|

|

市場調査レポート

商品コード

1591646

海底設備市場- 世界の産業規模、シェア、動向、機会、予測、タイプ別、コンポーネント別、地域別、競合、2019年~2029年Subsea Equipment Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type, By Component, By Region & Competition, 2019-2029F |

||||||

カスタマイズ可能

|

|||||||

| 海底設備市場- 世界の産業規模、シェア、動向、機会、予測、タイプ別、コンポーネント別、地域別、競合、2019年~2029年 |

|

出版日: 2024年11月15日

発行: TechSci Research

ページ情報: 英文 181 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

海底設備の世界市場規模は2023年に184億米ドル、2029年には264億9,000万米ドルに達すると予測され、2029年までのCAGRは6.1%で予測期間の堅調な成長を予測しています。

世界の海底設備市場は、オフショア石油・ガス探査・生産需要の高まりによって力強い成長を遂げています。事業者は深海や超深海の埋蔵量の掘り起こしを目指しており、高度な海底技術の必要性が最も高まっています。噴出防止装置、海底ツリー、アンビリカルなどの海底設備は、課題である海中環境での効率的で安全な操業を確保する上で重要な役割を果たしています。さらに、持続可能なエネルギー源の推進により、洋上風力発電所などの海底再生可能エネルギープロジェクトへの投資が増加しており、市場機会はさらに拡大しています。IoTやAIなどのデジタル技術の統合は、海底システムの性能と信頼性を高め、リアルタイムのモニタリングと予知保全を可能にしています。地理的には、北米海、メキシコ湾、西アフリカ沖などの地域が海底活動の重要な拠点であり、アジア太平洋やラテンアメリカの新興市場が徐々に牽引力を増しています。全体として、技術の進歩、エネルギー需要の増加、安全性と持続可能性への注目が、世界の海底設備市場の成長を促進しています。

| 市場概要 | |

|---|---|

| 予測期間 | 2025-2029 |

| 市場規模:2023年 | 184億米ドル |

| 市場規模:2029年 | 264億9,000万米ドル |

| CAGR:2024年~2029年 | 6.1% |

| 急成長セグメント | マニホールド |

| 最大市場 | 北米 |

市場促進要因

石油・ガス海洋探査の増加

海底技術の進歩

再生可能エネルギーへの注目の高まり

厳しい規制枠組み

地政学的要因と市場力学

主な市場課題

高額な設備投資

技術の複雑さ

規制遵守

環境への懸念

主な市場動向

深海探査需要の増加

デジタル技術の採用

持続可能な実践へのシフト

コラボレーションとパートナーシップの拡大

安全性とリスク管理の強化

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の海底設備市場概要

第6章 世界の海底設備市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別(海底生産システム、海底処理システム)

- コンポーネント別(海底アンビリカルライザーとフローライン、ツリー、坑口、マニホールド、その他)

- 地域別(北米、欧州、南米、中東・アフリカ、アジア太平洋)

- 企業別(2023)

- 市場マップ

第7章 北米の海底設備市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- コンポーネント別

- 国別

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第8章 欧州の海底設備市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- コンポーネント別

- 国別

- 欧州:国別分析

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ベルギー

第9章 南米の海底設備市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- コンポーネント別

- 国別

- 南米:国別分析

- ブラジル

- コロンビア

- アルゼンチン

- チリ

- ペルー

第10章 中東・アフリカの海底設備市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- コンポーネント別

- 国別

- 中東・アフリカ:国別分析

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

- トルコ

- イスラエル

第11章 アジア太平洋地域の海底設備市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別

- コンポーネント別

- 国別

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

- インドネシア

- ベトナム

第12章 市場力学

- 促進要因

- 課題

第13章 市場動向と発展

第14章 企業プロファイル

- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Baker Hughes Company

- TechnipFMC plc

- Subsea 7 S.A.

- Saipem S.p.A.

- Aker Solutions ASA

- Oceaneering International, Inc.

- Kongsberg Gruppen ASA

- Damen Shipyards Group

- C-Kore Technology Ltd.

- JDR Cable Systems Ltd.

第15章 戦略的提言

第16章 調査会社について・免責事項

Global Subsea Equipment Market was valued at USD 18.4 Billion in 2023 and is expected to reach at USD 26.49 Billion in 2029 and project robust growth in the forecast period with a CAGR of 6.1% through 2029. The Global Subsea Equipment Market is experiencing robust growth driven by the rising demand for offshore oil and gas exploration and production. As operators seek to tap into deepwater and ultra-deepwater reserves, the need for advanced subsea technologies has become paramount. Subsea equipment, including blowout preventers, subsea trees, and umbilicals, plays a critical role in ensuring efficient and safe operations in challenging underwater environments. Additionally, the push for sustainable energy sources has led to increased investment in subsea renewable energy projects, such as offshore wind farms, further expanding market opportunities. The integration of digital technologies, such as IoT and AI, is enhancing the performance and reliability of subsea systems, enabling real-time monitoring and predictive maintenance. Geographically, regions like the North Sea, Gulf of Mexico, and offshore West Africa are significant hubs for subsea activities, while emerging markets in Asia-Pacific and Latin America are gradually gaining traction. Overall, the combination of technological advancements, rising energy demands, and a focus on safety and sustainability is driving the growth of the Global Subsea Equipment Market.

| Market Overview | |

|---|---|

| Forecast Period | 2025-2029 |

| Market Size 2023 | USD 18.4 Billion |

| Market Size 2029 | USD 26.49 Billion |

| CAGR 2024-2029 | 6.1% |

| Fastest Growing Segment | Manifolds |

| Largest Market | North America |

Key Market Drivers

Increasing Offshore Oil and Gas Exploration

The continuous demand for oil and gas is a primary driver of the Global Subsea Equipment Market. As onshore reserves deplete, energy companies are increasingly investing in offshore exploration to access untapped deepwater and ultra-deepwater reserves. Subsea equipment, such as blowout preventers and subsea trees, is essential for the safe and efficient extraction of hydrocarbons in these challenging environments. The technological advancements in subsea systems allow operators to drill deeper and access more complex reservoirs, thereby increasing production capabilities. Furthermore, the rise in oil prices often spurs investments in offshore projects, leading to higher demand for subsea equipment. As governments and companies strive to meet global energy demands, the exploration of offshore resources is expected to continue, driving growth in the subsea equipment sector.

Advancements in Subsea Technology

Technological innovation plays a critical role in the subsea equipment market's expansion. Recent advancements in subsea technology have improved the efficiency and safety of operations. Innovations such as remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), and advanced sensing technologies allow for real-time monitoring and data collection, enhancing decision-making processes. Furthermore, the integration of digital technologies, including the Internet of Things (IoT) and artificial intelligence (AI), is transforming subsea operations by enabling predictive maintenance and reducing downtime. These technological improvements not only optimize performance but also lower operational costs, making subsea projects more financially viable. The continued development of sophisticated subsea equipment is crucial for addressing the complex challenges faced in deepwater environments, thus propelling market growth.

Rising Focus on Renewable Energy

Stringent Regulatory Frameworks

Stringent regulatory requirements regarding safety and environmental protection are driving the demand for advanced subsea equipment. Governments and regulatory bodies have implemented rigorous standards to mitigate risks associated with offshore operations. Compliance with these regulations necessitates the use of specialized subsea technologies that enhance safety and environmental protection. Equipment such as blowout preventers and subsea monitoring systems are designed to prevent accidents and manage potential hazards effectively. Companies are increasingly investing in state-of-the-art subsea equipment to meet these regulatory requirements, ensuring operational compliance while minimizing risks. This trend not only drives demand for existing technologies but also encourages innovation, as manufacturers strive to develop equipment that meets or exceeds regulatory standards. Thus, the evolving regulatory landscape serves as a catalyst for growth in the subsea equipment market.

Geopolitical Factors and Market Dynamics

Geopolitical factors significantly influence the Global Subsea Equipment Market, affecting exploration and production activities in various regions. Political stability, international relations, and trade policies can either facilitate or hinder investment in offshore projects. For instance, geopolitical tensions in oil-rich regions may prompt companies to seek safer alternatives or diversify their investments into more stable markets. Additionally, the fluctuating oil prices, driven by geopolitical developments, can directly impact spending on subsea projects. Companies may accelerate or postpone investment plans based on market conditions and price forecasts. The interplay between geopolitics and market dynamics creates an environment of uncertainty, prompting companies to adapt their strategies accordingly. Therefore, while geopolitical factors present challenges, they also create opportunities for subsea equipment manufacturers to innovate and offer solutions that cater to evolving market needs.

Key Market Challenges

High Capital Expenditure

One of the primary challenges facing the Global Subsea Equipment Market is the substantial capital expenditure required for subsea projects. The installation, maintenance, and operation of subsea equipment demand significant financial investment, making it challenging for companies, especially smaller players, to enter the market. Projects often require advanced technology and specialized equipment, which adds to the initial costs. Additionally, fluctuations in oil prices can further exacerbate these challenges, leading to project delays or cancellations as companies reassess their financial commitments. As operators seek to maximize returns, the pressure to innovate and reduce costs intensifies, which can inhibit investment in new technologies and equipment. This financial strain can hinder the development of subsea projects and slow the overall market growth.

Technological Complexity

The technological complexity associated with subsea equipment presents another significant challenge. As the industry advances, the demand for sophisticated technologies increases, necessitating continuous research and development. The integration of new technologies, such as autonomous underwater vehicles (AUVs) and advanced monitoring systems, can be cumbersome and require specialized expertise. Furthermore, the interoperability of different equipment types can create compatibility issues, leading to operational inefficiencies. Training personnel to operate and maintain these advanced systems adds to the operational burden and can lead to increased costs. As companies strive to keep pace with technological advancements, the complexity can pose risks to project timelines and budgets, potentially deterring investment in subsea projects.

Regulatory Compliance

Regulatory compliance is a crucial challenge in the Global Subsea Equipment Market. Companies must navigate a complex web of regulations governing environmental protection, safety standards, and operational practices. As regulatory bodies increasingly prioritize environmental sustainability, subsea operators face pressure to adopt greener technologies and practices. Compliance with these regulations often requires significant investments in technology and processes, which can strain financial resources. Additionally, failure to meet regulatory standards can result in hefty fines, project delays, or even complete shutdowns, posing significant risks to companies. As regulations continue to evolve, staying compliant will require ongoing investment and adaptation, which can divert resources from innovation and growth initiatives.

Environmental Concerns

Environmental concerns represent a growing challenge for the Global Subsea Equipment Market. The extraction of subsea resources often raises significant ecological issues, including the risk of oil spills, habitat destruction, and water pollution. Public scrutiny and pressure from environmental organizations are increasing, compelling companies to adopt more sustainable practices. Failure to address these concerns can lead to reputational damage and legal repercussions, further complicating project execution. Companies are thus tasked with implementing robust environmental management systems and seeking eco-friendly technologies, which can lead to increased operational costs. Balancing the need for resource extraction with environmental stewardship is crucial for the long-term sustainability of the subsea equipment market. As the industry grapples with these challenges, it will need to prioritize innovative solutions that minimize environmental impact while ensuring operational efficiency.

Key Market Trends

Increasing Demand for Deepwater Exploration

The Global Subsea Equipment Market is witnessing a significant shift toward deepwater exploration, driven by the depletion of onshore and shallow-water oil reserves. As energy companies seek new sources of hydrocarbons, they are increasingly investing in deepwater projects that require advanced subsea technology. This trend is propelled by the high production potential of deepwater fields, which often yield greater volumes of oil and gas compared to conventional sources. Companies are also focusing on enhancing their operational efficiencies, leveraging state-of-the-art subsea equipment designed for extreme conditions. Innovations in subsea production systems, such as enhanced subsea trees and riser systems, are crucial in enabling safe and efficient operations at depths previously considered unmanageable. The growing need for specialized equipment capable of withstanding high pressures and challenging environments has led to increased R&D investments, resulting in improved reliability and performance. Furthermore, the integration of advanced technologies, including digital monitoring and automation, is enhancing the overall efficiency of subsea operations, thereby attracting more investments in deepwater exploration projects.

