|

|

市場調査レポート

商品コード

1597120

北米の血液ガス・電解質分析装置市場:2031年までの予測 - 地域別分析 - 製品別、エンドユーザー別North America Blood Gas and Electrolyte Analyzer Market Forecast to 2031 - Regional Analysis - by Product and End User |

||||||

|

|||||||

| 北米の血液ガス・電解質分析装置市場:2031年までの予測 - 地域別分析 - 製品別、エンドユーザー別 |

|

出版日: 2024年10月17日

発行: The Insight Partners

ページ情報: 英文 72 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

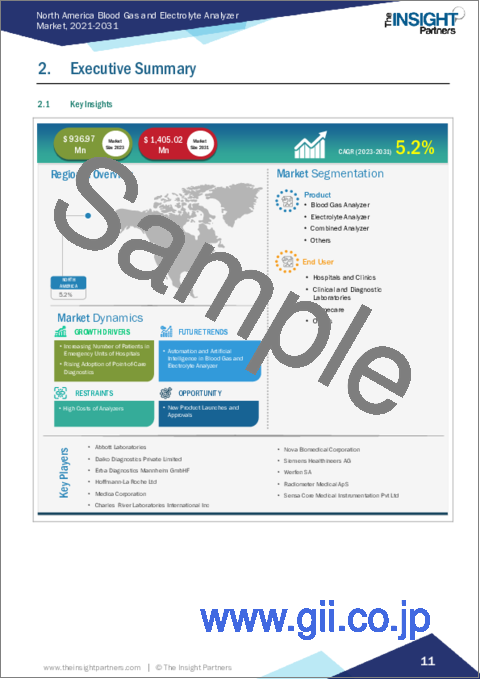

北米の血液ガス・電解質分析装置市場は、2023年に9億3,697万米ドルとなり、2031年までには14億502万米ドルに達すると予測され、2023年から2031年までのCAGRは5.2%を記録すると予測されています。

病院の救急治療室における患者数の増加が北米の血液ガス・電解質分析装置市場を活性化

糖尿病、がん、心臓病、その他の慢性疾患の有病率の上昇により、病院の救急治療室(ER)の必要性が高まっています。病院の救急室は、重度の慢性疾患に罹患し、早急な治療と医療介入が必要な患者に不可欠な医療を提供します。このようなサービスは複雑であり、各パートがケアを提供する上で極めて重要です。救急医療サービスの第一の目的は、内科的、外科的、産科的問題を即座に治療することです。救急病院の救急治療室で治療を求める患者の増加は、血液ガス・電解質分析装置の需要に好影響を与えています。世界保健機関(WHO)によると、世界中で年間約1億5,000万人の患者が病院の救急室を訪れています。2023年にCDCが発表したデータによると、米国では年間約1億3,980万件のER受診が記録されています。また、カリフォルニア州では2011年から2021年の間にED受診者が7.4%増加しています。救急外来では、重症患者を迅速かつ正確に評価しなければならないというプレッシャーが高まっており、血液ガス値、電解質レベル、酸塩基平衡に関するタイムリーな診断情報が最重要となっています。血液ガス・電解質分析装置は、呼吸困難、代謝異常、重篤な状態にある患者を評価・管理するための診断データをその場で提供します。これらの分析装置が患者の酸素化状態、酸塩基平衡、電解質レベルをリアルタイムで把握できることは、救急現場における蘇生措置の指針となり、臨床転帰を最適化する上で極めて重要です。

救急治療室における血液ガス・電解質分析装置に対する需要の高まりは、患者のベッドサイドで迅速な検査を可能にする携帯型やポイント・オブ・ケア機器などの技術の進歩を後押ししています。これらのコンパクトな分析装置は、ワークフローの効率を高め、迅速な診断と治療開始を促進することで患者の転帰を改善します。病院が患者数の増加に対応するために救急医療サービスの充実を優先させる中、血液ガス・電解質分析装置市場では、救急医療や重症患者を対象とした技術的に先進的なソリューションの採用が増加しています。

北米の血液ガス・電解質分析装置市場概要

北米の血液ガス・電解質分析装置市場は米国、カナダ、メキシコに区分されます。2023年の北米の血液ガス・電解質分析装置市場は米国が最大シェアを占めています。成長の原動力は、心血管疾患に関する一般市民の意識の高まりと、血液ガス・電解質分析装置市場における革新的な治療アプリケーションを探求するための研究と協力の拡大です。北米の血液ガス・電解質分析装置検査キット市場は、同市場におけるさまざまな主要企業の存在によって、拍車がかかると予測されます。また、ヘルスケアの質の向上とコスト削減を目的とした医療機器の導入が、同地域の血液ガス・電解質分析装置市場の成長を後押ししています。

北米の血液ガス・電解質分析装置市場の収益と2031年までの予測(金額)

北米の血液ガス・電解質分析装置市場セグメンテーション

北米の血液ガス・電解質分析装置市場は、製品、エンドユーザー、国に分類されます。

製品別では、北米の血液ガス・電解質分析装置市場は、血液ガス分析装置、電解質分析装置、複合分析装置、その他に分類されます。2023年には複合分析装置が最大の市場シェアを占めています。

エンドユーザー別では、北米の血液ガス・電解質分析装置市場は病院・診療所、臨床・診断検査室、在宅医療、その他に区分されます。2023年には臨床・診断検査室セグメントが最大の市場シェアを占めました。

国別では、北米の血液ガス・電解質分析装置市場は米国、カナダ、メキシコに区分されます。2023年の北米の血液ガス・電解質分析装置市場シェアは米国が独占しました。

Abbott Laboratories、Dalko Diagnostics Private Limited、Erba Diagnostics Mannheim GmbH、Hoffmann-La Roche Ltd、Medica Corporation、Nova Biomedical Corporation、Siemens Healthineers AG、Werfen SA、Radiometer Medical ApS、Sensa Core Medical Instrumentation Pvt Ltd.は、北米の血液ガス・電解質分析装置市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の血液ガス・電解質分析装置市場:主要市場力学

- 市場促進要因

- 病院の救急ユニットにおける患者数の増加

- ポイントオブケア診断の採用増加

- 市場抑制要因

- 分析装置の高コスト

- 市場機会

- 新製品の上市と承認

- 今後の動向

- 血液ガス・電解質分析装置の自動化と人工知能化

- 促進要因と抑制要因の影響

第5章 血液ガス・電解質分析装置市場:北米分析

- 北米の血液ガス・電解質分析装置市場収益、2021年~2031年

- 血液ガス・電解質分析装置市場の予測分析

第6章 北米の血液ガス・電解質分析装置市場分析:製品別

- 血液ガス分析装置

- 電解質分析装置

- 複合分析装置

- その他

第7章 北米の血液ガス・電解質分析装置市場分析:エンドユーザー別

- 病院・診療所

- 臨床・診断研究所

- 在宅医療

- その他

第8章 北米の血液ガス・電解質分析装置市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第9章 業界情勢

- 有機的成長戦略

- ブランドシェア / 収益 - 2022年

第10章 企業プロファイル

- Abbott Laboratories

- Dalko Diagnostics Private Limited

- Erba Diagnostics Mannheim GmbH

- Hoffmann-La Roche Ltd

- Medica Corporation

- Nova Biomedical Corporation

- Siemens Healthineers AG

- Werfen SA

- Radiometer Medical ApS

- Sensa Core Medical Instrumentation Pvt Ltd

第11章 付録

List Of Tables

- Table 1. North America Blood Gas and Electrolyte Analyzer Market Segmentation

- Table 2. Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 4. Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 5. North America: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 6. United States: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 7. United States: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 8. Canada: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 9. Canada: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 10. Mexico: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by Product

- Table 11. Mexico: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 12. Recent Organic Growth Strategies in the Blood Gas and Electrolyte Analyzer Market

