|

|

市場調査レポート

商品コード

1785176

液化水素貯蔵市場 - 世界の産業規模、シェア、動向、機会、予測:貯蔵容量別、エンドユーザー別、技術別、地域別、競合別、2020年~2030年Liquefied Hydrogen Storage Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented, By Storage Capacity, By End-User, By Technology, By Region, By Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| 液化水素貯蔵市場 - 世界の産業規模、シェア、動向、機会、予測:貯蔵容量別、エンドユーザー別、技術別、地域別、競合別、2020年~2030年 |

|

出版日: 2025年08月06日

発行: TechSci Research

ページ情報: 英文 180 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

液化水素貯蔵市場は2024年に78億3,000万米ドルと評価され、2030年にはCAGR 19.56%で230億8,000万米ドルに達すると予測されています。

液化水素貯蔵市場とは、様々な最終用途向けに液化水素を安全に貯蔵するために必要な技術、システム、インフラの開発、生産、展開に焦点を当てた世界の産業を指します。液化水素(LH2)とは、水素を-253℃以下の極低温に冷却して液体状態にしたもので、エネルギー密度を大幅に高め、効率的な貯蔵と長距離輸送を可能にします。この市場には、極低温タンク、断熱材、液化システム、据置型・移動型・輸送用の統合貯蔵モジュールなど、幅広いコンポーネントとソリューションが含まれます。

| 市場概要 | |

|---|---|

| 予測期間 | 2026-2030 |

| 市場規模:2024年 | 78億3,000万米ドル |

| 市場規模:2030年 | 230億8,000万米ドル |

| CAGR:2025年~2030年 | 19.56% |

| 急成長セグメント | 小規模(100トンまで) |

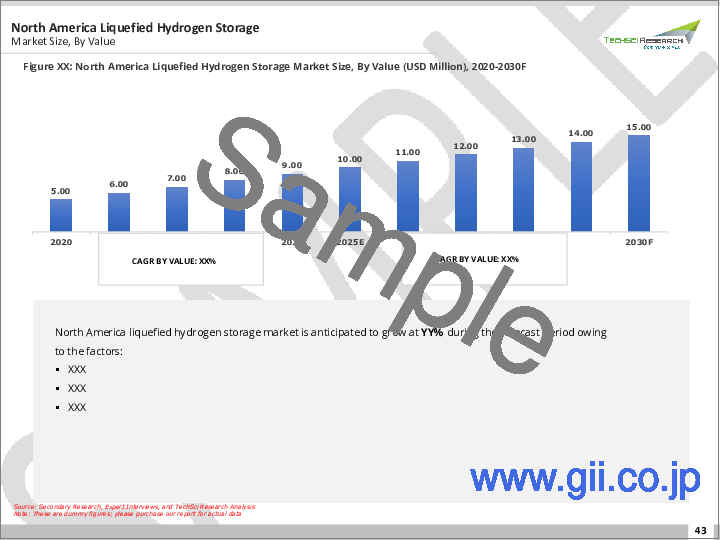

| 最大市場 | 北米 |

需要を牽引する主要セクターには、航空宇宙、防衛、海洋、自動車、鉄道、工業加工などがあり、水素はクリーンエネルギーキャリアとしてますます使用されるようになっています。二酸化炭素排出量の削減と低炭素経済への移行が世界的に重視される中、液化水素は、特に高エネルギー密度と長距離運転を必要とする用途において、実行可能な代替燃料として脚光を浴びています。この市場はまた、水素ステーション、大規模貯蔵施設、船舶や航空機の燃料補給ソリューションなど、水素インフラの拡大を支えています。さらに、材料科学、断熱材、極低温工学の進歩により、厳格な安全基準と性能基準を満たす、より効率的で軽量かつコスト効率の高い貯蔵システムの開発が可能になっています。

主な市場促進要因

クリーンエネルギーと脱炭素化への取り組みに対する需要の高まり

主な市場課題

液化水素インフラに関連する高い資本コストと運用コスト

主要市場動向

大規模グリーンエネルギープロジェクトにおける液化水素貯蔵の統合

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の液化水素貯蔵市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 貯蔵容量別(小規模(100トンまで)、中規模(100~1,000トン)、大規模(1,000トン以上))

- エンドユーザー別(発電、輸送(燃料ステーション)、産業プロセス(熱電併給)、ピークカットおよびグリッドバランシング)

