|

|

市場調査レポート

商品コード

1804917

北米の水産養殖の市場規模と予測(2021年~2031年)、地域シェア・動向・成長機会分析レポート:製品タイプ別、培養環境別North America Aquaculture Market Size and Forecast 2021 - 2031, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type and Culture Environment |

||||||

|

|||||||

| 北米の水産養殖の市場規模と予測(2021年~2031年)、地域シェア・動向・成長機会分析レポート:製品タイプ別、培養環境別 |

|

出版日: 2025年08月06日

発行: The Insight Partners

ページ情報: 英文 123 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の水産養殖の市場規模は、2024年には219億2,000万米ドルと評価され、2031年までには293億9,000万米ドルに達すると予測され、2025年から2031年にかけて4.3%のCAGRを記録すると期待されています。

北米の水産養殖市場を推進している主な要因は、環境保全と健康上の利点に対する消費者の意識の高まりに後押しされ、持続可能で地元産の水産物の需要が急増していることです。世界的な乱獲と天然魚資源の枯渇は、伝統的漁業の長期的な存続可能性に懸念を抱かせ、消費者、小売業者、政府を水産物の代替供給源を求める方向に駆り立てています。水産養殖は、野生個体群に新たな圧力をかけることなく、高品質の魚や水生植物を管理された効率的な生産が可能となるため、この課題に対する実行可能な解決策となります。北米では、持続可能な水産物消費へのシフトが、サケ、マス、ナマズ、ティラピアなどの水産養殖魚種への選好の高まりに反映されています。消費者は、トレーサビリティが確保され、環境に配慮し、有害な化学物質や抗生物質を使用しない水産物をますます優先するようになっています。このため生産者は、水を再利用し、廃棄物を最小限に抑え、資源効率を高めることで環境フットプリントを削減する、再循環型水産養殖システム(RAS)や総合多栄養型水産養殖(IMTA)などの高度な水産養殖技術を採用するようになりました。米国海洋大気庁(NOAA)やカナダ漁業海洋省(DFO)といった機関が、持続可能な水産養殖を促進するための資金、調査、規制の枠組みを提供しています。こうした取り組みは、技術革新を促進し、水産養殖場管理を改善し、環境基準の遵守を確実にします。

さらに、北米の健康志向の高い消費者層は、オメガ3脂肪酸や高品質のタンパク質など、栄養価の高い魚介類に価値を置いており、これが需要を押し上げています。魚の水産養殖と植物の栽培を組み合わせたアクアポニックスシステムの人気が高まっていることも、この地域の持続可能な食糧生産への取り組みを浮き彫りにしています。環境問題、健康意識、技術革新、政府支援といったこれらの要因が相まって、北米の水産養殖市場は力強い成長を遂げており、同地域の食糧安全保障と持続可能な開発目標にとって極めて重要な要素となっています。

北米の水産養殖市場にとって重要な機会のひとつは、洋上養殖の拡大と近代化にあります。伝統的な近海養殖や陸上養殖とは異なり、海洋養殖は、環境条件がより安定し、沿岸の汚染や生息地の破壊の影響を受けにくい、より深く開けた海域で魚類やその他の水生種を水産養殖するものです。この方法は、沿岸の水産養殖場にしばしば伴う空間的制限や環境上の懸念なしに、生産能力を増大させる大きな可能性を提供します。堅牢なケージ設計、自動給餌システム、センサーやドローンによる遠隔監視など、技術の進歩により、洋上養殖はより実現可能で費用対効果の高いものとなっています。さらに、洋上養殖場は沿岸のコミュニティや観光業との衝突を減らし、規制上の課題や社会的受容に対処するのに役立ちます。水産物需要の増大と天然魚の資源量に限りがある中、海洋水産養殖は市場のニーズを持続的に満たすための拡張可能な解決策を提示しています。洋上養殖のインフラと調査に投資することで、新たな生産フロンティアを切り開き、沿岸地域の経済成長を後押しし、持続可能な水産養殖イノベーションのリーダーとしての北米の地位を高めることができます。

北米の水産養殖市場に参入している主要企業には、Cooke Aquaculture、American Aquafarms、Atlantic Sapphire、Clearwater Seafoods、Pacific Seafood Group、Grieg Seafood BC、Kuterra、Maine Aquaculture Innovation Center、Regal Springs Tilapia、Mariculture Technologies Inc.などがあります。これらの企業は革新的な製品を手頃な価格で提供し、多くの消費者を引き付けています。

北米の水産養殖市場全体の規模は、一次情報と二次情報の両方を用いて算出しました。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、トピックに関する分析的洞察を得るために、業界関係者との複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、研究開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、北米の水産養殖市場を専門とするバリュエーション専門家、リサーチアナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- アナリスト市場の展望

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基本数値の開発

- データの三角測量

- 国レベルのデータ

- 前提条件と制限

第4章 北米の水産養殖市場の情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造業者

- ディストリビューターとサプライヤー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 北米の水産養殖市場:主要市場力学

- 北米の水産養殖市場:主要市場力学

- 市場促進要因

- 水産物の需要と消費の急増

- 政府の積極的な取り組み

- 市場抑制要因

- 環境への悪影響

- 市場機会

- RAS技術の導入

- 今後の動向

- いくつかの産業における魚油の応用

- 促進要因と抑制要因の影響

第6章 北米の水産養殖市場の分析

- 北米の水産養殖市場の数量(キロトン)、2021年~2031年

- 北米の水産養殖市場の数量予測・分析(キロトン)

- 北米の水産養殖市場の収益と予測、2021年~2031年

- 北米の水産養殖市場の予測・分析

第7章 北米の水産養殖市場の数量・収益分析:製品タイプ別

- 魚類

- 水生植物

- 甲殻類

- 軟体動物

- その他

第8章 北米の水産養殖市場の数量・収益分析:培養環境別

- 淡水

- 海洋水

- 汽水

第9章 北米の水産養殖市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第11章 北米の水産養殖市場の業界情勢

- 合併と買収

- 契約、提携、合弁事業

- 事業拡大とその他の戦略的開発

第12章 企業プロファイル

- JBS SA

- Bakkafrost

- Blue Ridge Aquaculture, Inc.

- Cermaq Group AS

- Cooke Aquaculture Inc.

- Danish Salmon

- Leroy Seafood Group ASA

- Mowi ASA

- Stolt-Nielsen Ltd

- Thai Union Group PCL.

第13章 付録

List Of Tables

- Table 1. North America Aquaculture Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Aquaculture Market - Volume, 2021-2024 (Kilo Tons)

- Table 4. North America Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons)

- Table 5. North America Aquaculture Market - Revenue, 2021-2024 (US$ Million)

- Table 6. North America Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million)

- Table 7. North America Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Product Type

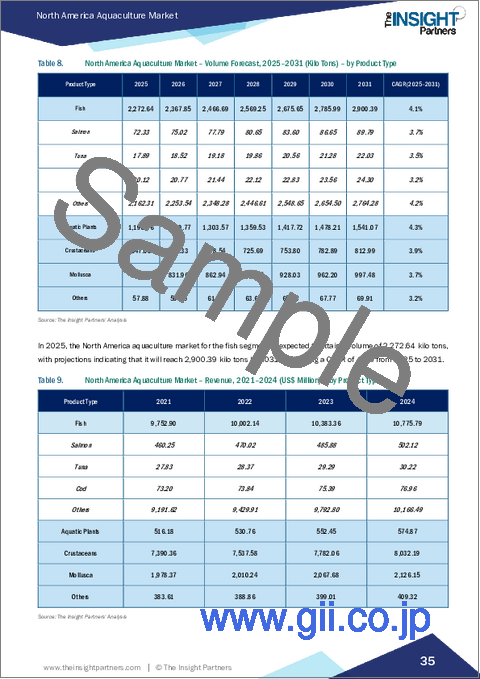

- Table 8. North America Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Product Type

- Table 9. North America Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Product Type

- Table 10. North America Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Product Type

- Table 11. North America Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Culture Environment

- Table 12. North America Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Culture Environment

- Table 13. North America Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Culture Environment

- Table 14. North America Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Culture Environment

- Table 15. North America Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Country

- Table 16. North America Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) -by Country

- Table 17. North America Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Country

- Table 18. North America Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Country

- Table 19. United States: Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Product Type

- Table 20. United States: Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Product Type

- Table 21. United States: Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Product Type

- Table 22. United States: Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Product Type

- Table 23. United States: Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Culture Environment

- Table 24. United States: Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Culture Environment

- Table 25. United States: Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Culture Environment

- Table 26. United States: Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Culture Environment

- Table 27. Canada: Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Product Type

- Table 28. Canada: Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Product Type

- Table 29. Canada: Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Product Type

- Table 30. Canada: Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Product Type

- Table 31. Canada: Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Culture Environment

- Table 32. Canada: Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Culture Environment

- Table 33. Canada: Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Culture Environment

- Table 34. Canada: Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Culture Environment

- Table 35. Mexico: Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Product Type

- Table 36. Mexico: Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Product Type

- Table 37. Mexico: Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Product Type

- Table 38. Mexico: Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Product Type

- Table 39. Mexico: Aquaculture Market - Volume, 2021-2024 (Kilo Tons) - by Culture Environment

- Table 40. Mexico: Aquaculture Market - Volume Forecast, 2025-2031 (Kilo Tons) - by Culture Environment

- Table 41. Mexico: Aquaculture Market - Revenue, 2021-2024 (US$ Million) - by Culture Environment

- Table 42. Mexico: Aquaculture Market - Revenue Forecast, 2025-2031 (US$ Million) - by Culture Environment

- Table 43. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. North America Aquaculture Market Segmentation

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Aquaculture Market Volume (Kilo Tons), 2021-2031

- Figure 5. North America Aquaculture Market Revenue and Forecast (US$ Million), 2021-2031

- Figure 6. North America Aquaculture Market Share (%) - by Product Type, 2024 and 2031

- Figure 7. Fish: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 8. Fish: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 9. Salmon: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 10. Salmon: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 11. Tuna: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 12. Tuna: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 13. Cod: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 14. Cod: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 15. Others: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 16. Others: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 17. Aquatic Plants: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 18. Aquatic Plants: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 19. Crustaceans: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 20. Crustaceans: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 21. Mollusca: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 22. Mollusca: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 23. Others: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 24. Others: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 25. North America Aquaculture Market Share (%) - by Culture Environment, 2024 and 2031

- Figure 26. Freshwater: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 27. Freshwater: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 28. Marine Water: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 29. Marine Water: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 30. Brackish Water: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- Figure 31. Brackish Water: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 32. North America Aquaculture Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 33. United States: Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 34. Canada: Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 35. Mexico: Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- Figure 36. Company Positioning and Concentration

The North America aquaculture market size was valued at US$ 21.92 billion in 2024 and is projected to reach US$ 29.39 billion by 2031; it is expected to register a CAGR of 4.3% from 2025 to 2031.

A major driver propelling the North America aquaculture market is the surging demand for sustainable and locally sourced seafood, fueled by increasing consumer awareness about environmental conservation and health benefits. Overfishing and depletion of wild fish stocks globally have raised concerns about the long-term viability of traditional fisheries, pushing consumers, retailers, and governments to seek alternative sources of seafood. Aquaculture presents a viable solution to this challenge by enabling controlled, efficient production of high-quality fish and aquatic plants without exerting additional pressure on wild populations. In North America, this shift toward sustainable seafood consumption is reflected in the growing preference for farm-raised species such as salmon, trout, catfish, and tilapia. Consumers are increasingly prioritizing seafood products that are traceable, environmentally responsible, and free from harmful chemicals or antibiotics. This has encouraged producers to adopt advanced farming technologies, such as recirculating aquaculture systems (RAS) and integrated multi-trophic aquaculture (IMTA), which reduce environmental footprints by recycling water, minimizing waste, and enhancing resource efficiency. Government support further amplifies this trend, with agencies like the National Oceanic and Atmospheric Administration (NOAA) and Fisheries and Oceans Canada (DFO) providing funding, research, and regulatory frameworks to promote sustainable aquaculture practices. These initiatives foster innovation, improve farm management, and ensure compliance with environmental standards.

Additionally, the health-conscious consumer base in North America values seafood for its nutritional benefits, including omega-3 fatty acids and high-quality protein, which boosts demand. The increasing popularity of aquaponics systems, which combine fish farming with plant cultivation, also highlights the region's commitment to sustainable food production. Together, these factors, environmental concerns, health awareness, technological innovation, and government support, are driving robust growth in the North America aquaculture market, positioning it as a crucial component of the region's food security and sustainable development goals.

One significant opportunity for the North America aquaculture market lies in the expansion and modernization of offshore aquaculture. Unlike traditional nearshore or land-based farming, offshore aquaculture involves cultivating fish and other aquatic species in deeper, open waters, where environmental conditions can be more stable and less susceptible to coastal pollution or habitat disruption. This approach offers tremendous potential to increase production capacity without the spatial limitations and environmental concerns often associated with coastal farms. Advancements in technology, including robust cage designs, automated feeding systems, and remote monitoring through sensors and drones, are making offshore aquaculture more feasible and cost-effective. Moreover, offshore farms can reduce conflicts with coastal communities and tourism, helping address regulatory challenges and social acceptance. With growing seafood demand and limited wild fish stocks, offshore aquaculture presents a scalable solution to meet market needs sustainably. Investing in offshore farming infrastructure and research can unlock new production frontiers, boost economic growth in coastal regions, and enhance North America's position as a leader in sustainable aquaculture innovation.

Some of the key players operating in the North America aquaculture market are Cooke Aquaculture, American Aquafarms, Atlantic Sapphire, Clearwater Seafoods, Pacific Seafood Group, Grieg Seafood BC, Kuterra, Maine Aquaculture Innovation Center, Regal Springs Tilapia, and Mariculture Technologies Inc. These players offer innovative products at affordable prices that attract a large number of consumers, opening new opportunities for them in the coming years.

The overall North America aquaculture market size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information about the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights into the topic. Participants in this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants, such as valuation experts, research analysts, and key opinion leaders, specializing in the North America aquaculture market.

Table Of Contents

1. Introduction

- 1.1 Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Analyst Market Outlook

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

- 3.3 Assumptions and Limitations

4. North America Aquaculture Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors and Suppliers

- 4.3.4 End Users

- 4.3.5 List of Vendors in the Value Chain

5. North America Aquaculture Market - Key Market Dynamics

- 5.1 North America Aquaculture Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Surge in Demand and Consumption of Seafood

- 5.2.2 Favourable Government Initiatives

- 5.3 Market Restraints

- 5.3.1 Harmful Impact on Environment

- 5.4 Market Opportunities

- 5.4.1 Implementation of RAS Technology

- 5.5 Future Trends

- 5.5.1 Application of Fish Oil in Several Industries

- 5.6 Impact of Drivers and Restraints:

6. North America Aquaculture Market Analysis

- 6.1 North America Aquaculture Market Volume (Kilo Tons), 2021-2031

- 6.2 North America Aquaculture Market Volume Forecast and Analysis (Kilo Tons)

- 6.3 North America Aquaculture Market Revenue and Forecast (US$ Million), 2021-2031

- 6.4 North America Aquaculture Market Forecast and Analysis (US$ Million)

7. North America Aquaculture Market Volume and Revenue Analysis - by Product Type

- 7.1 Fish

- 7.1.1 Overview

- 7.1.2 Fish: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.1.3 Fish: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.1.4 Salmon

- 7.1.4.1 Overview

- 7.1.4.2 Salmon: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.1.4.3 Salmon: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.1.5 Tuna

- 7.1.5.1 Overview

- 7.1.5.2 Tuna: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.1.5.3 Tuna: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.1.6 Cod

- 7.1.6.1 Overview

- 7.1.6.2 Cod: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.1.6.3 Cod: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.1.7 Others

- 7.1.7.1 Overview

- 7.1.7.2 Others: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.1.7.3 Others: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.2 Aquatic Plants

- 7.2.1 Overview

- 7.2.2 Aquatic Plants: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.2.3 Aquatic Plants: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.3 Crustaceans

- 7.3.1 Overview

- 7.3.2 Crustaceans: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.3.3 Crustaceans: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.4 Mollusca

- 7.4.1 Overview

- 7.4.2 Mollusca: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.4.3 Mollusca: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 7.5.3 Others: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

8. North America Aquaculture Market Volume and Revenue Analysis - by Culture Environment

- 8.1 Freshwater

- 8.1.1 Overview

- 8.1.2 Freshwater: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 8.1.3 Freshwater: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.2 Marine Water

- 8.2.1 Overview

- 8.2.2 Marine Water: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 8.2.3 Marine Water: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 8.3 Brackish Water

- 8.3.1 Overview

- 8.3.2 Brackish Water: North America Aquaculture Market - Volume and Forecast, 2021-2031 (Kilo Tons)

- 8.3.3 Brackish Water: North America Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

9. North America Aquaculture Market - Country Analysis

- 9.1 North America

- 9.1.1 North America Aquaculture Market Breakdown, by Countries

- 9.1.2 North America Aquaculture Market - Forecast and Analysis - by Country

- 9.1.2.1 North America Aquaculture Market - Volume and Forecast Analysis - by Country

- 9.1.2.2 North America Aquaculture Market - Revenue and Forecast Analysis - by Country

- 9.1.2.3 United States: Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.1.2.3.1 United States: Aquaculture Market Breakdown, by Product Type

- 9.1.2.3.2 United States: Aquaculture Market Breakdown, by Culture Environment

- 9.1.2.4 Canada: Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.1.2.4.1 Canada: Aquaculture Market Breakdown, by Product Type

- 9.1.2.4.2 Canada: Aquaculture Market Breakdown, by Culture Environment

- 9.1.2.5 Mexico: Aquaculture Market - Revenue and Forecast, 2021-2031 (US$ Million)

- 9.1.2.5.1 Mexico: Aquaculture Market Breakdown, by Product Type

- 9.1.2.5.2 Mexico: Aquaculture Market Breakdown, by Culture Environment

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning and Concentration

11. North America Aquaculture Market Industry Landscape

- 11.1 Overview

- 11.2 Mergers and Acquisitions

- 11.3 Agreements, Collaborations, And Joint Ventures

- 11.4 Expansions and Other Strategic Developments

12. Company Profiles

- 12.1 JBS SA

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 key Developments

- 12.2 Bakkafrost

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 SWOT Analysis

- 12.3 Blue Ridge Aquaculture, Inc.

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Cermaq Group AS

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 SWOT Analysis

- 12.5 Cooke Aquaculture Inc.

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Financial Overview

- 12.5.4 SWOT Analysis

- 12.5.5 Financial Overview

- 12.6 Danish Salmon

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Leroy Seafood Group ASA

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Business Description

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Mowi ASA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Stolt-Nielsen Ltd

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Thai Union Group PCL.

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners