|

|

市場調査レポート

商品コード

1567899

アジア太平洋の油汚染修復材:2030年までの市場予測 - 地域分析 - タイプ別Asia Pacific Oil Pollution Remediation Materials Market Forecast to 2030 - Regional Analysis - by Type |

||||||

|

|||||||

| アジア太平洋の油汚染修復材:2030年までの市場予測 - 地域分析 - タイプ別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 100 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

アジア太平洋の油汚染修復材市場は、2022年に8億4,015万米ドルと評価され、2030年には10億9,726万米ドルに達すると予測され、2022年から2030年までのCAGRは3.4%と推定されます。

効率的で環境に優しい油汚染修復ソリューションの利用重視の高まりがアジア太平洋の油汚染修復材市場を後押し

ICCA(船舶のバラスト水および沈殿物の制御および管理に関する国際条約)加盟国における汚染レベルの増加が、油汚染修復材市場の成長を促進しています。工業化と経済活動の増加に伴い、環境中に放出される汚染物質の量は憂慮すべきレベルに達しています。特に油流出は、海洋生物、生態系、人間の健康に重大な脅威をもたらし、大きな問題となっています。

主要な海洋国家を含むICCA諸国では、石油輸送、海洋掘削、石油タンカーの事故などの要因により、石油汚染事故が急増しています。こうした事故により、油流出の影響を修復するための効果的かつ効率的なソリューションに対する需要が高まっています。

その結果、油汚染修復材市場は大幅な盛り上がりを見せています。ICCA諸国が油汚染による環境的・経済的影響を最小限に抑えようとする中、油流出対応と浄化サービスを専門とする企業の需要が高まっています。これらの企業は、高度な技術と技術を駆使して、被害を受けた地域から油を封じ込め、除去すると同時に、さらなる汚染を防ぐための対策を実施します。

さらに、油汚染が環境や社会に与える影響に対する意識の高まりから、ICCA諸国の政府や規制機関は、油流出対応と修復に関する規制やガイドラインを強化するようになった。このことは、企業がこうした規制を遵守し、効率的な解決策を提供しようと努める中で、市場の成長をさらに後押ししています。

結論として、ICCA諸国における汚染レベルの増加が、油汚染修復サービスの需要を牽引しています。油流出件数の増加と、その環境的・経済的影響を緩和する必要性から、市場は大きく成長しています。ICCA諸国が環境保全を優先し続ける中、油汚染修復材市場は今後さらに成長すると予想されます。

アジア太平洋の油汚染修復材市場の概要

アジア太平洋は石油・ガス探査と生産、貿易活動の主要拠点です。アジア太平洋の各国政府は、自国の石油・ガス需要の増加に対応するためのプロジェクトを開始しています。2023年4月、インドラダヌシュ・ガス・グリッド社(IGGL)は、ブラマプトラ川の地下にアジア最大の水中炭化水素パイプラインを完成させました。このパイプラインはインド、アッサム州のジョルハットとマジュリを結ぶ。2023年5月、ONGCはインドのムンバイ沖のアラビア海鉱区で2つの主要な石油・ガス埋蔵量を発見しました。多数の原油探査・生産活動が行われる結果、原油流出・漏洩の可能性が高まり、油汚染浄化製品・サービスのニーズが高まる。2021年、アジアは主要な海上貨物取扱拠点であり、国連貿易開発会議(United Nations Conference on Trade and Development)によれば、アジア、欧州、米国間の主要東西航路におけるコンテナ貿易総額の40%を占めています。

米国エネルギー情報局によると、中国は2023年上半期に大量の原油を輸入しました。この増加は特に、同国における製油所の拡張と、政府がCOVID-19パンデミックに関連する規制を緩和した後の経済再開に向けた取り組みによるものです。2023年10月、西オーストラリア州は石油・ガス探査のために8つの陸上鉱区を解放しました。このように、アジア太平洋における石油需要の増大と石油化学部門の活況に伴う原油輸入の増加は、今後数年にわたって油汚染修復材市場を押し上げると予想されます。

アジア太平洋の油汚染修復材市場の収益と2030年までの予測(金額)

アジア太平洋の油汚染修復材市場のセグメンテーション

アジア太平洋の油汚染修復材市場は、タイプと国に分類されます。

タイプ別では、アジア太平洋の油汚染修復材市場は、物理的修復、化学的修復、熱的修復、バイオレメディエーションに区分されます。2022年には、物理的浄化セグメントが最大の市場シェアを占めています。さらに、物理的浄化セグメントは、ブーム、スキマー、吸着材にサブセグメント化されています。さらに、化学的浄化セグメントは分散剤と固化剤に二分されます。

国別では、アジア太平洋の油汚染修復材市場は、オーストラリア、中国、インド、日本、韓国、その他アジア太平洋地域に区分されます。2022年のアジア太平洋の油汚染修復材市場シェアは中国が独占。

Ansell Ltd、Brady Corp、Compania Espanola de Petroleos SA、Cosco Shipping Heavy Industry Co., Ltd、Ecolab Inc、NOV Inc、Oil-Dri Corp of America、Regenesis、およびRX Marine Internationalは、アジア太平洋の油汚染修復材市場で事業を展開している主要企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

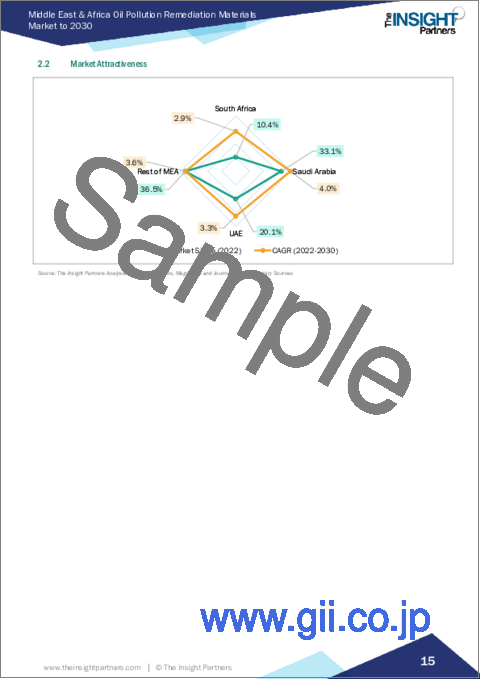

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の油汚染修復材市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 油汚染修復材料メーカー

- 流通業者/供給業者

- エンドユーザー

第5章 アジア太平洋の油汚染修復材市場:主要市場力学

- 市場促進要因

- 海洋石油探査および輸送活動の増加

- 油流出への備えと対応に関する政府規制

- ICCA諸国における汚染レベルの増加

- 市場抑制要因

- 物理的・化学的浄化の原材料価格の変動

- 市場機会

- 効率的で環境に優しい油汚染修復ソリューションの利用重視の高まり

- 今後の動向

- 新しい油汚染修復材料の開発

- 促進要因と抑制要因の影響

第6章 油汚染修復材市場-アジア太平洋地域分析

- アジア太平洋の油汚染修復材市場売上高、2022-2030年

- アジア太平洋の油汚染修復材市場予測分析

第7章 アジア太平洋の油汚染修復材市場:タイプ別

- 物理的修復

- 化学的修復

- 熱浄化

- バイオレメディエーション

第8章 アジア太平洋の油汚染修復材市場:国別分析

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

第9章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第10章 業界情勢

- 事業拡大

- パートナーシップ

第11章 企業プロファイル

- Ansell Ltd

- Oil-Dri Corp of America

- Ecolab Inc

- Cosco Shipping Heavy Industry Co., Ltd

- Regenesis

- Brady Corp

- NOV Inc

- RX Marine International

- Compania Espanola de Petroleos SA

第12章 付録

List Of Tables

- Table 1. Asia Pacific Oil Pollution Remediation Materials Market Segmentation

- Table 2. Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 4. Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million) - by Country

- Table 5. Australia: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 6. China: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 7. India: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 8. Japan: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 9. South Korea: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million) - by Type

- Table 10. Rest of Asia Pacific: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million) - by Type

List Of Figures

- Figure 1. Asia Pacific Oil Pollution Remediation Materials Market Segmentation, by Country

- Figure 2. Asia Pacific Oil Pollution Remediation Materials Market - Porter's Analysis

- Figure 3. Ecosystem: Oil Pollution Remediation Materials Market

- Figure 4. Asia Pacific Oil Pollution Remediation Materials Market - Key Market Dynamics

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. Asia Pacific Oil Pollution Remediation Materials Market Revenue (US$ Million), 2022-2030

- Figure 7. Asia Pacific Oil Pollution Remediation Materials Market Share (%) - by Type (2022 and 2030)

- Figure 8. Physical Remediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Booms: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Skimmers: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Adsorbent Materials: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Chemical Remediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Dispersants: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Solidifiers: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Thermal Remediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Bioremediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Asia Pacific Oil Pollution Remediation Materials Market, By Key Country - Revenue (2022) (US$ Million)

- Figure 18. Asia Pacific Oil Pollution Remediation Materials Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 19. Australia: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million)

- Figure 20. China: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million)

- Figure 21. India: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million)

- Figure 22. Japan: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million)

- Figure 23. South Korea: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million)

- Figure 24. Rest of Asia Pacific: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030(US$ Million)

- Figure 25. Heat Map Analysis by Key Players

- Figure 26. Company Positioning & Concentration

The Asia Pacific oil pollution remediation materials market was valued at US$ 840.15 million in 2022 and is expected to reach US$ 1,097.26 million by 2030; it is estimated to register a CAGR of 3.4% from 2022 to 2030.

