|

|

市場調査レポート

商品コード

1624227

米国の窒素発生装置市場規模・予測、地域シェア、動向、成長機会分析レポート:タイプ別、エンドユーザー別US Nitrogen Generator Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type and End User |

||||||

|

|||||||

| 米国の窒素発生装置市場規模・予測、地域シェア、動向、成長機会分析レポート:タイプ別、エンドユーザー別 |

|

出版日: 2024年11月25日

発行: The Insight Partners

ページ情報: 英文 86 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

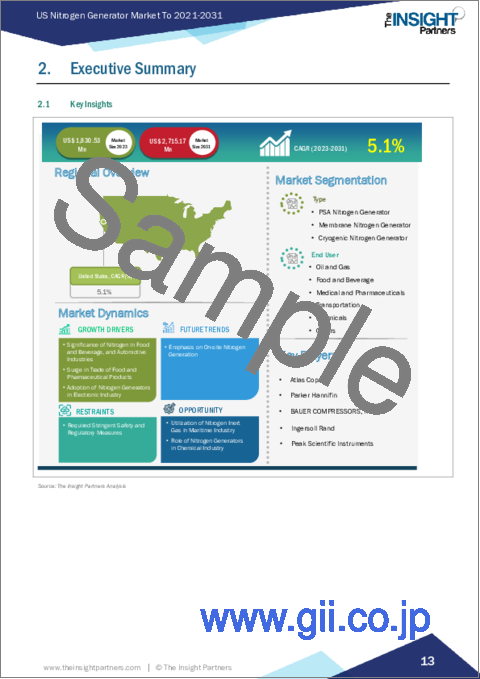

米国の窒素発生装置市場規模は、2023年に18億3,000万米ドルと評価され、2031年には27億1,000万米ドルに達すると予測され、2023年から2031年までのCAGRは5.1%を記録すると予測されています。

米国は大きく4つの地域に分けられる:北東部、中西部、南部、西部です。アラバマ州、アーカンソー州、デラウェア州、フロリダ州、ジョージア州、コロンビア特別区、ケンタッキー州、ルイジアナ州、メリーランド州、ミシシッピ州、ノースカロライナ州、オクラホマ州、サウスカロライナ州、テネシー州、テキサス州、バージニア州、ウェストバージニア州は、米国南部の主要な州/地域です。南部地域は米国経済全体において主要な役割を担っており、米国の窒素発生装置市場をリードしています。この地域の市場成長は、産業と石油・ガスセクターの継続的な発展に起因しています。同地域は、経済開拓、政府の取り組み、同地域に関連するイニシアティブにより、新規事業にとって魅力的な目的地となっており、今後数年間、窒素発生装置市場に新たな成長機会をもたらすと予想されています。例えば、CJロジスティクス・アメリカは2023年、テネシー州ナッシュビルに20万6,000平方フィートの保管施設を開設し、温度管理された倉庫機能を拡大すると発表しました。

イリノイ州、アイオワ州、インディアナ州、カンザス州、ミシガン州、ミズーリ州、ミネソタ州、ネブラスカ州、ノースダコタ州、オハイオ州、サウスダコタ州、ウィスコンシン州は米国中西部の主要州のひとつです。これらの州では工業化のペースが速く、製造施設の数が増加していることが、中西部における窒素発生装置市場の成長に拍車をかけています。自動車部品製造施設の増加も、この地域での窒素の応用に拍車をかけています。2024年2月、シェフラーは自動車用電動モビリティ・ソリューションの製造に特化した新しい製造施設を追加し、米国での事業拡大を発表しました。同社は、米国オハイオ州に先進製造施設を設立するために2億3,000万米ドルを超える投資を計画しており、2032年までの将来の拡張を意図しています。

Advanced Gas Technologies社、BAUER COMPRESSORS, INC.社、On Site Gas Systems Inc.社、Atlas Copco AB社、Parker Hannifin社、Holtec Gas Systems社、VICI DBS社、Peak Scientific Instruments Ltd.社、Air &Gas Solutions LLC社、Ingersoll Rand Inc.社などは、この市場調査で紹介されている米国の窒素発生装置市場の主要企業です。

米国の窒素発生装置市場全体の規模は、一次情報源と二次情報源の両方を用いて導き出されています。徹底的な二次調査は、米国の窒素発生装置市場規模に関連する質的・量的情報を得るために、社内外の情報源を用いて実施されました。このプロセスは、すべての市場セグメントに関する市場の概要と予測を得るのにも役立ちます。また、データを検証し、分析的洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスには、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、米国の窒素発生装置市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 米国の窒素発生装置市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 窒素発生装置の米国市場:主要市場力学

- 米国の窒素発生装置市場:主要市場力学

- 市場促進要因

- 飲食品、自動車産業における窒素の重要性

- 食品と医薬品の取引急増

- 電子産業における窒素発生装置の採用

- 市場抑制要因

- 厳しい安全規制措置の必要性

- 市場機会

- 海事産業における窒素不活性ガスの利用

- 化学産業における窒素発生装置の役割

- 今後の動向

- オンサイト窒素生成の重視

- 促進要因と阻害要因の影響

第6章 窒素発生装置の米国市場分析

- 米国の窒素発生装置市場売上高、2021年~2031年

- 米国の窒素発生装置市場の予測・分析

- 米国の窒素発生装置市場の数量予測・分析

第7章 窒素発生装置の米国市場分析:タイプ別

- PSA窒素発生装置

- 膜式窒素発生装置

- 低温窒素発生装置

第8章 米国の窒素発生装置市場分析-エンドユーザー別

- 石油・ガス

- 飲食品

- 医療・製薬

- 輸送

- 化学

- その他

第9章 米国の窒素発生装置市場-地域分析

- 米国

- 窒素発生装置の米国市場地域内訳

- 窒素発生装置の米国市場収益と地域別予測・分析

- 北東部の窒素発生装置市場:2031年までの収益と予測

- 西部の窒素発生装置市場:2031年までの収益と予測

- 中西部の窒素発生装置市場:2031年までの収益と予測

- 南部の窒素発生装置市場:2031年までの収益と予測

- 窒素発生装置の米国市場地域内訳

第10章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第12章 企業プロファイル

- Advanced Gas Technologies

- BAUER COMPRESSORS, INC.

- On Site Gas Systems

- Atlas Copco AB

- Parker Hannifin

- Holtec Gas Systems

- VICI DBS

- Peak Scientific Instruments Ltd

- Air & Gas Solutions LLC

- Ingersoll Rand Inc

第13章 付録

List Of Tables

- Table 1. US Nitrogen Generator Market Segmentation

- Table 2. List of Vendors

- Table 3. Major US Food Imports

- Table 4. US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Table 5. US Nitrogen Generator Market - Volume and Forecast to 2031 (Units)

- Table 6. US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 7. US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 8. US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by Regions

- Table 9. Northeast: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 10. Northeast: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 11. West: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 12. West: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 13. Midwest: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 14. Midwest: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 15. South: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 16. South: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million) - by End User

List Of Figures

- Figure 1. US Nitrogen Generator Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Ecosystem Analysis

- Figure 4. Major US Agricultural Exports (US$ million)

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. US Nitrogen Generator Market Revenue (US$ Million), 2021-2031

- Figure 7. US Nitrogen Generator Market Share (%) - by Type, 2023 and 2031

- Figure 8. PSA Nitrogen Generator: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Membrane Nitrogen Generator: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Cryogenic Nitrogen Generator: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. US Nitrogen Generator Market Share (%) - by End User, 2023 and 2031

- Figure 12. Oil and Gas: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Food and Beverage: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Medical and Pharmaceutical: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Transportation: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Chemicals: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Northeast: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. West: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Midwest: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. South: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Heat Map Analysis by Key Players

- Figure 23. Company Positioning & Concentration

The US nitrogen generator market size was valued at US$ 1.83 billion in 2023 and is expected to reach US$ 2.71 billion by 2031; it is estimated to record a CAGR of 5.1% from 2023 to 2031.

The US is divided into four major regions: Northeast, Midwest, South, and West. Alabama, Arkansas, Delaware, Florida, Georgia, the District of Columbia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia, and West Virginia are among the prime states/territories in the South of the US. The South region plays a major part in the overall US economy, and it also leads the US nitrogen generator market. The market growth in this region is attributed to the continuous progress of the industrial and oil and gas sectors. The region has become an attractive destination for new businesses owing to economic development, government efforts, and initiatives associated with this region, which is anticipated to bring new growth opportunities for the nitrogen generator market in the coming years. For example, in 2023, CJ Logistics America announced the expansion of its temperature-controlled warehousing capabilities with the inauguration of a 206,000 sq. ft. storage facility in Nashville, Tennessee.

Illinois, Iowa, Indiana, Kansas, Michigan, Minnesota, Nebraska, Missouri, North Dakota, Ohio, South Dakota, and Wisconsin are among the major states in the Midwest of the US. The rapid pace of industrialization and growing number of manufacturing facilities across these states are fueling the nitrogen generator market growth in the Midwest. The increasing number of automotive parts manufacturing facilities is also fueling the application of nitrogen in this region. In February 2024, Schaeffler announced the expansion of its operations in the US with the addition of a new manufacturing facility concentrating on fabricating automotive electric mobility solutions. The company planned an investment of over US$ 230 million for the establishment of an advanced manufacturing facility in Ohio, US, along with the intention of future expansion until 2032.

Advanced Gas Technologies; BAUER COMPRESSORS, INC.; On Site Gas Systems Inc.; Atlas Copco AB; Parker Hannifin; Holtec Gas Systems; VICI DBS; Peak Scientific Instruments Ltd; Air & Gas Solutions LLC; and Ingersoll Rand Inc. are among the key US nitrogen generator market players that are profiled in this market study.

The overall US nitrogen generator market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the US nitrogen generator size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the US nitrogen generator market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. US Nitrogen Generator Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. US Nitrogen Generator Market - Key Market Dynamics

- 5.1 US Nitrogen Generator Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Significance of Nitrogen in Food and Beverage, and Automotive Industries

- 5.2.2 Surge in Trade of Food and Pharmaceutical Products

- 5.2.3 Adoption of Nitrogen Generators in Electronic Industry

- 5.3 Market Restraints

- 5.3.1 Required Stringent Safety and Regulatory Measures:

- 5.4 Market Opportunities

- 5.4.1 Utilization of Nitrogen Inert Gas in Maritime Industry

- 5.4.2 Role of Nitrogen Generators in Chemical Industry:

- 5.5 Future Trends

- 5.5.1 Emphasis on On-site Nitrogen Generation

- 5.6 Impact of Drivers and Restraints:

6. US Nitrogen Generator Market Analysis

- 6.1 US Nitrogen Generator Market Revenue (US$ Million), 2021-2031

- 6.2 US Nitrogen Generator Market Forecast and Analysis

- 6.3 US Nitrogen Generator Market Volume Forecast and Analysis

7. US Nitrogen Generator Market Analysis - by Type

- 7.1 PSA Nitrogen Generator

- 7.1.1 Overview

- 7.1.2 PSA nitrogen Generator: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Membrane Nitrogen Generator

- 7.2.1 Overview

- 7.2.2 Membrane Nitrogen Generator: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Cryogenic Nitrogen Generator

- 7.3.1 Overview

- 7.3.2 Cryogenic Nitrogen Generator: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

8. US Nitrogen Generator Market Analysis - by End User

- 8.1 Oil and Gas

- 8.1.1 Overview

- 8.1.2 Oil and Gas: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Food and Beverage

- 8.2.1 Overview

- 8.2.2 Food and Beverage: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Medical and Pharmaceutical

- 8.3.1 Overview

- 8.3.2 Medical and Pharmaceutical: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Transportation

- 8.4.1 Overview

- 8.4.2 Transportation: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Chemicals

- 8.5.1 Overview

- 8.5.2 Chemicals: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: US nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

9. US Nitrogen Generator Market - Region Analysis

- 9.1 US

- 9.1.1 US Nitrogen Generator Market Breakdown by Regions

- 9.1.1.1 US Nitrogen Generator Market Revenue and Forecast and Analysis - by Regions

- 9.1.1.2 Northeast: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.2.1 Northeast: US Nitrogen Generator Market Breakdown by Type

- 9.1.1.2.2 Northeast: US Nitrogen Generator Market Breakdown by End User

- 9.1.1.3 West: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.3.1 West: US Nitrogen Generator Market Breakdown by Type

- 9.1.1.3.2 West: US Nitrogen Generator Market Breakdown by End User

- 9.1.1.4 Midwest: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.4.1 Midwest: US nitrogen Generator Market Breakdown by Type

- 9.1.1.4.2 Midwest: US Nitrogen Generator Market Breakdown by End User

- 9.1.1.5 South: US Nitrogen Generator Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.1.5.1 South: US Nitrogen Generator Market Breakdown by Type

- 9.1.1.5.2 South: US Nitrogen Generator Market Breakdown by End User

- 9.1.1 US Nitrogen Generator Market Breakdown by Regions

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Development

- 11.4 Mergers & Acquisitions

12. Company Profiles

- 12.1 Advanced Gas Technologies

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 BAUER COMPRESSORS, INC.

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 On Site Gas Systems

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Atlas Copco AB

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Parker Hannifin

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 Key Developments

- 12.6 Holtec Gas Systems

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 VICI DBS

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Peak Scientific Instruments Ltd

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Air & Gas Solutions LLC

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Ingersoll Rand Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 Appendix

- 13.2 About The Insight Partners