|

|

市場調査レポート

商品コード

1592674

欧州のカプセル化ガスケットとシール市場:2030年までの予測 - 地域別分析 - 材料別、最終用途別Europe Encapsulated Gaskets and Seals Market Forecast to 2030 - Regional Analysis - by Material (Silicon, Neoprene, Viton, Teflon, and Others) and End Use (Oil and Gas, Food, Pharmaceutical, Chemical, Automotive, and Others) |

||||||

|

|||||||

| 欧州のカプセル化ガスケットとシール市場:2030年までの予測 - 地域別分析 - 材料別、最終用途別 |

|

出版日: 2024年09月16日

発行: The Insight Partners

ページ情報: 英文 89 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州のカプセル化ガスケットとシール市場は、2022年に9,113万米ドルと評価され、2030年には1億5,646万米ドルに達すると予測され、2022年から2030年までのCAGRは7.0%と推定されます。

化学産業からの需要増加が欧州のカプセル化ガスケットとシール市場を牽引

化学産業は産業発展の要であり、様々な化学物質の生産、変換、取り扱いに関わる膨大なプロセスを包含しています。多様な用途を持つ重要なセクターとして、化学産業は安全性、効率性、規制遵守を確保するための機器や部品に厳しい要求を課しています。カプセル化ガスケットとシールは、化学処理装置の完全性と信頼性に貢献する不可欠なコンポーネントとして、これらの課題を満たすために重要な役割を果たしています。精度と封じ込めが最も重要な化学業界では、シーリングソリューションの選択が極めて重要です。カプセル化ガスケットとシールは、産業プロセスに関わる多くの化学物質の腐食性や攻撃性に対して強固な防御を提供します。

先進経済諸国や新興経済諸国において化学産業が拡大を続ける中、多くの化学物質の過酷な腐食性に耐える信頼性の高いシーリングソリューションの必要性が高まっています。カプセル化ガスケットとシールは効果的なバリアとなり、危険物質の流出を防ぎ、プロセスと作業員の安全を確保します。PTFEのような素材の耐薬品性は、一般的にカプセル化型シールに使用され、この要求の厳しい業界の用途に特に適しています。さらに、化学業界では規制の遵守と安全基準の順守が強く求められています。カプセル化ガスケットとシールは、このような厳しい要件を満たすのに貢献し、メンテナンスの必要性を減らし、機器の信頼性を高めるなどの利点を提供します。このことは、コストのかかるダウンタイムを防ぎ、環境汚染や事故のリスクを最小限に抑える上で特に重要です。このように、化学産業はプロセスの完全性と安全性を確保するために、カプセル化ガスケットとシールに大きく依存しています。化学業界とシーリングソリューションメーカーとの共生関係は、この重要なセクターの成長、効率、持続可能性を支える上で、カプセル化ガスケットとシールが極めて重要な役割を担っていることを強調しています。

欧州のカプセル化ガスケットとシール市場概要

欧州のカプセル化ガスケットとシール市場は、技術の進歩、厳格な規制基準、同地域の強固な産業インフラの組み合わせが主な要因となっています。これらの特殊部品は、自動車、化学、製薬、石油・ガスなど、さまざまな分野の機械システムの漏れを防ぎ、完全性を確保する上で重要な役割を果たしています。

重要な用途における高性能で耐久性のあるシーリングソリューションに対する需要の高まりが、欧州におけるカプセル化ガスケットとシールの需要を牽引しています。特に自動車業界では、エンジン、トランスミッション、その他の重要部品に信頼性の高いシールが必要なため、こうしたソリューションの採用が増加しています。欧州委員会によると、欧州は世界最大の自動車メーカーです。自動車産業は直接的・間接的に1,380万人を雇用しており、欧州連合(EU)の雇用全体の6.1%を占めています。国際自動車工業会(OICA)によると、EUは2022年に1,620万台の自動車を生産しました。さらに、環境の持続可能性が重視されるようになり、過酷な化学物質や極端な温度に対する耐性を強化したカプセル化ガスケットが好まれるようになっています。

欧州では、排出ガスと安全性に関する規制基準が厳しく、メーカーがこれらの要件を満たし、上回るよう努力しているため、市場はさらに活性化しています。製薬業界や食品加工業界も、これらの分野における厳格な衛生・汚染対策から、ガスケットやシールの需要に貢献しています。さらに、欧州の市場開拓企業は、革新的な材料や設計を導入するための研究開発に積極的に投資しており、多様な業界の新興国市場のニーズに対応しています。競合情勢は、製品ポートフォリオと地域情勢を拡大するための提携や戦略的パートナーシップによって特徴付けられています。

欧州のカプセル化ガスケットとシール市場の収益と2030年までの予測(金額)

欧州のカプセル化ガスケットとシール市場セグメンテーション

欧州のカプセル化ガスケットとシール市場は、材料、最終用途、国に分類されます。

材料別では、欧州のカプセル化ガスケットとシール市場はシリコン、ネオプレン、バイトン、テフロン、その他に区分されます。2022年にはバイトンが最大の市場シェアを占めています。

最終用途に基づき、欧州のカプセル化ガスケットとシール市場は石油・ガス、食品、製薬、化学、自動車、その他に区分されます。石油・ガスセグメントが2022年に最大の市場シェアを占めました。

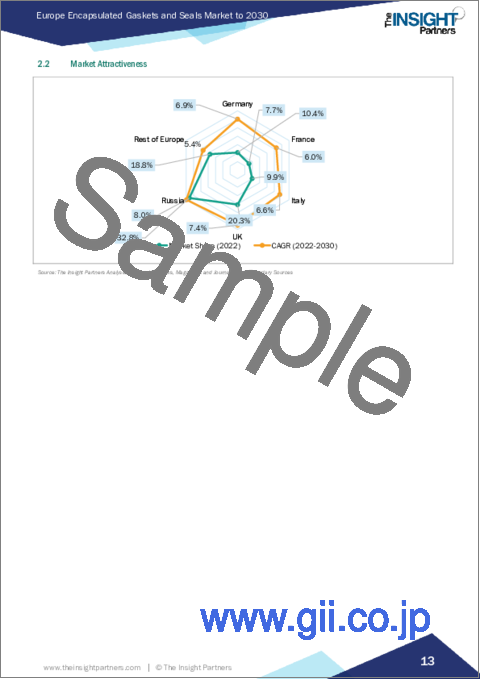

国別では、欧州のカプセル化ガスケットとシール市場はドイツ、フランス、イタリア、英国、ロシア、その他欧州に区分されます。ロシアが2022年の欧州のカプセル化ガスケットとシール市場シェアを独占。

AS Aston Seals SPA、Gasco Inc、MCM SPA、Polymax Ltd、Trelleborg AB、VH Polymers、Vulcan Engineering Ltdは、欧州のカプセル化ガスケットとシール市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 欧州のカプセル化ガスケットとシール市場情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 代替品の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 競争企業間の敵対関係

- エコシステム分析

- 原材料サプライヤー

- 製造業者

- 流通業者または供給業者

- 最終用途産業

- バリューチェーンのベンダー一覧

第5章 欧州のカプセル化ガスケットとシール市場:主要市場力学

- 市場促進要因

- 石油・ガス産業の急成長

- 化学産業からの需要増加

- 市場抑制要因

- 代替シーリングソリューションの利用可能性

- 市場機会

- 極低温用途へのフッ素化エチレンプロピレンカプセル化ガスケットの採用

- 今後の動向

- 製造技術の進歩

- 促進要因と抑制要因の影響

第6章 カプセル化ガスケットとシール市場-欧州分析

- 欧州のカプセル化ガスケットとシール市場の売上高、2020-2030年

- 欧州のカプセル化ガスケットとシール市場予測分析

第7章 欧州のカプセル化ガスケットとシール市場分析-材料別

- シリコン

- ネオプレン

- バイトン

- テフロン

- その他

第8章 欧州のカプセル化ガスケットとシール市場分析-最終用途別

- 石油・ガス

- 食品

- 医薬品

- 化学

- 自動車

- その他

第9章 欧州のカプセル化ガスケットとシール市場:国別分析

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他欧州

第10章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第11章 企業プロファイル

- Trelleborg AB

- Gasco Inc

- VH Polymers

- AS Aston Seals SPA

- MCM SPA

- Polymax Ltd

- Vulcan Engineering Ltd

第12章 付録

List Of Tables

- Table 1. Europe Encapsulated Gaskets and Seals Market Segmentation

- Table 2. List of Vendors

- Table 3. Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 5. Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 6. Europe: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 7. Germany: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 8. Germany: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 9. France: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 10. France: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 11. Italy: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 12. Italy: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 13. UK: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 14. UK: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 15. Russia: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 16. Russia: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

- Table 17. Rest of Europe: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 18. Rest of Europe: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million) - by End Use

List Of Figures

- Figure 1. Europe Encapsulated Gaskets and Seals Market Segmentation, by Country

- Figure 2. Encapsulated Gaskets and Seals Market - Porter's Analysis

- Figure 3. Ecosystem: Encapsulated Gaskets and Seals Market

- Figure 4. Europe Encapsulated Gaskets and Seals Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Europe Encapsulated Gaskets and Seals Market Revenue (US$ Million), 2020-2030

- Figure 7. Europe Encapsulated Gaskets and Seals Market Share (%) - by Material (2022 and 2030)

- Figure 8. Silicon: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Neoprene: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Viton: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Teflon: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Others: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Europe Encapsulated Gaskets and Seals Market Share (%) - by End Use (2022 and 2030)

- Figure 14. Oil and Gas: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Food: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Pharmaceutical: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Chemical: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Automotive: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Others: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Europe Encapsulated Gaskets and Seals Market, By Key Country - Revenue (2022) (US$ Million)

- Figure 21. Europe Encapsulated Gaskets and Seals Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 22. Germany: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. France: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Italy: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. UK: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Russia: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Rest of Europe: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 28. Heat Map Analysis by Key Players

- Figure 29. Company Positioning & Concentration

The Europe encapsulated gaskets and seals market was valued at US$ 91.13 million in 2022 and is expected to reach US$ 156.46 million by 2030; it is estimated to register a CAGR of 7.0% from 2022 to 2030.

Increasing Demand from Chemical Industry Drives Europe Encapsulated Gaskets and Seals Market

The chemicals industry stands as a cornerstone of industrial development, encompassing a vast array of processes involved in the production, transformation, and handling of various chemicals. As a critical sector with diverse applications, the chemical industry places stringent demand on equipment and components to ensure safety, efficiency, and regulatory compliance. Encapsulated gaskets and seals play a vital role in meeting these challenges, serving as essential components that contribute to the integrity and reliability of chemical processing equipment. In the chemical industry, where precision and containment are paramount, the choice of sealing solutions is pivotal. Encapsulated gaskets and seals provide a robust defense against the corrosive and aggressive nature of many chemicals involved in industrial processes.

As the chemical industry continues to expand in developed and developing economies, there is an increasing need for reliable sealing solutions that can withstand the harsh and corrosive nature of many chemicals. Encapsulated gaskets and seals provide an effective barrier, preventing the escape of hazardous materials and ensuring the safety of both the processes and personnel. The chemical resistance of materials such as PTFE, commonly used in encapsulated seals, makes them particularly suitable for applications in this demanding industry. Moreover, the chemical industry strongly emphasizes regulatory compliance and adherence to safety standards. Encapsulated gaskets and seals contribute to meeting these stringent requirements and offer benefits such as reduced maintenance needs and increased equipment reliability. This becomes especially crucial in preventing costly downtime and minimizing the risk of environmental contamination or accidents. Thus, the chemical industry relies heavily on encapsulated gaskets and seals to ensure the integrity and safety of its processes. The symbiotic relationship between the chemical industry and the manufacturers of sealing solutions underscores the pivotal role of encapsulated gaskets and seals in supporting the growth, efficiency, and sustainability of this critical sector.

Europe Encapsulated Gaskets and Seals Market Overview

The encapsulated gaskets and seals market in Europe is majorly driven by a combination of technological advancements, stringent regulatory standards, and the region's robust industrial infrastructure. These specialized components play a crucial role in preventing leaks and ensuring the integrity of mechanical systems across various sectors, including automotive, chemical, pharmaceutical, and oil & gas.

The increasing demand for high-performance and durable sealing solutions in critical applications drives the demand for encapsulated gaskets and seals in Europe. The automotive industry, in particular, is increasingly adopting these solutions due to the need for reliable seals in engines, transmissions, and other vital components. As per the European Commission, Europe is the biggest manufacturer of motor vehicles worldwide. The automobile industry directly and indirectly employs ?13.8 million people, resulting in 6.1% of overall employment in the European Union (EU). As per the International Organization of Motor Vehicle Manufacturers (OICA), the EU produced 16.2 million vehicles in 2022. Additionally, the emphasis on environmental sustainability has led to a growing preference for encapsulated gaskets that offer enhanced resistance to harsh chemicals and extreme temperatures.

Stringent regulatory standards regarding emissions and safety in Europe have further fueled the market as manufacturers strive to meet and exceed these requirements. The pharmaceutical and food processing industries also contribute to the demand for encapsulated gaskets and seals, given the stringent hygiene and contamination control measures in these sectors. Further, market players in Europe are actively investing in research and development to introduce innovative materials and designs, catering to the evolving needs of diverse industries. The competitive landscape is characterized by collaborations and strategic partnerships to expand product portfolios and geographic reach.

Europe Encapsulated Gaskets and Seals Market Revenue and Forecast to 2030 (US$ Million)

Europe Encapsulated Gaskets and Seals Market Segmentation

The Europe encapsulated gaskets and seals market is categorized into material, end use, and country.

Based on material, the Europe encapsulated gaskets and seals market is segmented into silicon, neoprene, Viton, Teflon, and others. The Viton segment held the largest market share in 2022.

Based on end use, the Europe encapsulated gaskets and seals market is segmented into oil and gas, food, pharmaceutical, chemical, automotive, and others. The oil and gas segment held the largest market share in 2022.

By country, the Europe encapsulated gaskets and seals market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Russia dominated the Europe encapsulated gaskets and seals market share in 2022.

AS Aston Seals SPA, Gasco Inc, MCM SPA, Polymax Ltd, Trelleborg AB, VH Polymers, and Vulcan Engineering Ltd are some of the leading companies operating in the Europe encapsulated gaskets and seals market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Encapsulated Gaskets and Seals Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Threat of Substitutes

- 4.2.3 Bargaining Power of Buyers

- 4.2.4 Bargaining Power of Suppliers

- 4.2.5 Competitive Rivalry

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors or Suppliers

- 4.3.4 End-use Industry

- 4.3.5 List of Vendors in the Value Chain

5. Europe Encapsulated Gaskets and Seals Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Soaring Growth of Oil & Gas Industry

- 5.1.2 Increasing Demand from Chemical Industry

- 5.2 Market Restraints

- 5.2.1 Availability of Alternative Sealing Solutions

- 5.3 Market Opportunities

- 5.3.1 Adoption of Fluorinated Ethylene Propylene Encapsulated Gaskets for Cryogenic Applications

- 5.4 Future Trends

- 5.4.1 Advancements in Manufacturing Technologies

- 5.5 Impact of Drivers and Restraints:

6. Encapsulated Gaskets and Seals Market - Europe Analysis

- 6.1 Europe Encapsulated Gaskets and Seals Market Revenue (US$ Million), 2020-2030

- 6.2 Europe Encapsulated Gaskets and Seals Market Forecast Analysis

7. Europe Encapsulated Gaskets and Seals Market Analysis - by Material

- 7.1 Silicon

- 7.1.1 Overview

- 7.1.2 Silicon: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Neoprene

- 7.2.1 Overview

- 7.2.2 Neoprene: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Viton

- 7.3.1 Overview

- 7.3.2 Viton: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Teflon

- 7.4.1 Overview

- 7.4.2 Teflon: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

8. Europe Encapsulated Gaskets and Seals Market Analysis - by End Use

- 8.1 Oil and Gas

- 8.1.1 Overview

- 8.1.2 Oil and Gas: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Food

- 8.2.1 Overview

- 8.2.2 Food: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Pharmaceutical

- 8.3.1 Overview

- 8.3.2 Pharmaceutical: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Chemical

- 8.4.1 Overview

- 8.4.2 Chemical: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Automotive

- 8.5.1 Overview

- 8.5.2 Automotive: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

9. Europe Encapsulated Gaskets and Seals Market - Country Analysis

- 9.1 Europe

- 9.1.1 Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast Analysis - by Country

- 9.1.1.1 Europe: Encapsulated Gaskets and Seals Market - Revenue and Forecast Analysis - by Country

- 9.1.1.2 Germany: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.2.1 Germany: Encapsulated Gaskets and Seals Market Breakdown, by Material

- 9.1.1.2.2 Germany: Encapsulated Gaskets and Seals Market Breakdown, by End Use

- 9.1.1.3 France: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.3.1 France: Encapsulated Gaskets and Seals Market Breakdown, by Material

- 9.1.1.3.2 France: Encapsulated Gaskets and Seals Market Breakdown, by End Use

- 9.1.1.4 Italy: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.4.1 Italy: Encapsulated Gaskets and Seals Market Breakdown, by Material

- 9.1.1.4.2 Italy: Encapsulated Gaskets and Seals Market Breakdown, by End Use

- 9.1.1.5 UK: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.5.1 UK: Encapsulated Gaskets and Seals Market Breakdown, by Material

- 9.1.1.5.2 UK: Encapsulated Gaskets and Seals Market Breakdown, by End Use

- 9.1.1.6 Russia: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.6.1 Russia: Encapsulated Gaskets and Seals Market Breakdown, by Material

- 9.1.1.6.2 Russia: Encapsulated Gaskets and Seals Market Breakdown, by End Use

- 9.1.1.7 Rest of Europe: Encapsulated Gaskets and Seals Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.1.7.1 Rest of Europe: Encapsulated Gaskets and Seals Market Breakdown, by Material

- 9.1.1.7.2 Rest of Europe: Encapsulated Gaskets and Seals Market Breakdown, by End Use

- 9.1.1 Europe Encapsulated Gaskets and Seals Market - Revenue and Forecast Analysis - by Country

10. Competitive Landscape

- 10.1 Heat Map Analysis by Key Players

- 10.2 Company Positioning & Concentration

11. Company Profiles

- 11.1 Trelleborg AB

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Gasco Inc

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 VH Polymers

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 AS Aston Seals SPA

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 MCM SPA

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 Polymax Ltd

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 Vulcan Engineering Ltd

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners