|

|

市場調査レポート

商品コード

1102248

SiC(炭化ケイ素)パワーエレクトロニクス:市場シェア、市場セグメント、市場予測(2022年~2028年)Silicon Carbide Power Electronics: Market Shares, Market Segments and Market Forecasts 2022-2028 |

||||||

| SiC(炭化ケイ素)パワーエレクトロニクス:市場シェア、市場セグメント、市場予測(2022年~2028年) |

|

出版日: 2022年07月10日

発行: WinterGreen Research, Inc.

ページ情報: 英文 326 Pages; 180 Tables & Figures

納期: 即日から翌営業日

|

- 全表示

- 概要

- 図表

- 目次

SiC(炭化ケイ素)は、電気自動車(EV)の次世代自動化と家庭やキャンパスの電力貯蔵を代表するもので、大幅な成長が見込まれる市場です。SiC市場は、2021年~2028年までのCAGRで147.8%の成長が予測されています。

SiCパワーエレクトロニクス市場は、CAGRで37.56%の成長が予測されています。市場の成長は、世界中の二酸化炭素排出量を削減する取り組みに対応して、EVが急速に採用された結果です。SiCは硬度が高く、耐久性に優れ、さまざまなEVの用途でパワーエレクトロニクスを効率的に実装できます。

当レポートでは、SiCパワーエレクトロニクス市場について調査分析し、市場シェア、市場セグメント、市場予測、主要企業などについて、最新の情報を提供しています。

目次

SiCパワーエレクトロニクスのエグゼクティブサマリー

第1章 SiCの市場定義と市場力学

- SiC

- 概要

- 現代のSiC製造

- 特性と用途

第2章 SiCの市場シェアと市場予測

- SiCの市場促進要因

- SiCパワーエレクトロニクスの市場シェア

- SiCの市場予測

- SiCの市場セグメント予測

- SiCの価格

- SiCの価格

- Infineon

- SiCの地域別市場セグメント

- 米国

- 欧州

- アジア太平洋

- 中国

第3章 SiCの技術と構成

- グリーンSiC、ブラックSiC、その他

- SiCパワーエレクトロニクス技術

- 電子チップ製造

- SiC構造 - SiC

- SiC MOSFET:実証済みの信頼性と性能

- SiC:シリカ(石英)と炭素の電気化学反応

- n型SiC基板

- SiCワイドバンドギャップ材料

- SiCセラミックスの構造

- SiCセラミックスの特性

- SiCセラミックスの用途

- SiCの仕様 2"、4"、6"

第4章 SiCの用途

- SiCの用途

- SiCの化合物イメージ

- SiCデバイスの典型的な用途

- SiC技術

- Teslaの革新的なパワーエレクトロニクス:SiCインバーター

- Lucid Motors

第5章 SiC企業プロファイル

- II-VI Incorporated

- Advanced Materials Advanced Silicon Carbide Materials (ASCM)

- Aymont Technology

- Bosch

- Murugappa Group/Carborundum Universal Ltd (CUMI)

- China Electronics Technology Group Corporation (CETC)

- CM Advanced Ceramics

- Dow Corning

- Entegris

- GlobalFoundries

- Saint-Gobain Group/GNO Grindwell Norton

- Hebei Synlight Crystal

- Infineon

- Kyocera

- Lucid Motors

- Macronix

- Microchip Technology

- Mitsubishi

- Morgan Advanced Materials

- Nippon Steel

- NXP Semiconductors

- Onsemi

- Powerex/G.E. and Mitsubishi

- Renesas Electronics

- RHI Magnesita GMBH

- Arrow Electronics/Richardson

- Rohm

- Showa Denko

- Sumitomo Metal

- Solitron

- ST Microelectronics

- Taiwan Semiconductor Manufacturing Company

- TankeBlue

- Tesla

- Toshiba

- Wolfspeed

- X-FAB

- Xiamen Powerway Advanced Material

- 主要なSiC企業

WinterGreen Research

List of Tables and Figures

- Figure 1. Significant EV Energy Conservation

- Figure 2. Thermal conductivity of Silicon vs. Silicon carbide

- Figure 3. Silicon Carbide

- Figure 4. Silicon Carbide Image

- Figure 5. Third-Generation Semiconductors High-Power Application, High-Frequency, Characteristics

- Figure 6. Silicon Carbide Applications

- Figure 7. Chemical Mechanical Planarization

- Figure 8. Silicon Carbide Market Driving Forces

- Figure 9. Silicon Carbide Power Electronics Market Shares, Dollars, Worldwide, 2021

- Figure 10. Silicon Carbide Power Electronics Market Shares, Worldwide, Dollars, 2021

- Figure 11. Silicon Carbide Power Electronics Market Participant Descriptions, Worldwide, Dollars, 2021

- Figure 12. Vendors Compete Primarily on The Basis of The Following Factors

- Figure 13. Silicon Carbide Power Electronics Market Forecasts, Dollars, Worldwide, 2022-2028

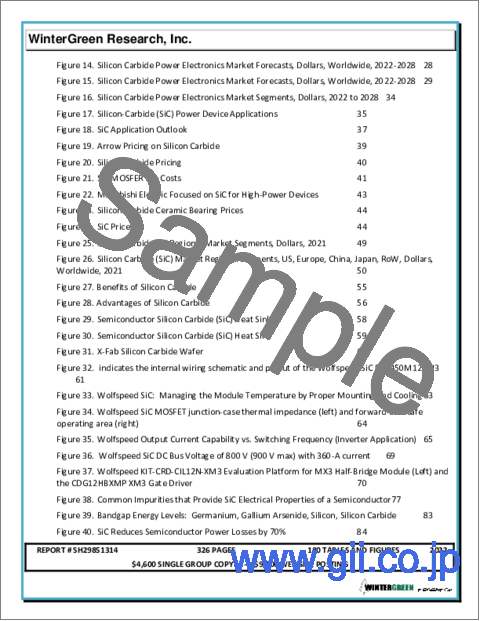

- Figure 14. Silicon Carbide Power Electronics Market Forecasts, Dollars, Worldwide, 2022-2028

- Figure 15. Silicon Carbide Power Electronics Market Forecasts, Dollars, Worldwide, 2022-2028

- Figure 16. Silicon Carbide Power Electronics Market Segments, Dollars, 2022 to 2028

- Figure 17. Silicon-Carbide (SiC) Power Device Applications

- Figure 18. SiC Application Outlook

- Figure 19. Arrow Pricing on Silicon Carbide

- Figure 20. Silicon Carbide Pricing

- Figure 21. SiC MOSFER Die Costs

- Figure 22. Mitsubishi Electric Focused on SiC for High-Power Devices

- Figure 23. Silicon Carbide Ceramic Bearing Prices

- Figure 24. SiC Prices

- Figure 25. Silicon Carbide SiC Regional Market Segments, Dollars, 2021

- Figure 26. Silicon Carbide (SiC) Market Regional Segments, US, Europe, China, Japan, RoW, Dollars, Worldwide, 2021

- Figure 27. Benefits of Silicon Carbide

- Figure 28. Advantages of Silicon Carbide

- Figure 29. Semiconductor Silicon Carbide (SiC) Heat Sink

- Figure 30. Semiconductor Silicon Carbide (SiC) Heat Sink

- Figure 31. X-Fab Silicon Carbide Wafer

- Figure 32. indicates the internal wiring schematic and pinout of the Wolfspeed SiC EAB450M12XM3

- Figure 33. Wolfspeed SiC: Managing the Module Temperature by Proper Mounting and Cooling

- Figure 34. Wolfspeed SiC MOSFET junction-case thermal impedance (left) and forward-bias safe operating area (right)

- Figure 35. Wolfspeed Output Current Capability vs. Switching Frequency (Inverter Application)

- Figure 36. Wolfspeed SiC DC Bus Voltage of 800 V (900 V max) with 360-A current

- Figure 37. Wolfspeed KIT-CRD-CIL12N-XM3 Evaluation Platform for MX3 Half-Bridge Module (Left) and the CDG12HBXMP XM3 Gate Driver

- Figure 38. Common Impurities that Provide SiC Electrical Properties of a Semiconductor

- Figure 39. Bandgap Energy Levels: Germanium, Gallium Arsenide, Silicon, Silicon Carbide

- Figure 40. SiC Reduces Semiconductor Power Losses by 70%

- Figure 41. Silicon Carbide Structure

- Figure 42. Uninterruptable Power Supply UPS Current Flow in a Semiconductor

- Figure 43. 2 Inch Diameter Silicon Carbide SiC Substrate Specification

- Figure 44. 4 Inch Diameter Silicon Carbide SiC Substrate Specification

- Figure 45. 4 Inch Diameter Silicon Carbide SiC Substrate Specification

- Figure 46. Silicon Carbide Products

- Figure 47. EV Powertrain

- Figure 48. II-VI SIC for Power Electronics

- Figure 49. II-VI Engineered Materials and Compound Semiconductors

- Figure 50. SiC Power Electronics in Electric Vehicles

- Figure 51. SiC-Based RF Electronics: 5G Wireless

- Figure 52. II-VI GaN/SiC power amplifiers

- Figure 53. II-VI SiC Positioning

- Figure 54. II-VI SiC Technologies

- Figure 55. II-VI Multiyear Agreement to Supply Silicon Carbide Substrates

- Figure 56. Advanced Silicon Carbide Materials (ASCM) Mirrors Materials

- Figure 57. Silicon Carbide High Performance Mirrors and Telescopes

- Figure 58. Advanced Silicon Carbide Materials (ASCM) CVC SiC® or Composites

- Figure 59. Bosch SiC Chips Fabricated on 8-Inch Wafers

- Figure 60. Bosch Silicon Carbide Manufacturing

- Figure 61. Bosch Silicon Carbide Sanding Disc

- Figure 62. Carborundum Universal Metrics

- Figure 63. Carborundum Universal Products

- Figure 64. Carborundum Universal Coated Abrasives

- Figure 65. Carborundum Universal Cumituff Material Features

- Figure 66. Carborundum Universal Associates and Subsidiaries

- Figure 67. CM Advanced Ceramics Sintered Silicon Carbide Main Components

- Figure 68. CM Advanced Ceramics Sintered Silicon Carbide Application Areas

- Figure 69. CM Advanced Ceramics Sintered Silicon Carbide Main Uses

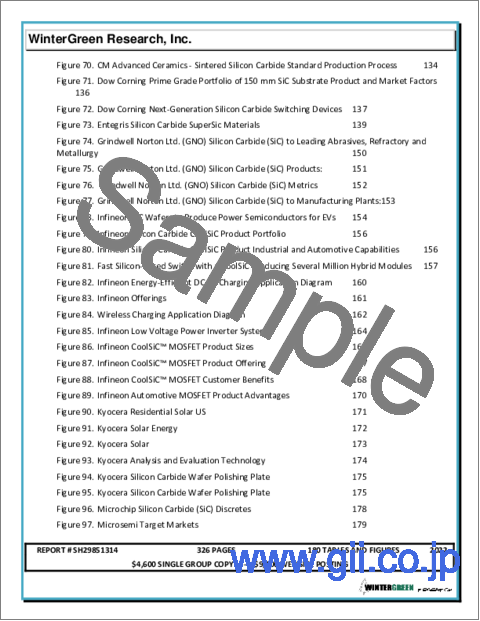

- Figure 70. CM Advanced Ceramics - Sintered Silicon Carbide Standard Production Process

- Figure 71. Dow Corning Prime Grade Portfolio of 150 mm SiC Substrate Product and Market Factors

- Figure 72. Dow Corning Next-Generation Silicon Carbide Switching Devices

- Figure 73. Entegris Silicon Carbide SuperSic Materials

- Figure 74. Grindwell Norton Ltd. (GNO) Silicon Carbide (SiC) to Leading Abrasives, Refractory and Metallurgy

- Figure 75. Grindwell Norton Ltd. (GNO) Silicon Carbide (SiC) Products:

- Figure 76. Grindwell Norton Ltd. (GNO) Silicon Carbide (SiC) Metrics

- Figure 77. Grindwell Norton Ltd. (GNO) Silicon Carbide (SiC) to Manufacturing Plants:

