|

|

市場調査レポート

商品コード

1361619

半導体製造装置市場- 世界の産業規模、シェア、動向、機会、予測、2018-2028年Semiconductor Manufacturing Equipment Market - Global Industry Size, Share, Trends, Opportunity, and Forecast, 2018-2028F Segmented By Equipment Type (Front-end Equipment), By Dimension, By Supply Chain Process, By Region, Competition |

||||||

カスタマイズ可能

|

|||||||

| 半導体製造装置市場- 世界の産業規模、シェア、動向、機会、予測、2018-2028年 |

|

出版日: 2023年10月03日

発行: TechSci Research

ページ情報: 英文 181 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 目次

世界の半導体製造装置市場は、予測期間を通じて急速なペースで成長すると予測されています。

半導体は、通信、コンピュータ、バイオテクノロジー、軍事技術、航空、再生可能エネルギーなどの分野の進歩を可能にする電子機器の重要な構成要素です。半導体製造装置は、ICチップ、メモリーチップ、回路、その他さまざまな製品の製造に使用されます。当初、製造装置はシリコンウエハーの製造に利用され、フォトリソグラフィ装置、エッチング装置、化学気相成長装置、測定装置、プロセス/品質管理装置などのウエハー加工ツールが含まれます。市場は、IDM、OSAT、ファウンドリーを含むサプライチェーンプロセスに分けられます。

半導体製造装置市場の主な促進要因の1つは、スマートフォンやノートパソコンなどの民生用電子機器の需要が増加していることであり、これにより半導体の小型化、高速化、高効率化のニーズが高まっています。また、モノのインターネット(IoT)の発展も、デバイスの接続や相互通信を可能にする半導体の需要に拍車をかけています。さらに、小型化の動向は、より小型で精密な半導体への需要を促進し、特殊な装置を必要とする3D ICなどの高度な半導体製造技術の発展につながっています。市場競争は激しいもの、研究開発に投資し、革新的な製品を提供できるリソースを持つ少数の大手企業が業界を支配しているのが現状です。

| 市場概要 | |

|---|---|

| 予測期間 | 2024-2028 |

| 市場規模2022年 | 637億1,000万米ドル |

| 2028年の市場規模 | 1,004億3,000万米ドル |

| CAGR 2023-2028 | 7.82% |

| 急成長セグメント | 組立・包装機器 |

| 最大市場 | 北米 |

半導体製造装置市場は、半導体業界の技術進歩によって牽引されています。半導体の小型化、高速化、高効率化の要求が高まるにつれ、高度な製造技術に対するニーズも高まっています。このため、3D ICやFinFETなど、特殊な装置を必要とする革新的な半導体製造技術が開発されています。

電子機器需要の増加:スマートフォン、ノートパソコン、タブレット端末などの電子機器の需要は急速に増加しています。半導体産業はエレクトロニクス産業の重要な構成要素であり、電子機器の需要が増加するにつれて、半導体の需要も増加します。そのため、半導体の製造に使用される半導体製造装置の需要も増加しています。したがって、半導体市場における半導体製造装置の採用拡大が市場成長を押し上げると予想されます。アジア太平洋などの新興市場では、急速な工業化と都市化が進んでおり、電子機器の需要が増加しています。さらに、この地域の国々は人口が多く、テクノロジーの導入が進んでいるため、半導体デバイスの需要が増加しています。これが世界の半導体製造装置市場の需要を牽引しています。

OSATベンダーの拡大を支えるサードパーティ製ICパッケージへの需要の高まり

アウトソーシング半導体組立・テスト(OSAT)サプライチェーンプロセス分野は、家電メーカーや自動車メーカーによる組立、パッケージング、テストサービスの利用により、予測期間中に発展すると予測されます。

OSAT企業は、製造施設に統合する自動化された機械や技術を求めており、顧客は半導体や電子デバイスをアウトソーシングできるようになります。半導体の製造時間と生産能力を最大化する要求の高まりは、より迅速で安定した半導体供給を保証するOSATの参加を促しています。

