|

|

市場調査レポート

商品コード

1592634

アジア太平洋の水処理産業用バルブ市場:2030年までの予測 - 地域別分析 - バルブタイプ別、材料タイプ別Asia Pacific Water Treatment Industry Valves Market Forecast to 2030 - Regional Analysis - by Valve Type and Material Type |

||||||

|

|||||||

| アジア太平洋の水処理産業用バルブ市場:2030年までの予測 - 地域別分析 - バルブタイプ別、材料タイプ別 |

|

出版日: 2024年09月16日

発行: The Insight Partners

ページ情報: 英文 90 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

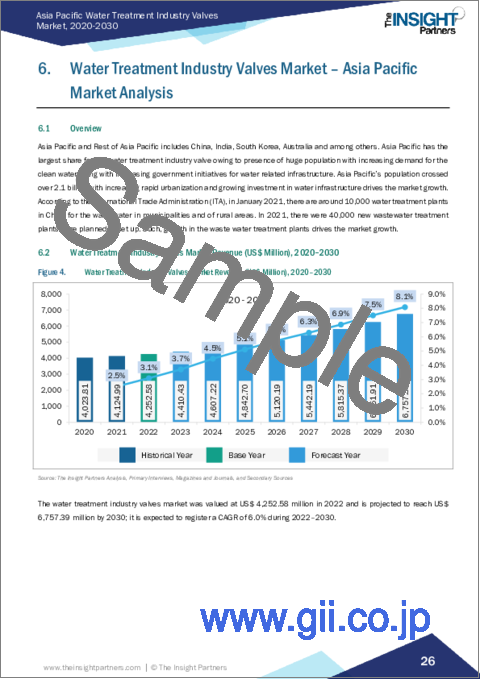

アジア太平洋の水処理産業用バルブ市場は、2022年に42億5,258万米ドルとなり、2030年までには67億5,739万米ドルに達すると予測され、2022年から2030年までのCAGRは6.0%と推定されます。

水処理プラントへの投資増がアジア太平洋の水処理産業用バルブ市場を押し上げる

都市部や農村部では、廃水や水処理プラントの需要が増加しているため、世界中のいくつかの政府が水処理プラントに大規模な投資を開始しています。インド政府は、国家全体の水インフラ改善に積極的に取り組んでいます。連邦予算は毎年、水インフラ建設のために多額の資金を確保しています。ネットワークの増強、処理のアップグレード、計量とロスの削減を通じて、Jal Jeevan Mission(JJM)、National Mission for Clean Ganga(NMCG)、Atal Mission for Rejuvenation and Urban Transformation(AMRUT)、その他農村部や都市部に焦点を当てたプロジェクトなどのプログラムは、安全で信頼でき、手頃な価格の水道水供給へのアクセスを大幅に拡大しています。政府のリサイクル・再利用に関する国家枠組み(SRTW)政策は、限られた淡水資源への圧力を軽減し、処理済み廃水の利用を促進するための重要な手段です。政府の資金援助とは別に、世界中のエネルギー・水処理企業が水処理施設の建設に投資しています。2023年、国際金融公社とタイ内務省は、タイの公共インフラの強化を支援するとともに、高品質の水へのアクセスを改善し、国の廃水処理能力を拡大するための覚書に署名しました。この協定は、タイの気候変動目標に沿い、協力的な取り組みへの扉を開き、サブナショナル・ファイナンスの機会を最大化し、持続可能性に重点を置いた官民パートナーシップ(PPP)プロジェクトを推進することを意図しています。また2023年には、Darco Water Technologies Limitedがベトナムのベンチェ省バライ地区で進めていた水処理・浄水供給プロジェクトの第一段階が完了し、操業を開始しました。Darco Water Technologies Limitedは、水処理、廃水管理、清潔な水の供給、真空固形廃棄物管理のための統合エンジニアリングと専門知識を駆使したソリューションを提供しています。これにより、最大2万戸の農村家庭が毎日5,000m3のきれいな水を利用できるようになります。2024年にプロジェクトの第2期工事が完了すると、プラントはベンチェ省バー・チー(Ba Tri)地区とその周辺15コミューンのさらに多くの家庭や企業に、1日あたり15,000m3の清潔な水を供給することになります。さらに2022年には、水処理技術を製造するDaiki Axis Japanが、インドのハリヤナ州に20億インドルピーを投じて第2工場を設立しました。1,000台の汚水処理ユニットを製造できる日本の「浄水場」技術工場がパルワールに建設されます。このように、水処理プラントへの投資の増加は、最終的に水処理産業用バルブ市場の需要を牽引する新たな水処理プロジェクトに直結します。

アジア太平洋の水処理産業用バルブ市場概要

アジア太平洋とその他アジア太平洋には、中国、インド、韓国、オーストラリアなどが含まれます。アジア太平洋は、水関連インフラのための政府のイニシアチブの増加とともに、清潔な水への需要が増加し、膨大な人口が存在するため、水処理産業用バルブの最大のシェアを持っています。アジア太平洋の人口は21億人を超え、急速な都市化が進み、水インフラへの投資が増加していることが市場成長の原動力となっています。国際貿易局(ITA)によると、2021年1月、中国には自治体や農村部の廃水を処理する浄水場が約1万カ所あります。2021年には、4万件の廃水処理プラントの新設が計画されています。このように、廃水処理プラントの成長が市場の成長を牽引しています。

アジア太平洋の水処理産業用バルブ市場の収益と2030年までの予測(金額)

アジア太平洋の水処理産業用バルブ市場のセグメンテーション

アジア太平洋の水処理産業用バルブ市場は、バルブタイプ、材料タイプ、国別に分類されます。

バルブタイプに基づき、アジア太平洋の水処理産業用バルブ市場は、ボールバルブ、バタフライバルブ、ダイヤフラムバルブ、安全バルブ、チェックバルブ、ゲートバルブ、その他にセグメント化されます。ボールバルブセグメントは2022年に最大の市場シェアを占めました。

材料タイプでは、アジア太平洋の水処理産業用バルブ市場は、鋼合金、ステンレス鋼、鋳鉄、およびその他にセグメント化されます。2022年のアジア太平洋の水処理産業用バルブ市場では、ステンレス鋼セグメントが最大のシェアを占めました。

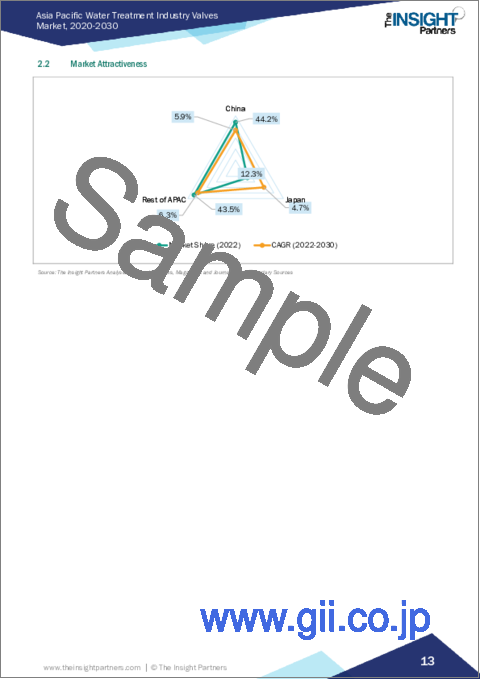

国別では、アジア太平洋の水処理産業用バルブ市場は中国、日本、その他アジア太平洋に区分されます。中国は2022年にアジア太平洋の水処理産業用バルブ市場シェアを独占しました。

Alfa Laval AB、Flowserve Corp、Valco Group、Spirax Sarco Engineering Plc、Velan Inc、KITZ Corp、Emerson Electric Coは、アジア太平洋の水処理産業用バルブ市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 水処理産業用バルブの市場情勢

- エコシステム分析

- 原材料サプライヤー

- 製造と組み立て

- エンドユーザー

- バリューチェーンのベンダー一覧

- 水処理産業におけるバルブの標準化分析:国別

- 日本

- 製品特徴:バルブタイプ別

第5章 アジア太平洋の水処理産業用バルブ市場:主要市場力学

- 市場促進要因

- 世界の急速な都市化が市場成長を促進

- 水処理プラントへの投資の増加

- 市場抑制要因

- バルブの高いメンテナンスコスト

- 市場機会

- スマートシティへの取り組みの増加

- 今後の動向

- 次世代バルブの開発の高まり

- 促進要因と抑制要因の影響

第6章 水処理産業用バルブ市場:アジア太平洋市場分析

- 水処理産業用バルブの市場収益、2020年~2030年

- 水処理産業用バルブの市場予測分析

第7章 アジア太平洋の水処理産業用バルブ市場分析:バルブタイプ別

- ボールバルブ

- バタフライバルブ

- ダイヤフラムバルブ

- 安全バルブ

- チェックバルブ

- ゲートバルブ

- その他

第8章 アジア太平洋の水処理産業用バルブ市場分析:材料タイプ別

- スチール合金

- ステンレス鋼

- 鋳鉄

- その他

第9章 アジア太平洋の水処理産業用バルブ市場:国別分析

- アジア太平洋

- 中国

- 日本

- その他アジア太平洋

第10章 競合情勢

- ヒートマップ分析

- 企業のポジショニングと集中度

- 水処理業界のバルブ市場シェア(%)、2022年

第11章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第12章 企業プロファイル

- Alfa Laval AB

- Flowserve Corp

- Valco Group

- Spirax Sarco Engineering Plc

- Velan Inc

- KITZ Corp

- Emerson Electric Co

第13章 付録

List Of Tables

- Table 1. Water Treatment Industry Valves Market Segmentation

- Table 2. List of Vendors

- Table 3. Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million) - by Valve Type

- Table 5. Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million) - by Material Type

- Table 6. Asia Pacific: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 7. Heat Map Analysis by Key Players

- Table 8. China: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million) - by Valve Type

- Table 9. China: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million) - by Material Type

- Table 10. Heat Map Analysis by Key Players

- Table 11. Japan: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million) - by Valve Type

- Table 12. Japan: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million) - by Material Type

- Table 13. Rest of Asia Pacific: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million) - by Valve Type

- Table 14. Rest of Asia Pacific: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million) - by Material Type

- Table 15. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. Water Treatment Industry Valves Market Segmentation, by Country

- Figure 2. Water Treatment Industry Valves Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Water Treatment Industry Valves Market Revenue (US$ Million), 2020-2030

- Figure 5. Water Treatment Industry Valves Market Share (%) - by Valve Type (2022 and 2030)

- Figure 6. Ball Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. Butterfly Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Diaphragm Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Safety Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Check Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Gate Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Others: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Water Treatment Industry Valves Market Share (%) - by Material Type (2022 and 2030)

- Figure 14. Steel Alloys: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Stainless Steel: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Cast Iron: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Others: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Asia Pacific: Water Treatment Industry Valves Market, By Key Country - Revenue 2022( US$ Million)

- Figure 19. Asia Pacific: Water Treatment Industry Valves Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 20. China: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million)

- Figure 21. Company Positioning & Concentration

- Figure 22. Japan: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million)

- Figure 23. Company Positioning & Concentration

- Figure 24. Rest of Asia Pacific: Water Treatment Industry Valves Market - Revenue and Forecast to 2030(US$ Million)

- Figure 25. Company Positioning & Concentration

- Figure 26. Company Market Share Analysis

The Asia Pacific water treatment industry valves market was valued at US$ 4,252.58 million in 2022 and is expected to reach US$ 6,757.39 million by 2030; it is estimated to register a CAGR of 6.0% from 2022 to 2030.

Rise in Investments in Water Treatment Plants Boost Asia Pacific Water Treatment Industry Valves Market

In urban and rural areas, there is an increased demand for wastewater and water treatment plants; hence, several governments across the globe have started investing extensively in water treatment plants. The Indian government is actively working to improve the nation's total water infrastructure. The Union Budget sets aside a sizeable sum of funds each year for the construction of water infrastructure. Through network augmentations, treatment upgrades, and metering and loss reduction, programs such as the Jal Jeevan Mission (JJM), National Mission for Clean Ganga (NMCG), Atal Mission for Rejuvenation and Urban Transformation (AMRUT), and other projects focused on rural and urban areas are significantly expanding access to safe, dependable, and affordable tap water supply. The National Framework on Recycle & Reuse (SRTW) policy of the government is a key tool in reducing the pressure on limited freshwater resources and encouraging the use of treated wastewater. Apart from government funding, several energy and water treatment companies across the globe are investing in the construction of water treatment facilities. In 2023, the International Finance Corporation and the Ministry of Interior of Thailand signed a memorandum of understanding (MoU) to support the strengthening of Thailand's public infrastructure, as well as to improve access to high-quality water and expand the nation's wastewater treatment capacity. The agreement intends to open the door for cooperative initiatives, maximize subnational finance opportunities, and promote public-private partnership (PPP) projects with an emphasis on sustainability, all in keeping with Thailand's climate goals. Also, in 2023, the first phase of Darco Water Technologies Limited's water treatment and clean water supply project in the Ba Lai district of Vietnam's Ben Tre Province was completed, and the company started operations. Darco Water Technologies Limited provides integrated engineering and expertise-driven solutions for water treatment, wastewater management, clean water supply, and vacuum solid waste management. It will give up to 20,000 rural homes access to 5,000 m3 of clean water each day. After the project's second phase of construction is finished in 2024, the plant will provide 15,000m3 of clean water per day to additional homes and businesses in the Ben Tre Province's district of Ba Tri township and its surrounding 15 communes. Further, in 2022, Daiki Axis Japan, a producer of water treatment technologies, is investing Rs 200 crore to establish its second plant in Haryana, India. The Japanese "Johkasou" technology factory, which can create 1,000 sewage treatment units, is being built in Palwal. Thus, the rise in investments in water treatment plants will directly lead new water treatment projects ultimately driving the demand of the water treatment industry valves market.

Asia Pacific Water Treatment Industry Valves Market Overview

Asia Pacific and Rest of Asia Pacific includes China, India, South Korea, Australia and among others. Asia Pacific has the largest share for the water treatment industry valve owing to presence of huge population with increasing demand for the clean water along with increasing government initiatives for water related infrastructure. Asia Pacific's population crossed over 2.1 billion with increasing rapid urbanization and growing investment in water infrastructure drives the market growth. According to the International Trade Administration (ITA), in January 2021, there are around 10,000 water treatment plants in China for the wastewater in municipalities and of rural areas. In 2021, there were 40,000 new wastewater treatment plants were planned to set up. Such, growth in the waste water treatment plants drives the market growth.

Asia Pacific Water Treatment Industry Valves Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Water Treatment Industry Valves Market Segmentation

The Asia Pacific water treatment industry valves market is categorized into valves type, material type, and country.

Based on valve type, the Asia Pacific water treatment industry valves market is segmented into ball valves, butterfly valves, diaphragm valves, safety valves, check valves, gate valves, and others. The ball valves segment held the largest market share in 2022.

In terms of material type, the Asia Pacific water treatment industry valves market is segmented into steel alloys, stainless steel, cast iron, and others. The stainless-steel segment held the largest share of Asia Pacific water treatment industry valves market in 2022.

By country, the Asia Pacific water treatment industry valves market is segmented into China, Japan, and the Rest of Asia Pacific. China dominated the Asia Pacific water treatment industry valves market share in 2022.

Alfa Laval AB, Flowserve Corp, Valco Group, Spirax Sarco Engineering Plc, Velan Inc, KITZ Corp, and Emerson Electric Co are some of the leading companies operating in the Asia Pacific water treatment industry valves market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Water Treatment Industry Valves Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 Raw Materials Suppliers-

- 4.2.2 Manufacturing and Assembly:

- 4.2.3 End Users:

- 4.2.4 List of Vendors in the Value Chain

- 4.3 Qualitative Analysis of Standardizations for Valves in Water Treatment Industry, By Country

- 4.3.1 Japan

- 4.4 Product Features, By Valve Types

5. Asia Pacific Water Treatment Industry Valves Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rapid Urbanization Across the Globe is Driving the Market Growth

- 5.1.2 Rise in Investments in Water Treatment Plants

- 5.2 Market Restraints

- 5.2.1 High Maintenance Costs of the Valves

- 5.3 Market Opportunities

- 5.3.1 Growing Number of Smart City Initiatives

- 5.4 Future Trends

- 5.4.1 Rising Development of Next Generation Valves

- 5.5 Impact of Drivers and Restraints:

6. Water Treatment Industry Valves Market - Asia Pacific Market Analysis

- 6.1 Overview

- 6.2 Water Treatment Industry Valves Market Revenue (US$ Million), 2020-2030

- 6.3 Water Treatment Industry Valves Market Forecast Analysis

7. Asia Pacific Water Treatment Industry Valves Market Analysis - by Valve Type

- 7.1 Ball Valve

- 7.1.1 Overview

- 7.1.2 Ball Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Butterfly Valve

- 7.2.1 Overview

- 7.2.2 Butterfly Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Diaphragm Valve

- 7.3.1 Overview

- 7.3.2 Diaphragm Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Safety Valve

- 7.4.1 Overview

- 7.4.2 Safety Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Check Valve

- 7.5.1 Overview

- 7.5.2 Check Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 7.6 Gate Valve

- 7.6.1 Overview

- 7.6.2 Gate Valve: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 7.7 Others

- 7.7.1 Overview

- 7.7.2 Others: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Water Treatment Industry Valves Market Analysis - by Material Type

- 8.1 Steel Alloys

- 8.1.1 Overview

- 8.1.2 Steel Alloys: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Stainless Steel

- 8.2.1 Overview

- 8.2.2 Stainless Steel: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Cast Iron

- 8.3.1 Overview

- 8.3.2 Cast Iron: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Water Treatment Industry Valves Market -Country Analysis

- 9.1 Asia Pacific

- 9.1.1 Asia Pacific: Water Treatment Industry Valves Market, By Key Country - Revenue 2022 (US$ Million)

- 9.1.2 Asia Pacific: Water Treatment Industry Valves Market - Revenue and Forecast Analysis - by Country

- 9.1.2.1 Asia Pacific: Water Treatment Industry Valves Market - Revenue and Forecast Analysis - by Country

- 9.1.2.2 China: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.2.1 Heat Map Analysis

- 9.1.2.2.2 Company Positioning & Concentration

- 9.1.2.2.3 China: Water Treatment Industry Valves Market Breakdown, by Valve Type

- 9.1.2.2.4 China: Water Treatment Industry Valves Market Breakdown, by Material Type

- 9.1.2.3 Japan: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.3.1 Heat Map Analysis

- 9.1.2.3.2 Company Positioning & Concentration

- 9.1.2.3.3 Japan: Water Treatment Industry Valves Market Breakdown, by Valve Type

- 9.1.2.3.4 Japan: Water Treatment Industry Valves Market Breakdown, by Material Type

- 9.1.2.4 Rest of Asia Pacific: Water Treatment Industry Valves Market - Revenue and Forecast to 2030 (US$ Million)

- 9.1.2.4.1 Rest of Asia Pacific: Water Treatment Industry Valves Market Breakdown, by Valve Type

- 9.1.2.4.2 Rest of Asia Pacific: Water Treatment Industry Valves Market Breakdown, by Material Type

10. Competitive Landscape

- 10.1 Heat Map Analysis

- 10.2 Company Positioning & Concentration

- 10.3 Water Treatment Industry Valve Market Share (%), 2022

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Development

- 11.4 Mergers & Acquisitions

12. Company Profiles

- 12.1 Alfa Laval AB

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Flowserve Corp

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Valco Group

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Spirax Sarco Engineering Plc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Velan Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 KITZ Corp

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Emerson Electric Co

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

13. Appendix

- 13.1 About the Insight Partners