- Figure 78. Infineon SiC Wafers to Produce Power Semiconductors for EVs

- Figure 79. Infineon Silicon Carbide CoolSiC Product Portfolio

- Figure 80. Infineon Silicon Carbide CoolSiC Product Industrial and Automotive Capabilities

- Figure 81. Fast Silicon-Based Switch with a CoolSiC Producing Several Million Hybrid Modules

- Figure 82. Infineon Energy-Efficient DC EV Charging Application Diagram

- Figure 83. Infineon Offerings

- Figure 84. Wireless Charging Application Diagram

- Figure 85. Infineon Low Voltage Power Inverter Systems

- Figure 86. Infineon CoolSiC™ MOSFET Product Sizes

- Figure 87. Infineon CoolSiC™ MOSFET Product Offering

- Figure 88. Infineon CoolSiC™ MOSFET Customer Benefits

- Figure 89. Infineon Automotive MOSFET Product Advantages

- Figure 90. Kyocera Residential Solar US

- Figure 91. Kyocera Solar Energy

- Figure 92. Kyocera Solar

- Figure 93. Kyocera Analysis and Evaluation Technology

- Figure 94. Kyocera Silicon Carbide Wafer Polishing Plate

- Figure 95. Kyocera Silicon Carbide Wafer Polishing Plate

- Figure 96. Microchip Silicon Carbide (SiC) Discretes

- Figure 97. Microsemi Target Markets

- Figure 98. Microsemi SiC Power Module

- Figure 99. Microsemi SiC MOSFETs Advantages

- Figure 100. Microsemi SiC Advantages

- Figure 101. Microsemi SiC Applications

- Figure 102. Mitsubishi Silicon Carbide Reduction of Electrical Resistance in MOSDET

- Figure 103. Mitsubishi Silicon Carbide Reduction of Energy Loss

- Figure 104. Mitsubishi UPS Data Center Uninterruptible, Conditioned, Reliable Power

- Figure 105. Morgan-Seals-Bearings-Silicon-Carbide

- Figure 106. Morgan-Seals Silicon-Carbide Production Environment

- Figure 107. Morgan Advanced Materials Desirable Characteristics:

- Figure 108. Morgan Silicon Carbide Material Families

- Figure 109. Morgan Advanced Materials Silicon Carbide Materials - Silicon Carbide Bearing

- Figure 110. Morgan Advanced Materials Silicon Carbide Materials - Silicon Carbide Bearing Applications

- Figure 111. Morgan Advanced Materials Applications for Silicon Carbide

- Figure 112. NXP SiC Tools and Services Available

- Figure 113. Onsemi Target Markets

- Figure 114. Onsemi Product Segment Technologies

- Figure 115. On Semiconductor Revenue

- Figure 116. On Semiconductor Revenue

- Figure 117. Powerex Target Markets:

- Figure 118. Powerex Manufacturing Capacity

- Figure 119. Powerex Development Strategy

- Figure 120. Powerex Mission Critical Applications

- Figure 121. Rohm Silicon-Carbide (SiC) Power Devices

- Figure 122. Rohm Silicon-carbide (SiC) Power Devices Surface Mount Package Types to Support Automated Mounting for Improved Productivity

- Figure 123. Rohm Silicon-Carbide (SiC) Power Device Applications

- Figure 124. Rohm Ultra-Compact Monolithic LED Drivers

- Figure 125. Rohm Automotive LED Lighting (Front light) Block Diagram

- Figure 126. SiCrystal Silicon Carbide Wafers

- Figure 127. Rohm Crystal Manufacturing Functions

- Figure 128. Rohm SiCrystal Silicon Carbide SiC-Wafer in Händen

- Figure 129. New Systems of SiC Power Electronics

- Figure 130. Requirements of Automotive OEMs for Electronic Systems

- Figure 131. Sumitomo Metal SiC Transistors on Epitaxial Wafer

- Figure 132. Sumitomo Metal Structure and On-Resistance in Of Next Generation VMOSFETs

- Figure 133. Solitron SiC Characteristics

- Figure 134. Solitron Silicon Carbide MOSFETs

- Figure 135. Solitron's Silicon Carbide (SiC) MOSFETs

- Figure 136. ST Microelectronics SiC MOSFETs features of our include:

- Figure 137. ST Microelectronics STPOWER SiC MOSFET Bare-Die in T&R

- Figure 138. Model 3 Main Inverter - Featuring 24 SiC MOSFET modules from ST Microelectronics

- Figure 139. Toshiba SiC MOSFETs

- Figure 140. ST Microelectronics Performance of Wide-Bandgap Materials

- Figure 141. ST Microelectronics Company Metrics

- Figure 142. ST Microelectronics Automotive SiC Applications

- Figure 143. ST Microelectronics Discrete & Power Transistors SiC Applications

- Figure 144. ST Microelectronics Analog, Industrial, & Power Conversion ICs Applications

- Figure 145. Product Portfolio

- Figure 146. ST Microelectronics IoT Product Portfolio

- Figure 147. ST Microelectronics Global Presence

- Figure 148. ST Microelectronics Serves 200,000 Customers, Including Tesla Among the Top 10

- Figure 149. ASICS Based on ST Proprietary Technologies

- Figure 150. Norstel AB Reportable Segments:

- Figure 151. TankeBlue Semiconductor Silicon Carbide Material Properties

- Figure 152. TankeBlue Semiconductor Silicon Carbide Applications

- Figure 153. TankeBlue Semiconductor Silicon Carbide SiC Substrate Orientation

- Figure 154. TankeBlue Semiconductor Silicon Carbide Orthogonal Misorientation

- Figure 155. TankeBlue Semiconductor Headquarters

- Figure 156. XinJiang TankeBlue Semiconductor

- Figure 157. Toshiba 1200V SiC MOSFET TW070J120B

- Figure 158. Toshiba SiC MOSFETs Merits

- Figure 159. Toshiba SiC MOSFETs Features

- Figure 160. Wolfspeed Revenue

- Figure 161. Wolfspeed Silicone Carbide Positioning

- Figure 162. Wolfspeed High-Performance X-Band Portfolio Key Features

- Figure 163. Wolfspeed High-Performance X-Band Portfolio Key Benefits

- Figure 164. Wolfspeed X-Band Product Lineups & X-band Diagram

- Figure 165. Wolfspeed SiC X-Band Power Amplifier Line-Up Solutions Features and Benefits

- Figure 166. Wolfspeed SiC X-Band Power Amplifier Line-Up Solutions Diagram

- Figure 167. Wolfspeed X-Band GaN on SiC Solutions Features and Benefits

- Figure 168. Wolfspeed X-Band GaN on SiC Solutions Diagram

- Figure 169. Wolfspeed X-Band Metrics

- Figure 170. Wolfspeed Advantages of Silicon Carbide (SiC) Technology

- Figure 171. Wolfspeed Automotive-Qualified 1200 V, 450A Silicon Carbide Half-Bridge Module

- Figure 172. Wolfspeed Power Module Portfolio

- Figure 173. Wolfspeed Utica NY Silicon Carbide Fab

- Figure 174. Wolfspeed Opened XM3 Half-Bridge Module

- Figure 175. Wolfspeed MOSFET Switching Energy

- Figure 176. Wolfspeed MOSFET Switching Reverse-Recovery Performance

- Figure 177. X-FAB manufacturing Sites in Germany Positioning

- Figure 178. X_Fab Silicon Carbide

- Figure 179. PAM-XIAMEN Wide Silicon Carbide Wafer

- Figure 180. PAM Xiamen SIC Epitaxial Wafer

EVs represent a primary market for silicon carbide. The electrical solid state battery energy industry will reshape the future. The integrated business model of storage is becoming an application for energy consumption.

Silicon Carbide represents next generation automation of EVs and home and campus electricity storage, a market in line for significant growth. It is expected to grow at a compound annual growth rate (CAGR) of 147.8% from 2021 to 2028.

Power Electronics - especially MOSFETs - must be able to handle extremely high voltages. Silicon carbide outperforms silicon: the thermal conductivity is superior. The thermal conductivity of silicon carbide is 1490 W/m-K compared to 150 W/m-K for silicon. Silicon carbide SiC power electronics markets are forecast to have a CAGR of 37.56 %. Market growth is the result of rapid adoption of EV electric vehicles in response to an effort to decrease carbon emission worldwide. The SiC is harder, more durable, and permits more efficient implementation of power electronics in a variety of EV applications.

SiC is useful in the implementation of 5G communications systems.

Next generation car companies will sell energy storage systems alongside vehicles. Rising demand for solid-state batteries among end-use sectors along with the rising research and development activities are focused on commercializing the battery via use of silicon carbide for power electronics in the EV. Lower costs for solid state batteries are expected to propel market growth.

Table of Contents

Silicon Carbide Power Electronics Executive Summary

- Silicon Carbide Power Electronics

- SiC Power Electronics

1. Silicon Carbide Market Definition and Market Dynamics

- 1.1 Silicon Carbide

- 1.2 Description

- 1.3 Modern SiC Manufacture

- 1.4 Properties and Applications.

2. Silicon Carbide Market Shares and Market Forecasts

- 2.1 Silicon Carbide Market Driving Forces

- 2.2 Silicon Carbide Power Electronics Market Shares

- 2.3 Silicon Carbide Market Forecasts

- 2.4 Silicon Carbide Market Segment Forecasts

- 2.5 Silicon Carbide Pricing

- 2.5.1 Silicon Carbide Prices

- 2.5.2 Infineon

- 2.6 Silicon Carbide Regional Market Segments

- 2.6.1 US

- 2.6.2 Europe

- 2.6.3 Asia-Pacific

- 2.6.4 China

3 Silicon Carbide Technology and Configurations

- 3.1 Green Silicon Carbide, Black Silicon Carbide, And Other

- 3.2 Silicon Carbide Power Electronics Technology

- 3.2.1 SiC Wide-Bandgap Advantage

- 3.2.2 Silicon Carbide Research Directions

- 3.2.3 Wolfspeed Schematic, Pinout, and Performance Plots

- 3.3 Electronic Chip Manufacture

- 3.3.1 U.S. Opens First Major Silicon Carbide Chip Plant In New York, Wolfspeed

- 3.3.2 Taiwan Semiconductor Manufacturing Company

- 3.3.3 Wolfspeed Reference Designs and Supporting Tools

- 3.3.4 Foxconn

- 3.4 Silicon Carbide Structure - SiC

- 3.4.1 Bonding in Silicon Carbide - SiC

- 3.5 Silicon Carbide MOSFETs: Proven Reliability and Performance

- 3.5.1 Managing Impurities So Silicon Carbides Can Embrace the Electrical Properties of a Semiconductor

- 3.5.2 SiC Chemical Stability

- 3.5.3 Production of Silicon Carbide

- 3.6 Silicon Carbide: An Electro-Chemical Reaction of Silica (Quartz) with Carbon

- 3.7 n-Type SiC Substrate

- 3.8 Silicon Carbide (SiC) Wide Bandgap Materials

- 3.9 Silicon Carbide Ceramics Structure

- 3.10 Silicon Carbide Ceramics Properties

- 3.11 Silicon Carbide Ceramics Applications

- 3.12 Silicon Carbide Specifications 2", 4", 6"

4 Silicon Carbide Applications

- 4.1 Silicon Carbide Applications

- 4.2 SiC Chemical Compound Images

- 4.3 Typical Applications of SiC Devices

- 4.3.1 5G Infrastructure: Communication Power

- 4.3.2 Application of Flexible Transmission DC Circuit Breaker

- 4.4 Silicon Carbide Technology

- 4.4 Tesla's Innovative Power Electronics: The Silicon Carbide Inverter

- 4.5 Lucid Motors

5 Silicon Carbide Company Profiles

- 5.1 II-VI Incorporated

- 5.1.1 II-VI Incorporated Licenses Technology for Silicon Carbide Devices and Modules for Power Electronics

- 5.1.2 II-VI Partner Dynax - Silicon Carbide Substrates for Wireless RF Devices

- 5.1.3 II-VI Multiyear $100M Agreement to Supply Silicon Carbide Substrates

- 5.2 Advanced Materials Advanced Silicon Carbide Materials (ASCM)

- 5.3 Aymont Technology

- 5.4 Bosch

- 6.1.1 Bosch Silicon Carbide Clean-Room Space

- 5.4.2 BOSCH Circular Sanding Discs

- 5.5 Murugappa Group / Carborundum Universal Ltd (CUMI)