- Table 13. Brand Share of Products for Each Company (US$ Million)

- Table 14. Glossary of Terms, Blood Gas and Electrolyte Analyzer Market

List Of Figures

- Figure 1. North America Blood Gas and Electrolyte Analyzer Market Segmentation, by country

- Figure 2. Blood Gas and Electrolyte Analyzer Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Blood Gas and Electrolyte Analyzer Market Revenue (US$ Million), 2021-2031

- Figure 5. Blood Gas and Electrolyte Analyzer Market Share (%) - by Product (2023 and 2031)

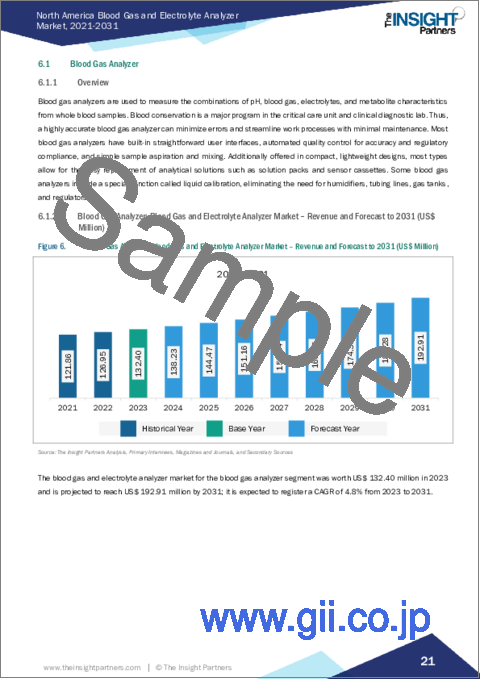

- Figure 6. Blood Gas Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Electrolyte Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Combined Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Blood Gas and Electrolyte Analyzer Market Share (%) - by End User (2023 and 2031)

- Figure 11. Hospitals and Clinics: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Clinical and Diagnostic Laboratories: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Homecare: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. North America: Blood Gas and Electrolyte Analyzer Market, by Key Country - Revenue (2023) (USD Million)

- Figure 16. North America: Blood Gas and Electrolyte Analyzer Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 17. United States: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Canada: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Mexico: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

The North America blood gas and electrolyte analyzer market was valued at US$ 936.97 million in 2023 and is projected to reach US$ 1,405.02 million by 2031; it is estimated to record a CAGR of 5.2% from 2023 to 2031.

Increasing Number of Patients in Emergency Units of Hospitals Fuels North America Blood Gas and Electrolyte Analyzer Market

The rising prevalence of diabetes, cancer, heart disease, and other chronic conditions propels the requirement for hospital emergency rooms (ER). Hospital emergency rooms offer vital medical care for patients affected by severe chronic conditions who need immediate attention and medical intervention. These services are complex, with each part being crucial to providing care. The primary objective of emergency medical services is immediately treating medical, surgical, and obstetric problems. The increasing number of patients seeking care in emergency hospital emergency units positively impacts the demand for blood gas and electrolyte analyzers. According to the World Health Organization (WHO), around 150 million patients visit hospital emergency rooms across the world annually. The US records about 139.8 million ER visits per year, according to data released by the CDC in 2023. In addition, there was a 7.4% rise in ED visits in California between 2011 and 2021. As emergency departments face mounting pressure to deliver rapid and accurate assessments of critically ill patients, timely diagnostic information on blood gas values, electrolyte levels, and acid-base balance becomes paramount. Blood gas and electrolyte analyzers provide on-the-spot diagnostic data for evaluating and managing patients affected by respiratory distress, metabolic abnormalities, or critical conditions. The ability of these analyzers to provide real-time insights into a patient's oxygenation status, acid-base equilibrium, and electrolyte levels is crucial for guiding resuscitative measures and optimizing clinical outcomes in emergency settings.

The growing demand for blood gas and electrolyte analyzers in emergency units drives advancements in technology, such as portable and point-of-care devices, that enable rapid testing at the patient's bedside. These compact analyzers enhance workflow efficiency and improve patient outcomes by facilitating prompt diagnosis and treatment initiation. As hospitals prioritize enhancing emergency care services to meet the needs of a rising patient population, the blood gas and electrolyte analyzers market is witnessing increased adoption of technologically advanced solutions tailored to the urgent and critical care setting.

North America Blood Gas and Electrolyte Analyzer Market Overview

The North America blood gas and electrolyte analyzer market has been segmented into the US, Canada, and Mexico. The US held the largest share of the North America blood gas and electrolyte analyzer market in 2023. The growth is driven by increasing public awareness regarding cardiovascular diseases and growing research and collaboration to explore innovative therapeutic applications in the blood gas and electrolyte analyzer market. The market for blood gas and electrolyte analyzer test kits in North America is projected to spur with the presence of various key players in the market. In addition, the adoption of medical devices in healthcare operations for improving quality and reducing costs augments the growth of the blood gas and electrolyte analyzer market in the region.

North America Blood Gas and Electrolyte Analyzer Market Revenue and Forecast to 2031 (US$ Million)

North America Blood Gas and Electrolyte Analyzer Market Segmentation

The North America blood gas and electrolyte analyzer market is categorized into product, end user, and country.

Based on product, the North America blood gas and electrolyte analyzer market is categorized into blood gas analyzer, electrolyte analyzer, combined analyzer, and others. The combined analyzer segment held the largest market share in 2023.

By end user, the North America blood gas and electrolyte analyzer market is segmented into hospitals and clinics, clinical and diagnostic laboratories, homecare, and others. The clinical and diagnostic laboratories segment held the largest market share in 2023.

By country, the North America blood gas and electrolyte analyzer market is segmented into the US, Canada, and Mexico. The US dominated the North America blood gas and electrolyte analyzer market share in 2023.

Abbott Laboratories, Dalko Diagnostics Private Limited, Erba Diagnostics Mannheim GmbH, Hoffmann-La Roche Ltd, Medica Corporation, Nova Biomedical Corporation, Siemens Healthineers AG, Werfen SA, Radiometer Medical ApS, and Sensa Core Medical Instrumentation Pvt Ltd. are some of the leading companies operating in the North America blood gas and electrolyte analyzer market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Blood Gas and Electrolyte Analyzer Market - Key Market Dynamics

- 4.1 Market Drivers

- 4.1.1 Increasing Number of Patients in Emergency Units of Hospitals

- 4.1.2 Rising Adoption of Point-of-Care Diagnostics

- 4.2 Market Restraints

- 4.2.1 High Costs of Analyzers

- 4.3 Market Opportunities

- 4.3.1 New Product Launches and Approvals

- 4.4 Future Trends

- 4.4.1 Automation and Artificial Intelligence in Blood Gas and Electrolyte Analyzer

- 4.5 Impact of Drivers and Restraints:

5. Blood Gas and Electrolyte Analyzer Market - North America Analysis

- 5.1 North America Blood Gas and Electrolyte Analyzer Market Revenue (US$ Million), 2021-2031

- 5.2 Blood Gas and Electrolyte Analyzer Market Forecast Analysis

6. North America Blood Gas and Electrolyte Analyzer Market Analysis - by Product

- 6.1 Blood Gas Analyzer

- 6.1.1 Overview

- 6.1.2 Blood Gas Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 6.2 Electrolyte Analyzer

- 6.2.1 Overview

- 6.2.2 Electrolyte Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 6.3 Combined Analyzer

- 6.3.1 Overview

- 6.3.2 Combined Analyzer: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 6.4 Others

- 6.4.1 Overview

- 6.4.2 Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

7. North America Blood Gas and Electrolyte Analyzer Market Analysis - by End User

- 7.1 Hospitals and Clinics

- 7.1.1 Overview

- 7.1.2 Hospitals and Clinics: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Clinical and Diagnostic Laboratories

- 7.2.1 Overview

- 7.2.2 Clinical and Diagnostic Laboratories: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Homecare

- 7.3.1 Overview

- 7.3.2 Homecare: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Blood Gas and Electrolyte Analyzer Market - Country Analysis

- 8.1 North America

- 8.1.1 North America: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast Analysis - by Country

- 8.1.1.1 North America: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast Analysis - by Country

- 8.1.1.2 United States: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.2.1 United States: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.2.2 United States: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1.3 Canada: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.3.1 Canada: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.3.2 Canada: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1.4 Mexico: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast to 2031 (US$ Million)

- 8.1.1.4.1 Mexico: Blood Gas and Electrolyte Analyzer Market Breakdown, by Product

- 8.1.1.4.2 Mexico: Blood Gas and Electrolyte Analyzer Market Breakdown, by End User

- 8.1.1 North America: Blood Gas and Electrolyte Analyzer Market - Revenue and Forecast Analysis - by Country

9. Industry Landscape

- 9.1 Overview

- 9.2 Organic Growth Strategies

- 9.2.1 Overview

- 9.3 Brand Share/Revenue- 2022

10. Company Profiles

- 10.1 Abbott Laboratories

- 10.1.1 Key Facts

- 10.1.2 Business Description

- 10.1.3 Products and Services

- 10.1.4 Financial Overview

- 10.1.5 SWOT Analysis

- 10.1.6 Key Developments

- 10.2 Dalko Diagnostics Private Limited

- 10.2.1 Key Facts

- 10.2.2 Business Description

- 10.2.3 Products and Services

- 10.2.4 Financial Overview

- 10.2.5 SWOT Analysis

- 10.2.6 Key Developments

- 10.3 Erba Diagnostics Mannheim GmbH

- 10.3.1 Key Facts

- 10.3.2 Business Description

- 10.3.3 Products and Services

- 10.3.4 Financial Overview

- 10.3.5 SWOT Analysis

- 10.3.6 Key Developments

- 10.4 Hoffmann-La Roche Ltd

- 10.4.1 Key Facts

- 10.4.2 Business Description

- 10.4.3 Products and Services

- 10.4.4 Financial Overview

- 10.4.5 SWOT Analysis

- 10.4.6 Key Developments

- 10.5 Medica Corporation

- 10.5.1 Key Facts

- 10.5.2 Business Description

- 10.5.3 Products and Services

- 10.5.4 Financial Overview

- 10.5.5 SWOT Analysis

- 10.5.6 Key Developments

- 10.6 Nova Biomedical Corporation

- 10.6.1 Key Facts

- 10.6.2 Business Description

- 10.6.3 Products and Services

- 10.6.4 Financial Overview

- 10.6.5 SWOT Analysis

- 10.6.6 Key Developments

- 10.7 Siemens Healthineers AG

- 10.7.1 Key Facts

- 10.7.2 Business Description

- 10.7.3 Products and Services

- 10.7.4 Financial Overview

- 10.7.5 SWOT Analysis

- 10.7.6 Key Developments

- 10.8 Werfen SA

- 10.8.1 Key Facts

- 10.8.2 Business Description

- 10.8.3 Products and Services

- 10.8.4 Financial Overview

- 10.8.5 SWOT Analysis

- 10.8.6 Key Developments

- 10.9 Radiometer Medical ApS

- 10.9.1 Key Facts

- 10.9.2 Business Description

- 10.9.3 Products and Services

- 10.9.4 Financial Overview

- 10.9.5 SWOT Analysis

- 10.9.6 Key Developments

- 10.10 Sensa Core Medical Instrumentation Pvt Ltd

- 10.10.1 Key Facts

- 10.10.2 Business Description

- 10.10.3 Products and Services

- 10.10.4 Financial Overview

- 10.10.5 SWOT Analysis

- 10.10.6 Key Developments

11. Appendix

- 11.1 About The Insight Partners

- 11.2 Glossary of Terms