|

|

市場調査レポート

商品コード

1567897

北米の油汚染修復材:2030年までの市場予測 - 地域分析 - タイプ別North America Oil Pollution Remediation Materials Market Forecast to 2030 - Regional Analysis - by Type |

||||||

|

|||||||

| 北米の油汚染修復材:2030年までの市場予測 - 地域分析 - タイプ別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 122 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の油汚染修復材市場は2022年に8億6,422万米ドルと評価され、2030年には10億6,346万米ドルに達すると予測され、2022年から2030年までのCAGRは2.6%と推定されます。

海洋石油探査と輸送活動の増加が北米の油汚染修復材市場を活性化

海洋探査・掘削活動の増加、パイプラインやタンカーによる石油輸送、石油採掘・貯蔵中の人為的ミスが、石油流出事故の可能性を高めています。エネルギー情報局のデータによると、米国の石油需要は2023年に4年ぶりの高水準に達し、2024年までその状態が続くと予想されています。昨年の燃料消費量は日量2,023万バレルで、2019年以降で最も多かった。米国エネルギー情報局が2024年1月に発表した報告書によると、2024年1月9日時点の原油生産量は、COVID-19のパンデミック以降、2年間の減少から反転して増加しています。米国の原油生産量は2021年の1,127万バレル/日から2023年には1,321万バレル/日に増加し、2024年には1,344万バレル/日に達すると予測されています。

カナダ・エネルギー規制当局によると、カナダで生産される原油のほとんどは、西部の州から米国、オンタリオ州、ケベック州の製油所までパイプラインを使って輸送されます。非効率的な安全対策と老朽化したインフラは、探鉱活動や原油生産中に原油流出や汚染が発生する一因となっています。油流出による悪影響を軽減するため、効果的な油汚染修復材料や技術の開発・導入が重視されるようになっています。海洋石油探査と輸送活動の増加による浄化ソリューションの必要性の高まりが、油汚染浄化資材の需要を煽っています。

北米の油汚染修復材市場の概要

吸着剤、分散剤、機械的浄化、バイオレメディエーションの利用は、油流出による水質汚染を抑制するために北米諸国が採用している顕著なアプローチです。環境規制と持続可能性への関心の高まりにより、政府機関は油流出事故に対処するための先進技術と材料の採用を奨励しています。同地域における油流出事故と油汚染の発生件数の増加が、環境保護と油流出事故対応の重視を後押ししています。北米には多くの環境当局や対応機関が存在します。これには、海洋流出対応公社、国家環境緊急事態センター、カナダ運輸緊急事態センター、米国環境保護庁、米国沿岸警備隊国家対応センター、米国沿岸警備隊、米国国家対応チーム、米国海洋大気庁などが含まれます。

米国科学・工学・医学アカデミーの報告書によると、北米の海域における油汚染は、油流出、自然湧出油、石油・ガスサイトの流出とともに、陸上からの油流出によって引き起こされています。パイプライン・危険物安全管理局によると、北米には年間260万マイルのパイプラインがあり、大量の液体石油製品(数千億トン)と天然ガス(数兆立方フィート)を輸送しています。カナダ・エネルギー規制当局によると、カナダで生産される原油のほとんどは、西部の州から米国、オンタリオ州、ケベック州の製油所までパイプラインを使って輸送されます。原油生産活動の増加、探査活動の活発化、大規模な海上輸送活動は、今後数年間、北米諸国における油汚染修復材の需要をさらに促進すると予想されます。

北米の油汚染修復材市場の収益と2030年までの予測(金額)

北米の油汚染修復材市場セグメンテーション

北米の油汚染修復材市場は、タイプと国に分類されます。

タイプ別では、北米の油汚染修復材市場は、物理的修復、化学的修復、熱的修復、バイオレメディエーションに区分されます。2022年には、物理的浄化セグメントが最大の市場シェアを占めています。さらに、物理的浄化セグメントは、ブーム、スキマー、吸着材にサブセグメント化されています。さらに、化学的浄化セグメントは分散剤と固化剤に二分されます。

国別では、北米の油汚染修復材市場は米国、カナダ、メキシコに区分されます。2022年の北米油汚染修復材市場シェアは米国が独占。

Ansell Ltd、Brady Corp、CL Solutions, LLC、Compania Espanola de Petroleos SA、Cosco Shipping Heavy Industry Co., Ltd、Cura Inc、Ecolab Inc、NOV Inc、Oil Spill Eater International Corp、Oil-Dri Corp of America、Osprey Spill Control、Regenesis、Sarva Bio Remed LLC、SkimOIL LLC、TOLSA SAは、北米の油汚染修復材市場で事業を展開している主要企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の油汚染修復材市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 油汚染修復材料メーカー

- 流通業者/供給業者

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 北米の油汚染修復材市場:主要市場力学

- 市場促進要因

- 海洋石油探査および輸送活動の増加

- 油流出への備えと対応に関する政府規制

- ICCA諸国における汚染レベルの増加

- 市場抑制要因

- 物理的・化学的浄化の原材料価格の変動

- 市場機会

- 効率的で環境に優しい油汚染修復ソリューションの利用重視の高まり

- 今後の動向

- 新しい油汚染修復材料の開発

- 促進要因と抑制要因の影響

第6章 油汚染修復材市場-北米分析

- 北米の油汚染修復材市場売上高、2020年~2030年

- 北米の油汚染修復材市場予測分析

第7章 北米の油汚染修復材市場:タイプ別

- 物理的修復

- 化学的修復

- 熱浄化

- バイオレメディエーション

第8章 北米の油汚染修復材市場:国別分析

- 米国

- カナダ

- メキシコ

第9章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第10章 業界情勢

- 事業拡大

- パートナーシップ

第11章 企業プロファイル

- Sarva Bio Remed, LLC

- Ansell Ltd

- Oil-Dri Corp of America

- Ecolab Inc.

- Cosco Shipping Heavy Industry Co., Ltd

- Regenesis

- TOLSA SA

- CL Solutions, LLC

- Brady Corp

- Oil Spill Eater International Corp

- Osprey Spill Control

- NOV Inc

- Cura Inc

- Compania Espanola de Petroleos SA

- SkimOIL LLC

第12章 付録

List Of Tables

- Table 1. North America Oil Pollution Remediation Materials Market Segmentation

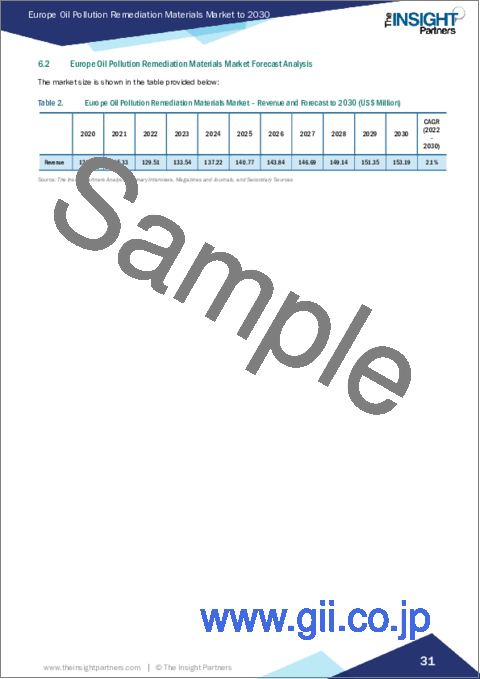

- Table 2. North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Table 3. North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 4. North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 5. US: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 6. Canada: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 7. Mexico: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million) - by Type

List Of Figures

- Figure 1. North America Oil Pollution Remediation Materials Market Segmentation, by Country

- Figure 2. North America Oil Pollution Remediation Materials Market - Porter's Analysis

- Figure 3. Ecosystem: Oil Pollution Remediation Materials Market

- Figure 4. North America Oil Pollution Remediation Materials Market - Key Market Dynamics

- Figure 5. Crude Oil Production (Million Barrels per Day) in the US

- Figure 6. Impact Analysis of Drivers and Restraints

- Figure 7. North America Oil Pollution Remediation Materials Market Revenue (US$ Million), 2020-2030

- Figure 8. North America Oil Pollution Remediation Materials Market Share (%) - by Type (2022 and 2030)

- Figure 9. Physical Remediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Booms: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Skimmers: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Adsorbent Materials: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Chemical Remediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Dispersants: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Solidifiers: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Thermal Remediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Bioremediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. North America Oil Pollution Remediation Materials Market, By Key Country - Revenue (2022) (US$ Million)

- Figure 19. North America Oil Pollution Remediation Materials Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 20. US: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Canada: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Mexico: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Heat Map Analysis by Key Players

- Figure 24. Company Positioning & Concentration

The North America oil pollution remediation materials market was valued at US$ 864.22 million in 2022 and is expected to reach US$ 1,063.46 million by 2030; it is estimated to register a CAGR of 2.6% from 2022 to 2030.

Rising Offshore Oil Exploration and Transportation Activities Fuels North America Oil Pollution Remediation Materials Market

Increased offshore exploration and drilling activities, transportation of oil via pipelines or tankers, and human errors during oil extraction and storage propel the chances of oil spill incidences. As per the Energy Information Administration data, the US oil demand climbed to a four-year high in 2023, and it is anticipated to remain there through 2024. The amount of fuel consumed last year was 20.23 million barrels per day, the most since 2019. According to a report released by the US Energy Information Administration on January 2024, crude oil production has increased since the COVID-19 pandemic as of January 9, 2024, reversing a two-year decline. The US crude oil production rose from 11.27 million barrels/day in 2021 to 13.21 million barrels/day in 2023 and is forecasted to reach 13.44 million barrels/day by 2024.

According to the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. Inefficient safety measures and aging infrastructure contribute to the occurrence of oil spills or pollution during exploration activities and crude oil production, thereby posing a significant environmental threat and prompting an effective response effort. There is growing emphasis on the development and adoption of effective oil pollution remediation materials and technologies to mitigate the adverse impacts of oil spills. The increased need for remediation solutions due to rising offshore oil exploration and transportation activities fuels the demand for oil pollution remediation materials.

North America Oil Pollution Remediation Materials Market Overview

The utilization of sorbents, dispersants, mechanical remediation, and bioremediation are the prominent approaches adopted by North American countries to control water pollution due to oil spillage. Environmental regulations and growing focus on sustainability encourage government bodies to adopt advanced technologies and materials to tackle oil spill incidents. An increasing number of oil spills and oil pollution incidences in the region drive the emphasis on environmental protection and oil spill responses. North America marks the presence of many environmental authorities and response agencies. These include the Marine Spill Response Corporation, National Environmental Emergencies Center, Canadian Transport Emergency Centre, the US Environmental Protection Agency, the US Coast Guard National Response Center, the US Coast Guard, the US National Response Team, and National Oceanic & Atmospheric Administration.

As per a report by the National Academies of Sciences, Engineering, and Medicine, oil pollution in North American ocean waters is caused by land-based oil runoff along with oil spills, natural oil seeps, and oil and gas site discharge. According to the Pipeline and Hazardous Materials Safety Administration, North America has ?2.6 million miles of pipelines that deliver huge volumes of liquid petroleum products (hundreds of billions of tons) and natural gas (trillions of cubic feet) yearly. Per the Canada Energy Regulator, most of the crude oil produced in Canada is shipped using pipelines from western provinces to refineries in the US, Ontario, and Quebec. The increasing crude oil production operations, rising exploration activities, and large-scale marine transportation activities are further expected to drive the demand for oil pollution remediation materials in North American countries over the coming years.

North America Oil Pollution Remediation Materials Market Revenue and Forecast to 2030 (US$ Million)

North America Oil Pollution Remediation Materials Market Segmentation

The North America oil pollution remediation materials market is categorized into type and country.

Based on type, the North America oil pollution remediation materials market is segmented into physical remediation, chemical remediation, thermal remediation, and bioremediation. The physical remediation segment held the largest market share in 2022. Furthermore, the physical remediation segment is sub segmented into booms, skimmers, and adsorbent materials. Additionally, the chemical remediation segment is bifurcated into dispersants and solidifiers.

By country, the North America oil pollution remediation materials market is segmented into the US, Canada, and Mexico. The US dominated the North America oil pollution remediation materials market share in 2022.

Ansell Ltd; Brady Corp; CL Solutions, LLC; Compania Espanola de Petroleos SA; Cosco Shipping Heavy Industry Co., Ltd; Cura Inc; Ecolab Inc; NOV Inc; Oil Spill Eater International Corp; Oil-Dri Corp of America; Osprey Spill Control; Regenesis; Sarva Bio Remed LLC; SkimOIL LLC; and TOLSA SA are some of the leading companies operating in the North America oil pollution remediation materials market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

- 1.3 Limitations and Assumptions

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Oil Pollution Remediation Materials Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Oil Pollution Remediation Materials Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End Users

- 4.3.5 List of Vendors in Value Chain

5. North America Oil Pollution Remediation Materials Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Rising Offshore Oil Exploration and Transportation Activities

- 5.1.2 Government Regulations Related to Oil Spill Preparedness and Responses

- 5.1.3 Increasing Levels of Pollution in ICCA Countries

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Prices of Physical and Chemical Remediation

- 5.3 Market Opportunities

- 5.3.1 Growing Emphasis on Utilization of Efficient and Eco-friendly Oil Pollution Remediation Solutions

- 5.4 Future Trends

- 5.4.1 Development of Novel Oil Pollution Remediation Materials

- 5.5 Impact of Drivers and Restraints:

6. Oil Pollution Remediation Materials Market - North America Analysis

- 6.1 North America Oil Pollution Remediation Materials Market Revenue (US$ Million), 2020-2030

- 6.2 North America Oil Pollution Remediation Materials Market Forecast Analysis

7. North America Oil Pollution Remediation Materials Market Analysis - by Type

- 7.1 Physical Remediation

- 7.1.1 Overview

- 7.1.2 Physical Remediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Booms

- 7.1.3.1 Overview

- 7.1.3.2 Booms: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.4 Skimmers

- 7.1.4.1 Overview

- 7.1.4.2 Skimmers: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.1.5 Adsorbent Materials

- 7.1.5.1 Overview

- 7.1.5.2 Adsorbent Materials: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Chemical Remediation

- 7.2.1 Overview

- 7.2.2 Chemical Remediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 Dispersants

- 7.2.3.1 Overview

- 7.2.3.2 Dispersants: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2.4 Solidifiers

- 7.2.4.1 Overview

- 7.2.4.2 Solidifiers: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Thermal Remediation

- 7.3.1 Overview

- 7.3.2 Thermal Remediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Bioremediation

- 7.4.1 Overview

- 7.4.2 Bioremediation: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Oil Pollution Remediation Materials Market - Country Analysis

- 8.1 North America Oil Pollution Remediation Materials Market - Country Analysis

- 8.1.1 North America Oil Pollution Remediation Materials Market - Revenue and Forecast Analysis - by Country

- 8.1.1.1 North America Oil Pollution Remediation Materials Market - Revenue and Forecast Analysis - by Country

- 8.1.1.2 US: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.2.1 US: North America Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.3 Canada: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.3.1 Canada: North America Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1.4 Mexico: North America Oil Pollution Remediation Materials Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.1.4.1 Mexico: North America Oil Pollution Remediation Materials Market Breakdown, by Type

- 8.1.1 North America Oil Pollution Remediation Materials Market - Revenue and Forecast Analysis - by Country

9. Competitive Landscape

- 9.1 Heat Map Analysis by Key Players

- 9.2 Company Positioning & Concentration

10. Industry Landscape

- 10.1 Overview

- 10.2 Expansion

- 10.3 Partnerships

11. Company Profiles

- 11.1 Sarva Bio Remed, LLC

- 11.1.1 Key Facts

- 11.1.2 Business Description

- 11.1.3 Products and Services

- 11.1.4 Financial Overview

- 11.1.5 SWOT Analysis

- 11.1.6 Key Developments

- 11.2 Ansell Ltd

- 11.2.1 Key Facts

- 11.2.2 Business Description

- 11.2.3 Products and Services

- 11.2.4 Financial Overview

- 11.2.5 SWOT Analysis

- 11.2.6 Key Developments

- 11.3 Oil-Dri Corp of America

- 11.3.1 Key Facts

- 11.3.2 Business Description

- 11.3.3 Products and Services

- 11.3.4 Financial Overview

- 11.3.5 SWOT Analysis

- 11.3.6 Key Developments

- 11.4 Ecolab Inc.

- 11.4.1 Key Facts

- 11.4.2 Business Description

- 11.4.3 Products and Services

- 11.4.4 Financial Overview

- 11.4.5 SWOT Analysis

- 11.4.6 Key Developments

- 11.5 Cosco Shipping Heavy Industry Co., Ltd

- 11.5.1 Key Facts

- 11.5.2 Business Description

- 11.5.3 Products and Services

- 11.5.4 Financial Overview

- 11.5.5 SWOT Analysis

- 11.5.6 Key Developments

- 11.6 Regenesis

- 11.6.1 Key Facts

- 11.6.2 Business Description

- 11.6.3 Products and Services

- 11.6.4 Financial Overview

- 11.6.5 SWOT Analysis

- 11.6.6 Key Developments

- 11.7 TOLSA SA

- 11.7.1 Key Facts

- 11.7.2 Business Description

- 11.7.3 Products and Services

- 11.7.4 Financial Overview

- 11.7.5 SWOT Analysis

- 11.7.6 Key Developments

- 11.8 CL Solutions, LLC

- 11.8.1 Key Facts

- 11.8.2 Business Description

- 11.8.3 Products and Services

- 11.8.4 Financial Overview

- 11.8.5 SWOT Analysis

- 11.8.6 Key Developments

- 11.9 Brady Corp

- 11.9.1 Key Facts

- 11.9.2 Business Description

- 11.9.3 Products and Services

- 11.9.4 Financial Overview

- 11.9.5 SWOT Analysis

- 11.9.6 Key Developments

- 11.10 Oil Spill Eater International Corp

- 11.10.1 Key Facts

- 11.10.2 Business Description

- 11.10.3 Products and Services

- 11.10.4 Financial Overview

- 11.10.5 SWOT Analysis

- 11.10.6 Key Developments

- 11.11 Osprey Spill Control

- 11.11.1 Key Facts

- 11.11.2 Business Description

- 11.11.3 Products and Services

- 11.11.4 Financial Overview

- 11.11.5 SWOT Analysis

- 11.11.6 Key Developments

- 11.12 NOV Inc

- 11.12.1 Key Facts

- 11.12.2 Business Description

- 11.12.3 Products and Services

- 11.12.4 Financial Overview

- 11.12.5 SWOT Analysis

- 11.12.6 Key Developments

- 11.13 Cura Inc

- 11.13.1 Key Facts

- 11.13.2 Business Description

- 11.13.3 Products and Services

- 11.13.4 Financial Overview

- 11.13.5 SWOT Analysis

- 11.13.6 Key Developments

- 11.14 Compania Espanola de Petroleos SA

- 11.14.1 Key Facts

- 11.14.2 Business Description

- 11.14.3 Products and Services

- 11.14.4 Financial Overview

- 11.14.5 SWOT Analysis

- 11.14.6 Key Developments

- 11.15 SkimOIL LLC

- 11.15.1 Key Facts

- 11.15.2 Business Description

- 11.15.3 Products and Services

- 11.15.4 Financial Overview

- 11.15.5 SWOT Analysis

- 11.15.6 Key Developments

12. Appendix

- 12.1 About The Insight Partners