|

|

市場調査レポート

商品コード

1592592

北米の抗体探索市場の2030年までの予測 - 地域別分析:抗体タイプ別、性質別、サービス別、エンドユーザー別North America Antibody Discovery Market Forecast to 2030 - Regional Analysis - by Antibody Type, Nature, Services, and End User |

||||||

|

|||||||

| 北米の抗体探索市場の2030年までの予測 - 地域別分析:抗体タイプ別、性質別、サービス別、エンドユーザー別 |

|

出版日: 2024年09月16日

発行: The Insight Partners

ページ情報: 英文 94 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の抗体探索市場は、2022年に1兆2,982億3,757万米ドルとなり、2030年までには2兆2,016億9,241万米ドルに達すると予測され、2022年から2030年までのCAGRは6.8%と推定されます。

研究開発投資の増加が北米の抗体探索市場を牽引

モノクローナルやポリクローナルを含む抗体は、学術、研究、製薬機関や組織で応用されており、医薬品やバイオマーカー開発、その他の治療薬や臨床診断薬の製品開発に関連する研究開発活動で使用されています。中小企業は毎年、研究開発投資の引き上げに注力しています。2020年4月、米国連邦政府は、ワクチン、診断薬、治療薬、低分子医薬品有効成分(API)などの製造、生産、調達のための財政支援を提供するため、コロナウイルス支援・救済・経済安全保障(CARES)法に基づき、バイオメディカル先端研究開発局(BARDA)に35億米ドルを割り当てました。さらに、製薬会社であるBio-Radは、体外診断検査を開発するために、抗原、試薬、緩衝液とともに10,000種類の抗体を提供しています。そのため、様々な疾患に対するより良い治療法を開発するための抗体探索に関する研究開発活動への製薬会社の投資が増加しており、抗体探索市場の成長を後押ししています。

北米の抗体探索市場の概要

北米の抗体探索市場は米国、カナダ、メキシコに区分されます。同地域の市場成長は、がん罹患率の増加、抗体研究産業の強い存在感、研究開発部門の技術進歩によって決定されます。米国がん協会によると、米国では2020年に新たに180万人ががんと診断され、60万6,520人ががんによる死亡を記録しました。これにより、治療用抗体のニーズが高まり、抗体探索市場の成長に拍車がかかります。資金調達の急増はさらに、新技術の開発、国や組織を超えたリソースや専門知識の共有、既存の抗体治療に関する研究開発を可能にしています。その結果、免疫システムに対する理解が深まり、効果的で標的を絞った抗体が開発されるようになりました。さらに、資金が増加したことで、科学者は特定の抗体の有効性を評価するために必須の大規模臨床試験を実施できるようになりました。

北米の抗体探索市場の収益と2030年までの予測(10億米ドル)

北米の抗体探索市場のセグメンテーション

北米の抗体探索市場は、抗体タイプ、性質、サービス、エンドユーザー、国に分類されます。

抗体タイプに基づき、北米の抗体探索市場はモノクローナル抗体、ポリクローナル抗体、その他に区分されます。モノクローナル抗体セグメントは、2022年の北米の抗体探索市場で最大のシェアを占めました。

性質別では、北米の抗体探索市場はヒトおよびヒト化、キメラ、マウスに区分されます。ヒトおよびヒト化セグメントは2022年に北米の抗体探索市場で最大のシェアを占めました。

サービス別では、北米の抗体探索市場はファージディスプレイ、ハイブリドーマ、トランスジェニック動物、シングルセル、イーストディスプレイに分けられます。2022年の北米の抗体探索市場シェアは、ファージディスプレイセグメントが最大でした。

エンドユーザー別に見ると、北米の抗体探索市場は製薬・バイオテクノロジー企業、研究所、その他に分類されます。製薬・バイオテクノロジー企業セグメントが2022年に北米の抗体探索市場で最大のシェアを占めました。

国別では、北米の抗体探索市場は米国、カナダ、メキシコに分類されます。米国が2022年の北米の抗体探索市場シェアを独占しました。

Charles River Laboratories International Inc、Creative Biolabs Inc、Evotec SE、Bruker Cellular Analysis Inc、BioDuro LLC、Sartorius AG、Aragen Life Sciences Ltd、Twist Bioscience Corp、NanoCellect Biomedical Inc、Biocytogen Pharmaceuticals Beijing Co Ltd.などが北米の抗体探索市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の抗体探索市場 - 主要市場力学

- 市場促進要因

- 研究開発投資の増加

- がん罹患率の上昇

- 市場抑制要因

- 生産コストの高さ

- 市場機会

- 発展途上地域におけるバイオテクノロジー産業の普及

- 今後の動向

- カスタム抗体の開発

- 促進要因と抑制要因の影響

第5章 抗体探索市場:北米市場分析

- 北米の抗体探索市場の収益、2020年~2030年

第6章 北米の抗体探索市場の分析:抗体タイプ別

- モノクローナル抗体

- ポリクローナル抗体

- その他

第7章 北米の抗体探索市場の分析:性質別

- ヒト・ヒト化抗体

- キメラ

- マウス

第8章 北米の抗体探索市場の分析:サービス別

- ファージディスプレイ

- ハイブリドーマ

- トランスジェニック動物

- 酵母ディスプレイ

- シングルセル

第9章 北米の抗体探索市場の分析:エンドユーザー別

- 製薬・バイオテクノロジー企業

- 研究機関

- その他

第10章 北米の抗体探索市場:国別分析

- 北米市場概要

- 北米

- 米国

- カナダ

- メキシコ

- 北米

第11章 抗体探索市場:業界情勢

- 抗体探索市場における成長戦略

- 無機的成長戦略

- 有機的成長戦略

第12章 企業プロファイル

- Charles River Laboratories International Inc

- Creative Biolabs Inc

- Evotec SE

- Bruker Cellular Analysis Inc

- BioDuro LLC

- Sartorius AG

- Aragen Life Sciences Ltd

- Twist Bioscience Corp

- NanoCellect Biomedical Inc

- Biocytogen Pharmaceuticals Beijing Co Ltd

第13章 付録

List Of Tables

- Table 1. North America Antibody Discovery Market Segmentation

- Table 2. New Cancer Cases Worldwide, in 2020

- Table 3. United States: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Antibody Type

- Table 4. United States: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Nature

- Table 5. United States: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Services

- Table 6. United States: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by End User

- Table 7. Canada: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Antibody Type

- Table 8. Canada: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Nature

- Table 9. Canada: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Services

- Table 10. Canada: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by End User

- Table 11. Mexico: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Antibody Type

- Table 12. Mexico: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Nature

- Table 13. Mexico: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by Services

- Table 14. Mexico: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million) - by End User

- Table 15. Recent Inorganic Growth Strategies in the Antibody Discovery Market

- Table 16. Recent Organic Growth Strategies in the Antibody Discovery Market

- Table 17. Glossary of Terms, Antibody Discovery Market

List Of Figures

- Figure 1. North America Antibody Discovery Market Segmentation, by Country

- Figure 2. North America Antibody Discovery Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Antibody Discovery Market Revenue (US$ Million), 2020 - 2030

- Figure 5. North America Antibody Discovery Market Share (%) - by Antibody Type (2022 and 2030)

- Figure 6. Monoclonal Antibodies: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. Polyclonal Antibodies: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Others: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. North America Antibody Discovery Market Share (%) - by Nature (2022 and 2030)

- Figure 10. Human and Humanized: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

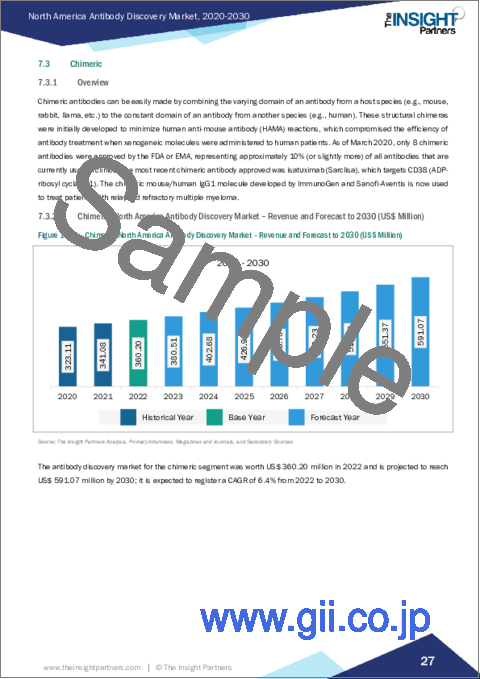

- Figure 11. Chimeric: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Murine: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. North America Antibody Discovery Market Share (%) - by Services (2022 and 2030)