Growing Emphasis on Utilization of Efficient and Eco-friendly Oil Pollution Remediation Solutions Boosts Asia Pacific Oil Pollution Remediation Materials Market

The increasing levels of pollution in ICCA (International Convention for the Control and Management of Ships' Ballast Water and Sediments) countries are driving the growth of the oil pollution remediation market. With the rise in industrialization and economic activities, the amount of pollutants released into the environment has reached alarming levels. Oil spills, in particular, have become a major concern, posing significant threats to marine life, ecosystems, and human health.

ICCA countries, which include major maritime nations, are witnessing a surge in oil pollution incidents due to factors such as oil transportation, offshore drilling, and accidents involving oil tankers. These incidents have led to a growing demand for effective and efficient solutions to remediate the impacts of oil spills.

As a result, the oil pollution remediation market has experienced a substantial boost. Companies specializing in oil spill response and cleanup services are in high demand as ICCA countries seek to minimize the environmental and economic consequences of oil pollution. These companies deploy advanced technologies and techniques to contain and remove oil from affected areas while also implementing measures to prevent further contamination.

Moreover, the increasing awareness about the environmental and social impacts of oil pollution has prompted governments and regulatory bodies in ICCA countries to enforce stricter regulations and guidelines for oil spill response and remediation. This has further propelled the growth of the market as companies strive to comply with these regulations and provide efficient solutions.

In conclusion, the increasing levels of pollution in ICCA countries have driven the demand for oil pollution remediation services. The market has witnessed significant growth due to the rising number of oil spills and the need to mitigate their environmental and economic impacts. As ICCA countries continue to prioritize environmental conservation, the oil pollution remediation market is expected to grow even further in the coming years.

Asia Pacific Oil Pollution Remediation Materials Market Overview

Asia Pacific is a major hub for oil & gas exploration and production, as well as trade activities. Governments of various countries in Asia Pacific have initiated projects to address the rising demand for oil and gas in their countries. In April 2023, Indradhanush Gas Grid Limited (IGGL) completed Asia's largest underwater hydrocarbon pipeline below the river Brahmaputra. The pipeline connects Jorhat and Majuli in Assam, India. In May 2023, ONGC discovered two major oil & gas reserves in the Arabian Sea block off the Mumbai coast, India. A large number of crude oil exploration and production activities results in an increased possibility of oil spills and leakages, which bolsters the need for oil pollution remediation products and services. In 2021, Asia was the major maritime cargo handling center, accounting for 40% of total containerized trade on the main East-West routes - between Asia, Europe and the US, as per the United Nations Conference on Trade and Development.

According to the US Energy Information Administration, China imported high volumes of crude oil during the first half of 2023. This increase is specifically attributed to the expansion of refineries in the country, and initiatives to reopen the economy after the government eased restrictions related to the COVID-19 pandemic. In October 2023, the state of Western Australia released 8 onshore blocks for oil and gas exploration. Thus, a rise in crude oil imports accompanied by growing oil demand and booming petrochemical sector in Asia Pacific is expected to boost the oil pollution remediation materials market over the coming years.

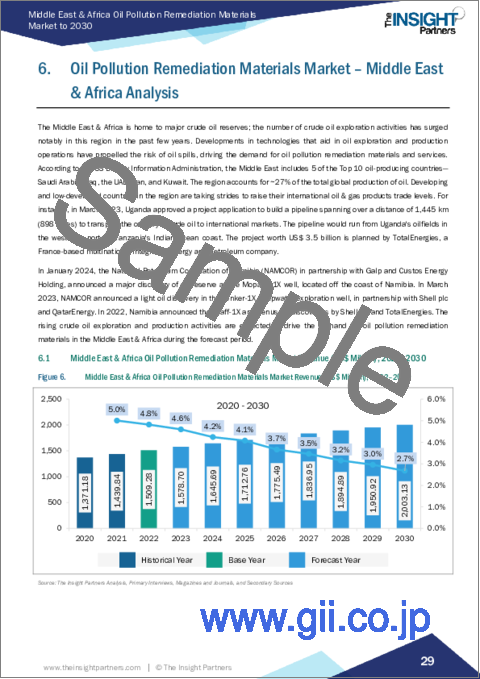

Asia Pacific Oil Pollution Remediation Materials Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Oil Pollution Remediation Materials Market Segmentation

The Asia Pacific oil pollution remediation materials market is categorized into type and country.

Based on type, the Asia Pacific oil pollution remediation materials market is segmented into physical remediation, chemical remediation, thermal remediation, and bioremediation. The physical remediation segment held the largest market share in 2022. Furthermore, the physical remediation segment is sub segmented into booms, skimmers, and adsorbent materials. Additionally, the chemical remediation segment is bifurcated into dispersants and solidifiers.

By country, the Asia Pacific oil pollution remediation materials market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific oil pollution remediation materials market share in 2022.

Ansell Ltd; Brady Corp; Compania Espanola de Petroleos SA; Cosco Shipping Heavy Industry Co., Ltd; Ecolab Inc; NOV Inc; Oil-Dri Corp of America; Regenesis; and RX Marine International are some of the leading companies operating in the Asia Pacific oil pollution remediation materials market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

- 1.3 Limitations and Assumptions

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Oil Pollution Remediation Materials Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Oil Pollution Remediation Materials Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End Users

5. Asia Pacific Oil Pollution Remediation Materials Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Offshore Oil Exploration and Transportation Activities

- 5.1.2 Government Regulations Related to Oil Spill Preparedness and Responses

- 5.1.3 Increasing Levels of Pollution in ICCA Countries

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Prices of Physical and Chemical Remediation

- 5.3 Market Opportunities

- 5.3.1 Growing Emphasis on Utilization of Efficient and Eco-friendly Oil Pollution Remediation Solutions

- 5.4 Future Trends

- 5.4.1 Development of Novel Oil Pollution Remediation Materials

- 5.5 Impact of Drivers and Restraints:

6. Oil Pollution Remediation Materials Market - Asia Pacific Analysis

- 6.1 Asia Pacific Oil Pollution Remediation Materials Market Revenue (US$ Million), 2022-2030

- 6.2 Asia Pacific Oil Pollution Remediation Materials Market Forecast Analysis

7. Asia Pacific Oil Pollution Remediation Materials Market Analysis - by Type

- 7.1 Physical Remediation

- 7.1.1 Overview

- 7.1.2 Physical Remediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Booms

- 7.1.3.1 Overview

- 7.1.3.2 Booms: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.4 Skimmers

- 7.1.4.1 Overview

- 7.1.4.2 Skimmers: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.5 Adsorbent Materials

- 7.1.5.1 Overview

- 7.1.5.2 Adsorbent Materials: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Chemical Remediation

- 7.2.1 Overview

- 7.2.2 Chemical Remediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 Dispersants

- 7.2.3.1 Overview

- 7.2.3.2 Dispersants: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2.4 Solidifiers

- 7.2.4.1 Overview

- 7.2.4.2 Solidifiers: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Thermal Remediation

- 7.3.1 Overview

- 7.3.2 Thermal Remediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Bioremediation

- 7.4.1 Overview

- 7.4.2 Bioremediation: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

8. Asia Pacific Oil Pollution Remediation Materials Market - Country Analysis

- 8.1 Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast Analysis - by Country

- 8.1.1 Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast Analysis - by Country

- 8.1.1.1 Australia: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.1.1 Australia: Asia Pacific Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.2 China: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.2.1 China: Asia Pacific Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.3 India: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.3.1 India: Asia Pacific Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.4 Japan: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.4.1 Japan: Asia Pacific Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.5 South Korea: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.5.1 South Korea: Asia Pacific Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.6 Rest of Asia Pacific: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.6.1 Rest of Asia Pacific: Asia Pacific Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.1 Australia: Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1 Asia Pacific Oil Pollution Remediation Materials Market - Revenue and Forecast Analysis - by Country

9. Competitive Landscape

- 9.1 Heat Map Analysis by Key Players

- 9.2 Company Positioning & Concentration

10. Industry Landscape

- 10.1 Overview

- 10.2 Expansion

- 10.3 Partnerships

11. Company Profiles

- 11.1 Ansell Ltd

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Oil-Dri Corp of America

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 Ecolab Inc

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 Cosco Shipping Heavy Industry Co., Ltd

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 Regenesis

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 Brady Corp

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 NOV Inc

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 RX Marine International

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 Compania Espanola de Petroleos SA

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners