|

|

市場調査レポート

商品コード

1597121

アジア太平洋の血液ガス・電解質分析装置市場の将来予測 (2031年まで) - 地域別分析:製品別、エンドユーザー別Asia Pacific Blood Gas and Electrolyte Analyzer Market Forecast to 2031 - Regional Analysis - by Product and End User |

||||||

|

|||||||

| アジア太平洋の血液ガス・電解質分析装置市場の将来予測 (2031年まで) - 地域別分析:製品別、エンドユーザー別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 82 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の血液ガス・電解質分析装置市場は、2023年に3億333万米ドルと評価され、2031年には5億3,184万米ドルに達すると予測され、2023年から2031年までのCAGRは7.3%を記録すると予測されています。

新製品の発売と承認が、アジア太平洋の血液ガス・電解質分析装置市場を牽引

医療産業の発展により、世界中の医療従事者の間で血液ガス・電解質分析装置に対する需要が高まっています。この需要増加は、世界レベルでの新製品開発、製品発売、承認に寄与しています。また、大手の市場関係者は効率的な製品の革新と開発を確実にするために研究開発活動に取り組んでいます。最近の製品発表と動向をいくつか紹介します:

2023年7月、Siemens Healthineersは臨床化学および免疫測定検査用の新しいAtellica CI Analyserを発売しました。米国食品医薬品局 (FDA) はこの分析装置の発売を許可しました。現在、世界の数カ所で使用可能です。2022年7月、第74回米国臨床化学会年次学術集会および臨床検査博覧会 (2022 AACC) において、EDAN Instrumentsは史上初のポイントオブケア (POC) 蛍光ベースCO-OX血液ガス・化学分析システムi20の発売を発表しました。このシステムは、血液ガスから電解質、CO-OX測定まで45以上のパラメーターを備えています。2021年9月、Sensa Core Medical Instrumentation APACは、クリニック、病院、診断センターで使用されるST-200 CC血液ガス分析装置-ウルトラスマートを発売しました。同社の高度先進血液ガスモデルはST-200 CC Ultra Smart ABGEM血液ガス分析装置です。これは、イオン選択電極 (ISE)、インピーダンス (Hct)、アンペロメトリー (pO2) 技術を用いた電流直接測定により、動脈血ガス分析と電解質測定を行う全自動マイクロプロセッサー制御の電解質システムです。2021年4月、Siemens Healthiness EUは、1分未満で患者側の結果を提供するワイヤレス携帯機器、epoc血液分析システムを発売しました。室温で安定した1枚の検査カードでヘマトクリットと乳酸、完全血液ガス、基礎代謝パネルを測定します。血液ガス検査は感染者の管理に不可欠であるため、COVID-19の対応活動をサポートすることができます。このように、製品開発や市場投入、市場関係者間の戦略的提携の増加は、今後数年間、血液ガス・電解質分析装置市場に十分な機会を創出する可能性が高いです。

アジア太平洋の血液ガス・電解質分析装置市場の概要

アジア太平洋の血液ガス・電解質分析装置市場は、中国、日本、オーストラリア、インド、韓国、その他アジア太平洋に区分されます。アジア太平洋の血液ガス・電解質分析装置市場は、インド、オーストラリア、韓国などの国々で腎臓疾患や呼吸器疾患に対する意識が高まっていることから、大幅な成長が見込まれています。また、日本や中国などの国々で医療機器産業が発展していることから、市場の成長も見込まれています。さらに、これらの国々における呼吸器分野の動向は、市場推計・予測期間中の市場成長を促進すると予測されます。

アジア太平洋の血液ガス・電解質分析装置市場の収益と2031年までの予測 (単位:100万米ドル)

アジア太平洋の血液ガス・電解質分析装置市場のセグメンテーション

アジア太平洋の血液ガス・電解質分析装置市場は、製品別、エンドユーザー別、国別に分類されます。

製品別では、アジア太平洋の血液ガス・電解質分析装置市場は、血液ガス分析装置、電解質分析装置、複合分析装置、その他に分類されます。2023年には複合分析装置が最大の市場シェアを占めています。

エンドユーザー別では、アジア太平洋の血液ガス・電解質分析装置市場は病院・診療所、臨床/診断検査室、在宅医療、その他に分類されます。2023年には臨床/診断検査部門が最大の市場シェアを占めました。

国別では、アジア太平洋血液ガス・電解質分析装置市場は、中国、日本、インド、オーストラリア、韓国、その他アジア太平洋に区分されます。2023年のアジア太平洋血液ガス・電解質分析装置市場シェアは中国が独占しました。

Abbott Laboratories、Dalko Diagnostics Private Limited、Erba Diagnostics Mannheim GmbH、Hoffmann-La Roche Ltd、Medica Corporation、Nova Biomedical Corporation、Siemens Healthineers AG、Werfen SA、Radiometer Medical ApS、Sensa Core Medical Instrumentation Pvt Ltd.などが、アジア太平洋血液ガス・電解質分析装置市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 分析手法

第4章 アジア太平洋の血液ガス・電解質分析装置市場:主な市場力学

- 市場促進要因

- 病院の救急治療室における患者数の増加

- ポイントオブケア診断の採用増加

- 市場抑制要因

- 分析装置の高コスト

- 市場機会

- 新製品の上市と承認

- 今後の動向

- 血液ガス・電解質分析装置の自動化と人工知能化

- 促進要因と抑制要因の影響

第5章 アジア太平洋の血液ガス・電解質分析装置市場の分析

- 血液ガス・電解質分析装置市場の収益 (2021~2031年)

- 血液ガス・電解質分析装置市場の予測分析

第6章 アジア太平洋の血液ガス・電解質分析装置市場の分析:製品別

- 血液ガス分析装置

- 電解質分析装置

- 複合分析装置

- その他

第7章 アジア太平洋の血液ガス・電解質分析装置市場の分析:エンドユーザー別

- 病院・診療所

- 臨床/診断研究所

- 在宅医療

- その他

第8章 アジア太平洋の血液ガス・電解質分析装置市場:国別分析

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- 韓国

- その他のアジア太平洋諸国

第9章 業界情勢

- 有機的成長戦略

- ブランドシェア/収益 (2022年)

第10章 企業プロファイル

- Abbott Laboratories

- Dalko Diagnostics Private Limited

- Erba Diagnostics Mannheim GmbH

- Hoffmann-La Roche Ltd

- Medica Corporation

- Nova Biomedical Corporation

- Siemens Healthineers AG

- Werfen SA

- Radiometer Medical ApS

- Sensa Core Medical Instrumentation Pvt Ltd

第11章 付録

List Of Tables

- Table 1. Asia Pacific Blood Gas and Electrolyte Analyzer Market Segmentation

- Table 2. Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 4. Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 5. Asia Pacific: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 6. China: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by Product

- Table 7. China: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 8. Japan: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by Product

- Table 9. Japan: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 10. India: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by Product

- Table 11. India: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 12. Australia: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by Product

- Table 13. Australia: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 14. South Korea: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by Product

- Table 15. South Korea: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 16. Rest of APAC: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by Product

- Table 17. Rest of APAC: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million) - by End User

- Table 18. Recent Organic Growth Strategies in the Blood Gas and Electrolyte Analyzer Market

- Table 19. Brand Share of Products for Each Company (US$ Million)

- Table 20. Glossary of Terms, Blood Gas and Electrolyte Analyzer Market

List Of Figures

- Figure 1. Asia Pacific Blood Gas and Electrolyte Analyzer Market Segmentation, by country

- Figure 2. Blood Gas and Electrolyte Analyzer Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Blood Gas and Electrolyte Analyzer Market Revenue (US$ Million), 2021-2031

- Figure 5. Blood Gas and Electrolyte Analyzer Market Share (%) - by Product (2023 and 2031)

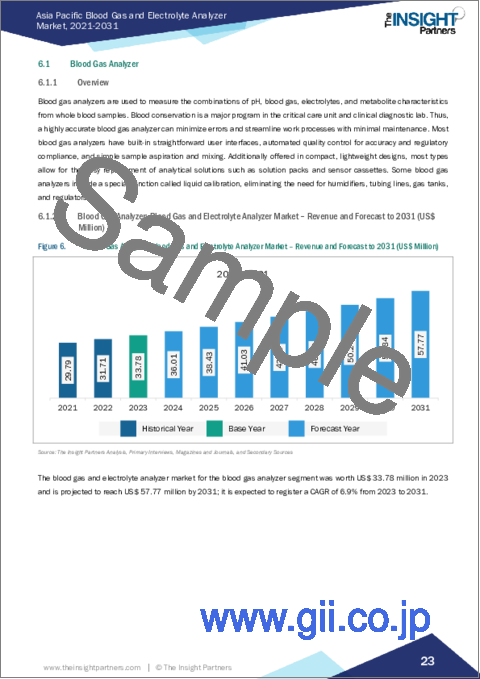

- Figure 6. Blood Gas Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Electrolyte Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Combined Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Blood Gas and Electrolyte Analyzer Market Share (%) - by End User (2023 and 2031)

- Figure 11. Hospitals and Clinics: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Clinical and Diagnostic Laboratories: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Homecare: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Asia Pacific : Blood Gas and Electrolyte Analyzer Market, by Key Country - Revenue (2023) (USD Million)

- Figure 16. Asia Pacific: Blood Gas and Electrolyte Analyzer Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 17. China: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million)

- Figure 18. Japan: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million)

- Figure 19. India: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million)

- Figure 20. Australia: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million)

- Figure 21. South Korea: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million)

- Figure 22. Rest of APAC: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031(US$ Million)

The Asia Pacific blood gas and electrolyte analyzer market was valued at US$ 303.33 million in 2023 and is projected to reach US$ 531.84 million by 2031; it is estimated to record a CAGR of 7.3% from 2023 to 2031.

New Product Launches and Approvals Boost Asia Pacific Blood Gas and Electrolyte Analyzer Market

The development of the healthcare industry has led to a rise in the demand for blood gas and electrolyte analyzers among healthcare providers across the world. This increased demand contributes to new product developments, product launches, and approvals on a global level. In addition, major market players are involved in research and development activities to ensure the innovation and development of efficient products. Following are a few of the recent product launches and developments:

In July 2023, Siemens Healthineers launched the new Atellica CI Analyser for clinical chemistry and immunoassay testing. The US Food and Drug Administration (FDA) permitted the analyzer before its debut. It is currently accessible in several international locations. In July 2022, at the 74th American Association for Clinical Chemistry Annual Scientific Meeting and Clinical Laboratory Exposition (2022 AACC), EDAN Instruments, Inc. announced the launch of the first-ever point-of-care (POC) fluorescence-based CO-OX blood gas and chemistry analysis system, i20. The system has over 45 parameters, ranging from blood gases to electrolytes to CO-oximetry. In September 2021, Sensa Core Medical Instrumentation APAC launched ST-200 CC Blood Gas Analyzers - Ultra Smart for use in clinics, hospitals, and diagnostic centers. The highly advanced blood gas model from the company is the ST-200 CC Ultra Smart ABGEM blood gas analyzer. It is a fully automated, microprocessor-controlled electrolyte system that performs arterial blood gas analysis and electrolyte measurements using current direct measurement with ION selective electrode (ISE), impedance (Hct), and amperometry (pO2) technologies. In April 2021, Siemens Healthiness EU launched the epoc Blood Analysis System, a wireless, portable device that provides patient-side results in less than a minute. It measures hematocrit and lactate on a single room temperature-stable test card, complete blood gas, and a basic metabolic panel. It is aided by its support of COVID-19 response efforts, as blood gas testing is essential for managing infected individuals. Thus, an increase in product developments, launches, and strategic collaborations among market players is likely to create ample opportunities for the blood gas and electrolyte analyzers market in the coming years.

Asia Pacific Blood Gas and Electrolyte Analyzer Market Overview

The Asia Pacific blood gas and electrolyte analyzer market is segmented into China, Japan, Australia, India, South Korea, and the Rest of Asia Pacific. The blood gas and electrolyte analyzer market in Asia Pacific is expected to grow considerably owing to the rising awareness regarding kidney and respiratory diseases in countries such as India, Australia, and South Korea. The market is also expected to grow due to the rising development of the medical device industry in countries such as Japan and China. In addition, the development in the respiratory sectors across these countries is estimated to fuel the market growth during the forecast period.

Asia Pacific Blood Gas and Electrolyte Analyzer Market Revenue and Forecast to 2031 (US$ Million)

Asia Pacific Blood Gas and Electrolyte Analyzer Market Segmentation

The Asia Pacific blood gas and electrolyte analyzer market is categorized into product, end user, and country.

Based on product, the Asia Pacific blood gas and electrolyte analyzer market is categorized into blood gas analyzer, electrolyte analyzer, combined analyzer, and others. The combined analyzer segment held the largest market share in 2023.

By end user, the Asia Pacific blood gas and electrolyte analyzer market is segmented into hospitals and clinics, clinical and diagnostic laboratories, homecare, and others. The clinical and diagnostic laboratories segment held the largest market share in 2023.

By country, the Asia Pacific blood gas and electrolyte analyzer market is segmented into China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific blood gas and electrolyte analyzer market share in 2023.

Abbott Laboratories, Dalko Diagnostics Private Limited, Erba Diagnostics Mannheim GmbH, Hoffmann-La Roche Ltd, Medica Corporation, Nova Biomedical Corporation, Siemens Healthineers AG, Werfen SA, Radiometer Medical ApS, and Sensa Core Medical Instrumentation Pvt Ltd. are some of the leading companies operating in the Asia Pacific blood gas and electrolyte analyzer market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Blood Gas and Electrolyte Analyzer Market - Key Market Dynamics

- 4.1 Market Drivers

- 4.1.1 Increasing Number of Patients in Emergency Units of Hospitals

- 4.1.2 Rising Adoption of Point-of-Care Diagnostics

- 4.2 Market Restraints

- 4.2.1 High Costs of Analysers

- 4.3 Market Opportunities

- 4.3.1 New Product Launches and Approvals

- 4.4 Future Trends

- 4.4.1 Automation and Artificial Intelligence in Blood Gas and Electrolyte Analyzer

- 4.5 Impact of Drivers and Restraints:

5. Blood Gas and Electrolyte Analyzer Market - Asia Pacific Market Analysis

- 5.1 Blood Gas and Electrolyte Analyzer Market Revenue (US$ Million), 2021-2031

- 5.2 Blood Gas and Electrolyte Analyzer Market Forecast Analysis

6. Asia Pacific Blood Gas and Electrolyte Analyzer Market Analysis - by Product

- 6.1 Blood Gas Analyzer

- 6.1.1 Overview

- 6.1.2 Blood Gas Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 6.2 Electrolyte Analyzer

- 6.2.1 Overview

- 6.2.2 Electrolyte Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 6.3 Combined Analyzer

- 6.3.1 Overview

- 6.3.2 Combined Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 6.4 Others

- 6.4.1 Overview

- 6.4.2 Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

7. Asia Pacific Blood Gas and Electrolyte Analyzer Market Analysis - by End User

- 7.1 Hospitals and Clinics

- 7.1.1 Overview

- 7.1.2 Hospitals and Clinics: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Clinical and Diagnostic Laboratories

- 7.2.1 Overview

- 7.2.2 Clinical and Diagnostic Laboratories: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Homecare

- 7.3.1 Overview

- 7.3.2 Homecare: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

8. Asia Pacific Blood Gas and Electrolyte Analyzer Market - Country Analysis

- 8.1 Asia Pacific

- 8.1.1 Asia Pacific: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast Analysis - by Country

- 8.1.1.1 Asia Pacific: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast Analysis - by Country

- 8.1.1.2 China: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.2.1 China: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.2.2 China: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1.3 Japan: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.3.1 Japan: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.3.2 Japan: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1.4 India: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.4.1 India: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.4.2 India: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1.5 Australia: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.5.1 Australia: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.5.2 Australia: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1.6 South Korea: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.6.1 South Korea: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.6.2 South Korea: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1.7 Rest of APAC: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.7.1 Rest of APAC: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.7.2 Rest of APAC: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1 Asia Pacific: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast Analysis - by Country

9. Industry Landscape

- 9.1 Overview

- 9.2 Organic Growth Strategies

- 9.2.1 Overview

- 9.3 Brand Share/Revenue- 2022

10. Company Profiles

- 10.1 Abbott Laboratories

- 10.1.1 Key Facts

- 10.1.2 Business Description

- 10.1.3 Products and Services

- 10.1.4 Financial Overview

- 10.1.5 SWOT Analysis

- 10.1.6 Key Developments

- 10.2 Dalko Diagnostics Private Limited

- 10.2.1 Key Facts

- 10.2.2 Business Description

- 10.2.3 Products and Services

- 10.2.4 Financial Overview

- 10.2.5 SWOT Analysis

- 10.2.6 Key Developments

- 10.3 Erba Diagnostics Mannheim GmbH

- 10.3.1 Key Facts

- 10.3.2 Business Description

- 10.3.3 Products and Services

- 10.3.4 Financial Overview

- 10.3.5 SWOT Analysis

- 10.3.6 Key Developments

- 10.4 Hoffmann-La Roche Ltd

- 10.4.1 Key Facts

- 10.4.2 Business Description

- 10.4.3 Products and Services

- 10.4.4 Financial Overview

- 10.4.5 SWOT Analysis

- 10.4.6 Key Developments

- 10.5 Medica Corporation

- 10.5.1 Key Facts

- 10.5.2 Business Description

- 10.5.3 Products and Services

- 10.5.4 Financial Overview

- 10.5.5 SWOT Analysis

- 10.5.6 Key Developments

- 10.6 Nova Biomedical Corporation

- 10.6.1 Key Facts

- 10.6.2 Business Description

- 10.6.3 Products and Services

- 10.6.4 Financial Overview

- 10.6.5 SWOT Analysis

- 10.6.6 Key Developments

- 10.7 Siemens Healthineers AG

- 10.7.1 Key Facts

- 10.7.2 Business Description

- 10.7.3 Products and Services

- 10.7.4 Financial Overview

- 10.7.5 SWOT Analysis

- 10.7.6 Key Developments

- 10.8 Werfen SA

- 10.8.1 Key Facts

- 10.8.2 Business Description

- 10.8.3 Products and Services

- 10.8.4 Financial Overview

- 10.8.5 SWOT Analysis

- 10.8.6 Key Developments

- 10.9 Radiometer Medical ApS

- 10.9.1 Key Facts

- 10.9.2 Business Description

- 10.9.3 Products and Services

- 10.9.4 Financial Overview

- 10.9.5 SWOT Analysis

- 10.9.6 Key Developments

- 10.10 Sensa Core Medical Instrumentation Pvt Ltd

- 10.10.1 Key Facts

- 10.10.2 Business Description

- 10.10.3 Products and Services

- 10.10.4 Financial Overview

- 10.10.5 SWOT Analysis

- 10.10.6 Key Developments

11. Appendix

- 11.1 About The Insight Partners

- 11.2 Glossary of Terms