|

|

市場調査レポート

商品コード

1764840

北米の細胞・遺伝子治療市場の2031年までの予測:地域別分析 - タイプ別、サービスプロバイダー別、規模別、サービスプロバイダー別、エンドユーザー別North America Cell and Gene Therapy Market Forecast to 2031 - Regional Analysis - by Type, Services, Scale, Service Providers, and End User |

||||||

|

|||||||

| 北米の細胞・遺伝子治療市場の2031年までの予測:地域別分析 - タイプ別、サービスプロバイダー別、規模別、サービスプロバイダー別、エンドユーザー別 |

|

出版日: 2025年04月14日

発行: The Insight Partners

ページ情報: 英文 142 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の細胞・遺伝子治療市場は、2023年に21億5,908万米ドルと評価され、2031年には140億4,906万米ドルに達すると予測され、2023年から2031年までのCAGRは26.4%を記録すると推定されます。

細胞・遺伝子治療の承認件数の増加が北米の細胞・遺伝子治療市場を押し上げます。

バイオテクノロジーの進歩により、幅広い適応症に対する個別化治療の導入が進んでいます。幹細胞治療は、がん、神経疾患、遺伝性疾患、その他の慢性疾患の治療に用いられています。さらに、細胞治療の利点として、標的を絞った治療、迅速かつ効率的な回復、副作用の軽減などが挙げられます。細胞療法は、食品医薬品局(FDA)認可の製品が入手可能なことから、世界中で広く採用されています。2024年4月、FDAはBEQVEZを、第IX因子(FIX)予防療法を受けている中等度から重度の血友病Bに罹患している成人の治療に使用することをファイザー社に承認しました。FIX欠乏症は、稀な遺伝的出血性疾患である血友病Bの患者を、健康な人に比べてより頻繁に、より長期間出血させます。この病気は正常な血液凝固を妨げます。2023年、FDAは、コラーゲンVII型α1鎖(COL7A1)遺伝子に変異を示す生後6カ月以上のジストロフィー性表皮水疱症患者の創傷治療薬として、クリスタル・バイオテック社製のVYJUVEKを承認しました。2023年、Ferring Pharmaceuticals A/Sによって製造されたアデノウイルス製剤ADSTILADRINがFDAによって承認されました。この組換えアデノウイルス(rAd-IFNa/Syn3)は、ヒトインターフェロンアルファ-2b cDNAを膀胱上皮に送り込み、ある種の膀胱がん患者を治療します。2023年、ヤンセン・バイオテック社製のCARVYKTI(レンチウイルスで操作された自己CAR-T細胞で、BCMAを発現する腫瘍細胞を攻撃し、ある種の再発または難治性の多発性骨髄腫の治療に使用)もFDAに承認されました。2021年3月、再発・難治性多発性骨髄腫に対する初の抗BCMA CAR T細胞療法であるAbecma(イデカブタジェンビクリューセル)が、ブリストル・マイヤーズスクイブ社とブルーバード・バイオ社により米国FDAより承認されました。2020年4月、FDAは成人の難治性(r/r)濾胞性リンパ腫(FL)の治療薬としてノバルティスのKymriahに再生医療先進治療の指定を与えました。2020年7月、FDAはマントル細胞リンパ腫患者を対象としたCAR T細胞療法brexucabtagene autoleucel(Tecartus)を承認しました。マントル細胞リンパ腫に対してFDAが承認した初めてのCAR T細胞療法であり、加速承認経路の下で承認されました。また、Tecartusは希少疾病治療薬の開発を奨励する希少疾病用医薬品の指定も受けています。がんに対する他のCAR-T細胞療法として承認されているのは、急性リンパ芽球性白血病に対するKymriahとびまん性大細胞型B細胞リンパ腫に対するYescartaです。したがって、細胞・遺伝子治療の承認件数の増加は製造能力を高め、北米の細胞・遺伝子治療市場の成長を後押ししています。

北米の細胞・遺伝子治療市場概要

北米の細胞・遺伝子治療市場は米国、カナダ、メキシコに区分されます。2023年の北米の細胞・遺伝子治療市場シェアは米国が最大。米国における細胞・遺伝子治療市場の成長は、幹細胞治療、遺伝子治療、免疫治療などの細胞治療の採用が拡大していることに起因しています。遺伝性疾患や細胞性疾患の増加が、細胞療法の需要増につながっています。米国遺伝子・細胞治療学会(ASGCT)によると、現在、前臨床試験から予備登録までのパイプラインにある治療法は3,633種類あり、その55%が遺伝子治療、22%が非遺伝子組み換え細胞、23%がRNA治療です。これらは、がん、遺伝性疾患、神経疾患など、さまざまな疾患や病態を対象としています。2024年2月現在、米国では19の細胞・遺伝子治療製品が、がん、眼疾患、希少遺伝性疾患の治療薬として承認されています。また、米国では細胞療法を革新する新興企業の数が増加しています。加えて、政府からの支援の高まりが細胞治療の成長を促進し、市場開拓に影響を与えています。例えば、公的機関である米国遺伝子・細胞治療学会(ASGCT)は、遺伝子・細胞治療に携わる科学者、医師、専門家、患者擁護者に会員資格を提供しています。ASGCTは、細胞・遺伝子治療の臨床応用に関する知識、教育、認識を高めることを目的としています。

北米の細胞・遺伝子治療市場のセグメンテーション

北米の細胞・遺伝子治療市場は、タイプ、サービス、規模、エンドユーザー、国に分類されます。

タイプ別では、北米の細胞・遺伝子治療市場は細胞治療と遺伝子治療に二分されます。2023年には、細胞療法分野がより大きな市場シェアを占めています。さらに、細胞療法セグメントは同種、自家、ウイルスベクターに細分化されます。さらに、遺伝子治療セグメントは非ウイルスベクターとウイルスベクターに分けられます。

サービスの面では、北米の細胞・遺伝子治療市場はプロセス開発、cGMP製造、レギュラトリーサービス、バイオアッセイサービスに分類されます。2023年にはプロセス開発分野が最大の市場シェアを占めています。

規模別では、北米の細胞・遺伝子治療市場はプレコマーシャル/R&D製造とコマーシャルスケール製造に二分されます。2023年には、プレコマーシャル/R&D製造セグメントがより大きな市場シェアを占めました。

エンドユーザー別に見ると、北米の細胞・遺伝子治療市場は、契約研究機関、製薬・バイオ製薬企業、学術・研究機関に区分されます。2023年には、契約研究機関セグメントが最大の市場シェアを占めました。

国別では、北米の細胞・遺伝子治療市場は米国、カナダ、メキシコに区分されます。2023年の北米の細胞・遺伝子治療市場シェアは米国が独占しました。

Catalent Inc.、Charles River Laboratories International Inc.、F. Hoffmann-La Roche Ltd.、FUJIFILM Holdings Corp.、Lonza Group AG、Lotte Corp.、Merck KGaA、Takara Bio Inc.、Thermo Fisher Scientific Inc.、WuXi AppTec Co Ltd.などが北米の細胞・遺伝子治療市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 細胞・遺伝子治療の市場情勢

