|

|

市場調査レポート

商品コード

1784652

アジア太平洋の基礎芳香族市場の分析(2021~2031年):市場範囲・区分・動向・競合分析Asia Pacific Basic Aromatics Market Report 2021-2031 by Scope, Segmentation, Dynamics, and Competitive Analysis |

||||||

|

|||||||

| アジア太平洋の基礎芳香族市場の分析(2021~2031年):市場範囲・区分・動向・競合分析 |

|

出版日: 2025年07月10日

発行: The Insight Partners

ページ情報: 英文 154 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の基礎芳香族の市場規模は、2023年の1,056億9,728万米ドルから2031年には1,756億1,552万米ドルに達すると予測されます。2023~2031年までのCAGRは6.6%を記録すると推定されます。

エグゼクティブサマリー - アジア太平洋の基礎芳香族市場の分析

Invest Indiaのレポートによると、インドの医薬品生産量は世界第3位で、2023年の市場規模は500億米ドルでした。国際貿易局によると、バイオ医薬品産業は2021年に医薬品売上高の15%を占めました。日本の厚生労働省による医薬品生産統計年報によると、日本の医療用医薬品および非医療用医薬品の市場規模は2021年に1,060億米ドルとなりました。この地域には、Pfizer Inc.、Eli Lilly and Company、Merck & Co. Inc.、The Procter & Gamble Company、Reckitt Benckiser Group plcといった大手製薬企業が進出しています。

アジア太平洋には、インド、中国、日本の主要農薬メーカーも存在します。世界貿易機関(WTO)によると、インドは2022年に第2位の農薬輸出国になると記録されています。ベンゼンとキシレンは農薬の生産に使用されます。p-キシレンは、ポリエチレンテレフタレートやポリエステルプラスチックの製造に使用されます。日本プラスチック工業連盟によると、2022年の日本のプラスチック製品の生産量は300万トンを超え、重量ベースではプラスチックフィルムとシートが生産量全体の大きな割合を占めています。そのため、予測期間中、最終用途産業の成長が基礎芳香族の需要を押し上げると予想されます。

アジア太平洋の基礎芳香族市場 - セグメント別分析:

基礎芳香族市場の分析に寄与した主なセグメントは、タイプと最終用途です。

タイプ別に見ると、スチレンモノマー、ジビニルベンゼン、ベンゼン、トルエン、キシレン、クレゾール、ピリジンに区分されます。2023年にはキシレンが最大のシェアを占めています。

最終用途別では、医薬品、農薬、農業、飲食品、化粧品・パーソナルケア、塗料・コーティング、溶剤に区分されます。2023年の市場シェアは溶剤セグメントが最大でした。

アジア太平洋の基礎芳香族市場 - 展望

今後数年間、アジア太平洋地域では高度製造業の成長が見込まれます。ベンゼン、トルエン、キシレンなどの基礎芳香族は、合成繊維、化学薬品、ゴム、接着剤、塗料・コーティング剤の生産に使用される主要原料です。トルエンは医薬品や医薬品の製造に利用されます。基礎芳香族は、ナイロン、ポリエステルなどの合成繊維や、ポリエチレンテレフタレート、ポリスチレン、アクリロニトリルブタジエンスチレンなどの合成樹脂の生産にも使用されます。企業がアジア諸国に製造拠点を拡大し続けているため、アジア太平洋地域の製造量は増加しています。アジア各国の政府が打ち出した多くの支援策や政策が、プラスチック、繊維、ゴム、塗料・コーティング、医薬品、化学品といったいくつかの分野への外国直接投資を誘致しています。多くのアジア諸国は、製造業のGDP貢献目標を野心的に設定しています。国務院が発表した「2024年国務院政府業務報告」によると、同国はGDP成長率目標を5%に設定しています。

持続可能な開発のための国際研究所によると、アジア太平洋地域は世界の化学製造業の45%以上を占めています。欧州化学工業協会によると、中国、インド、韓国、台湾が主要新興国で、化学製品の平均生産量はそれぞれ年率6.9%、1.8%、1.1%、0.7%の成長率(2012~2022年)を占めています。India Brand Equity Foundationによると、2021年に5年間にわたり、人工繊維および産業用繊維を対象とした14億4,000万米ドルの生産連動インセンティブ(PLI)制度が設立されました。2023年8月、インドは人工繊維と産業用繊維製品を促進するため、繊維製品のPLIスキームを更新する予定です。同国は、PLIスキームの下で人工繊維と産業用繊維製品の製造能力を向上させることを目指しています。Information Technology and Innovation Foundationによると、中国は世界最大の化学メーカーであり、市場関係者はファインケミカルと消費者向け化学製品の世界市場シェアを獲得することに非常に注力しています。このように、新興国における産業成長は、予測期間中、基礎芳香族の需要を牽引すると予想されます。

アジア太平洋の基礎芳香族市場 - 国別考察

地域別に見ると、アジア太平洋地域の基礎芳香族市場は、オーストラリア、中国、インド、日本、韓国、その他アジア太平洋地域で構成されます。2023年には中国が最大のシェアを占めています。

European Chemical Industry Councilによると、中国の化学産業は世界最大級の産業であり、2022年の市場規模は2兆6,000億米ドルです。Information Technology and Innovation Foundationによると、2022年の世界の化学生産に占める中国の割合は44%です。中国国家統計局によると、中国は世界最大のプラスチック生産国であり、2020年8月~2021年8月までのプラスチック製品の生産量は約795万トンでした。中国には多くの大手プラスチックポリマーメーカーがあり、Qingdao Xintongda Plastic Products Co Ltd、Suzhou Fansheng Plastic Manufacture Co Ltd、Dongguan Xinhai Environmental-Friendly Material Co Ltdなどがあります。

アジア太平洋基礎芳香族市場 - 企業プロファイル

市場で事業を展開する主要企業には、BASF SE、Exxon Mobil Corp、Jubilant Ingrevia Limited、Lanxess AG、LyondellBasell Industries NV、Nippon Steel Corp、Sasol Ltd、Shell Plc、The Dow Chemical Coなどがあります。これらの企業は、消費者に革新的な製品を提供し、市場シェアを拡大するために、事業拡大、製品革新、M&Aなど様々な戦略を採用しています。

アジア太平洋の基礎芳香族市場 - 調査手法:

本レポートで紹介するデータの収集と分析には、以下の調査手法を採用しています:

二次調査の調査プロセスは、各市場の質的・量的データを収集するために、社内外の情報源を活用した包括的な二次調査から始まります。一般的に参照される二次調査情報源は以下の通りですが、これらに限定されるものではありません:

企業のウェブサイト、年次報告書、財務諸表、ブローカーの分析、投資家のプレゼンテーション、業界専門誌、その他関連出版物政府文書、統計データベース、市場レポートニュース記事、プレスリリース、ウェブキャスト。(企業プロファイルに含まれる財務データはすべて米ドルで統一されています。他通貨で報告されている企業については、該当年度の関連為替レートを使用して数値を米ドルに換算しています。)

一次調査:インサイト・パートナーズでは、データ分析を検証し、貴重な知見を得るために、毎年、業界利害関係者や専門家に相当数の1次インタビューを実施しています。これらの調査は、以下を目的としています:

二次調査の結果を検証し、改良します。分析チームの専門知識と市場理解を深めます。市場規模、動向、成長パターン、競合力学、将来の見通しに関する考察を得ます。一次調査は、様々な市場、カテゴリー、セグメント、サブセグメントを対象とし、Eメールでのやり取りや電話インタビューで実施します。参加者は通常以下の通りです:

業界の利害関係者(副社長、事業開発マネージャー、マーケット・インテリジェンス・マネージャー、国内営業マネージャー)、業界固有の専門知識を持つ外部専門家(評価専門家、リサーチアナリスト、国内営業マネージャー、主要オピニオンリーダー)

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の動向

- データの三角測量

- 国レベルのデータ

第4章 アジア太平洋の基礎芳香族市場情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 代替品の脅威

- 買い手の交渉力:新規参入企業の脅威

- 供給企業の交渉力

- 競争企業間の敵対関係

- エコシステム分析

- 原材料サプライヤー

- 製造業者

- 流通業者または供給業者

- 最終用途産業

第5章 アジア太平洋の基礎芳香族市場- 主要市場力学

- 市場促進要因

- 塗料・コーティング産業の成長

- 最終用途産業における溶剤需要の増加

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- 新興経済国の産業成長

- 医薬品・パーソナルケア産業の成長

- 今後の動向

- 基礎芳香族の回収プロセスの進歩

- 促進要因と抑制要因の影響

第6章 基礎芳香族市場:アジア太平洋市場の分析

- アジア太平洋の基礎芳香族市場の規模(2021~2031年)

- アジア太平洋の基礎芳香族市場の予測・分析

- アジア太平洋の基礎芳香族市場の収益(2023~2031年)

- アジア太平洋の基礎芳香族市場の予測・分析

第7章 アジア太平洋の基礎芳香族の市場規模・収益分析:タイプ別

- スチレンモノマー

- ジビニルベンゼン

- ベンゼン

- トルエン

- キシレン

- クレゾール

- ピリジン

第8章 アジア太平洋の基礎芳香族の市場規模・収益分析:最終用途別

- 医薬品

- 農薬

- 農業

- 飲食品

- 化粧品・パーソナルケア

- 塗料・コーティング

- 溶剤

第9章 アジア太平洋の基礎芳香族市場:国別分析

- アジア太平洋地域

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

第10章 競合情勢

- ヒートマップ分析- 主要プレーヤー別

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 合併と買収

第12章 企業プロファイル

- The Dow Chemical Co

- Exxon Mobil Corp

- Lanxess AG

- Sasol Ltd

- LyondellBasell Industries NV

- BASF SE

- Nippon Steel Corp

- Shell Plc

- Jubilant Ingrevia Limited

第13章 付録

List Of Tables

- Table 1. Asia Pacific Basic Aromatics Market Segmentation

- Table 2. Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Table 3. Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

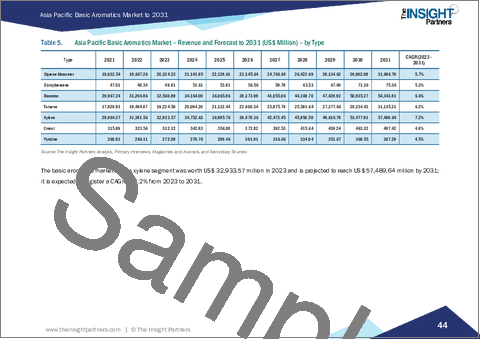

- Table 5. Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 6. Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 7. Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Country

- Table 8. Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 9. Australia: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 10. Australia: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 11. Australia: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 12. China: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 13. China: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 14. China: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 15. India: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 16. India: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 17. India: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 18. Japan: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 19. Japan: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 20. Japan: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 21. South Korea: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 22. South Korea: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 23. South Korea: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 24. Rest of Asia Pacific: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 25. Rest of Asia Pacific: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 26. Rest of Asia Pacific: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

List Of Figures

- Figure 1. Asia Pacific Basic Aromatics Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: Basic Aromatic Market

- Figure 4. Asia Pacific Basic Aromatics Market - Key Market Dynamics

- Figure 5. Global Electric Car Sales (2016-2023)

- Figure 6. Impact Analysis of Drivers and Restraints

- Figure 7. Asia Pacific Basic Aromatics Market Volume (Kilo Tons), 2021-2031

- Figure 8. Asia Pacific Basic Aromatics Market Revenue (US$ Million), 2023-2031

- Figure 9. Asia Pacific Basic Aromatics Market Share (%) - Type, 2023 and 2031

- Figure 10. Styrene Monomer: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 11. Styrene Monomer: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Divinylbenzene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 13. Divinylbenzene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Benzene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 15. Benzene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Toluene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 17. Toluene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Xylene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 19. Xylene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Cresol: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 21. Cresol: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Pyridine: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 23. Pyridine: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Asia Pacific Basic Aromatics Market Share (%) - End Use, 2023 and 2031

- Figure 25. Pharmaceuticals: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Pesticides: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Agriculture: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Food and Beverages: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Cosmetics and Personal Care: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Paints and Coatings: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Solvents: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Asia Pacific Basic Aromatics Market Breakdown by Key Countries - Revenue (2023) (US$ Million)

- Figure 33. Asia Pacific Basic Aromatics Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 34. Australia: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 35. China: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 36. India: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 37. Japan: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 38. South Korea: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 39. Rest of Asia Pacific: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 40. Heat Map Analysis - By Key Players

- Figure 41. Company Positioning & Concentration

The Asia Pacific basic aromatics market size is expected to reach US$ 1,75,615.52 million by 2031 from US$ 1,05,697.28 million in 2023. The market is estimated to record a CAGR of 6.6% from 2023 to 2031.

Executive Summary and Asia Pacific Basic Aromatics Market Analysis:

According to the Invest India report, in terms of pharmaceutical production by volume, the pharmaceutical industry in India ranks third worldwide and was valued at US$ 50 billion in 2023. Per the International Trade Administration, the biopharmaceuticals industry accounted for ~15% of drug sales in 2021. The annual Pharmaceutical Production statistics report by the Japan Ministry of Health, Labor and Welfare revealed that the Japanese market for prescription and nonprescription pharmaceuticals was valued at US$ 106 billion in 2021. The region marks the presence of some major pharmaceutical companies such as Pfizer Inc., Eli Lilly and Company, Merck & Co. Inc., The Procter & Gamble Company, and Reckitt Benckiser Group plc.

Asia Pacific also marks the presence of major agrochemical producers in India, China, and Japan. According to the World Trade Organization, India was recorded to be the second-largest exporter of agrochemicals in 2022. Basic aromatics, namely benzene and xylene, are used for the production of pesticides. Benzene is also used for the production of rubber, dyes, drugs, and lubricants. p-Xylene is used as a building block chemical for the production of polyethylene terephthalate and polyester plastics. According to the Japan Plastics Industry Federation, in 2022, Japan produced more than 3 million metric tons of plastic products; in terms of weight, plastic film and sheets accounted for a significant share of the total production. Therefore, the growth in the end-use industries is expected to boost the demand for basic aromatics during the forecast period.

Asia Pacific Basic Aromatics Market Segmentation Analysis:

Key segments that contributed to the derivation of the basic aromatics market analysis are type and end user.

Based on type, the Asia Pacific basic aromatics market is segmented into styrene monomer, divinylbenzene, benzene, toluene, xylene, cresol, and pyridine. The xylene held the largest share of the market in 2023.

By end user, the Asia Pacific basic aromatics market is segmented into pharmaceuticals, pesticides, agriculture, food and beverages, cosmetics and personal care, paints and coatings, and solvents. The solvents segment held the largest share of the market in 2023.

Asia Pacific Basic Aromatics Market Outlook

In coming years, the advanced manufacturing sector is expected to grow in the Asia Pacific. Basic aromatics such as benzene toluene and xylene are major feedstock used in the production of synthetic fibers, chemicals, rubber, adhesives, and paints and coatings. Toluene is utilized for the production of drugs and medicines. Basic aromatics are also used in the production of synthetic fibers such as nylon, polyester, and synthetic resins such as polyethylene terephthalate, polystyrene, and acrylonitrile butadiene styrene. The manufacturing output in Asia Pacific has grown as companies continue to expand their manufacturing footprint in the Asian countries. Many supportive initiatives and policies launched by government across Asian countries attract foreign direct investment in several sectors such as plastics, textiles, rubber, paints & coatings, pharmaceuticals, and chemicals. Many Asian countries have set ambitious GDP contribution targets for manufacturing sector. As per the 2024 Government Work Report by State Council released by State Council, the country has set GDP growth rate targets at 5%.

As per the International Institute for Sustainable Development, Asia Pacific represents more than 45% of global chemical manufacturing industry. According to the European Chemical Industry Council, China, India, South Korea and Taiwan were the key emerging economies, accounting for 6.9%, 1.8%, 1.1%, and 0.7% growth per annum (2012-2022), respectively for average chemicals production. According to the India Brand Equity Foundation, the Production-linked Incentive (PLI) Scheme of US$ 1.44 billion for man-made fibers and technical textiles was established in 2021 over a five-year period. In August 2023, India planned to update the PLI scheme for textiles to promote man-made fibers and technical textile products. The country aims to upgrade the manufacturing capabilities for man-made fabrics and technical textile products under the PLI Scheme. As per the Information Technology and Innovation Foundation, China is largest chemical manufacturer in the world, wherein the market players are highly focused on gaining global market share in fine chemicals and consumer chemicals. Thus, industrial growth in the emerging economies is expected to drive the demand for basic aromatics during the forecast period.

Asia Pacific Basic Aromatics Market Country Insights

Based on geography, the Asia Pacific basic aromatics market comprises Australia, China, India, Japan, South Korea, and the Rest of APAC. China held the largest share in 2023.

According to the European Chemical Industry Council, the chemical industry in China is one of the largest industries worldwide, valued at ~US$ 2,600 billion in 2022. According to the Information Technology & Innovation Foundation, China accounted for 44% of global chemical production in 2022. Per the National Bureau of Statistics of China, the country is the world's largest producer of plastics; it produced ~7.95 million metric tons of plastic products between August 2020 and August 2021. China has many major plastic and polymer manufacturers; these include Qingdao Xintongda Plastic Products Co Ltd, Suzhou Fansheng Plastic Manufacture Co Ltd, and Dongguan Xinhai Environmental-Friendly Material Co Ltd.

Asia Pacific Basic Aromatics Market Company Profiles

Some of the key players operating in the market include BASF SE, Exxon Mobil Corp, Jubilant Ingrevia Limited, Lanxess AG, LyondellBasell Industries NV, Nippon Steel Corp, Sasol Ltd, Shell Plc, and The Dow Chemical Co among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

Asia Pacific Basic Aromatics Market Research Methodology :

The following methodology has been followed for the collection and analysis of data presented in this report:

Secondary Research The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Company websites , annual reports, financial statements, broker analyses, and investor presentations. Industry trade journals and other relevant publications. Government documents , statistical databases, and market reports. News articles , press releases, and webcasts specific to companies operating in the market. Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

Primary Research The Insight Partners' conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Validate and refine findings from secondary research. Enhance the expertise and market understanding of the analysis team. Gain insights into market size, trends, growth patterns, competitive dynamics, and future prospects. Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

Industry stakeholders : Vice Presidents, business development managers, market intelligence managers, and national sales managers External experts : Valuation specialists, research analysts, and key opinion leaders with industry-specific expertise

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Asia Pacific Basic Aromatics Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants:

- 4.2.2 Threat of Substitutes:

- 4.2.3 Bargaining Power of Buyers:

- 4.2.4 Bargaining Power of Suppliers:

- 4.2.5 Competitive Rivalry:

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors or Suppliers

- 4.3.4 End-Use Industry

5. Asia Pacific Basic Aromatics Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growth of Paints & Coatings Industry

- 5.1.2 Rising Demand for Solvents Across End-Use Industries

- 5.2 Market Restraints

- 5.2.1 Fluctuation in Raw Material Prices

- 5.3 Market Opportunities

- 5.3.1 Industrial Growth in the Emerging Economies

- 5.3.2 Growth of Pharmaceuticals and Personal Care Industry

- 5.4 Future Trends

- 5.4.1 Advancement in Recovery Processes of Basic Aromatics

- 5.5 Impact of Drivers and Restraints:

6. Basic Aromatics Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Basic Aromatics Market Volume (Kilo Tons), 2021-2031

- 6.2 Asia Pacific Basic Aromatics Market Volume Forecast and Analysis (Kilo Tons)

- 6.3 Asia Pacific Basic Aromatics Market Revenue (US$ Million), 2023-2031

- 6.4 Asia Pacific Basic Aromatics Market Forecast and Analysis

7. Asia Pacific Basic Aromatics Market Volume and Revenue Analysis - by Type

- 7.1 Styrene Monomer

- 7.1.1 Overview

- 7.1.2 Styrene Monomer: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.1.3 Styrene Monomer: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Divinylbenzene

- 7.2.1 Overview

- 7.2.2 Divinylbenzene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.2.3 Divinylbenzene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Benzene

- 7.3.1 Overview

- 7.3.2 Benzene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.3.3 Benzene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Toluene

- 7.4.1 Overview

- 7.4.2 Toluene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.4.3 Toluene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Xylene

- 7.5.1 Overview

- 7.5.2 Xylene: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.5.3 Xylene: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Cresol

- 7.6.1 Overview

- 7.6.2 Cresol: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.6.3 Cresol: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 7.7 Pyridine

- 7.7.1 Overview

- 7.7.2 Pyridine: Asia Pacific Basic Aromatics Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.7.3 Pyridine: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

8. Asia Pacific Basic Aromatics Market Revenue Analysis - by End Use

- 8.1 Pharmaceuticals

- 8.1.1 Overview

- 8.1.2 Pharmaceuticals: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Pesticides

- 8.2.1 Overview

- 8.2.2 Pesticides: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Agriculture

- 8.3.1 Overview

- 8.3.2 Agriculture: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Food and Beverages

- 8.4.1 Overview

- 8.4.2 Food and Beverages: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Cosmetics and Personal Care

- 8.5.1 Overview

- 8.5.2 Cosmetics and Personal Care: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Paints and Coatings

- 8.6.1 Overview

- 8.6.2 Paints and Coatings: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 8.7 Solvents

- 8.7.1 Overview

- 8.7.2 Solvents: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

9. Asia Pacific Basic Aromatics Market - Country Analysis

- 9.1 Asia Pacific

- 9.1.1 Asia Pacific Basic Aromatics Market Overview

- 9.1.2 Asia Pacific Basic Aromatics Market Revenue and Forecast and Analysis - by Country

- 9.1.2.1 Asia Pacific Basic Aromatics Market Volume and Forecast and Analysis - by Country

- 9.1.2.2 Asia Pacific Basic Aromatics Market Revenue and Forecast and Analysis - by Country

- 9.1.2.3 Australia: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.3.1 Australia: Asia Pacific Basic Aromatics Market Breakdown by Type

- 9.1.2.4 China: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.4.1 China: Asia Pacific Basic Aromatics Market Breakdown by Type

- 9.1.2.5 India: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.5.1 India: Asia Pacific Basic Aromatics Market Breakdown by Type

- 9.1.2.6 Japan: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.6.1 Japan: Asia Pacific Basic Aromatics Market Breakdown by Type

- 9.1.2.7 South Korea: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.7.1 South Korea: Asia Pacific Basic Aromatics Market Breakdown by Type

- 9.1.2.8 Rest of Asia Pacific: Asia Pacific Basic Aromatics Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.2.8.1 Rest of Asia Pacific: Asia Pacific Basic Aromatics Market Breakdown by Type

10. Competitive Landscape

- 10.1 Heat Map Analysis - By Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Merger and Acquisition

12. Company Profiles

- 12.1 The Dow Chemical Co

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Exxon Mobil Corp

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Lanxess AG

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Sasol Ltd

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 LyondellBasell Industries NV

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 BASF SE

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Nippon Steel Corp

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Shell Plc

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Jubilant Ingrevia Limited

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners