|

|

市場調査レポート

商品コード

1373019

ウエハー洗浄装置の世界市場-世界産業規模、シェア、動向、装置タイプ、ウエハーサイズ、機能、用途、地域、予測と機会2018-2028年Global Wafer Cleaning Equipment Market-Global Industry Size, Share, Trends, Opportunity, Forecast, Global Wafer Cleaning Equipment Market is Segmented by Equipment Type, Wafer Size, Functions, Application, Region, Forecast & Opportunities, 2018-2028 |

||||||

カスタマイズ可能

|

|||||||

| ウエハー洗浄装置の世界市場-世界産業規模、シェア、動向、装置タイプ、ウエハーサイズ、機能、用途、地域、予測と機会2018-2028年 |

|

出版日: 2023年10月03日

発行: TechSci Research

ページ情報: 英文 190 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

ウエハー洗浄装置の世界市場規模は2022年に62億米ドルとなり、予測期間を通じてCAGR7.4%という力強い成長が見込まれています。

この成長は、より小さく、より強力で、よりクリーンなチップを作ろうという、拡大し続ける半導体業界の揺るぎないコミットメントによって推進されています。これらのチップは、スマートフォンやラップトップから自律走行車やIoTデバイスに至るまで、多様な技術革新の基盤となっています。

メーカー各社は、半導体製造における集積度の向上と小型化に熱心に取り組んでいます。その結果、半導体の基本的な構成要素であるウエハーに対する要求は、かつてないほど重要なレベルに達しています。このような状況において、ウエハー洗浄装置は、シリコンウエハーに汚染物質、パーティクル、化学残留物がないことを保証することにより、中心的な役割を担っています。この入念な洗浄プロセスにより、最終的にチップの歩留まりと性能が向上します。

さらに、半導体ノードの微細化が進むにつれて、ウエハーの清浄度に対する要求はますます厳しくなっています。半導体製造プロセスの複雑化、3Dパッケージング技術の出現、5Gや人工知能などの新興アプリケーションの拡大により、市場の成長はさらに加速しています。

| 市場概要 | |

|---|---|

| 予測期間 | 2024-2028 |

| 市場規模2022年 | 62億米ドル |

| 2028年の市場規模 | 99億9,000万米ドル |

| CAGR 2023-2028 | 7.4% |

| 急成長セグメント | 粒子状不純物 |

| 最大市場 | 北米 |

半導体産業が技術革命の最前線に位置し続ける中、ウエハー洗浄装置の世界市場は上昇軌道を維持する好位置にあります。この市場は、現代の風景を定義する、縮小を続ける、より強力な電子デバイスの生産を促進する上で、極めて重要な役割を果たし続けると思われます。

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 ウエハー洗浄装置の世界市場におけるCOVID-19の影響

第5章 顧客の声

第6章 ウエハー洗浄装置の世界市場概要

第7章 ウエハー洗浄装置の世界市場展望

- 市場規模と予測

- 金額別

- 市場シェアと予測

- 装置タイプ別(枚葉式低温洗浄装置、枚葉式スプレー洗浄装置、バッチ式浸漬洗浄装置、バッチ式スプレー洗浄装置、スクラバー)

- ウエハーサイズ別(300mm、200mm、125mm)

- 機能別(手動装置、自動装置、半自動装置)

- アプリケーション別(LED, MEMS,メモリ, RFデバイスその他)

- 地域別(北米、欧州、南米、中東・アフリカ、アジア太平洋)

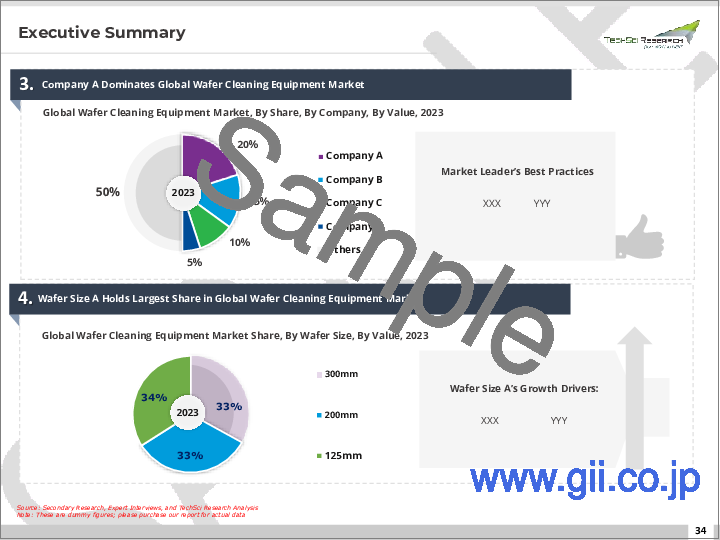

- 企業別(2022年)

- 市場マップ

第8章 北米ウエハー洗浄装置の市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 装置タイプ別

- ウエハーサイズ別

- 機能別

- 用途別

- 国別

第9章 欧州ウエハー洗浄装置市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 装置タイプ別

- ウエハーサイズ別

- 機能別

- 用途別

- 国別

第10章 南米ウエハー洗浄装置の市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 装置タイプ別

- ウエハーサイズ別

- 機能別

- 用途別

- 国別

第11章 中東・アフリカのウエハー洗浄装置市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 装置タイプ別

- ウエハーサイズ別

- 機能別

- 用途別

- 国別

第12章 アジア太平洋地域のウエハー洗浄装置市場展望

- 市場規模・予測

- 装置タイプ別

- ウエハーサイズ別

- 機能別

- 用途別

- 国別

第13章 市場力学

- 促進要因

- 課題

第14章 市場動向と開拓

第15章 企業プロファイル企業プロファイル

- Screen Holdings Co., Ltd.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Tokyo Electron Limited(TEL)

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Lam Research Corporation

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Applied Materials, Inc.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Cleaning Technologies Group

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Modutek Corporation

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- SEMCO Engineering

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Entegris, Inc.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- S3 Alliance

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- AP&S International GmbH

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Falcon Process Systems, Inc.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Dainippon Screen Manufacturing Co., Ltd.

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- PVA TePla AG

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

- Axus Technology

- Business Overview

- Key Revenue and Financials

- Recent Developments

- Key Personnel

- Key Product/Services Offered

第16章 戦略的提言

第17章 調査会社について・免責事項

The Global Wafer Cleaning Equipment Market, valued at USD 6.2 Billion in 2022, is undergoing substantial growth with a robust Compound Annual Growth Rate (CAGR) of 7.4% expected throughout the forecast period. This growth is propelled by the unwavering commitment of the ever-expanding semiconductor industry to create smaller, more potent, and cleaner chips. These chips serve as the foundation for a diverse range of technological innovations, from smartphones and laptops to autonomous vehicles and IoT devices.

Manufacturers are diligently striving for elevated levels of integration and miniaturization in semiconductor production. Consequently, the demand for pristine wafers, which serve as the fundamental building blocks of semiconductors, has reached unprecedented levels of importance. In this context, wafer cleaning equipment assumes a central role by ensuring that silicon wafers remain free from contaminants, particles, and chemical residues. This meticulous cleaning process ultimately enhances chip yield and performance.

Furthermore, as semiconductor nodes progress towards smaller geometries, the requisites for wafer cleanliness become increasingly stringent. The market's growth is further accentuated by the escalating intricacies of semiconductor fabrication processes, the emergence of 3D packaging technologies, and the expansion of nascent applications such as 5G and artificial intelligence.

| Market Overview | |

|---|---|

| Forecast Period | 2024-2028 |

| Market Size 2022 | USD 6.2 Billion |

| Market Size 2028 | USD 9.99 Billion |

| CAGR 2023-2028 | 7.4% |

| Fastest Growing Segment | Particle impurities |

| Largest Market | North America |

As the semiconductor industry remains at the forefront of the technological revolution, the Global Wafer Cleaning Equipment Market is well-positioned to sustain its upward trajectory. It will continue to play a pivotal role in facilitating the production of ever-shrinking and more potent electronic devices that define the contemporary landscape.

Key Market Drivers

Rise of Advanced Semiconductor Technologies

The rise of advanced semiconductor technologies is a driving force behind the growth of the Global Wafer Cleaning Equipment Market. As the demand for smaller, more powerful, and energy-efficient electronic devices continues to surge, semiconductor manufacturers are pushing the boundaries of innovation. This drive has led to the development of advanced semiconductor technologies, including smaller process nodes, 3D chip stacking, and novel materials such as gallium nitride (GaN) and silicon carbide (SiC). These advancements enable the production of cutting-edge microchips that power applications like 5G wireless communication, artificial intelligence, autonomous vehicles, and high-performance computing. However, these advanced semiconductor technologies also present unique challenges, particularly in terms of wafer cleanliness. Even the tiniest particle or contamination on a wafer's surface can result in defective chips, compromising the performance and reliability of electronic devices. As a result, there is an escalating need for wafer cleaning equipment that can meet the exacting standards required by advanced semiconductor processes. Wafer cleaning equipment plays a pivotal role in ensuring the integrity of semiconductor manufacturing. It removes contaminants, residues, and particles from wafers, allowing for precise patterning and deposition of materials. With advanced semiconductor technologies, the stakes are higher, and the cleanliness requirements are stricter. Sub-micron and nanoscale particles must be eliminated to guarantee the functionality of these cutting-edge chips.

