|

|

市場調査レポート

商品コード

1715171

北米の医療用外骨格市場:2031年までの予測 - 地域別分析 - コンポーネント別、タイプ別、四肢別、用途別、モビリティ別、エンドユーザー別North America Medical Exoskeleton Market Forecast to 2031 - Regional Analysis - by Component, Type, Extremity, Application, Mobility, and End Users |

||||||

|

|||||||

| 北米の医療用外骨格市場:2031年までの予測 - 地域別分析 - コンポーネント別、タイプ別、四肢別、用途別、モビリティ別、エンドユーザー別 |

|

出版日: 2025年02月11日

発行: The Insight Partners

ページ情報: 英文 102 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の医療用外骨格市場は、2023年に1億5,930万米ドルと評価され、2031年までには14億25万米ドルに達すると予測され、2023年から2031年までのCAGRは31.2%と推定されます。

戦略的イニシアチブの増加が北米の医療用外骨格市場を活性化

医療用外骨格市場で事業を展開する中小企業や大企業は、地理的拡大、新製品発売、技術進歩など様々な戦略を採用し、収益を上げています。2022年7月、Ekso Bionics Holdings Inc.は米国食品医薬品局(FDA)から多発性硬化症患者向けのロボット外骨格EksoNRの販売承認を取得しました。2016年には脳卒中と脊髄損傷(SCI)のリハビリテーション、2020年には後天性脳損傷の認可を受けました。また、CE認証も取得しており、欧州で販売されています。

Samsung Electronicsは、歩行と筋肉の動きを改善するアクティブアシストアルゴリズムを用いて、移動に問題を抱えるユーザーのための外骨格として機能するウェアラブルデバイスである支援ロボット「GEMS Hip」の米国FDAを取得しました。2021年12月、German Bionicは第5世代の外骨格「Cray X」を発表しました。第5世代のCray Xは、大きく成長する国際的な外骨格市場における技術リーダーシップを強調するものです。同社のイノベーションは、世界中のより多くの人々や企業が、より幅広い使用事例や産業分野で恩恵を受ける道を開いています。2021年11月、Ottobockはベイエリアを拠点とする外骨格の新興企業SuitXを買収しました。SuitXは、カリフォルニア大学バークレー校のロボット工学・人間工学研究所からスピンアウトした企業です。両社は事実上同じカテゴリーで事業を展開しており、作業補助とヘルスケアという2つの異なる目的のために設計されたロボット外骨格を製造しています。2021年5月、Roam Roboticsは、膝の痛みを軽減し、運動能力を回復させるスマート膝装具「アセンド」を発表しました。身体の動きを感知し、装着者のニーズに合わせて自動的に調整し、ターゲットとなる筋群に対して適切なタイミングで正確なサポートを提供します。FDA認可のクラスIデバイスであり、直接購入することも、民間保険やメディケア保険を通じて購入することも可能です。そのため、市場参入企業の製品発表、事業拡大、市場参入、M&Aへの積極的な参加が医療用外骨格市場の成長を後押ししています。

北米の医療用外骨格市場の概要

市場プレーヤーは、外骨格ビジネスを強化するために米国で製品認可を受けています。例えば、2022年7月、Ekso Bionics Holdings Inc.は、多発性硬化症患者に使用するEksoNRロボット外骨格の販売承認を米国食品医薬品局から取得しました。このように、米国のヘルスケア業界における様々な医療機器大手による開発の拡大は、今後数年間で同国の医療用外骨格市場をさらに押し上げると思われます。

北米の医療用外骨格市場の収益と2031年までの予測(金額)

北米の医療用外骨格市場のセグメンテーション

北米の医療用外骨格市場は、コンポーネント、タイプ、四肢、用途、モビリティ、エンドユーザー、国に分類されます。

コンポーネント別では、北米の医療用外骨格市場はハードウェアとソフトウェアに区分されます。2023年の北米の医療用外骨格市場シェアでは、ハードウェアセグメントが大きなシェアを占めています。

タイプ別では、北米の医療用外骨格市場は動力式外骨格と受動式外骨格に区分されます。2023年の北米の医療用外骨格市場シェアでは、動力式外骨格セグメントが大きなシェアを占めています。

四肢に基づいて、北米の医療用外骨格市場は下半身外骨格、上半身外骨格、全身外骨格にセグメント化されます。2023年の北米の医療用外骨格市場シェアでは、下半身外骨格セグメントが最大シェアを占めています。