市場が直面する課題

装置コストの高さは、半導体製造装置部門が直面する大きな課題のひとつです。半導体製造装置の製造は高度で資本集約的なプロセスであり、研究開発に多額の投資を必要とします。その結果、装置のコストは相当なものとなり、中小企業の市場参入を困難にしています。

さらに、半導体製造装置業界は競争が激しく、複数のメーカーが同一商品を販売しています。その結果、競争が激化し、価格と利幅が低下しています。とはいえ、この業界はまだ、研究開発費を投じて斬新な商品を生み出す能力を持つ少数の大手企業によって支配されています。

市場セグメンテーション:

機器タイプ別では、市場はフロントエンド機器とバックエンド機器に区分されます。市場セグメンテーション:次元別では、市場は2D、2.5D、3Dに区分されます。サプライチェーンプロセスベースでは、市場はさらに半導体組立・テストアウトソーシング(OSAT)、集積デバイスメーカー(IDM)、ファウンドリーに分割されます。

利用可能なカスタマイズ:

TechSci Researchは、与えられた市場データをもとに、企業固有のニーズに応じたカスタマイズを提供します。レポートでは以下のカスタマイズが可能です:

企業情報:

- 追加市場プレイヤーの詳細分析とプロファイリング(最大5社)。

目次

第1章 概要

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 半導体製造装置の世界市場展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 装置タイプ別((前工程装置(リソグラフィ装置、エッチング装置、成膜装置、計測/検査装置、材料除去/洗浄装置、フォトレジスト処理装置)、後工程装置(ウエハー製造装置、アセンブリ&パッケージング装置、テスト装置)))

- 次元別(2次元、2.5次元、3次元)

- サプライチェーンプロセス別(半導体組立・テスト受託(OSAT)、集積デバイスメーカー(IDM)、ファウンドリ)

- 地域別

- 企業別(2022年)

- 市場マップ

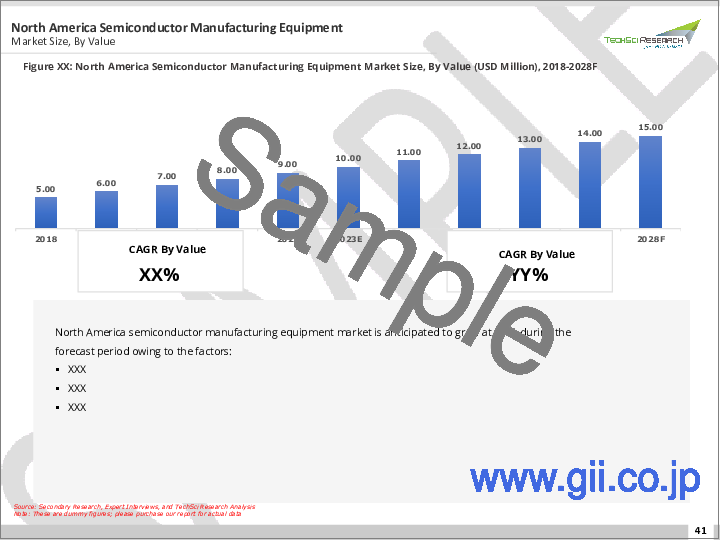

第6章 北米半導体製造装置市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 装置タイプ別

- ディメンション別

- サプライチェーンプロセス別

- 国別

- 北米国別分析

- 米国

- カナダ

- メキシコ

第7章 アジア太平洋半導体製造装置市場の展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 装置タイプ別

