|

|

市場調査レポート

商品コード

1667855

電磁鋼板市場- 世界の産業規模、シェア、動向、機会、予測、セグメント別、タイプ別、用途別、業種別、地域別、競合別、2020~2030年Electrical Steel Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, Segmented, By Type, By Application, By Vertical, By Region, By Competition, 2020-2030F |

||||||

カスタマイズ可能

|

|||||||

| 電磁鋼板市場- 世界の産業規模、シェア、動向、機会、予測、セグメント別、タイプ別、用途別、業種別、地域別、競合別、2020~2030年 |

|

出版日: 2025年02月28日

発行: TechSci Research

ページ情報: 英文 188 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

電磁鋼板の世界市場規模は、2024年に257億8,000万米ドルで、予測期間中のCAGRは5.82%で、2030年には365億2,000万米ドルに達すると予測されています。

この市場には、ヒステリシスや渦電流によるエネルギー損失を低減して電気機器の効率を最適化するために設計された特殊鋼合金の世界の生産、流通、使用が含まれます。シリコン鋼または変圧器鋼としても知られる電磁鋼板は、主に2つのカテゴリーに分類されます。粒度電磁鋼板(GOES)と非粒度電磁鋼板(NGOES)。それぞれのタイプは、発電、配電、モーター製造において明確な役割を担っています。GOESは主に送電に使用され、その高い透磁率と低いコアロス特性は送電システムの効率を高めます。一方、NGOESはモーター、発電機、その他の回転機械に広く採用され、最適な磁気性能と省エネを実現しています。

| 市場概要 | |

|---|---|

| 予測期間 | 2026~2030年 |

| 市場規模:2024年 | 257億8,000万米ドル |

| 市場規模:2030年 | 365億2,000万米ドル |

| CAGR:2025~2030年 | 5.82% |

| 急成長セグメント | 非粒度電磁鋼板 |

| 最大市場 | 北米 |

市場促進要因

エネルギー効率の高い変圧器とモーターへの需要増加

主要市場課題

原料価格の変動

主要市場動向

電気自動車(EV)の普及が先進的電磁鋼板の需要を牽引

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の電磁鋼板市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- タイプ別(粒電磁鋼板、非粒度電磁鋼板)

- 用途別(変圧器、モーター、発電機、インダクタ)

- 産業別(自動車、建設、製造、エネルギー電力その他)

- 地域別

- 企業別(2024)

- 市場マップ

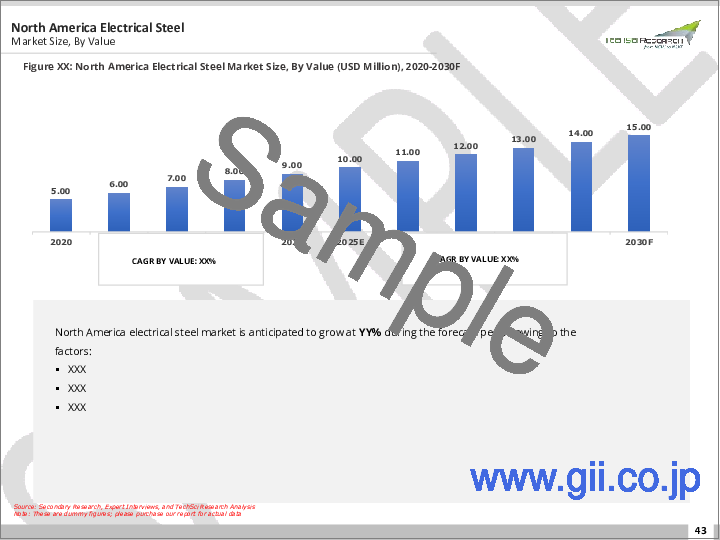

第6章 北米の電磁鋼板市場展望

- 市場規模・予測

- 市場シェア・予測

- 北米:国別分析

- 米国

- カナダ

- メキシコ

第7章 欧州の電磁鋼板市場展望

- 市場規模・予測

- 市場シェア・予測

- 欧州:国別分析

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

第8章 アジア太平洋の電磁鋼板市場展望

- 市場規模・予測

- 市場シェア・予測

- アジア太平洋:国別分析

- 中国

- インド

- 日本

- 韓国

- オーストラリア

第9章 南米の電磁鋼板市場展望

- 市場規模・予測

- 市場シェア・予測

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 中東・アフリカの電磁鋼板市場展望

- 市場規模・予測

- 市場シェア・予測

- 中東・アフリカ:国別分析

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- クウェート

- トルコ

第11章 市場力学

- 促進要因

- 課題

第12章 市場動向と発展

第13章 企業プロファイル

- Benxi Steel Group Co., Ltd

- Nucor Corporation

- Yieh Corporation

- Tata Steel UK Limited

- Arcelormittal Group

- Nippon Steel Corporation

- Arnold Magnetic Technologies

- JFE Steel Corporation

第14章 戦略的提言

第15章 調査会社について・免責事項

The Global Electrical Steel Market was valued at USD 25.78 billion in 2024 and is projected to reach USD 36.52 billion by 2030, with a compound annual growth rate (CAGR) of 5.82% during the forecast period. This market encompasses the worldwide production, distribution, and use of specialized steel alloys designed to optimize the efficiency of electrical devices by reducing energy losses caused by hysteresis and eddy currents. Electrical steel, also known as silicon steel or transformer steel, is divided into two primary categories: grain-oriented electrical steel (GOES) and non-grain-oriented electrical steel (NGOES). Each type serves distinct roles in power generation, distribution, and electric motor manufacturing. GOES is predominantly used in transformers, where its high permeability and low core loss characteristics enhance the efficiency of electrical transmission systems. NGOES, on the other hand, is widely employed in motors, generators, and other rotating machinery, ensuring optimal magnetic performance and energy conservation.

| Market Overview | |

|---|---|

| Forecast Period | 2026-2030 |

| Market Size 2024 | USD 25.78 Billion |

| Market Size 2030 | USD 36.52 Billion |

| CAGR 2025-2030 | 5.82% |

| Fastest Growing Segment | Non-Grain Oriented Electrical Steel |

| Largest Market | North America |

Key Market Drivers

Increasing Demand for Energy-Efficient Transformers and Motors

The global push towards energy efficiency is a significant driver of growth in the electrical steel market, especially for the development of high-performance transformers and motors. Governments and regulatory bodies worldwide are enforcing strict energy-efficiency standards, such as the Minimum Energy Performance Standards (MEPS) and the European Union's Ecodesign Directive, which mandate reduced energy losses in electrical equipment. Electrical steel, particularly GOES, plays a vital role in minimizing core losses in transformers, thereby improving energy efficiency. Additionally, NGOES is widely used in electric motors, which are critical to various industrial and consumer applications, including HVAC systems, home appliances, and industrial automation.

Key Market Challenges

Fluctuations in Raw Material Prices

One of the primary challenges for the electrical steel market is the volatility in raw material prices, particularly iron ore and alloying elements like silicon and aluminum. Electrical steel production relies heavily on these materials, and any price fluctuations directly impact manufacturing costs. Iron ore, a key component in steelmaking, has experienced significant price volatility due to factors such as global supply chain disruptions, geopolitical tensions, and environmental regulations affecting mining operations. Likewise, alloying elements like silicon and aluminum, which enhance the electrical and magnetic properties of steel, are subject to price changes driven by shifts in global demand, trade restrictions, and extraction challenges.

Key Market Trends

Growing Electric Vehicle (EV) Adoption Driving Demand for Advanced Electrical Steel

The increasing adoption of electric vehicles (EVs) is a major factor driving the demand for high-performance electrical steel, especially NGOES, which is essential for enhancing the efficiency of electric motors and powertrain components. Governments in various regions are implementing stricter emission regulations, offering subsidies, and providing incentives to encourage EV adoption. This transition is prompting automakers to accelerate their shift towards electrification, thereby increasing the demand for advanced electrical steel grades that offer superior magnetic properties, reduced energy loss, and enhanced efficiency.

Key Market Players

- Benxi Steel Group Co., Ltd

- Nucor Corporation

- Yieh Corporation

- Tata Steel UK Limited

- ArcelorMittal Group

- Nippon Steel Corporation

- Arnold Magnetic Technologies

- JFE Steel Corporation

Report Scope

The Global Electrical Steel Market has been segmented as follows, with detailed industry trends outlined in this report:

Market Segmentation by Type:

- Grain-Oriented Electrical Steel

- Non-Grain-Oriented Electrical Steel

Market Segmentation by Application:

- Transformers

- Motors & Generators

- Inductors

Market Segmentation by Vertical:

- Automotive

- Construction

- Manufacturing

- Energy & Power

- Others

Market Segmentation by Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

- Turkey

Competitive Landscape

Company profiles provide an in-depth analysis of the major players in the Global Electrical Steel Market.

Available Customizations

Tech Sci Research offers customizations to the Global Electrical Steel Market report based on specific business needs. The following customization options are available:

- Company Information: Detailed analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Formulation of the Scope

- 2.4. Assumptions and Limitations

- 2.5. Sources of Research

- 2.5.1. Secondary Research

- 2.5.2. Primary Research

- 2.6. Approach for the Market Study

- 2.6.1. The Bottom-Up Approach

- 2.6.2. The Top-Down Approach

- 2.7. Methodology Followed for Calculation of Market Size & Market Shares

- 2.8. Forecasting Methodology

- 2.8.1. Data Triangulation & Validation

3. Executive Summary

4. Voice of Customer

5. Global Electrical Steel Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Type (Grain Oriented Electrical Steel, Non-Grain Oriented Electrical Steel)

- 5.2.2. By Application (Transformers, Motors & Generators, Inductors)

- 5.2.3. By Vertical (Automotive, Construction, Manufacturing, Energy & Power Others)

- 5.2.4. By Region

- 5.3. By Company (2024)

- 5.4. Market Map

6. North America Electrical Steel Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Type

- 6.2.2. By Application

- 6.2.3. By Vertical

- 6.2.4. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Electrical Steel Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Type

- 6.3.1.2.2. By Application

- 6.3.1.2.3. By Vertical

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Electrical Steel Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Type

- 6.3.2.2.2. By Application

- 6.3.2.2.3. By Vertical

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Electrical Steel Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Type

- 6.3.3.2.2. By Application

- 6.3.3.2.3. By Vertical

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Electrical Steel Market Outlook

7. Europe Electrical Steel Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Type

- 7.2.2. By Application

- 7.2.3. By Vertical

- 7.2.4. By Country

- 7.3. Europe: Country Analysis

- 7.3.1. Germany Electrical Steel Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Type

- 7.3.1.2.2. By Application

- 7.3.1.2.3. By Vertical

- 7.3.1.1. Market Size & Forecast

- 7.3.2. United Kingdom Electrical Steel Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Type

- 7.3.2.2.2. By Application

- 7.3.2.2.3. By Vertical

- 7.3.2.1. Market Size & Forecast

- 7.3.3. Italy Electrical Steel Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Type

- 7.3.3.2.2. By Application

- 7.3.3.2.3. By Vertical

- 7.3.3.1. Market Size & Forecast

- 7.3.4. France Electrical Steel Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Type

- 7.3.4.2.2. By Application

- 7.3.4.2.3. By Vertical

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Spain Electrical Steel Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Type

- 7.3.5.2.2. By Application

- 7.3.5.2.3. By Vertical

- 7.3.5.1. Market Size & Forecast

- 7.3.1. Germany Electrical Steel Market Outlook

8. Asia-Pacific Electrical Steel Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Type

- 8.2.2. By Application

- 8.2.3. By Vertical

- 8.2.4. By Country

- 8.3. Asia-Pacific: Country Analysis

- 8.3.1. China Electrical Steel Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Type

- 8.3.1.2.2. By Application

- 8.3.1.2.3. By Vertical

- 8.3.1.1. Market Size & Forecast

- 8.3.2. India Electrical Steel Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Type

- 8.3.2.2.2. By Application

- 8.3.2.2.3. By Vertical

- 8.3.2.1. Market Size & Forecast

- 8.3.3. Japan Electrical Steel Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Type

- 8.3.3.2.2. By Application

- 8.3.3.2.3. By Vertical

- 8.3.3.1. Market Size & Forecast

- 8.3.4. South Korea Electrical Steel Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Type

- 8.3.4.2.2. By Application

- 8.3.4.2.3. By Vertical

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Australia Electrical Steel Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Type

- 8.3.5.2.2. By Application

- 8.3.5.2.3. By Vertical

- 8.3.5.1. Market Size & Forecast

- 8.3.1. China Electrical Steel Market Outlook

9. South America Electrical Steel Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Type

- 9.2.2. By Application

- 9.2.3. By Vertical

- 9.2.4. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Electrical Steel Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Type

- 9.3.1.2.2. By Application

- 9.3.1.2.3. By Vertical

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Electrical Steel Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Type

- 9.3.2.2.2. By Application

- 9.3.2.2.3. By Vertical

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Electrical Steel Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Type

- 9.3.3.2.2. By Application

- 9.3.3.2.3. By Vertical

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Electrical Steel Market Outlook

10. Middle East and Africa Electrical Steel Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Type

- 10.2.2. By Application

- 10.2.3. By Vertical

- 10.2.4. By Country

- 10.3. Middle East and Africa: Country Analysis

- 10.3.1. South Africa Electrical Steel Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Type

- 10.3.1.2.2. By Application

- 10.3.1.2.3. By Vertical

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Saudi Arabia Electrical Steel Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Type

- 10.3.2.2.2. By Application

- 10.3.2.2.3. By Vertical

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Electrical Steel Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Type

- 10.3.3.2.2. By Application

- 10.3.3.2.3. By Vertical

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Kuwait Electrical Steel Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Type

- 10.3.4.2.2. By Application

- 10.3.4.2.3. By Vertical

- 10.3.4.1. Market Size & Forecast

- 10.3.5. Turkey Electrical Steel Market Outlook

- 10.3.5.1. Market Size & Forecast

- 10.3.5.1.1. By Value

- 10.3.5.2. Market Share & Forecast

- 10.3.5.2.1. By Type

- 10.3.5.2.2. By Application

- 10.3.5.2.3. By Vertical

- 10.3.5.1. Market Size & Forecast

- 10.3.1. South Africa Electrical Steel Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.2. Challenges

12. Market Trends & Developments

13. Company Profiles

- 13.1. Benxi Steel Group Co., Ltd

- 13.1.1. Business Overview

- 13.1.2. Key Revenue and Financials

- 13.1.3. Recent Developments

- 13.1.4. Key Personnel/Key Contact Person

- 13.1.5. Key Product/Services Offered

- 13.2. Nucor Corporation

- 13.2.1. Business Overview

- 13.2.2. Key Revenue and Financials

- 13.2.3. Recent Developments

- 13.2.4. Key Personnel/Key Contact Person

- 13.2.5. Key Product/Services Offered

- 13.3. Yieh Corporation

- 13.3.1. Business Overview

- 13.3.2. Key Revenue and Financials

- 13.3.3. Recent Developments

- 13.3.4. Key Personnel/Key Contact Person

- 13.3.5. Key Product/Services Offered

- 13.4. Tata Steel UK Limited

- 13.4.1. Business Overview

- 13.4.2. Key Revenue and Financials

- 13.4.3. Recent Developments

- 13.4.4. Key Personnel/Key Contact Person

- 13.4.5. Key Product/Services Offered

- 13.5. Arcelormittal Group

- 13.5.1. Business Overview

- 13.5.2. Key Revenue and Financials

- 13.5.3. Recent Developments

- 13.5.4. Key Personnel/Key Contact Person

- 13.5.5. Key Product/Services Offered

- 13.6. Nippon Steel Corporation

- 13.6.1. Business Overview

- 13.6.2. Key Revenue and Financials

- 13.6.3. Recent Developments

- 13.6.4. Key Personnel/Key Contact Person

- 13.6.5. Key Product/Services Offered

- 13.7. Arnold Magnetic Technologies

- 13.7.1. Business Overview

- 13.7.2. Key Revenue and Financials

- 13.7.3. Recent Developments

- 13.7.4. Key Personnel/Key Contact Person

- 13.7.5. Key Product/Services Offered

- 13.8. JFE Steel Corporation

- 13.8.1. Business Overview

- 13.8.2. Key Revenue and Financials

- 13.8.3. Recent Developments

- 13.8.4. Key Personnel/Key Contact Person

- 13.8.5. Key Product/Services Offered