|

|

市場調査レポート

商品コード

1637657

北米のオピオイド市場の予測(~2030年)・地域別分析:製品別、用途別、投与経路別、流通チャネル別North America Opioids Market Forecast to 2030 - Regional Analysis - by Product, Application, Route of Administration, and Distribution Channel |

||||||

|

|||||||

| 北米のオピオイド市場の予測(~2030年)・地域別分析:製品別、用途別、投与経路別、流通チャネル別 |

|

出版日: 2024年11月22日

発行: The Insight Partners

ページ情報: 英文 90 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米のオピオイド市場は、2022年に49億2,189万米ドルと評価され、2030年には54億4,988万米ドルに達すると予測され、2022年から2030年までのCAGRは1.3%と推定されます。

高齢者人口の増加が北米のオピオイド市場を牽引

高齢者の大半は慢性的な痛みを抱えて生活しており、その結果、日常生活を送るための体力が低下しています。高齢者人口は、骨・関節疾患、関節炎、がん、その他痛みを引き起こす慢性疾患に広く悩まされています。2018年2月の世界保健機関(WHO)のデータによると、高齢者人口は2015年の12%に対し、2050年には22%増加すると推定されています。また、この急増の80%近くを低・中所得国が占めると同データは述べています。米国、カナダ、英国、フランス、ドイツ、日本などの先進諸国や、中国、インド、韓国などの新興諸国でも、高齢者人口の大幅な増加が見られます。NCBI Journalによると、強力なオピオイド処方は高齢者層でより一般的であり、この年齢層で最も速いペースで増加しています。米国ヘルスケア研究品質庁によると、米国では2020~2021年の間に、65歳以上の成人の平均12.8%が少なくとも1回の外来オピオイド処方を受け、4.4%が4回以上のオピオイド処方を受けた。さらに、貧困層(6.1%)、低所得層(6.6%)、中間所得層(5.2%)に属する高齢者は、高所得層(2.6%)に属する高齢者よりも、2020~2021年の間に4回以上のオピオイド処方を受ける可能性が高かったです。このように、世界中で高齢者人口が増加していることが、北米のオピオイド市場の成長を牽引しています。

北米のオピオイド市場の概要

オピオイドベースの鎮痛薬は、中等度から重度の関節痛を抱える患者に対する整形外科治療の要です。米国疾病予防管理センター(CDC)が2023年10月に発表した関節炎の有病率に関するデータによると、2019年~2021年の間に、米国の成人の約21.2%(5,320万人)が医師から関節炎と診断されており、その数は2040年までに7,840万人に達すると予測されています。関節炎の症例増加に伴い、疼痛管理のためにオピオイドの需要が増加しています。

一方、オピオイド過剰摂取の急増が北米のオピオイド市場の成長に影響を与えています。世界保健機関(WHO)のオピオイド過剰摂取に関する統計によると、米国では2019年に薬物の過剰摂取による死亡者が70,630人発生しました。また、CDCは、1999年から2021年の間に、国内で~28万人が処方オピオイドの過剰摂取により死亡したと推定しています。2021年には、国内のオピオイド過剰摂取による死亡の約21%に処方オピオイドが関与しています。オピオイド過剰摂取による症例数と死亡率の増加により、CDCは2017年にこの状況を全国的な公衆衛生上の緊急事態と位置づけた。この状況はオピオイド危機とも呼ばれ、オピオイドの一種に起因する過剰使用、誤用・乱用、過剰摂取による死亡の急増を含んでいた。オピオイド危機の状況に対処し、意図的な誤用を防ぐために、食品医薬品局(FDA)は乱用抑止製剤(ADF)を用いた処方オピオイドの開発を奨励しています。FDAは2021年3月にヒドロコドン酒石酸塩を承認しました。これはFDAが承認した初のADFを有するジェネリック・オピオイドであり、この薬は、噛んで経口摂取、砕いて吸引、または注射した場合の誤用を減らすことが期待される特性を有しています。さらに、アンメット・メディカル・ニーズに対応するため、米国では薬の承認が増加しています。そのため、北米のオピオイド市場企業は、製品ポートフォリオを拡大するための製品承認や進歩、市場シェア向上のための事業拡大や合併といった戦略に注力しています。2020年3月、Trevena, Inc.はオピオイド作動薬OLINVYK(オリセリジン)のFDA承認を取得しました。OLINVYKは、成人の中等度から重度の急性疼痛、特にオピオイド静注を必要とするほど重度の疼痛の管理に適応があります。

北米のオピオイド市場の収益と2030年までの予測

北米のオピオイド市場のセグメンテーション

北米のオピオイド市場は、製品、用途、投与経路、流通チャネル、国に分類されます。

製品別に見ると、北米のオピオイド市場は、即時放出型短時間作用型オピオイドと徐放型長時間作用型オピオイドに二分されます。2022年の市場シェアは、即放性短時間作用型オピオイドセグメントが大きいです。即放性短時間作用型オピオイドはさらに、オキシコドン、ヒドロコドン、トラマドール、コデイン、プロポキシフェン、その他に細分化されます。徐放性長時間作用型オピオイドは、さらにオキシコドン、フェンタニル、モルヒネ、メタドン、その他に細分化されます。

用途別では、北米のオピオイド市場は疼痛管理、麻酔、下痢抑制、咳抑制、脱中毒、その他に分類されます。2022年には疼痛管理分野が最大の市場シェアを占めました。

投与経路別では、北米のオピオイド市場は経口剤、注射剤、経皮パッチ剤に区分されます。2022年には経口剤が最大の市場シェアを占めました。

流通チャネル別では、北米のオピオイド市場は病院薬局と小売薬局に二分されます。2022年には病院薬局セグメントがより大きな市場シェアを占めました。

国別では、北米のオピオイド市場は米国、カナダ、メキシコに区分されます。2022年の北米のオピオイド市場シェアは米国が独占しました。

Purdue Pharma LP、Endo International plc、Mallinckrodt Plc、Collegium Pharmaceutical Inc、Neuraxpharm Pharmaceuticals SL、Hikma Pharmaceuticals Plc、Rusan Pharma Ltd、Trevena Inc、Teva Pharmaceutical Industries Ltdなどが北米のオピオイド市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のオピオイド市場:主要市場力学

- 北米のオピオイド市場:主要市場力学

- 市場促進要因

- 慢性疼痛の急増

- 高齢者人口の増加

- 市場抑制要因

- 薬物乱用の増加

- 市場機会

- 市場企業の戦略的取り組み

- 今後の動向

- オピオイド過剰摂取・乱用予防・治療薬の開発に注力する政府の取り組み

- 促進要因と抑制要因の影響

第5章 オピオイド市場:北米分析

- 北米のオピオイド市場収益、2020年~2030年

- 北米のオピオイド市場予測分析

第6章 北米のオピオイド市場分析:製品別

- 即放性短時間作用型オピオイド

- 徐放性長時間作用型オピオイド

第7章 北米のオピオイド市場分析:用途別

- 疼痛管理

- 麻酔薬

- 下痢抑制

- 咳止め

- 脱中毒

- その他

第8章 北米のオピオイド市場分析:投与経路別

- 経口剤

- 注射剤

- 経皮パッチ

第9章 北米のオピオイド市場の分析:流通経路別

- 病院薬局

- 小売薬局

第10章 北米のオピオイド市場:国別分析

- 米国

- カナダ

- メキシコ

第11章 業界情勢

- オピオイド市場の成長戦略

- 有機的成長戦略

- 無機的成長戦略

- 成長戦略

第12章 企業プロファイル

- Purdue Pharma L.P.

- Endo International plc

- Mallinckrodt Plc

- Collegium Pharmaceutical, Inc.

- Neuraxpharm Pharmaceuticals SL

- Hikma Pharmaceuticals Plc

- Rusan Pharma Ltd

- Trevena, Inc.

- Teva Pharmaceutical Industries Ltd

第13章 付録

List Of Tables

- Table 1. North America Opioids Market Segmentation

- Table 2. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Product

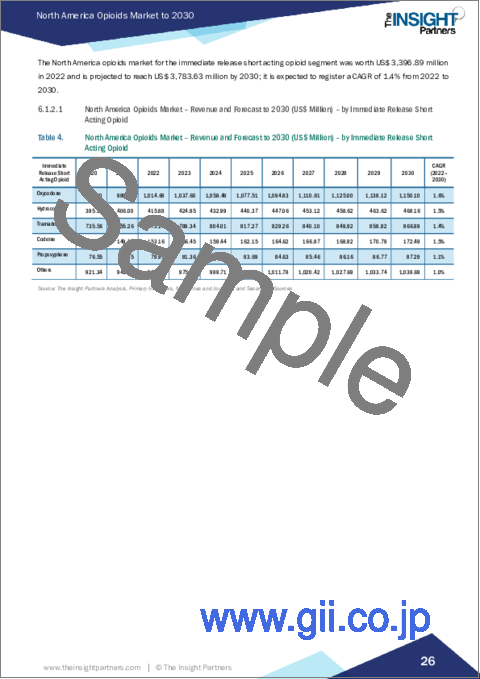

- Table 4. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Immediate Release Short Acting Opioid

- Table 5. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Extended Release Long-Acting Opioid

- Table 6. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 7. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Route of Administration

- Table 8. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

- Table 9. North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 10. United States: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Product

- Table 11. United States: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Immediate Release Short Acting Opioid

- Table 12. United States: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Extended Release Long-Acting Opioid

- Table 13. United States: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 14. United States: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Route of Administration

- Table 15. United States: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

- Table 16. Canada: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Product

- Table 17. Canada: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Immediate Release Short Acting Opioid

- Table 18. Canada: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Extended Release Long-Acting Opioid

- Table 19. Canada: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 20. Canada: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Route of Administration

- Table 21. Canada: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

- Table 22. Mexico: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Product

- Table 23. Mexico: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Immediate Release Short Acting Opioid

- Table 24. Mexico: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Extended Release Long-Acting Opioid

- Table 25. Mexico: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 26. Mexico: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Route of Administration

- Table 27. Mexico: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Distribution Channel

- Table 28. Recent Organic Growth Strategies in Opioids Market

- Table 29. Recent Inorganic Growth Strategies in the Opioids Market

- Table 30. Glossary of Terms, Opioids Market

List Of Figures

- Figure 1. North America Opioids Market Segmentation, by Country

- Figure 2. Impact Analysis of Drivers and Restraints

- Figure 3. North America Opioids Market Revenue (US$ Million), 2020-2030

- Figure 4. North America Opioids Market Share (%) - by Product (2022 and 2030)

- Figure 5. Immediate Release Short Acting Opioid: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 6. Extended Release Long-Acting Opioid: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. North America Opioids Market Share (%) - by Application (2022 and 2030)

- Figure 8. Pain Management: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Anesthesia: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Diarrhea Suppression: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Cough Suppression: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. De-Addiction: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Others: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. North America Opioids Market Share (%) - by Route of Administration (2022 and 2030)

- Figure 15. Oral: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Injectable: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Transdermal Patch: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. North America Opioids Market Share (%) - by Distribution Channel (2022 and 2030)

- Figure 19. Hospital Pharmacies: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Retail Pharmacies: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. North America Opioids Market Breakdown, by Key Countries - Revenue (2022) (US$ Million)

- Figure 22. North America Opioids Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 23. United States: North America Opioids Market - Revenue and Forecast to 2030(US$ Million)

- Figure 24. Canada: North America Opioids Market - Revenue and Forecast to 2030(US$ Million)

- Figure 25. Mexico: North America Opioids Market - Revenue and Forecast to 2030(US$ Million)

- Figure 26. Growth Strategies in Opioids Market

The North America opioids market was valued at US$ 4,921.89 million in 2022 and is expected to reach US$ 5,449.88 million by 2030; it is estimated to register a CAGR of 1.3% from 2022 to 2030.

Increasing Geriatric Population Fuels North America Opioids Market

The majority of older people live with chronic pain, resulting in reduced strength to carry out their daily routine. The geriatric population widely suffers from bone and joint disorders, arthritis, cancer, and other chronic disorders causing pain. According to the World Health Organization (WHO) data from February 2018, the geriatric population is estimated to grow by 22% by 2050 compared with 12% in 2015. The data also stated that low- and middle-income countries would account for nearly 80% of this surge. Developed countries such as the US, Canada, the UK, France, Germany, and Japan, and developing countries such as China, India, and South Korea are also experiencing significant growth in the geriatric population, which is driven by improved healthcare facilities and better healthcare services; this has resulted in increased life expectancy in these regions. According to NCBI Journal, strong opioid prescribing is more prevalent in the aging population, growing at the fastest rate in this age group. As per the Agency for Healthcare Research and Quality, 12.8% of adults aged 65 and older, on average, had at least one outpatient opioid prescription, and 4.4% had four or more opioid prescriptions during 2020-2021 in the US. Furthermore, older adults qualifying under the poor category (6.1%), low-income category (6.6%), and middle-income category (5.2%) were more likely than those grouped under the high-income category (2.6%) to get four or more opioid prescription fills during 2020-2021. Thus, the growing geriatric population across the world drives the growth of the North America opioids market.

North America Opioids Market Overview

Opioid-based pain medications are a cornerstone of orthopedic care for patients with moderate to severe arthritis pain. As per data released by the Centers for Disease Control and Prevention (CDC) in October 2023 on arthritis prevalence, nearly 21.2% of adults in the US (i.e., 53.2 million people) had doctor-diagnosed arthritis during 2019-2021, and the number is projected to reach 78.4 million by 2040. The demand for opioids is increasing for pain management with the growing cases of arthritis.

On the other hand, the surging cases of opioid overdose are affecting the growth of the North America opioids market. As per the World Health Organization (WHO) statistics on opioid overdose, there were 70,630 deaths due to drug overdose in 2019 in the US. The CDC also estimated that ~280,000 people in the country died from the overdose of prescription opioids during 1999-2021. In 2021, nearly 21% of all opioid overdose deaths in the country involved a prescription opioid. Due to the increasing number of cases and mortality rate from opioid overdoses, the CDC labeled the situation as a nationwide Public Health Emergency in 2017. This situation was also referred to as the opioid crisis, which included the rapid increase in overuse, misuse/abuse, and overdose deaths attributed to the class of opioid drugs. To tackle the situation of opioid crisis and prevent intentional misuse, the Food and Drug Administration (FDA) is encouraging the development of prescription opioids with abuse-deterrent formulations (ADFs). The FDA approved hydrocodone bitartrate in March 2021. It is the first FDA-approved generic opioid with an ADF, and the medication has properties that are expected to reduce the misuse of the drug when chewed and then taken orally, crushed and snorted, or injected. Further, to address the unmet medical needs, there has been an increase in medication approval in the US. Thus, the North America opioids market players have been focusing on strategies such as product approvals and advancements to broaden their product portfolio, and expansions and mergers to improve their market share. In March 2020, Trevena, Inc. received FDA approval for OLINVYK (oliceridine), an opioid agonist indicated for the management of moderate to severe acute pain in adults, especially when the pain is severe enough to require an intravenous opioid.

North America Opioids Market Revenue and Forecast to 2030 (US$ Million)

North America Opioids Market Segmentation

The North America opioids market is categorized into product, application, route of administration, distribution channel, and country.

Based on product, the North America opioids market is bifurcated immediate release short acting opioid and extended release long acting opioid. The immediate release short acting opioid segment held a larger market share in 2022. The immediate release short acting opioid is further sub segmented into oxycodone, hydrocodone, tramadol, codeine, propoxyphene, and others. The extended release long acting opioid is further sub segmented into oxycodone, fentanyl, morphine, methadone, and others.

In terms of application, the North America opioids market is categorized into pain management, anesthesia, diarrhea suppression, cough suppression, de-addiction, and others. The pain management segment held the largest market share in 2022.

By route of administration, the North America opioids market is segmented into oral, injectable, and transdermal patch. The oral segment held the largest market share in 2022.

By distribution channel, the North America opioids market is bifurcated into hospital pharmacies and retail pharmacies. The hospital pharmacies segment held a larger market share in 2022.

By country, the North America opioids market is segmented into the US, Canada, and Mexico. The US dominated the North America opioids market share in 2022.

Purdue Pharma LP, Endo International plc, Mallinckrodt Plc, Collegium Pharmaceutical Inc, Neuraxpharm Pharmaceuticals SL, Hikma Pharmaceuticals Plc, Rusan Pharma Ltd, Trevena Inc, and Teva Pharmaceutical Industries Ltd are some of the leading companies operating in the North America opioids market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Opioids Market - Key Market Dynamics

- 4.1 North America Opioids Market - Key Market Dynamics

- 4.2 Market Drivers

- 4.2.1 Surging Chronic Pain Incidence

- 4.2.2 Increasing Geriatric Population

- 4.3 Market Restraints

- 4.3.1 Increasing Drug Abuse

- 4.4 Market Opportunities

- 4.4.1 Strategic Initiatives by Market Players

- 4.5 Future Trends

- 4.5.1 Government Initiatives Focusing on Development of Medication to Prevent and Treat Opioid Overdose and Disorder

- 4.6 Impact of Drivers and Restraints:

5. Opioids Market - North America Analysis

- 5.1 North America Opioids Market Revenue (US$ Million), 2020-2030

- 5.2 North America Opioids Market Forecast Analysis

6. North America Opioids Market Analysis - by Product

- 6.1 Immediate Release Short Acting Opioid

- 6.1.1 Overview

- 6.1.2 Immediate Release Short Acting Opioid: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 6.1.2.1 North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Immediate Release Short Acting Opioid

- 6.2 Extended Release Long-Acting Opioid

- 6.2.1 Overview

- 6.2.2 Extended Release Long-Acting Opioid: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 6.2.2.1 North America Opioids Market - Revenue and Forecast to 2030 (US$ Million) - by Extended Release Long-Acting Opioid

7. North America Opioids Market Analysis - by Application

- 7.1 Pain Management

- 7.1.1 Overview

- 7.1.2 Pain Management: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Anesthesia

- 7.2.1 Overview

- 7.2.2 Anesthesia: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Diarrhea Suppression

- 7.3.1 Overview

- 7.3.2 Diarrhea Suppression: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Cough Suppression

- 7.4.1 Overview

- 7.4.2 Cough Suppression: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 De-Addiction

- 7.5.1 Overview

- 7.5.2 De-Addiction: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Opioids Market Analysis - by Route of Administration

- 8.1 Oral

- 8.1.1 Overview

- 8.1.2 Oral: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Injectable

- 8.2.1 Overview

- 8.2.2 Injectable: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Transdermal Patch

- 8.3.1 Overview

- 8.3.2 Transdermal Patch: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Opioids Market Analysis - by Distribution Channel

- 9.1 Hospital Pharmacies

- 9.1.1 Overview

- 9.1.2 Hospital Pharmacies: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Retail Pharmacies

- 9.2.1 Overview

- 9.2.2 Retail Pharmacies: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Opioids Market - Country Analysis

- 10.1 North America Opioids Market - Country Analysis

- 10.1.1 North America Opioids Market Breakdown, by Key Countries, 2022 and 2030 (%)

- 10.1.1.1 North America Opioids Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.2.1 United States: North America Opioids Market Breakdown, by Product

- 10.1.1.2.2 United States: North America Opioids Market Breakdown, by Immediate Release Short Acting Opioid

- 10.1.1.2.3 United States: North America Opioids Market Breakdown, by Extended Release Long-Acting Opioid

- 10.1.1.2.4 United States: North America Opioids Market Breakdown, by Application

- 10.1.1.2.5 United States: North America Opioids Market Breakdown, by Route of Administration

- 10.1.1.2.6 United States: North America Opioids Market Breakdown, by Distribution Channel

- 10.1.1.3 Canada: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.3.1 Canada: North America Opioids Market Breakdown, by Product

- 10.1.1.3.2 Canada: North America Opioids Market Breakdown, by Immediate Release Short Acting Opioid

- 10.1.1.3.3 Canada: North America Opioids Market Breakdown, by Extended Release Long-Acting Opioid

- 10.1.1.3.4 Canada: North America Opioids Market Breakdown, by Application

- 10.1.1.3.5 Canada: North America Opioids Market Breakdown, by Route of Administration

- 10.1.1.3.6 Canada: North America Opioids Market Breakdown, by Distribution Channel

- 10.1.1.4 Mexico: North America Opioids Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.4.1 Mexico: North America Opioids Market Breakdown, by Product

- 10.1.1.4.2 Mexico: North America Opioids Market Breakdown, by Immediate Release Short Acting Opioid

- 10.1.1.4.3 Mexico: North America Opioids Market Breakdown, by Extended Release Long-Acting Opioid

- 10.1.1.4.4 Mexico: North America Opioids Market Breakdown, by Application

- 10.1.1.4.5 Mexico: North America Opioids Market Breakdown, by Route of Administration

- 10.1.1.4.6 Mexico: North America Opioids Market Breakdown, by Distribution Channel

- 10.1.1 North America Opioids Market Breakdown, by Key Countries, 2022 and 2030 (%)

11. Industry Landscape

- 11.1 Overview

- 11.2 Growth Strategies in Opioids Market

- 11.3 Organic Growth Strategies

- 11.3.1 Overview

- 11.4 Inorganic Growth Strategies

- 11.4.1 Overview

12. Company Profiles

- 12.1 Purdue Pharma L.P.

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Endo International plc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Mallinckrodt Plc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Collegium Pharmaceutical, Inc.

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Neuraxpharm Pharmaceuticals SL

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Hikma Pharmaceuticals Plc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Rusan Pharma Ltd

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Trevena, Inc.

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Teva Pharmaceutical Industries Ltd

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Glossary of Terms