- ディメンション別

- サプライチェーンプロセス別

- 国別

- アジア太平洋地域国別分析

- 中国

- 日本

- 韓国

- インド

- オーストラリア

第8章 欧州半導体製造装置市場展望

- 市場規模・予測

- 金額別

- 市場シェア・予測

- 装置タイプ別

- ディメンション別

- サプライチェーンプロセス別

- 国別

- 欧州国別分析

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

第9章 南米半導体製造装置市場展望

- 市場規模・予測

- 金額別

- 市場シェア&予測

- 装置タイプ別

- 寸法別

- サプライチェーンプロセス別

- 国別

- 南米:国別分析

- ブラジル

- アルゼンチン

- コロンビア

第10章 中東・アフリカ半導体製造装置市場の展望

- 市場規模・予測

- 金額別

- 市場シェアと予測

- 装置タイプ別

- ディメンション別

- サプライチェーンプロセス別

- 国別

- 中東・アフリカ:国別分析

- イスラエル

- トルコ

- アラブ首長国連邦

- サウジアラビア

第11章 市場力学

- 促進要因

- エレクトロニクス需要の拡大

- 研究開発投資の増加

- クラウド・コンピューティング需要の増加

- 課題

- 設備コストの高騰

- サプライチェーンの混乱

第12章 市場動向と発展

- コンシューマー・エレクトロニクス機器の需要増加

- 産業別におけるAI、IoT、コネクテッドデバイスの普及

- IoTの成長が半導体需要を牽引。

- ブロックチェーン技術の採用

- AIが新たな半導体アプリケーションの開発を促進

第13章 企業プロファイル

- Applied Materials Inc

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- ASML Holding Semiconductor Company

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- Tokyo Electron Limited

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- Lam Research Corporation

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- KLA Corporation

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- Veeco Instruments Inc

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- Screen Holdings Co. Ltd

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- Teradyne Inc

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- Hitachi High-Technologies Corporation

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

- Ferrotec Holdings Corporation.

- Business Overview

- Key Revenue(If Available)

- Recent Developments

- Key Personnel

- Key Product/Service Offered

第14章 戦略的提言

第15章 調査会社について・免責事項

(注:企業リストはクライアントの要望に応じてカスタマイズ可能)

Global Semiconductor manufacturing equipment market is predicted to grow at a rapid pace throughout the forecast period. A semiconductor is a critical component of electronic equipment that enables advancements in telecommunication, computers, biotechnology, military technology, aviation, renewable energy, and other sectors. Semiconductor manufacturing equipment is used to create IC chips, memory chips, circuits, and a variety of other products. Initially, manufacturing equipment is utilized to produce silicon wafers, including wafer processing tools such as photolithography tools, etching machines, chemical vapor deposition machines, measurement devices, and process/quality control equipment. The market is divided into supply chain processes, which include IDM, OSAT, and foundry.

One of the primary drivers of the semiconductor manufacturing equipment market is the increasing demand for consumer electronics, such as smartphones and laptops, which is driving the need for smaller, faster, and more efficient semiconductors. The development of the Internet of Things (IoT) has also fueled the demand for semiconductors, which can help connect devices and enable them to communicate with each other. Furthermore, the trend of miniaturization is driving the demand for smaller and more precise semiconductors, leading to the development of advanced semiconductor manufacturing technologies, such as 3D ICs, which require specialized equipment. Despite intense competition in the market, the industry is still dominated by a few large players who have the resources to invest in research and development and offer innovative products.

Technological advancements

| Market Overview | |

|---|---|

| Forecast Period | 2024-2028 |

| Market Size 2022 | USD 63.71 Billion |

| Market Size 2028 | USD 100.43 Billion |

| CAGR 2023-2028 | 7.82% |

| Fastest Growing Segment | Assembly & Packaging Equipment |

| Largest Market | North America |

The semiconductor manufacturing equipment market is driven by technological advancements in the semiconductor industry. With the increasing demand for smaller, faster, and more efficient semiconductors, the need for advanced manufacturing technologies has also increased. This has led to the development of innovative semiconductor manufacturing technologies such as 3D ICs, FinFETs, and others, which require specialized equipment.

Increasing demand for electronic devices: The demand for electronic devices such as smartphones, laptops, and tablets has been increasing rapidly. The semiconductor industry is a crucial component of the electronics industry, and as the demand for electronic devices increases, the demand for semiconductors also increases. This, in turn, drives the demand for semiconductor equipment, which is used in the manufacturing of semiconductors. Hence, the growing adoption of semiconductor manufacturing equipment in semiconductor market is expected to boost market growth. Emerging markets, such as Asia-Pacific, are experiencing rapid industrialization and urbanization, which has led to an increase in demand for electronic devices. Moreover, the countries in this region have a large population that is increasingly adopting technology, thereby increasing the demand for semiconductor devices. This, in turn, drives the demand for global semiconductor manufacturing equipment market.

Growing demand for third-party IC packaging to support OSAT vendor expansion

The outsourced semiconductor assembly and test (OSAT) supply chain process sector is predicted to develop during the forecast period, owing to the use of assembly, packaging, and testing services by consumer electronics and automotive manufacturers.

OSAT enterprises are looking for automated machinery and technology to integrate into their manufacturing facilities, allowing clients to outsource semiconductor and electronic devices. The increased requirement to maximize semiconductor fab time and capacity is encouraging OSAT participation to assure a speedier and consistent supply of semiconductors.

Challenges faced by the Market

The high cost of equipment is one of the major challenges that the semiconductor manufacturing equipment sector faces. Manufacturing semiconductor manufacturing equipment is a sophisticated and capital-intensive process that necessitates substantial investment in research and development. As a result, the cost of equipment is considerable, making it difficult for small and medium-sized businesses to enter the market.

Furthermore, the semiconductor manufacturing equipment industry is very competitive, with multiple manufacturers selling identical goods. This has resulted in increased rivalry, which has resulted in a drop in prices and margins. Yet, the industry is still controlled by a few major businesses with the ability to spend in R&D and create novel goods.

Market Segmentation:

On the basis of Equipment Type, the market is segmented into Front-end Equipment and Back-end Equipment. On the basis of Dimension, the market is segmented into 2D, 2.5D and 3D. On the basis of Supply Chain Process, the market is further split into Outsourced Semiconductor Assembly and Test (OSAT), Integrated Device Manufacturer (IDM) and Foundry.

Company Profiles

Applied Materials Inc, ASML Holding Semiconductor Company, Tokyo Electron Limited, Lam Research Corporation, KLA Corporation, Veeco Instruments Inc, Screen Holdings Co. Ltd, Teradyne Inc, Hitachi High -Technologies Corporation, Ferrotec Holdings Corporation, are among the major players that are driving the growth of the global semiconductor manufacturing equipment market.

Report Scope:

In this report, the global semiconductor manufacturing equipment market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:

- Semiconductor manufacturing equipment Market, By Equipment Type:

Front-end Equipment

- Lithography Equipment

- Etching Equipment

- Deposition Equipment

- Metrology/Inspection Equipment

- Material Removal/Cleaning Equipment

- Photoresist Processing Equipment

Back-end Equipment

- Wafer Manufacturing Equipment

- Assembly & Packaging Equipment

- Test Equipment

- Semiconductor manufacturing equipment Market, By Dimension:

2D

2.5D

3D

- Semiconductor manufacturing equipment Market, By Supply Chain Process:

Outsourced Semiconductor Assembly and Test (OSAT)

Integrated Device Manufacturer (IDM)

Foundry

- Semiconductor manufacturing equipment Market, By Region:

Asia-Pacific

- China

- Japan

- India

- Australia

- South Korea

North America

- United States

- Canada

- Mexico

Europe

- United Kingdom

- Germany

- France

- Spain

- Italy

Middle East & Africa

- Israel

- Turkey

- Saudi Arabia

- UAE

South America

- Brazil

- Argentina

- Colombia

Competitive Landscape:

Company Profiles: Detailed analysis of the major companies present in the global semiconductor manufacturing equipment market.

Available Customizations:

With the given market data, TechSci Research offers customizations according to a company's specific needs. The following customization options are available for the report:

Company Information:

- Detailed an analysis and profiling of additional market players (up to five).

Table of Contents

1. Product Overview

- 1.1. Market Definition

- 1.2. Scope of the Market

- 1.2.1. Markets Covered

- 1.2.2. Years Considered for Study

- 1.2.3. Key Market Segmentations

2. Research Methodology

- 2.1. Objective of the Study

- 2.2. Baseline Methodology

- 2.3. Key Industry Partners

- 2.4. Major Association and Secondary Sources

- 2.5. Forecasting Methodology

- 2.6. Data Triangulation & Validation

- 2.7. Assumptions and Limitations

3. Executive Summary

4. Voice of Customer

5. Global Semiconductor manufacturing equipment Market Outlook

- 5.1. Market Size & Forecast

- 5.1.1. By Value

- 5.2. Market Share & Forecast

- 5.2.1. By Equipment Type ((Front-end Equipment (Lithography Equipment, Etching Equipment, Deposition Equipment, Metrology/Inspection Equipment, Material Removal/Cleaning Equipment, Photoresist Processing Equipment), Back-end Equipment (Wafer Manufacturing Equipment, Assembly & Packaging Equipment, Test Equipment))

- 5.2.2. By Dimension (2D, 2.5D and 3D)

- 5.2.3. By Supply Chain Process (Outsourced Semiconductor Assembly and Test (OSAT), Integrated Device Manufacturer (IDM), Foundry)

- 5.2.4. By Region

- 5.3. By Company (2022)

- 5.4. Market Map

6. North America Semiconductor manufacturing equipment Market Outlook

- 6.1. Market Size & Forecast

- 6.1.1. By Value

- 6.2. Market Share & Forecast

- 6.2.1. By Equipment Type

- 6.2.2. By Dimension

- 6.2.3. By Supply Chain Process

- 6.2.4. By Country

- 6.3. North America: Country Analysis

- 6.3.1. United States Semiconductor manufacturing equipment Market Outlook

- 6.3.1.1. Market Size & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.2. Market Share & Forecast

- 6.3.1.2.1. By Equipment Type

- 6.3.1.2.2. By Dimension

- 6.3.1.2.3. By Supply Chain Process

- 6.3.1.1. Market Size & Forecast

- 6.3.2. Canada Semiconductor manufacturing equipment Market Outlook

- 6.3.2.1. Market Size & Forecast

- 6.3.2.1.1. By Value

- 6.3.2.2. Market Share & Forecast

- 6.3.2.2.1. By Equipment Type

- 6.3.2.2.2. By Dimension

- 6.3.2.2.3. By Supply Chain Process

- 6.3.2.1. Market Size & Forecast

- 6.3.3. Mexico Semiconductor manufacturing equipment Market Outlook

- 6.3.3.1. Market Size & Forecast

- 6.3.3.1.1. By Value

- 6.3.3.2. Market Share & Forecast

- 6.3.3.2.1. By Equipment Type

- 6.3.3.2.2. By Dimension

- 6.3.3.2.3. By Supply Chain Process

- 6.3.3.1. Market Size & Forecast

- 6.3.1. United States Semiconductor manufacturing equipment Market Outlook

7. Asia-Pacific Semiconductor manufacturing equipment Market Outlook

- 7.1. Market Size & Forecast

- 7.1.1. By Value

- 7.2. Market Share & Forecast

- 7.2.1. By Equipment Type

- 7.2.2. By Dimension

- 7.2.3. By Supply Chain Process

- 7.2.4. By Country

- 7.3. Asia-Pacific: Country Analysis

- 7.3.1. China Semiconductor manufacturing equipment Market Outlook

- 7.3.1.1. Market Size & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share & Forecast

- 7.3.1.2.1. By Equipment Type

- 7.3.1.2.2. By Dimension

- 7.3.1.2.3. By Supply Chain Process

- 7.3.1.1. Market Size & Forecast

- 7.3.2. Japan Semiconductor manufacturing equipment Market Outlook

- 7.3.2.1. Market Size & Forecast

- 7.3.2.1.1. By Value

- 7.3.2.2. Market Share & Forecast

- 7.3.2.2.1. By Equipment Type

- 7.3.2.2.2. By Dimension

- 7.3.2.2.3. By Supply Chain Process

- 7.3.2.1. Market Size & Forecast

- 7.3.3. South Korea Semiconductor manufacturing equipment Market Outlook

- 7.3.3.1. Market Size & Forecast

- 7.3.3.1.1. By Value

- 7.3.3.2. Market Share & Forecast

- 7.3.3.2.1. By Equipment Type

- 7.3.3.2.2. By Dimension

- 7.3.3.2.3. By Supply Chain Process

- 7.3.3.1. Market Size & Forecast

- 7.3.4. India Semiconductor manufacturing equipment Market Outlook

- 7.3.4.1. Market Size & Forecast

- 7.3.4.1.1. By Value

- 7.3.4.2. Market Share & Forecast

- 7.3.4.2.1. By Equipment Type

- 7.3.4.2.2. By Dimension

- 7.3.4.2.3. By Supply Chain Process

- 7.3.4.1. Market Size & Forecast

- 7.3.5. Australia Semiconductor manufacturing equipment Market Outlook

- 7.3.5.1. Market Size & Forecast

- 7.3.5.1.1. By Value

- 7.3.5.2. Market Share & Forecast

- 7.3.5.2.1. By Equipment Type

- 7.3.5.2.2. By Dimension

- 7.3.5.2.3. By Supply Chain Process

- 7.3.5.1. Market Size & Forecast

- 7.3.1. China Semiconductor manufacturing equipment Market Outlook

8. Europe Semiconductor manufacturing equipment Market Outlook

- 8.1. Market Size & Forecast

- 8.1.1. By Value

- 8.2. Market Share & Forecast

- 8.2.1. By Equipment Type

- 8.2.2. By Dimension

- 8.2.3. By Supply Chain Process

- 8.2.4. By Country

- 8.3. Europe: Country Analysis

- 8.3.1. Germany Semiconductor manufacturing equipment Market Outlook

- 8.3.1.1. Market Size & Forecast

- 8.3.1.1.1. By Value

- 8.3.1.2. Market Share & Forecast

- 8.3.1.2.1. By Equipment Type

- 8.3.1.2.2. By Dimension

- 8.3.1.2.3. By Supply Chain Process

- 8.3.1.1. Market Size & Forecast

- 8.3.2. United Kingdom Semiconductor manufacturing equipment Market Outlook

- 8.3.2.1. Market Size & Forecast

- 8.3.2.1.1. By Value

- 8.3.2.2. Market Share & Forecast

- 8.3.2.2.1. By Equipment Type

- 8.3.2.2.2. By Dimension

- 8.3.2.2.3. By Supply Chain Process

- 8.3.2.1. Market Size & Forecast

- 8.3.3. France Semiconductor manufacturing equipment Market Outlook

- 8.3.3.1. Market Size & Forecast

- 8.3.3.1.1. By Value

- 8.3.3.2. Market Share & Forecast

- 8.3.3.2.1. By Equipment Type

- 8.3.3.2.2. By Dimension

- 8.3.3.2.3. By Supply Chain Process

- 8.3.3.1. Market Size & Forecast

- 8.3.4. Italy Semiconductor manufacturing equipment Market Outlook

- 8.3.4.1. Market Size & Forecast

- 8.3.4.1.1. By Value

- 8.3.4.2. Market Share & Forecast

- 8.3.4.2.1. By Equipment Type

- 8.3.4.2.2. By Dimension

- 8.3.4.2.3. By Supply Chain Process

- 8.3.4.1. Market Size & Forecast

- 8.3.5. Spain Semiconductor manufacturing equipment Market Outlook

- 8.3.5.1. Market Size & Forecast

- 8.3.5.1.1. By Value

- 8.3.5.2. Market Share & Forecast

- 8.3.5.2.1. By Equipment Type

- 8.3.5.2.2. By Dimension

- 8.3.5.2.3. By Supply Chain Process

- 8.3.5.1. Market Size & Forecast

- 8.3.1. Germany Semiconductor manufacturing equipment Market Outlook

9. South America Semiconductor manufacturing equipment Market Outlook

- 9.1. Market Size & Forecast

- 9.1.1. By Value

- 9.2. Market Share & Forecast

- 9.2.1. By Equipment Type

- 9.2.2. By Dimension

- 9.2.3. By Supply Chain Process

- 9.2.4. By Country

- 9.3. South America: Country Analysis

- 9.3.1. Brazil Semiconductor manufacturing equipment Market Outlook

- 9.3.1.1. Market Size & Forecast

- 9.3.1.1.1. By Value

- 9.3.1.2. Market Share & Forecast

- 9.3.1.2.1. By Equipment Type

- 9.3.1.2.2. By Dimension

- 9.3.1.2.3. By Supply Chain Process

- 9.3.1.1. Market Size & Forecast

- 9.3.2. Argentina Semiconductor manufacturing equipment Market Outlook

- 9.3.2.1. Market Size & Forecast

- 9.3.2.1.1. By Value

- 9.3.2.2. Market Share & Forecast

- 9.3.2.2.1. By Equipment Type

- 9.3.2.2.2. By Dimension

- 9.3.2.2.3. By Supply Chain Process

- 9.3.2.1. Market Size & Forecast

- 9.3.3. Colombia Semiconductor manufacturing equipment Market Outlook

- 9.3.3.1. Market Size & Forecast

- 9.3.3.1.1. By Value

- 9.3.3.2. Market Share & Forecast

- 9.3.3.2.1. By Equipment Type

- 9.3.3.2.2. By Dimension

- 9.3.3.2.3. By Supply Chain Process

- 9.3.3.1. Market Size & Forecast

- 9.3.1. Brazil Semiconductor manufacturing equipment Market Outlook

10. Middle East & Africa Semiconductor manufacturing equipment Market Outlook

- 10.1. Market Size & Forecast

- 10.1.1. By Value

- 10.2. Market Share & Forecast

- 10.2.1. By Equipment Type

- 10.2.2. By Dimension

- 10.2.3. By Supply Chain Process

- 10.2.4. By Country

- 10.3. Middle East & Africa: Country Analysis

- 10.3.1. Israel Semiconductor manufacturing equipment Market Outlook

- 10.3.1.1. Market Size & Forecast

- 10.3.1.1.1. By Value

- 10.3.1.2. Market Share & Forecast

- 10.3.1.2.1. By Equipment Type

- 10.3.1.2.2. By Dimension

- 10.3.1.2.3. By Supply Chain Process

- 10.3.1.1. Market Size & Forecast

- 10.3.2. Turkey Semiconductor manufacturing equipment Market Outlook

- 10.3.2.1. Market Size & Forecast

- 10.3.2.1.1. By Value

- 10.3.2.2. Market Share & Forecast

- 10.3.2.2.1. By Equipment Type

- 10.3.2.2.2. By Dimension

- 10.3.2.2.3. By Supply Chain Process

- 10.3.2.1. Market Size & Forecast

- 10.3.3. UAE Semiconductor manufacturing equipment Market Outlook

- 10.3.3.1. Market Size & Forecast

- 10.3.3.1.1. By Value

- 10.3.3.2. Market Share & Forecast

- 10.3.3.2.1. By Equipment Type

- 10.3.3.2.2. By Dimension

- 10.3.3.2.3. By Supply Chain Process

- 10.3.3.1. Market Size & Forecast

- 10.3.4. Saudi Arabia Semiconductor manufacturing equipment Market Outlook

- 10.3.4.1. Market Size & Forecast

- 10.3.4.1.1. By Value

- 10.3.4.2. Market Share & Forecast

- 10.3.4.2.1. By Equipment Type

- 10.3.4.2.2. By Dimension

- 10.3.4.2.3. By Supply Chain Process

- 10.3.4.1. Market Size & Forecast

- 10.3.1. Israel Semiconductor manufacturing equipment Market Outlook

11. Market Dynamics

- 11.1. Drivers

- 11.1.1. Growing demand for electronics

- 11.1.2. Increasing investments in research and development

- 11.1.3. Increasing demand for cloud computing

- 11.2. Challenges

- 11.2.1. high cost of equipment

- 11.2.2. Supply chain disruptions

12. Market Trends & Developments

- 12.1. Rising Consumer Electronics Device Demand

- 12.2. AI, IoT, and Connected Device Proliferation Across Industrial Verticals

- 12.3. The growth of the IoT is driving demand for semiconductors.

- 12.4. The adoption of blockchain technology

- 12.5. AI is driving the development of new semiconductor applications.

13. Company Profiles

- 13.1. Applied Materials Inc

- 13.1.1. Business Overview

- 13.1.2. Key Revenue (If Available)

- 13.1.3. Recent Developments

- 13.1.4. Key Personnel

- 13.1.5. Key Product/Service Offered

- 13.2. ASML Holding Semiconductor Company

- 13.2.1. Business Overview

- 13.2.2. Key Revenue (If Available)

- 13.2.3. Recent Developments

- 13.2.4. Key Personnel

- 13.2.5. Key Product/Service Offered

- 13.3. Tokyo Electron Limited

- 13.3.1. Business Overview

- 13.3.2. Key Revenue (If Available)

- 13.3.3. Recent Developments

- 13.3.4. Key Personnel

- 13.3.5. Key Product/Service Offered

- 13.4. Lam Research Corporation

- 13.4.1. Business Overview

- 13.4.2. Key Revenue (If Available)

- 13.4.3. Recent Developments

- 13.4.4. Key Personnel

- 13.4.5. Key Product/Service Offered

- 13.5. KLA Corporation

- 13.5.1. Business Overview

- 13.5.2. Key Revenue (If Available)

- 13.5.3. Recent Developments

- 13.5.4. Key Personnel

- 13.5.5. Key Product/Service Offered

- 13.6. Veeco Instruments Inc

- 13.6.1. Business Overview

- 13.6.2. Key Revenue (If Available)

- 13.6.3. Recent Developments

- 13.6.4. Key Personnel

- 13.6.5. Key Product/Service Offered

- 13.7. Screen Holdings Co. Ltd

- 13.7.1. Business Overview

- 13.7.2. Key Revenue (If Available)

- 13.7.3. Recent Developments

- 13.7.4. Key Personnel

- 13.7.5. Key Product/Service Offered

- 13.8. Teradyne Inc

- 13.8.1. Business Overview

- 13.8.2. Key Revenue (If Available)

- 13.8.3. Recent Developments

- 13.8.4. Key Personnel

- 13.8.5. Key Product/Service Offered

- 13.9. Hitachi High -Technologies Corporation

- 13.9.1. Business Overview

- 13.9.2. Key Revenue (If Available)

- 13.9.3. Recent Developments

- 13.9.4. Key Personnel

- 13.9.5. Key Product/Service Offered

- 13.10. Ferrotec Holdings Corporation.

- 13.10.1. Business Overview

- 13.10.2. Key Revenue (If Available)

- 13.10.3. Recent Developments

- 13.10.4. Key Personnel

- 13.10.5. Key Product/Service Offered

14. Strategic Recommendations

15. About Us & Disclaimer

(Note: The companies list can be customized based on the client requirements.)