|

|

市場調査レポート

商品コード

1582839

ATM市場- 世界の産業規模、シェア、動向、機会、予測:ソリューション別、ATMタイプ別、用途別、地域別、競合、2019年~2029年ATM Market - Global Industry Size, Share, Trends, Opportunity, and Forecast Segmented By Solution, By ATM Type, By Application, By Region & Competition, 2019-2029F |

||||||

カスタマイズ可能

|

|||||||

| ATM市場- 世界の産業規模、シェア、動向、機会、予測:ソリューション別、ATMタイプ別、用途別、地域別、競合、2019年~2029年 |

|

出版日: 2024年10月30日

発行: TechSci Research

ページ情報: 英文 185 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

ATMの世界市場規模は2023年に248億7,000万米ドルとなり、2029年までのCAGRは4.54%で、予測期間中に力強い成長が予測されています。

現金自動預け払い機(ATM)は、顧客が銀行スタッフと直接やり取りすることなく、現金引き出し、預金、資金移動、残高照会などの金融取引を実行できる電子バンキング機器です。ATMの世界市場が拡大している背景には、いくつかの要因があります。特に、従来の銀行インフラが限られている新興国では、便利で24時間いつでも利用できる銀行サービスへの需要が高まっています。より多くの人々が銀行サービスを利用できるようになると、ATMのニーズが高まり、金融包摂が促進されます。セキュリティ機能の強化、生体認証、モバイルバンキングとの統合など、ATM機能の技術的進歩はATMをより使いやすく安全なものにし、普及を後押ししています。小売店、空港、娯楽施設など、従来とは異なる場所へのATMの設置が増加しており、ATMの利用しやすさと利便性が拡大しています。また、銀行の支店数の増加や銀行ネットワークの拡大も市場を牽引しており、これらの銀行では業務をサポートするためにより多くのATMが必要とされています。逆説的ではあるが、世界のデジタル化とキャッシュレス化の推進もATM市場に拍車をかけています。新興国市場では、ATMの旧モデルをより新しく、より先進的な機械にアップグレードしたり、入れ替えたりする傾向があり、これが市場成長に寄与しています。さらに、請求書の支払い、携帯電話へのチャージ、チケットの予約など、現金の払い出し以外のサービスでのATMの利用が増加しており、ATMの有用性と消費者にとっての魅力が高まっています。全体として、銀行サービスの拡大、技術の進歩、アクセシビリティの向上、ATMの提供するサービスの幅の広がりが組み合わさって、世界のATM市場の成長を促進しています。

| 市場概要 | |

|---|---|

| 予測期間 | 2025-2029 |

| 市場規模:2023年 | 248億7,000万米ドル |

| 市場規模:2029年 | 327億5,000万米ドル |

| CAGR:2024年~2029年 | 4.54% |

| 急成長セグメント | 展開ソリューション |

| 最大市場 | アジア太平洋 |

市場促進要因

便利で24時間365日利用可能な銀行サービスへの需要の高まり

現金自動預け払い機機能の技術的進歩

従来とは異なる場所への自動現金受払機の導入の増加

主な市場課題

サイバーセキュリティ脅威の増加

高い保守・運用コスト

主な市場動向

高度なセキュリティ機能の統合

多機能現金自動預け払い機の拡大

非接触・カードレス技術の採用

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界のATM市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- ソリューション別(デプロイメントソリューション、マネージドサービス)

- ATMタイプ別(従来型/銀行 ATM、ブラウンラベルATM、ホワイトラベルATM、スマート ATM、キャッシュディスペンサー)

- 用途別(出金、振替、入金)

- 地域別

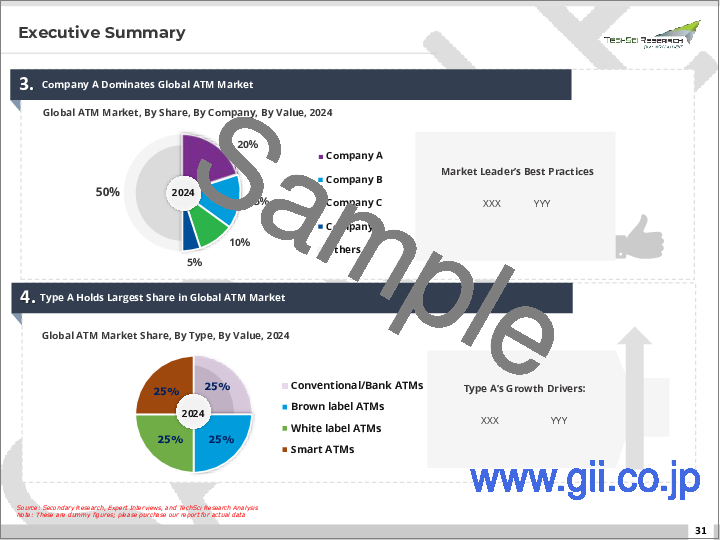

- 企業別(2023)

- 市場マップ

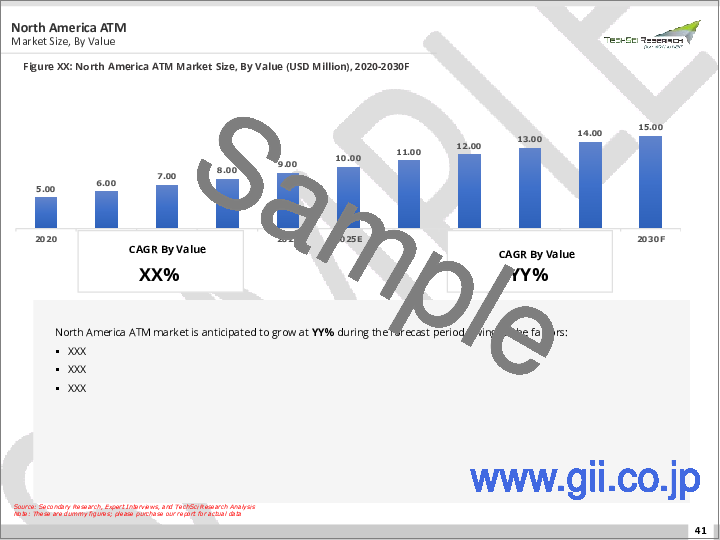

第6章 北米のATM市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- ソリューション別

- ATMタイプ別

- 用途別

- 国別

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 アジア太平洋地域のATM市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- ソリューション別

- ATMタイプ別

- 用途別

- 国別

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- インドネシア

第8章 欧州のATM市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- ソリューション別

- ATMタイプ別

- 用途別

- 国別

- 欧州:国別分析

- ドイツ

- 英国

- フランス

- ロシア

- スペイン

第9章 南米のATM市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- ソリューション別

- ATMタイプ別

- 用途別

- 国別

- 南米:国別分析

- ブラジル

- アルゼンチン

第10章 中東・アフリカのATM市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- ソリューション別

- ATMタイプ別

- 用途別

- 国別

- 中東・アフリカ:国別分析

- サウジアラビア

- 南アフリカ

- アラブ首長国連邦

- イスラエル

- エジプト

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

第13章 企業プロファイル

- Diebold Nixdorf, Inc

- NCR Atleos Corporation

- Hitachi Channel Solutions, Corp

- Hyosung TNS Incorporation

- Triton Systems of Delaware, LLC

- Euronet Worldwide, Inc

- GRG Banking Equipment Co., Ltd

- Fujitsu Limited.

- HESS Cash Systems GmbH

- KEBA Group AG

第14章 戦略的提言

第15章 調査会社について・免責事項

Global ATM Market was valued at USD 24.87 Billion in 2023 and is anticipated to project robust growth in the forecast period with a CAGR of 4.54% through 2029. An Automated Teller Machine (ATM) is an electronic banking device that enables customers to perform financial transactions, such as cash withdrawals, deposits, fund transfers, and balance inquiries, without the need for direct interaction with bank staff. The rise in the global ATM market can be attributed to several factors. There is a growing demand for convenient and 24/7 access to banking services, particularly in emerging economies where traditional banking infrastructure is limited. As more people gain access to banking services, the need for ATMs increases, facilitating financial inclusion. Technological advancements in ATM functionality, such as enhanced security features, biometric authentication, and integration with mobile banking, are making ATMs more user-friendly and secure, thereby boosting their adoption. The increasing deployment of ATMs in non-traditional locations, such as retail stores, airports, and entertainment venues, is expanding their accessibility and convenience. The market is also driven by the rising number of bank branches and the expansion of banking networks, which require more ATMs to support their operations. The global push towards digitalization and cashless transactions, paradoxically, is also fueling the ATM market, as ATMs are being upgraded to handle various forms of digital payments and cardless transactions. In developed markets, there is a trend towards upgrading and replacing older ATM models with newer, more advanced machines, which is contributing to market growth. Furthermore, the increasing use of ATMs for services beyond cash dispensing, such as bill payments, mobile top-ups, and ticket booking, is enhancing their utility and attractiveness to consumers. Overall, the combination of expanding banking services, technological advancements, increased accessibility, and the broadening range of services offered by ATMs is driving the growth of the global ATM market.

| Market Overview | |

|---|---|

| Forecast Period | 2025-2029 |

| Market Size 2023 | USD 24.87 Billion |

| Market Size 2029 | USD 32.75 Billion |

| CAGR 2024-2029 | 4.54% |

| Fastest Growing Segment | Deployment Solutions |

| Largest Market | Asia-Pacific |

Key Market Drivers

Rising Demand for Convenient and 24/7 Access to Banking Services

The increasing global demand for convenient and round-the-clock access to banking services is a significant driver for the Automated Teller Machine market. As modern lifestyles become increasingly busy and customers seek quick and easy ways to manage their finances, Automated Teller Machines provide a solution by offering banking services at any time of the day or night. This is particularly important in regions where traditional banking infrastructure is underdeveloped or insufficient to meet the needs of a growing population. In many developing countries, Automated Teller Machines serve as critical access points for financial services, helping to bridge the gap between the unbanked population and formal banking systems. The convenience of being able to withdraw cash, check account balances, transfer funds, and perform other banking transactions without the need to visit a bank branch is highly valued by consumers. Moreover, Automated Teller Machines are increasingly being installed in high-traffic areas such as shopping centers, transportation hubs, and entertainment venues, further enhancing their accessibility and convenience. This increased availability and accessibility drive consumer reliance on Automated Teller Machines, thus propelling market growth.

Technological Advancements in Automated Teller Machine Functionality

Technological advancements in Automated Teller Machine functionality are another critical factor driving the market. Modern Automated Teller Machines are no longer limited to simple cash withdrawal and deposit functions. They now offer a wide range of services, including bill payments, mobile phone top-ups, and even ticket booking. The integration of advanced technologies such as biometric authentication, contactless payments, and mobile integration has significantly enhanced the security and user experience of Automated Teller Machines. Biometric authentication, for example, reduces the risk of fraud by using fingerprint or facial recognition to verify the identity of the user. Contactless payment options allow users to perform transactions quickly and securely without inserting a card, which is particularly appealing in the current era where hygiene and speed are paramount. Additionally, Automated Teller Machines are now capable of supporting multiple languages and providing personalized services based on customer preferences, making them more user-friendly and accessible to a broader audience. These technological innovations not only improve the functionality and appeal of Automated Teller Machines but also encourage banks and other financial institutions to invest in upgrading their Automated Teller Machine networks, thereby driving market growth.

Increasing Deployment of Automated Teller Machines in Non-Traditional Locations

The increasing deployment of Automated Teller Machines in non-traditional locations is a significant driver of market expansion. Traditionally, Automated Teller Machines were primarily installed within or near bank branches. However, the landscape has changed dramatically, with Automated Teller Machines now being placed in a variety of non-traditional locations such as retail stores, airports, railway stations, and entertainment venues. This strategic placement of Automated Teller Machines in high-traffic areas is designed to provide greater convenience to customers by offering banking services in locations where they are already spending their time. For instance, an Automated Teller Machine in a shopping mall allows shoppers to withdraw cash or perform other banking transactions without having to leave the premises. Similarly, Automated Teller Machines at airports and railway stations cater to the needs of travelers who may require access to cash or other banking services during their journeys. This trend not only enhances customer convenience but also increases the transaction volume and usage rates of Automated Teller Machines, thereby driving market growth. Financial institutions and independent Automated Teller Machine deployers recognize the potential of these high-traffic locations to attract more users and generate higher revenues, leading to increased investment in the deployment of Automated Teller Machines in non-traditional settings.

Key Market Challenges

Increasing Incidence of Cybersecurity Threats

One of the foremost challenges facing the Global Automated Teller Machine Market is the increasing incidence of cybersecurity threats. As Automated Teller Machines evolve to include advanced technological features such as internet connectivity, biometric authentication, and mobile integration, they become more susceptible to various forms of cyberattacks. Cybercriminals are continuously developing sophisticated methods to exploit vulnerabilities in Automated Teller Machine networks, which can lead to significant financial losses for banks and a loss of consumer trust. Common cyber threats include skimming, where devices are attached to Automated Teller Machines to steal card information, and more advanced malware attacks that can remotely control Automated Teller Machines and siphon off cash. The rapid advancement of these threats necessitates substantial investment in robust cybersecurity measures, including regular software updates, advanced encryption techniques, and real-time monitoring systems. Financial institutions must allocate significant resources to protect their Automated Teller Machine networks, which can be costly and complex, particularly for smaller banks with limited budgets. Additionally, the reputational damage resulting from successful cyberattacks can have long-term negative effects on consumer confidence and the broader market. The increasing incidence of cybersecurity threats thus poses a formidable challenge to the growth and stability of the Global Automated Teller Machine Market.

High Maintenance and Operational Costs

Another critical challenge facing the Global Automated Teller Machine Market is the high maintenance and operational costs associated with Automated Teller Machine deployment and management. Automated Teller Machines require regular maintenance to ensure they function correctly and securely. This includes routine servicing, software updates, cash replenishment, and repairs, which can be both time-consuming and expensive. In remote or rural areas, these costs can be even higher due to the logistical challenges involved in accessing these locations. Additionally, the need to comply with stringent regulatory requirements and security standards adds to the operational burden for financial institutions. Automated Teller Machines must adhere to various national and international regulations concerning data protection, consumer privacy, and transaction security, necessitating continuous investment in compliance measures. The cost of upgrading older Automated Teller Machines to meet these evolving standards further exacerbates the financial strain on banks and independent Automated Teller Machine deployers. Moreover, the operational costs of Automated Teller Machines include insurance against theft and vandalism, which are significant risks in certain regions. The combined effect of these factors results in substantial ongoing expenditures, making it challenging for financial institutions to sustain and expand their Automated Teller Machine networks profitably.

Key Market Trends

Integration of Advanced Security Features

One of the prominent trends in the Global Automated Teller Machine Market is the integration of advanced security features. As cyber threats and fraud become increasingly sophisticated, financial institutions are prioritizing the enhancement of Automated Teller Machine security to protect both their assets and customer data. Modern Automated Teller Machines are being equipped with advanced technologies such as biometric authentication, which includes fingerprint and facial recognition, to verify user identity and reduce the risk of unauthorized access. Additionally, the deployment of real-time monitoring systems and artificial intelligence-driven analytics helps detect and prevent suspicious activities by identifying patterns indicative of fraud. Encryption technologies are also being enhanced to secure data transmission and storage, ensuring that sensitive information remains protected. These advancements not only bolster the security of Automated Teller Machine transactions but also instill greater confidence in consumers, encouraging continued use of Automated Teller Machines for various banking services. As security concerns remain a top priority for both consumers and financial institutions, the trend towards integrating advanced security features in Automated Teller Machines is expected to continue driving innovation and investment in the market.

Expansion of Multifunctional Automated Teller Machines

The expansion of multifunctional Automated Teller Machines is another significant trend shaping the Global Automated Teller Machine Market. Financial institutions are increasingly upgrading their Automated Teller Machine fleets to offer a broader range of services beyond traditional cash withdrawals and deposits. Modern Automated Teller Machines now provide a variety of banking and non-banking services, such as bill payments, mobile phone top-ups, ticket booking, and account management. Some Automated Teller Machines even support video conferencing with bank representatives, enabling customers to receive personalized assistance for more complex transactions. This multifunctionality enhances customer convenience by consolidating multiple services into a single, easily accessible point. Additionally, it allows banks to improve customer engagement and satisfaction by providing a more comprehensive service experience. The trend towards multifunctional Automated Teller Machines also supports financial inclusion initiatives by extending a wider array of services to underserved and remote areas where traditional banking infrastructure may be lacking. As consumer expectations for convenience and comprehensive service continue to rise, the development and deployment of multifunctional Automated Teller Machines are expected to remain a key growth driver in the market.

Adoption of Contactless and Cardless Technologies

The adoption of contactless and cardless technologies is a rapidly growing trend in the Global Automated Teller Machine Market. With the increasing preference for convenience and hygiene, particularly in the wake of the COVID-19 pandemic, contactless transactions have gained significant traction. Automated Teller Machines are being equipped with near-field communication (NFC) technology, allowing users to perform transactions using their smartphones, smartwatches, or contactless cards without the need to physically insert a card into the machine. This not only speeds up the transaction process but also minimizes physical contact, enhancing user safety and convenience. Cardless transactions, facilitated through mobile banking applications and QR code scanning, are also becoming more prevalent. These technologies enable users to initiate Automated Teller Machine transactions directly from their mobile devices, further simplifying the process and reducing the risk of card-related fraud. The shift towards contactless and cardless technologies aligns with the broader trend of digital transformation in the banking sector, as financial institutions strive to meet the evolving demands of tech-savvy consumers. As these technologies continue to mature and gain widespread acceptance, their adoption is expected to drive significant growth and innovation in the Automated Teller Machine market.

Segmental Insights

Solution Insights

In 2023, the Managed Services segment dominated the Global Automated Teller Machine Market and is expected to maintain its dominance during the forecast period. The Managed Services segment encompasses a comprehensive suite of solutions provided by third-party vendors, including maintenance, cash management, security services, and software updates, which are increasingly preferred by financial institutions looking to streamline operations and reduce costs. The primary driver behind the dominance of the Managed Services segment is the growing trend among banks and financial institutions to outsource non-core activities, enabling them to focus on their core banking functions and improve overall operational efficiency. Managed Services providers offer specialized expertise and advanced technological capabilities that ensure the optimal performance and security of Automated Teller Machine networks, which is particularly critical in an environment of escalating cybersecurity threats. Additionally, Managed Services facilitate scalability and flexibility, allowing financial institutions to rapidly adapt to changing market conditions and regulatory requirements without the burden of managing extensive in-house Automated Teller Machine infrastructure. The cost-effectiveness of Managed Services, combined with the ability to leverage cutting-edge technologies and best practices, further contributes to their attractiveness. As the demand for enhanced customer experiences and seamless banking operations continues to rise, the Managed Services segment is well-positioned to lead the Global Automated Teller Machine Market, driven by its comprehensive, efficient, and secure solutions that meet the evolving needs of financial institutions globally.

Regional Insights

In 2023, the Asia-Pacific region dominated the Global Automated Teller Machine Market and is expected to maintain its dominance during the forecast period. This region's supremacy in the market is driven by several factors, including rapid urbanization, increasing financial inclusion efforts, and the expanding middle-class population. Countries such as China and India are at the forefront of this growth, with significant investments in banking infrastructure and the deployment of Automated Teller Machines in both urban and rural areas. The push for financial inclusion by governments and financial institutions in these countries has led to a substantial increase in the number of Automated Teller Machines to cater to previously unbanked populations. Additionally, the Asia-Pacific region has seen a surge in technological advancements and innovations in Automated Teller Machine functionalities, including biometric authentication and contactless transactions, which enhance security and user convenience. The region's high population density and growing consumer base further amplify the demand for accessible and convenient banking services, reinforcing the need for an extensive Automated Teller Machine network. Moreover, the economic growth and rising disposable incomes in the Asia-Pacific region contribute to increased banking activities, thereby driving Automated Teller Machine usage. As these factors continue to influence the market, the Asia-Pacific region is well-positioned to sustain its leadership in the Global Automated Teller Machine Market, supported by ongoing investments in technology, infrastructure, and financial services expansion.

Key Market Players

- Diebold Nixdorf, Inc

- NCR Atleos Corporation

- Hitachi Channel Solutions, Corp

- Hyosung TNS Incorporation

- Triton Systems of Delaware, LLC

- Euronet Worldwide, Inc

- GRG Banking Equipment Co., Ltd

- Fujitsu Limited

- HESS Cash Systems GmbH

- KEBA Group AG

Report Scope:

In this report, the Global ATM Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

ATM Market, By Solution:

- Deployment Solution

- Managed Services

ATM Market, By ATM Type:

- Conventional/Bank ATMs

- Brown Label ATMs

- White Label ATMs

- Smart ATMs

- Cash Dispensers

ATM Market, By Application:

- Withdrawals

- Transfers

- Deposits

ATM Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Europe

- Germany

- United Kingdom

- France

- Russia

- Spain

- South America

- Brazil

- Argentina

- Middle East & Africa

- Saudi Arabia

- South Africa

- Egypt

- UAE

- Israel

Competitive Landscape

Company Profiles: Detailed analysis of the major companies presents in the Global ATM Market.

Available Customizations:

Global ATM Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.3. Markets Covered

- 1.4. Years Considered for Study

- 1.5. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validation

- 2.7. Assumptions and Limitations

3. Executive Summary

4. Voice of Customers

5. Global ATM Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Solution (Deployment Solutions, Managed Services)

- 5.2.2. By ATM Type (Conventional/Bank ATMs, Brown Label ATMs, White Label ATMs, Smart ATMs, Cash Dispensers)

- 5.2.3. By Application (Withdrawals, Transfers, Deposits)

- 5.2.4. By Region

- 5.3. By Company (2023)

- 5.4. Market Map

6. North America ATM Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Solution

- 6.2.2. By ATM Type

- 6.2.3. By Application

- 6.2.4. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States ATM Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Solution

- 6.3.1.2.2. By ATM Type

- 6.3.1.2.3. By Application

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada ATM Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Solution

- 6.3.2.2.2. By ATM Type

- 6.3.2.2.3. By Application

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico ATM Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Solution

- 6.3.3.2.2. By ATM Type

- 6.3.3.2.3. By Application

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States ATM Market Outlook

7. Asia-Pacific ATM Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Solution

- 7.2.2. By ATM Type

- 7.2.3. By Application

- 7.2.4. By Country

- 7.3. Asia-Pacific: Country Analysis

- 7.3.1. China ATM Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Solution

- 7.3.1.2.2. By ATM Type

- 7.3.1.2.3. By Application

- 7.3.1.1. Market Size & Forecast

- 7.3.2. India ATM Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Solution

- 7.3.2.2.2. By ATM Type

- 7.3.2.2.3. By Application

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Japan ATM Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Solution

- 7.3.3.2.2. By ATM Type

- 7.3.3.2.3. By Application

- 7.3.3.1. Market Size & Forecast

- 7.3.4. South Korea ATM Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Solution

- 7.3.4.2.2. By ATM Type

- 7.3.4.2.3. By Application

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Indonesia ATM Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Solution

- 7.3.5.2.2. By ATM Type

- 7.3.5.2.3. By Application

- 7.3.5.1. Market Size & Forecast

- 7.3.1. China ATM Market Outlook

8. Europe ATM Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Solution

- 8.2.2. By ATM Type

- 8.2.3. By Application

- 8.2.4. By Country

- 8.3. Europe: Country Analysis

- 8.3.1. Germany ATM Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Solution

- 8.3.1.2.2. By ATM Type

- 8.3.1.2.3. By Application

- 8.3.1.1. Market Size & Forecast

- 8.3.2. United Kingdom ATM Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Solution

- 8.3.2.2.2. By ATM Type

- 8.3.2.2.3. By Application

- 8.3.2.1. Market Size & Forecast

- 8.3.3. France ATM Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Solution

- 8.3.3.2.2. By ATM Type

- 8.3.3.2.3. By Application

- 8.3.3.1. Market Size & Forecast

- 8.3.4. Russia ATM Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Solution

- 8.3.4.2.2. By ATM Type

- 8.3.4.2.3. By Application

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Spain ATM Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Solution

- 8.3.5.2.2. By ATM Type

- 8.3.5.2.3. By Application

- 8.3.5.1. Market Size & Forecast

- 8.3.1. Germany ATM Market Outlook

9. South America ATM Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Solution

- 9.2.2. By ATM Type

- 9.2.3. By Application

- 9.2.4. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil ATM Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Solution

- 9.3.1.2.2. By ATM Type

- 9.3.1.2.3. By Application

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina ATM Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Solution

- 9.3.2.2.2. By ATM Type

- 9.3.2.2.3. By Application

- 9.3.2.1. Market Size & Forecast

- 9.3.1. Brazil ATM Market Outlook

10. Middle East & Africa ATM Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Solution

- 10.2.2. By ATM Type

- 10.2.3. By Application

- 10.2.4. By Country

- 10.3. Middle East & Africa: Country Analysis

- 10.3.1. Saudi Arabia ATM Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Solution

- 10.3.1.2.2. By ATM Type

- 10.3.1.2.3. By Application

- 10.3.1.1. Market Size & Forecast

- 10.3.2. South Africa ATM Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Solution

- 10.3.2.2.2. By ATM Type

- 10.3.2.2.3. By Application

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE ATM Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Solution

- 10.3.3.2.2. By ATM Type

- 10.3.3.2.3. By Application

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Israel ATM Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Solution

- 10.3.4.2.2. By ATM Type

- 10.3.4.2.3. By Application

- 10.3.4.1. Market Size & Forecast

- 10.3.5. Egypt ATM Market Outlook

- 10.3.5.1. Market Size & Forecast

- 10.3.5.1.1. By Value

- 10.3.5.2. Market Share & Forecast

- 10.3.5.2.1. By Solution

- 10.3.5.2.2. By ATM Type

- 10.3.5.2.3. By Application

- 10.3.5.1. Market Size & Forecast

- 10.3.1. Saudi Arabia ATM Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenge

12. Market Trends & Developments

13. Company Profiles

- 13.1. Diebold Nixdorf, Inc

- 13.1.1. Business Overview

- 13.1.2. Key Revenue and Financials

- 13.1.3. Recent Developments

- 13.1.4. Key Personnel

- 13.1.5. Key Product/Services

- 13.2. NCR Atleos Corporation

- 13.2.1. Business Overview

- 13.2.2. Key Revenue and Financials

- 13.2.3. Recent Developments

- 13.2.4. Key Personnel

- 13.2.5. Key Product/Services

- 13.3. Hitachi Channel Solutions, Corp

- 13.3.1. Business Overview

- 13.3.2. Key Revenue and Financials

- 13.3.3. Recent Developments

- 13.3.4. Key Personnel

- 13.3.5. Key Product/Services

- 13.4. Hyosung TNS Incorporation

- 13.4.1. Business Overview

- 13.4.2. Key Revenue and Financials

- 13.4.3. Recent Developments

- 13.4.4. Key Personnel

- 13.4.5. Key Product/Services

- 13.5. Triton Systems of Delaware, LLC

- 13.5.1. Business Overview

- 13.5.2. Key Revenue and Financials

- 13.5.3. Recent Developments

- 13.5.4. Key Personnel

- 13.5.5. Key Product/Services

- 13.6. Euronet Worldwide, Inc

- 13.6.1. Business Overview

- 13.6.2. Key Revenue and Financials

- 13.6.3. Recent Developments

- 13.6.4. Key Personnel

- 13.6.5. Key Product/Services

- 13.7. GRG Banking Equipment Co., Ltd

- 13.7.1. Business Overview

- 13.7.2. Key Revenue and Financials

- 13.7.3. Recent Developments

- 13.7.4. Key Personnel

- 13.7.5. Key Product/Services

- 13.8. Fujitsu Limited.

- 13.8.1. Business Overview

- 13.8.2. Key Revenue and Financials

- 13.8.3. Recent Developments

- 13.8.4. Key Personnel

- 13.8.5. Key Product/Services

- 13.9. HESS Cash Systems GmbH

- 13.9.1. Business Overview

- 13.9.2. Key Revenue and Financials

- 13.9.3. Recent Developments

- 13.9.4. Key Personnel

- 13.9.5. Key Product/Services

- 13.10. KEBA Group AG

- 13.10.1. Business Overview

- 13.10.2. Key Revenue and Financials

- 13.10.3. Recent Developments

- 13.10.4. Key Personnel

- 13.10.5. Key Product/Services