- 5.5.1 Murugappa_Group / Carborundum Universal

- 5.6 China Electronics Technology Group Corporation (CETC)

- 5.7 CM Advanced Ceramics

- 5.8 Dow Corning

- 5.9 Entegris

- 5.9.1 Entegris SUPERSiC-3CX

- 5.9.2 Entegris Revenue

- 5.9.3 Entegris - CMC Materials and Acquisitions

- 5.9.4 Entegris Segment Reporting

- 5.9.5 Specialty Chemicals and Engineered Materials Segment

- 5.9.6 Entegris Manufacturing Capacity

- 5.10 GlobalFoundries

- 5.11 Saint-Gobain Group / GNO Grindwell Norton

- 5.12 Hebei Synlight Crystal

- 5.13 Infineon

- 5.13.1 Infineon CoolSiC™ MOSFETs in Trench Technology

- 5.13.2 Infineon Fast/Wireless EV Charging

- 5.13.3 Wireless Methods for Power Transfer to Charge the Batteries

- 5.13.4 Infineon Silicon Carbide CoolSiC™ MOSFETs

- 5.13.5 Infineon AC/DC Battery Charger

- 5.13.6 Infineon Power Controllers for Solar

- 5.13.7 Infineon Automotive MOSFET

- 5.14 Kyocera

- 5.15 Lucid Motors

- 5.16 Macronix

- 5.17 Microchip Technology

- 5.17.1 Microchip Technology / Microsemi

- 5.17.2 Microchip Technology Revenue

- 5.18 Mitsubishi

- 5.19 Morgan Advanced Materials

- 5.19.1 Morgan Advanced Materials Chemical Vapor Deposition - Silicon Carbide (CVD-SiC)

- 5.20 Nippon Steel

- 5.21 NXP Semiconductors

- 5.22 Onsemi

- 5.22.1 On Semiconductor Acquisition of GT Advanced Technologies

- 5.23 Powerex / G.E. and Mitsubishi

- 5.24 Renesas Electronics

- 5.25 RHI Magnesita GMBH

- 5.26 Arrow Electronics / Richardson

- 5.27 Rohm

- 5.27.1 Rohm's SiC MOSFET

- 5.27.2 Rohm SiC MOSFETs

- 5.27.3 Rohm's 4th Generation SiC MOSFET

- 5.27.4 Rohm Automotive-Grade 6ch Buck Constant Current White LED Driver

- 5.27.5 Rohm / SiCrystal

- 5.28 Showa Denko

- 5.29 Sumitomo Metal

- 5.27.1 Sumitomo Metal High-Efficiency SiC Power Transistor

- 5.30 Solitron

- 5.31 ST Microelectronics

- 5.31.1 ST Microelectronics Corporate Profile

- 5.31.2 STMicroelectronics / Norstel

- 5.31.3 STMicroelectronics Power MOSFET, Silicon Carbide ("SiC")

- 5.32 Taiwan Semiconductor Manufacturing Company

- 5.33 TankeBlue

- 5.33.1 TankeBlue Semiconductor Silicon Carbide Material Properties

- 5.34 Tesla

- 5.35 Toshiba

- 5.36 Wolfspeed

- 5.36.1 Wolfspeed Revenue

- 5.36.2 Wolfspeed Silicone Carbide Positioning

- 5.36.3 Wolfspeed Automotive-Qualified Silicon Carbide Power Module

- 5.36.4 Wolfspeed Utica NY Silicon Carbide Fab

- 5.36.5 General Motors / Wolfspeed

- 5.36.6 Wolfspeed XM3 series

- 5.36.7 Wolfspeed Manufacturing Capacity

- 5.36.8 Wolfspeed Silicon Carbide SiC Summary

- 5.37 X-FAB

- 5.37.1 Silicon Carbide High Voltage

- 5.38 Xiamen Powerway Advanced Material

- 5.39 Selected Silicon Carbide Companies

WinterGreen Research,

- WinterGreen Research Methodology

- WinterGreen Research Process

- Market Research Study

- WinterGreen Research Global Market Intelligence Company

- Report Description: Revenue Models Matter