|

|

市場調査レポート

商品コード

1698101

スニーカー市場- 世界の産業規模、シェア、動向、機会、予測、製品タイプ別、エンドユーザー別、流通チャネル別、地域別、競合市場別、2020-2030年Sneakers Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Product Type, By End User, By Distribution Channel, By Region & Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| スニーカー市場- 世界の産業規模、シェア、動向、機会、予測、製品タイプ別、エンドユーザー別、流通チャネル別、地域別、競合市場別、2020-2030年 |

|

出版日: 2025年03月28日

発行: TechSci Research

ページ情報: 英文 186 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

スニーカーの世界市場規模は2024年に889億1,000万米ドルとなり、予測期間中のCAGRは7.32%で2030年には1,354億2,000万米ドルに達すると予測されています。

あらゆる年齢層でファッショナブルでブランドの高級スニーカーが好まれるようになり、可処分所得の増加と相まって、より快適で革新的な履物の需要が高まっており、市場の成長を加速させています。しかし、現地メーカーの偽造品が広く出回っていることが、業界の拡大を阻害する可能性があります。一方で、カスタマイズされた革新的なスニーカーが利用できることは、市場プレーヤーにとって収益性の高い機会となります。人口の増加と健康意識の高まりは、フィットネス活動への意欲を高め、需要をさらに押し上げています。また、若年層におけるフィットネスやスポーツへの関心の高まりも、スニーカーの需要拡大に寄与しています。

| 市場概要 | |

|---|---|

| 予測期間 | 2026-2030 |

| 市場規模:2024年 | 889億1,000万米ドル |

| 市場規模:2030年 | 1,354億2,000万米ドル |

| CAGR:2025年~2030年 | 7.32% |

| 急成長セグメント | 女性 |

| 最大市場 | 北米 |

市場促進要因

アスレジャーとカジュアルシューズの人気上昇

主な市場課題

偽造品と製品の真正性

主要市場動向

持続可能性と環境に優しい素材

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声分析

- ブランド認知度

- 購入決定に影響を与える要因

第5章 世界のスニーカー市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 製品タイプ別(ローカットスニーカー、ミッドカットスニーカー、ハイカットスニーカー)

- エンドユーザー別(男性、女性、子供)

- 流通チャネル別(スーパーマーケット/ハイパーマーケット、専門店、オンライン、その他)

- 地域別

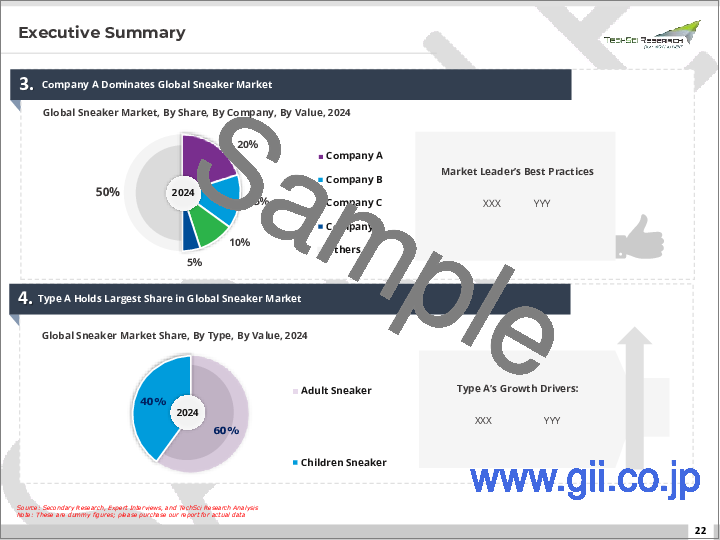

- 企業別(2024)