- PEST分析

第5章 北米の細胞・遺伝子治療市場:主要市場力学

- 細胞・遺伝子治療市場:主要市場力学

- 市場促進要因

- 細胞・遺伝子治療の承認件数の増加

- 細胞・遺伝子治療製造のアウトソーシングの急速な普及

- 市場抑制要因

- 細胞・遺伝子治療製造の高コスト

- 市場機会

- 企業による戦略的取り組み

- 今後の動向

- 細胞・遺伝子治療製造サービスの自動化

- 促進要因と抑制要因の影響

第6章 細胞・遺伝子治療市場:北米市場分析

- 北米の細胞・遺伝子治療市場概要

- 北米の細胞・遺伝子治療市場収益、2021年~2031年

- 北米の細胞・遺伝子治療市場予測分析

第7章 北米の細胞・遺伝子治療市場分析:タイプ別

- 細胞療法

- 遺伝子治療

第8章 北米の細胞・遺伝子治療市場分析:サービス別

- プロセス開発

- cGMP製造

- レギュラトリーサービス

- バイオアッセイサービス

第9章 北米の細胞・遺伝子治療市場分析:規模別

- プレコマーシャル/R&D製造

- 商業スケール製造

第10章 北米の細胞・遺伝子治療市場分析:サービスプロバイダー別

- CDMO

- CMO

第11章 北米の細胞・遺伝子治療市場分析:エンドユーザー別

- 契約研究機関

- 製薬・バイオ製薬企業

- 学術・研究機関

第12章 北米の細胞・遺伝子治療市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第13章 業界情勢

- 細胞・遺伝子治療市場における成長戦略

- 有機的成長戦略

- 無機的成長戦略

第14章 企業プロファイル

- Thermo Fisher Scientific Inc.

- Merck KGaA

- Charles River Laboratories International Inc

- Lonza Group AG

- WuXi AppTec Co Ltd

- Takara Bio Inc

- FUJIFILM Holdings Corp

- F. Hoffmann-La Roche Ltd

- Catalent Inc

- Lotte Corp

第15章 付録

List Of Tables

- Table 1. Cell and Gene Therapy Market Segmentation

- Table 2. North America Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 4. Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million) - by Cell Therapy

- Table 5. Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million) - by Gene Therapy

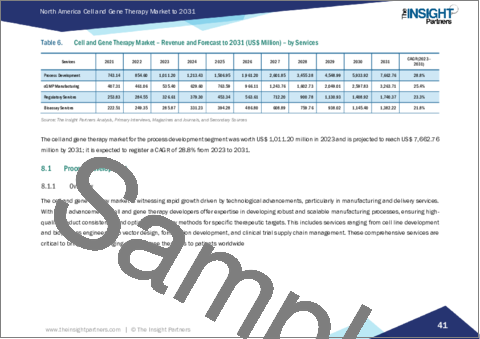

- Table 6. Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million) - by Services

- Table 7. Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million) - by Scale

- Table 8. Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million) - by Service Providers

- Table 9. Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 10. North America: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 11. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 12. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Cell Therapy

- Table 13. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Gene Therapy

- Table 14. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 15. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Scale

- Table 16. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Service Providers

- Table 17. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 18. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 19. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Cell Therapy

- Table 20. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Gene Therapy

- Table 21. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 22. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Scale

- Table 23. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Service Providers

- Table 24. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 25. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 26. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Cell Therapy

- Table 27. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Gene Therapy

- Table 28. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Services

- Table 29. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Scale

- Table 30. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by Service Providers

- Table 31. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 32. Recent Organic Growth Strategies in Cell and Gene Therapy Market

- Table 33. Recent Inorganic Growth Strategies in the Cell and Gene Therapy Market

- Table 34. Glossary of Terms

List Of Figures

- Figure 1. Cell and Gene Therapy Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Norh America Cell and Gene Therapy Market Revenue (US$ Million), 2021-2031

- Figure 5. Cell and Gene Therapy Market Share (%) - by Type (2023 and 2031)

- Figure 6. Cell Therapy: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Gene Therapy: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Cell and Gene Therapy Market Share (%) - by Services (2023 and 2031)

- Figure 9. Process Development: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. cGMP Manufacturing: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Regulatory Services: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Bioassay Services: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Cell and Gene Therapy Market Share (%) - by Scale (2023 and 2031)

- Figure 14. Pre-Commercial/R&D Manufacturing: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Commercial Scale Manufacturing: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Cell and Gene Therapy Market Share (%) - by Service Providers (2023 and 2031)

- Figure 17. CDMOs: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. CMOs: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Cell and Gene Therapy Market Share (%) - by End User (2023 and 2031)

- Figure 20. Contract Research Organizations: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Pharmaceutical and Biopharmaceutical Companies: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Academic and Research Institutes: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. North America Cell and Gene Therapy Market, by Key Country- Revenue (2023) (US$ Million)

- Figure 24. North America Cell and Gene Therapy Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 25. United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million)

- Figure 26. Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million)

- Figure 27. Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031(US$ Million)

- Figure 28. Growth Strategies in Cell and Gene Therapy Market

The North America cell and gene therapy market was valued at US$ 2,159.08 million in 2023 and is projected to reach US$ 14,049.06 million by 2031; it is estimated to record a CAGR of 26.4% from 2023 to 2031.

Increase in Number of Approval of Cell and Gene Therapies Boosts North America Cell and Gene Therapy Market

The advancements in biotechnology have led to the adoption of personalized treatments for a wide range of indications. Stem cell therapies are being used to treat cancer, neurological disorders, genetic disorders, and other chronic diseases. Further, the advantages of cell therapy include targeted treatment, rapid and efficient recovery, and reduced side effects. Cell therapies are widely adopted worldwide owing to the availability of Food and Drug Administration (FDA) approved products. A few of the cell and gene therapy products approved by the FDA in recent years are mentioned; In April 2024, the FDA approved BEQVEZ for use by Pfizer Inc. to treat adults suffering from moderate to severe hemophilia B who are on factor IX (FIX) prophylaxis therapy. A FIX deficiency causes people with hemophilia B, a rare genetic bleeding illness, to bleed more frequently and for longer periods than healthy people. The disease hinders normal blood clotting. In 2023, the FDA approved VYJUVEK, manufactured by Krystal Biotech, Inc., for the treatment of wounds in patients ages 6 months and above with dystrophic epidermolysis bullosa, showing mutation(s) in the collagen type VII alpha 1 chain (COL7A1) gene. In 2023, ADSTILADRIN, an adenovirus manufactured by Ferring Pharmaceuticals A/S, was approved by the FDA. This recombinant adenovirus (rAd-IFNa/Syn3) delivers human interferon alfa-2b cDNA into the bladder epithelium to treat patients with certain types of bladder cancer. In 2023, CARVYKTI, manufactured by Janssen Biotech, Inc.-an autologous CAR-T cell engineered with lentivirus to attack BCMA-expressing tumor cells for the treatment of certain kinds of relapsed or refractory multiple myeloma-was also approved by the FDA. In 2023, the FDA approved HEMGENIX, manufactured by CSL Behring LLC, which is a recombinant AAV5 that delivers F9 to treat patients with certain kinds of Hemophilia B. In March 2021, the first anti-BCMA CAR T cell therapy for relapsed or resistant multiple myeloma, called Abecma (idecabtagene vicleucel), has been approved by the US FDA for use by Bristol Myers Squibb and Bluebird Bio. In April 2020, the FDA awarded regenerative medicine advanced therapy designation to Novartis' Kymriah to treat refractory (r/r) follicular lymphoma (FL) in adults. In July 2020, the FDA approved a CAR T-cell therapy brexucabtagene autoleucel (Tecartus) for patients with mantle cell lymphoma. It is the first FDA-approved CAR T-cell therapy for mantle cell lymphoma, and it was approved under the accelerated approval pathway. Tecartus also received Orphan Drug designation, which encourages the development of drugs for rare diseases. The other approved CAR-T cell therapies for cancer are Kymriah for acute lymphoblastic leukemia and Yescarta for diffuse large B-cell lymphoma. Therefore, the increasing number of approvals of cell and gene therapies enhances manufacturing capabilities, which fuels the North America cell and gene therapy market growth.

North America Cell and Gene Therapy Market Overview

The cell and gene therapy market in North America is segmented into the US, Canada, and Mexico. The US held the largest North American cell and gene therapy market share in 2023. The cell and gene therapies market growth in the US is attributed the growing adoption of cell therapies such as stem cell, gene, and immune therapies. Growing incidences of genetic and cellular disorders are leading to increasing demand for cell therapies. According to the American Society of Gene & Cell Therapy (ASGCT), there are currently 3,633 therapies in the pipeline-55% are gene, 22% are non-genetically modified cells, and 23% are RNA-from preclinical through pre-registration. These are focused on various diseases and conditions varying from cancer to genetic disorders to neurological conditions. As of February 2024, 19 cell and gene therapy products have been approved in the US for treating cancer, eye diseases, and rare hereditary diseases. Also, the country is experiencing an increasing number of start-ups innovating cell therapies. In addition, growing support from the government is promoting the growth of cell therapies, influencing the development of the market. For instance, the American Society of Gene & Cell Therapy (ASGCT), a public organization, offers memberships to scientists, physicians, professionals, and patient advocates who are engaged in gene and cell therapies. ASGCT aims to enhance knowledge, education, and awareness regarding the clinical application of cell and gene therapies.

North America Cell and Gene Therapy Market Revenue and Forecast to 2031 (US$ Million)

North America Cell and Gene Therapy Market Segmentation

The North America cell and gene therapy market is categorized into type, services, scale, end user, and country.

Based on type, the North America cell and gene therapy market is bifurcated into cell therapy and gene therapy. The cell therapy segment held a larger market share in 2023. Furthermore, the cell therapy segment is sub segmented into allogeneic, autologous, viral vectors. Additionally, the gene therapy segment is divided into non-viral vectors and viral vectors.

In terms of services, the North America cell and gene therapy market is categorized process development, cGMP manufacturing, regulatory services, and bioassay services. The process development segment held the largest market share in 2023.

By scale, the North America cell and gene therapy market is bifurcated into pre-commercial/R&D manufacturing and commercial scale manufacturing. The pre-commercial/R&D manufacturing segment held a larger market share in 2023.

Based on end user, the North America cell and gene therapy market is segmented into contract research organizations, pharmaceutical and biopharmaceutical companies, and academic and research institutes. The contract research organizations segment held the largest market share in 2023.

By country, the North America cell and gene therapy market is segmented into the US, Canada, and Mexico. The US dominated the North America cell and gene therapy market share in 2023.

Catalent Inc., Charles River Laboratories International Inc., F. Hoffmann-La Roche Ltd, FUJIFILM Holdings Corp, Lonza Group AG, Lotte Corp, Merck KGaA, Takara Bio Inc, Thermo Fisher Scientific Inc., and WuXi AppTec Co Ltd are some of the leading companies operating in the North America cell and gene therapy market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Cell and Gene Therapy Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

5. North America Cell and Gene Therapy Market - Key Market Dynamics

- 5.1 Cell and Gene Therapy Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Number of Approval of Cell and Gene Therapies

- 5.2.2 Rapid Popularity of Outsourcing Cell and Gene Therapy Manufacturing

- 5.3 Market Restraints

- 5.3.1 High Cost of Cell and Gene Therapy Manufacturing

- 5.4 Market Opportunities

- 5.4.1 Strategic Initiatives by Companies

- 5.5 Future Trends

- 5.5.1 Automation of Cell and Gene Therapy Manufacturing Services

- 5.6 Impact of Drivers and Restraints:

6. Cell and Gene Therapy Market -North America Market Analysis

- 6.1 North America Cell and Gene Therapy Market Overview

- 6.2 North America Cell and Gene Therapy Market Revenue (US$ Million), 2021-2031

- 6.3 North America Cell and Gene Therapy Market Forecast Analysis

7. North America Cell and Gene Therapy Market Analysis - by Type

- 7.1 Cell Therapy

- 7.1.1 Overview

- 7.1.2 Cell Therapy: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Gene Therapy

- 7.2.1 Overview

- 7.2.2 Gene Therapy: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Cell and Gene Therapy Market Analysis - by Services

- 8.1 Process Development

- 8.1.1 Overview

- 8.1.2 Process Development: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 cGMP Manufacturing

- 8.2.1 Overview

- 8.2.2 cGMP Manufacturing: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Regulatory Services

- 8.3.1 Overview

- 8.3.2 Regulatory Services: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Bioassay Services

- 8.4.1 Overview

- 8.4.2 Bioassay Services: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Cell and Gene Therapy Market Analysis - by Scale

- 9.1 Pre-Commercial/R&D Manufacturing

- 9.1.1 Overview

- 9.1.2 Pre-Commercial/R&D Manufacturing: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Commercial Scale Manufacturing

- 9.2.1 Overview

- 9.2.2 Commercial Scale Manufacturing: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Cell and Gene Therapy Market Analysis - by Service Providers

- 10.1 CDMOs

- 10.1.1 Overview

- 10.1.2 CDMOs: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 CMOs

- 10.2.1 Overview

- 10.2.2 CMOs: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Cell and Gene Therapy Market Analysis - by End User

- 11.1 Contract Research Organizations

- 11.1.1 Overview

- 11.1.2 Contract Research Organizations: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 11.2 Pharmaceutical and Biopharmaceutical Companies

- 11.2.1 Overview

- 11.2.2 Pharmaceutical and Biopharmaceutical Companies: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3 Academic and Research Institutes

- 11.3.1 Overview

- 11.3.2 Academic and Research Institutes: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

12. North America Cell and Gene Therapy Market - Country Analysis

- 12.1 North America Cell and Gene Therapy Market Overview

- 12.1.1 North America Cell and Gene Therapy Market, by Key Country - Revenue (2023) (US$ Million)

- 12.1.2 North America Cell and Gene Therapy Market - Revenue and Forecast Analysis - by Country

- 12.1.2.1 North America: Cell and Gene Therapy Market - Revenue and Forecast Analysis - by Country

- 12.1.2.2 United States: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.2.2.1 United States: Cell and Gene Therapy Market Breakdown, by Type

- 12.1.2.2.1.1 United States: Cell and Gene Therapy Market Breakdown, by Cell Therapy

- 12.1.2.2.1.2 United States: Cell and Gene Therapy Market Breakdown, by Gene Therapy

- 12.1.2.2.2 United States: Cell and Gene Therapy Market Breakdown, by Services

- 12.1.2.2.3 United States: Cell and Gene Therapy Market Breakdown, by Scale

- 12.1.2.2.4 United States: Cell and Gene Therapy Market Breakdown, by Service Providers

- 12.1.2.2.5 United States: Cell and Gene Therapy Market Breakdown, by End User

- 12.1.2.2.1 United States: Cell and Gene Therapy Market Breakdown, by Type

- 12.1.2.3 Canada: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.2.3.1 Canada: Cell and Gene Therapy Market Breakdown, by Type

- 12.1.2.3.1.1 Canada: Cell and Gene Therapy Market Breakdown, by Cell Therapy

- 12.1.2.3.1.2 Canada: Cell and Gene Therapy Market Breakdown, by Gene Therapy

- 12.1.2.3.2 Canada: Cell and Gene Therapy Market Breakdown, by Services

- 12.1.2.3.3 Canada: Cell and Gene Therapy Market Breakdown, by Scale

- 12.1.2.3.4 Canada: Cell and Gene Therapy Market Breakdown, by Service Providers

- 12.1.2.3.5 Canada: Cell and Gene Therapy Market Breakdown, by End User

- 12.1.2.3.1 Canada: Cell and Gene Therapy Market Breakdown, by Type

- 12.1.2.4 Mexico: Cell and Gene Therapy Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.2.4.1 Mexico: Cell and Gene Therapy Market Breakdown, by Type

- 12.1.2.4.1.1 Mexico: Cell and Gene Therapy Market Breakdown, by Cell Therapy

- 12.1.2.4.1.2 Mexico: Cell and Gene Therapy Market Breakdown, by Gene Therapy

- 12.1.2.4.2 Mexico: Cell and Gene Therapy Market Breakdown, by Services

- 12.1.2.4.3 Mexico: Cell and Gene Therapy Market Breakdown, by Scale

- 12.1.2.4.4 Mexico: Cell and Gene Therapy Market Breakdown, by Service Providers

- 12.1.2.4.5 Mexico: Cell and Gene Therapy Market Breakdown, by End User

- 12.1.2.4.1 Mexico: Cell and Gene Therapy Market Breakdown, by Type

13. Industry Landscape

- 13.1 Overview

- 13.2 Growth Strategies in Cell and Gene Therapy Market

- 13.3 Organic Growth Strategies

- 13.3.1 Overview

- 13.4 Inorganic Growth Strategies

- 13.4.1 Overview

14. Company Profiles

- 14.1 Thermo Fisher Scientific Inc.

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Merck KGaA

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Charles River Laboratories International Inc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Lonza Group AG

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 WuXi AppTec Co Ltd

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Takara Bio Inc

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 FUJIFILM Holdings Corp

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 F. Hoffmann-La Roche Ltd

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Catalent Inc

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Lotte Corp

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Glossary of Terms