|

|

市場調査レポート

商品コード

1591428

アジア太平洋地域の工業用チラーの市場規模および予測、地域シェア、動向、成長機会分析レポート:チラータイプ別、プロセス別、用途別、国別Asia Pacific Industrial Chillers Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Chiller Type, Process, Application, and Country |

||||||

|

|||||||

| アジア太平洋地域の工業用チラーの市場規模および予測、地域シェア、動向、成長機会分析レポート:チラータイプ別、プロセス別、用途別、国別 |

|

出版日: 2024年10月22日

発行: The Insight Partners

ページ情報: 英文 118 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋地域の工業用チラー市場規模は2023年に12億2,000万米ドルと評価され、2031年には21億6,000万米ドルに達すると予測され、2023年から2031年までのCAGRは7.4%を記録すると推定されます。

アジア太平洋地域の工業用チラー市場は、中国、日本、インド、韓国、オーストラリア、インドネシア、その他アジア太平洋地域の主要7カ国に区分されます。Atradiusによると、2024年4月、アジア太平洋地域のGDP成長率は世界で2.4%を超えると予想されています。運輸、食品、ICT、化学などの主要セクターは、今後数年間で成長が見込まれます。アジア太平洋の化学生産高は、2024年には世界の3%増に対し5.2%増となる見込みです。さらに、化学生産高は中国で6.2%、タイで5.8%、インドネシアで4.8%、インドで4.2%の増加が見込まれます。このように、同地域には堅調な化学セクターが存在することが、効率的な化学生産・処理のための工業用チラーの需要を促進する主な要因のひとつとなっています。さらに、さまざまな市場関係者がこの地域に新しい化学プラントを建設しており、化学処理による熱を放散させる工業用チラーの需要をさらに高めています。以下にいくつかの動きを紹介します。

2023年3月、韓国のS-Oil Corpは大規模石油化学プラントをShaheen製油所と統合する計画を発表しました。この提携には、エチレンを年間1.8トン生産できるナフサ供給型スチームクラッカーが含まれ、建設は2026年までに完了する予定です。

Shin-Etsu Chemical Co., Ltd.は2024年4月、半導体露光用材料事業を拡大するため、群馬県伊勢崎市に新工場を建設すると発表しました。新工場は、同事業におけるShin-Etsu Chemical Co., Ltd.の4番目の生産拠点となります。

アジア太平洋地域は、投資による半導体産業の育成に力を入れています。例えば、インド政府は2024年2月、Tata Groupによる同国初の大規模なチップ製造施設の建設提案を含む、3つの半導体工場設立への150億米ドルの巨額投資を承認しました。このように、半導体チップ製造工場の建設が増加していることが、アジア太平洋地域の工業用チラー市場を牽引しています。半導体製造のプロセスには、正確な液冷が必要です。

アジア太平洋地域の政府政策の実施は、工業生産高を促進しています。例えば、Made in China 2025戦略やMake in Indiaは、技術革新、自動化、ハイテク産業の発展を奨励しています。これらの政策は、国内の製造業を後押しし、外国投資を誘致し、さまざまな産業で技術革新を進めることを目的としています。このような産業の拡大と近代化により、プロセス冷却装置の需要が増加する可能性が高いです。こうした取り組みが飲食品、医薬品、化学などの分野の成長を刺激するため、プロセス用チラーのニーズは今後数年間で高まると予想されます。

アジア太平洋地域の工業用チラー市場は、チラーの種類によって水冷式チラーと空冷式チラーに二分されます。アジア太平洋地域の工業用チラー市場で最大のシェアを占めるのは水冷式チラーです。水冷式チラーは冷媒として水を使用し、製造業のプロセスや設備を冷却します。水冷式チラーは、射出成形、工具・型抜き、飲食品、化学、レーザー、工作機械、半導体など幅広い用途で使用されています。産業用セットアップでは、これらのチラーは機器の過熱を止め、寿命を最大化し、生産ダウンタイムを最小化することが求められます。設計および操作によって、水によって冷却されるスリラーは空気によって冷却されるスリラーより費用効果が大きく、エネルギー効率が良いです。このようなチラーは、温度の変動要因を排除し、プロセス開発を強化し、高品質の製品を確保するのに役立つため、大規模な製造工場や加工工場で必要とされています。

Dimplex Thermal Solutions;Blue Star Ltd;Panasonic Holdings Corp;Johnson Controls International Plc;Mitsubishi Heavy Industries Ltd;Sanhe Tongfei Refrigeration Co., Ltd;Guangzhou Teyu Electromechanical Co., Ltd;Shenzhen Envicool Technology Co., Ltd;Wuhan Hanli Refrigeration Technology Co、Ltd.、WERNER FINLEY PRIVATE LIMITED、Advance Cooling Systems Pvt.Ltd.、Prasad GWK Cooltech Pvt.Ltd.、Reynold India Private Limited、Nu-Vu Conair Pvt.Ltd.などがアジア太平洋地域の工業用チラー市場の主要企業として挙げられます。

アジア太平洋地域の工業用チラーの市場規模は、一次情報と二次情報の両方を用いて算出されています。徹底的な二次調査は、アジア太平洋地域の工業用チラー市場規模に関連する質的および量的情報を得るために、内部および外部の情報源を用いて実施しました。また、このプロセスは、すべての市場セグメントに関する市場の概要と予測を得るのに役立ちます。また、データを検証し分析的洞察を得るために、業界関係者に複数の一次インタビューを実施しています。このプロセスには、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、アジア太平洋地域の工業用チラー市場を専門とする評価専門家、調査アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

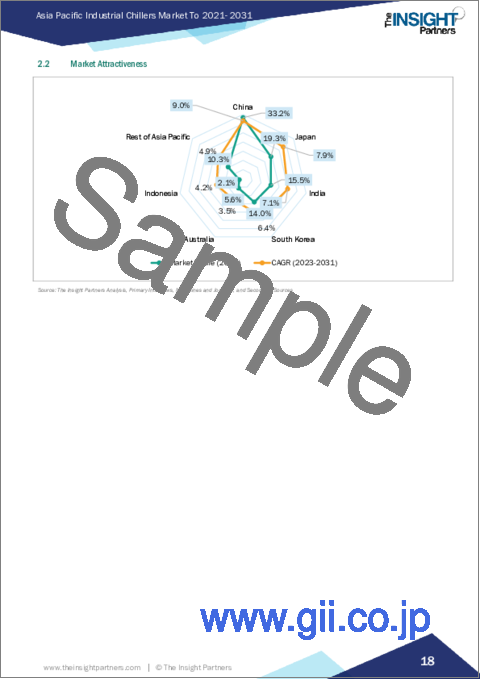

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 アジア太平洋地域の工業用チラー市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 アジア太平洋地域の工業用チラー市場:主要市場力学

- アジア太平洋地域の工業用チラー市場:主要市場力学

- 市場促進要因

- 金属加工産業の拡大

- 新しいリサイクルプラスチック工場の立ち上げ

- 成長する化学産業における工業用チラー需要の急増

- 市場抑制要因

- サプライチェーンの混乱

- 市場機会

- 製造業の成長を支える政府投資

- エネルギー効率の高い技術に対する政府の注目

- 市場動向

- 工業用チラーと先端技術の統合

- 促進要因と抑制要因の影響

第6章 アジア太平洋地域の工業用チラー市場:市場分析

- アジア太平洋地域の工業用チラー市場売上高:2021年~2031年

- アジア太平洋地域の工業用チラー市場予測分析

第7章 アジア太平洋地域の工業用チラー市場分析:チラータイプ別

- 水冷式チラー

- 空冷式チラー

第8章 アジア太平洋地域の工業用チラーの市場分析:プロセス別

- 連続フローチラー

- 液浸チラー

第9章 アジア太平洋地域の工業用チラーの市場分析:用途別

- 工業用製造

- 飲食品加工

- 医療機器

- その他

第10章 アジア太平洋地域の工業用チラー市場:国別分析

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- インドネシア

- その他アジア太平洋

第11章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Dimplex Thermal Solutions

- Blue Star Ltd

- Panasonic Holdings Corp

- Johnson Controls International Plc

- Mitsubishi Heavy Industries Ltd

- Sanhe Tongfei Refrigeration Co., Ltd.

- Guangzhou Teyu Electromechanical Co., Ltd

- Shenzhen Envicool Technology Co., Ltd.

- Wuhan Hanli Refrigeration Technology Co.,Ltd.

- WERNER FINLEY PRIVATE LIMITED

- Advance Cooling Systems Pvt. Ltd.

- Prasad GWK Cooltech Pvt. Ltd.

- Reynold India Private Limited

- Nu-Vu Conair Pvt. Ltd.

第14章 付録

List Of Tables

- Table 1. Asia Pacific Industrial Chillers Market Segmentation

- Table 2. List of Vendors

- Table 3. Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million) - by Chillers Type

- Table 5. Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 6. Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 7. Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 8. Asia Pacific: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 9. China: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Chillers Type

- Table 10. China: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Process

- Table 11. China: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 12. China: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 13. Japan: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Chillers Type

- Table 14. Japan: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Process

- Table 15. Japan: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 16. Japan: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 17. India: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Chillers Type

- Table 18. India: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Process

- Table 19. India: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 20. India: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 21. South Korea: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Chillers Type

- Table 22. South Korea: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Process

- Table 23. South Korea: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 24. South Korea: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 25. Australia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Chillers Type

- Table 26. Australia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Process

- Table 27. Australia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 28. Australia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 29. Indonesia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Chillers Type

- Table 30. Indonesia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Process

- Table 31. Indonesia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 32. Indonesia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 33. Rest of APAC: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Chillers Type

- Table 34. Rest of APAC: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Process

- Table 35. Rest of APAC: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 36. Rest of APAC: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million) - by Type

- Table 37. Company Positioning & Concentration

- Table 38. List of Abbreviation

List Of Figures

- Figure 1. Asia Pacific Industrial Chillers Market Segmentation, by Geography

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Asia Pacific Industrial Chillers Market Revenue (US$ Million), 2021-2031

- Figure 5. Asia Pacific Industrial Chillers Market Share (%) - by Chillers Type (2023 and 2031)

- Figure 6. Water Cooled Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Air Cooled Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Asia Pacific Industrial Chillers Market Share (%) - by Process (2023 and 2031)

- Figure 9. Continuous Flow Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Immersion Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Asia Pacific Industrial Chillers Market Share (%) - by Application (2023 and 2031)

- Figure 12. Industrial Manufacturing: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Asia Pacific Industrial Chillers Market Share (%) - by Type (2023 and 2031)

- Figure 14. Machine Tool: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Laser Systems: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Others: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Food and Beverage Processing: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Medical Equipment: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Others: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Asia Pacific: Asia Pacific Industrial Chillers Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 21. China: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million)

- Figure 22. Japan: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million)

- Figure 23. India: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million)

- Figure 24. South Korea: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million)

- Figure 25. Australia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million)

- Figure 26. Indonesia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million)

- Figure 27. Rest of APAC: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031(US$ Million)

- Figure 28. Heat Map Analysis by Key Players

The Asia Pacific industrial chillers market size was valued at US$ 1.22 billion in 2023 and is expected to reach US$ 2.16 billion by 2031; it is estimated to record a CAGR of 7.4% from 2023 to 2031.

The Asia Pacific industrial chillers market is segmented into seven major countries- China, Japan, India, South Korea, Australia, Indonesia, and rest of Asia Pacific. According to Atradius, in April 2024, the GDP growth of Asia Pacific is expected to exceed 2.4% worldwide. Major sectors, including transportation, food, ICT, and chemicals, are expected to witness growth in the coming years. Asia Pacific's chemical output is likely to increase by 5.2% in 2024, compared to 3% worldwide. Furthermore, the chemical output is expected to increase by 6.2% in China, 5.8% in Thailand, 4.8% in Indonesia, and 4.2% in India. Thus, the presence of a robust chemical sector in the region is one of the major factors driving the demand for industrial chillers for efficient chemical production and processing. In addition, various market players are constructing new chemical plants in the region, further generating the demand for industrial chillers to dissipate the heat from chemical processing. A few developments are listed below.

In March 2023, South Korea's S-Oil Corp announced its plans to integrate a large-scale petrochemical plant with the Shaheen refinery. This collaboration includes a Naphtha-fed steam cracker that will be capable of producing 1.8 metric ton/year of ethylene; the construction is expected to be completed by 2026.

In April 2024, Shin-Etsu Chemical Co., Ltd. announced that in order to expand its semiconductor lithography materials business, the company will build a new plant in Isesaki City, Gunma Prefecture. The new plant will be Shin-Etsu's fourth production base in this business.

Asia Pacific is focused on fostering its semiconductor industry with investments. For example, in February 2024, the Government of India approved a massive US$ 15 billion investment in the establishment of three semiconductor plants, including a proposal from Tata Group to build the country's first major chipmaking facility. Thus, such a rise in the construction of semiconductor chipmaking plants drives the Asia Pacific industrial chiller market, as the controlled temperature in semiconductor production is crucial. The processes in semiconductor production require precise and liquid cooling.

The implementation of government policies in Asia Pacific is fueling the industrial output. For example, the Made in China 2025 strategy and Make in India encourage technological innovation, automation, and development of high-tech industries. These policies aim to boost domestic manufacturing, attract foreign investment, and advance technological innovation across various industries. This industrial expansion and modernization will likely increase demand for process cooling equipment. As these initiatives stimulate growth in sectors such as food & beverages, pharmaceuticals, and chemicals, the need for process chillers is expected to rise in the coming years.

Based on chiller type, the Asia Pacific industrial chillers market is segmented bifurcated into water cooled chillers and air cooled chillers. The water cooled chillers segment held the largest Asia Pacific industrial chillers market share. Water cooled chillers use water as a refrigerant to cool processes or equipment in the manufacturing industry. They are used in a wide range of applications, including injection molding, tool and die cutting, food and beverage, chemicals, lasers, machine tools, and semiconductors, among others. In the industrial setup, these chillers are required to stop equipment from overheating, maximizing its lifespan and minimizing production downtime. By design and operation, water cooled chillers are more cost-efficient and energy-efficient than air cooled chillers. These chillers are required in larger manufacturing and processing plants as they help eliminate temperature variables, enhance process development, and ensure high-quality products.

Dimplex Thermal Solutions; Blue Star Ltd; Panasonic Holdings Corp; Johnson Controls International Plc; Mitsubishi Heavy Industries Ltd; Sanhe Tongfei Refrigeration Co., Ltd.; Guangzhou Teyu Electromechanical Co., Ltd; Shenzhen Envicool Technology Co., Ltd.; Wuhan Hanli Refrigeration Technology Co.,Ltd.; WERNER FINLEY PRIVATE LIMITED; Advance Cooling Systems Pvt. Ltd.; Prasad GWK Cooltech Pvt. Ltd.; Reynold India Private Limited; and Nu-Vu Conair Pvt. Ltd. are among the key Asia Pacific industrial chillers market players that are profiled in this market study.

The overall Asia Pacific industrial chillers market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Asia Pacific industrial chillers market size. The process also helps obtain an overview and forecast of the market with respect to all the market segments. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain analytical insights. This process includes industry experts such as VPs, business development managers, market intelligence managers, and national sales managers, along with external consultants such as valuation experts, research analysts, and key opinion leaders, specializing in the Asia Pacific industrial chillers market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.1 Developing base number:

- 3.2.2 Data Triangulation:

- 3.2.3 Country level data:

4. Asia Pacific Industrial Chillers Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. Asia Pacific Industrial Chillers Market - Key Market Dynamics

- 5.1 Asia Pacific Industrial Chillers Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Expansion of Metalworking Industry

- 5.2.2 Launch of New Recycled Plastic Plants

- 5.2.3 Surge in Demand for Industrial Chillers in Growing Chemical Industry

- 5.3 Market Restraints

- 5.3.1 Supply Chain Disruption

- 5.4 Market Opportunities

- 5.4.1 Government Investment to Support Growth in Manufacturing Industry

- 5.4.2 Government Focus on Energy-Efficient Technologies

- 5.5 Market Trends

- 5.5.1 Integration of Advanced Technologies with Industrial Chillers

- 5.6 Impact of Drivers and Restraints:

6. Asia Pacific Industrial Chillers Market -Market Analysis

- 6.1 Asia Pacific Industrial Chillers Market Revenue (US$ Million), 2021-2031

- 6.2 Asia Pacific Industrial Chillers Market Forecast Analysis

7. Asia Pacific Industrial Chillers Market Analysis - by Chillers Type

- 7.1 Water Cooled Chillers

- 7.1.1 Overview

- 7.1.2 Water Cooled Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Air Cooled Chillers

- 7.2.1 Overview

- 7.2.2 Air Cooled Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

8. Asia Pacific Industrial Chillers Market Analysis - by Process

- 8.1 Continuous Flow Chillers

- 8.1.1 Overview

- 8.1.2 Continuous Flow Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Immersion Chillers

- 8.2.1 Overview

- 8.2.2 Immersion Chillers: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

9. Asia Pacific Industrial Chillers Market Analysis - by Application

- 9.1 Industrial Manufacturing

- 9.1.1 Overview

- 9.1.2 Industrial Manufacturing: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 ( US$ Million)

- 9.1.3 Machine Tool

- 9.1.3.1 Overview

- 9.1.3.2 Machine Tool: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.4 Laser Systems

- 9.1.4.1 Overview

- 9.1.4.2 Laser Systems: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.5 Others

- 9.1.5.1 Overview

- 9.1.5.2 Others: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Food and Beverage Processing

- 9.2.1 Overview

- 9.2.2 Food and Beverage Processing: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Medical Equipment

- 9.3.1 Overview

- 9.3.2 Medical Equipment: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

10. Asia Pacific Industrial Chillers Market - Country Analysis

- 10.1 Asia Pacific Industrial Chillers Market - Country Analysis

- 10.1.1 Asia Pacific: Asia Pacific Industrial Chillers Market - Revenue and Forecast Analysis - by Country

- 10.1.1.1 Asia Pacific: Asia Pacific Industrial Chillers Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 China: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 China: Asia Pacific Industrial Chillers Market Breakdown, by Chillers Type

- 10.1.1.2.2 China: Asia Pacific Industrial Chillers Market Breakdown, by Process

- 10.1.1.2.3 China: Asia Pacific Industrial Chillers Market Breakdown, by Application

- 10.1.1.2.3.1 China: Asia Pacific Industrial Chillers Market Breakdown, by Type

- 10.1.1.3 Japan: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 Japan: Asia Pacific Industrial Chillers Market Breakdown, by Chillers Type

- 10.1.1.3.2 Japan: Asia Pacific Industrial Chillers Market Breakdown, by Process

- 10.1.1.3.3 Japan: Asia Pacific Industrial Chillers Market Breakdown, by Application

- 10.1.1.3.3.1.1 Japan: Asia Pacific Industrial Chillers Market Breakdown, by Type

- 10.1.1.4 India: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 India: Asia Pacific Industrial Chillers Market Breakdown, by Chillers Type

- 10.1.1.4.2 India: Asia Pacific Industrial Chillers Market Breakdown, by Process

- 10.1.1.4.3 India: Asia Pacific Industrial Chillers Market Breakdown, by Application

- 10.1.1.4.3.1.1 India: Asia Pacific Industrial Chillers Market Breakdown, by Type

- 10.1.1.5 South Korea: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.5.1 South Korea: Asia Pacific Industrial Chillers Market Breakdown, by Chillers Type

- 10.1.1.5.2 South Korea: Asia Pacific Industrial Chillers Market Breakdown, by Process

- 10.1.1.5.3 South Korea: Asia Pacific Industrial Chillers Market Breakdown, by Application

- 10.1.1.5.3.1 South Korea: Asia Pacific Industrial Chillers Market Breakdown, by Type

- 10.1.1.6 Australia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.6.1 Australia: Asia Pacific Industrial Chillers Market Breakdown, by Chillers Type

- 10.1.1.6.2 Australia: Asia Pacific Industrial Chillers Market Breakdown, by Process

- 10.1.1.6.3 Australia: Asia Pacific Industrial Chillers Market Breakdown, by Application

- 10.1.1.6.3.1 Australia: Asia Pacific Industrial Chillers Market Breakdown, by Type

- 10.1.1.7 Indonesia: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.7.1 Indonesia: Asia Pacific Industrial Chillers Market Breakdown, by Chillers Type

- 10.1.1.7.2 Indonesia: Asia Pacific Industrial Chillers Market Breakdown, by Process

- 10.1.1.7.3 Indonesia: Asia Pacific Industrial Chillers Market Breakdown, by Application

- 10.1.1.7.3.1 Indonesia: Asia Pacific Industrial Chillers Market Breakdown, by Type

- 10.1.1.8 Rest of APAC: Asia Pacific Industrial Chillers Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.8.1 Rest of APAC: Asia Pacific Industrial Chillers Market Breakdown, by Chillers Type

- 10.1.1.8.2 Rest of APAC: Asia Pacific Industrial Chillers Market Breakdown, by Process

- 10.1.1.8.3 Rest of APAC: Asia Pacific Industrial Chillers Market Breakdown, by Application

- 10.1.1.8.3.1 Rest of APAC: Asia Pacific Industrial Chillers Market Breakdown, by Type

- 10.1.1 Asia Pacific: Asia Pacific Industrial Chillers Market - Revenue and Forecast Analysis - by Country

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Merger and Acquisition

13. Company Profiles

- 13.1 Dimplex Thermal Solutions

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Blue Star Ltd

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Panasonic Holdings Corp

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Johnson Controls International Plc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Mitsubishi Heavy Industries Ltd

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 1Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Sanhe Tongfei Refrigeration Co., Ltd.

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Guangzhou Teyu Electromechanical Co., Ltd

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Shenzhen Envicool Technology Co., Ltd.

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Wuhan Hanli Refrigeration Technology Co.,Ltd.

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 WERNER FINLEY PRIVATE LIMITED

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Advance Cooling Systems Pvt. Ltd.

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Prasad GWK Cooltech Pvt. Ltd.

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Reynold India Private Limited

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 Nu-Vu Conair Pvt. Ltd.

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

14. Appendix

- 14.1 Word Index

- 14.2 About The Insight Partners