|

|

市場調査レポート

商品コード

1764868

北米のプラスチックパイプ市場の2031年までの予測-地域別分析-タイプ別、材料別、用途別、最終用途産業別North America Plastic Pipes Market Forecast to 2031- Regional Analysis- by Type, Material Type, Application, and End-Use Industry |

||||||

|

|||||||

| 北米のプラスチックパイプ市場の2031年までの予測-地域別分析-タイプ別、材料別、用途別、最終用途産業別 |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 89 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のプラスチックパイプ市場は、2023年に125億42万米ドルと評価され、2031年には194億6,032万米ドルに達すると予測され、2023~2031年のCAGRは5.7%と予測されています。

住宅・商業建設活動の拡大が北米のプラスチックパイプ市場を牽引

住宅市場の成長は、人口増加、都市化、良好な経済状況などの要因によるものです。Redfinによると、2024年1月に販売された住宅数は28万4,121戸で、2023年1月に米国で販売された数を1.8%上回りました。住宅建設は民間部門の重要なコンポーネントです。2023年6月の季節調整済み年率は8,563億米ドルとなり、5月修正値の8,486億米ドルから0.9%増加しました。2023年3月、政府はカナダ全土で少なくとも10万戸の住宅建設を支援するため、29億6,000万米ドルの住宅促進基金を立ち上げました。米国国勢調査局によると、2023年11月の個人所有住宅数(季節調整済み年率)は156万戸で、2022年11月の143万戸に比べ9.3%増加しました。

米国の月次住宅新築件数(2022~2023年)

供給源米国国勢調査局と米国住宅都市開発省(2023年)

米国国勢調査局が発表した報告書によると、2023年の建設(民間・公共)投資総額は1兆9,787億米ドルで、2022年の投資額1兆8,487億米ドルから7%増加しました。プラスチックパイプは、その汎用性、耐久性、費用対効果により、建設用途に広く使用されています。PVC、PEX、HDPEは、設置が容易で寿命が長いため、好まれる材料です。商業建築では、プラスチックパイプは給水、配管、HVACシステム、消火システムに使用されます。住宅の配管では、温水と冷水の両方の配管にプラスチック管が使われています。そのため、住宅や商業施設の建設活動の増加が北米のプラスチックパイプ市場を牽引しています。

北米のプラスチックパイプ市場概要

北米のには膨大なパイプライン網があり、水、有害液体、原料の輸送に重要な役割を果たしています。パイプライン危険物安全管理局によると、北米のでは約260万マイルのパイプラインが年間数千億トンの液体石油製品と数兆立方フィートの天然ガスを輸送しています。カナダエネルギー規制当局によると、カナダで生産される原油のほとんどは、西部の州から米国、オンタリオ州、ケベック州の製油所までパイプラインを使って輸送されます。北米の石油・ガス産業では、生産される流体ラインの塩分、硫黄、その他の腐食性成分による水質汚染に起因する腐食に関する課題を解決するため、定格圧力が高く、口径の大きな配管が必要とされています。プラスチック複合パイプの難燃性と非腐食性の特性は、これらの問題に対する効果的な解決策を記載しています。このように、石油・ガス生産の増加に伴い、プラスチックパイプの需要は北米ので高まっています。米国やカナダなどの国々では、パイプラインやタンカーよりも鉄道などの他の輸送媒体の方がコストが高いため、パイプラインを使用して原油を地域の製油所まで輸送しています。

北米のプラスチックパイプ市場の収益と2031年までの予測(金額)

北米のプラスチックパイプ市場のセグメンテーション

北米のプラスチックパイプ市場は、タイプ、材料タイプ、用途、最終用途産業、国に分類されます。

タイプ別では、北米のプラスチックパイプ市場は波型と平滑壁に二分されます。平滑壁セグメントは2023年に大きな市場シェアを占めました。

材料タイプ別では、北米のプラスチックパイプ市場はポリ塩化ビニル、高密度ポリエチレン、ポリプロピレン、その他に分けられます。2023年にはポリ塩化ビニルセグメントが最大の市場シェアを占めています。

用途別では、北米のプラスチックパイプ市場は、給水、下水・排水、灌漑、ガス配給、その他に区分されます。2023年には給水セグメントが最大の市場シェアを占めました。

最終用途産業に基づいて、北米のプラスチックパイプ市場は建設インフラ、上下水道管理、石油・ガス、その他に区分されます。2023年の市場シェアは建設インフラセグメントが大きいです。

国別では、北米のプラスチックパイプ市場は米国、カナダ、メキシコに区分されます。2023年の北米のプラスチックパイプ市場シェアは米国が独占しました。

Advanced Drainage Systems Inc、Aliaxis Holdings SA、Genuit Group Plc、Georg Fischer Ltd、JM Eagle, Inc、Orbia、and Sekisui Chemical Co Ltdなどが北米のプラスチックパイプ市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

- 市場の魅力

第3章 調査手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国別データ

第4章 北米のプラスチックパイプ市場情勢

- イントロダクション

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原料サプライヤー

- プラスチックパイプメーカー

- ディストリビューター/サプライヤー

- 最終用途産業

- バリューチェーンのベンダー一覧

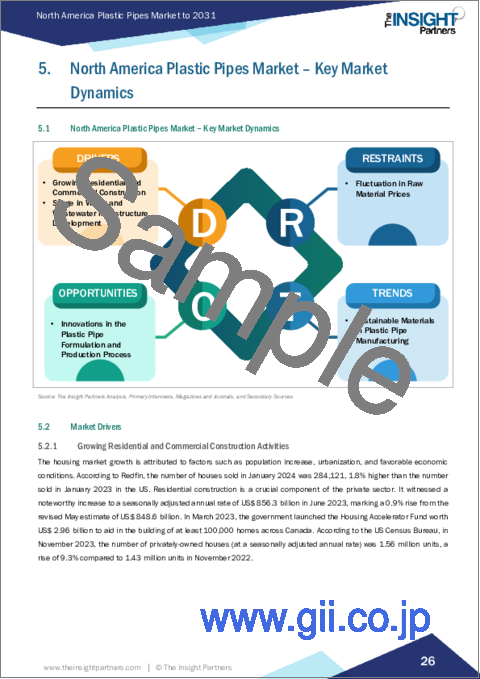

第5章 北米のプラスチックパイプ市場:主要市場力学

- 北米のプラスチックパイプ市場:主要市場力学

- 市場促進要因

- 住宅と商業施設の建設活動の成長

- 上下水道インフラ開発の急増

- 市場抑制要因

- 原料価格の変動

- 市場機会

- プラスチックパイプの配合と製造プロセスにおける技術革新

- 今後の動向

- プラスチックパイプ製造におけるサステイナブル材料の使用

- 促進要因と抑制要因の影響

第6章 北米のプラスチックパイプ市場:市場分析

- イントロダクション

- 北米のプラスチックパイプ市場売上高:2021~2031年

- 北米のプラスチックパイプ市場予測分析

第7章 北米のプラスチックパイプ市場分析-タイプ別

- 波形

- スムースウォール

第8章 北米のプラスチックパイプ市場分析-材料タイプ別

- ポリ塩化ビニル

- 高密度ポリエチレン

- ポリプロピレン

- その他

第9章 北米のプラスチックパイプ市場分析-用途別

- 上水道

- 下水・排水

- 灌漑

- ガス配給

- その他

第10章 北米のプラスチックパイプ市場分析-最終用途産業別

- 建設インフラ

- 上下水道管理

- 石油・ガス

- その他

第11章 北米のプラスチックパイプ市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- 主要市場参入企業によるヒートマップ分析

- 企業のポジショニングと集中度

第13章 産業情勢

- イントロダクション

- 有機的成長戦略

- 無機的成長戦略

第14章 企業プロファイル

- JM Eagle, Inc.

- Sekisui Chemical Co Ltd

- Georg Fischer Ltd

- Genuit Group Plc

- Orbia

- Aliaxis Holdings SA

- Advanced Drainage Systems Inc

第15章 企業概要付録

List Of Tables

- Table 1. North America Plastic Pipes Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 5. North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million) - by Material Type

- Table 6. North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 7. North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million) - by End-use Industry

- Table 8. North America: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 9. United States: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 10. United States: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 11. United States: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 12. United States: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by End-use Industry

- Table 13. Canada: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 14. Canada: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 15. Canada: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 16. Canada: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by End-use Industry

- Table 17. Mexico: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 18. Mexico: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Material Type

- Table 19. Mexico: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 20. Mexico: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million) - by End-use Industry

List Of Figures

- Figure 1. North America Plastic Pipes Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem Analysis: North America Plastic Pipes Market

- Figure 4. Monthly New Residential Construction in the US (2022-2023)

- Figure 5. Producer Price Index by Industry: Plastics Material and Resin Manufacturing (2018-2024)

- Figure 6. Impact Analysis of Drivers and Restraints

- Figure 7. North America Plastic Pipes Market Revenue (US$ Million), 2021-2031

- Figure 8. North America Plastic Pipes Market Share (%) - by Type (2023 and 2031)

- Figure 9. Corrugated: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Single-Wall: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Multi-Wall: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Smoothwall: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. North America Plastic Pipes Market Share (%) - by Material Type (2023 and 2031)

- Figure 14. Polyvinyl Chloride: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. High-Density Polyethylene: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Polypropylene: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. North America Plastic Pipes Market Share (%) - by Application (2023 and 2031)

- Figure 19. Water Supply: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Sewage and Drainage: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Irrigation: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Gas Distribution: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Others: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. North America Plastic Pipes Market Share (%) - by End-use Industry (2023 and 2031)

- Figure 25. Construction and Infrastructure: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Water and Wastewater Management: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Oil and Gas: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Others: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. North America Plastic Pipes Market, by Key Countries- Revenue (2023) US$ Million

- Figure 30. North America: Plastic Pipes Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 31. United States: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. Canada: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million)

- Figure 33. Mexico: Plastic Pipes Market - Revenue and Forecast to 2031(US$ Million)

- Figure 34. Heat Map Analysis by Key Market Players

- Figure 35. Company Positioning & Concentration

The North America plastic pipes market was valued at US$ 12,500.42 million in 2023 and is projected to reach US$ 19,460.32 million by 2031; it is anticipated to register a CAGR of 5.7% from 2023 to 2031.

Growing Residential and Commercial Construction Activities Drives North America Plastic Pipes Market

The housing market growth is attributed to factors such as population increase, urbanization, and favorable economic conditions. According to Redfin, the number of houses sold in January 2024 was 284,121, 1.8% higher than the number sold in January 2023 in the US. Residential construction is a crucial component of the private sector. It witnessed a noteworthy increase to a seasonally adjusted annual rate of US$ 856.3 billion in June 2023, marking a 0.9% rise from the revised May estimate of US$ 848.6 billion. In March 2023, the government launched the Housing Accelerator Fund worth US$ 2.96 billion to aid in the building of at least 100,000 homes across Canada. According to the US Census Bureau, in November 2023, the number of privately-owned houses (at a seasonally adjusted annual rate) was 1.56 million units, a rise of 9.3% compared to 1.43 million units in November 2022.

Monthly New Residential Construction in the Us (2022-2023)

Source: The US Census Bureau and the US Department of Housing and Urban Development, 2023

According to a report released by the US Census Bureau, the value of total construction (private and public) investment in 2023 was US$ 1,978.7 billion, a 7% increase from investments of US$ 1,848.7 billion in 2022. Plastic pipes are extensively used in construction applications due to their versatility, durability, and cost-effectiveness. PVC, PEX, and HDPE are preferred materials due to their ease of installation and long lifespan. In commercial construction, plastic pipes are used in water supply, plumbing, HVAC systems, and fire suppression systems. Plastic pipes are used in residential plumbing for both hot and cold-water lines. Therefore, the growing residential and commercial construction activities drive the North America plastic pipes market.

North America Plastic Pipes Market Overview

North America has a massive network of inter and intrastate pipelines that serve an important role in transporting water, hazardous liquids, and raw materials. According to the Pipeline and Hazardous Materials Safety Administration, in North America, approximately 2.6 million miles of pipelines deliver hundreds of billions of tons of liquid petroleum products and trillions of cubic feet of natural gas yearly. Per the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. In North America, the oil & gas industry requires higher-pressure rated and larger diameter piping to control challenges related to corrosion caused by contamination of water with salt, sulfur, and other corrosive elements in produced fluid lines. The flame retardant and non-corrosive characteristics of plastic composite pipes provide an effective solution for these issues. Thus, with the growing oil & gas production, the demand for plastic pipes is rising in North America. Countries such as the US and Canada use pipelines to transport crude oil to refineries in the region, as other transport mediums, such as rail, are more expensive than pipelines and tankers.

North America Plastic Pipes Market Revenue and Forecast to 2031 (US$ Million)

North America Plastic Pipes Market Segmentation

The North America plastic pipes market is categorized into type, material type, application, end-use industry, and country.

Based on type, the North America plastic pipes market is bifurcated into corrugated and smooth wall. The smooth wall segment held a larger market share in 2023.

By material type, the North America plastic pipes market is divided into polyvinyl chloride, high-density polyethylene, polypropylene, and others. The polyvinyl chloride segment held the largest market share in 2023.

In terms of application, the North America plastic pipes market is segmented into water supply, sewage and drainage, irrigation, gas distribution, and others. The water supply segment held the largest market share in 2023.

Based on end-use industry, the North America plastic pipes market is segmented into construction and infrastructure, water and wastewater management, oil and gas, and others. The construction and infrastructure segment held a larger market share in 2023.

By country, the North America plastic pipes market is segmented into the US, Canada, and Mexico. The US dominated the North America plastic pipes market share in 2023.

Advanced Drainage Systems Inc; Aliaxis Holdings SA; Genuit Group Plc; Georg Fischer Ltd; JM Eagle, Inc.; Orbia; and Sekisui Chemical Co Ltd are some of the leading companies operating in the North America plastic pipes market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Plastic Pipes Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.1 Threat of New Entrants

- 4.2.2 Intensity of Competitive Rivalry

- 4.2.3 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Plastic Pipe Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End-Use Industry

- 4.3.5 List of Vendors in the Value Chain

5. North America Plastic Pipes Market - Key Market Dynamics

- 5.1 North America Plastic Pipes Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Residential and Commercial Construction Activities

- 5.2.2 Surging Water and Wastewater Infrastructure Development

- 5.3 Market Restraints

- 5.3.1 Fluctuations in Raw Material Prices

- 5.4 Market Opportunities

- 5.4.1 Innovations in Plastic Pipe Formulation and Production Processes

- 5.5 Future Trends

- 5.5.1 Use of Sustainable Materials in Plastic Pipe Manufacturing

- 5.6 Impact of Drivers and Restraints:

6. North America Plastic Pipes Market - Market Analysis

- 6.1 Overview

- 6.2 North America Plastic Pipes Market Revenue (US$ Million), 2021-2031

- 6.3 North America Plastic Pipes Market Forecast Analysis

7. North America Plastic Pipes Market Analysis - by Type

- 7.1 Corrugated

- 7.1.1 Overview

- 7.1.2 Corrugated: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.3 Single-Wall

- 7.1.3.1 Overview

- 7.1.3.2 Single-Wall: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.4 Multi-Wall

- 7.1.4.1 Overview

- 7.1.4.2 Multi-Wall: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Smoothwall

- 7.2.1 Overview

- 7.2.2 Smoothwall: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Plastic Pipes Market Analysis - by Material Type

- 8.1 Polyvinyl Chloride

- 8.1.1 Overview

- 8.1.2 Polyvinyl Chloride: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 High-Density Polyethylene

- 8.2.1 Overview

- 8.2.2 High-Density Polyethylene: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Polypropylene

- 8.3.1 Overview

- 8.3.2 Polypropylene: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Plastic Pipes Market Analysis - by Application

- 9.1 Water Supply

- 9.1.1 Overview

- 9.1.2 Water Supply: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Sewage and Drainage

- 9.2.1 Overview

- 9.2.2 Sewage and Drainage: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Irrigation

- 9.3.1 Overview

- 9.3.2 Irrigation: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Gas Distribution

- 9.4.1 Overview

- 9.4.2 Gas Distribution: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Plastic Pipes Market Analysis - by End-use Industry

- 10.1 Construction and Infrastructure

- 10.1.1 Overview

- 10.1.2 Construction and Infrastructure: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Water and Wastewater Management

- 10.2.1 Overview

- 10.2.2 Water and Wastewater Management: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Oil and Gas

- 10.3.1 Overview

- 10.3.2 Oil and Gas: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Others

- 10.4.1 Overview

- 10.4.2 Others: North America Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Plastic Pipes Market -Country Analysis

- 11.1 North America Plastic Pipes Market, by Key Countries- Revenue (2023) US$ Million

- 11.1.1 North America: Plastic Pipes Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 North America: Plastic Pipes Market - Revenue and Forecast Analysis - by Country

- 11.1.1.2 United States: Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.2.1 United States: Plastic Pipes Market Breakdown, by Type

- 11.1.1.2.2 United States: Plastic Pipes Market Breakdown, by Material Type

- 11.1.1.2.3 United States: Plastic Pipes Market Breakdown, by Application

- 11.1.1.2.4 United States: Plastic Pipes Market Breakdown, by End-use Industry

- 11.1.1.3 Canada: Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.3.1 Canada: Plastic Pipes Market Breakdown, by Type

- 11.1.1.3.2 Canada: Plastic Pipes Market Breakdown, by Material Type

- 11.1.1.3.3 Canada: Plastic Pipes Market Breakdown, by Application

- 11.1.1.3.4 Canada: Plastic Pipes Market Breakdown, by End-use Industry

- 11.1.1.4 Mexico: Plastic Pipes Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.4.1 Mexico: Plastic Pipes Market Breakdown, by Type

- 11.1.1.4.2 Mexico: Plastic Pipes Market Breakdown, by Material Type

- 11.1.1.4.3 Mexico: Plastic Pipes Market Breakdown, by Application

- 11.1.1.4.4 Mexico: Plastic Pipes Market Breakdown, by End-use Industry

- 11.1.1 North America: Plastic Pipes Market - Revenue and Forecast Analysis - by Country

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Market Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Organic Growth Strategies

- 13.3 Inorganic Growth Strategies

14. Company Profiles

- 14.1 JM Eagle, Inc.

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Sekisui Chemical Co Ltd

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Georg Fischer Ltd

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Genuit Group Plc

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Orbia

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Aliaxis Holdings SA

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Advanced Drainage Systems Inc

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners