|

|

市場調査レポート

商品コード

1643272

船舶リース市場- 世界の産業規模、シェア、動向、機会、予測、セグメント、リースタイプ別、タイプ別、用途別、地域別、競合、2020年~2030年Ship Leasing Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Lease Type, By Type, By Application, By Region & Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| 船舶リース市場- 世界の産業規模、シェア、動向、機会、予測、セグメント、リースタイプ別、タイプ別、用途別、地域別、競合、2020年~2030年 |

|

出版日: 2025年01月24日

発行: TechSci Research

ページ情報: 英文 185 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

船舶リースの世界市場規模は2024年に140億8,000万米ドルで、予測期間中のCAGRは12.08%で2030年には279億1,000万米ドルに達する見込みです。

世界の船舶リース市場は、海上オペレーションにおける柔軟でコスト効率の高いソリューションへのニーズの高まりに後押しされ、力強い成長を遂げています。船舶リースは、事業者に多額の資本支出なしに先進的な船舶にアクセスする能力を提供し、世界な海運・物流ネットワークの需要を満たします。このモデルは、石油・ガス探査、コンテナ輸送、オフショア業務など、特定の業務に特化した船舶を必要とする業界にとって特に魅力的です。技術の進歩が船舶の効率と能力を再定義する中、リースは、企業が購入価格を全額負担することなく、より新しく持続可能な船舶技術を採用するために不可欠なアプローチであり続けています。

| 市場概要 | |

|---|---|

| 予測期間 | 2026-2030 |

| 市場規模:2024年 | 140億8,000万米ドル |

| 市場規模:2030年 | 279億1,000万米ドル |

| CAGR:2025年~2030年 | 12.08% |

| 急成長セグメント | フルサービス・リース |

| 最大市場 | アジア太平洋 |

船舶リース市場の成長は、いくつかの重要な要因によって牽引されています。世界貿易の急増と海上輸送量の増加により、より多くの船腹が必要となり、需要に柔軟に対応するために船舶をリースする企業が増えています。例えば、2023年の世界の海上貿易は2.4%成長し、123億トンに達しました。この分野は2024年に2%成長し、2029年まで年平均2.4%成長すると予測されています。鉄鉱石、石炭、穀物の需要は引き続き旺盛であるが、コンテナ貿易は2023年には0.3%の伸びにとどまったが、2024年には3.5%の回復が見込まれます。2023年下半期にコンテナ船が寄港した港は25万港近くに上り、トンマイルは4.2%増加しました。地政学的緊張と気候変動リスクは、引き続き回復努力の課題となっています。LNG船や自律型船舶を含む近代的な船舶の複雑化とコストの上昇も、リース契約の魅力を高めています。リースを利用すれば、企業は所有に伴う経済的負担を負うことなく、こうした最新鋭船を利用できます。さらに、環境規制の高まりにより、船舶運航会社は環境に優しい船舶の採用を余儀なくされており、リースはより環境に優しい技術への効率的な移行経路を提供しています。これらの要因が相まって、当面の市場需要は堅調に推移するものと思われます。

船舶リース市場の動向には、LNG用タンカーやeコマース用コンテナ船など、特定の産業に特化した船舶へのシフトが含まれます。また、IoT、AI、リアルタイムモニタリングシステムを搭載した先進的な船舶を貸主が提供するなど、船舶へのスマートテクノロジーの統合も一般的になりつつあります。海運産業が急拡大している新興市場におけるリース需要の高まりがチャンスとなります。しかし、運賃の変動やメンテナンスコストの上昇など、長期リース契約を複雑にする課題に直面しています。成長を維持するためには、運航コストのバランスをとり、世界の海運基準へのコンプライアンスを確保することが重要です。

市場促進要因

海上貿易量の増加

環境コンプライアンス要件

オフショア活動の成長

主な市場課題

運賃の変動

高い保守・運航コスト

経済の不確実性と市場リスク

主な市場動向

グリーン輸送への嗜好の高まり

短期リース契約の拡大

リース・ポートフォリオの多様化

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 世界の船舶リース市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- リースタイプ別(ファイナンシャルリース、フルサービスリース)

- タイプ別(リアルタイムリース、定期借地、ベアボートチャーター、その他)

- 用途別(コンテナ船、ばら積み貨物船)

- 地域別

- 上位5社、その他(2024)

- 世界の船舶リース市場マッピング&機会評価

- リースタイプ別

- タイプ別

- 用途別

- 地域別

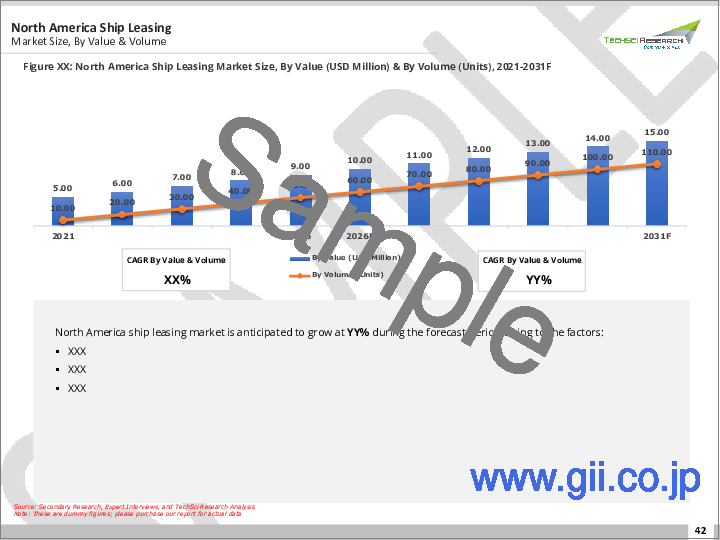

第5章 北米の船舶リース市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- リースタイプ別

- タイプ別

- 用途別

- 国別

第6章 欧州・CISの船舶リース市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- リースタイプ別

- タイプ別

- 用途別

- 国別

第7章 アジア太平洋地域の船舶リース市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- リースタイプ別

- タイプ別

- 用途別

- 国別

第8章 中東・アフリカの船舶リース市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- リースタイプ別

- タイプ別

- 用途別

- 国別

第9章 南米の船舶リース市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- リースタイプ別

- タイプ別

- 用途別

- 国別

第10章 市場力学

- 促進要因

- 課題

第11章 COVID-19の影響世界の船舶リース市場

第12章 市場動向と発展

第13章 競合情勢

- 企業プロファイル

- A.P. Moller-Maersk A/S

- Global Ship Lease, Inc.

- Hamburg Commercial Bank AG

- First Ship Lease Trust

- Galbraiths Ltd.

- ICBC Co., Ltd.

- Minsheng Financial Leasing Co., Ltd.

- CMB Financial Leasing CO., LTD.

- Bothra Group

- MUFG Bank, Ltd.

第14章 戦略的提言・アクションプラン

- 主要な重点分野

第15章 調査会社について・免責事項

The Global Ship Leasing Market was valued at USD 14.08 Billion in 2024 and is expected to reach USD 27.91 Billion by 2030 with a CAGR of 12.08% during the forecast period. The global ship leasing market is witnessing robust growth, fueled by the increasing need for flexible and cost-efficient solutions in maritime operations. Ship leasing provides operators with the ability to access advanced vessels without substantial capital expenditure, meeting the demands of global shipping and logistics networks. This model is especially attractive to industries requiring specialized ships for specific tasks, such as oil and gas exploration, container transport, and offshore operations. As technological advancements redefine ship efficiency and capabilities, leasing remains a vital approach for companies to adopt newer, more sustainable vessel technologies without incurring the full purchase price.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 14.08 Billion |

| Market Size 2030 | USD 27.91 Billion |

| CAGR 2025-2030 | 12.08% |

| Fastest Growing Segment | Full-Service Lease |

| Largest Market | Asia-Pacific |

The growth of the ship leasing market is driven by several key factors. The surge in global trade and rising maritime transportation volumes require more shipping capacity, encouraging companies to lease ships to meet demand flexibly. For instance, In 2023, global maritime trade grew by 2.4%, reaching 12.3 billion tons. The sector is projected to grow by 2% in 2024 and average 2.4% annually through 2029. While demand for iron ore, coal, and grains remains strong, container trade grew by only 0.3% in 2023 but is expected to rebound by 3.5% in 2024. Nearly 250,000 port calls were made by container ships in the second half of 2023, with ton-miles increasing by 4.2%. Geopolitical tensions and climate risks continue to challenge recovery efforts. The increasing complexity and cost of modern vessels, including LNG carriers and autonomous ships, have also boosted the appeal of leasing arrangements. Leasing provides companies with access to these advanced vessels without the financial burden of ownership. Furthermore, growing environmental regulations are compelling ship operators to adopt eco-friendly ships, and leasing offers an efficient pathway to transition toward greener technologies. These factors collectively ensure strong market demand in the foreseeable future.