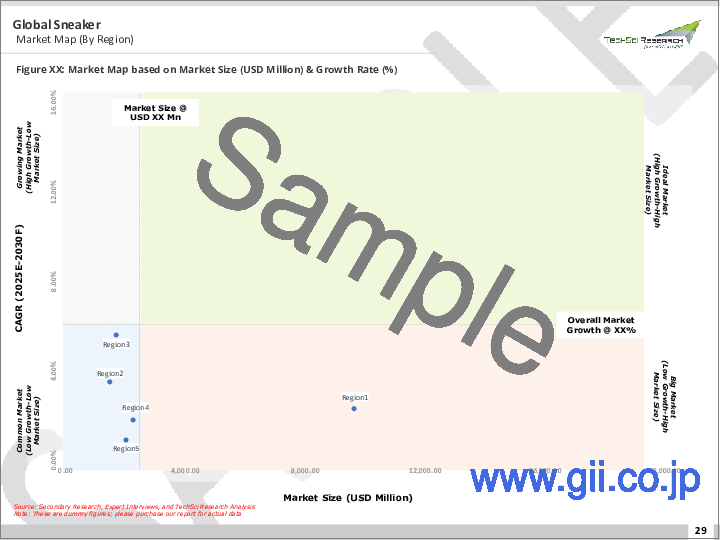

- 市場マップ

第6章 北米のスニーカー市場展望

- 市場規模・予測

- 市場シェア・予測

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 欧州のスニーカー市場展望

- 市場規模・予測

- 市場シェア・予測

- 欧州:国別分析

- フランス

- ドイツ

- スペイン

- イタリア

- 英国

第8章 アジア太平洋地域のスニーカー市場展望

- 市場規模・予測

- 市場シェア・予測

- アジア太平洋地域:国別分析

- 中国

- 日本

- インド

- ベトナム

- 韓国

第9章 中東・アフリカのスニーカー市場展望

- 市場規模・予測

- 市場シェア・予測

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- トルコ

- クウェート

- エジプト

第10章 南米のスニーカー市場展望

- 市場規模・予測

- 市場シェア・予測

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

- 合併と買収

- 製品の発売

- 最近の動向

第13章 ポーターのファイブフォース分析

- 業界内の競合

- 新規参入の可能性

- サプライヤーの力

- 顧客の力

- 代替品の脅威

第14章 競合情勢

- 企業プロファイル

- Nike Inc.

- Adidas AG

- New Balance Athletics, Inc.

- ASICS Corp.

- Kering SA

- Skechers USA, Inc.

- Under Armour Inc.

- VF Corp.

- Puma SE

- Relaxo Footwears Ltd.

第15章 戦略的提言

第16章 調査会社について・免責事項

The global Sneakers Market was valued at USD 88.91 Billion in 2024 and is expected to reach USD 135.42 Billion by 2030 with a CAGR of 7.32% during the forecast period. The increasing preference for fashionable, branded, and high-end sneakers across all age groups, coupled with a rise in disposable income, is driving the demand for more comfortable and innovative footwear, thereby accelerating market growth. However, the widespread availability of counterfeit products from local manufacturers may hinder industry expansion. On the other hand, the availability of customized and innovative sneakers presents profitable opportunities for market players. The growing population and rising awareness of health and wellness are motivating more individuals to engage in fitness activities, further boosting demand. Additionally, the increasing interest in fitness and sports among the younger population is contributing to the rising demand for sneakers.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 88.91 Billion |

| Market Size 2030 | USD 135.42 Billion |

| CAGR 2025-2030 | 7.32% |

| Fastest Growing Segment | Women |

| Largest Market | North America |

Market Drivers

Rising Popularity of Athleisure and Casual Footwear

The growing trend of athleisure and casual wear is a significant driver of the sneakers market. Over the past decade, consumer preferences have shifted towards comfortable, versatile, and stylish footwear that can seamlessly transition from the gym to daily life. This demand for sneakers is fueled by changing lifestyles and a shift toward more relaxed dress codes in both professional and social settings. Athleisure refers to clothing designed for both athletic activities and casual wear, and sneakers are at the heart of this trend. The rise of athleisure can be traced back to the increasing focus on health and wellness, where people not only prioritize physical fitness but also seek attire that aligns with their active lifestyles. As consumers embrace a more laid-back and functional approach to fashion, sneakers have become the footwear of choice, replacing traditional dress shoes or sandals in many situations. Moreover, the growth of fitness culture and increased participation in sports and outdoor activities have also bolstered the demand for sneakers. Popular brands have capitalized on this shift by introducing trendy and performance-enhancing designs, making sneakers an essential part of modern wardrobes. With high-profile endorsements from athletes and influencers, sneakers have become synonymous with both style and performance.

Key Market Challenges

Counterfeiting and Product Authenticity

One of the biggest challenges facing the sneakers market is the prevalence of counterfeiting. As sneaker culture has grown, so has the demand for high-end and limited-edition models, making them prime targets for counterfeiters. Fake sneakers often mimic the design, branding, and packaging of popular brands, which can deceive consumers and hurt the credibility of legitimate companies. The counterfeit sneaker market not only causes financial losses for genuine brands but also damages their reputation. Consumers who unknowingly purchase counterfeit products may be disappointed with quality, durability, or comfort, which can tarnish brand loyalty and diminish trust in the market as a whole. This challenge is particularly pronounced with online sales, where the risk of encountering fake products is higher. To combat this, many sneaker companies have adopted advanced anti-counterfeiting technologies such as holograms, RFID tags, and blockchain for authentication, allowing customers to verify the authenticity of their purchases. However, these measures can be costly and complicated to implement across global markets, especially in regions with weak intellectual property enforcement. Despite these efforts, counterfeiting remains a significant challenge that brands must address to protect their reputation and maintain consumer confidence.

Key Market Trends

Sustainability and Eco-Friendly Materials

Sustainability has become one of the most prominent trends in the sneakers market as consumers and brands alike respond to increasing environmental concerns. With rising awareness about climate change and pollution, there is a growing demand for sneakers that are environmentally friendly, made from recycled or biodegradable materials, and produced through ethical manufacturing processes. Many sneaker brands are embracing eco-friendly alternatives to traditional materials. For example, some companies are using recycled plastic bottles, organic cotton, and vegan leather to create shoes with a lower environmental footprint. Additionally, brands like Adidas have introduced products made from ocean plastic, partnering with organizations like Parley for the Oceans to tackle marine pollution while creating fashionable, sustainable sneakers. Brands are also looking into designing sneakers with the end of their lifecycle in mind, making them easier to recycle or even biodegrade. This trend is driven not only by consumer demand but also by the increasing regulatory pressure on industries to reduce carbon emissions and waste. As millennials and Gen Z are more inclined to support brands that demonstrate a commitment to sustainability, companies are increasingly investing in green production technologies and supply chain transparency. While the transition to fully sustainable sneakers presents challenges, such as higher production costs and sourcing difficulties, it is becoming a key differentiator in a competitive market, pushing brands toward more responsible innovation.

Key Market Players

- Nike Inc.

- Adidas AG

- New Balance Athletics, Inc.

- ASICS Corp.

- Kering SA

- Skechers USA, Inc.

- Under Armour Inc.

- VF Corp.

- Puma SE

- Relaxo Footwears Ltd.

Report Scope:

In this report, the global Sneakers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Sneakers Market, By Product Type:

- Low-top Sneakers

- Mid-top Sneakers

- High-top Sneakers

* Sneakers Market, By End User:

- Men

- Women

- Kids

* Sneakers Market, By Distribution Channel:

- Supermarket/Hypermarkets

- Specialty Stores

- Online

- Others

* Sneakers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Kuwait

- Egypt

- South America

- Brazil

- Argentina

- Colombia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the global Sneakers Market.

Available Customizations:

Global Sneakers Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Introduction

- 1.1. Product Overview

- 1.2. Key Highlights of the Report

- 1.3. Market Coverage

- 1.4. Market Segments Covered

- 1.5. Research Tenure Considered

2. Research Methodology

- 2.1. Methodology Landscape

- 2.2. Objective of the Study

- 2.3. Baseline Methodology

- 2.4. Formulation of the Scope

- 2.5. Assumptions and Limitations

- 2.6. Sources of Research

- 2.7. Approach for the Market Study

- 2.8. Methodology Followed for Calculation of Market Size & Market Shares

- 2.9. Forecasting Methodology

3. Executive Summary

- 3.1. Overview of the Market

- 3.2. Overview of Key Market Segmentations

- 3.3. Overview of Key Market Players

- 3.4. Overview of Key Regions

- 3.5. Overview of Market Drivers, Challenges, and Trends

4. Voice of Customer Analysis

- 4.1. Brand Awareness

- 4.2. Factor Influencing Purchasing Decision

5. Global Sneakers Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Product Type (Low-top Sneakers, Mid-top Sneakers, High-top Sneakers)

- 5.2.2. By End User (Men, Women, Kids)

- 5.2.3. By Distribution Channel (Supermarket/Hypermarkets, Specialty Stores, Online, Others)

- 5.2.4. By Region

- 5.2.5. By Company (2024)

- 5.3. Market Map

6. North America Sneakers Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Product Type

- 6.2.2. By End User

- 6.2.3. By Distribution Channel

- 6.2.4. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Sneakers Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Product Type

- 6.3.1.2.2. By End User

- 6.3.1.2.3. By Distribution Channel

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Sneakers Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Product Type

- 6.3.2.2.2. By End User

- 6.3.2.2.3. By Distribution Channel

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Sneakers Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Product Type

- 6.3.3.2.2. By End User

- 6.3.3.2.3. By Distribution Channel

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Sneakers Market Outlook

7. Europe Sneakers Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Product Type

- 7.2.2. By End User

- 7.2.3. By Distribution Channel

- 7.2.4. By Country

- 7.3. Europe: Country Analysis

- 7.3.1. France Sneakers Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Product Type

- 7.3.1.2.2. By End User

- 7.3.1.2.3. By Distribution Channel

- 7.3.1.1. Market Size & Forecast

- 7.3.2. Germany Sneakers Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Product Type

- 7.3.2.2.2. By End User

- 7.3.2.2.3. By Distribution Channel

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Spain Sneakers Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Product Type

- 7.3.3.2.2. By End User

- 7.3.3.2.3. By Distribution Channel

- 7.3.3.1. Market Size & Forecast

- 7.3.4. Italy Sneakers Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Product Type

- 7.3.4.2.2. By End User

- 7.3.4.2.3. By Distribution Channel

- 7.3.4.1. Market Size & Forecast

- 7.3.5. United Kingdom Sneakers Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Product Type

- 7.3.5.2.2. By End User

- 7.3.5.2.3. By Distribution Channel

- 7.3.5.1. Market Size & Forecast

- 7.3.1. France Sneakers Market Outlook

8. Asia-Pacific Sneakers Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Product Type

- 8.2.2. By End User

- 8.2.3. By Distribution Channel

- 8.2.4. By Country

- 8.3. Asia-Pacific: Country Analysis

- 8.3.1. China Sneakers Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Product Type

- 8.3.1.2.2. By End User

- 8.3.1.2.3. By Distribution Channel

- 8.3.1.1. Market Size & Forecast

- 8.3.2. Japan Sneakers Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Product Type

- 8.3.2.2.2. By End User

- 8.3.2.2.3. By Distribution Channel

- 8.3.2.1. Market Size & Forecast

- 8.3.3. India Sneakers Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Product Type

- 8.3.3.2.2. By End User

- 8.3.3.2.3. By Distribution Channel

- 8.3.3.1. Market Size & Forecast

- 8.3.4. Vietnam Sneakers Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Product Type

- 8.3.4.2.2. By End User

- 8.3.4.2.3. By Distribution Channel

- 8.3.4.1. Market Size & Forecast

- 8.3.5. South Korea Sneakers Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Product Type

- 8.3.5.2.2. By End User

- 8.3.5.2.3. By Distribution Channel

- 8.3.5.1. Market Size & Forecast

- 8.3.1. China Sneakers Market Outlook

9. Middle East & Africa Sneakers Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Product Type

- 9.2.2. By End User

- 9.2.3. By Distribution Channel

- 9.2.4. By Country

- 9.3. MEA: Country Analysis

- 9.3.1. South Africa Sneakers Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Product Type

- 9.3.1.2.2. By End User

- 9.3.1.2.3. By Distribution Channel

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Saudi Arabia Sneakers Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Product Type

- 9.3.2.2.2. By End User

- 9.3.2.2.3. By Distribution Channel

- 9.3.2.1. Market Size & Forecast

- 9.3.3. UAE Sneakers Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Product Type

- 9.3.3.2.2. By End User

- 9.3.3.2.3. By Distribution Channel

- 9.3.3.1. Market Size & Forecast

- 9.3.4. Turkey Sneakers Market Outlook

- 9.3.4.1. Market Size & Forecast

- 9.3.4.1.1. By Value

- 9.3.4.2. Market Share & Forecast

- 9.3.4.2.1. By Product Type

- 9.3.4.2.2. By End User

- 9.3.4.2.3. By Distribution Channel

- 9.3.4.1. Market Size & Forecast

- 9.3.5. Kuwait Sneakers Market Outlook

- 9.3.5.1. Market Size & Forecast

- 9.3.5.1.1. By Value

- 9.3.5.2. Market Share & Forecast

- 9.3.5.2.1. By Product Type

- 9.3.5.2.2. By End User

- 9.3.5.2.3. By Distribution Channel

- 9.3.5.1. Market Size & Forecast

- 9.3.6. Egypt Sneakers Market Outlook

- 9.3.6.1. Market Size & Forecast

- 9.3.6.1.1. By Value

- 9.3.6.2. Market Share & Forecast

- 9.3.6.2.1. By Product Type

- 9.3.6.2.2. By End User

- 9.3.6.2.3. By Distribution Channel

- 9.3.6.1. Market Size & Forecast

- 9.3.1. South Africa Sneakers Market Outlook

10. South America Sneakers Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Product Type

- 10.2.2. By End User

- 10.2.3. By Distribution Channel

- 10.2.4. By Country

- 10.3. South America: Country Analysis

- 10.3.1. Brazil Sneakers Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Product Type

- 10.3.1.2.2. By End User

- 10.3.1.2.3. By Distribution Channel

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Argentina Sneakers Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Product Type

- 10.3.2.2.2. By End User

- 10.3.2.2.3. By Distribution Channel

- 10.3.2.1. Market Size & Forecast

- 10.3.3. Colombia Sneakers Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Product Type

- 10.3.3.2.2. By End User

- 10.3.3.2.3. By Distribution Channel

- 10.3.3.1. Market Size & Forecast

- 10.3.1. Brazil Sneakers Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Market Trends & Developments

- 12.1. Merger & Acquisition (If Any)

- 12.2. Product Launches (If Any)

- 12.3. Recent Developments

13. Porters Five Forces Analysis

- 13.1. Competition in the Industry

- 13.2. Potential of New Entrants

- 13.3. Power of Suppliers

- 13.4. Power of Customers

- 13.5. Threat of Substitute Products

14. Competitive Landscape

- 14.1. Company Profiles

- 14.1.1. Nike Inc.

- 14.1.1.1. Business Overview

- 14.1.1.2. Company Snapshot

- 14.1.1.3. Products & Services

- 14.1.1.4. Financials (As Per Availability)

- 14.1.1.5. Key Market Focus & Geographical Presence

- 14.1.1.6. Recent Developments

- 14.1.1.7. Key Management Personnel

- 14.1.2. Adidas AG

- 14.1.3. New Balance Athletics, Inc.

- 14.1.4. ASICS Corp.

- 14.1.5. Kering SA

- 14.1.6. Skechers USA, Inc.

- 14.1.7. Under Armour Inc.

- 14.1.8. VF Corp.

- 14.1.9. Puma SE

- 14.1.10. Relaxo Footwears Ltd.

- 14.1.1. Nike Inc.