用途別では、北米の医療用外骨格市場は脊髄損傷、多発性硬化症、脳卒中、脳性麻痺、パーキンソン病、その他に区分されます。2023年の北米の医療用外骨格市場シェアでは、脊髄損傷分野が最大シェアを占めています。

モビリティの観点から、北米の医療用外骨格市場は移動式外骨格と据置型外骨格に区分されます。2023年の北米の医療用外骨格市場シェアでは、動力式外骨格セグメントが大きなシェアを占めています。

エンドユーザー別では、北米の医療用外骨格市場はリハビリセンター、理学療法センター、長期ケアセンター、在宅ケア環境、その他に区分されます。2023年の北米の医療用外骨格市場シェアでは、リハビリセンター分野が最大シェアを占めています。

国別に見ると、北米の医療用外骨格市場は米国、カナダ、メキシコに区分されます。米国セグメントが2023年に北米の医療用外骨格市場の最大シェアを占めました。

BIONIK、B-Temia Inc、Cyberdyne Inc、Ekso Bionics Holdings Inc、ExoAtlet、Hocoma AG、Lifeward, Inc、Myomo Inc、and Rex Bionics Ltd.は、北米の医療用外骨格市場で事業を展開する主要企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- ファンデーション数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の医療用外骨格市場:主要市場力学

- 市場促進要因

- 戦略的イニシアチブの増加

- 脳卒中・筋骨格系の罹患率の増加

- 高齢化による長寿化

- 市場抑制要因

- 製品コストの高騰と規制上の懸念

- 市場機会

- SCIの有病率の増加

- 今後の動向

- 技術の進歩と投資の増加

- 促進要因と抑制要因の影響

第5章 医療用外骨格市場:北米分析

- 北米の医療用外骨格市場収益、2021年~2031年

- 北米の医療用外骨格市場予測分析

第6章 北米の医療用外骨格市場の分析:コンポーネント別

- ハードウェア

- ソフトウェア

第7章 北米の医療用外骨格市場の分析:タイプ別

- 動力付き外骨格

- パッシブ外骨格

第8章 北米の医療用外骨格市場の分析:四肢別

- 下半身用外骨格

- 上半身用外骨格

- 全身用外骨格

第9章 北米の医療用外骨格市場の分析:用途別

- 脊髄損傷

- 多発性硬化症

- 脳卒中

- 脳性麻痺

- パーキンソン病

- その他

第10章 北米の医療用外骨格市場分析:モビリティ別

- 移動式外骨格

- 据置型外骨格

第11章 北米の医療用外骨格市場分析:エンドユーザー別

- リハビリセンター

- 理学療法センター

- 長期介護センター

- 在宅介護

- その他

第12章 北米の医療用外骨格市場:国別分析

- 米国

- カナダ

- メキシコ

第13章 医療用外骨格市場:業界情勢

- 医療用外骨格市場における成長戦略

- 有機的成長戦略

- 無機的成長戦略

第14章 企業プロファイル

- Ekso Bionics Holdings Inc

- Lifeward, Inc

- ExoAtlet

- Cyberdyne Inc

- BIONIK

- B-Temia Inc

- Hocoma AG

- Myomo Inc

- Rex Bionics Ltd.

第15章 付録

List Of Tables

- Table 1. North America Medical Exoskeleton Market Segmentation

- Table 2. North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. North America Medical Exoskeleton Market, by Hardware - Revenue and Forecast to 2031 (USD Million)

- Table 4. North America Medical Exoskeleton Market, by Actuators - Revenue and Forecast to 2031 (USD Million)

- Table 5. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 6. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Hardware

- Table 7. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Actuators

- Table 8. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 9. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Extremity

- Table 10. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 11. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Mobility

- Table 12. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by End Users

- Table 13. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 14. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Hardware

- Table 15. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Actuators

- Table 16. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 17. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Extremity

- Table 18. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 19. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Mobility

- Table 20. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by End Users

- Table 21. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 22. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Hardware

- Table 23. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Actuators

- Table 24. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 25. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Extremity

- Table 26. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 27. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by Mobility

- Table 28. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million) - by End Users

- Table 29. Recent Organic Growth Strategies in Medical Exoskeleton Market

- Table 30. Recent Inorganic Growth Strategies in the Medical Exoskeleton Market

- Table 31. Glossary of Terms, Medical Exoskeleton Market

List Of Figures

- Figure 1. North America Medical Exoskeleton Market Segmentation, by Country

- Figure 2. North America Medical Exoskeleton Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Medical Exoskeleton Market Revenue (US$ Million), 2021-2031

- Figure 5. North America Medical Exoskeleton Market Share (%) - by Component (2023 and 2031)

- Figure 6. Hardware: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Software: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. North America Medical Exoskeleton Market Share (%) - by Type (2023 and 2031)

- Figure 9. Powered Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Passive Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. North America Medical Exoskeleton Market Share (%) - by Extremity (2023 and 2031)

- Figure 12. Lower Body Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Upper Body Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Full Body Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. North America Medical Exoskeleton Market Share (%) - by Application (2023 and 2031)

- Figure 16. Spinal Cord Injury: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Multiple Sclerosis: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Stroke: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Cerebral Palsy: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Parkinson's Diseases: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Others: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. North America Medical Exoskeleton Market Share (%) - by Mobility (2023 and 2031)

- Figure 23. Mobile Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Stationary Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. North America Medical Exoskeleton Market Share (%) - by End Users (2023 and 2031)

- Figure 26. Rehabilitation Centers: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Physiotherapy Centers: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Long Term Care Centers: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. Homecare Settings: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Others: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. North America Medical Exoskeleton Market, by Key Country - Revenue (2023) (US$ Million)

- Figure 32. North America Medical Exoskeleton Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 33. United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 34. Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 35. Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 36. Growth Strategies in Medical Exoskeleton Market

The North America medical exoskeleton market was valued at US$ 159.30 million in 2023 and is expected to reach US$ 1,400.25 million by 2031; it is estimated to register a CAGR of 31.2% from 2023 to 2031.

Rising Number of Strategic Initiatives Fuels North America Medical Exoskeleton Market

Small and big companies operating in the medical exoskeleton market adopt various strategies such as geographic expansion, new product launches, and technological advancements to boost their revenues. A few recent developments in the medical exoskeleton market are mentioned below; In July 2022, Ekso Bionics Holdings Inc. received approval from the US Food and Drug Administration (FDA) to market its EksoNR robotic exoskeleton for patients suffering from multiple sclerosis. It was cleared for stroke and spinal cord injury (SCI) rehabilitation in 2016 and acquired brain injury in 2020. It has also received CE certification and is available in Europe.

Samsung Electronics has received the US FDA for its assistive robot "GEMS Hip," a wearable device that acts as an exoskeleton for users with mobility issues using an active assist algorithm to improve gait and muscle movement. In December 2021, German Bionic launched the fifth generation of the Cray X exoskeleton. The fifth-generation Cray X underscores technology leadership in the massively growing international exoskeleton market. The company's innovations are paving the way for more people and businesses worldwide to benefit across a wider range of use cases and industries. In November 2021, Ottobock acquired Bay Area-based exoskeleton startup SuitX. SuitX is a spinout of UC Berkeley's Robotics and Human Engineering Lab. Both companies effectively operate in the same category, producing robotic exoskeletons designed for two distinct purposes-work assistance and healthcare. In May 2021, Roam Robotics launched "Ascend," a smart knee orthosis that helps wearers reduce knee pain and regain mobility. It senses the body's movement, automatically adjusts to the wearer's needs, and provides precise support at the right moment for target muscle groups. It is a registered Class I device with FDA approval available for purchase directly and through private and Medicare insurance, radically expanding public accessibility to wearable robotic devices. Therefore, the active participation of market players in product launches, expansions, partnerships, and mergers & acquisitions boosts the growth of the medical exoskeleton market.

North America Medical Exoskeleton Market Overview

Market players are receiving product approvals in the US to enhance the exoskeleton business. For instance, in July 2022, Ekso Bionics Holdings Inc. received marketing approval from the US Food and Drug Administration for its EksoNR robotic exoskeleton to use in patients with multiple sclerosis. Thus, the growing developments by various medical device giants in the US healthcare industry will further boost the market for medical exoskeletons in the country in the upcoming years.

North America Medical Exoskeleton Market Revenue and Forecast to 2031 (US$ Million)

North America Medical Exoskeleton Market Segmentation

The North America medical exoskeleton market is categorized into component, type, extremity, application, mobility, end users, and country.

By component, the North America medical exoskeleton market is segmented into hardware and software. The hardware segment held a larger share of the North America medical exoskeleton market share in 2023.

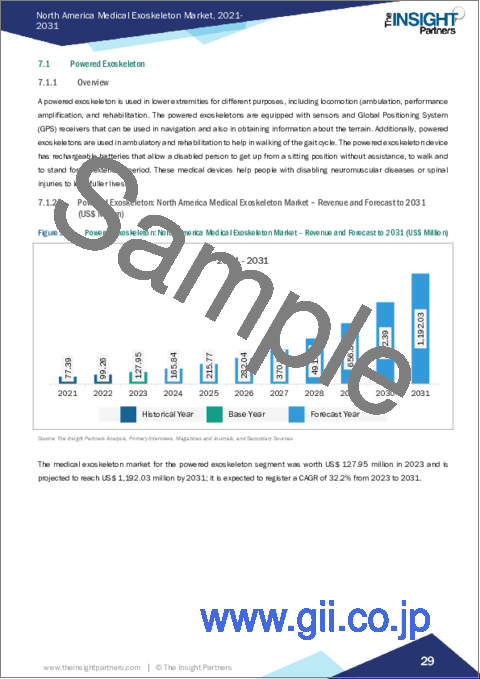

In terms of type, the North America medical exoskeleton market is segmented into powered exoskeleton and passive exoskeleton. The powered exoskeleton segment held a larger share of the North America medical exoskeleton market share in 2023.

Based on extremity, the North America medical exoskeleton market is segmented into lower body exoskeleton, upper body exoskeleton, and full body exoskeleton. The lower body exoskeleton segment held the largest share of the North America medical exoskeleton market share in 2023.

By application, the North America medical exoskeleton market is segmented into spinal cord injury, multiple sclerosis, stroke, cerebral palsy, Parkinson's Disease, and others. The spinal cord injury segment held the largest share of the North America medical exoskeleton market share in 2023.

In terms of mobility, the North America medical exoskeleton market is segmented into mobile exoskeleton and stationary exoskeleton. The powered exoskeleton segment held a larger share of the North America medical exoskeleton market share in 2023.

By end users, the North America medical exoskeleton market is segmented into rehabilitation centers, physiotherapy centers, long term care centers, homecare settings, and others. The rehabilitation centers segment held the largest share of the North America medical exoskeleton market share in 2023.

Based on country, the North America medical exoskeleton market is segmented into the US, Canada, and Mexico. The US segment held the largest share of North America medical exoskeleton market in 2023.

BIONIK; B-Temia Inc; Cyberdyne Inc; Ekso Bionics Holdings Inc; ExoAtlet; Hocoma AG; Lifeward, Inc; Myomo Inc; and Rex Bionics Ltd. are some of the leading companies operating in the North America medical exoskeleton market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Medical Exoskeleton Market - Key Market Dynamics

- 4.1 Market Drivers:

- 4.1.1 Rising Number of Strategic Initiatives

- 4.1.2 Growing Incidence of Stroke and Musculoskeletal

- 4.1.3 Increasing Longevity of Aging Population

- 4.2 Market Restraints

- 4.2.1 High Cost of Product and Regulatory Concerns

- 4.3 Market Opportunities

- 4.3.1 Increasing Prevalence of SCI

- 4.4 Future Trends

- 4.4.1 Increasing Technological Advancements and Rising Investments

- 4.5 Impact of Drivers and Restraints:

5. Medical Exoskeleton Market - North America Analysis

- 5.1 North America Medical Exoskeleton Market Revenue (US$ Million), 2021-2031

- 5.2 North America Medical Exoskeleton Market Forecast Analysis

6. North America Medical Exoskeleton Market Analysis - by Component

- 6.1 Hardware

- 6.1.1 Overview

- 6.1.2 Hardware: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 6.2 Software

- 6.2.1 Overview

- 6.2.2 Software: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

7. North America Medical Exoskeleton Market Analysis - by Type

- 7.1 Powered Exoskeleton

- 7.1.1 Overview

- 7.1.2 Powered Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Passive Exoskeleton

- 7.2.1 Overview

- 7.2.2 Passive Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Medical Exoskeleton Market Analysis - by Extremity

- 8.1 Lower Body Exoskeleton

- 8.1.1 Overview

- 8.1.2 Lower Body Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Upper Body Exoskeleton

- 8.2.1 Overview

- 8.2.2 Upper Body Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Full Body Exoskeleton

- 8.3.1 Overview

- 8.3.2 Full Body Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Medical Exoskeleton Market Analysis - by Application

- 9.1 Spinal Cord Injury

- 9.1.1 Overview

- 9.1.2 Spinal Cord Injury: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Multiple Sclerosis

- 9.2.1 Overview

- 9.2.2 Multiple Sclerosis: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Stroke

- 9.3.1 Overview

- 9.3.2 Stroke: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Cerebral Palsy

- 9.4.1 Overview

- 9.4.2 Cerebral Palsy: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Parkinson's Diseases