Trends in the ship leasing market include a shift toward specialized vessels tailored for specific industries, such as tankers for LNG or container ships for e-commerce. The integration of smart technologies in ships is also becoming common, with lessors offering advanced vessels equipped with IoT, AI, and real-time monitoring systems. Opportunities lie in the increasing demand for leasing in emerging markets, where shipping industries are expanding rapidly. However, the market faces challenges, such as fluctuations in freight rates and rising maintenance cost, which can complicate long-term leasing contracts. Balancing operational cost and ensuring compliance with global shipping standards will be crucial for sustaining growth.

Market Drivers

Rising Maritime Trade Volumes

Maritime trade continues to grow as the backbone of global commerce, handling over 80% of world trade by volume. The rising demand for consumer goods, raw materials, and energy sources has led to an increase in the need for shipping capacity. Ship leasing plays a crucial role in meeting this demand by providing flexible access to vessels for operators. Container shipping is particularly benefiting from the surge in e-commerce, while bulk carriers and tankers are seeing heightened demand for transporting agricultural products and energy resources. Leasing allows companies to adjust their fleet size quickly, avoiding large capital expenditures. This model is especially valuable for smaller operators who cannot afford to purchase vessels outright. The ability to lease vessels as needed enhances the efficiency of global supply chains, helping businesses adapt to fluctuating market conditions and trade routes.

Environmental Compliance Requirements

Stringent environmental regulations, such as IMO, require ships to reduce their emissions and adopt cleaner technologies. For instance, in 2023, the IMO implemented key regulations, including the Carbon Intensity Indicator (CII) and Energy Efficiency Existing Index (EEXI). Ships must be approved in their first periodical survey of 2023, with EEXI values calculated and compared to required standards. If below the threshold, vessels could face penalties. To meet EEXI requirements, ships may need engine modifications or energy-saving devices. Reducing speed by 20% can cut CO2 emissions by 50%. Other options include using batteries or zero-carbon fuels for cleaner technologies. These measures aim to promote sustainability in global shipping.

Compliance often necessitates the adoption of eco-friendly vessels powered by LNG, hybrid engines, or equipped with scrubbers. For many operators, upgrading or purchasing new ships to meet these standards is not financially feasible. Ship leasing emerges as a practical alternative, offering access to environmentally compliant vessels without significant upfront cost. Leasing companies are focusing on expanding their fleets with green technologies, enabling operators to align with global sustainability goals and avoid penalties. This trend underscores the importance of leasing in transitioning the shipping industry toward greener operations.

Growth in Offshore Activities

The expansion of offshore industries, including oil and gas, renewable energy, and subsea exploration, has significantly increased the demand for specialized vessels. Offshore support vessels, seismic survey ships, and wind turbine installation vessels are critical for these sectors. Leasing provides a cost-effective way for companies to acquire such highly specialized vessels, often needed for specific projects or short durations. This flexibility allows operators to optimize their cost while ensuring the availability of appropriate ships for their operations. As offshore industries continue to expand, ship leasing is poised to play a pivotal role in supporting their growth.

Key Market Challenges

Volatility in Freight Rates

Freight rates in the shipping industry are highly volatile, influenced by factors like demand fluctuations, geopolitical events, and economic conditions. These variations pose challenges for ship leasing, as lessees may find it difficult to meet contractual obligations during periods of low rates. For lessors, this volatility complicates the forecasting of revenue streams, impacting their financial stability. Lessees often renegotiate terms or default during market downturns, creating risks for leasing companies. This uncertainty necessitates strategic planning and flexible contract structures to mitigate financial risks for both parties.

High Maintenance and Operating Cost

Operating a ship entails significant expenses, including crew salaries, fuel, insurance, and periodic maintenance. Leasing companies often bear a portion of these cost, reducing their profit margins. Modern vessels equipped with advanced systems require specialized maintenance, further escalating cost. For lessees, operational expenses can diminish the financial benefits of leasing, particularly in low-revenue periods. Addressing these challenges requires innovative cost-sharing agreements and investments in energy-efficient technologies to reduce long-term operating cost.

Economic Uncertainty and Market Risks

Economic instability, influenced by global events, inflation, and trade disruptions, poses significant risks to the ship leasing market. Economic downturns reduce trade volumes and shipping demand, leading to lower lease rates and revenue for lessors. Lessees may struggle with cash flow during such periods, increasing the likelihood of contract defaults. These uncertainties necessitate robust risk management strategies and contingency planning to ensure market resilience.

Key Market Trends

Growing Preference for Green Shipping

The shipping industry is moving toward sustainability, with increasing demand for eco-friendly vessels equipped with LNG engines, hybrid propulsion systems, and energy-efficient designs. Ship leasing companies are expanding their fleets to include greener options, allowing operators to reduce their environmental impact without incurring high purchase cost. This trend aligns with global initiatives to decarbonize maritime transport and supports the adoption of clean technologies across the industry.

Expansion of Short-Term Leasing Contracts

Short-term leasing agreements are becoming more popular, driven by fluctuating trade demands and project-specific requirements. These contracts provide flexibility for operators to adjust their fleets based on immediate needs, avoiding long-term financial commitments. Leasing companies are adapting to this trend by offering tailored solutions, enabling lessees to manage capacity and cost more effectively.

Diversification of Leasing Portfolios

Ship leasing companies are diversifying their offerings to include specialized vessels for emerging industries, such as offshore wind energy and deep-sea exploration. This diversification allows lessors to cater to a broader range of clients and revenue streams, enhancing market stability. Expanding portfolios also supports industry-specific requirements, ensuring a steady demand for leased ships across sectors.

Segmental Insights

Type Insights

In 2024, Bareboat Charter emerged as the dominant type in the global ship leasing market due to its versatility and widespread adoption across various industries. This leasing model allowed lessees to operate vessels independently while taking full responsibility for crew management, maintenance, and operational cost. It was particularly favored by companies requiring long-term vessel usage but seeking to avoid the significant capital expenditure associated with ownership. The autonomy of bareboat charters and the flexibility to customize operations made it an ideal choice for sectors such as shipping, offshore exploration, and cargo transportation.

Bareboat charters delivered financial benefits by providing access to advanced and specialized vessels without the burden of outright purchase. These charters often catered to operators aiming to utilize newer, more fuel-efficient ships or those equipped with cutting-edge technologies like LNG engines and automated systems. This leasing type enabled lessees to align their fleets with industry requirements and comply with evolving regulatory standards. Additionally, it supported cost optimization by allowing operators to allocate financial resources toward operational enhancements instead of asset acquisition.

The long-term nature of bareboat charters provided stability in leasing agreements, which attracted both lessors and lessees. Lessors benefitted from predictable revenue streams, while lessees accessed ships tailored to their specific operational needs. The strategic importance of bareboat charters and their extensive adoption across diverse maritime applications underscored their dominance in 2024.

Region Insights

In 2024, Asia-Pacific dominated the global ship leasing market, driven by the region's robust maritime trade and expansive industrial base. As one of the largest contributors to global shipping, Asia-Pacific benefited from the extensive import and export activities across its economies. The region's strategic location with key maritime routes, including the Strait of Malacca and the South China Sea, supported its leadership in the market. The rise in container shipping, fueled by the growth of e-commerce and manufacturing exports, further propelled the demand for leased vessels. Operators in the region utilized ship leasing to access advanced container ships and bulk carriers, optimizing their operations to meet the high trade volumes.

The demand for specialized vessels, such as LNG carriers and offshore support ships, was another factor that solidified Asia-Pacific's dominance. With the increasing focus on energy transportation and offshore exploration, companies in the region relied heavily on leasing models to procure the necessary vessels without bearing significant capital cost. The availability of shipyards and strong collaboration between lessors and lessees ensured the steady supply of leased vessels, meeting the diverse needs of operators across the region.

Asia-Pacific also led the market due to its proactive adoption of sustainable and technologically advanced ships. Governments and shipping companies prioritized compliance with environmental regulations, creating a significant demand for eco-friendly vessels equipped with LNG propulsion, scrubbers, and other emissions-reducing technologies. Leasing provided a cost-effective pathway for operators to transition their fleets, ensuring regulatory compliance while maintaining profitability. The integration of smart technologies in ships, such as IoT-based tracking and AI-driven navigation, further enhanced the region's appeal, as operators sought to modernize their fleets through leasing arrangements.

The dominance of Asia-Pacific was further supported by its thriving maritime infrastructure, with numerous ports, logistics hubs, and interconnectivity facilitating the efficient operation of leased vessels. This infrastructure allowed operators to maximize the utilization of leased ships, making leasing an integral part of the region's shipping ecosystem. The combination of strong trade activity, a focus on specialized vessels, and advancements in sustainable shipping solidified Asia-Pacific's position as the leading region in the global ship leasing market in 2024.

Key Market Players

- A.P. Moller - Maersk A/S

- Global Ship Lease, Inc.

- Hamburg Commercial Bank AG

- First Ship Lease Trust

- Galbraiths Ltd.

- ICBC Co., Ltd.

- Minsheng Financial Leasing Co., Ltd.

- CMB Financial Leasing CO., LTD.

- Bothra Group

- MUFG Bank, Ltd.

Report Scope:

In this report, the Global Ship Leasing market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Ship Leasing Market, By Lease Type:

- Financial Lease

- Full-Service Lease

Ship Leasing Market, By Type:

- Real-Time Lease

- Periodic Tenancy

- Bareboat Charter

- Other Types

Ship Leasing Market, By Application:

- Container Ships

- Bulk Carriers

Ship Leasing Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe & CIS

- France

- Germany

- Spain

- Italy

- United Kingdom

- Asia-Pacific

- China

- Japan

- India

- Vietnam

- South Korea

- Thailand

- Australia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- South America

- Brazil

- Argentina

Competitive Landscape

Company Profiles: Detailed analysis of the major Global Ship Leasing Market companies.

Available Customizations:

Global Ship Leasing Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Introduction

- 1.1. Market Overview

- 1.2. Key Highlights of the Report

- 1.3. Market Coverage

- 1.4. Market Segments Covered

- 1.5. Research Tenure Considered

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validation

- 2.7. Assumptions and Limitations

3. Executive Summary

- 3.1. Market Overview

- 3.2. Market Forecast

- 3.3. Key Regions

- 3.4. Key Segments

4. Global Ship Leasing Market Outlook

- 4.1. Market Size & Forecast

- 4.1.1. By Value

- 4.2. Market Share & Forecast

- 4.2.1. By Lease Type Market Share Analysis (Financial Lease, Full-Service Lease)

- 4.2.2. By Type Market Share Analysis (Real-Time Lease, Periodic Tenancy, Bareboat Charter, Other Types)

- 4.2.3. By Application Market Share Analysis (Container Ships, Bulk Carriers)

- 4.2.4. By Regional Market Share Analysis

- 4.2.4.1. North America Market Share Analysis

- 4.2.4.2. Europe & CIS Market Share Analysis

- 4.2.4.3. Asia-Pacific Market Share Analysis

- 4.2.4.4. Middle East & Africa Market Share Analysis

- 4.2.4.5. South America Market Share Analysis

- 4.2.5. By Top 5 Companies Market Share Analysis, Others (2024)

- 4.3. Global Ship Leasing Market Mapping & Opportunity Assessment

- 4.3.1. By Lease Type Market Mapping & Opportunity Assessment

- 4.3.2. By Type Market Mapping & Opportunity Assessment

- 4.3.3. By Application Market Mapping & Opportunity Assessment

- 4.3.4. By Regional Market Mapping & Opportunity Assessment

5. North America Ship Leasing Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Lease Type Market Share Analysis

- 5.2.2. By Type Market Share Analysis

- 5.2.3. By Application Market Share Analysis

- 5.2.4. By Country Market Share Analysis

- 5.2.4.1. United States Ship Leasing Market Outlook

- 5.2.4.1.1. Market Size & Forecast

- 5.2.4.1.1.1. By Value

- 5.2.4.1.2. Market Share & Forecast

- 5.2.4.1.2.1. By Lease Type Market Share Analysis

- 5.2.4.1.2.2. By Type Market Share Analysis

- 5.2.4.1.2.3. By Application Market Share Analysis

- 5.2.4.2. Canada Ship Leasing Market Outlook

- 5.2.4.2.1. Market Size & Forecast

- 5.2.4.2.1.1. By Value

- 5.2.4.2.2. Market Share & Forecast

- 5.2.4.2.2.1. By Lease Type Market Share Analysis

- 5.2.4.2.2.2. By Type Market Share Analysis

- 5.2.4.2.2.3. By Application Market Share Analysis

- 5.2.4.3. Mexico Ship Leasing Market Outlook

- 5.2.4.3.1. Market Size & Forecast

- 5.2.4.3.1.1. By Value

- 5.2.4.3.2. Market Share & Forecast

- 5.2.4.3.2.1. By Lease Type Market Share Analysis

- 5.2.4.3.2.2. By Type Market Share Analysis

- 5.2.4.3.2.3. By Application Market Share Analysis

- 5.2.4.1. United States Ship Leasing Market Outlook

6. Europe & CIS Ship Leasing Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Lease Type Market Share Analysis

- 6.2.2. By Type Market Share Analysis

- 6.2.3. By Application Market Share Analysis

- 6.2.4. By Country Market Share Analysis

- 6.2.4.1. France Ship Leasing Market Outlook

- 6.2.4.1.1. Market Size & Forecast

- 6.2.4.1.1.1. By Value

- 6.2.4.1.2. Market Share & Forecast

- 6.2.4.1.2.1. By Lease Type Market Share Analysis

- 6.2.4.1.2.2. By Type Market Share Analysis

- 6.2.4.1.2.3. By Application Market Share Analysis

- 6.2.4.2. Germany Ship Leasing Market Outlook

- 6.2.4.2.1. Market Size & Forecast

- 6.2.4.2.1.1. By Value

- 6.2.4.2.2. Market Share & Forecast

- 6.2.4.2.2.1. By Lease Type Market Share Analysis

- 6.2.4.2.2.2. By Type Market Share Analysis

- 6.2.4.2.2.3. By Application Market Share Analysis

- 6.2.4.3. Spain Ship Leasing Market Outlook

- 6.2.4.3.1. Market Size & Forecast

- 6.2.4.3.1.1. By Value

- 6.2.4.3.2. Market Share & Forecast

- 6.2.4.3.2.1. By Lease Type Market Share Analysis

- 6.2.4.3.2.2. By Type Market Share Analysis

- 6.2.4.3.2.3. By Application Market Share Analysis

- 6.2.4.4. Italy Ship Leasing Market Outlook

- 6.2.4.4.1. Market Size & Forecast

- 6.2.4.4.1.1. By Value

- 6.2.4.4.2. Market Share & Forecast

- 6.2.4.4.2.1. By Lease Type Market Share Analysis

- 6.2.4.4.2.2. By Type Market Share Analysis

- 6.2.4.4.2.3. By Application Market Share Analysis

- 6.2.4.5. United Kingdom Ship Leasing Market Outlook

- 6.2.4.5.1. Market Size & Forecast

- 6.2.4.5.1.1. By Value

- 6.2.4.5.2. Market Share & Forecast

- 6.2.4.5.2.1. By Lease Type Market Share Analysis

- 6.2.4.5.2.2. By Type Market Share Analysis

- 6.2.4.5.2.3. By Application Market Share Analysis

- 6.2.4.1. France Ship Leasing Market Outlook

7. Asia-Pacific Ship Leasing Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Lease Type Market Share Analysis

- 7.2.2. By Type Market Share Analysis

- 7.2.3. By Application Market Share Analysis

- 7.2.4. By Country Market Share Analysis

- 7.2.4.1. China Ship Leasing Market Outlook

- 7.2.4.1.1. Market Size & Forecast

- 7.2.4.1.1.1. By Value

- 7.2.4.1.2. Market Share & Forecast

- 7.2.4.1.2.1. By Lease Type Market Share Analysis

- 7.2.4.1.2.2. By Type Market Share Analysis

- 7.2.4.1.2.3. By Application Market Share Analysis

- 7.2.4.2. Japan Ship Leasing Market Outlook

- 7.2.4.2.1. Market Size & Forecast

- 7.2.4.2.1.1. By Value

- 7.2.4.2.2. Market Share & Forecast

- 7.2.4.2.2.1. By Lease Type Market Share Analysis

- 7.2.4.2.2.2. By Type Market Share Analysis

- 7.2.4.2.2.3. By Application Market Share Analysis

- 7.2.4.3. India Ship Leasing Market Outlook

- 7.2.4.3.1. Market Size & Forecast

- 7.2.4.3.1.1. By Value

- 7.2.4.3.2. Market Share & Forecast

- 7.2.4.3.2.1. By Lease Type Market Share Analysis

- 7.2.4.3.2.2. By Type Market Share Analysis

- 7.2.4.3.2.3. By Application Market Share Analysis

- 7.2.4.4. Vietnam Ship Leasing Market Outlook

- 7.2.4.4.1. Market Size & Forecast

- 7.2.4.4.1.1. By Value

- 7.2.4.4.2. Market Share & Forecast

- 7.2.4.4.2.1. By Lease Type Market Share Analysis

- 7.2.4.4.2.2. By Type Market Share Analysis

- 7.2.4.4.2.3. By Application Market Share Analysis

- 7.2.4.5. South Korea Ship Leasing Market Outlook

- 7.2.4.5.1. Market Size & Forecast

- 7.2.4.5.1.1. By Value

- 7.2.4.5.2. Market Share & Forecast

- 7.2.4.5.2.1. By Lease Type Market Share Analysis

- 7.2.4.5.2.2. By Type Market Share Analysis

- 7.2.4.5.2.3. By Application Market Share Analysis

- 7.2.4.6. Australia Ship Leasing Market Outlook

- 7.2.4.6.1. Market Size & Forecast

- 7.2.4.6.1.1. By Value

- 7.2.4.6.2. Market Share & Forecast

- 7.2.4.6.2.1. By Lease Type Market Share Analysis

- 7.2.4.6.2.2. By Type Market Share Analysis

- 7.2.4.6.2.3. By Application Market Share Analysis

- 7.2.4.7. Thailand Ship Leasing Market Outlook

- 7.2.4.7.1. Market Size & Forecast

- 7.2.4.7.1.1. By Value

- 7.2.4.7.2. Market Share & Forecast

- 7.2.4.7.2.1. By Lease Type Market Share Analysis

- 7.2.4.7.2.2. By Type Market Share Analysis

- 7.2.4.7.2.3. By Application Market Share Analysis

- 7.2.4.1. China Ship Leasing Market Outlook

8. Middle East & Africa Ship Leasing Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Lease Type Market Share Analysis