- Figure 14. Phage Display: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Hybridoma: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Transgenic Animal: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Yeast Display: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Single Cell: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. North America Antibody Discovery Market Share (%) - by End User (2022 and 2030)

- Figure 20. Pharmaceutical and Biotechnology Companies: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Research Laboratories: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Others: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. North America: Antibody Discovery Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 24. North America: Antibody Discovery Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 25. US: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million)

- Figure 26. Canada: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million)

- Figure 27. Mexico: Antibody Discovery Market - Revenue and Forecast to 2030(US$ Million)

- Figure 28. Growth Strategies in the Antibody Discovery Market

The North America antibody discovery market was valued at US$ 12,98,237.57 million in 2022 and is expected to reach US$ 22,01,692.41 million by 2030; it is estimated to register a CAGR of 6.8% from 2022 to 2030.

Increasing Investments in Research & Development Fuel North America Antibody Discovery Market

Antibodies, including monoclonal and polyclonal, find applications in academic, research, and pharmaceutical institutes and organizations, wherein they are used in several R&D activities related to drug and biomarker development, and other therapeutic and clinical diagnostics product development. Small and medium-sized companies focus on raising their R&D investments every year. In April 2020, the US federal government assigned US$ 3.5 billion to the Biomedical Advanced Research and Development Authority (BARDA) under its Coronavirus Aid, Relief, and Economic Security (CARES) Act to provide financial support for the manufacturing, production, and procurement of vaccines, diagnostics, therapeutics, and small molecule active pharmaceutical ingredients (APIs), among others. Further, Bio-Rad, a pharmaceutical company, provides 10,000 antibodies, along with antigens, reagents, and buffers, to develop in vitro diagnostic tests. Therefore, the increasing investments by pharmaceutical companies in research and development activities related to antibody discovery to develop better treatment options for various diseases propels the antibody discovery market growth.

North America Antibody Discovery Market Overview

The North America antibody discovery market is segmented into the US, Canada, and Mexico. Market growth in the region is determined by an increase in the prevalence of cancer, the strong presence of the antibody research industry, and technological advancements in the R&D sector. According to the American Cancer Society, ~1.8 million new cancer cases were diagnosed and ~606,520 deaths related to cancer were recorded in the US in 2020. This bolsters the need for therapeutic antibodies, thereby fueling the antibody discovery market growth. An upsurge in funding further enables the development of new technologies, pooling of resources and expertise across countries and organizations, and conducting research work into existing antibody treatments. This has led to a better understanding of the immune system, and the development of effective and targeted antibodies. Additionally, the increased funding allows scientists to conduct large-scale clinical trials that are mandatory to evaluate the effectiveness of a particular antibody.

North America Antibody Discovery Market Revenue and Forecast to 2030 (US$ Billion)

North America Antibody Discovery Market Segmentation

The North America antibody discovery market is categorized into antibody type, nature, services, end user, and country.

Based on antibody type, the North America antibody discovery market is segmented into monoclonal antibodies, polyclonal antibodies, and others. The monoclonal antibodies segment held the largest North America antibody discovery market share in 2022.

In terms of nature, the North America antibody discovery market is segmented into human and humanized, chimeric, and murine. The human and humanized segment held the largest North America antibody discovery market share in 2022.

By services, the North America antibody discovery market is divided into phage display, hybridoma, transgenic animal, single cell, and yeast display. The phage display segment held the largest North America antibody discovery market share in 2022.

Based on end user, the North America antibody discovery market is categorized into pharmaceutical and biotechnology companies, research laboratories, and others. The pharmaceutical and biotechnology companies segment held the largest North America antibody discovery market share in 2022.

Based on country, the North America antibody discovery market is categorized into the US, Canada, and Mexico. The US dominated the North America antibody discovery market share in 2022.

Charles River Laboratories International Inc, Creative Biolabs Inc, Evotec SE, Bruker Cellular Analysis Inc, BioDuro LLC, Sartorius AG, Aragen Life Sciences Ltd, Twist Bioscience Corp, NanoCellect Biomedical Inc, and Biocytogen Pharmaceuticals Beijing Co Ltd. are some of the leading companies operating in the North America antibody discovery market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Antibody Discovery Market - Key Market Dynamics

- 4.1 Market Drivers

- 4.1.1 Increasing Investments in Research & Development

- 4.1.2 Rising Incidence of Cancer

- 4.2 Market Restraints

- 4.2.1 High Cost of Production

- 4.3 Market Opportunities

- 4.3.1 Proliferation of Biotechnology Industry in Developing Regions

- 4.4 Future Trends

- 4.4.1 Developments for Custom Antibodies

- 4.5 Impact of Drivers and Restraints:

5. Antibody Discovery Market - North America Market Analysis

- 5.1 North America Antibody Discovery Market Revenue (US$ Million), 2020-2030

6. North America Antibody Discovery Market Analysis - by Antibody Type

- 6.1 Overview

- 6.2 Monoclonal Antibodies

- 6.2.1 Overview

- 6.2.2 Monoclonal Antibodies: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 6.3 Polyclonal Antibodies

- 6.3.1 Overview

- 6.3.2 Polyclonal Antibodies: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 6.4 Others

- 6.4.1 Overview

- 6.4.2 Others: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

7. North America Antibody Discovery Market Analysis - by Nature

- 7.1 Overview

- 7.2 Human and Humanized

- 7.2.1 Overview

- 7.2.2 Human and Humanized: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Chimeric

- 7.3.1 Overview

- 7.3.2 Chimeric: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Murine

- 7.4.1 Overview

- 7.4.2 Murine: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Antibody Discovery Market Analysis - by Services

- 8.1 Overview

- 8.2 Phage Display

- 8.2.1 Overview

- 8.2.2 Phage Display: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Hybridoma

- 8.3.1 Overview

- 8.3.2 Hybridoma: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Transgenic Animal

- 8.4.1 Overview

- 8.4.2 Transgenic Animal: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Yeast Display

- 8.5.1 Overview

- 8.5.2 Yeast Display: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Single Cell

- 8.6.1 Overview

- 8.6.2 Single Cell: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Antibody Discovery Market Analysis - by End User

- 9.1 Overview

- 9.2 Pharmaceutical and Biotechnology Companies

- 9.2.1 Overview

- 9.2.2 Pharmaceutical and Biotechnology Companies: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Research Laboratories

- 9.3.1 Overview

- 9.3.2 Research Laboratories: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others: North America Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Antibody Discovery Market - Country Analysis

- 10.1 North America Market Overview

- 10.1.1 North America: Antibody Discovery Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 US

- 10.1.1.1.1 Overview

- 10.1.1.1.2 US: Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.1.3 United States: Antibody Discovery Market Breakdown, by Antibody Type

- 10.1.1.1.4 United States: Antibody Discovery Market Breakdown, by Nature

- 10.1.1.1.5 United States: Antibody Discovery Market Breakdown, by Services

- 10.1.1.1.6 United States: Antibody Discovery Market Breakdown, by End User

- 10.1.1.2 Canada

- 10.1.1.2.1 Overview

- 10.1.1.2.2 Canada: Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.2.3 Canada: Antibody Discovery Market Breakdown, by Antibody Type

- 10.1.1.2.4 Canada: Antibody Discovery Market Breakdown, by Nature

- 10.1.1.2.5 Canada: Antibody Discovery Market Breakdown, by Services

- 10.1.1.2.6 Canada: Antibody Discovery Market Breakdown, by End User

- 10.1.1.3 Mexico

- 10.1.1.3.1 Overview

- 10.1.1.3.2 Mexico: Antibody Discovery Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.3.3 Mexico: Antibody Discovery Market Breakdown, by Antibody Type

- 10.1.1.3.4 Mexico: Antibody Discovery Market Breakdown, by Nature

- 10.1.1.3.5 Mexico: Antibody Discovery Market Breakdown, by Services

- 10.1.1.3.6 Mexico: Antibody Discovery Market Breakdown, by End User

- 10.1.1.1 US

- 10.1.1 North America: Antibody Discovery Market - Revenue and Forecast Analysis - by Country

11. Antibody Discovery Market-Industry Landscape

- 11.1 Overview

- 11.2 Growth Strategies in the Antibody Discovery Market

- 11.3 Inorganic Growth Strategies

- 11.3.1 Overview

- 11.4 Organic Growth Strategies

- 11.4.1 Overview

12. Company Profiles

- 12.1 Charles River Laboratories International Inc

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Creative Biolabs Inc

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Evotec SE

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Bruker Cellular Analysis Inc

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 BioDuro LLC

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Sartorius AG

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Aragen Life Sciences Ltd

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Twist Bioscience Corp

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 NanoCellect Biomedical Inc

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Biocytogen Pharmaceuticals Beijing Co Ltd

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Glossary of Terms