- 9.5.1 Overview

- 9.5.2 Parkinson's Diseases: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Medical Exoskeleton Market Analysis - by Mobility

- 10.1 Mobile Exoskeleton

- 10.1.1 Overview

- 10.1.2 Mobile Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Stationary Exoskeleton

- 10.2.1 Overview

- 10.2.2 Stationary Exoskeleton: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Medical Exoskeleton Market Analysis - by End Users

- 11.1 Rehabilitation Centers

- 11.1.1 Overview

- 11.1.2 Rehabilitation Centers: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 11.2 Physiotherapy Centers

- 11.2.1 Overview

- 11.2.2 Physiotherapy Centers: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3 Long Term Care Centers

- 11.3.1 Overview

- 11.3.2 Long Term Care Centers: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4 Homecare Settings

- 11.4.1 Overview

- 11.4.2 Homecare Settings: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 11.5 Others

- 11.5.1 Overview

- 11.5.2 Others: North America Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

12. North America Medical Exoskeleton Market - Country Analysis

- 12.1 North America Medical Exoskeleton Market

- 12.1.1 North America Medical Exoskeleton Market - Revenue and Forecast Analysis - by Country

- 12.1.1.1 United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.1.1 United States: Medical Exoskeleton Market Breakdown, by Component

- 12.1.1.1.1.1 United States: Medical Exoskeleton Market Breakdown, by Hardware

- 12.1.1.1.1.1.1 United States: Medical Exoskeleton Market Breakdown, by Actuators

- 12.1.1.1.2 United States: Medical Exoskeleton Market Breakdown, by Type

- 12.1.1.1.3 United States: Medical Exoskeleton Market Breakdown, by Extremity

- 12.1.1.1.4 United States: Medical Exoskeleton Market Breakdown, by Application

- 12.1.1.1.5 United States: Medical Exoskeleton Market Breakdown, by Mobility

- 12.1.1.1.6 United States: Medical Exoskeleton Market Breakdown, by End Users

- 12.1.1.2 Canada: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.2.1 Canada: Medical Exoskeleton Market Breakdown, by Component

- 12.1.1.2.1.1 Canada: Medical Exoskeleton Market Breakdown, by Hardware

- 12.1.1.2.1.1.1 Canada: Medical Exoskeleton Market Breakdown, by Actuators

- 12.1.1.2.2 Canada: Medical Exoskeleton Market Breakdown, by Type

- 12.1.1.2.3 Canada: Medical Exoskeleton Market Breakdown, by Extremity

- 12.1.1.2.4 Canada: Medical Exoskeleton Market Breakdown, by Application

- 12.1.1.2.5 Canada: Medical Exoskeleton Market Breakdown, by Mobility

- 12.1.1.2.6 Canada: Medical Exoskeleton Market Breakdown, by End Users

- 12.1.1.3 Mexico: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1.3.1 Mexico: Medical Exoskeleton Market Breakdown, by Component

- 12.1.1.3.1.1 Mexico: Medical Exoskeleton Market Breakdown, by Hardware

- 12.1.1.3.1.1.1 Mexico: Medical Exoskeleton Market Breakdown, by Actuators

- 12.1.1.3.2 Mexico: Medical Exoskeleton Market Breakdown, by Type

- 12.1.1.3.3 Mexico: Medical Exoskeleton Market Breakdown, by Extremity

- 12.1.1.3.4 Mexico: Medical Exoskeleton Market Breakdown, by Application

- 12.1.1.3.5 Mexico: Medical Exoskeleton Market Breakdown, by Mobility

- 12.1.1.3.6 Mexico: Medical Exoskeleton Market Breakdown, by End Users

- 12.1.1.1 United States: Medical Exoskeleton Market - Revenue and Forecast to 2031 (US$ Million)

- 12.1.1 North America Medical Exoskeleton Market - Revenue and Forecast Analysis - by Country

13. Medical Exoskeleton Market - Industry Landscape

- 13.1 Overview

- 13.2 Growth Strategies in Medical Exoskeleton Market

- 13.3 Organic Growth Strategies

- 13.3.1 Overview

- 13.4 Inorganic Growth Strategies

- 13.4.1 Overview

14. Company Profiles

- 14.1 Ekso Bionics Holdings Inc

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Lifeward, Inc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 ExoAtlet

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Cyberdyne Inc

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 BIONIK

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 B-Temia Inc

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Hocoma AG

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Myomo Inc

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Rex Bionics Ltd.

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

15. Appendix

- 15.1 About Us

- 15.2 Glossary of Terms