Furthermore, advanced semiconductor technologies often involve intricate and delicate structures, such as FinFET transistors and through-silicon vias (TSVs). These structures demand specialized cleaning processes that can target specific areas while avoiding damage to the wafer's surface. This level of precision is achievable through automation and the integration of advanced sensors and robotics in wafer cleaning equipment. As semiconductor manufacturers invest heavily in research and development to stay competitive in the era of advanced technologies, the demand for state-of-the-art wafer cleaning equipment is set to rise. These cleaning solutions must keep pace with the evolving requirements of semiconductor fabrication, offering not only higher levels of cleanliness but also improved efficiency, reduced chemical consumption, and compatibility with a wider range of materials. In this context, the Global Wafer Cleaning Equipment Market is poised for substantial growth as it becomes an indispensable partner in the production of the sophisticated semiconductor devices that drive technological progress and innovation across industries worldwide.

Automation and Industry 4.0 Integration

Automation and Industry 4.0 integration are the driving forces propelling the Global Wafer Cleaning Equipment Market to new heights. At the heart of modern technology lies the semiconductor industry, which constantly pushes the envelope to create smaller and more powerful chips. With semiconductor nodes shrinking to meet the demands of cutting-edge applications, there is an exponential increase in the need for impeccably clean silicon wafers, making wafer cleaning equipment absolutely indispensable. Automation stands as a cornerstone of this growth story, revolutionizing the way wafer cleaning processes are conducted. By reducing human intervention and associated errors, automation streamlines operations and significantly enhances production efficiency. Automated systems, equipped with advanced robotics and sensors, exhibit the capability to delicately handle wafers with pinpoint precision. This precision is paramount as it ensures that semiconductor fabrication maintains unwavering standards of cleanliness even as the industry advances into increasingly intricate and miniaturized technologies. The integration of Industry 4.0 principles further elevates the capabilities of wafer cleaning equipment. It transforms these machines into smart, data-driven solutions that not only clean wafers but also optimize the entire manufacturing process. Through real-time monitoring of equipment performance, predictive maintenance, and data analytics, Industry 4.0 principles empower semiconductor manufacturers to achieve operational excellence. This translates into minimized downtime, reduced operational costs, and enhanced overall productivity.

In a world where the semiconductor industry is at the forefront of groundbreaking technologies like 5G, artificial intelligence, and the Internet of Things (IoT), the demand for silicon wafers with unprecedented levels of cleanliness continues to surge. Each of these technologies requires chips that meet exceptionally high standards of quality and precision. Automation and Industry 4.0 integration equip wafer cleaning equipment to rise to this challenge efficiently, positioning the market for sustained expansion as technology progresses further into the future. The synergy between automation and Industry 4.0 is not merely driving growth in the Global Wafer Cleaning Equipment Market; it is fundamentally shaping the trajectory of the semiconductor industry itself. As this market continues to evolve, it will play an increasingly crucial role in ensuring that the technological innovations of tomorrow are built on a foundation of exceptional quality and cleanliness, setting the stage for a more connected and advanced world.

Key Market Challenges

Interoperability and Standards

The Global Wafer Cleaning Equipment Market faces a significant challenge in achieving seamless technological integration and standardized communication among various cleaning equipment solutions. With a multitude of manufacturers offering specialized wafer cleaning systems designed for diverse semiconductor fabrication processes, ensuring compatibility and interoperability within complex manufacturing environments becomes a daunting task. These environments often feature a mix of legacy equipment, proprietary protocols, and evolving industry standards. To overcome this challenge, the establishment of common standards and interfaces is imperative, enabling different cleaning equipment components to work cohesively. Industry-wide collaboration is essential to establish a unified approach that addresses interoperability concerns, streamlines integration processes, and accommodates the specific needs of semiconductor manufacturers.

Scalability and Performance Optimization

Maintaining consistent scalability and optimal performance is a key challenge within the Global Wafer Cleaning Equipment Market. As semiconductor manufacturing demands evolve and production volumes fluctuate, ensuring that cleaning processes can efficiently scale while upholding rigorous cleanliness standards is a complex undertaking. Achieving precise cleaning results, efficient resource allocation, and robust fault tolerance across cleaning equipment units is vital, given the diverse range of semiconductor wafers and intricate microstructures they contain. Optimizing the performance of wafer cleaning equipment while adapting to changing production requirements necessitates the development of advanced management tools, intelligent process control algorithms, and dynamic resource allocation strategies. Manufacturers and solution providers must continuously innovate to address this challenge and provide semiconductor manufacturers with cleaning solutions that can seamlessly scale and deliver consistently high performance across varying production scenarios.

Environmental Sustainability and Chemical Management

The challenge of environmental sustainability and effective chemical management is an increasingly critical consideration in the Global Wafer Cleaning Equipment Market. While achieving impeccable wafer cleanliness is essential for semiconductor manufacturing, the use of chemicals and water-intensive processes raises environmental concerns. Meeting regulatory requirements, minimizing chemical waste, and reducing water usage are paramount. Manufacturers need to focus on developing environmentally friendly cleaning solutions, implementing closed-loop chemical recycling systems, and optimizing resource consumption. Adhering to stringent environmental standards is not only a regulatory necessity but also an ethical obligation to minimize the industry's ecological footprint and ensure a sustainable future.

Key Market Trends

Advanced Cleaning Technologies and Process Optimization

The Global Wafer Cleaning Equipment Market is witnessing a significant trend driven by the continuous evolution of advanced cleaning technologies and process optimization. As semiconductor fabrication processes become increasingly intricate, there is a growing demand for cutting-edge cleaning solutions capable of effectively removing nanoscale contaminants and ensuring the pristine quality of semiconductor wafers. Manufacturers are investing in research and development to enhance cleaning methods, materials, and equipment design. Moreover, process optimization through real-time monitoring, data analytics, and artificial intelligence is gaining prominence. This trend enables semiconductor manufacturers to achieve higher yields, lower defect rates, and improved overall production efficiency.

Environmental Sustainability and Chemical Management

Environmental sustainability and effective chemical management are becoming pivotal trends in the Global Wafer Cleaning Equipment Market. While maintaining the highest standards of wafer cleanliness remains paramount, there is a growing focus on reducing the environmental impact of cleaning processes. Semiconductor manufacturers are increasingly adopting eco-friendly and water-saving cleaning solutions to minimize resource consumption and chemical waste. Closed-loop chemical recycling systems and environmentally responsible disposal practices are becoming standard, aligning with global efforts to reduce the industry's ecological footprint. As environmental regulations become more stringent, manufacturers of wafer cleaning equipment are collaborating with semiconductor companies to develop environmentally responsible solutions that meet both performance and sustainability objectives.

Miniaturization and Handling of Advanced Materials

The trend of miniaturization and the handling of advanced materials are shaping the Global Wafer Cleaning Equipment Market. With semiconductor nodes shrinking and the emergence of novel materials, such as advanced compound semiconductors and 2D materials like graphene, wafer handling and cleaning processes require precise and specialized equipment. This trend demands innovations in robotics, automation, and material handling systems to delicately manage increasingly delicate wafers while ensuring thorough cleaning. The ability to handle advanced materials and maintain cleanliness standards in microscale and nanoscale structures is a key differentiator for cleaning equipment manufacturers.

Cost Efficiency and Cost of Ownership

Cost efficiency and the total cost of ownership remain prominent trends within the Global Wafer Cleaning Equipment Market. Semiconductor manufacturers are looking for cost-effective cleaning solutions that align with their budgetary constraints while delivering superior performance. Manufacturers of wafer cleaning equipment are responding by developing systems that optimize resource usage, reduce chemical consumption, and minimize downtime for maintenance. The emphasis is on providing semiconductor companies with cleaning solutions that offer a strong return on investment over the equipment's lifespan.

Globalization and Supply Chain Optimization

Globalization and supply chain optimization are trends impacting the Global Wafer Cleaning Equipment Market. As semiconductor manufacturing becomes a globally distributed industry, there is a need for standardized cleaning processes and equipment across various manufacturing facilities worldwide. Companies are looking to streamline their supply chains by working with equipment providers capable of delivering consistent cleaning solutions, support, and spare parts globally. This trend emphasizes the importance of global partnerships and service networks for wafer cleaning equipment manufacturers.

Segmental Insights

Application Insights

The Memory segment emerged as the dominant application type in the Global Wafer Cleaning Equipment Market, and it is expected to maintain its leadership position during the forecast period. Memory devices, such as dynamic random-access memory (DRAM) and NAND flash memory, constitute a fundamental component of electronic devices, including smartphones, laptops, data storage devices, and more. As consumer demand for higher storage capacities and faster data access continues to rise, semiconductor manufacturers are under constant pressure to produce memory wafers of impeccable quality. Wafer cleaning equipment plays a critical role in ensuring that memory wafers are free from contaminants and defects, as even minor impurities can adversely affect memory chip performance. Moreover, advancements in memory technologies, including the transition to smaller nanometer nodes and 3D stacking, intensify the need for precision cleaning processes. Therefore, the Memory segment is anticipated to maintain its dominance in the Global Wafer Cleaning Equipment Market, driven by the persistent demand for clean and high-performance memory wafers to meet the evolving requirements of the electronics industry.

Function Insights

the Automatic Equipment segment established its dominance in the Global Wafer Cleaning Equipment Market, and it is poised to maintain its leadership throughout the forecast period. The semiconductor manufacturing industry demands high-throughput and consistently reliable wafer cleaning processes to ensure the production of pristine and defect-free wafers. Automatic wafer cleaning equipment, characterized by its advanced robotics, precision controls, and autonomous cleaning capabilities, addresses these critical requirements effectively. These systems can efficiently handle large volumes of wafers in semiconductor fabs, offering not only high-speed cleaning but also superior consistency and repeatability in the cleaning process. Additionally, automation reduces the risk of human error, minimizes contamination risks, and enhances overall production efficiency, making it the preferred choice for semiconductor manufacturers striving for optimal yield and product quality. As the semiconductor industry continues to push the boundaries of miniaturization, with the transition to smaller nodes and the production of more complex and advanced integrated circuits, the demand for Automatic Equipment in wafer cleaning is expected to remain robust, solidifying its dominant position in the market.

Processor Type Insights

The Single-Wafer Cryogenic Systems segment emerged as the dominant force in the Global Wafer Cleaning Equipment Market, and it is anticipated to maintain this leading position in the foreseeable future. Single-Wafer Cryogenic Systems are highly favored in the semiconductor manufacturing industry for their exceptional precision and effectiveness in cleaning individual wafers. These systems utilize extremely low temperatures to remove contaminants and particles from the wafer surfaces, ensuring a thorough and contamination-free cleaning process. The semiconductor industry's stringent requirements for cleanliness and defect-free wafers make Single-Wafer Cryogenic Systems indispensable, particularly in advanced node semiconductor fabrication. These systems offer precise control over the cleaning process, resulting in a high level of cleanliness and minimal damage to the delicate wafers. As semiconductor nodes continue to shrink and device structures become more intricate, the demand for Single-Wafer Cryogenic Systems is set to rise further. Their ability to deliver top-tier cleaning performance while maintaining the integrity of increasingly sensitive semiconductor materials positions them as the preferred choice for semiconductor manufacturers, and this trend is expected to drive their dominance in the market for the foreseeable future.

Regional Insights

Asia-Pacific region emerged as the dominant force in the Global Wafer Cleaning Equipment Market, and it is poised to maintain its commanding position throughout the forecast period. Several factors contribute to Asia-Pacific's leadership in this market. Firstly, Asia-Pacific is home to some of the world's largest semiconductor manufacturers, particularly in countries like Taiwan, South Korea, and China, which collectively represent a significant portion of global semiconductor production. The semiconductor industry's continuous growth and expansion in this region drive the demand for advanced wafer cleaning equipment to ensure the production of high-quality, defect-free semiconductor wafers. Additionally, Asia-Pacific's position as a global electronics manufacturing hub, including the production of consumer electronics, drives the need for semiconductor manufacturing and, consequently, wafer cleaning equipment. Furthermore, the region benefits from robust government initiatives and investments in semiconductor manufacturing, research, and development, which further boost the demand for cutting-edge wafer cleaning solutions. As semiconductor nodes continue to shrink, and advanced technologies like 5G, artificial intelligence, and the Internet of Things (IoT) gain momentum, the requirement for wafer cleaning equipment remains pivotal. Given these factors, Asia-Pacific is expected to maintain its dominance in the Global Wafer Cleaning Equipment Market, underpinned by the region's strategic importance in the global semiconductor and electronics industries.

Key Market Players

Screen Holdings Co., Ltd.

Tokyo Electron Limited (TEL)

Lam Research Corporation

Applied Materials, Inc.

Cleaning Technologies Group

Modutek Corporation

SEMCO Engineering

Entegris, Inc.

S3 Alliance

AP&S International GmbH

Falcon Process Systems, Inc.

Dainippon Screen Manufacturing Co., Ltd.

PVA TePla AG

Axus Technology

Report Scope:

In this report, the Global Wafer Cleaning Equipment Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

Global Wafer Cleaning Equipment Market, By Equipment Type:

- Single-Wafer Cryogenic Systems

- Single-Wafer Spray Systems

- Batch Immersion Cleaning Systems

- Batch Spray Cleaning Systems

- Scrubbers

Global Wafer Cleaning Equipment Market, By Wafer Size:

- 300mm

- 200mm

- 125mm

Global Wafer Cleaning Equipment Market, By Functions:

- Manual Equipment

- Automatic Equipment

- Semi-Automatic Equipment

Global Wafer Cleaning Equipment Market, By Application:

- LED

- MEMS

- Memory

- RF Device

- Others

Global Wafer Cleaning Equipment Market, By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

- Company Profiles: Detailed analysis of the major companies present in the Global Wafer Cleaning Equipment Market.

Available Customizations:

- Global Wafer Cleaning Equipment Market report with the given market data, Tech Sci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.2.3. Key Market Segmentations

2. Research Methodology

- 2.1. Baseline Methodology

- 2.2. Key Industry Partners

- 2.3. Major Association and Secondary Sources

- 2.4. Forecasting Methodology

- 2.5. Data Triangulation & Validation

- 2.6. Assumptions and Limitations

3. Executive Summary

4. Impact of COVID-19 on Global Wafer Cleaning Equipment Market

5. Voice of Customer

6. Global Wafer Cleaning Equipment Market Overview

7. Global Wafer Cleaning Equipment Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Equipment Type (Single-Wafer Cryogenic Systems, Single-Wafer Spray Systems, Batch Immersion Cleaning Systems, Batch Spray Cleaning Systems, Scrubbers)

- 7.2.2. By Wafer Size (300mm, 200mm, 125mm)

- 7.2.3. By Functions (Manual Equipment, Automatic Equipment, Semi-Automatic Equipment)

- 7.2.4. By Application (LED, MEMS, Memory, RF Device Others)

- 7.2.5. By Region (North America, Europe, South America, Middle East & Africa, Asia Pacific)

- 7.3. By Company (2022)

- 7.4. Market Map

8. North America Wafer Cleaning Equipment Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Equipment Type

- 8.2.2. By Wafer Size

- 8.2.3. By Functions

- 8.2.4. By Application

- 8.2.5. By Country

- 8.2.5.1. United States Wafer Cleaning Equipment Market Outlook

- 8.2.5.1.1. Market Size & Forecast

- 8.2.5.1.1.1. By Value

- 8.2.5.1.2. Market Share & Forecast

- 8.2.5.1.2.1. By Equipment Type

- 8.2.5.1.2.2. By Wafer Size

- 8.2.5.1.2.3. By Functions

- 8.2.5.1.2.4. By Application

- 8.2.5.2. Canada Wafer Cleaning Equipment Market Outlook

- 8.2.5.2.1. Market Size & Forecast

- 8.2.5.2.1.1. By Value

- 8.2.5.2.2. Market Share & Forecast

- 8.2.5.2.2.1. By Equipment Type

- 8.2.5.2.2.2. By Wafer Size

- 8.2.5.2.2.3. By Functions

- 8.2.5.2.2.4. By Application

- 8.2.5.3. Mexico Wafer Cleaning Equipment Market Outlook

- 8.2.5.3.1. Market Size & Forecast

- 8.2.5.3.1.1. By Value

- 8.2.5.3.2. Market Share & Forecast

- 8.2.5.3.2.1. By Equipment Type

- 8.2.5.3.2.2. By Wafer Size

- 8.2.5.3.2.3. By Functions

- 8.2.5.3.2.4. By Application

- 8.2.5.1. United States Wafer Cleaning Equipment Market Outlook

9. Europe Wafer Cleaning Equipment Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Equipment Type

- 9.2.2. By Wafer Size

- 9.2.3. By Functions

- 9.2.4. By Application

- 9.2.5. By Country

- 9.2.5.1. Germany Wafer Cleaning Equipment Market Outlook

- 9.2.5.1.1. Market Size & Forecast

- 9.2.5.1.1.1. By Value

- 9.2.5.1.2. Market Share & Forecast

- 9.2.5.1.2.1. By Equipment Type

- 9.2.5.1.2.2. By Wafer Size

- 9.2.5.1.2.3. By Functions

- 9.2.5.1.2.4. By Application

- 9.2.5.2. France Wafer Cleaning Equipment Market Outlook

- 9.2.5.2.1. Market Size & Forecast

- 9.2.5.2.1.1. By Value

- 9.2.5.2.2. Market Share & Forecast

- 9.2.5.2.2.1. By Equipment Type

- 9.2.5.2.2.2. By Wafer Size

- 9.2.5.2.2.3. By Functions

- 9.2.5.2.2.4. By Application

- 9.2.5.3. United Kingdom Wafer Cleaning Equipment Market Outlook

- 9.2.5.3.1. Market Size & Forecast

- 9.2.5.3.1.1. By Value

- 9.2.5.3.2. Market Share & Forecast

- 9.2.5.3.2.1. By Equipment Type

- 9.2.5.3.2.2. By Wafer Size

- 9.2.5.3.2.3. By Functions

- 9.2.5.3.2.4. By Application

- 9.2.5.4. Italy Wafer Cleaning Equipment Market Outlook

- 9.2.5.4.1. Market Size & Forecast

- 9.2.5.4.1.1. By Value

- 9.2.5.4.2. Market Share & Forecast

- 9.2.5.4.2.1. By Equipment Type

- 9.2.5.4.2.2. By Wafer Size

- 9.2.5.4.2.3. By Functions

- 9.2.5.4.2.4. By Application

- 9.2.5.5. Spain Wafer Cleaning Equipment Market Outlook

- 9.2.5.5.1. Market Size & Forecast

- 9.2.5.5.1.1. By Value

- 9.2.5.5.2. Market Share & Forecast

- 9.2.5.5.2.1. By Equipment Type

- 9.2.5.5.2.2. By Wafer Size

- 9.2.5.5.2.3. By Functions

- 9.2.5.5.2.4. By Application

- 9.2.5.1. Germany Wafer Cleaning Equipment Market Outlook

10. South America Wafer Cleaning Equipment Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Equipment Type

- 10.2.2. By Wafer Size

- 10.2.3. By Functions

- 10.2.4. By Application

- 10.2.5. By Country

- 10.2.5.1. Brazil Wafer Cleaning Equipment Market Outlook

- 10.2.5.1.1. Market Size & Forecast

- 10.2.5.1.1.1. By Value

- 10.2.5.1.2. Market Share & Forecast

- 10.2.5.1.2.1. By Equipment Type

- 10.2.5.1.2.2. By Wafer Size

- 10.2.5.1.2.3. By Functions

- 10.2.5.1.2.4. By Application

- 10.2.5.2. Colombia Wafer Cleaning Equipment Market Outlook

- 10.2.5.2.1. Market Size & Forecast

- 10.2.5.2.1.1. By Value

- 10.2.5.2.2. Market Share & Forecast

- 10.2.5.2.2.1. By Equipment Type

- 10.2.5.2.2.2. By Wafer Size

- 10.2.5.2.2.3. By Functions

- 10.2.5.2.2.4. By Application

- 10.2.5.3. Argentina Wafer Cleaning Equipment Market Outlook

- 10.2.5.3.1. Market Size & Forecast

- 10.2.5.3.1.1. By Value

- 10.2.5.3.2. Market Share & Forecast

- 10.2.5.3.2.1. By Equipment Type

- 10.2.5.3.2.2. By Wafer Size

- 10.2.5.3.2.3. By Functions

- 10.2.5.3.2.4. By Application

- 10.2.5.1. Brazil Wafer Cleaning Equipment Market Outlook

11. Middle East & Africa Wafer Cleaning Equipment Market Outlook

- 11.1. Market Size & Forecast

- 11.1.1. By Value

- 11.2. Market Share & Forecast

- 11.2.1. By Equipment Type

- 11.2.2. By Wafer Size

- 11.2.3. By Functions

- 11.2.4. By Application

- 11.2.5. By Country

- 11.2.5.1. Saudi Arabia Wafer Cleaning Equipment Market Outlook

- 11.2.5.1.1. Market Size & Forecast

- 11.2.5.1.1.1. By Value

- 11.2.5.1.2. Market Share & Forecast

- 11.2.5.1.2.1. By Equipment Type

- 11.2.5.1.2.2. By Wafer Size

- 11.2.5.1.2.3. By Functions

- 11.2.5.1.2.4. By Application

- 11.2.5.2. UAE Wafer Cleaning Equipment Market Outlook

- 11.2.5.2.1. Market Size & Forecast

- 11.2.5.2.1.1. By Value

- 11.2.5.2.2. Market Share & Forecast

- 11.2.5.2.2.1. By Equipment Type

- 11.2.5.2.2.2. By Wafer Size

- 11.2.5.2.2.3. By Functions

- 11.2.5.2.2.4. By Application

- 11.2.5.3. South Africa Wafer Cleaning Equipment Market Outlook

- 11.2.5.3.1. Market Size & Forecast

- 11.2.5.3.1.1. By Value

- 11.2.5.3.2. Market Share & Forecast

- 11.2.5.3.2.1. By Equipment Type

- 11.2.5.3.2.2. By Wafer Size

- 11.2.5.3.2.3. By Functions

- 11.2.5.3.2.4. By Application

- 11.2.5.1. Saudi Arabia Wafer Cleaning Equipment Market Outlook

12. Asia Pacific Wafer Cleaning Equipment Market Outlook

- 12.1. Market Size & Forecast

- 12.1.1. By Equipment Type

- 12.1.2. By Wafer Size

- 12.1.3. By Functions

- 12.1.4. By Application

- 12.1.5. By Country

- 12.1.5.1. China Wafer Cleaning Equipment Market Outlook

- 12.1.5.1.1. Market Size & Forecast

- 12.1.5.1.1.1. By Value

- 12.1.5.1.2. Market Share & Forecast

- 12.1.5.1.2.1. By Equipment Type

- 12.1.5.1.2.2. By Wafer Size

- 12.1.5.1.2.3. By Functions

- 12.1.5.1.2.4. By Application

- 12.1.5.2. India Wafer Cleaning Equipment Market Outlook

- 12.1.5.2.1. Market Size & Forecast

- 12.1.5.2.1.1. By Value

- 12.1.5.2.2. Market Share & Forecast

- 12.1.5.2.2.1. By Equipment Type

- 12.1.5.2.2.2. By Wafer Size

- 12.1.5.2.2.3. By Functions

- 12.1.5.2.2.4. By Application

- 12.1.5.3. Japan Wafer Cleaning Equipment Market Outlook

- 12.1.5.3.1. Market Size & Forecast

- 12.1.5.3.1.1. By Value

- 12.1.5.3.2. Market Share & Forecast

- 12.1.5.3.2.1. By Equipment Type

- 12.1.5.3.2.2. By Wafer Size

- 12.1.5.3.2.3. By Functions

- 12.1.5.3.2.4. By Application

- 12.1.5.4. South Korea Wafer Cleaning Equipment Market Outlook

- 12.1.5.4.1. Market Size & Forecast

- 12.1.5.4.1.1. By Value

- 12.1.5.4.2. Market Share & Forecast

- 12.1.5.4.2.1. By Equipment Type

- 12.1.5.4.2.2. By Wafer Size

- 12.1.5.4.2.3. By Functions

- 12.1.5.4.2.4. By Application

- 12.1.5.5. Australia Wafer Cleaning Equipment Market Outlook

- 12.1.5.5.1. Market Size & Forecast

- 12.1.5.5.1.1. By Value

- 12.1.5.5.2. Market Share & Forecast

- 12.1.5.5.2.1. By Equipment Type

- 12.1.5.5.2.2. By Wafer Size

- 12.1.5.5.2.3. By Functions

- 12.1.5.5.2.4. By Application

- 12.1.5.1. China Wafer Cleaning Equipment Market Outlook

13. Market Dynamics

- 13.1. Drivers

- 13.2. Challenges

14. Market Trends and Developments

15. Company Profiles

- 15.1. Screen Holdings Co., Ltd.

- 15.1.1. Business Overview

- 15.1.2. Key Revenue and Financials

- 15.1.3. Recent Developments

- 15.1.4. Key Personnel

- 15.1.5. Key Product/Services Offered

- 15.2. Tokyo Electron Limited (TEL)

- 15.2.1. Business Overview

- 15.2.2. Key Revenue and Financials

- 15.2.3. Recent Developments

- 15.2.4. Key Personnel

- 15.2.5. Key Product/Services Offered

- 15.3. Lam Research Corporation

- 15.3.1. Business Overview

- 15.3.2. Key Revenue and Financials

- 15.3.3. Recent Developments

- 15.3.4. Key Personnel

- 15.3.5. Key Product/Services Offered

- 15.4. Applied Materials, Inc.

- 15.4.1. Business Overview

- 15.4.2. Key Revenue and Financials

- 15.4.3. Recent Developments

- 15.4.4. Key Personnel

- 15.4.5. Key Product/Services Offered

- 15.5. Cleaning Technologies Group

- 15.5.1. Business Overview

- 15.5.2. Key Revenue and Financials

- 15.5.3. Recent Developments

- 15.5.4. Key Personnel

- 15.5.5. Key Product/Services Offered

- 15.6. Modutek Corporation

- 15.6.1. Business Overview

- 15.6.2. Key Revenue and Financials

- 15.6.3. Recent Developments

- 15.6.4. Key Personnel

- 15.6.5. Key Product/Services Offered

- 15.7. SEMCO Engineering

- 15.7.1. Business Overview

- 15.7.2. Key Revenue and Financials

- 15.7.3. Recent Developments

- 15.7.4. Key Personnel

- 15.7.5. Key Product/Services Offered

- 15.8. Entegris, Inc.

- 15.8.1. Business Overview

- 15.8.2. Key Revenue and Financials

- 15.8.3. Recent Developments

- 15.8.4. Key Personnel

- 15.8.5. Key Product/Services Offered

- 15.9. S3 Alliance

- 15.9.1. Business Overview

- 15.9.2. Key Revenue and Financials

- 15.9.3. Recent Developments

- 15.9.4. Key Personnel

- 15.9.5. Key Product/Services Offered

- 15.10. AP&S International GmbH

- 15.10.1. Business Overview

- 15.10.2. Key Revenue and Financials

- 15.10.3. Recent Developments

- 15.10.4. Key Personnel

- 15.10.5. Key Product/Services Offered

- 15.11. Falcon Process Systems, Inc.

- 15.11.1. Business Overview

- 15.11.2. Key Revenue and Financials

- 15.11.3. Recent Developments

- 15.11.4. Key Personnel

- 15.11.5. Key Product/Services Offered

- 15.12. Dainippon Screen Manufacturing Co., Ltd.

- 15.12.1. Business Overview

- 15.12.2. Key Revenue and Financials

- 15.12.3. Recent Developments

- 15.12.4. Key Personnel

- 15.12.5. Key Product/Services Offered

- 15.13. PVA TePla AG

- 15.13.1. Business Overview

- 15.13.2. Key Revenue and Financials

- 15.13.3. Recent Developments

- 15.13.4. Key Personnel

- 15.13.5. Key Product/Services Offered

- 15.14. Axus Technology

- 15.14.1. Business Overview

- 15.14.2. Key Revenue and Financials

- 15.14.3. Recent Developments

- 15.14.4. Key Personnel

- 15.14.5. Key Product/Services Offered