|

|

市場調査レポート

商品コード

1637642

北米の水処理システム市場予測(~2031年)と地域別分析:ろ過プロセス別、タイプ別、用途別、エンドユーザー別North America Water Treatment System Market Forecast to 2031 - Regional Analysis - by Filtration Process, Type, Application, and End User |

||||||

|

|||||||

| 北米の水処理システム市場予測(~2031年)と地域別分析:ろ過プロセス別、タイプ別、用途別、エンドユーザー別 |

|

出版日: 2024年11月22日

発行: The Insight Partners

ページ情報: 英文 137 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の水処理システム市場は、2023年に157億4,015万米ドルと評価され、2031年には242億4,149万米ドルに達すると予測され、2023年から2031年までのCAGRは5.5%と推定されます。

廃水処理に関する政府規制の増加が北米の水処理システム市場を牽引

人口増加に伴い廃水量は増加しています。廃水の大部分は家庭と産業から発生しています。毎年、世界全体で約3,800億立方メートルの都市廃水が発生しています。その結果、人口の増加と都市化の進展に伴い、廃水管理分野における適切なインフラ開発の必要性が高まっています。多くの国の政府は、環境を汚染から守るため、適切な廃水処理施設の設置に注力しています。2022年、米国には16,000以上の公共廃水管理施設がありました。米国の人口の80%以上が、適切な治療後にこれらの施設からの飲料水を消費しており、~75%がこれらの施設で衛生的な治療を受けています。適切な水処理インフラの重要性の高まりが、水処理施設の需要を押し上げています。

世界全体では、廃水の78%近くが未処理のまま地下水や河川、湖沼に捨てられており、深刻な水質汚染を引き起こしています。そのため、世界各国の政府は、さまざまな産業への水処理システムの導入を奨励するとともに、全体的な水質を向上させるための規制政策を強化しています。米国では、環境保護庁が廃水管理を管理し、国家汚染物質排出削減制度(National Pollutant Discharge Elimination System)がすべての廃水処理施設に許可を与えています。さらに、水質汚濁防止法は、産業用途に使用される水が効率的に利用されることを保証するため、政府機関を支援しています。このように、環境問題への対応と持続可能性の向上に対する政府の関心の高まりが、水処理システム市場を牽引しています。

北米の水処理システム市場概要

米国、カナダ、メキシコは北米の主要貢献国のひとつです。環境汚染と持続可能性への関心の高まりが、北米における水処理施設の需要を促進しています。例えば、2023年7月、米国内務省は超党派インフラストラクチャー法の一環として、米国西部の地域社会に清潔で信頼できる飲料水を提供するために1億5,200万米ドルを投資しました。このプロジェクトは、カリフォルニア州、コロラド州、ワシントン州の170万エーカーフィートで開始されました。また、同地域の貯水能力を向上させるための資金も提供されました。

Pentair plc、Xylem Inc、GE Water &Process Technologies、MPW Industrial Services、Suez Environment、Pall、Veolia Water Technologiesなどが、北米で水処理システムとサービスを提供している主要企業です。水処理システム市場で事業を展開する企業は、戦略的イニシアチブをとり、水処理施設に技術を活用しています。例えば、2020年5月、ヴェオリアは高純度水製造用のスキッドマウント逆浸透システムであるSIRION Proを発売しました。別の例を挙げると、2022年にはペンテェアがペンテェア・ウォーター・ソリューション事業で住宅用水処理サービスの拡大を発表しています。このような開発と水管理インフラへの投資の拡大が、北米の水処理システム市場の成長を後押ししています。

北米の水処理システム市場の収益と2031年までの予測(金額)

北米の水処理システム市場セグメンテーション

北米の水処理システム市場は、ろ過プロセス、タイプ、用途、エンドユーザー、国に分類されます。

ろ過プロセスに基づき、北米の水処理システム市場は蒸留、紫外線殺菌、逆浸透、ろ過、イオン交換、その他にセグメント化されます。逆浸透膜セグメントは2023年に最大の市場シェアを占めました。

タイプ別では、北米の水処理システム市場は飲料水処理システム、工業用水処理システム、廃水処理システム、ポータブル水処理システム、井戸水処理システムに分類されます。2023年には飲料水処理システム分野が最大の市場シェアを占めています。

用途別では、北米の水処理システム市場は地下水、汽水・海水淡水化、雨水利用、飲料水、その他に区分されます。飲料水セグメントは2023年に最大の市場シェアを占めました。

エンドユーザー別では、北米の水処理システム市場は、住宅、自治体、農業、食品・飲料、商業、鉱業・金属、石油・ガス、医薬品、その他に区分されます。2023年には、自治体セグメントが最大の市場シェアを占めています。

国別では、北米の水処理システム市場は米国、カナダ、メキシコに区分されます。2023年の北米の水処理システム市場シェアは米国が独占しました。

3M Co.、Aquatech International LLC.、Culligan International Co.、DuPont de Nemours Inc.、日立造船株式会社、Filtra-Systems Company LLC、Pall Corp、Pentair Plc、Pure Aqua, Inc.、Thermax Limited、Thermo Fisher Scientific Inc.、Veolia Environnement SA、Xylem Inc.は北米の水処理システム市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の水処理システム市場情勢

- PEST分析

- エコシステム分析

第5章 北米の水処理システム市場:主要市場力学

- 市場促進要因

- 様々な最終用途産業におけるプロセス水需要の増加

- 廃水処理に関する政府規制の増加

- 市場抑制要因

- 水処理システムの高いメンテナンスコストと設置コスト

- 市場機会

- 廃水処理施設への投資の増加

- 今後の動向

- 新興諸国におけるスマートシティの開発

- 促進要因と抑制要因の影響

第6章 水処理システム市場:北米分析

- 北米の水処理システム市場収益(2021年~2031年)

- 北米の水処理システム市場予測分析

第7章 北米の水処理システム市場分析:ろ過プロセス別

- 蒸留

- 紫外線殺菌

- 逆浸透

- ろ過

- イオン交換

- その他

第8章 北米の水処理システム市場分析:タイプ別

- 飲料水処理システム

- 工業用水処理システム

- 廃水処理システム

- ポータブル水処理システム

- 井戸水処理システム

第9章 北米の水処理システム市場分析:用途別

- 地下水

- 汽水および海水の脱塩

- 雨水利用

- 飲料水

- その他

第10章 北米の水処理システム市場分析:エンドユーザー別

- 住宅用

- 自治体

- 農業

- 食品・飲料

- 商業

- 鉱業および金属

- 石油・ガス

- 製薬

- その他

第11章 北米の水処理システム市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- 企業のポジショニングと集中度

- ヒートマップ分析

第13章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第14章 企業プロファイル

- Hitachi Zosen Corporation

- Pentair Plc

- Thermax Limited

- Xylem Inc

- Veolia Environnement SA

- Pall Corp

- Culligan International Co

- DuPont de Nemours Inc

- Thermo Fisher Scientific Inc

- 3M Co

- Pure Aqua, Inc.

- Aquatech International LLC.

- Filtra-Systems Company LLC

第15章 付録

List Of Tables

- Table 1. North America Water Treatment Systems Market Segmentation

- Table 2. North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Table 3. North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Filtration Process

- Table 4. North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Type

- Table 5. North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Application

- Table 6. North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by End User

- Table 7. North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Country

- Table 8. United States: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Filtration Process

- Table 9. United States: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Type

- Table 10. United States: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Application

- Table 11. United States: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by End User

- Table 12. Canada: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Filtration Process

- Table 13. Canada: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Type

- Table 14. Canada: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Application

- Table 15. Canada: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by End User

- Table 16. Mexico: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Filtration Process

- Table 17. Mexico: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Type

- Table 18. Mexico: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by Application

- Table 19. Mexico: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion) - by End User

List Of Figures

- Figure 1. North America Water Treatment Systems Market Segmentation, by Country

- Figure 2. North America Water Treatment Systems Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Water Treatment Systems Market Revenue (US$ Billion), 2021-2031

- Figure 5. North America Water Treatment Systems Market Share (%) - by Filtration Process (2023 and 2031)

- Figure 6. Distillation: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 7. Ultra-violet Sterilization: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 8. Reverse Osmosis: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 9. Filtration: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 10. Ion-exchange: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 11. Others: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 12. North America Water Treatment Systems Market Share (%) - by Type (2023 and 2031)

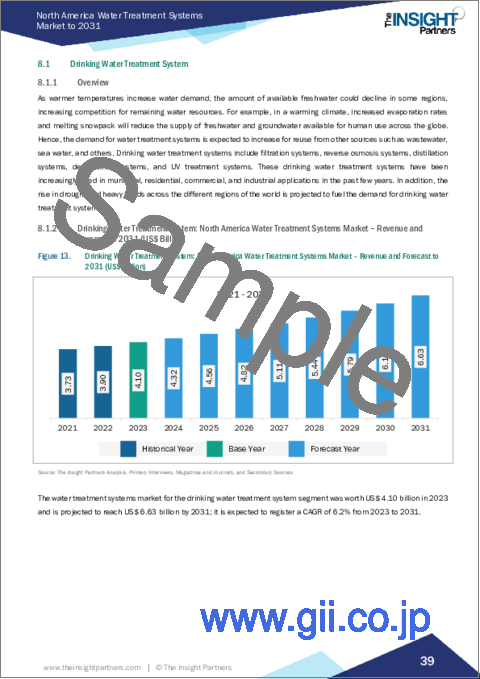

- Figure 13. Drinking Water Treatment System: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 14. Industrial Water Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 15. Wastewater Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 16. Portable Water Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 17. Well Water Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 18. North America Water Treatment Systems Market Share (%) - by Application (2023 and 2031)

- Figure 19. Ground Water: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 20. Brackish and Sea Water Desalination: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 21. Rainwater Harvesting: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 22. Drinking Water: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 23. Others: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 24. North America Water Treatment Systems Market Share (%) - by End User (2023 and 2031)

- Figure 25. Residential: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 26. Municipal: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 27. Agriculture: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 28. Food and Beverage: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 29. Commercial: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 30. Mining and Metal: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 31. Oil and Gas: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 32. Pharmaceuticals: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 33. Others: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 34. North America Water Treatment Systems Market Breakdown, by Key Countries - Revenue (2023) (US$ Billion)

- Figure 35. North America Water Treatment Systems Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 36. United States: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 37. Canada: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 38. Mexico: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- Figure 39. Company Positioning & Concentration

- Figure 40. Heat Map Analysis

The North America water treatment system market was valued at US$ 15,740.15 million in 2023 and is expected to reach US$ 24,241.49 million by 2031; it is estimated to register a CAGR of 5.5% from 2023 to 2031.

Increasing Government Regulations on Wastewater Treatment Fuel North America Water Treatment System Market

The volume of wastewater is growing with the increase in population. Households and industries produce the majority of wastewater. Every year, ~380 billion cubic meters of municipal wastewater is produced globally. As a result, the requirement for proper infrastructure development in the wastewater management sector is growing, led by the growing population and rising urbanization. Governments of numerous countries are concentrating on installing proper wastewater treatment facilities to protect the environment from pollution. In 2022, there were more than 16,000 public wastewater management facilities in the US. Over 80% of the US population consumes drinking water from these facilities after proper treatment, and ~75% of the US population has sanitary treatment in these facilities. The growing importance of proper water treatment infrastructure is boosting the demand for water treatment facilities.

Globally, almost 78% of the wastewater stays untreated and is disposed of in groundwater, rivers, or lakes, which causes critical water pollution. Therefore, governments across the globe are strengthening their regulatory policies to enhance the overall water quality, along with encouraging the deployment of water treatment systems in various industries. In the US, the Environmental Protection Agency controls wastewater management, while the National Pollutant Discharge Elimination System gives permits to all wastewater treatment facilities. Furthermore, the Water Pollution Control Act supports agencies to guarantee water obtained for industrial applications is utilized efficiently. Thus, the growing government focus on addressing environmental concerns and increasing sustainability drives the water treatment systems market.

North America Water Treatment System Market Overview

The US, Canada, and Mexico are among the major contributing countries in North America. The growing focus on environmental pollution and sustainability is driving the demand for water treatment facilities in North America. For instance, in July 2023, the US Department of Interior invested ~US$ 152 million as a part of the Bipartisan Infrastructure Law to bring clean and reliable drinking water to communities across the West US. The projects were initiated in California, Colorado, and Washington in an area of 1.7-million-acre feet for the additional water storage capacity. The funding was also made available to advance water storage capacities in that area.

Pentair plc, Xylem Inc, GE Water & Process Technologies, MPW Industrial Services, Suez Environment, Pall, and Veolia Water Technologies are among the key players offering water treatment systems and services in North America. Companies operating in the water treatment systems market are taking strategic initiatives and utilizing technologies for water treatment facilities. For instance, in May 2020, Veolia launched SIRION Pro, which is a skid-mounted reverse osmosis system for high-purity water production. To cite another instance, in 2022, Pentair announced the expansion of its residential water treatment offerings with its Pentair water solutions segment. Thus, such developments and growing investment in water management infrastructure are propelling the growth of the water treatment systems market in North America.

North America Water Treatment System Market Revenue and Forecast to 2031 (US$ Million)

North America Water Treatment System Market Segmentation

The North America water treatment system market is categorized into filtration process, type, application, end user, and country.

Based on filtration process, the North America water treatment system market is segmented distillation, ultra-violet sterilization, reverse osmosis, filtration, ion-exchange, and others. The reverse osmosis segment held the largest market share in 2023.

In terms of type, the North America water treatment system market is categorized into drinking water treatment system, industrial water treatment systems, wastewater treatment systems, portable water treatment systems, and well water treatment systems. The drinking water treatment system segment held the largest market share in 2023.

By application, the North America water treatment system market is segmented into ground water, brackish and sea water desalination, rainwater harvesting, drinking water, and others. The drinking water segment held the largest market share in 2023.

By end user, the North America water treatment system market is segmented into residential, municipal, agriculture, food and beverage, commercial, mining and metal, oil and gas, pharmaceuticals, and others. The municipal segment held the largest market share in 2023.

By country, the North America water treatment system market is segmented into the US, Canada, and Mexico. The US dominated the North America water treatment system market share in 2023.

3M Co; Aquatech International LLC.; Culligan International Co; DuPont de Nemours Inc; Hitachi Zosen Corporation; Filtra-Systems Company LLC; Pall Corp; Pentair Plc; Pure Aqua, Inc.; Thermax Limited; Thermo Fisher Scientific Inc; Veolia Environnement SA; and Xylem Inc are some of the leading companies operating in the North America water treatment system market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Water Treatment Systems Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

5. North America Water Treatment Systems Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Process Water in Various End-Use Industries

- 5.1.2 Increasing Government Regulations on Wastewater Treatment

- 5.2 Market Restraints

- 5.2.1 High Maintenance and Installation Costs of Water Treatment Systems

- 5.3 Market Opportunities

- 5.3.1 Rising Investments in Wastewater Treatment Facilities

- 5.4 Future Trends

- 5.4.1 Development of Smart Cities in Emerging Countries

- 5.5 Impact of Drivers and Restraints:

6. Water Treatment Systems Market - North America Analysis

- 6.1 Overview

- 6.2 North America Water Treatment Systems Market Revenue (US$ Billion), 2021-2031

- 6.3 North America Water Treatment Systems Market Forecast Analysis

7. North America Water Treatment Systems Market Analysis - by Filtration Process

- 7.1 Distillation

- 7.1.1 Overview

- 7.1.2 Distillation: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.2 Ultra-violet Sterilization

- 7.2.1 Overview

- 7.2.2 Ultra-violet Sterilization: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.3 Reverse Osmosis

- 7.3.1 Overview

- 7.3.2 Reverse Osmosis: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.4 Filtration

- 7.4.1 Overview

- 7.4.2 Filtration: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.5 Ion-exchange

- 7.5.1 Overview

- 7.5.2 Ion-exchange: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 7.6 Others

- 7.6.1 Overview

- 7.6.2 Others: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

8. North America Water Treatment Systems Market Analysis - by Type

- 8.1 Drinking Water Treatment System

- 8.1.1 Overview

- 8.1.2 Drinking Water Treatment System: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 8.2 Industrial Water Treatment Systems

- 8.2.1 Overview

- 8.2.2 Industrial Water Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 8.3 Wastewater Treatment Systems

- 8.3.1 Overview

- 8.3.2 Wastewater Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 8.4 Portable Water Treatment Systems

- 8.4.1 Overview

- 8.4.2 Portable Water Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 8.5 Well Water Treatment Systems

- 8.5.1 Overview

- 8.5.2 Well Water Treatment Systems: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

9. North America Water Treatment Systems Market Analysis - by Application

- 9.1 Ground Water

- 9.1.1 Overview

- 9.1.2 Ground Water: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 9.2 Brackish and Sea Water Desalination

- 9.2.1 Overview

- 9.2.2 Brackish and Sea Water Desalination: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 9.3 Rainwater Harvesting

- 9.3.1 Overview

- 9.3.2 Rainwater Harvesting: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 9.4 Drinking Water

- 9.4.1 Overview

- 9.4.2 Drinking Water: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 9.5 Others

- 9.5.1 Overview

- 9.5.2 Others: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

10. North America Water Treatment Systems Market Analysis - by End User

- 10.1 Residential

- 10.1.1 Overview

- 10.1.2 Residential: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.2 Municipal

- 10.2.1 Overview

- 10.2.2 Municipal: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.3 Agriculture

- 10.3.1 Overview

- 10.3.2 Agriculture: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.4 Food and Beverage

- 10.4.1 Overview

- 10.4.2 Food and Beverage: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.5 Commercial

- 10.5.1 Overview

- 10.5.2 Commercial: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.6 Mining and Metal

- 10.6.1 Overview

- 10.6.2 Mining and Metal: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.7 Oil and Gas

- 10.7.1 Overview

- 10.7.2 Oil and Gas: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.8 Pharmaceuticals

- 10.8.1 Overview

- 10.8.2 Pharmaceuticals: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 10.9 Others

- 10.9.1 Overview

- 10.9.2 Others: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

11. North America Water Treatment Systems Market - Country Analysis

- 11.1 North America

- 11.1.1 North America Water Treatment Systems Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 North America Water Treatment Systems Market - Revenue and Forecast Analysis - by Country

- 11.1.1.2 United States: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.2.1 United States: North America Water Treatment Systems Market Breakdown, by Filtration Process

- 11.1.1.2.2 United States: North America Water Treatment Systems Market Breakdown, by Type

- 11.1.1.2.3 United States: North America Water Treatment Systems Market Breakdown, by Application

- 11.1.1.2.4 United States: North America Water Treatment Systems Market Breakdown, by End User

- 11.1.1.3 Canada: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.3.1 Canada: North America Water Treatment Systems Market Breakdown, by Filtration Process

- 11.1.1.3.2 Canada: North America Water Treatment Systems Market Breakdown, by Type

- 11.1.1.3.3 Canada: North America Water Treatment Systems Market Breakdown, by Application

- 11.1.1.3.4 Canada: North America Water Treatment Systems Market Breakdown, by End User

- 11.1.1.4 Mexico: North America Water Treatment Systems Market - Revenue and Forecast to 2031 (US$ Billion)

- 11.1.1.4.1 Mexico: North America Water Treatment Systems Market Breakdown, by Filtration Process

- 11.1.1.4.2 Mexico: North America Water Treatment Systems Market Breakdown, by Type

- 11.1.1.4.3 Mexico: North America Water Treatment Systems Market Breakdown, by Application

- 11.1.1.4.4 Mexico: North America Water Treatment Systems Market Breakdown, by End User

- 11.1.1 North America Water Treatment Systems Market - Revenue and Forecast Analysis - by Country

12. Competitive Landscape

- 12.1 Company Positioning & Concentration

- 12.2 Heat Map Analysis

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 Product Development

- 13.4 Mergers & Acquisitions

14. Company Profiles

- 14.1 Hitachi Zosen Corporation

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Pentair Plc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Thermax Limited

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Xylem Inc

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Veolia Environnement SA

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Pall Corp

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Culligan International Co

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 DuPont de Nemours Inc

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Thermo Fisher Scientific Inc

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 3M Co

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

- 14.11 Pure Aqua, Inc.

- 14.11.1 Key Facts

- 14.11.2 Business Description

- 14.11.3 Products and Services

- 14.11.4 Financial Overview

- 14.11.5 SWOT Analysis

- 14.11.6 Key Developments

- 14.12 Aquatech International LLC.

- 14.12.1 Key Facts

- 14.12.2 Business Description

- 14.12.3 Products and Services

- 14.12.4 Financial Overview

- 14.12.5 SWOT Analysis

- 14.12.6 Key Developments

- 14.13 Filtra-Systems Company LLC

- 14.13.1 Key Facts

- 14.13.2 Business Description

- 14.13.3 Products and Services

- 14.13.4 Financial Overview

- 14.13.5 SWOT Analysis

- 14.13.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners