|

|

市場調査レポート

商品コード

1666206

北米の溶接鋼管の市場規模と予測(2021年~2031年)、地域シェア、動向・成長機会分析:鋼グレード別、用途別、タイプ別、コーティングタイプ別、国別North America Welded Steel Tubes Market Size and Forecast 2021 - 2031, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Steel Grades, Application, Type, Coating Type, and Country |

||||||

|

|||||||

| 北米の溶接鋼管の市場規模と予測(2021年~2031年)、地域シェア、動向・成長機会分析:鋼グレード別、用途別、タイプ別、コーティングタイプ別、国別 |

|

出版日: 2025年02月07日

発行: The Insight Partners

ページ情報: 英文 129 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の溶接鋼管の市場規模は、2023年に393億6,000万米ドルとなり、2031年までには593億6,000万米ドルに達すると予測されています。2023年から2031年までのCAGRは5.3%を記録すると推定されます。商用車や乗用車を含む自動車生産の増加が、北米の溶接鋼管市場を牽引しています。自動車における溶接鋼管の主な用途には、シャーシと車体フレーム、衝突防止、大型車フレーム、貨物車体、サスペンション部品、排気管とマフラー、ブレーキライン、ロールケージと補強バーなどがあります。これらの部品には、さまざまな等級の溶接鋼管が必要であり、その需要は、地域全体の自動車生産台数の増加やそれぞれのアフターマーケットでの代替品に伴って拡大しています。

北米では、建設業が急成長している産業のひとつです。米国、カナダ、メキシコの政府機関は、住宅、空港、病院、ホテル、オフィスビル、大学など、住宅および非住宅インフラの開発に多額の投資を行っています。米国国勢調査局によるデータの分析によると、2024年9月の全米建設支出総額は、2023年9月と比較して前年同月比で4.6%増加しました。インフラプロジェクトの急増に伴い、建築構造物、鉄骨、支柱などのエンジニアリング分野で使用される溶接鋼管の需要も伸びています。

2024年9月、米国国際貿易委員会(ITC)は、中国からの円形溶接炭素品質鋼ラインパイプに対するアンチダンピング関税と相殺関税のサンセット見直しを開始する計画を発表しました。これらの関税が実施されれば、中国からの輸入が妨げられることになります。このことは、製造業、自動車、医療機器など様々な産業における溶接鋼管の需要に応えることで、北米の地元溶接鋼管メーカーにチャンスをもたらす可能性があります。

COREMARK Metals、Phillips Tube Group、ArcelorMittal、Markin Tubing、Pennsylvania Steel Company, Inc、Hofmann Industries, Inc、AMETEK Inc、Infra-Metals Co.、Vest LLC、RathGibsonnなどは、北米の溶接鋼管市場レポートで紹介されている著名な企業です。市場企業は新製品の発売、市場の拡大と多様化、買収戦略に重点を置いており、これにより有力なビジネスチャンスにアクセスすることができます。

北米の溶接鋼管市場全体の分析は、一次情報と二次情報の両方を使用して導き出されています。北米の溶接鋼管市場の調査プロセスを開始するために、北米の溶接鋼管市場に関連する質的および量的情報を入手するために、社内外の情報源を用いて徹底的な二次調査を実施しました。このプロセスでは、北米の溶接鋼管市場の概要と市場予測を、すべての市場セグメントに関して得ることも目的としています。また、データを検証し、このテーマについてより分析的な洞察を得るために、業界参加者やコメンテーターに対して複数の一次インタビューを実施しました。この調査プロセスには、副社長、市場開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家や、北米の溶接鋼管市場予測を専門とする評価専門家、調査アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参入しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

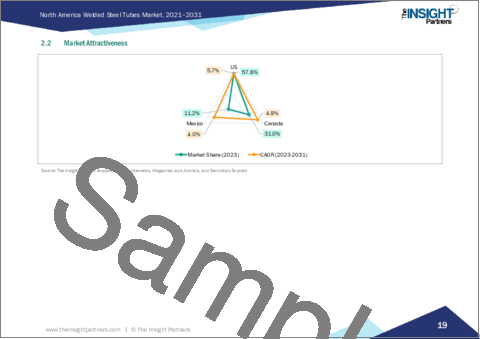

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の溶接鋼管市場情勢

- PEST分析

- エコシステム分析

- 材料サプライヤー

- 溶接鋼管メーカー

- 小売業者と正規販売代理店

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 北米の溶接鋼管市場:主要市場力学

- 北米の溶接鋼管市場:主要市場力学

- 市場促進要因

- 自動車生産の急増

- 建設用足場の用途拡大

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- エネルギーインフラ開発への取り組みの高まり

- 産業・製造施設の高度化への注目の高まり

- 今後の動向

- 溶接技術の革新

- 促進要因と抑制要因の影響

第6章 北米の溶接鋼管市場分析

- 北米の溶接鋼管市場収益、2021年~2031年

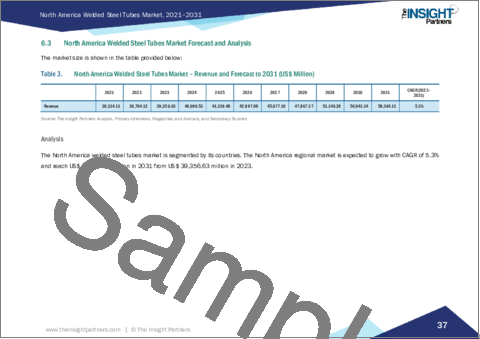

- 北米の溶接鋼管市場の予測と分析

第7章 北米の溶接鋼管市場分析:鋼グレード別

- 炭素ベースグレード

- ホウ素グレード

- 合金グレード

- HSLA

- AHSS

- その他

第8章 北米の溶接鋼管市場分析:用途別

- 排気

- 自動車

- 家電製品

- 医療機器

- 空調

- バーナー

- コンベヤーベルト

- その他

第9章 北米の溶接鋼管市場分析:タイプ別

- 電気抵抗溶接(ERW)

- 縦型サブマージアーク溶接(LSAW)

- スパイラルサブマージアーク溶接(SSAW)

第10章 北米の溶接鋼管市場分析:コーティングタイプ別

- クリアコート

- ノンコーティング

第11章 北米の溶接鋼管市場:国別分析

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- ヒートマップ分析:主要企業別

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併・買収

- その他

第14章 企業プロファイル

- COREMARK Metals

- Phillips Tube Group

- ArcelorMittal

- Markin Tubing

- Pennsylvania Steel Company, Inc.

- Hofmann Industries, Inc

- AMETEK Inc.

- Infra-Metals Co.

- Vest LLC

- RathGibson

第15章 付録

List Of Tables

- Table 1. North America Welded Steel Tubes Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Steel Grades

- Table 5. North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 6. North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 7. North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Coating Type

- Table 8. North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 9. United States: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Steel Grades

- Table 10. United States: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 11. United States: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 12. United States: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Coating Type

- Table 13. Canada: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Steel Grades

- Table 14. Canada: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 15. Canada: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 16. Canada: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Coating Type

- Table 17. Mexico: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Steel Grades

- Table 18. Mexico: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 19. Mexico: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 20. Mexico: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million) - by Coating Type

- Table 21. Heat Map Analysis

List Of Figures

- Figure 1. North America Welded Steel Tubes Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Welded Steel Tubes Market Revenue (US$ Million), 2021-2031

- Figure 5. North America Welded Steel Tubes Market Share (%) - by Steel Grades, 2023 and 2031

- Figure 6. Carbon Base Grades: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Boron Grades: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Alloy Grades: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. HSLA: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. AHSS: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Others: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. North America Welded Steel Tubes Market Share (%) - by Application, 2023 and 2031

- Figure 13. Exhaust: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Automotive: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Appliances: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Medical Devices: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. HVAC: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Burner: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Conveyor Belts: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Others: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. North America Welded Steel Tubes Market Share (%) - by Type, 2023 and 2031

- Figure 22. Electric Resistance Welding (ERW): North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Longitudinal Submerged Arc Welding (LSAW): North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Spiral Submerged Arc Welded (SSAW): North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. North America Welded Steel Tubes Market Share (%) - by Coating Type, 2023 and 2031

- Figure 26. Clear Coat: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Non-Coated: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. North America Welded Steel Tubes Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 29. United States: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 30. Canada: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Mexico: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Company Positioning and Concentration

The North America Welded Steel Tubes market size was valued at US$ 39.36 billion in 2023 and is expected to reach US$ 59.36 billion by 2031. The market is estimated to record a CAGR of 5.3% from 2023 to 2031. The growing automobile production, including commercial vehicles and passenger cars, drives the North America welded steel tubes market. A few of the major applications of welded steel tubes in vehicles are chassis and body frames, crash protection, heavy-duty vehicle frames, cargo bodies, suspension components, exhaust pipes and mufflers, brake lines, and roll cages and reinforcement bars. The components require different grades of welded steel tubes, and their demand is growing with the rise in vehicle production and their respective aftermarket replacements across the region.

Construction is one of the exponentially growing industries in North America. Government bodies in the US, Canada, and Mexico are investing substantially in developing residential and nonresidential infrastructures, including housing units, airports, hospitals, hotels, office buildings, and universities. According to an Associated Builders and Contractors analysis of data by the US Census Bureau, national total construction spending increased by 4.6% in September 2024 on a year-on-year basis compared to September 2023. With the burgeoning number of infrastructural projects, the demand for welded steel pipes used in engineering fields, such as building structures, steel frames, and supports, is also growing.

In September 2024, the US International Trade Commission (ITC) announced its plan to initiate sunset reviews of antidumping and countervailing duties on circular welded carbon quality steel line pipe from China. The implementation of these duties will hamper the imports from China. This factor can create opportunities for North America's local welded steel tube players by catering to the demand for welded steel tubes in various industries such as manufacturing, automotive, medical devices, etc.

COREMARK Metals; Phillips Tube Group; ArcelorMittal; Markin Tubing; Pennsylvania Steel Company, Inc.; Hofmann Industries, Inc; AMETEK Inc.; Infra-Metals Co.; Vest LLC; and RathGibsonn are among the prominent players profiled in the North America Welded Steel Tubes market report. The market players focus on new product launches, expansion and diversification, and acquisition strategies, which allow them to access prevailing business opportunities.

The overall North America Welded Steel Tubes market analysis has been derived using both primary and secondary sources. To begin the North America Welded Steel Tubes market research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the North America Welded Steel Tubes market. The process also serves the purpose of obtaining an overview and market forecast for the North America Welded Steel Tubes market growth with respect to all market segments. Also, multiple primary interviews have been conducted with industry participants and commentators to validate the data and gain more analytical insights about the topic. Participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants such as valuation experts, research analysts, and key opinion leaders-specializing in the North America Welded Steel Tubes market forecast.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Welded Steel Tubes Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Material Suppliers:

- 4.3.2 Welded Steel Tube Manufacturers:

- 4.3.3 Retailers and Authorized Distributors:

- 4.3.4 End Users:

- 4.3.5 List of Vendors in the Value Chain

5. North America Welded Steel Tubes Market - Key Market Dynamics

- 5.1 North America Welded Steel Tubes Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Surging Automotive Production

- 5.2.2 Growing Use of Construction Scaffoldings

- 5.3 Market Restraints

- 5.3.1 Fluctuating Raw Material Prices

- 5.4 Market Opportunities

- 5.4.1 Growing Energy Infrastructure Development Initiatives

- 5.4.2 Increasing Focus on Advancements of Industrial/Manufacturing Facilities

- 5.5 Future Trends

- 5.5.1 Innovations in Welding Techniques

- 5.6 Impact of Drivers and Restraints:

6. North America Welded Steel Tubes Market Analysis

- 6.1 Overview

- 6.2 North America Welded Steel Tubes Market Revenue (US$ Million), 2021-2031

- 6.3 North America Welded Steel Tubes Market Forecast and Analysis

7. North America Welded Steel Tubes Market Analysis - by Steel Grades

- 7.1 Carbon Base Grades

- 7.1.1 Overview

- 7.1.2 Carbon Base Grades: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Boron Grades

- 7.2.1 Overview

- 7.2.2 Boron Grades: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Alloy Grades

- 7.3.1 Overview

- 7.3.2 Alloy Grades: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 HSLA

- 7.4.1 Overview

- 7.4.2 HSLA: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 AHSS

- 7.5.1 Overview

- 7.5.2 AHSS: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Welded Steel Tubes Market Analysis - by Application

- 8.1 Exhaust

- 8.1.1 Overview

- 8.1.2 Exhaust: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Automotive

- 8.2.1 Overview

- 8.2.2 Automotive: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Appliances

- 8.3.1 Overview

- 8.3.2 Appliances: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Medical Devices

- 8.4.1 Overview

- 8.4.2 Medical Devices: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 HVAC

- 8.5.1 Overview

- 8.5.2 HVAC: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Burner

- 8.6.1 Overview

- 8.6.2 Burner: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.7 Conveyor Belts

- 8.7.1 Overview

- 8.7.2 Conveyor Belts: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 8.8 Others

- 8.8.1 Overview

- 8.8.2 Others: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Welded Steel Tubes Market Analysis - by Type

- 9.1 Electric Resistance Welding (ERW)

- 9.1.1 Overview

- 9.1.2 Electric Resistance Welding (ERW): North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Longitudinal Submerged Arc Welding (LSAW)

- 9.2.1 Overview

- 9.2.2 Longitudinal Submerged Arc Welding (LSAW): North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Spiral Submerged Arc Welded (SSAW)

- 9.3.1 Overview

- 9.3.2 Spiral Submerged Arc Welded (SSAW): North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Welded Steel Tubes Market Analysis - by Coating Type

- 10.1 Clear Coat

- 10.1.1 Overview

- 10.1.2 Clear Coat: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Non-Coated

- 10.2.1 Overview

- 10.2.2 Non-Coated: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Welded Steel Tubes Market - Country Analysis

- 11.1 North America Welded Steel Tubes Market Revenue and Forecast and Analysis

- 11.1.1 North America Welded Steel Tubes Market Revenue and Forecast and Analysis - by Country

- 11.1.1.1 North America Welded Steel Tubes Market Revenue and Forecast and Analysis - by Country

- 11.1.1.2 United States: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.2.1 United States: North America Welded Steel Tubes Market Breakdown by Steel Grades

- 11.1.1.2.2 United States: North America Welded Steel Tubes Market Breakdown by Application

- 11.1.1.2.3 United States: North America Welded Steel Tubes Market Breakdown by Type

- 11.1.1.2.4 United States: North America Welded Steel Tubes Market Breakdown by Coating Type

- 11.1.1.3 Canada: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.3.1 Canada: North America Welded Steel Tubes Market Breakdown by Steel Grades

- 11.1.1.3.2 Canada: North America Welded Steel Tubes Market Breakdown by Application

- 11.1.1.3.3 Canada: North America Welded Steel Tubes Market Breakdown by Type

- 11.1.1.3.4 Canada: North America Welded Steel Tubes Market Breakdown by Coating Type

- 11.1.1.4 Mexico: North America Welded Steel Tubes Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.1.4.1 Mexico: North America Welded Steel Tubes Market Breakdown by Steel Grades

- 11.1.1.4.2 Mexico: North America Welded Steel Tubes Market Breakdown by Application

- 11.1.1.4.3 Mexico: North America Welded Steel Tubes Market Breakdown by Type

- 11.1.1.4.4 Mexico: North America Welded Steel Tubes Market Breakdown by Coating Type

- 11.1.1 North America Welded Steel Tubes Market Revenue and Forecast and Analysis - by Country

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning and Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 New Product Development

- 13.4 Mergers & Acquisitions

- 13.5 Others

14. Company Profiles

- 14.1 COREMARK Metals

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Phillips Tube Group

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 ArcelorMittal

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Markin Tubing

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Pennsylvania Steel Company, Inc.

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Financial Overview

- 14.5.4 Products and Services

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Hofmann Industries, Inc

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Financial Overview

- 14.6.4 Products and Services

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 AMETEK Inc.

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Financial Overview

- 14.7.4 Products and Services

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Infra-Metals Co.

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Vest LLC

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Financial Overview

- 14.9.4 Products and Services

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 RathGibson

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Financial Overview

- 14.10.4 SWOT Analysis

- 14.10.5 Key Developments

15. Appendix

- 15.1 About The Insight Partners