- 8.2.2. By Type Market Share Analysis

- 8.2.3. By Application Market Share Analysis

- 8.2.4. By Country Market Share Analysis

- 8.2.4.1. South Africa Ship Leasing Market Outlook

- 8.2.4.1.1. Market Size & Forecast

- 8.2.4.1.1.1. By Value

- 8.2.4.1.2. Market Share & Forecast

- 8.2.4.1.2.1. By Lease Type Market Share Analysis

- 8.2.4.1.2.2. By Type Market Share Analysis

- 8.2.4.1.2.3. By Application Market Share Analysis

- 8.2.4.2. Saudi Arabia Ship Leasing Market Outlook

- 8.2.4.2.1. Market Size & Forecast

- 8.2.4.2.1.1. By Value

- 8.2.4.2.2. Market Share & Forecast

- 8.2.4.2.2.1. By Lease Type Market Share Analysis

- 8.2.4.2.2.2. By Type Market Share Analysis

- 8.2.4.2.2.3. By Application Market Share Analysis

- 8.2.4.3. UAE Ship Leasing Market Outlook

- 8.2.4.3.1. Market Size & Forecast

- 8.2.4.3.1.1. By Value

- 8.2.4.3.2. Market Share & Forecast

- 8.2.4.3.2.1. By Lease Type Market Share Analysis

- 8.2.4.3.2.2. By Type Market Share Analysis

- 8.2.4.3.2.3. By Application Market Share Analysis

- 8.2.4.4. Turkey Ship Leasing Market Outlook

- 8.2.4.4.1. Market Size & Forecast

- 8.2.4.4.1.1. By Value

- 8.2.4.4.2. Market Share & Forecast

- 8.2.4.4.2.1. By Lease Type Market Share Analysis

- 8.2.4.4.2.2. By Type Market Share Analysis

- 8.2.4.4.2.3. By Application Market Share Analysis

- 8.2.4.1. South Africa Ship Leasing Market Outlook

9. South America Ship Leasing Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Lease Type Market Share Analysis

- 9.2.2. By Type Market Share Analysis

- 9.2.3. By Application Market Share Analysis

- 9.2.4. By Country Market Share Analysis

- 9.2.4.1. Brazil Ship Leasing Market Outlook

- 9.2.4.1.1. Market Size & Forecast

- 9.2.4.1.1.1. By Value

- 9.2.4.1.2. Market Share & Forecast

- 9.2.4.1.2.1. By Lease Type Market Share Analysis

- 9.2.4.1.2.2. By Type Market Share Analysis

- 9.2.4.1.2.3. By Application Market Share Analysis

- 9.2.4.2. Argentina Ship Leasing Market Outlook

- 9.2.4.2.1. Market Size & Forecast

- 9.2.4.2.1.1. By Value

- 9.2.4.2.2. Market Share & Forecast

- 9.2.4.2.2.1. By Lease Type Market Share Analysis

- 9.2.4.2.2.2. By Type Market Share Analysis

- 9.2.4.2.2.3. By Application Market Share Analysis

- 9.2.4.1. Brazil Ship Leasing Market Outlook

10. Market Dynamics

- 10.1. Drivers

- 10.2. Challenges

11. Impact of COVID-19 on the Global Ship Leasing Market

12. Market Trends & Developments

13. Competitive Landscape

- 13.1. Company Profiles

- 13.1.1. A.P. Moller - Maersk A/S

- 13.1.1.1. Company Details

- 13.1.1.2. Products

- 13.1.1.3. Financials (As Per Availability)

- 13.1.1.4. Key Market Focus & Geographical Presence

- 13.1.1.5. Recent Developments

- 13.1.1.6. Key Management Personnel

- 13.1.2. Global Ship Lease, Inc.

- 13.1.2.1. Company Details

- 13.1.2.2. Products

- 13.1.2.3. Financials (As Per Availability)

- 13.1.2.4. Key Market Focus & Geographical Presence

- 13.1.2.5. Recent Developments

- 13.1.2.6. Key Management Personnel

- 13.1.3. Hamburg Commercial Bank AG

- 13.1.3.1. Company Details

- 13.1.3.2. Products

- 13.1.3.3. Financials (As Per Availability)

- 13.1.3.4. Key Market Focus & Geographical Presence

- 13.1.3.5. Recent Developments

- 13.1.3.6. Key Management Personnel

- 13.1.4. First Ship Lease Trust

- 13.1.4.1. Company Details

- 13.1.4.2. Products

- 13.1.4.3. Financials (As Per Availability)

- 13.1.4.4. Key Market Focus & Geographical Presence

- 13.1.4.5. Recent Developments

- 13.1.4.6. Key Management Personnel

- 13.1.5. Galbraiths Ltd.

- 13.1.5.1. Company Details

- 13.1.5.2. Products

- 13.1.5.3. Financials (As Per Availability)

- 13.1.5.4. Key Market Focus & Geographical Presence

- 13.1.5.5. Recent Developments

- 13.1.5.6. Key Management Personnel

- 13.1.6. ICBC Co., Ltd.

- 13.1.6.1. Company Details

- 13.1.6.2. Products

- 13.1.6.3. Financials (As Per Availability)

- 13.1.6.4. Key Market Focus & Geographical Presence

- 13.1.6.5. Recent Developments

- 13.1.6.6. Key Management Personnel

- 13.1.7. Minsheng Financial Leasing Co., Ltd.

- 13.1.7.1. Company Details

- 13.1.7.2. Products

- 13.1.7.3. Financials (As Per Availability)

- 13.1.7.4. Key Market Focus & Geographical Presence

- 13.1.7.5. Recent Developments

- 13.1.7.6. Key Management Personnel

- 13.1.8. CMB Financial Leasing CO., LTD.

- 13.1.8.1. Company Details

- 13.1.8.2. Products

- 13.1.8.3. Financials (As Per Availability)

- 13.1.8.4. Key Market Focus & Geographical Presence

- 13.1.8.5. Recent Developments

- 13.1.8.6. Key Management Personnel

- 13.1.9. Bothra Group

- 13.1.9.1. Company Details

- 13.1.9.2. Products

- 13.1.9.3. Financials (As Per Availability)

- 13.1.9.4. Key Market Focus & Geographical Presence

- 13.1.9.5. Recent Developments

- 13.1.9.6. Key Management Personnel

- 13.1.10. MUFG Bank, Ltd.

- 13.1.10.1. Company Details

- 13.1.10.2. Products

- 13.1.10.3. Financials (As Per Availability)

- 13.1.10.4. Key Market Focus & Geographical Presence

- 13.1.10.5. Recent Developments

- 13.1.10.6. Key Management Personnel

- 13.1.1. A.P. Moller - Maersk A/S

14. Strategic Recommendations/Action Plan

- 14.1. Key Focus Areas

- 14.1.1. Target By Lease Type

- 14.1.2. Target By Type