- 技術別(単一タンク貯蔵、複数タンク貯蔵、クライオコンプレッサー、その他)

- 地域別

- 企業別(2024)

- 市場マップ

第6章 北米の液化水素貯蔵市場展望

- 市場規模・予測

- 市場シェア・予測

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 欧州の液化水素貯蔵市場展望

- 市場規模・予測

- 市場シェア・予測

- 欧州:国別分析

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

第8章 アジア太平洋地域の液化水素貯蔵市場展望

- 市場規模・予測

- 市場シェア・予測

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

第9章 南米の液化水素貯蔵市場展望

- 市場規模・予測

- 市場シェア・予測

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 中東・アフリカの液化水素貯蔵市場展望

- 市場規模・予測

- 市場シェア・予測

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

- トルコ

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

- 合併と買収

- 製品上市

- 最近の動向

第13章 企業プロファイル

- Linde plc

- Air Liquide

- Chart Industries, Inc.

- Plug Power Inc.

- Nel ASA

- Mitsubishi Heavy Industries, Ltd.

- Iwatani Corporation

- Hexagon Purus ASA

- Samsung C&T Corporation

- Cryostar SAS

第14章 戦略的提言

第15章 調査会社について・免責事項

The Liquefied Hydrogen Storage Market was valued at USD 7.83 Billion in 2024 and is expected to reach USD 23.08 Billion by 2030 with a CAGR of 19.56%. The Liquefied Hydrogen Storage Market refers to the global industry focused on the development, production, and deployment of technologies, systems, and infrastructure required to safely store hydrogen in its liquefied form for various end-use applications. Liquefied hydrogen, or LH2, is hydrogen that has been cooled to cryogenic temperatures below -253°C to achieve a liquid state, thereby significantly increasing its energy density and enabling efficient storage and transportation over long distances. The market encompasses a broad spectrum of components and solutions, including cryogenic tanks, insulation materials, liquefaction systems, and integrated storage modules designed for stationary, mobile, and transport applications.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 7.83 Billion |

| Market Size 2030 | USD 23.08 Billion |

| CAGR 2025-2030 | 19.56% |

| Fastest Growing Segment | Small Scale (Up to 100 Metric Tons) |

| Largest Market | North America |

Key sectors driving demand include aerospace, defense, marine, automotive, rail, and industrial processing, where hydrogen is increasingly used as a clean energy carrier. With growing global emphasis on reducing carbon emissions and transitioning to low-carbon economies, liquefied hydrogen is gaining prominence as a viable alternative fuel, particularly for applications requiring high energy density and long-range operation. The market also supports the expansion of hydrogen infrastructure, including hydrogen fueling stations, large-scale storage facilities, and bunkering solutions for ships and aircraft. Additionally, advancements in materials science, thermal insulation, and cryogenic engineering are enabling the development of more efficient, lightweight, and cost-effective storage systems that meet rigorous safety and performance standards.

Key Market Drivers

Growing Demand for Clean Energy and Decarbonization Initiatives

The accelerating global demand for clean energy, coupled with increasing urgency to decarbonize major industrial and transportation sectors, is a key driver of growth in the liquefied hydrogen storage market. Governments and private stakeholders across the globe are intensifying efforts to reduce greenhouse gas emissions, particularly from hard-to-abate sectors like steel, cement, chemicals, and heavy-duty transport, where hydrogen is seen as a viable alternative to fossil fuels. Liquefied hydrogen, with its high energy density and ability to be stored and transported at scale, has emerged as a preferred solution for enabling energy transition strategies.

Countries are setting ambitious net-zero targets, which are translating into direct investments in hydrogen infrastructure, including production, liquefaction, storage, and distribution networks. As renewable electricity becomes increasingly abundant, especially from solar and wind, the surplus is being used to produce green hydrogen via electrolysis. This green hydrogen is then liquefied for storage and later use, making storage technologies pivotal to the hydrogen economy. Liquefied hydrogen enables long-term storage of excess renewable energy and supports continuous energy supply, overcoming intermittency challenges commonly associated with renewable power generation. Moreover, hydrogen's role in enabling sector coupling-linking electricity, transportation, and industrial sectors-makes storage solutions essential in facilitating integration and operational efficiency across energy systems.

As national hydrogen roadmaps and international collaborations gain momentum, the need for safe, efficient, and scalable liquefied hydrogen storage technologies is becoming more pronounced. Market participants are ramping up R&D efforts to improve the thermodynamic efficiency, safety, and economics of cryogenic storage systems, while policymakers are introducing financial incentives and regulatory frameworks to promote hydrogen adoption. These developments are collectively shaping a supportive ecosystem for liquefied hydrogen storage and ensuring long-term growth opportunities.

The synergy between public policy, private investment, and technological advancement is not only accelerating project deployments but also lowering the cost of liquefied hydrogen storage solutions. As such, the drive toward a low-carbon economy and the increasing deployment of hydrogen across sectors stand out as foundational growth pillars for the liquefied hydrogen storage market. Global clean energy investments surpassed USD 1.5 trillion annually in recent years. Over 70 countries have announced net-zero targets, accelerating decarbonization strategies. Renewable energy accounted for more than 30% of global power generation in the past year. Hydrogen demand is expected to reach 500 million tons annually by 2050. More than 50% of new power capacity additions globally are from solar and wind sources. The industrial sector aims to cut CO2 emissions by over 60% by 2040 through clean technologies.

Key Market Challenges

High Capital and Operational Costs Associated with Liquefied Hydrogen Infrastructure

One of the most significant challenges facing the liquefied hydrogen storage market is the high capital and operational costs involved in establishing and maintaining the necessary infrastructure. The process of liquefying hydrogen is energy-intensive and technologically complex, requiring cryogenic cooling to temperatures as low as -253°C. This demands highly specialized and expensive equipment such as cryogenic compressors, liquefiers, insulated tanks, and advanced control systems to manage safety and temperature consistency.

Moreover, the storage of liquefied hydrogen presents significant engineering and material challenges, as maintaining ultra-low temperatures over extended periods leads to boil-off losses, where hydrogen gradually evaporates despite insulation. Preventing or mitigating such losses requires additional investment in high-efficiency insulation materials and boil-off gas management systems, which further drives up costs. Additionally, the design, construction, and certification of storage tanks and refueling stations must comply with rigorous international safety standards and regulatory frameworks, adding to time and financial burdens. These capital-intensive requirements can be a major deterrent, especially for small and medium-sized enterprises or emerging markets with limited budgets.

On the operational side, ongoing costs related to maintenance, energy consumption, safety checks, and workforce training also add pressure on financial sustainability. The highly flammable nature of hydrogen necessitates advanced monitoring, safety protocols, and emergency response systems, all of which demand ongoing investment. Furthermore, the transportation of liquefied hydrogen between production sites and storage facilities involves the use of specially designed tankers and carriers, which are significantly more costly than conventional fuel transport vehicles. Insurance premiums for such infrastructure are also notably higher due to the associated safety risks.

These economic challenges limit the scalability and pace of deployment for liquefied hydrogen infrastructure, particularly in regions where conventional fuels or alternative green energy solutions offer more cost-effective options. In addition, the return on investment for liquefied hydrogen storage solutions is currently uncertain in many markets, as demand is still developing, and long-term offtake agreements are not always guaranteed. This makes it difficult for companies and investors to commit substantial resources to this segment without clear policy support or market incentives. While technological advancements may help reduce costs in the long term, the current financial barriers remain a significant roadblock to widespread adoption and commercialization, creating a gap between innovation and market readiness that industry players must strategically address.

Key Market Trends

Integration of Liquefied Hydrogen Storage in Large-Scale Green Energy Projects

The Liquefied Hydrogen Storage Market is witnessing a strong trend toward integration within large-scale green energy infrastructure and projects, particularly as nations accelerate their transition to cleaner energy systems. As hydrogen emerges as a vital component in decarbonization strategies across various sectors, liquefied hydrogen storage is becoming increasingly important due to its higher energy density compared to gaseous hydrogen. This trend is being driven by the expansion of renewable energy sources like wind and solar, which often generate electricity intermittently.

By converting excess electricity into hydrogen through electrolysis and storing it in liquefied form, energy producers can ensure stable supply and grid reliability. Liquefied hydrogen storage offers a compact and efficient means to store energy over long durations and transport it over long distances, making it a preferred choice for utility-scale projects. Countries investing in hydrogen hubs and industrial-scale hydrogen valleys are incorporating liquefied hydrogen tanks and terminals as a core part of their infrastructure planning. These projects are also prompting advancements in cryogenic technologies to ensure safe, efficient, and cost-effective storage at temperatures as low as -253°C. The development of integrated storage solutions that can be paired with liquefaction and regasification systems is gaining traction, facilitating end-to-end hydrogen supply chains.

Key Market Players

- Linde plc

- Air Liquide

- Chart Industries, Inc.

- Plug Power Inc.

- Nel ASA

- Mitsubishi Heavy Industries, Ltd.

- Iwatani Corporation

- Hexagon Purus ASA

- Samsung C&T Corporation

- Cryostar SAS

Report Scope:

In this report, the Global Liquefied Hydrogen Storage Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Liquefied Hydrogen Storage Market, By Storage Capacity:

- Small Scale (Up to 100 Metric Tons)

- Medium Scale (100-1,000 Metric Tons)

- Large Scale (Over 1,000 Metric Tons)

Liquefied Hydrogen Storage Market, By End-User:

- Power Generation

- Transportation (Fueling Stations)

- Industrial Processes (Heat & Power)

- Peak Shaving

- Grid Balancing

Liquefied Hydrogen Storage Market, By Technology:

- Single Tank Storage

- Multiple Tank Storage

- Cryo-Compressors

- Others

Liquefied Hydrogen Storage Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global Liquefied Hydrogen Storage Market.

Available Customizations:

Global Liquefied Hydrogen Storage Market report with the given Market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional Market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Formulation of the Scope

- 2.4. Assumptions and Limitations

- 2.5. Sources of Research

- 2.5.1. Secondary Research

- 2.5.2. Primary Research

- 2.6. Approach for the Market Study

- 2.6.1. The Bottom-Up Approach

- 2.6.2. The Top-Down Approach

- 2.7. Methodology Followed for Calculation of Market Size & Market Shares

- 2.8. Forecasting Methodology

- 2.8.1. Data Triangulation & Validation

3. Executive Summary

- 3.1. Overview of the Market

- 3.2. Overview of Key Market Segmentations

- 3.3. Overview of Key Market Players

- 3.4. Overview of Key Regions/Countries

- 3.5. Overview of Market Drivers, Challenges, and Trends

4. Voice of Customer

5. Global Liquefied Hydrogen Storage Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Storage Capacity (Small Scale (Up to 100 Metric Tons), Medium Scale (100-1,000 Metric Tons), Large Scale (Over 1,000 Metric Tons))

- 5.2.2. By End-User (Power Generation, Transportation (Fueling Stations), Industrial Processes (Heat & Power), Peak Shaving and Grid Balancing)

- 5.2.3. By Technology (Single Tank Storage, Multiple Tank Storage, Cryo-Compressors, Others)

- 5.2.4. By Region

- 5.3. By Company (2024)

- 5.4. Market Map

6. North America Liquefied Hydrogen Storage Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Storage Capacity

- 6.2.2. By End-User

- 6.2.3. By Technology

- 6.2.4. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Liquefied Hydrogen Storage Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Storage Capacity

- 6.3.1.2.2. By End-User

- 6.3.1.2.3. By Technology

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Liquefied Hydrogen Storage Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Storage Capacity

- 6.3.2.2.2. By End-User

- 6.3.2.2.3. By Technology

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Liquefied Hydrogen Storage Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Storage Capacity

- 6.3.3.2.2. By End-User

- 6.3.3.2.3. By Technology

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Liquefied Hydrogen Storage Market Outlook

7. Europe Liquefied Hydrogen Storage Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Storage Capacity

- 7.2.2. By End-User

- 7.2.3. By Technology

- 7.2.4. By Country

- 7.3. Europe: Country Analysis

- 7.3.1. Germany Liquefied Hydrogen Storage Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Storage Capacity

- 7.3.1.2.2. By End-User

- 7.3.1.2.3. By Technology

- 7.3.1.1. Market Size & Forecast

- 7.3.2. United Kingdom Liquefied Hydrogen Storage Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Storage Capacity

- 7.3.2.2.2. By End-User

- 7.3.2.2.3. By Technology

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Italy Liquefied Hydrogen Storage Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Storage Capacity

- 7.3.3.2.2. By End-User

- 7.3.3.2.3. By Technology

- 7.3.3.1. Market Size & Forecast

- 7.3.4. France Liquefied Hydrogen Storage Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Storage Capacity

- 7.3.4.2.2. By End-User

- 7.3.4.2.3. By Technology

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Spain Liquefied Hydrogen Storage Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Storage Capacity

- 7.3.5.2.2. By End-User

- 7.3.5.2.3. By Technology

- 7.3.5.1. Market Size & Forecast

- 7.3.1. Germany Liquefied Hydrogen Storage Market Outlook

8. Asia-Pacific Liquefied Hydrogen Storage Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Storage Capacity

- 8.2.2. By End-User

- 8.2.3. By Technology

- 8.2.4. By Country

- 8.3. Asia-Pacific: Country Analysis

- 8.3.1. China Liquefied Hydrogen Storage Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Storage Capacity

- 8.3.1.2.2. By End-User

- 8.3.1.2.3. By Technology

- 8.3.1.1. Market Size & Forecast

- 8.3.2. India Liquefied Hydrogen Storage Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Storage Capacity

- 8.3.2.2.2. By End-User

- 8.3.2.2.3. By Technology

- 8.3.2.1. Market Size & Forecast

- 8.3.3. Japan Liquefied Hydrogen Storage Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Storage Capacity

- 8.3.3.2.2. By End-User

- 8.3.3.2.3. By Technology

- 8.3.3.1. Market Size & Forecast

- 8.3.4. South Korea Liquefied Hydrogen Storage Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Storage Capacity

- 8.3.4.2.2. By End-User

- 8.3.4.2.3. By Technology

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Australia Liquefied Hydrogen Storage Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Storage Capacity

- 8.3.5.2.2. By End-User

- 8.3.5.2.3. By Technology

- 8.3.5.1. Market Size & Forecast

- 8.3.1. China Liquefied Hydrogen Storage Market Outlook

9. South America Liquefied Hydrogen Storage Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Storage Capacity

- 9.2.2. By End-User

- 9.2.3. By Technology

- 9.2.4. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Liquefied Hydrogen Storage Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Storage Capacity

- 9.3.1.2.2. By End-User

- 9.3.1.2.3. By Technology

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Liquefied Hydrogen Storage Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Storage Capacity

- 9.3.2.2.2. By End-User

- 9.3.2.2.3. By Technology

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Liquefied Hydrogen Storage Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Storage Capacity

- 9.3.3.2.2. By End-User

- 9.3.3.2.3. By Technology

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Liquefied Hydrogen Storage Market Outlook

10. Middle East and Africa Liquefied Hydrogen Storage Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Storage Capacity

- 10.2.2. By End-User

- 10.2.3. By Technology

- 10.2.4. By Country

- 10.3. Middle East and Africa: Country Analysis

- 10.3.1. South Africa Liquefied Hydrogen Storage Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Storage Capacity

- 10.3.1.2.2. By End-User

- 10.3.1.2.3. By Technology

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Saudi Arabia Liquefied Hydrogen Storage Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Storage Capacity

- 10.3.2.2.2. By End-User

- 10.3.2.2.3. By Technology

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Liquefied Hydrogen Storage Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Storage Capacity

- 10.3.3.2.2. By End-User

- 10.3.3.2.3. By Technology

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Kuwait Liquefied Hydrogen Storage Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Storage Capacity

- 10.3.4.2.2. By End-User

- 10.3.4.2.3. By Technology

- 10.3.4.1. Market Size & Forecast

- 10.3.5. Turkey Liquefied Hydrogen Storage Market Outlook

- 10.3.5.1. Market Size & Forecast

- 10.3.5.1.1. By Value

- 10.3.5.2. Market Share & Forecast

- 10.3.5.2.1. By Storage Capacity

- 10.3.5.2.2. By End-User

- 10.3.5.2.3. By Technology

- 10.3.5.1. Market Size & Forecast

- 10.3.1. South Africa Liquefied Hydrogen Storage Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Market Trends & Developments

- 12.1. Merger & Acquisition (If Any)

- 12.2. Product Launches (If Any)

- 12.3. Recent Developments

13. Company Profiles

- 13.1. Linde plc

- 13.1.1. Business Overview

- 13.1.2. Key Revenue and Financials

- 13.1.3. Recent Developments

- 13.1.4. Key Personnel/Key Contact Person

- 13.1.5. Key Product/Services Offered

- 13.2. Air Liquide

- 13.3. Chart Industries, Inc.

- 13.4. Plug Power Inc.

- 13.5. Nel ASA

- 13.6. Mitsubishi Heavy Industries, Ltd.

- 13.7. Iwatani Corporation

- 13.8. Hexagon Purus ASA

- 13.9. Samsung C&T Corporation

- 13.10. Cryostar SAS