|

市場調査レポート

商品コード

1698618

IoTおよび組込みOS:需要と差別化を促進する安全認証とリアルタイム機能IoT & Embedded Operating Systems: Safety Certification & Real-Time Capabilities Driving Demand & Differentiation |

||||||

|

|||||||

| IoTおよび組込みOS:需要と差別化を促進する安全認証とリアルタイム機能 |

|

出版日: 2025年03月31日

発行: VDC Research Group, Inc.

ページ情報: 英文 51 Pages/31 Exhibits; plus 446 Exhibits/Excel

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

IoT導入の全体的な成長により、IoTおよび組込みOSの需要は引き続き高まる見通しです。ADAS (先進運転支援システム)、自律走行システム、産業用予知保全など、組込み市場全体の先進技術の台頭は、信頼性と低レイテンシ要件に対応しながら、セーフティクリティカルなコンプライアンスを提供できるOSへの需要を高めています。これらの需要促進要因が複合的に作用し、業界や使用事例にとらわれない幅広い洗練された機能をサポートするソリューションに対する新たな市場機会が生まれています。また、OSベンダーは、自社ソリューションが準拠する機能安全認証を拡大し、製品マーケティングメッセージングの最前線に位置付けています。そうすることで、かつては特定の市場に注力していたベンダーが、セーフティクリティカルソリューションの系譜と専門知識を重視する他の隣接業界にもソリューションを提供するようになっています。

航空宇宙・防衛や自動車などのセーフティクリティカル市場では、コスト上昇の圧力により、高額なロイヤリティやライセンシング料を回避するために、オープンソースのソリューションを求める開発者やエンジニアリング組織が増加しています。また、オープンソースOSの進歩、安全性・セキュリティに敏感な業界のニーズに対応する能力、強固な開発者コミュニティといった要因から、組み込み開発者のプロジェクトにおけるオープンソースソリューションの統合に対する信頼が高まっています。商用ベンダーは、自社のプロプライエタリソリューションと並行して、LinuxベースのOSの提供を拡大し続けており、最近ではオープンソースの安全認証への取り組みに重点を移しています。デバイスの処理能力とメモリ機能の進歩は、RTOSベンダーがMCUベースのデバイスからの需要に対応する市場機会を示しています。過去には複数の大手OSベンダーがサービスを提供してきましたが、現在では新規参入企業にとっても将来性のある市場ギャップとして浮上しています。

どのような疑問が解決されるのか?

- IoTおよび組み込みOSの世界の市場規模は、収益および出荷数の両面でどの程度か?

- オープンソースOSは、どのような点で市販のプロプライエタリソリューションに競合の脅威を与えているか?

- 組み込みエンジニアにとって、どのOSの購買決定要因が依然として最重要か?

- 自動車業界の競合情勢において、最近のM&Aはどのような変化をもたらしたか?

- 商用プロプライエタリOS、商用オープンソースOS、一般公開オープンソースOSの使用状況は、業界別、地域別にどのように異なるのか?

本レポートに掲載されている組織

|

|

レポート抜粋

セキュリティと信頼性が引き続き購買決定の重要な要因に

本レポートでは、IoTおよび組み込みOSの市場と新たな動向を分析しています。長年の市場規範に影響を与え、新たな商機を開拓している新たな動向や技術、規格や規制、エンジニアの嗜好、競合戦略について詳細に考察しています。

目次

本レポートの内容

取り上げられている質問

本レポートを読むべき人

本レポートに掲載されている組織

エグゼクティブサマリー

- 主な調査結果

世界市場の概要

イントロダクション

- 安全性認証に重点を置くオープンソース

- MCUの新たな商業的機会

- RISC-Vのサポートは将来の開発にとって重要

最近の市場動向

- 基準と規制

- 組織

- パートナーシップと買収

垂直市場

- 航空宇宙および防衛

- 自動車/鉄道/輸送

- 産業オートメーション

地域市場

- 南北アメリカ

- 欧州・中東・アフリカ

- アジア太平洋

競合情勢

- 主要ベンダーの洞察

- eSol

- Green Hills Software

- Lynx

- Microsoft

- PX5

- QNX

- Red Hat

- Siemens

- Wind River

エンドユーザーの洞察

- オープンソースOSの利用の増加

- セキュリティと信頼性は依然として購入決定の重要な要因

- リアルタイム機能に対する需要の高まり

- 安全性が重要なオープンソースへのオープン性

著者について

VDC Researchについて

Inside this Report

The overall market for IoT & embedded operating systems will continue steady growth over the forecast period, while emerging trends and dynamics will lead to shifts in the internal market makeup. Factors including engineering practices, commercial strategies, government pressures, and industry group initiatives will lead to shifts in the markets for proprietary, commercial open source, and publicly available open source operating systems. Continued advancements in embedded hardware performance has exposed gaps in the market servicing certain processor types, while emerging architectures are forcing vendors to adapt to future development needs.

This report analyzes the market and emerging trends for IoT & embedded operating systems. It includes detailed discussion of emerging trends and technologies, standards and regulations, engineer preferences, and competitive strategies that are impacting longstanding market norms and opening up new commercial opportunities.

What Questions are Addressed?

- How large is the global market for IoT & Embedded Operating Systems, both in terms of attributable revenue and unit shipments?

- In what ways are open source operating systems posing a competitive threat to commercial proprietary solutions?

- Which operating system purchasing decision factors remain top of mind for embedded engineers?

- What shifts have recent mergers and acquisitions (M&A) activity caused within the automotive industry's competitive landscape?

- How does use of commercial proprietary, commercial open source, and publicly available open source OSs differ by vertical and regional market?

Who Should Read this Report?

This research program is written for those making critical business decisions regarding product, market, channel, and competitive strategy and tactics. This report is intended for senior decision-makers who are developing embedded technology, including:

- CEO or other C-level executives

- Corporate development and M&A teams

- Marketing executives

- Business development and sales leaders

- Product development and product strategy leaders

- Channel management and channel strategy leaders

Organizations Listed in this Report:

|

|

Executive Summary

Overall growth in IoT deployments will continue to drive demand for IoT & embedded operating systems. The rise of advanced technologies across embedded markets, including advanced driver assistance systems (ADAS), autonomous systems, and industrial predictive maintenance, are increasing demand for operating systems (OSs) that can provide safety-critical compliance while addressing reliability and low latency requirements. Together, these drivers of demand have opened up a new market opportunity for solutions that can support broad, industry- and use-case agnostic sophisticated functionalities. At the same time, OS vendors are expanding the functional safety certifications their solutions adhere to, placing them at the forefront of product marketing messaging. In doing so, vendors that once focused on specific markets are increasingly offering their solutions to other adjacent industries that value their lineage of safety-critical solutions and expertise.

Within safety-critical markets including aerospace & defense and automotive, rising cost pressures have turned more developers and engineering organizations towards open source solutions to avoid expensive royalty and licensing fees. At the same time, advancements in open source operating systems' ability to address the needs of these safety and security sensitive industries combined with a robust developer community has increased embedded developers' confidence with integrating open source solutions into their projects. Commercial vendors are continuing to expand their Linux-based OS offerings alongside their proprietary solutions, with recent focus shifting to open source safety-certification efforts. Advancements in device processing power and memory capabilities have exposed a market opportunity for RTOS vendors to address demand from MCU-based devices that, while in the past has been serviced by multiple leading OS vendors, has now emerged as a potential future- proofed market gap for a new entrant.

Embedded development organizations are seeking to consolidate the oftentimes disparate tool sets their use within projects and across enterprises. As such, OS vendors are responding in kind with unified platforms, offering their OS solutions alongside software development tools, acting as single source for engineers to help simplify development processes and ensure compatibility.

Key Findings:

- Bare metal development and use of lightweight executives has decreased within MCU-based embedded projects, highlighting a growing demand and commercial opportunity for operating systems targeting smaller hardware footprints.

- The IoT & embedded operating systems market is experiencing significant M&A activity, corporate restructurings, and partnerships that have the potential to redefine the competitive landscape.

- The expansion of product portfolios through both internally developed solutions as well as collaborative partnerships will drive vendor differentiation within the IoT & embedded operating system market, as engineers seek to consolidate toolsets and look for ease of integration.

Report Excerpt

Security and Reliability Remain Key Drivers of Purchasing Decision

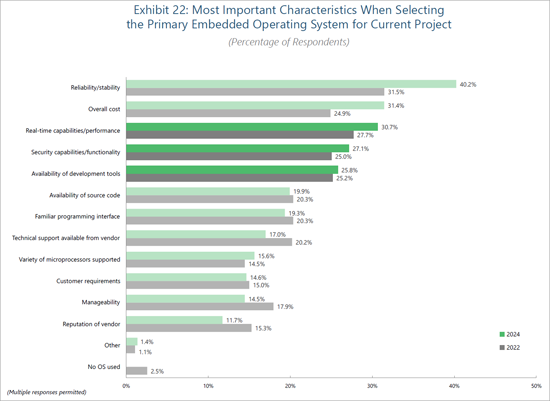

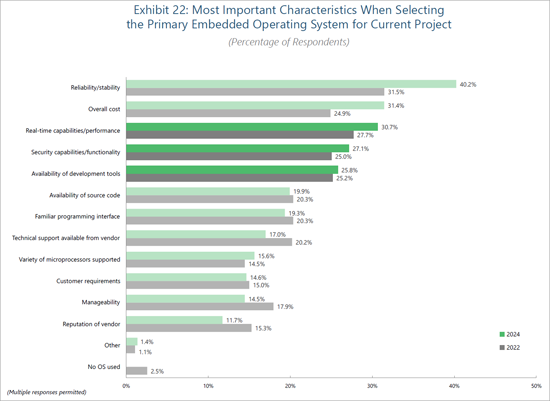

With advancements in regulations combined with increasingly complex and demanding standards across industries, embedded engineers are demanding more stringent safety and security certifications built into their operating systems. Offerings from leading vendors including BlackBerry QNX, SEGGER, and WITTENSTEIN offer built-in certifications to leading industry standards such as ISO 26262, IEC 62304, and IEC 61508. Aside from longstanding purchasing decision factors such as overall cost and overall reliability, security capabilities serve as a leading driver of primary embedded operating system selection. The importance of this factor has increased since 2022, highlighting the growing emphasis that embedded engineers place upon safety and security functions. Vendors across the ecosystem regularly highlight the safety and security certifications of their commercial operating system solutions - a marketing approach that should continue to be utilized to attract business and confidence among safety-critical embedded industries.

Being able to offer engineers suites of complementary solutions remains a considerable driver of embedded operating system purchasing decision, ranking fifth (25.8%). Vendors such as Green Hills Software and Wind River offer product development tools alongside their operating systems, with their tool suites acting as strategic launching pads to penetrate into large development organizations. Once developing both brand reputation as well as familiarity with their tooling solutions, vendors can effectively cross-sell their OS solutions, increasing overall wallet share and account size. This dynamic can be spurred along by the growing consolidation sought out among developers seeking to standardize dispersed sets of development tools on one specific vendor. A considerable downside to open source OS use is the lack of robust and readily available complementary development tools, which may hamper sustained use of open source operating systems. The growing and extending software lifecycle will only increase the premium associated with advanced development tools, especially as more OEMs look for platforms not only for code composition, but also to audit and manage code updates across deployed devices.

A notable increase in the importance of overall cost has occurred since 2022, highlighting the need for vendors of commercial non open source OS solutions to address their offerings. While multiple companies including eSOL and Red Hat have experimented with and introduced new pricing structures more akin to multi-year contracts and subscription models that include support and service than traditional perpetual licensing schemes, a more holistic approach considering a total reconsideration of value proposition may prove to be more fruitful in addressing cost sensitivities. Changes to licensing structures within the OS market are not a new dynamic, with Wind River adopting a term licensing structure over a decade ago. Siemens has ceased offering its OS solutions as standalone solutions, deciding instead to roll them into its new Innexis product portfolio to inadvertently enhance the capabilities of its solutions through packaged complementary offerings. Elsewhere, vendors like SEGGER are adapting to this increased price sensitivity by lowering licensing costs for its OS solutions for R&D purposes, incentivizing experimentation that will hopefully translate to realized revenue down the line.

Table of Contents

Inside this Report

What Questions are Addressed?

Who Should Read this Report?

Organizations Listed in this Report

Executive Summary

- Key Findings

Global Market Overview

Introduction

- Open Source Focusing on Safety Certification

- Renewed Commercial Opportunity for the MCU

- RISC-V Support Critical for Future Development

Recent Market Developments

- Standards & Regulations

- Portable Operating System Interface (POSIX)

- Organizations

- The Eclipse Foundation

- The Linux Foundation

- Partnerships & Acquisitions

- Azure RTOS is now ThreadX (Again)

- Bosch Repositions ETAS to Service the Entire SDV

- Green Hills Software and NXP Partner on SDV Platform

- Lynx Acquires CoreAVI

Vertical Markets

- Aerospace & Defense

- Automotive/Rail/Transportation

- Industrial Automation

Regional Markets

- The Americas

- Europe, the Middle East & Africa (EMEA)

- Asia-Pacific (APAC)

Competitive Landscape

- Selected Vendor Insights

- eSol

- Green Hills Software

- Lynx

- Microsoft

- PX5

- QNX

- Red Hat

- Siemens

- Wind River

End-User Insights

- Rising Utilization of Open Source Operating Systems

- Security and Reliability Remain Key Drivers of Purchasing Decision

- Increasing Demand for Real-Time Capabilities

- An Openness to Safety-Critical Open Source

About the Authors

About VDC Research

List of Exhibits

- Exhibit 1: Global Revenue of IoT & Embedded Operating Systems & Related Services, 2023 - 2028

- Exhibit 2: Global Revenue of IoT & Embedded Operating Systems & Related Services, Segmented by Operating System Type; 2023 - 2028

- Exhibit 3: Global Unit Shipments of IoT & Embedded Operating Systems, 2023 - 2028

- Exhibit 4: Global Unit Shipments of IoT & Embedded Operating Systems, Segmented by Operating System Type; 2023 - 2028

- Exhibit 5: Most Important Characteristics when Selecting the Primary Embedded Operating System for Current Project, by use of Windows OS

- Exhibit 6: Estimation of Number of Defects and Software Patches Required by Customer Per Year for Most Current Project, Segmented by Primary Operating System Type

- Exhibit 7: Primary Operating System Used on Current Project, Segmented by Primary Application Processor Type

- Exhibit 8: Processor Family/Architecture of Primary/Application Processor in Current Project

- Exhibit 9: Global Revenue of IoT & Embedded Operating Systems & Related Services, Segmented by Vertical Market; 2023 & 2028

- Exhibit 10: Global Revenue of IoT & Embedded Operating Systems & Related Services, Segmented by Vertical Market (Excluding Microsoft); 2023 & 2028

- Exhibit 11: Global Revenue of IoT & Embedded Operating Systems and Related Services, Segmented by Vertical Market and Revenue Leaders; 2023

- Exhibit 12: Global Aerospace & Defense Revenue of IoT & Embedded Operating Systems & Related Services, 2023 - 2028

- Exhibit 13: Global Automotive/Rail/Transportation Revenue of IoT & Embedded Operating Systems & Related Services, 2023 - 2028

- Exhibit 14: Global Industrial Automation Revenue of IoT & Embedded Operating Systems & Related Services, 2023 - 2028

- Exhibit 15: Global Revenue of IoT & Embedded Operating Systems & Related Services, Segmented by Regional Market; 2023 & 2028

- Exhibit 16: Global Revenue of IoT & Embedded Operating Systems & Related Services, Segmented by Regional Market (Excluding Microsoft); 2023 & 2028

- Exhibit 17: Global Revenue of IoT & Embedded Operating Systems and Related Services, Segmented by Regional Market and Revenue Leaders; 2023

- Exhibit 18: The Americas Revenue of IoT & Embedded Operating Systems & Related Services, 2023 - 2028

- Exhibit 19: EMEA Revenue of IoT & Embedded Operating Systems & Related Services, 2023 - 2028

- Exhibit 20: APAC Revenue of IoT & Embedded Operating Systems & Related Services, 2023 - 2028

- Exhibit 21: Global Revenue of IoT & Embedded Operating Systems & Related Services, Segmented by Leading Vendors; 2023

- Exhibit 22: Global Revenue of IoT & Embedded Real-Time Operating Systems & Related Services, Segmented by Leading Vendors; 2023

- Exhibit 23: Global Revenue of IoT & Embedded Linux Operating Systems & Related Services, Segmented by Leading Vendors; 2023

- Exhibit 24: Global Unit Share of IoT & Embedded Operating Systems and Related Services, Segmented by Leading Vendors; 2023

- Exhibit 25: Primary Operating System Used on Current Project

- Exhibit 26: Primary Operating System Expected to be Used in Three Years

- Exhibit 27: Most Important Characteristics When Selecting the Primary Embedded Operating System for Current Project

- Exhibit 28: Capabilities/Features of Current Project

- Exhibit 29: Type of Real-Time Capabilities for Current Project

- Exhibit 30: Primary Operating System Used on Current Project, Segmented by Certification/Process Standard Requirement

- Exhibit 31: Primary Operating System Used on Current Project, Segmented by Lack of Certification/Process Standard Requirement