Adoption of Digital Technologies

Digital transformation is becoming a key trend in the Global Subsea Equipment Market as companies seek to enhance operational efficiency and reduce costs. The adoption of digital technologies, including the Internet of Things (IoT), artificial intelligence (AI), and data analytics, is revolutionizing subsea operations. These technologies enable real-time monitoring and predictive maintenance, minimizing downtime and optimizing asset performance. For instance, digital twins are being utilized to create virtual models of subsea assets, allowing operators to simulate and predict performance under various conditions. This capability not only improves decision-making but also enhances safety by allowing for proactive measures before issues arise. Moreover, companies are increasingly implementing remote operation centers to manage subsea assets from onshore, reducing the need for personnel in challenging underwater environments. The integration of these digital solutions is making subsea operations more efficient, sustainable, and safer, thereby contributing to the overall growth of the market.

Shift Towards Sustainable Practices

Sustainability is becoming a major focus in the Global Subsea Equipment Market, driven by increasing environmental regulations and societal pressure for greener practices. Energy companies are actively seeking ways to minimize their environmental footprint while maintaining operational efficiency. This trend is prompting the development of subsea technologies that not only enhance extraction processes but also reduce emissions and environmental impact. Innovations in materials, such as bio-degradable products and energy-efficient systems, are gaining traction. Additionally, the industry is witnessing a rise in subsea carbon capture and storage technologies, which are crucial for mitigating the impact of offshore operations on climate change. Companies are investing in research to develop eco-friendly solutions that comply with stringent environmental regulations, and this commitment to sustainability is becoming a competitive advantage. As the global focus on sustainable energy transitions grows, subsea equipment providers that prioritize environmentally responsible practices will be better positioned for long-term success.

Growing Collaborations and Partnerships

Strategic collaborations and partnerships are emerging as a significant trend in the Global Subsea Equipment Market, enabling companies to leverage complementary strengths and enhance their service offerings. These alliances are essential for addressing the increasing complexity and scale of subsea projects, particularly in deepwater and remote locations. By partnering with technology providers, energy companies can access innovative solutions that improve operational efficiency and reduce costs. Joint ventures are also becoming common as firms seek to share the financial burden of expensive subsea projects while pooling expertise. This trend is particularly relevant in the context of emerging markets, where local partnerships can facilitate market entry and compliance with regional regulations. Furthermore, collaborative efforts in R&D are driving advancements in subsea technologies, fostering innovation that enhances the performance and reliability of subsea equipment. As the market evolves, these collaborations will play a crucial role in driving growth and ensuring competitiveness.

Enhanced Focus on Safety and Risk Management

The Global Subsea Equipment Market is increasingly prioritizing safety and risk management, reflecting the industry's commitment to minimizing accidents and enhancing operational integrity. With the rising complexity of subsea operations, companies are implementing robust safety protocols and investing in advanced technologies to mitigate risks. This trend includes the adoption of sophisticated monitoring systems that provide real-time data on operational conditions, enabling proactive risk management. Additionally, regulatory bodies are imposing stricter safety standards, compelling companies to prioritize compliance and invest in equipment that meets these requirements. Training and development initiatives for personnel working in subsea environments are also gaining importance, ensuring that staff are well-equipped to handle potential challenges. As safety becomes a central theme in subsea operations, companies that prioritize risk management will not only enhance their operational efficiency but also improve their reputation and stakeholder trust in the industry.

Segmental Insights

Type Insights

The Global Subsea Equipment Market was predominantly driven by the Subsea Production Systems segment, which is anticipated to maintain its dominance throughout the forecast period. Subsea Production Systems encompass essential components such as subsea trees, manifolds, and wellheads, crucial for extracting hydrocarbons from beneath the seabed. The increasing demand for offshore oil and gas, coupled with advancements in deep-water exploration technologies, has propelled the adoption of these systems. Operators are increasingly investing in subsea production to enhance recovery rates and operational efficiency in challenging environments. Furthermore, the growing emphasis on cost-effective solutions in the face of fluctuating oil prices has led companies to favor subsea production systems that facilitate higher output with lower operational expenditures. The ability of these systems to integrate with existing infrastructure and streamline operations further contributes to their appeal. In contrast, while Subsea Processing Systems, which include systems for separating, processing, and transporting hydrocarbons, are vital for specific applications, they are not yet as widely adopted as production systems. The investment in subsea processing tends to follow the establishment of production systems, as operators prioritize initial production capabilities before addressing the complexities of processing. As exploration moves into deeper waters and harsher environments, the reliance on advanced subsea production technologies will likely grow, reinforcing their market leadership. Additionally, ongoing innovations aimed at enhancing the efficiency and reliability of subsea production systems will further solidify their position in the market, addressing challenges such as maintenance and operational safety. Overall, the Subsea Production Systems segment is well-positioned to continue leading the Global Subsea Equipment Market, supported by industry trends favoring deeper offshore exploration and increased recovery initiatives.

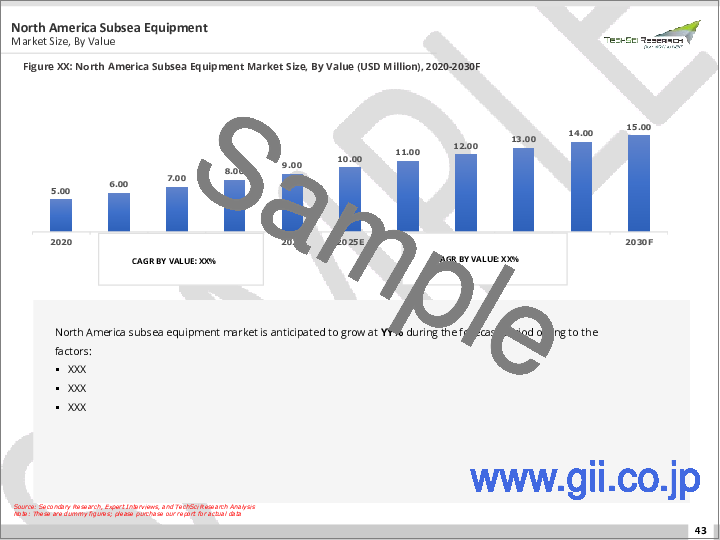

Regional Insights

The North America region emerged as the dominant player in the Global Subsea Equipment Market and is expected to maintain this leadership position throughout the forecast period. This dominance can be attributed to several key factors, including the significant presence of major oil and gas companies and a robust infrastructure for offshore exploration and production. The region's extensive investment in advanced subsea technologies, particularly in the Gulf of Mexico, has fueled growth, driven by the need for enhanced extraction techniques in deepwater and ultra-deepwater projects. Additionally, the regulatory environment in North America has encouraged innovation, pushing companies to adopt cutting-edge subsea solutions to meet safety and environmental standards. Furthermore, the ongoing transition toward sustainable energy practices has led to increased investments in subsea carbon capture and storage technologies, positioning North America at the forefront of the industry's shift toward environmentally responsible operations. The region's well-established supply chain, comprising leading subsea equipment manufacturers and service providers, further strengthens its market position. As companies in North America continue to focus on digital transformation, leveraging IoT and AI for improved operational efficiency, the demand for advanced subsea equipment is anticipated to rise. This technological advancement, coupled with strategic collaborations and partnerships, will enable firms to address the complexities associated with offshore projects effectively. Moreover, the rise in exploration activities in both conventional and unconventional reserves will contribute to sustained growth in subsea equipment demand. Given these factors, North America is poised to remain the dominant region in the Global Subsea Equipment Market, capitalizing on its strategic advantages and continued investments in innovation and sustainability.

Key Market Players

- Schlumberger Limited

- Halliburton Energy Services, Inc.

- Baker Hughes Company

- TechnipFMC plc

- Subsea 7 S.A.

- Saipem S.p.A.

- Aker Solutions ASA

- Oceaneering International, Inc.

- Kongsberg Gruppen ASA

- Damen Shipyards Group

- C-Kore Technology Ltd.

- JDR Cable Systems Ltd.

Report Scope:

In this report, the Global Subsea Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Subsea Equipment Market, By Component:

- Subsea Umbilical Riser & Flowlines

- Trees

- Wellheads

- Manifolds

- Other

Subsea Equipment Market, By Type:

- Subsea Production Systems

- Subsea Processing Systems

Subsea Equipment Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Belgium

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- Indonesia

- Vietnam

- South America

- Brazil

- Argentina

- Colombia

- Chile

- Peru

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Turkey

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Subsea Equipment Market.

Available Customizations:

Global Subsea Equipment market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.2.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Formulation of the Scope

- 2.4. Assumptions and Limitations

- 2.5. Sources of Research

- 2.5.1. Secondary Research

- 2.5.2. Primary Research

- 2.6. Approach for the Market Study

- 2.6.1. The Bottom-Up Approach

- 2.6.2. The Top-Down Approach

- 2.7. Methodology Followed for Calculation of Market Size & Market Shares

- 2.8. Forecasting Methodology

- 2.8.1. Data Triangulation & Validation

3. Executive Summary

4. Voice of Customer

5. Global Subsea Equipment Market Overview

6. Global Subsea Equipment Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Type (Subsea Production Systems, Subsea Processing Systems)

- 6.2.2. By Component (Subsea Umbilical Riser & Flowlines, Trees, Wellheads, Manifolds, Other)

- 6.2.3. By Region (North America, Europe, South America, Middle East & Africa, Asia Pacific)

- 6.3. By Company (2023)

- 6.4. Market Map

7. North America Subsea Equipment Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Type

- 7.2.2. By Component

- 7.2.3. By Country

- 7.3. North America: Country Analysis

- 7.3.1. United States Subsea Equipment Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Type

- 7.3.1.2.2. By Component

- 7.3.1.1. Market Size & Forecast

- 7.3.2. Canada Subsea Equipment Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Type

- 7.3.2.2.2. By Component

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Mexico Subsea Equipment Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Type

- 7.3.3.2.2. By Component

- 7.3.3.1. Market Size & Forecast

- 7.3.1. United States Subsea Equipment Market Outlook

8. Europe Subsea Equipment Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Type

- 8.2.2. By Component

- 8.2.3. By Country

- 8.3. Europe: Country Analysis

- 8.3.1. Germany Subsea Equipment Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Type

- 8.3.1.2.2. By Component

- 8.3.1.1. Market Size & Forecast

- 8.3.2. France Subsea Equipment Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Type

- 8.3.2.2.2. By Component

- 8.3.2.1. Market Size & Forecast

- 8.3.3. United Kingdom Subsea Equipment Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Type

- 8.3.3.2.2. By Component

- 8.3.3.1. Market Size & Forecast

- 8.3.4. Italy Subsea Equipment Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Type

- 8.3.4.2.2. By Component

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Spain Subsea Equipment Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Type

- 8.3.5.2.2. By Component

- 8.3.5.1. Market Size & Forecast

- 8.3.6. Belgium Subsea Equipment Market Outlook

- 8.3.6.1. Market Size & Forecast

- 8.3.6.1.1. By Value

- 8.3.6.2. Market Share & Forecast

- 8.3.6.2.1. By Type

- 8.3.6.2.2. By Component

- 8.3.6.1. Market Size & Forecast

- 8.3.1. Germany Subsea Equipment Market Outlook

9. South America Subsea Equipment Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Type

- 9.2.2. By Component

- 9.2.3. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Subsea Equipment Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Type

- 9.3.1.2.2. By Component

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Colombia Subsea Equipment Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Type

- 9.3.2.2.2. By Component

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Argentina Subsea Equipment Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Type

- 9.3.3.2.2. By Component

- 9.3.3.1. Market Size & Forecast

- 9.3.4. Chile Subsea Equipment Market Outlook

- 9.3.4.1. Market Size & Forecast

- 9.3.4.1.1. By Value

- 9.3.4.2. Market Share & Forecast

- 9.3.4.2.1. By Type

- 9.3.4.2.2. By Component

- 9.3.4.1. Market Size & Forecast

- 9.3.5. Peru Subsea Equipment Market Outlook

- 9.3.5.1. Market Size & Forecast

- 9.3.5.1.1. By Value

- 9.3.5.2. Market Share & Forecast

- 9.3.5.2.1. By Type

- 9.3.5.2.2. By Component

- 9.3.5.1. Market Size & Forecast

- 9.3.1. Brazil Subsea Equipment Market Outlook

10. Middle East & Africa Subsea Equipment Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Type

- 10.2.2. By Component

- 10.2.3. By Country

- 10.3. Middle East & Africa: Country Analysis

- 10.3.1. Saudi Arabia Subsea Equipment Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Type

- 10.3.1.2.2. By Component

- 10.3.1.1. Market Size & Forecast

- 10.3.2. UAE Subsea Equipment Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Type

- 10.3.2.2.2. By Component

- 10.3.2.1. Market Size & Forecast

- 10.3.3. South Africa Subsea Equipment Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Type

- 10.3.3.2.2. By Component

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Turkey Subsea Equipment Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Type

- 10.3.4.2.2. By Component

- 10.3.4.1. Market Size & Forecast

- 10.3.5. Israel Subsea Equipment Market Outlook

- 10.3.5.1. Market Size & Forecast

- 10.3.5.1.1. By Value

- 10.3.5.2. Market Share & Forecast

- 10.3.5.2.1. By Type

- 10.3.5.2.2. By Component

- 10.3.5.1. Market Size & Forecast

- 10.3.1. Saudi Arabia Subsea Equipment Market Outlook

11. Asia Pacific Subsea Equipment Market Outlook

- 11.1. Market Size & Forecast

- 11.1.1. By Value

- 11.2. Market Share & Forecast

- 11.2.1. By Type

- 11.2.2. By Component

- 11.2.3. By Country

- 11.3. Asia-Pacific: Country Analysis

- 11.3.1. China Subsea Equipment Market Outlook

- 11.3.1.1. Market Size & Forecast

- 11.3.1.1.1. By Value

- 11.3.1.2. Market Share & Forecast

- 11.3.1.2.1. By Type

- 11.3.1.2.2. By Component

- 11.3.1.1. Market Size & Forecast

- 11.3.2. India Subsea Equipment Market Outlook

- 11.3.2.1. Market Size & Forecast

- 11.3.2.1.1. By Value

- 11.3.2.2. Market Share & Forecast

- 11.3.2.2.1. By Type

- 11.3.2.2.2. By Component

- 11.3.2.1. Market Size & Forecast

- 11.3.3. Japan Subsea Equipment Market Outlook

- 11.3.3.1. Market Size & Forecast

- 11.3.3.1.1. By Value

- 11.3.3.2. Market Share & Forecast

- 11.3.3.2.1. By Type

- 11.3.3.2.2. By Component

- 11.3.3.1. Market Size & Forecast

- 11.3.4. South Korea Subsea Equipment Market Outlook

- 11.3.4.1. Market Size & Forecast

- 11.3.4.1.1. By Value

- 11.3.4.2. Market Share & Forecast

- 11.3.4.2.1. By Type

- 11.3.4.2.2. By Component

- 11.3.4.1. Market Size & Forecast

- 11.3.5. Australia Subsea Equipment Market Outlook

- 11.3.5.1. Market Size & Forecast

- 11.3.5.1.1. By Value

- 11.3.5.2. Market Share & Forecast

- 11.3.5.2.1. By Type

- 11.3.5.2.2. By Component

- 11.3.5.1. Market Size & Forecast

- 11.3.6. Indonesia Subsea Equipment Market Outlook

- 11.3.6.1. Market Size & Forecast

- 11.3.6.1.1. By Value

- 11.3.6.2. Market Share & Forecast

- 11.3.6.2.1. By Type

- 11.3.6.2.2. By Component

- 11.3.6.1. Market Size & Forecast

- 11.3.7. Vietnam Subsea Equipment Market Outlook

- 11.3.7.1. Market Size & Forecast

- 11.3.7.1.1. By Value

- 11.3.7.2. Market Share & Forecast

- 11.3.7.2.1. By Type

- 11.3.7.2.2. By Component

- 11.3.7.1. Market Size & Forecast

- 11.3.1. China Subsea Equipment Market Outlook

12. Market Dynamics

- 12.1. Drivers

- 12.2. Challenges

13. Market Trends and Developments

14. Company Profiles

- 14.1. Schlumberger Limited

- 14.1.1. Business Overview

- 14.1.2. Key Revenue and Financials

- 14.1.3. Recent Developments

- 14.1.4. Key Personnel/Key Contact Person

- 14.1.5. Key Product/Services Offered

- 14.2. Halliburton Energy Services, Inc.

- 14.2.1. Business Overview

- 14.2.2. Key Revenue and Financials

- 14.2.3. Recent Developments

- 14.2.4. Key Personnel/Key Contact Person

- 14.2.5. Key Product/Services Offered

- 14.3. Baker Hughes Company

- 14.3.1. Business Overview

- 14.3.2. Key Revenue and Financials

- 14.3.3. Recent Developments

- 14.3.4. Key Personnel/Key Contact Person

- 14.3.5. Key Product/Services Offered

- 14.4. TechnipFMC plc

- 14.4.1. Business Overview

- 14.4.2. Key Revenue and Financials

- 14.4.3. Recent Developments

- 14.4.4. Key Personnel/Key Contact Person

- 14.4.5. Key Product/Services Offered

- 14.5. Subsea 7 S.A.

- 14.5.1. Business Overview

- 14.5.2. Key Revenue and Financials

- 14.5.3. Recent Developments

- 14.5.4. Key Personnel/Key Contact Person

- 14.5.5. Key Product/Services Offered

- 14.6. Saipem S.p.A.

- 14.6.1. Business Overview

- 14.6.2. Key Revenue and Financials

- 14.6.3. Recent Developments

- 14.6.4. Key Personnel/Key Contact Person

- 14.6.5. Key Product/Services Offered

- 14.7. Aker Solutions ASA

- 14.7.1. Business Overview

- 14.7.2. Key Revenue and Financials

- 14.7.3. Recent Developments

- 14.7.4. Key Personnel/Key Contact Person

- 14.7.5. Key Product/Services Offered

- 14.8. Oceaneering International, Inc.

- 14.8.1. Business Overview

- 14.8.2. Key Revenue and Financials

- 14.8.3. Recent Developments

- 14.8.4. Key Personnel/Key Contact Person

- 14.8.5. Key Product/Services Offered

- 14.9. Kongsberg Gruppen ASA

- 14.9.1. Business Overview

- 14.9.2. Key Revenue and Financials

- 14.9.3. Recent Developments

- 14.9.4. Key Personnel/Key Contact Person

- 14.9.5. Key Product/Services Offered

- 14.10. Damen Shipyards Group

- 14.10.1. Business Overview

- 14.10.2. Key Revenue and Financials

- 14.10.3. Recent Developments

- 14.10.4. Key Personnel/Key Contact Person

- 14.10.5. Key Product/Services Offered

- 14.11. C-Kore Technology Ltd.

- 14.11.1. Business Overview

- 14.11.2. Key Revenue and Financials

- 14.11.3. Recent Developments

- 14.11.4. Key Personnel/Key Contact Person

- 14.11.5. Key Product/Services Offered

- 14.12. JDR Cable Systems Ltd.

- 14.12.1. Business Overview

- 14.12.2. Key Revenue and Financials

- 14.12.3. Recent Developments

- 14.12.4. Key Personnel/Key Contact Person

- 14.12.5. Key Product/Services Offered