|

|

市場調査レポート

商品コード

1666234

アジア太平洋のジェノタイピング市場の2031年までの予測 - 地域別分析- 製品タイプ別、技術別、用途別、エンドユーザー別Asia Pacific Genotyping Market Forecast to 2031 - Regional Analysis - by Product Type, Technology, Application, End user |

||||||

|

|||||||

| アジア太平洋のジェノタイピング市場の2031年までの予測 - 地域別分析- 製品タイプ別、技術別、用途別、エンドユーザー別 |

|

出版日: 2024年12月30日

発行: The Insight Partners

ページ情報: 英文 160 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋のジェノタイピング市場は、2023年に64億8,996万米ドルとなり、2031年までには350億4,862万米ドルに達すると予測され、2023年から2031年までのCAGRは23.5%を記録すると推定されます。

用途の拡大がアジア太平洋のジェノタイピング市場を後押し

ジェノタイピングは、診断研究、薬理ゲノミクス、農業バイオテクノロジーへの応用が期待されています。さらに、この技術はさまざまな植物育種、法医学、環境検査に適しています。製薬会社は、多遺伝子リスクスコア、患者の健康情報とリンクした膨大な遺伝子データベース、臨床試験参加者のシーケンスデータなどの利用可能性から利益を得ています。製薬会社の団体であるIndustry Pharmacogenomics Working Group(I-PWG)は、ファーマコゲノミクス研究に積極的に関与しています。I-PWGは26社で構成され、毎年数多くの臨床試験を実施し、プロトコールの一環として被験者のDNAサンプルを収集しています。I-PWGは、臨床薬理ゲノミクスに重点を置き、今後数年間で製薬会社にチャンスをもたらすことを目指しています。I-PWGは、がん研究において最も頻繁に使用されているほか、希少疾患、免疫学、循環器学など、がん以外の治療領域で実施されるPGx調査にも使用されています。臨床試験サンプルのNGSを含むより包括的な研究では、臨床試験参加者の精巧なゲノム評価が可能となり、一般的な遺伝子変異と稀な遺伝子変異の両方が明らかになります。PGxには、ゲノムレベルの薬物/有害生物効果、薬物応答、疾患感受性、および遺伝子型/表現型の関係の決定における多型の違いの研究が含まれます。

GBS(Genotyping-by-sequencing)は、NGS法を用いて作物ゲノムやヒトゲノムのSNPを特定し、遺伝子型を決定する新しい手法です。GBSは、トウモロコシや小麦のような巨大作物のゲノムシーケンスにおけるNGS用途をさらに強化するために、分子マーカーをプロセスに組み込むことにより、複数サンプルのシーケンスにおいて開発・展開されています。GBSによって検出されたハイスループットSNPは、多くの植物種において、遺伝的多様性解析、ゲノムワイド関連研究(GWAS)、QTLマッピング、ゲノム予測(GP)に広く利用されています。NGS技術は、ハイスループットかつ低コストで現代の生物学を一変させました。NGS技術によってもたらされた目覚ましい進歩により、全ゲノムシーケンスは植物のジェノタイピングと育種に革命をもたらす超スループットシーケンスを提供します。合成によるシーケンス(SBS)とマルチプレックスにより、シーケンスの効率が大幅に向上します。

したがって、さまざまな研究分野でジェノタイピングの採用が進めば、最終的にこれらの技術に対する需要が高まり、市場に大きな機会が生まれることになります。

アジア太平洋のジェノタイピング市場概要

アジア太平洋のジェノタイピング市場は、インド、中国、日本、オーストラリア、韓国、その他アジア太平洋に細分化されます。技術進歩の急増、DNAシーケンスの価格低下、アジア諸国と欧米諸国との共同研究(ゲノム研究開拓)の急増、遺伝病やその他の対象疾患の有病率の上昇が、アジア太平洋のジェノタイピング市場を促進している要因のひとつです。

アジア太平洋のジェノタイピング市場の収益と2031年までの予測(金額)

アジア太平洋のジェノタイピング市場のセグメンテーション

アジア太平洋のジェノタイピング市場は、製品タイプ、技術、用途、エンドユーザー、国に分類されます。

製品タイプ別に見ると、アジア太平洋のジェノタイピング市場は、機器、試薬・キット、バイオインフォマティクス、ジェノタイピングサービスに区分されます。2023年には試薬・キット分野が最大の市場シェアを占めました。

技術別では、アジア太平洋のジェノタイピング市場は、マイクロアレイ、キャピラリー電気泳動、シーケンシング、ポリメラーゼ連鎖反応(PCR)、マトリックス支援レーザー脱離/MALDI-TOF、その他の技術に区分されます。2023年には、ポリメラーゼ連鎖反応(PCR)分野が最大の市場シェアを占めました。

用途別に見ると、アジア太平洋のジェノタイピング市場は、ファーマコゲノミクス、診断と個別化医療、動物遺伝学、農業バイオテクノロジー、その他の用途に二分されます。診断と個別化医療分野が2023年に最大の市場シェアを占めました。

エンドユーザー別では、アジア太平洋のジェノタイピング市場は製薬・バイオ製薬企業、診断・研究ラボ、学術機関、その他のエンドユーザーに二分されます。2023年には製薬・バイオ製薬企業セグメントが最大の市場シェアを占めました。

国別では、アジア太平洋のジェノタイピング市場は、中国、日本、インド、オーストラリア、韓国、その他アジア太平洋に区分されます。2023年のアジア太平洋のジェノタイピング市場シェアは中国が独占しました。

Hoffmann-La Roche Ltd、QIAGEN NV、Merck KGaA、XCELRIS GENOMICS、Thermo Fisher Scientific Inc、BioTek Instruments Inc、Illumina Inc、Danaher Corp、Bio-Rad Laboratories Inc、GE HealthCare Technologies Inc、Standard BioTools Inc、Laboratory Corp of America Holdings、Beckman Coulter Inc、BGI、Takara Bio Inc、DiaSorin SpAは、アジア太平洋のジェノタイピング市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 アジア太平洋のジェノタイピング市場情勢

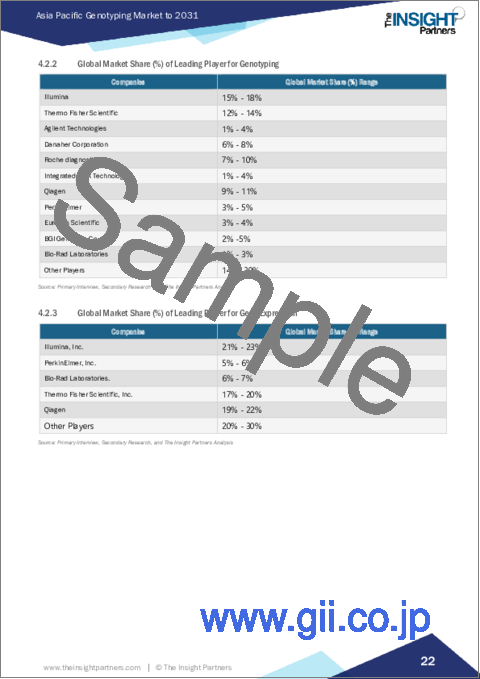

- 世界市場シェア分析

- NGSライブラリー調製における主要企業の世界市場シェア(%)

- ジェノタイピングの主要企業の世界市場シェア(%)

- 遺伝子発現における主要企業の世界市場シェア(%)

第5章 アジア太平洋のジェノタイピング市場-主要な市場力学

- 市場促進要因

- 遺伝性疾患・希少疾患の診断における使用

- バイオテクノロジーと製薬産業における技術の進歩と研究開発投資の増加

- 市場抑制要因

- 機器の高コストと熟練専門家の不足

- 市場機会

- 用途の拡大

- 今後の動向

- 個別化医療の人気の高まり

- 促進要因と抑制要因の影響

第6章 ジェノタイピング市場:アジア太平洋分析

- ジェノタイピング市場収益、2021年~2031年

第7章 アジア太平洋のジェノタイピング市場分析:製品タイプ別

- 機器

- 試薬・キット

- バイオインフォマティクス

- ジェノタイピングサービス

第8章 アジア太平洋のジェノタイピング市場分析:技術別

- マイクロアレイ

- キャピラリー電気泳動

- シーケンシング

- ポリメラーゼ連鎖反応(PCR)

- マトリックス支援レーザー脱離/MALDI-TOF

- その他の技術

第9章 アジア太平洋のジェノタイピング市場分析:用途別

- ファーマコゲノミクス

- 診断・個別化医療

- 動物遺伝学

- 農業バイオテクノロジー

- その他の用途

第10章 アジア太平洋のジェノタイピング市場分析:エンドユーザー別

- 製薬・バイオ医薬品企業

- 診断・研究機関

- 学術機関

- その他のエンドユーザー

第11章 アジア太平洋のジェノタイピング市場:国別分析

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他アジア太平洋

第12章 業界情勢

- ジェノタイピング市場における成長戦略

- 有機的成長戦略

- 無機的成長戦略

第13章 企業プロファイル

- Hoffmann-La Roche Ltd

- QIAGEN NV

- Merck KGaA

- EUROFINS GENOMICS

- Thermo Fisher Scientific Inc

- BioTek Instruments, Inc.

- XCELRIS GENOMICS

- TRIMGEN CORPORATION

- Illumina Inc

- Danaher Corp

- Bio-Rad Laboratories Inc

- GE HealthCare Technologies Inc

- Standard BioTools Inc

- Laboratory Corp of America Holdings

- Beckman Coulter Inc

- BGI

- Takara Bio Inc

- DiaSorin SpA

第14章 付録

List Of Tables

- Table 1. Asia Pacific Genotyping Market Segmentation

- Table 2. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 3. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Technology

- Table 4. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 5. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by End-user

- Table 6. China: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 7. China: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 8. China: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 9. China: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 10. Japan: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 11. Japan: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 12. Japan: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 13. Japan: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 14. India: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 15. India: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 16. India: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 17. India: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 18. Australia: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 19. Australia: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 20. Australia: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 21. Australia: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 22. South Korea: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 23. South Korea: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 24. South Korea: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 25. South Korea: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 26. Rest of APAC: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 27. Rest of APAC: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 28. Rest of APAC: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 29. Rest of APAC: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 30. Recent Organic Growth Strategies in Genotyping Market

- Table 31. Recent Inorganic Growth Strategies in the Genotyping Market

- Table 32. Glossary of Terms, Genotyping Market

List Of Figures

- Figure 1. Asia Pacific Genotyping Market Segmentation, by Country

- Figure 2. Genotyping Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Genotyping Market Revenue (US$ Million), 2021-2031

- Figure 5. Genotyping Market Share (%) - by Product Type (2023 and 2031)

- Figure 6. Instruments: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Reagents and Kits: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Bioinformatics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Genotyping Services: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Genotyping Market Share (%) - by Technology (2023 and 2031)

- Figure 11. Microarray: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Capillary Electrophoresis: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Sequencing: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Polymerase Chain Reaction (PCR): Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Matrix-Assisted Laser Desorption / MALDI-TOF: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Other Technologies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Genotyping Market Share (%) - by Application (2023 and 2031)

- Figure 18. Pharmacogenomics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

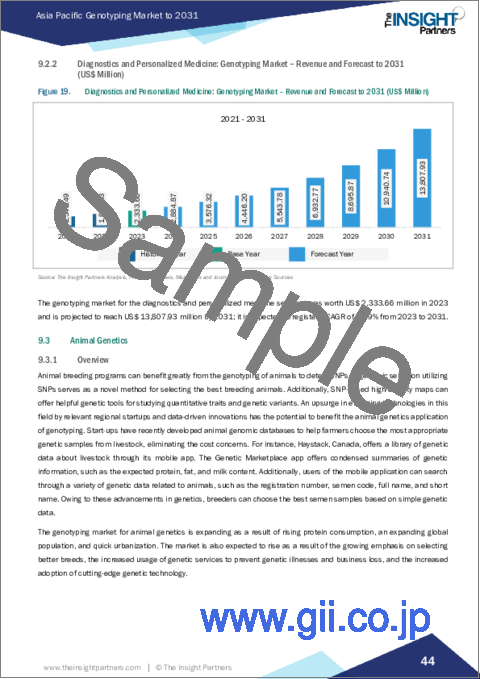

- Figure 19. Diagnostics and Personalized Medicine: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Animal Genetics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Agricultural Biotechnology: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Other Applications: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Genotyping Market Share (%) - by End-user (2023 and 2031)

- Figure 24. Pharmaceutical and Biopharmaceutical Companies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Diagnostic and Research Laboratories: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Academic Institutes: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Other End Users: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Asia Pacific Genotyping Market, by Key Countries - Revenue (2023) (US$ Million)

- Figure 29. Asia Pacific: Genotyping Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 30. China: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 31. Japan: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. India: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 33. Australia: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 34. South Korea: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 35. Rest of APAC: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 36. Growth Strategies in Genotyping Market

The Asia Pacific genotyping market was valued at US$ 6,489.96 million in 2023 and is expected to reach US$ 35,048.62 million by 2031; it is estimated to record a CAGR of 23.5% from 2023 to 2031.

Expanding Range of Applications Boosts Asia Pacific Genotyping Market

Genotyping holds potential applications in diagnostic research, pharmacogenomics, and agricultural biotechnology. Moreover, this technique is suitable for a variety of plant breeding, forensic, and environmental testing procedures. Pharmaceutical companies are profiting from the availability of polygenic risk scores, substantial genetic databases linked to patient health information, and the sequencing data of clinical trial participants, among other advancements. The Industry Pharmacogenomics Working Group (I-PWG), an association of pharmaceutical companies, is actively involved in pharmacogenomic research. The I-PWG comprises 26member companies that undertake numerous clinical trials annually, collecting DNA samples of study subjects as part of the protocol. With its focus on clinical pharmacogenomics, the I-PWG aims to generate opportunities for pharmaceutical companies in the coming years. In addition to its most frequent use in oncology research, it is also used for PGx studies conducted in non-oncology therapeutic areas such as rare diseases, immunology, and cardiology. A more comprehensive study, involving the NGS of clinical trial samples, allows for an elaborate genomic evaluation of trial participants, revealing both common and rare genetic variations. PGx includes the study of polymorphic differences in the determination of genomic-level drug/xenobiotic effects, drug response and disease susceptibility, and genotype/phenotype relationships.

Genotyping-by-sequencing (GBS) is a new method to locate and genotype SNPs in crop genomes and human genome by using NGS methods. GBS is developed and deployed in sequencing multiple samples by incorporating molecular markers in the process to further enhance NGS applications in giant crop genome sequencing, such as maize and wheat. High-throughput SNPs detected by GBS are widely used in genetic diversity analysis, genome-wide association studies (GWAS), QTL mapping, and genome prediction (GP) in many plant species. NGS technology has transformed modern biology with high throughput and low cost. With remarkable advancements unlocked by NGS technologies, whole-genome sequencing provides ultra-throughput sequences that revolutionize plant genotyping and breeding. Sequencing by synthesis (SBS) and multiplexing greatly enhances the efficiency of the sequence.

Therefore, greater adoption of genotyping in various research areas would eventually lead to a rise in the demand for these techniques, creating significant opportunities in the market.

Asia Pacific Genotyping Market Overview

The genotyping market in Asia Pacific is sub-segmented into India, China, Japan, Australia, South Korea, and the Rest of Asia Pacific. An upsurge in technological advancements, decreasing prices of DNA sequencing, the surge in collaborations (for the development of genomic research) among Asian and Western countries, and the rising prevalence of genetic and other target diseases are among the factors propelling the APAC genotyping market.

Asia Pacific Genotyping Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Genotyping Market Segmentation

The Asia Pacific genotyping market is categorized into product type, technology, application, end user, and country.

Based on product type, the Asia Pacific genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the Asia Pacific genotyping market is segmented into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the Asia Pacific genotyping market is bifurcated into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the Asia Pacific genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the Asia Pacific genotyping market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, XCELRIS GENOMICS, Thermo Fisher Scientific Inc, BioTek Instruments Inc, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are some of the leading companies operating in the Asia Pacific genotyping market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Asia Pacific Genotyping Market Landscape

- 4.1 Overview

- 4.2 Global Market Share Analysis

- 4.2.1 Global Market Share (%) of Leading Players for NGS Library Preparation

- 4.2.2 Global Market Share (%) of Leading Player for Genotyping

- 4.2.3 Global Market Share (%) of Leading Player for Gene Expression

5. Asia Pacific Genotyping Market - Key Market Dynamics

- 5.1 Market Drivers:

- 5.1.1 Use in Diagnosis of Genetic and Rare Diseases

- 5.1.2 Technological Advancements and Rising R&D Investments in Biotechnology and Pharmaceutical Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Equipment and Shortage of Skilled Professionals

- 5.3 Market Opportunities

- 5.3.1 Expanding Range of Applications

- 5.4 Future Trends

- 5.4.1 Increasing Popularity of Personalized Medicine

- 5.5 Impact of Drivers and Restraints:

6. Genotyping Market - Asia Pacific Analysis

- 6.1 Genotyping Market Revenue (US$ Million), 2021-2031

7. Asia Pacific Genotyping Market Analysis - by Product Type

- 7.1 Instruments

- 7.1.1 Overview

- 7.1.2 Instruments: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Reagents and Kits

- 7.2.1 Overview

- 7.2.2 Reagents and Kits: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Bioinformatics

- 7.3.1 Overview

- 7.3.2 Bioinformatics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Genotyping Services

- 7.4.1 Overview

- 7.4.2 Genotyping Services: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

8. Asia Pacific Genotyping Market Analysis - by Technology

- 8.1 Microarray

- 8.1.1 Overview

- 8.1.2 Microarray: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Capillary Electrophoresis

- 8.2.1 Overview

- 8.2.2 Capillary Electrophoresis: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Sequencing

- 8.3.1 Overview

- 8.3.2 Sequencing: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Polymerase Chain Reaction (PCR)

- 8.4.1 Overview

- 8.4.2 Polymerase Chain Reaction (PCR): Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Matrix-Assisted Laser Desorption / MALDI-TOF

- 8.5.1 Overview

- 8.5.2 Matrix-Assisted Laser Desorption / MALDI-TOF: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Other Technologies

- 8.6.1 Overview

- 8.6.2 Other Technologies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

9. Asia Pacific Genotyping Market Analysis - by Application

- 9.1 Pharmacogenomics

- 9.1.1 Overview

- 9.1.2 Pharmacogenomics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Diagnostics and Personalized Medicine

- 9.2.1 Overview

- 9.2.2 Diagnostics and Personalized Medicine: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Animal Genetics

- 9.3.1 Overview

- 9.3.2 Animal Genetics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Agricultural Biotechnology

- 9.4.1 Overview

- 9.4.2 Agricultural Biotechnology: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Other Applications

- 9.5.1 Overview

- 9.5.2 Other Applications: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

10. Asia Pacific Genotyping Market Analysis - by End-user

- 10.1 Pharmaceutical and Biopharmaceutical Companies

- 10.1.1 Overview

- 10.1.2 Pharmaceutical and Biopharmaceutical Companies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Diagnostic and Research Laboratories

- 10.2.1 Overview

- 10.2.2 Diagnostic and Research Laboratories: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Academic Institutes

- 10.3.1 Overview

- 10.3.2 Academic Institutes: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Other End Users

- 10.4.1 Overview

- 10.4.2 Other End Users: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

11. Asia Pacific Genotyping Market - Country Analysis

- 11.1 Asia Pacific

- 11.1.1 Asia Pacific: Genotyping Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 China: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.1.1 China: Genotyping Market Breakdown, by Product Type

- 11.1.1.1.2 China: Genotyping Market Breakdown, by Technology

- 11.1.1.1.3 China: Genotyping Market Breakdown, by Application

- 11.1.1.1.4 China: Genotyping Market Breakdown, by End-user

- 11.1.1.2 Japan: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.2.1 Japan: Genotyping Market Breakdown, by Product Type

- 11.1.1.2.2 Japan: Genotyping Market Breakdown, by Technology

- 11.1.1.2.3 Japan: Genotyping Market Breakdown, by Application

- 11.1.1.2.4 Japan: Genotyping Market Breakdown, by End-user

- 11.1.1.3 India: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.3.1 India: Genotyping Market Breakdown, by Product Type

- 11.1.1.3.2 India: Genotyping Market Breakdown, by Technology

- 11.1.1.3.3 India: Genotyping Market Breakdown, by Application

- 11.1.1.3.4 India: Genotyping Market Breakdown, by End-user

- 11.1.1.4 Australia: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.4.1 Australia: Genotyping Market Breakdown, by Product Type

- 11.1.1.4.2 Australia: Genotyping Market Breakdown, by Technology

- 11.1.1.4.3 Australia: Genotyping Market Breakdown, by Application

- 11.1.1.4.4 Australia: Genotyping Market Breakdown, by End-user

- 11.1.1.5 South Korea: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.5.1 South Korea: Genotyping Market Breakdown, by Product Type

- 11.1.1.5.2 South Korea: Genotyping Market Breakdown, by Technology

- 11.1.1.5.3 South Korea: Genotyping Market Breakdown, by Application

- 11.1.1.5.4 South Korea: Genotyping Market Breakdown, by End-user

- 11.1.1.6 Rest of APAC: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.6.1 Rest of APAC: Genotyping Market Breakdown, by Product Type

- 11.1.1.6.2 Rest of APAC: Genotyping Market Breakdown, by Technology

- 11.1.1.6.3 Rest of APAC: Genotyping Market Breakdown, by Application

- 11.1.1.6.4 Rest of APAC: Genotyping Market Breakdown, by End-user

- 11.1.1.1 China: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1 Asia Pacific: Genotyping Market - Revenue and Forecast Analysis - by Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Growth Strategies in Genotyping Market

- 12.3 Organic Growth Strategies

- 12.3.1 Overview

- 12.4 Inorganic Growth Strategies

- 12.4.1 Overview

13. Company Profiles

- 13.1 Hoffmann-La Roche Ltd

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 QIAGEN NV

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Merck KGaA

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 EUROFINS GENOMICS

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Thermo Fisher Scientific Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 BioTek Instruments, Inc.

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 XCELRIS GENOMICS

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 TRIMGEN CORPORATION

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Illumina Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Danaher Corp

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Bio-Rad Laboratories Inc

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 GE HealthCare Technologies Inc

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Standard BioTools Inc

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 Laboratory Corp of America Holdings

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 Beckman Coulter Inc

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

- 13.16 BGI

- 13.16.1 Key Facts

- 13.16.2 Business Description

- 13.16.3 Products and Services

- 13.16.4 Financial Overview

- 13.16.5 SWOT Analysis

- 13.16.6 Key Developments

- 13.17 Takara Bio Inc

- 13.17.1 Key Facts

- 13.17.2 Business Description

- 13.17.3 Products and Services

- 13.17.4 Financial Overview

- 13.17.5 SWOT Analysis

- 13.17.6 Key Developments

- 13.18 DiaSorin SpA

- 13.18.1 Key Facts

- 13.18.2 Business Description

- 13.18.3 Products and Services

- 13.18.4 Financial Overview

- 13.18.5 SWOT Analysis

- 13.18.6 Key Developments

14. Appendix

- 14.1 About Us

- 14.2 Glossary of Terms