|

|

市場調査レポート

商品コード

1666233

北米のジェノタイピング市場:2031年までの予測 - 地域別分析 - 製品タイプ別、技術別、用途別、エンドユーザー別North America Genotyping Market Forecast to 2031 - Regional Analysis - by Product Type, Technology, Application, and End user |

||||||

|

|||||||

| 北米のジェノタイピング市場:2031年までの予測 - 地域別分析 - 製品タイプ別、技術別、用途別、エンドユーザー別 |

|

出版日: 2024年12月31日

発行: The Insight Partners

ページ情報: 英文 147 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のジェノタイピング市場は、2023年に120億4,457万米ドルとなり、2031年までには629億63万米ドルに達すると予測され、2023年から2031年にかけて23.0%のCAGRを記録すると推定されます。

遺伝性疾患や希少疾患の診断への利用が北米のジェノタイピング市場を活性化

世界保健機関(WHO)によると、2050年には新たに3,500万人のがん患者が発生する可能性があり、2022年の2,000万人から77%増加します。2022年、アルツハイマー病協会(Alzheimer's Association)は、米国でアルツハイマー病患者が急増していると発表しました。この病気は、あらゆる年齢層の600万人以上のアメリカ人が罹患しています。同協会の推計によれば、2022年時点で65歳以上のアメリカ人のうち650万人がアルツハイマー病に罹患しており、このうち73%が75歳以上です。Journal of Health Monitoring誌に掲載された研究によると、世界中で3億人もの人々が希少疾病に苦しんでいます。個々の疾患は希少ですが、全体としては世界のヘルスケアシステムに大きな課題をもたらしています。

がん、アルツハイマー病、希少疾患は臨床的に特定することが困難であるため、ジェノタイピングは集団における診断検査のバックボーンとなっています。ジェノタイピングで得られたDNA配列は、サンプルまたは参照配列と比較され、変異を決定することができます。ジェノタイピングは一塩基多型(SNP)を検出するためにも使用されます。ヒトゲノムには約6億6,000万個のSNPがあり、これは最も広範な遺伝的変異です。さらに、健康な集団と病気の集団の多型を比較することで、ゲノムワイド関連研究(GWAS)は、一般的な病気とSNPとの関連を明らかにすることができます。GWASは、推定される原因を見つけることで、疾患の根底にある分子メカニズムを解明することができます。SNPはバクテリアのような単細胞生物にも存在します。SNPジェノタイピングは、微生物の分離株を識別することができ、抗生物質耐性株の識別にも利用できます。SNPに基づく菌株検出は、各医薬品および臨床分析に大きな影響を与えており、感染症疫学にも利用されています。

北米のジェノタイピング市場概要

北米のジェノタイピング市場は米国、カナダ、メキシコに区分されます。技術的に先進的な製品やソリューションの開発の開拓、研究開発活動の活発化が、この地域のジェノタイピング市場に利益をもたらしている要因です。さらに、「All of Us Research Program」などの政府主導のプログラム、さまざまなゲノムコミュニティによるイニシアティブ、ジェノタイピングサービスに対する認知度の向上が、北米全域における市場拡大の主な促進要因となっています。

北米のジェノタイピング市場の収益と2031年までの予測(金額)

北米のジェノタイピング市場セグメンテーション

北米のジェノタイピング市場は、製品タイプ、技術、用途、エンドユーザー、国に分類されます。

製品タイプに基づき、北米のジェノタイピング市場は機器、試薬・キット、バイオインフォマティクス、ジェノタイピングサービスに区分されます。2023年には試薬・キット分野が最大の市場シェアを占めました。

技術別では、北米のジェノタイピング市場はマイクロアレイ、キャピラリー電気泳動、シーケンシング、ポリメラーゼ連鎖反応(PCR)、マトリックス支援レーザー脱離/MALDI-TOF、その他の技術に分類されます。2023年にはポリメラーゼ連鎖反応(PCR)分野が最大の市場シェアを占めました。

用途別に見ると、北米のジェノタイピング市場は、薬理ゲノミクス、診断・個別化医療、動物遺伝学、農業バイオテクノロジー、その他の用途に区分されます。診断・個別化医療分野が2023年に最大の市場シェアを占めました。

エンドユーザー別では、北米のジェノタイピング市場は製薬・バイオ製薬企業、診断・研究ラボ、学術機関、その他のエンドユーザーに二分されます。2023年には製薬・バイオ製薬企業セグメントが最大の市場シェアを占めました。

国別では、北米のジェノタイピング市場は米国、カナダ、メキシコに区分されます。2023年の北米のジェノタイピング市場シェアは米国が独占しました。

Hoffmann-La Roche Ltd、QIAGEN NV、Merck KGaA、Thermo Fisher Scientific Inc、BioTek Instruments, Inc、TRIMGEN CORPORATION、Illumina Inc、Danaher Corp、Bio-Rad Laboratories Inc、GE HealthCare Technologies Inc、Standard BioTools Inc、Laboratory Corp of America Holdings、Beckman Coulter Inc、BGI、Takara Bio Inc、DiaSorin SpAは、北米のジェノタイピング市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米のジェノタイピング市場情勢

- PEST分析

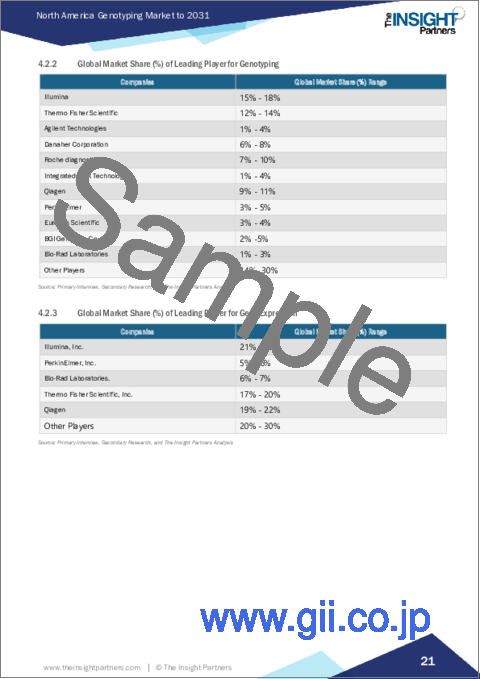

- 世界市場シェア分析

- NGSライブラリー調製における主要企業の世界市場シェア(%)

- ジェノタイピングの主要企業の世界市場シェア(%)

- 遺伝子発現における主要企業の世界市場シェア(%)

第5章 北米のジェノタイピング市場:主要市場力学

- 市場促進要因

- 遺伝性疾患・希少疾患の診断における使用

- バイオテクノロジー・製薬産業における技術の進歩と研究開発投資の増加

- 市場抑制要因

- 機器の高コストと熟練専門家の不足

- 市場機会

- 用途の拡大

- 今後の動向

- 個別化医療の人気の高まり

- 促進要因と抑制要因の影響

第6章 ジェノタイピング市場:北米分析

- ジェノタイピング市場収益、2021年~2031年

第7章 北米のジェノタイピング市場分析:製品タイプ別

- 機器

- 試薬・キット

- バイオインフォマティクス

- ジェノタイピングサービス

第8章 北米のジェノタイピング市場分析:技術別

- マイクロアレイ

- キャピラリー電気泳動

- シーケンシング

- ポリメラーゼ連鎖反応(PCR)

- マトリックス支援レーザー脱離/MALDI-TOF

- その他の技術

第9章 北米のジェノタイピング市場分析:用途別

- ファーマコゲノミクス

- 診断・個別化医療

- 動物遺伝学

- 農業バイオテクノロジー

- その他の用途

第10章 北米のジェノタイピング市場分析:エンドユーザー別

- 製薬・バイオ医薬品企業

- 診断・研究機関

- 学術機関

- その他のエンドユーザー

第11章 北米のジェノタイピング市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 業界情勢

- ジェノタイピング市場の成長戦略

- 有機的成長戦略

- 無機的成長戦略

第13章 企業プロファイル

- Hoffmann-La Roche Ltd

- QIAGEN NV

- Merck KGaA

- Thermo Fisher Scientific Inc

- BioTek Instruments, Inc.

- TRIMGEN CORPORATION

- Illumina Inc

- Danaher Corp

- Bio-Rad Laboratories Inc

- GE HealthCare Technologies Inc

- Standard BioTools Inc

- Laboratory Corp of America Holdings

- Beckman Coulter Inc

- BGI

- Takara Bio Inc

- DiaSorin SpA

第14章 付録

List Of Tables

- Table 1. North America Genotyping Market Segmentation

- Table 2. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 3. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Technology

- Table 4. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 5. Genotyping Market - Revenue and Forecast to 2031 (US$ Million) - by End-user

- Table 6. United States: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 7. United States: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 8. United States: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 9. United States: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 10. Canada: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 11. Canada: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 12. Canada: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 13. Canada: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 14. Mexico: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Product Type

- Table 15. Mexico: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Technology

- Table 16. Mexico: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 17. Mexico: Genotyping Market - Revenue and Forecast to 2031(US$ Million) - by End-user

- Table 18. Recent Organic Growth Strategies in Genotyping Market

- Table 19. Recent Inorganic Growth Strategies in the Genotyping Market

- Table 20. Glossary of Terms, Genotyping Market

List Of Figures

- Figure 1. North America Genotyping Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Genotyping Market - Key Market Dynamics

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Genotyping Market Revenue (US$ Million), 2021-2031

- Figure 6. Genotyping Market Share (%) - by Product Type (2023 and 2031)

- Figure 7. Instruments: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Reagents and Kits: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Bioinformatics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Genotyping Services: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Genotyping Market Share (%) - by Technology (2023 and 2031)

- Figure 12. Microarray: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Capillary Electrophoresis: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Sequencing: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Polymerase Chain Reaction (PCR): Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Matrix-Assisted Laser Desorption / MALDI-TOF: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Other Technologies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Genotyping Market Share (%) - by Application (2023 and 2031)

- Figure 19. Pharmacogenomics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Diagnostics and Personalized Medicine: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Animal Genetics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Agricultural Biotechnology: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Other Applications: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Genotyping Market Share (%) - by End-user (2023 and 2031)

- Figure 25. Pharmaceutical and Biopharmaceutical Companies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Diagnostic and Research Laboratories: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Academic Institutes: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Other End Users: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. North America Genotyping Market, by Key Countries - Revenue (2023) (US$ Million)

- Figure 30. North America: Genotyping Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 31. United States: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. Canada: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 33. Mexico: Genotyping Market - Revenue and Forecast to 2031(US$ Million)

- Figure 34. Growth Strategies in Genotyping Market

The North America genotyping market was valued at US$ 12,044.57 million in 2023 and is expected to reach US$ 62,900.63 million by 2031; it is estimated to record a CAGR of 23.0% from 2023 to 2031.

Use in Diagnosis of Genetic and Rare Diseases Fuels North America Genotyping Market

According to the World Health Organization (WHO), ~35 million new cancer cases are likely to occur in 2050, a 77% increase from the corresponding 20 million cases in 2022. In 2022, the Alzheimer's Association stated that the number of people living with Alzheimer's in the US is rapidly increasing. The disease affects more than 6 million Americans from all age groups. As per the association's estimates, 6.5 million Americans aged more than 65 suffered from Alzheimer's as of 2022, and 73% of this population was aged 75 or older. As per a study published in the Journal of Health Monitoring, up to 300 million people worldwide suffer from rare diseases. Although individual diseases are rare, they collectively pose significant challenges to the global healthcare system.

Since cancer, Alzheimer's disease, and rare diseases are difficult to identify clinically, genotyping stands as the backbone of diagnostic testing in the population. DNA sequences obtained from genotyping can be compared to sample or reference sequences to determine variations. Genotyping is also employed to detect single-nucleotide polymorphisms (SNPs), which are minor variations in genetic complement within the population. The human genome has nearly 660 million SNPs, which makes them the most widespread genetic variation. Moreover, by comparing polymorphisms in healthy and diseased populations, genome-wide association studies (GWAS) can uncover links between common illnesses and SNPs. GWAS can untangle the molecular mechanisms in underlying disease states by finding probable causes. SNPs are even present in single-celled organisms, such as bacteria. SNP genotyping can discriminate between microorganism isolates and could even be accustomed to identifying antibiotic-resistant strains. SNP-based strain detection has a significant impact on each pharmaceutical and clinical analysis, and it has also been used in infectious disease epidemiology.

North America Genotyping Market Overview

The North America genotyping market is segmented into the US, Canada, and Mexico. Increasing adoption of technologically advanced products and solutions, and surging research and development activities are the factors benefiting the genotyping market in this region. Moreover, government-led programs such as the "All of Us Research Program," initiatives by various genomic communities, and the increasing awareness of genotyping services are the key drivers of the market expansion across North America.

North America Genotyping Market Revenue and Forecast to 2031 (US$ Million)

North America Genotyping Market Segmentation

The North America genotyping market is categorized into product type, technology, application, end user, and country.

Based on product type, the North America genotyping market is segmented into instruments, reagents and kits, bioinformatics, and genotyping services. The reagents and kits segment held the largest market share in 2023.

By technology, the North America genotyping market is categorized into microarrays, capillary electrophoresis, sequencing, polymerase chain reaction (PCR), matrix-assisted laser desorption / MALDI-TOF, and other technologies. The polymerase chain reaction (PCR) segment held the largest market share in 2023.

Based on application, the North America genotyping market is segmented into pharmacogenomics, diagnostics and personalized medicine, animal genetics, agricultural biotechnology, and other applications. The diagnostics and personalized medicine segment held the largest market share in 2023.

In terms of end user, the North America genotyping market is bifurcated into pharmaceutical and biopharmaceutical companies, diagnostic and research laboratories, academic institutes, and other end users. The pharmaceutical and biopharmaceutical companies segment held the largest market share in 2023.

By country, the North America genotyping market is segmented into the US, Canada, and Mexico. The US dominated the North America genotyping market share in 2023.

Hoffmann-La Roche Ltd, QIAGEN NV, Merck KGaA, Thermo Fisher Scientific Inc, BioTek Instruments, Inc, TRIMGEN CORPORATION, Illumina Inc, Danaher Corp, Bio-Rad Laboratories Inc, GE HealthCare Technologies Inc, Standard BioTools Inc, Laboratory Corp of America Holdings, Beckman Coulter Inc, BGI, Takara Bio Inc, and DiaSorin SpA. are some of the leading companies operating in the North America genotyping market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Genotyping Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Global Market Share Analysis

- 4.3.1 Global Market Share (%) of Leading Players for NGS Library Preparation

- 4.3.2 Global Market Share (%) of Leading Player for Genotyping

- 4.3.3 Global Market Share (%) of Leading Player for Gene Expression

5. North America Genotyping Market - Key Market Dynamics

- 5.1 Market Drivers:

- 5.1.1 Use in Diagnosis of Genetic and Rare Diseases

- 5.1.2 Technological Advancements and Rising R&D Investments in Biotechnology and Pharmaceutical Industry

- 5.2 Market Restraints

- 5.2.1 High Cost of Equipment and Shortage of Skilled Professionals

- 5.3 Market Opportunities

- 5.3.1 Expanding Range of Applications

- 5.4 Future Trends

- 5.4.1 Increasing Popularity of Personalized Medicine

- 5.5 Impact of Drivers and Restraints:

6. Genotyping Market - North America Analysis

- 6.1 Genotyping Market Revenue (US$ Million), 2021-2031

7. North America Genotyping Market Analysis - by Product Type

- 7.1 Instruments

- 7.1.1 Overview

- 7.1.2 Instruments: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Reagents and Kits

- 7.2.1 Overview

- 7.2.2 Reagents and Kits: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Bioinformatics

- 7.3.1 Overview

- 7.3.2 Bioinformatics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Genotyping Services

- 7.4.1 Overview

- 7.4.2 Genotyping Services: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Genotyping Market Analysis - by Technology

- 8.1 Microarray

- 8.1.1 Overview

- 8.1.2 Microarray: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Capillary Electrophoresis

- 8.2.1 Overview

- 8.2.2 Capillary Electrophoresis: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Sequencing

- 8.3.1 Overview

- 8.3.2 Sequencing: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Polymerase Chain Reaction (PCR)

- 8.4.1 Overview

- 8.4.2 Polymerase Chain Reaction (PCR): Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Matrix-Assisted Laser Desorption / MALDI-TOF

- 8.5.1 Overview

- 8.5.2 Matrix-Assisted Laser Desorption / MALDI-TOF: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Other Technologies

- 8.6.1 Overview

- 8.6.2 Other Technologies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Genotyping Market Analysis - by Application

- 9.1 Pharmacogenomics

- 9.1.1 Overview

- 9.1.2 Pharmacogenomics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Diagnostics and Personalized Medicine

- 9.2.1 Overview

- 9.2.2 Diagnostics and Personalized Medicine: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Animal Genetics

- 9.3.1 Overview

- 9.3.2 Animal Genetics: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Agricultural Biotechnology

- 9.4.1 Overview

- 9.4.2 Agricultural Biotechnology: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Other Applications

- 9.5.1 Overview

- 9.5.2 Other Applications: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Genotyping Market Analysis - by End-user

- 10.1 Pharmaceutical and Biopharmaceutical Companies

- 10.1.1 Overview

- 10.1.2 Pharmaceutical and Biopharmaceutical Companies: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Diagnostic and Research Laboratories

- 10.2.1 Overview

- 10.2.2 Diagnostic and Research Laboratories: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Academic Institutes

- 10.3.1 Overview

- 10.3.2 Academic Institutes: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Other End Users

- 10.4.1 Overview

- 10.4.2 Other End Users: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Genotyping Market - Country Analysis

- 11.1 North America

- 11.1.1 North America: Genotyping Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 United States: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.1.1 United States: Genotyping Market Breakdown, by Product Type

- 11.1.1.1.2 United States: Genotyping Market Breakdown, by Technology

- 11.1.1.1.3 United States: Genotyping Market Breakdown, by Application

- 11.1.1.1.4 United States: Genotyping Market Breakdown, by End-user

- 11.1.1.2 Canada: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.2.1 Canada: Genotyping Market Breakdown, by Product Type

- 11.1.1.2.2 Canada: Genotyping Market Breakdown, by Technology

- 11.1.1.2.3 Canada: Genotyping Market Breakdown, by Application

- 11.1.1.2.4 Canada: Genotyping Market Breakdown, by End-user

- 11.1.1.3 Mexico: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.3.1 Mexico: Genotyping Market Breakdown, by Product Type

- 11.1.1.3.2 Mexico: Genotyping Market Breakdown, by Technology

- 11.1.1.3.3 Mexico: Genotyping Market Breakdown, by Application

- 11.1.1.3.4 Mexico: Genotyping Market Breakdown, by End-user

- 11.1.1.1 United States: Genotyping Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1 North America: Genotyping Market - Revenue and Forecast Analysis - by Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Growth Strategies in Genotyping Market

- 12.3 Organic Growth Strategies

- 12.3.1 Overview

- 12.4 Inorganic Growth Strategies

- 12.4.1 Overview

13. Company Profiles

- 13.1 Hoffmann-La Roche Ltd

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 QIAGEN NV

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Merck KGaA

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Thermo Fisher Scientific Inc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 BioTek Instruments, Inc.

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 TRIMGEN CORPORATION

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Illumina Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Danaher Corp

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Bio-Rad Laboratories Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 GE HealthCare Technologies Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Standard BioTools Inc

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Laboratory Corp of America Holdings

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Beckman Coulter Inc

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 BGI

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 Takara Bio Inc

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

- 13.16 DiaSorin SpA

- 13.16.1 Key Facts

- 13.16.2 Business Description

- 13.16.3 Products and Services

- 13.16.4 Financial Overview

- 13.16.5 SWOT Analysis

- 13.16.6 Key Developments

14. Appendix

- 14.1 About Us

- 14.2 Glossary of Terms