|

|

市場調査レポート

商品コード

1796994

オキソアルコール市場- 世界の産業規模 - 世界の産業規模、シェア、動向、機会、予測:タイプ別、用途別、地域別、競合、2020年~2030年Oxo Alcohol Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented By Type, By Application, By Region and Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| オキソアルコール市場- 世界の産業規模 - 世界の産業規模、シェア、動向、機会、予測:タイプ別、用途別、地域別、競合、2020年~2030年 |

|

出版日: 2025年08月25日

発行: TechSci Research

ページ情報: 英文 185 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のオキソアルコール市場は、2024年に121億5,000万米ドルと評価され、CAGR 3.80%で2030年には152億3,000万米ドルに達すると予測されています。

有機化学品の一群であるオキソアルコールは、オレフィンまたはアルケンと合成ガス(一酸化炭素および水素)を、触媒の存在下、加圧下で反応させて得られます。この化学プロセスにより、炭素鎖長の異なる直鎖および分岐アルコールの混合物が得られます。最も一般的に使用されるオキソアルコールには、2-エチルヘキサノール(2-EH)、イソノニルアルコール(INA)、イソデシルアルコール(IDA)などがあります。これらの汎用性の高いアルコールは、可塑剤、溶剤、樹脂の製造に幅広く利用されており、自動車、建築、包装、パーソナルケアなど、さまざまな産業で欠かせないものとなっています。特に可塑剤は、ポリマーの柔軟性、耐久性、弾力性を高める上で重要な役割を果たしています。可塑剤は、パイプ、ワイヤー、ケーブルなどのPVC製品の製造や、ダッシュボード、内装トリム、ドアパネルなどの自動車産業で広く使用されています。可塑剤としてのオキソアルコールの需要は、これらの産業の成長によって牽引されています。

| 市場概要 | |

|---|---|

| 予測期間 | 2026-2030 |

| 市場規模:2024年 | 121億5,000万米ドル |

| 市場規模:2030年 | 152億3,000万米ドル |

| CAGR:2025年~2030年 | 3.80% |

| 急成長セグメント | 可塑剤 |

| 最大市場 | アジア太平洋 |

オキソアルコールは、塗料やコーティング剤、印刷インキ、接着剤、医薬品などの産業で不可欠な溶媒としての役割を果たします。そのユニークな特性から、界面活性剤、潤滑剤、エステルなどの様々な化学化合物の製造における中間体としての使用に適しています。これらの産業、特に新興諸国における需要の高まりが、溶剤としてのオキソアルコールの需要をさらに押し上げています。

主な市場促進要因

化学産業におけるオキソアルコールの需要拡大

主な市場課題

原材料価格の変動

主要市場動向

可塑剤需要の増加

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 オキソアルコール市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別(2-エチルヘキサノール、n-ブタノール、イソブタノール)

- 用途別(可塑剤、アクリレート、酢酸エステル、樹脂、溶剤、グリコールエーテル、潤滑剤、添加剤、界面活性剤、安定剤、その他)

- 地域別

- 企業別(2024)

- 市場マップ

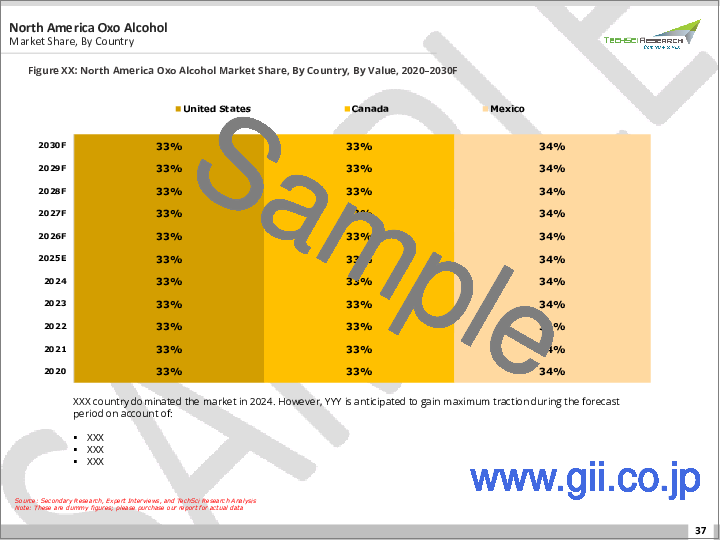

第6章 北米のオキソアルコール市場展望

- 市場規模・予測

- 市場シェア・予測

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 欧州のオキソアルコール市場展望

- 市場規模・予測

- 市場シェア・予測

- 欧州:国別分析

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

第8章 アジア太平洋地域のオキソアルコール市場展望

- 市場規模・予測

- 市場シェア・予測

- アジア太平洋地域:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

第9章 南米のオキソアルコール市場展望

- 市場規模・予測

- 市場シェア・予測

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 中東・アフリカのオキソアルコール市場展望

- 市場規模・予測

- 市場シェア・予測

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

- 最近の動向

- 製品上市

- 合併と買収

第13章 世界のオキソアルコール市場:SWOT分析

第14章 競合情勢

- LG Chem Ltd.

- BAX Chemicals BV

- Eastman Chemical Company

- Dow Chemical Company

- BASF SE

- Petronas International Corp Ltd

- ExxonMobil Chemical Company

- Qatar Petroleum Development Company

- Andhra Petrochemicals Ltd.

- Arkema SA

第15章 戦略的提言

第16章 調査会社について・免責事項

Global Oxo Alcohol market was valued at USD 12.15 Billion in 2024 and is expected to reach USD 15.23 Billion by 2030 with a CAGR of 3.80%. Oxo alcohols, a group of organic chemicals, are derived from the reaction of olefins or alkenes with synthesis gas (carbon monoxide and hydrogen) under pressure and in the presence of a catalyst. This chemical process results in a mixture of linear and branched alcohols with varying carbon chain lengths. The most commonly used oxo alcohols include 2-ethylhexanol (2-EH), isononyl alcohol (INA), and isodecyl alcohol (IDA). These versatile alcohols find extensive applications in the production of plasticizers, solvents, and resins, which are indispensable in various industries such as automotive, construction, packaging, and personal care. Plasticizers, in particular, play a vital role in enhancing the flexibility, durability, and resilience of polymers. They are widely used in the production of PVC products like pipes, wires, and cables, as well as in the automotive industry for manufacturing dashboards, interior trims, and door panels. The demand for oxo alcohols as plasticizers is driven by the growth of these industries.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 12.15 Billion |

| Market Size 2030 | USD 15.23 Billion |

| CAGR 2025-2030 | 3.80% |

| Fastest Growing Segment | Plasticizer |

| Largest Market | Asia-Pacific |

Oxo alcohols serve as essential solvents in industries like paints and coatings, printing inks, adhesives, and pharmaceuticals. Their unique properties make them suitable for use as intermediates in the production of various chemical compounds like surfactants, lubricants, and esters. The growing demand for these industries, particularly in developing countries, further fuels the demand for oxo alcohols as solvents.

Key Market Drivers

Growing Demand of Oxo Alcohol in Chemical Industry

Oxo alcohols, also known as aldehydes, are a class of alcohols that are synthesized by introducing carbon monoxide and hydrogen to an olefin, resulting in the formation of an aldehyde. Subsequently, the aldehyde undergoes hydrogenation to yield the desired alcohol compound. These versatile compounds find extensive applications as solvents and intermediates in the production of various polymers, including plasticizers, coatings, adhesives, and more.

The demand for oxo alcohols in the chemical industry has witnessed a remarkable surge in recent years, especially for the production of plasticizers, which represents the largest segment of the market. Plasticizers play a vital role in enhancing the plasticity and fluidity of materials, and their increasing demand is primarily driven by the thriving plastics and polymers industry.

Apart from their use as plasticizers, oxo alcohols are also widely employed in the production of acrylates. Acrylates find diverse applications in surface coatings, adhesives, sealants, textiles, detergents, and more. The growing demand for these products across various industries further propels the market for oxo alcohols.

The burgeoning demand for oxo alcohols is also attributed to technological advancements and innovations in the chemical industry. For instance, the development of bio-based plasticizers, which offer enhanced environmental sustainability compared to traditional plasticizers, has opened up new avenues of opportunity for the oxo alcohol market.

The global oxo alcohol market is experiencing significant growth owing to the escalating demand in the chemical industry, particularly for plasticizers and acrylates. As the chemical industry continues to expand and innovate, the demand for oxo alcohols is anticipated to witness further growth, thereby driving the market forward and unlocking new horizons of possibilities.

Key Market Challenges

Volatility in Prices of Raw Materials

Oxo alcohols, crucial components in various industries, are synthesized through a multi-step process. Carbon monoxide and hydrogen are introduced to an olefin, resulting in the formation of an aldehyde. This aldehyde is then subjected to hydrogenation, ultimately yielding the desired alcohol.

The production of oxo alcohols heavily relies on specific raw materials, namely propylene, acetylene, and ethylene. These primary ingredients play a pivotal role in determining the cost of production. Any fluctuations in the prices of these raw materials directly impact the overall cost and profitability of manufacturing oxo alcohols.

Unfortunately, the oxo alcohol market faces significant challenges due to the volatile nature of raw material prices. Fluctuations in the costs of these essential ingredients create considerable obstacles for manufacturers, as they struggle to maintain stable pricing for their products. This predicament not only affects their profit margins but also hinders their ability to meet market demands consistently.

Compounding the issue, several outages at oxo-alcohol production facilities have led to constrained availability and subsequent increases in raw material prices. These circumstances further exacerbate the challenges faced by manufacturers, putting additional strain on an already delicate market situation.

Key Market Trends

Increasing Demand for Plasticizers

Oxo alcohols, which are produced through the addition of carbon monoxide and hydrogen to an olefin, undergo a series of chemical transformations to ultimately yield alcohol. This process involves the conversion of the resulting aldehyde through hydrogenation. These versatile alcohols find widespread application as crucial raw materials in the production of plasticizers.

Plasticizers, as their name suggests, are substances incorporated into materials to enhance their flexibility, workability, and durability. They play an integral role in the manufacturing of various products, including polyvinyl chloride (PVC), adhesives, sealants, and more. By imparting desirable properties to the materials, plasticizers contribute significantly to the functionality and performance of the end products.

The oxo alcohol market is witnessing a notable upsurge, driven by the rising demand for plasticizers across various end-user sectors. The growth of the plastic industry, as well as sectors such as construction, automotive, and consumer goods, contributes to this increasing demand. Notably, the construction sector is witnessing a surge in demand for flexible PVC in applications such as flooring, wall coverings, and roofing membranes. The automotive industry extensively utilizes plasticizers in manufacturing car interiors, under-the-hood components, and wire and cable coverings.

This growing demand for plasticizers underscores the importance of oxo alcohols as key intermediates in the production process. As the plasticizer industry continues to expand, driven by the ever-increasing demand for flexible PVC and other plastic-based products, the demand for oxo alcohols is expected to remain strong. The versatility and wide range of applications make oxo alcohols a crucial component in various industries, contributing to their sustained growth and significance in the global market.

Key Market Players

- LG Chem Ltd.

- BAX Chemicals BV

- Eastman Chemical Company

- Dow Chemical Company

- BASF SE

- Petronas International Corp Ltd

- ExxonMobil Chemical Company

- Qatar Petroleum Development Company

- Andhra Petrochemicals Ltd.

- Arkema SA

Report Scope:

In this report, the Global Oxo Alcohol Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Oxo Alcohol Market, By Type:

- 2-Ethyl Hexanol

- n-Butanol

- Iso-Butanol

Oxo Alcohol Market, By Application:

- Plasticizer

- Acrylates

- Acetate Esters

- Resins

- Solvents

- Glycol Ethers

- Lubricants Additives

- Surfactants

- Stabilizers

- Others

Oxo Alcohol Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Oxo Alcohol Market.

Available Customizations:

Global Oxo Alcohol Market report with the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.2.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validation

- 2.7. Assumptions and Limitations

3. Executive Summary

- 3.1. Overview of the Market

- 3.2. Overview of Key Market Segmentations

- 3.3. Overview of Key Market Players

- 3.4. Overview of Key Regions/Countries

- 3.5. Overview of Market Drivers, Challenges, Trends

4. Voice of Customer

5. Oxo Alcohol Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Type (2-Ethyl Hexanol, n-Butanol, and Iso-Butanol)

- 5.2.2. By Application (Plasticizer, Acrylates, Acetate Esters, Resins, Solvents, Glycol Ethers, Lubricants Additives, Surfactants, Stabilizers, Others)

- 5.2.3. By Region

- 5.2.4. By Company (2024)

- 5.3. Market Map

6. North America Oxo Alcohol Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Type

- 6.2.2. By Application

- 6.2.3. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Oxo Alcohol Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Type

- 6.3.1.2.2. By Application

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Oxo Alcohol Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Type

- 6.3.2.2.2. By Application

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Oxo Alcohol Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Type

- 6.3.3.2.2. By Application

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Oxo Alcohol Market Outlook

7. Europe Oxo Alcohol Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Type

- 7.2.2. By Application

- 7.2.3. By Country

- 7.3. Europe: Country Analysis

- 7.3.1. Germany Oxo Alcohol Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Type

- 7.3.1.2.2. By Application

- 7.3.1.1. Market Size & Forecast

- 7.3.2. United Kingdom Oxo Alcohol Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Type

- 7.3.2.2.2. By Application

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Italy Oxo Alcohol Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Type

- 7.3.3.2.2. By Application

- 7.3.3.1. Market Size & Forecast

- 7.3.4. France Oxo Alcohol Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Type

- 7.3.4.2.2. By Application

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Spain Oxo Alcohol Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Type

- 7.3.5.2.2. By Application

- 7.3.5.1. Market Size & Forecast

- 7.3.1. Germany Oxo Alcohol Market Outlook

8. Asia-Pacific Oxo Alcohol Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Type

- 8.2.2. By Application

- 8.2.3. By Country

- 8.3. Asia-Pacific: Country Analysis

- 8.3.1. China Oxo Alcohol Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Type

- 8.3.1.2.2. By Application

- 8.3.1.1. Market Size & Forecast

- 8.3.2. India Oxo Alcohol Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Type

- 8.3.2.2.2. By Application

- 8.3.2.1. Market Size & Forecast

- 8.3.3. Japan Oxo Alcohol Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Type

- 8.3.3.2.2. By Application

- 8.3.3.1. Market Size & Forecast

- 8.3.4. South Korea Oxo Alcohol Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Type

- 8.3.4.2.2. By Application

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Australia Oxo Alcohol Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Type

- 8.3.5.2.2. By Application

- 8.3.5.1. Market Size & Forecast

- 8.3.1. China Oxo Alcohol Market Outlook

9. South America Oxo Alcohol Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Type

- 9.2.2. By Application

- 9.2.3. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Oxo Alcohol Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Type

- 9.3.1.2.2. By Application

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Oxo Alcohol Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Type

- 9.3.2.2.2. By Application

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Oxo Alcohol Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Type

- 9.3.3.2.2. By Application

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Oxo Alcohol Market Outlook

10. Middle East and Africa Oxo Alcohol Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Type

- 10.2.2. By Application

- 10.2.3. By Country

- 10.3. MEA: Country Analysis

- 10.3.1. South Africa Oxo Alcohol Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Type

- 10.3.1.2.2. By Application

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Saudi Arabia Oxo Alcohol Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Type

- 10.3.2.2.2. By Application

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Oxo Alcohol Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Type

- 10.3.3.2.2. By Application

- 10.3.3.1. Market Size & Forecast

- 10.3.1. South Africa Oxo Alcohol Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Market Trends & Developments

- 12.1. Recent Developments

- 12.2. Product Launches

- 12.3. Mergers & Acquisitions

13. Global Oxo Alcohol Market: SWOT Analysis

14. Competitive Landscape

- 14.1. LG Chem Ltd.

- 14.1.1. Business Overview

- 14.1.2. Product & Service Offerings

- 14.1.3. Recent Developments

- 14.1.4. Financials (If Listed)

- 14.1.5. Key Personnel

- 14.1.6. SWOT Analysis

- 14.2. BAX Chemicals BV

- 14.3. Eastman Chemical Company

- 14.4. Dow Chemical Company

- 14.5. BASF SE

- 14.6. Petronas International Corp Ltd

- 14.7. ExxonMobil Chemical Company

- 14.8. Qatar Petroleum Development Company

- 14.9. Andhra Petrochemicals Ltd.

- 14.10.Arkema SA