|

|

市場調査レポート

商品コード

1764933

北米の航空機用ブラケット市場の2031年までの予測-航空機タイプ、用途、材料、最終用途別の地域分析North America Aircraft Brackets Market Forecast to 2031 - Regional Analysis by Aircraft Type, Application, Material, and End Use |

||||||

|

|||||||

| 北米の航空機用ブラケット市場の2031年までの予測-航空機タイプ、用途、材料、最終用途別の地域分析 |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 146 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の航空機用ブラケット市場は、2023年に8,617万米ドルと評価され、2031年には1億3,767万米ドルに達すると予測され、2023~2031年のCAGRは6.0%に達すると予測されています。

ナローボディ航空機の受注と納入の増加が北米の航空機用ブラケット市場を後押し

航空産業は長年にわたって急速に成熟し、航空機の生産と納入の数が大幅に増加しています。これにより、世界中の様々な民間航空機メーカーに大量の注文が舞い込んでいます。民間航空は、航空旅客数と航空機数の増加に伴い、今後数年間で急増すると予測されています。世界中でナローボディの旅客機や民間航空機の受注が増加していることが、航空機用ブラケットの需要を牽引しています。COVID-19パンデミックや欧州のと中東で続く地政学的戦争後、世界経済は弱体化しています。しかし、人々の旅行意欲と旅行の流れは増加しています。また、COVID-19の流行により、二次空港や三次空港の急成長が続いています。それゆえ、航空会社は小規模な都市空港への路線を開設することで、より遠隔地への進出を計画しています。航空機と空港の増加に伴い、航空機用ブラケットの需要も高まっています。

ここ2年間で、BoeingとAirbusはナローボディ機の受注を大幅に伸ばしています。Airbusの受注・納入データベースによると、2022年の民間航空機受注は820機で、上図のように2023年には2094機に増加しました。しかし、同データによると、2023年にはA330やA350といったワイドボディ機に比べ、A220、A319&A320、A321といったナローボディ機の納入が増加している(下図)。

AirbusとBoeingは、受注量と納入統計が大幅に多い航空機製造大手2社です。これら2つの航空機OEM(相手先商標製品製造会社)は、民間航空会社からさまざまな機種の航空機を継続的に受注しています。下表は、2020~2023年におけるAirbusとBoeingの受注と納入の比較です。

さらに、Airbusは、今後20年間で40,850機の旅客機と貨物機が新たに納入され、そのうち2023~2042年までの間に32,630機が典型的な単通路機、8,220機が典型的なワイドボディ機となると予測しています。また、貨物機の需要は2,510機に達し、同時期に920機が新造されると予測されています。このように、ナローボディ航空機の受注と納入の増加が市場を牽引しています。

北米の航空機用ブラケット市場概要

米国、カナダ、メキシコは北米の主要経済国です。この地域全体の航空機フリートの拡大は、主に北米の航空機ブラケット産業を牽引しています。さらに、米国やカナダなどの国々の航空産業の成長が航空機用ブラケット市場を牽引しています。航空産業は米国で最も注目される産業の1つです。Airlines for Americaが2023年に発表したデータによると、商業航空は2022年に米国のGDPの5%、1兆2,500億米ドルを占めました。航空旅客輸送量の増加に加え、防衛と民間航空セグメントにおける航空機保有台数を増加させる政府の取り組みが、予測期間中の北米の航空機ブラケット市場の需要を促進すると予想されます。

北米の航空機用ブラケット市場の収益と2031年までの予測(100万米ドル)

北米の航空機用ブラケット市場のセグメンテーション

北米の航空機用ブラケット市場は、航空機タイプ、用途、材料、最終用途、国に分類されます。

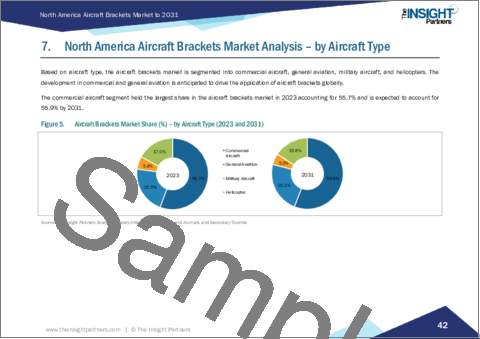

航空機タイプに基づいて、北米の航空機ブラケット市場は、民間航空機、一般航空、軍用機、ヘリコプターにセグメント化されます。民間航空機セグメントが2023年に最大の市場シェアを占めています。

用途別では、北米の航空機ブラケット市場は航空機胴体、航空機翼、航空機制御面、エンジン、その他に区分されます。航空機胴体セグメントが2023年に最大の市場シェアを占めました。

材料では、北米の航空機ブラケット市場はアルミニウム、スチール、その他に区分されます。アルミニウムセグメントが2023年に最大の市場シェアを占めました。

最終用途別では、北米の航空機ブラケット市場はOEMとアフターマーケットに二分されます。OEMセグメントが2023年に大きな市場シェアを占めました。

国別では、北米の航空機ブラケット市場は米国、カナダ、メキシコに区分されます。2023年の北米の航空機ブラケット市場シェアは米国が独占しました。

Arconic Corp、Godrej & Boyce Manufacturing Co Ltd、Hexagon AB、Hutchinson SA、Legend Aerospace、Precision Castparts Corp、Premium Aerotec GmbH、RTP Company、SEKISUI Aerospace、Singapore Technologies Engineering Ltd、Spirit AeroSystems Holdings Inc、STROCO Manufacturing Inc、Triumph Group Incは、北米の航空機ブラケット市場で事業展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

- 市場の魅力

第3章 調査手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国別データ

第4章 北米の航空機用ブラケットの市場情勢

- イントロダクション

- ポーターのファイブフォース分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の航空機用ブラケット市場:主要市場力学

- 航空機用ブラケット市場:主要市場力学

- 市場促進要因

- ナローボディ航空機の受注と納入の増加

- 一般旅客機とヘリコプターの納入増加

- 市場抑制要因

- スピリット航空によるB737 Maxプログラムの生産停止とAirbusA320の着陸停止

- A380とB747ジャンボジェットの製造中止

- 市場機会

- 世界の航空機保有機数の増加

- 今後の動向

- 軽量材料ベースの航空機ブラケットの採用増加

- 促進要因と抑制要因の影響

第6章 航空機用ブラケット市場:北米市場分析

- 北米の概要

- 北米の航空機用ブラケット市場収益(2021~2031年)

- 北米の航空機用ブラケット市場予測分析

第7章 北米の航空機用ブラケット市場分析-航空機タイプ別

- 民間航空機

- 一般航空機

- 軍用機

- ヘリコプター

第8章 北米の航空機ブラケットの市場分析-用途別

- 航空機胴体

- 航空機翼

- 航空機制御面

- エンジン

- その他

第9章 北米の航空機用ブラケットの市場分析-材料別

- アルミニウム

- スチール

- その他

第10章 北米の航空機用ブラケットの市場分析-最終用途別

- OEM市場

- アフターマーケット

第11章 北米の航空機用ブラケット市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- 企業のポジショニングと集中度

第13章 産業情勢

- イントロダクション

- 市場イニシアティブ

第14章 企業プロファイル

- Hexagon AB

- Singapore Technologies Engineering Ltd

- Legend Aerospace

- RTP Company

- Triumph Group Inc

- Spirit AeroSystems Holdings Inc

- Premium Aerotec GmbH

- Hutchinson SA

- Arconic Corp

- SEKISUI Aerospace

- Avantus Aerospace, Inc.

- Precision Castparts Corp.

- STROCO Manufacturing Inc

第15章 会社概要付録

List Of Tables

- Table 1. Aircraft Brackets Market Segmentation

- Table 2. List of Vendors

- Table 3. Aircraft Orders and Deliveries, by Boeing and Airbus, 2020 and 2023

- Table 4. North America Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Table 5. Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million) - by Aircraft Type

- Table 6. Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 7. Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 8. Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 9. North America Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 10. United States: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Aircraft Type

- Table 11. United States: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 12. United States: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 13. United States: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by End Use

- Table 14. Canada: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Aircraft Type

- Table 15. Canada: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 16. Canada: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 17. Canada: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by End Use

- Table 18. Mexico: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Aircraft Type

- Table 19. Mexico: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 20. Mexico: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 21. Mexico: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million) - by End Use

List Of Figures

- Figure 1. Aircraft Brackets Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Aircraft Brackets Market Revenue (US$ Million), 2021-2031

- Figure 5. Aircraft Brackets Market Share (%) - by Aircraft Type (2023 and 2031)

- Figure 6. Commercial Aircraft: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. General Aviation: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Military Aircraft: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Helicopter: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Aircraft Brackets Market Share (%) - by Application (2023 and 2031)

- Figure 11. Aircraft Fuselage: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Aircraft Wings: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Aircraft Control Surfaces: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Engine: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Others: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Aircraft Brackets Market Share (%) - by Material (2023 and 2031)

- Figure 17. Aluminum: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Steel: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Others: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Aircraft Brackets Market Share (%) - by End Use (2023 and 2031)

- Figure 21. OEMs: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Aftermarket: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. North America Aircraft Brackets Market, by Key Country- Revenue (2023) (US$ Million)

- Figure 24. North America Aircraft Brackets Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 25. United States: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million)

- Figure 26. Canada: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million)

- Figure 27. Mexico: Aircraft Brackets Market - Revenue and Forecast to 2031(US$ Million)

- Figure 28. Company Positioning & Concentration

The North America aircraft brackets market was valued at US$ 86.17 million in 2023 and is expected to reach US$ 137.67 million by 2031; it is anticipated to reach a CAGR of 6.0% from 2023 to 2031 .

Increasing Orders and Deliveries of Narrow Body Aircraft Fuel North America Aircraft Brackets Market

The aviation industry has matured rapidly over the years, recording a significant number of aircraft production and deliveries. This has showcased massive order volumes for various commercial aircraft manufacturers worldwide. Commercial aviation is foreseen to surge in the coming years with an increase in air travel passengers and aircraft volumes. The increase in orders of narrow body passenger and commercial aircraft across the globe drives the demand for aircraft brackets. After the COVID-19 pandemic and ongoing geopolitical wars in Europe and the Middle East, the global economy is weakening. However, people's desire to travel and the flow of travel have increased. In addition, the rapid growth of secondary and tertiary airports has continued due to the COVID-19 pandemic. Hence, airlines plan to expand to more remote locations by launching routes to smaller city airports. With the increasing number of aircraft and airports, the demand for aircraft brackets is also rising.

In the last two years, Boeing and Airbus have seen a significant increase in orders for narrow body aircraft. According to the Airbus order and delivery database, there were 820 commercial aircraft orders in 2022, which rose to 2094 in 2023, as shown in the above figure. However, according to the data, there is a rise in deliveries for narrow body aircraft-such as A220, A319 & A320, and A321-compared to the wide body aircraft-such as A330 and A350-in 2023, shown in the figure below.

Airbus and Boeing are the two aircraft manufacturing giants with significantly higher volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) continuously encounter orders for various aircraft models from civil airlines. The table below highlights the comparison of orders and deliveries from Airbus and Boeing during 2020-2023.

Moreover, Airbus forecasts that 40,850 new passenger and cargo aircraft will be delivered over the next 20 years, of which 32,630 will be typical single-aisle aircraft and 8,220 will be typical wide body aircraft from 2023 to 2042. In addition, the demand for freight aircraft is projected to reach 2,510 aircraft, with 920 newly built during the same timeframe. Thus, the increase in orders and deliveries of narrow body aircraft drives the market.

North America Aircraft Brackets Market Overview

The US, Canada, and Mexico are the major economies in North America. The expansion of aircraft fleets across the region primarily drives the aircraft brackets industry in North America. Additionally, the growing aviation industry in countries such as the US and Canada drives the aircraft brackets market. The aviation industry is one of the most notable industries in the US. According to data released by Airlines for America in 2023, commercial aviation accounted for 5% of US GDP and US$ 1.25 trillion in 2022. In addition to the rise in air passenger traffic, government initiatives to increase aircraft fleets in defense and commercial aviation sectors are expected to fuel the demand of North America aircraft brackets market during the forecast period.

North America Aircraft Brackets Market Revenue and Forecast to 2031 (US$ Million)

North America Aircraft Brackets Market Segmentation

The North America aircraft brackets market is categorized into aircraft type, application, material, end use, and country.

Based on aircraft type, the North America aircraft brackets market is segmented into commercial aircraft, general aviation, military aircraft, and helicopter. The commercial aircraft segment held the largest market share in 2023.

By application, the North America aircraft brackets market is segmented into aircraft fuselage, aircraft wings, aircraft control surfaces, engine, and others. The aircraft fuselage segment held the largest market share in 2023.

In the terms of material, the North America aircraft brackets market is segmented into aluminum, steel, and others. The aluminum segment held the largest market share in 2023.

By end use, the North America aircraft brackets market is bifurcated into OEMs and aftermarket. The OEMs segment held a larger market share in 2023.

By country, the North America aircraft brackets market is segmented into the US, Canada, and Mexico. The US dominated the North America aircraft brackets market share in 2023.

Arconic Corp; Godrej & Boyce Manufacturing Co Ltd; Hexagon AB; Hutchinson SA; Legend Aerospace; Precision Castparts Corp.; Premium Aerotec GmbH; RTP Company; SEKISUI Aerospace; Singapore Technologies Engineering Ltd; Spirit AeroSystems Holdings Inc; STROCO Manufacturing Inc.; and Triumph Group Inc are some of the leading companies operating in the North America aircraft brackets market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Aircraft Brackets Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. North America Aircraft Brackets Market - Key Market Dynamics

- 5.1 Aircraft Brackets Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Orders and Deliveries of Narrow Body Aircraft

- 5.2.2 Rising Deliveries of General Aviation Aircraft and Helicopters

- 5.3 Market Restraints

- 5.3.1 Suspended Production of B737 Max Program and Grounding of Airbus A320 by Spirit Airlines

- 5.3.2 Discontinuation of A380s and B747 Jumbo Jets

- 5.4 Market Opportunities

- 5.4.1 Increasing Global Aircraft Fleet Size

- 5.5 Future Trends

- 5.5.1 Increasing Adoption of Lightweight Material Based Aircraft Brackets

- 5.6 Impact of Drivers and Restraints:

6. Aircraft Brackets Market -North America Market Analysis

- 6.1 North America Overview

- 6.2 North America Aircraft Brackets Market Revenue (US$ Million), 2021-2031

- 6.3 North America Aircraft Brackets Market Forecast Analysis

7. North America Aircraft Brackets Market Analysis - by Aircraft Type

- 7.1 Commercial Aircraft

- 7.1.1 Overview

- 7.1.2 Commercial Aircraft: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 General Aviation

- 7.2.1 Overview

- 7.2.2 General Aviation: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Military Aircraft

- 7.3.1 Overview

- 7.3.2 Military Aircraft: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Helicopter

- 7.4.1 Overview

- 7.4.2 Helicopter: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Aircraft Brackets Market Analysis - by Application

- 8.1 Aircraft Fuselage

- 8.1.1 Overview

- 8.1.2 Aircraft Fuselage: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Aircraft Wings

- 8.2.1 Overview

- 8.2.2 Aircraft Wings: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Aircraft Control Surfaces

- 8.3.1 Overview

- 8.3.2 Aircraft Control Surfaces: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Engine

- 8.4.1 Overview

- 8.4.2 Engine: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Aircraft Brackets Market Analysis - by Material

- 9.1 Aluminum

- 9.1.1 Overview

- 9.1.2 Aluminum: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Steel

- 9.2.1 Overview

- 9.2.2 Steel: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Others

- 9.3.1 Overview

- 9.3.2 Others: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Aircraft Brackets Market Analysis - by End Use

- 10.1 OEMs

- 10.1.1 Overview

- 10.1.2 OEMs: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Aftermarket

- 10.2.1 Overview

- 10.2.2 Aftermarket: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Aircraft Brackets Market - Country Analysis

- 11.1 North America

- 11.1.1 North America Aircraft Brackets Market, by Key Country- Revenue (2023) (US$ Million)

- 11.1.2 North America Aircraft Brackets Market - Revenue and Forecast Analysis - by Country

- 11.1.2.1 North America Aircraft Brackets Market - Revenue and Forecast Analysis - by Country

- 11.1.2.2 United States: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.2.1 United States: Aircraft Brackets Market Breakdown, by Aircraft Type

- 11.1.2.2.2 United States: Aircraft Brackets Market Breakdown, by Application

- 11.1.2.2.3 United States: Aircraft Brackets Market Breakdown, by Material

- 11.1.2.2.4 United States: Aircraft Brackets Market Breakdown, by End Use

- 11.1.2.3 Canada: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.3.1 Canada: Aircraft Brackets Market Breakdown, by Aircraft Type

- 11.1.2.3.2 Canada: Aircraft Brackets Market Breakdown, by Application

- 11.1.2.3.3 Canada: Aircraft Brackets Market Breakdown, by Material

- 11.1.2.3.4 Canada: Aircraft Brackets Market Breakdown, by End Use

- 11.1.2.4 Mexico: Aircraft Brackets Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.4.1 Mexico: Aircraft Brackets Market Breakdown, by Aircraft Type

- 11.1.2.4.2 Mexico: Aircraft Brackets Market Breakdown, by Application

- 11.1.2.4.3 Mexico: Aircraft Brackets Market Breakdown, by Material

- 11.1.2.4.4 Mexico: Aircraft Brackets Market Breakdown, by End Use

12. Competitive Landscape

- 12.1 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

14. Company Profiles

- 14.1 Hexagon AB

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Singapore Technologies Engineering Ltd

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Legend Aerospace

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 RTP Company

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Triumph Group Inc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Spirit AeroSystems Holdings Inc

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Premium Aerotec GmbH

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Hutchinson SA

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Arconic Corp

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 SEKISUI Aerospace

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

- 14.11 Avantus Aerospace, Inc.

- 14.11.1 Key Facts

- 14.11.2 Business Description

- 14.11.3 Products and Services

- 14.11.4 Financial Overview

- 14.11.5 SWOT Analysis

- 14.11.6 Key Developments

- 14.12 Precision Castparts Corp.

- 14.12.1 Key Facts

- 14.12.2 Business Description

- 14.12.3 Products and Services

- 14.12.4 Financial Overview

- 14.12.5 SWOT Analysis

- 14.12.6 Key Developments

- 14.13 STROCO Manufacturing Inc

- 14.13.1 Key Facts

- 14.13.2 Business Description

- 14.13.3 Products and Services

- 14.13.4 Financial Overview

- 14.13.5 SWOT Analysis

- 14.13.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners