.4. Megatrends driving sensor adoption

- 2.5. Sensor usefulness

- 2.6. Demand trends

3. Primary factors influencing sensor design, pricing and adoption

- 3.1. Definitions, inputs, anatomy, outputs

- 3.2. Smart sensor anatomy and purpose

- 3.3. Important sensor parameters

- 3.4. Why light sensing will dominate 2024-2044

- 3.5. Sensor trend from search of 3.7 million patents

- 3.6. Look beyond the tip of the iceberg: catalog sensor vendors are only the tip

- 3.7. The size challenge and significance of energy harvesting

- 3.8. Trend to multiple sensors: 12 examples for smartphones, medical predictive analysis

- 3.9. Biomimetics: skin sensors, self-healing sensors and sensor fusion

- 3.9.1. Skin sensors and self-healing

- 3.9.2. Sensor fusion

- 3.9.3. Printed sensors

- 3.10. Importance of energy harvesting as on-board power and in reverse as forms of sensor

- 3.10.1. Overview

- 3.10.2. Mechanical (electrodynamic and acoustic) harvesting including acoustic in detail

- 3.10.3. Sources of electromagnetic sensing targets and sensor power options 2023-2043

- 3.10.4. Patenting self-powered sensors using energy harvesting modes or separate harvester modules

- 3.10.5. Importance of flexible laminar energy harvesting and sensing 2023-2043

- 3.11. Shrinking the market for sensors-host system and vehicle simplification

4. Analysis by parameter measured in 31 categories: technologies, manufacturers, successes, prospects, patenting leaders and trends, research pipeline including 2024 Patsnap engine forecasts

- 4.1. Overview

- 4.2. Acoustic (sound) sensors

- 4.3. Alcohol sensors

- 4.4. Altitude sensors

- 4.5. Angle-of-attack sensors

- 4.6. Attitude sensors

- 4.7. Blood glucose sensors

- 4.8. Blood oxygen sensors

- 4.9. CGM continuous glucose monitoring sensors

- 4.10. Chemical sensors

- 4.11. Colour sensors

- 4.12. Distance sensors

- 4.13. Flow sensors

- 4.14. Force sensors

- 4.15. Fuel injection sensors

- 4.16. Humidity sensors

- 4.17. Incontinence sensors

- 4.18. Image sensors

- 4.19. Level sensors

- 4.20. Light sensors

- 4.21. Measurement sensors

- 4.22. Metal sensors

- 4.23. Moisture sensors

- 4.24. Motion sensors

- 4.25. Position sensors

- 4.26. Pressure and strain sensors

- 4.27. Proximity sensors

- 4.28. Temperature sensors

- 4.29. Tilt sensors

- 4.30. Touch sensors

- 4.31. Vibration sensors

- 4.32. Weight sensors

5. Analysis by mode of operation in 36 categories: technologies, manufacturers, successes, prospects, patenting leaders and trends, research pipeline including 2024 Patsnap engine forecasts

- 5.1. Overview

- 5.2. Acceleration sensors and accelerometers

- 5.3. Barometric sensors

- 5.4. Biosensors

- 5.5. Camera sensors

- 5.6. Capacitive sensors

- 5.7. CMOS and MOS sensors

- 5.8. Electrochemical sensors

- 5.9. Electrodynamic sensors

- 5.10. Electro-optic sensors

- 5.11. Electrostatic sensors

- 5.12. Fiber optic and THz waveguide sensors

- 5.13. Gyroscope sensors

- 5.14. Hall effect sensors

- 5.15. Inducive sensors

- 5.16. Infrared sensors

- 5.17. Infrasound sensors

- 5.18. LIDAR sensors

- 5.19. Magnetometer sensors

- 5.20. MEMS sensors

- 5.21. Optical sensors including biometric optoelectronic memtransistors

- 5.22. Photoelectric sensors

- 5.23. Photonic sensors

- 5.24. Photovoltaic sensors

- 5.25. Piezoelectric sensors

- 5.26. Piezoresistive sensors

- 5.27. Piezotronic sensors

- 5.28. Quantum sensors

- 5.29. RADAR sensors

- 5.30. Thermistor sensor

- 5.31. Thermoelectric sensors

- 5.32. Triboelectric sensors

- 5.33. Ultrasound sensors

6. Analysis application and business sector in 20 categories: technologies, manufacturers, successes, prospects, patenting leaders and trends, research pipeline including 2024 Patsnap engine forecasts

- 6.1. Overview

- 6.2. Automotive including engine and traction motor sensors

- 6.2.1. Automotive sensors

- 6.2.2. Engine sensors

- 6.2.3. Traction motor sensors

- 6.3. Environmental, mining, pathogen and gas sensors

- 6.3.1. Environmental

- 6.3.2. Pathogen sensors

- 6.3.3. Mining

- 6.3.4. Gas sensors

- 6.4. Industrial including IoT sensors

- 6.4.1. Industrial sensors

- 6.4.2. IoT sensors

- 6.4.3. Logistics sensors

- 6.5. Medical, fitness, wellness sensors

- 6.5.1. Medical sensors

- 6.5.2. Heart sensors

- 6.5.3. Nerve sensors

- 6.5.4. Healthcare sensors

- 6.5.5. Fitness sensors

- 6.5.6. Exercise sensors

- 6.6. Telecommunications and personal electronics

- 6.6.1. 6G Communications sensors

- 6.6.2. Smartphone sensors

- 6.6.3. Smartwatch sensors

- 6.7. Wearable sensors

7. Top 16 sensor companies for 2024-2044 based on metrics with profiles, patent activity, SWOT analysis

- 7.1. Overview

- 7.2. Apple strategy, patent trends, forecasts, sensor SWOT

- 7.3. Canon strategy, patent trends, forecasts sensor SWOT

- 7.4. Denso strategy, patent trends, forecasts sensor SWOT

- 7.5. F. Hoffmann La Roche strategy, patent trends, forecasts sensor SWOT

- 7.6. Medtronic strategy, patent trends, forecasts sensor SWOT

- 7.7. Mitsubishi strategy, patent trends, forecasts sensor SWOT

- 7.8. Panasonic strategy, patent trends, forecasts sensor SWOT

- 7.9. Qualcomm strategy, patent trends, forecasts sensor SWOT

- 7.10. Robert Bosch strategy, patent trends, forecasts sensor SWOT

- 7.11. Samsung strategy, patent trends, forecasts sensor SWOT

- 7.12. Sensata Technologies strategy, patent trends, forecasts sensor SWOT

- 7.13. Sony strategy, patent trends, forecasts sensor SWOT

- 7.14. TE Connectivity strategy, patent trends, forecasts sensor SWOT

- 7.15. Teledyne Technologies strategy, patent trends, forecasts sensor SWOT

- 7.16. Toshiba strategy, patent trends, forecasts sensor SWOT

- 7.17. Toyota strategy, patent trends, forecasts sensor SWOT

8. 130 sensor companies compared by country, capability, Zhar Research strategy score

- 8.1. Overview

- 8.2. 130 company table comparison by company, examples, background and Zhar Research strategy score