|

|

市場調査レポート

商品コード

1713223

製薬用メンブレンフィルター:市場規模と予測 (2021~2031年)、世界・地域シェア、動向、成長機会 - 分析範囲 (技術別、設計別、材料別、エンドユーザー別、地域別)Pharmaceutical Membrane Filters Market Size and Forecast 2021 - 2031, Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Technology, Design, Material, End User, and Geography |

||||||

|

|||||||

| 製薬用メンブレンフィルター:市場規模と予測 (2021~2031年)、世界・地域シェア、動向、成長機会 - 分析範囲 (技術別、設計別、材料別、エンドユーザー別、地域別) |

|

出版日: 2025年03月20日

発行: The Insight Partners

ページ情報: 英文 224 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

製薬用メンブレンフィルター市場は、2024年に84億7,000万米ドルと評価され、2031年には200億5,000万米ドルに達すると予測され、2025年から2031年までのCAGRは13.0%と予測されています。市場成長を促進する主な要因としては、バイオ医薬品需要の増加、厳しい規制要件と品質などが挙げられます。

製薬用メンブレンフィルター市場は、製薬にに使用される膜ベースろ過技術に焦点を当てた世界の産業を指します。これらのフィルターは、滅菌、コンタミネーションコントロール、製品精製プロセスに役立ち、医薬品の安全性と規制遵守を保証します。

北米の製薬用メンブレンフィルター市場は、米国、カナダ、メキシコに区分されます。北米地域は市場の成長を牽引する極めて重要な役割を果たすと予想されています。米国、カナダ、メキシコで構成される北米は、厳しい規制、生物製剤需要の増加、製造業の拡大により、製薬用メンブレンフィルター市場で大きな成長を遂げています。米国はバイオテクノロジーの進歩でリードし、カナダはR&D投資の増加、メキシコは医薬品アウトソーシングの増加で利益を得ており、これらが市場拡大を牽引しています。

北米では、米国が製薬用メンブレンフィルター市場で最も高いシェアを占めています。米国の製薬用メンブレンフィルター市場は、医薬・バイオ医薬品生産の増加、無菌ろ過に関する厳格な規制ガイドライン、高純度ろ過ソリューションに対する需要の高まりによって力強い成長を遂げています。Ibis Worldによると、2024年、米国には約2,432社のバイオテクノロジー企業が存在し、同様にCRO(医薬品開発業務受託機関)分野では約4,321社が米国で事業を展開しています。

メンブレンフィルターは、無菌性を確保し、微粒子を除去し、生物製剤やバイオシミラーの薬剤品質を向上させる上で重要な役割を果たしています。高度な高分子膜の開発、ナノろ過や限外ろ過の技術革新など、技術の進歩がこれらのフィルターの採用に拍車をかけています。厳格なFDA規制やUSP規格により、医薬品製造では高性能ろ過技術の採用が必要となっており、滅菌、精密ろ過、ウイルス除去などの用途でメンブレンフィルターの需要を押し上げています。バイオプロセスにおけるシングルユース技術の重視の高まりは、使い捨てろ過システムの採用を促進し、二次汚染のリスクを低減して業務効率を高めています。慢性疾患の増加や、それに伴う医薬品開発活動、特にモノクローナル抗体、ワクチン、組換えタンパク質の急増が、メンブレンフィルターの消費拡大に寄与しています。例えば、CDCの四半期暫定死亡率推計によると、心臓病とがんは依然として主要な死因です。2024年第2四半期までの12ヵ月間、心臓病の年齢調整死亡率は人口10万人当たり168.5人、がんは146.2人でした。

メルク・ミリポア、ザルトリウスAG、ダナハーコーポレーションなどの主な企業は、フィルター性能の向上、スループットの向上、進化する業界標準への準拠のための研究開発に継続的に投資しています。製薬メーカーとろ過技術プロバイダーとの戦略的提携は技術革新を促進し、特定の製剤に合わせたカスタマイズされたろ過ソリューションの開発を可能にしています。COVID-19の大流行は、ワクチン製造と治療薬製造における製薬用メンブレンフィルターの重要な役割を浮き彫りにしました。製薬分野での連続製造プロセスの採用が増加していることも、一貫した製品品質とスケーラビリティを確保する高効率膜ろ過システムへの需要を後押ししています。

製薬・バイオテクノロジー産業への政府および民間投資の増加が、高性能ろ過技術の採用を後押ししています。例えば、2023会計年度において、国立衛生研究所(NIH)は約477億米ドルの予算を受け取っており、その内訳は、公衆衛生局(PHS)の評価融資による14億1,200万米ドル、1型糖尿病特別会計の義務的資金1億4,150万米ドル、21世紀治療法から割り当てられた10億8,500万米ドルです。

米国におけるバイオ医薬品研究の拡大と臨床試験の増加は、特に無菌ろ過と細胞培養用途におけるメンブレンフィルターの需要を維持すると予想されます。さらに、持続可能性と環境に優しいろ過技術への注目の高まりは、エネルギー効率が高くリサイクル可能な膜ろ過製品の開発をメーカーに促しています。

医療用ケーブル設計の進歩が今後の市場動向をもたらす

新興市場、特にインドと中国の医薬品産業は急速に拡大しており、これらの国々は世界の医薬品製造拠点へと変貌を遂げています。コスト効率に優れた生産、熟練した労働力、有利な政府政策、国内需要の拡大といった競争上の優位性が、大規模な医薬品生産に拍車をかけています。その結果、先進的な膜ろ過システムのニーズが急増し、医薬品の純度、規制遵守、製造効率が確保されています。

世界の薬局」と呼ばれるインドは、世界のジェネリック医薬品の20%以上を供給しています。3,000以上の製薬会社と10,500以上の製造施設を擁し、その多くが米国FDAやEMAなどの国際的な規制基準に準拠しているインドは、世界・サプライ・チェーンにおいて重要な役割を果たしています。一方、中国は、政府の強力なバックアップと、医薬品製造プロセスを合理化する製造販売業者(MAH)制度などの規制改革により、バイオ医薬品と原薬(API)の分野で大きな進歩を遂げています。両国とも医薬品の輸出を拡大し続けているため、世界の安全・品質基準への準拠を確保するため、高品質のろ過技術への需要が高まっています。

これらの市場では製造コストが重視されるため、製薬企業は効率と手頃な価格のバランスが取れた膜ろ過ソリューションを求めています。このため、再利用可能またはシングルユースの膜、エネルギー効率の高い設計、高スループットろ過技術によって製造コストを最適化する、高性能でスケーラブルなろ過システムの採用が増加しています。インドの生産連動奨励金(PLI)制度や中国のメイド・イン・チャイナ2025戦略などの政府の取り組みは、医薬品の自給自足を支援し、高度な製造能力への投資を促しています。米国や欧州のような規制の厳しい市場への輸出が増加する中、インドや中国の製薬企業は厳しいろ過基準を満たす必要があり、最先端の膜ろ過ソリューションへの需要がさらに高まっています。これらの新興国における医薬品製造の長期的な成長は、ヘルスケアニーズの増加、政府のインセンティブ、バイオシミラーや個別化医療の台頭などに支えられ、ろ過技術に対する高い需要を維持すると予想されます。持続可能性も優先されるようになり、企業は廃棄物の削減、エネルギー消費の低減、業務効率の向上を実現する環境に優しいろ過システムにシフトしています。

インドと中国が世界の製薬大国としての地位を固めるにつれて、高度な膜ろ過技術が医薬品の安全性、品質、コスト効率を確保する上で重要な役割を果たすようになり、こうした高成長市場での事業拡大を目指す国内外のメンブレンフィルターメーカーにとって大きなチャンスとなっています。

業界動向の一部を紹介します:

国内の医薬品製造を強化するため、インド政府は医薬品・医療機器PLI計画で30億米ドル近くを割り当てた。この構想は、2024年4月時点で約40億米ドルの投資誘致に成功しました。

約580億米ドルとされるインドの医薬品セクターは、2030年までに1,200~1,300億米ドル、2047年までに4,000~4,500億米ドルに達すると予測されています。この成長の原動力となっているのは、生活習慣病の増加、高齢化、全人的健康志向の高まりといった要因です。

2022年から2025年にかけて、欧米の製薬会社は、革新的な「スーパー・ミー・ツー」医薬品にアクセスするために、中国企業との提携を増やしています。GSK、メルク、アストラゼネカなどの大手企業は、中国の迅速な臨床試験プロセスを活用し、中国の医薬品を国際的に開発・販売するために10億米ドル規模の契約を締結しました。

2023年、中国とインドは、前年比1.5%増の1,362億米ドルという記録的な二国間貿易額を達成しました。この成長を支えたのは、インドの対中輸出が6%増加したことであり、両国の経済的結びつきが強まっていることを示しています。

世界保健機関(WHO)、保健省(National Health of Health)、経済協力開発機構(Organization for Economic Co-operation and Development)などは、医療用射出成形市場レポート作成時に参照した一次情報および二次情報のひとつです。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 分析手法

- 二次調査

- 一次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

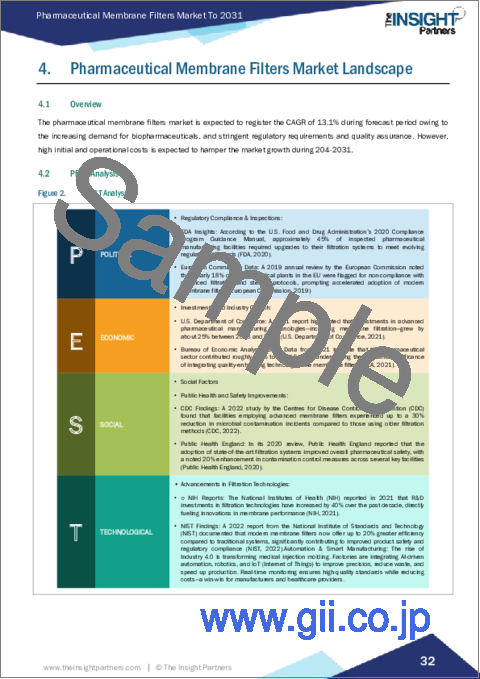

第4章 製薬用メンブレンフィルター市場の情勢

- PEST分析

第5章 製薬用メンブレンフィルター市場:主な市場力学

- 製薬用メンブレンフィルター市場:主な市場力学

- 市場促進要因

- バイオ医薬品需要の増加

- 厳しい規制要件と品質保証

- 市場抑制要因

- 高い初期コストと運用コスト

- 市場機会

- 膜ろ過の技術進歩

- 今後の動向

- 医療用ケーブル設計の進歩

- 促進要因と抑制要因の影響

第6章 製薬用メンブレンフィルター市場:世界市場の分析

- 製薬用メンブレンフィルター市場の収益 (2021~2031年)

- 製薬用メンブレンフィルター市場の予測・分析

第7章 製薬用メンブレンフィルター市場の分析:技術別

- 精密ろ過

- 限外ろ過

- 逆浸透

- ナノろ過

第8章 製薬用メンブレンフィルター市場の分析:設計別

- 中空糸

- 渦巻状

- 管状システム

- プレート状・フレーム状

第9章 製薬用メンブレンフィルター市場の分析:材料別

- ポリエーテルスルホン(PES)

- ポリスルホン(PS)

- セルロース系メンブレン

- ポリテトラフルオロエチレン(PTFE)

- ポリ塩化ビニル(PVC)

- ポリアクリロニトリル(PAN)

- その他

第10章 製薬用メンブレンフィルター市場の分析:エンドユーザー別

- 製薬・バイオテクノロジー産業

- CRO・CDMO

第11章 製薬用メンブレンフィルター市場:地域別分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋

- 中東・アフリカ

- 南アフリカ

- サウジアラビア

- アラブ首長国連邦

- その他中東・アフリカ

- 中南米

- ブラジル

- アルゼンチン

- その他中南米

第12章 業界情勢

- 事業拡大

- コラボレーション

- 企業合併・買収 (M&A)

- パートナーシップ

- その他の事業戦略

第13章 企業プロファイル

- Thermo Fisher Scientific Inc

- Merck KGaA

- Danaher Corporation

- 3M

- Sartorius AG

- Repligen Corporation

- Parker Hannifin Corporation

- Asahi Kasei Corporation

- GEA Group

- Alfa Laval

- TAMI Industries

- Membrane Solutions

- Koch Industries

- W L Gore and Associates Inc

- Meissner Filtration Products, Inc.

第14章 付録

List Of Tables

- Table 1. Pharmaceutical Membrane Filters Market Segmentation

- Table 2. Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Table 3. Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million) - by Technology

- Table 4. Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million) - by Design

- Table 5. Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million) - by Material

- Table 6. Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 7. North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 8. North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 9. North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 10. North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 11. United States: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 12. United States: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 13. United States: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 14. United States: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 15. Canada: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 16. Canada: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 17. Canada: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 18. Canada: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 19. Mexico: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 20. Mexico: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 21. Mexico: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 22. Mexico: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 23. Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 24. Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 25. Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 26. Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 27. Germany: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 28. Germany: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 29. Germany: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 30. Germany: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 31. United Kingdom: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 32. United Kingdom: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 33. United Kingdom: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 34. United Kingdom: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 35. France: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 36. France: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 37. France: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 38. France: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 39. Italy: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 40. Italy: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 41. Italy: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 42. Italy: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 43. Spain: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 44. Spain: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 45. Spain: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 46. Spain: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 47. Rest of Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 48. Rest of Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 49. Rest of Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 50. Rest of Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 51. Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 52. Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 53. Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 54. Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 55. China: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 56. China: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 57. China: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 58. China: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 59. Japan: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 60. Japan: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 61. Japan: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 62. Japan: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 63. India: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 64. India: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 65. India: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 66. India: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 67. South Korea: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 68. South Korea: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 69. South Korea: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 70. South Korea: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 71. Australia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 72. Australia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 73. Australia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 74. Australia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 75. Rest of APAC: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 76. Rest of APAC: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 77. Rest of APAC: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 78. Rest of APAC: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 79. Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 80. Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 81. Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 82. Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 83. South Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 84. South Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 85. South Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 86. South Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 87. Saudi Arabia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 88. Saudi Arabia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 89. Saudi Arabia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 90. Saudi Arabia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 91. United Arab Emirates: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 92. United Arab Emirates: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 93. United Arab Emirates: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 94. United Arab Emirates: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 95. Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 96. Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 97. Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 98. Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 99. South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 100. South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 101. South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 102. South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 103. Brazil: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 104. Brazil: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 105. Brazil: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 106. Brazil: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 107. Argentina: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 108. Argentina: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 109. Argentina: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 110. Argentina: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 111. Rest of South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 112. Rest of South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Design

- Table 113. Rest of South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by Material

- Table 114. Rest of South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 115. Glossary of Terms, global pharmaceutical membrane filters market.

List Of Figures

- Figure 1. Pharmaceutical Membrane Filters Market Segmentation, by Geography

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Pharmaceutical Membrane Filters Market Revenue (US$ Million), 2021-2031

- Figure 5. Pharmaceutical Membrane Filters Market Share (%) - by Technology (2024 and 2031)

- Figure 6. Microfiltration: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Ultrafiltration: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Reverse Osmosis: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Nanofiltration: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Pharmaceutical Membrane Filters Market Share (%) - by Design (2024 and 2031)

- Figure 11. Hollow Fiber: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Spiral Wound: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Tubular System: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Plate and Frame: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Pharmaceutical Membrane Filters Market Share (%) - by Material (2024 and 2031)

- Figure 16. Polyethersulfone (PES): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Polysulfone (PS): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Cellulose-Based Membranes: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Polytetrafluoroethylene (PTFE): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Polyvinyl Chloride (PVC): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Polyacrylonitrile (PAN): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Others: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Pharmaceutical Membrane Filters Market Share (%) - by End User (2024 and 2031)

- Figure 24. Pharmaceutical and Biotech Industries: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. CROs and CDMOs: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Pharmaceutical Membrane Filters Market Breakdown by Region, 2024 and 2031 (%)

- Figure 27. North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 28. North America: Pharmaceutical Membrane Filters Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 29. United States: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 30. Canada: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 31. Mexico: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 33. Europe: Pharmaceutical Membrane Filters Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 34. Germany: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 35. United Kingdom: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 36. France: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 37. Italy: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 38. Spain: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 39. Rest of Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 40. Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 41. Asia Pacific: Pharmaceutical Membrane Filters Market Breakdown, by Technology (2024 and 2031)

- Figure 42. Asia Pacific: Pharmaceutical Membrane Filters Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 43. China: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 44. Japan: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 45. India: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 46. South Korea: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 47. Australia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 48. Rest of APAC: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 49. Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 50. Middle East and Africa: Pharmaceutical Membrane Filters Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 51. South Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 52. Saudi Arabia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 53. United Arab Emirates: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 54. Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 55. South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 56. South and Central America: Pharmaceutical Membrane Filters Market Breakdown, by Key Countries, 2024 and 2031 (%)

- Figure 57. Brazil: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 58. Argentina: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

- Figure 59. Rest of South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031(US$ Million)

The Pharmaceutical Membrane Filters market was valued at US$ 8.47 billion in 2024 and is projected to reach US$ 20.05 billion by 2031; it is expected to register a CAGR of 13.0% from 2025 to 2031. Major factors driving the market growth include the increasing demand for biopharmaceuticals and stringent regulatory requirements and quality.

The Pharmaceutical Membrane Filters Market refers to the global industry focused on membrane-based filtration technologies used in pharmaceutical manufacturing. These filters help in sterilization, contamination control, and product purification processes, ensuring drug safety and regulatory compliance.

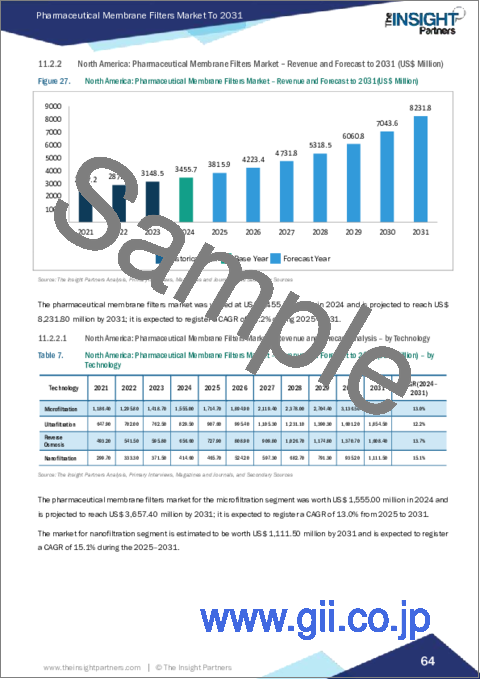

The pharmaceutical membrane filters market in North America is segmented into the US, Canada, and Mexico. The North American region is anticipated to play a pivotal role in driving the market's growth. North America, comprising the U.S., Canada, and Mexico, is witnessing significant growth in the pharma membrane filter market due to stringent regulations, rising biologics demand, and expanding manufacturing. The U.S. leads with biotech advancements, Canada sees increased R&D investments, and Mexico benefits from growing pharmaceutical outsourcing, collectively driving market expansion.

In North America, the US holds the highest share of the pharmaceutical membrane filters market. The US pharmaceutical membrane filters market is witnessing robust growth driven by increasing pharmaceutical and biopharmaceutical production, stringent regulatory guidelines for sterile filtration, and rising demand for high-purity filtration solutions. As per Ibis World, in 2024, the United States was home to approximately 2,432 biotechnology companies; likewise, in the contract research organization (CRO) sector, about 4,321 businesses are operating in the US.

Membrane filters play a critical role in ensuring sterility, removing particulates, and improving the drug quality of biologics and biosimilars. Technological advancements, including the development of advanced polymeric membranes and innovations in nanofiltration and ultrafiltration, are fueling the adoption of these filters. Stringent FDA regulations and USP standards necessitate the adoption of high-performance filtration technologies in drug manufacturing, thereby boosting demand for membrane filters across applications such as sterilization, microfiltration, and virus removal. The growing emphasis on single-use technologies in bioprocessing is driving the adoption of disposable filtration systems, reducing the risk of cross-contamination and enhancing operational efficiency. The rising prevalence of chronic diseases and the subsequent surge in drug development activities, particularly in monoclonal antibodies, vaccines, and recombinant proteins, are contributing to increased consumption of membrane filters. For instance, according to the CDC's Quarterly Provisional Mortality Estimates, heart disease and cancer remain the leading causes of death. For the 12-month period ending in the second quarter of 2024, the age-adjusted death rate for heart disease was 168.5 per 100,000 population, while cancer had a rate of 146.2 per 100,000.

Key players such as Merck Millipore, Sartorius AG, and Danaher Corporation are continuously investing in research and development to enhance filter performance, increase throughput, and comply with evolving industry standards. Strategic collaborations between pharmaceutical manufacturers and filtration technology providers are fostering innovation, enabling the development of customized filtration solutions tailored to specific drug formulations. The COVID-19 pandemic has underscored the critical role of pharmaceutical membrane filters in vaccine production and therapeutic drug manufacturing. The rising adoption of continuous manufacturing processes in the pharmaceutical sector is also fueling demand for high-efficiency membrane filtration systems that ensure consistent product quality and scalability.

The increasing government and private investments in the pharmaceutical and biotechnology industries are supporting the adoption of high-performance filtration technologies. For instance, in fiscal year 2023, the National Institutes of Health (NIH) received a budget of approximately US$ 47.7 billion, which included US$ 1.412 billion from Public Health Service (PHS) Evaluation financing, US$ 141.5 million in mandatory funding for the Special Type 1 Diabetes account, and US$ 1.085 billion allocated from the 21st Century Cures Act.

The expansion of biopharmaceutical research and increasing clinical trials in the US are expected to sustain the demand for membrane filters, particularly in sterile filtration and cell culture applications. Additionally, the growing focus on sustainability and eco-friendly filtration technologies is encouraging manufacturers to develop energy-efficient and recyclable membrane filtration products.

Advancements in Medical Cable Design to Provide Market trends in Future

The pharmaceutical industry in emerging markets, particularly India and China, is expanding rapidly, transforming these countries into global drug manufacturing hubs. Their competitive advantages-cost-effective production, skilled labor, favorable government policies, and growing domestic demand-are fueling large-scale pharmaceutical production. As a result, the need for advanced membrane filtration systems has surged, ensuring drug purity, regulatory compliance, and manufacturing efficiency.

India, often referred to as the "Pharmacy of the World," supplies over 20% of global generic drugs. With more than 3,000 pharmaceutical companies and 10,500 manufacturing facilities, many of which comply with international regulatory standards such as the US FDA and EMA, the country plays a critical role in the global supply chain. China, on the other hand, has made significant strides in biopharmaceuticals and active pharmaceutical ingredients (APIs), with strong government backing and regulatory reforms, such as the Marketing Authorization Holder (MAH) system, which has streamlined the drug manufacturing process. As both nations continue expanding their pharmaceutical exports, the demand for high-quality filtration technologies is growing to ensure compliance with global safety and quality standards.

Given the cost-sensitive nature of manufacturing in these markets, pharmaceutical companies are seeking membrane filtration solutions that balance efficiency with affordability; this has led to increased adoption of high-performance, scalable filtration systems that optimize production costs through reusable or single-use membranes, energy-efficient designs, and high-throughput filtration technologies. Government initiatives such as India's Production Linked Incentive (PLI) scheme and China's Made in China 2025 strategy support pharmaceutical self-sufficiency and encourage investments in advanced manufacturing capabilities. With rising exports to highly regulated markets such as the US and Europe, pharmaceutical firms in India and China must meet stringent filtration standards, further driving demand for cutting-edge membrane filtration solutions. The long-term growth of pharmaceutical manufacturing in these emerging economies is expected to sustain high demand for filtration technologies, supported by increasing healthcare needs, government incentives, and the rise of biosimilars and personalized medicine. As sustainability also becomes a priority, companies are shifting toward eco-friendly filtration systems that reduce waste, lower energy consumption, and enhance operational efficiency.

As India and China solidify their positions as global pharmaceutical powerhouses, advanced membrane filtration technologies will be instrumental in ensuring drug safety, quality, and cost efficiency; this presents a significant opportunity for both domestic and international membrane filter manufacturers looking to expand in these high-growth markets.

Some of the developments are:

To bolster domestic pharmaceutical manufacturing, the Indian government allocated close to US$3 billion under the PLI scheme for pharmaceuticals and medical devices. This initiative successfully attracted investments worth nearly US$4 billion as of April 2024.

India's pharmaceutical sector, valued at approximately USD 58 billion, is projected to reach US$ 120-130 billion by 2030 and US$ 400-450 billion by 2047. This growth is driven by factors such as the rising prevalence of lifestyle-related diseases, an aging population, and an increased focus on holistic health.

Between 2022 and 2025, Western pharmaceutical companies increasingly partnered with Chinese firms to access innovative "super me-too" drugs. Major companies such as GSK, Merck, and AstraZeneca entered into billion-dollar agreements to develop and market Chinese drugs internationally, leveraging China's expedited clinical trial processes.sss

In 2023, China and India achieved a record bilateral trade volume of US$136.2 billion, marking a 1.5% increase from the previous year. This growth was supported by a 6% rise in Indian exports to China, indicating strengthening economic ties between the two nations.

The World Health Organization, National Health of Health, and Organization for Economic Co-operation and Development are among the primary and secondary sources referred to while preparing the medical injection molding market report.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Pharmaceutical Membrane Filters Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

5. Pharmaceutical Membrane Filters Market - Key Market Dynamics

- 5.1 Pharmaceutical Membrane Filters Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Demand for Biopharmaceuticals

- 5.2.2 Stringent Regulatory Requirements and Quality Assurance

- 5.3 Market Restraints

- 5.3.1 High Initial and Operational Costs

- 5.4 Market Opportunities

- 5.4.1 Technological Advancements in Membrane Filtration

- 5.5 Market Trends

- 5.5.1 Advancements in Medical Cable Design

- 5.6 Impact of Drivers and Restraints:

6. Pharmaceutical Membrane Filters Market - Global Market Analysis

- 6.1 Pharmaceutical Membrane Filters Market Revenue (US$ Million), 2021-2031

- 6.2 Pharmaceutical Membrane Filters Market Forecast Analysis

7. Pharmaceutical Membrane Filters Market Analysis - by Technology

- 7.1 Microfiltration

- 7.1.1 Overview

- 7.1.2 Microfiltration: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Ultrafiltration

- 7.2.1 Overview

- 7.2.2 Ultrafiltration: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Reverse Osmosis

- 7.3.1 Overview

- 7.3.2 Reverse Osmosis: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031

- 7.3.3 (US$ Million)

- 7.4 Nanofiltration

- 7.4.1 Overview

- 7.4.2 Nanofiltration: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

8. Pharmaceutical Membrane Filters Market Analysis - by Design

- 8.1 Hollow Fiber

- 8.1.1 Overview

- 8.1.2 Hollow Fiber: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Spiral Wound

- 8.2.1 Overview

- 8.2.2 Spiral Wound: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Tubular System

- 8.3.1 Overview

- 8.3.2 Tubular System: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Plate and Frame

- 8.4.1 Overview

- 8.4.2 Plate and Frame: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

9. Pharmaceutical Membrane Filters Market Analysis - by Material

- 9.1 Polyethersulfone (PES)

- 9.1.1 Overview

- 9.1.2 Polyethersulfone (PES): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Polysulfone (PS)

- 9.2.1 Overview

- 9.2.2 Polysulfone (PS): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Cellulose-Based Membranes

- 9.3.1 Overview

- 9.3.2 Cellulose-Based Membranes: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Polytetrafluoroethylene (PTFE)

- 9.4.1 Overview

- 9.4.2 Polytetrafluoroethylene (PTFE): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Polyvinyl Chloride (PVC)

- 9.5.1 Overview

- 9.5.2 Polyvinyl Chloride (PVC): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Polyacrylonitrile (PAN)

- 9.6.1 Overview

- 9.6.2 Polyacrylonitrile (PAN): Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

10. Pharmaceutical Membrane Filters Market Analysis - by End User

- 10.1 Pharmaceutical and Biotech Industries

- 10.1.1 Overview

- 10.1.2 Pharmaceutical and Biotech Industries: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 CROs and CDMOs

- 10.2.1 Overview

- 10.2.2 CROs and CDMOs: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

11. Pharmaceutical Membrane Filters Market - Geographical Analysis

- 11.1 Overview

- 11.2 North America

- 11.2.1 North America Pharmaceutical Membrane Filters Market Overview

- 11.2.2 North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.2.2.1 North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Technology

- 11.2.2.2 North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Design

- 11.2.2.3 North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Material

- 11.2.2.4 North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by End User

- 11.2.3 North America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Country

- 11.2.3.1 United States: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.2.3.1.1 United States: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.2.3.1.2 United States: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.2.3.1.3 United States: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.2.3.1.4 United States: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.2.3.2 Canada: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.2.3.2.1 Canada: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.2.3.2.2 Canada: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.2.3.2.3 Canada: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.2.3.2.4 Canada: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.2.3.3 Mexico: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.2.3.3.1 Mexico: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.2.3.3.2 Mexico: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.2.3.3.3 Mexico: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.2.3.3.4 Mexico: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.2.3.1 United States: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3 Europe

- 11.3.1 Europe Pharmaceutical Membrane Filters Market Overview

- 11.3.2 Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3.2.1 Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Technology

- 11.3.2.2 Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Design

- 11.3.2.3 Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Material

- 11.3.2.4 Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by End User

- 11.3.3 Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Country

- 11.3.3.1 Germany: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3.3.1.1 Germany: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.3.3.1.2 Germany: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.3.3.1.3 Germany: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.3.3.1.4 Germany: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.3.3.2 United Kingdom: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3.3.2.1 United Kingdom: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.3.3.2.2 Kingdom: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.3.3.2.3 United Kingdom: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.3.3.2.4 United Kingdom: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.3.3.3 France: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3.3.3.1 France: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.3.3.3.2 France: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.3.3.3.3 France: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.3.3.3.4 France: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.3.3.4 Italy: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3.3.4.1 Italy: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.3.3.4.2 Italy: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.3.3.4.3 Italy: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.3.3.4.4 Italy: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.3.3.5 Spain: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3.3.5.1 Spain: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.3.3.5.2 Spain: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.3.3.5.3 Spain: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.3.3.5.4 Spain: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.3.3.6 Rest of Europe: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.3.3.6.1 Rest of Europe: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.3.3.6.2 Rest of Europe: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.3.3.6.3 Rest of Europe: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.3.3.6.4 Rest of Europe: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.3.3.1 Germany: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4 Asia Pacific

- 11.4.1 Asia Pacific Pharmaceutical Membrane Filters Market Overview

- 11.4.2 Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4.3 Asia Pacific: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.4.3.1 Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Technology

- 11.4.3.2 Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Design

- 11.4.3.3 Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Material

- 11.4.3.4 Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by End User

- 11.4.4 Asia Pacific: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Country

- 11.4.4.1 China: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4.4.1.1 China: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.4.4.1.2 China: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.4.4.1.3 China: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.4.4.1.4 China: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.4.4.2 Japan: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4.4.2.1 Japan: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.4.4.2.2 Japan: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.4.4.2.3 Japan: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.4.4.2.4 Japan: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.4.4.3 India: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4.4.3.1 India: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.4.4.3.2 India: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.4.4.3.3 India: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.4.4.3.4 India: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.4.4.4 South Korea: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4.4.4.1 South Korea: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.4.4.4.2 South Korea: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.4.4.4.3 South Korea: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.4.4.4.4 South Korea: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.4.4.5 Australia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4.4.5.1 Australia: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.4.4.5.2 Australia: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.4.4.5.3 Australia: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.4.4.5.4 Australia: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.4.4.6 Rest of APAC: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.4.4.6.1 Rest of APAC: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.4.4.6.2 Rest of APAC: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.4.4.6.3 Rest of APAC: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.4.4.6.4 Rest of APAC: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.4.4.1 China: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.5 Middle East and Africa

- 11.5.1 Middle East and Africa Pharmaceutical Membrane Filters Market Overview

- 11.5.2 Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.5.2.1 Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Technology

- 11.5.2.2 Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Design

- 11.5.2.3 Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Material

- 11.5.2.4 Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by End User

- 11.5.3 Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Country

- 11.5.3.1 South Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.5.3.1.1 South Africa: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.5.3.1.2 South Africa: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.5.3.1.3 South Africa: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.5.3.1.4 South Africa: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.5.3.2 Saudi Arabia: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.5.3.2.1 Saudi Arabia: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.5.3.2.2 Saudi Arabia: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.5.3.2.3 Saudi Arabia: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.5.3.2.4 Saudi Arabia: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.5.3.3 United Arab Emirates: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.5.3.3.1 United Arab Emirates: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.5.3.3.2 United Arab Emirates: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.5.3.3.3 United Arab Emirates: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.5.3.3.4 United Arab Emirates: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.5.3.4 Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.5.3.4.1 Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.5.3.4.2 Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.5.3.4.3 Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.5.3.4.4 Rest of Middle East and Africa: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.5.3.1 South Africa: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.6 South and Central America

- 11.6.1 South and Central America Pharmaceutical Membrane Filters Market Overview

- 11.6.2 South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.6.2.1 South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Technology

- 11.6.2.2 South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Design

- 11.6.2.3 South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Material

- 11.6.2.4 South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by End User

- 11.6.3 South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast Analysis - by Country

- 11.6.3.1 Brazil: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.6.3.1.1 Brazil: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.6.3.1.2 Brazil: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.6.3.1.3 Brazil: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.6.3.1.4 Brazil: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.6.3.2 Argentina: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.6.3.2.1 Argentina: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.6.3.2.2 Argentina: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.6.3.2.3 Argentina: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.6.3.2.4 Argentina: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.6.3.3 Rest of South and Central America: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

- 11.6.3.3.1 Rest of South and Central America: Pharmaceutical Membrane Filters Market Breakdown, by Technology

- 11.6.3.3.2 Rest of South and Central America: Pharmaceutical Membrane Filters Market Breakdown, by Design

- 11.6.3.3.3 Rest of South and Central America: Pharmaceutical Membrane Filters Market Breakdown, by Material

- 11.6.3.3.4 Rest of South and Central America: Pharmaceutical Membrane Filters Market Breakdown, by End User

- 11.6.3.1 Brazil: Pharmaceutical Membrane Filters Market - Revenue and Forecast to 2031 (US$ Million)

12. Industry Landscape

- 12.1 Overview

- 12.2 Expansion

- 12.3 Collaboration

- 12.4 Merger and Acquisition

- 12.5 Partnerships

- 12.6 Other Business Strategies

13. Company Profiles

- 13.1 Thermo Fisher Scientific Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Merck KGaA

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Danaher Corporation

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 3M

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Sartorius AG

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Repligen Corporation

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Parker Hannifin Corporation

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Asahi Kasei Corporation

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 GEA Group

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Alfa Laval

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 TAMI Industries

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Membrane Solutions

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Koch Industries

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 W L Gore and Associates Inc

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 Meissner Filtration Products, Inc.

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Glossary of Terms