|

|

市場調査レポート

商品コード

1567814

北米の研磨剤市場:2030年までの市場予測 - 地域分析 - 材質、タイプ、用途、販売チャネル別North America Abrasive Market Forecast to 2030 - Regional Analysis - by Material, Type, Application, and Sales Channel |

||||||

|

|||||||

| 北米の研磨剤市場:2030年までの市場予測 - 地域分析 - 材質、タイプ、用途、販売チャネル別 |

|

出版日: 2024年08月07日

発行: The Insight Partners

ページ情報: 英文 126 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の研磨剤市場は、2022年に43億5,077万米ドルと評価され、2030年には63億7,503万米ドルに達すると予測され、2022年から2030年までのCAGRは4.9%と推定されます。

持続可能な研磨剤の開発が北米の研磨剤市場を活性化

各国政府は、人の健康と環境の保護を確実にするため、化学・材料を含む加工産業において、持続可能な材料を使用して製品を製造するよういくつかの規制を課しています。こうした規制は温室効果ガスの排出を削減するためのもので、製造企業は天然由来の原料開発への投資を増やす必要に迫られています。温室効果ガス(GHG)排出や環境汚染に対する意識の高まりは、バイオベースの持続可能な製品に対する需要を急増させると予測されます。各国政府は、持続可能な素材に対する認識と開発を高めるため、いくつかのイニシアチブを採用しています。持続可能性に関する新たな動向が研磨剤市場の技術革新に拍車をかけています。精密工学や表面改質などの研磨剤製造技術の進歩は、効率を高め、廃棄物の発生を減らすために活用されています。いくつかのメーカーは、研磨剤の生産と使用時に発生するエネルギー消費と排出の最小化にも注力しています。このため、持続可能な研磨材の市場開発が予測期間中の研磨材市場を牽引するとみられます。

北米の研磨剤市場概要

北米は、建設、自動車、航空宇宙、電気・電子、エネルギー、半導体、金属加工などの最終用途産業からの需要が増加しているため、研磨剤メーカーにとって幅広い成長機会があります。金属加工、自動車生産、機械製造など様々な産業プロセスにおいて研磨材は不可欠であるため、製造業は極めて重要な役割を担っています。この地域の堅調な製造業は、技術の進歩と革新に牽引され、研磨剤の需要に大きく貢献しています。さらに、北米の建設とインフラ整備も研磨剤需要に貢献しています。北米の建設セクターは、堅調な経済諸国と公共事業や施設構造物に対する連邦政府・州政府の融資増加により急速に発展しています。急速な開発と都市化も北米の研磨剤市場を牽引しています。米国国勢調査局が発表した報告書によると、2023年の建設(民間および公共)投資総額は1兆9,787億米ドルで、2022年の投資額1兆8,487億米ドルから7%増加しました。建設分野では、表面処理、コンクリート研磨、石材切断などの用途で研磨剤を使用することが極めて重要です。この地域は継続的な成長と都市化が進んでいるため、建設活動における研磨剤の需要は高水準で推移すると思われます。北米では、乗用車が最も一般的な交通手段であり、一人当たり所得の上昇に伴いその使用量も増加しています。OICA(Organisation Internationale des Constructeurs d'Automobiles)によると、北米の自動車生産台数は2021年の~1,350万台から2022年には1,480万台へと10%増加しました。自動車セクターの拡大に伴い、塗料や錆を除去し、表面を研磨または滑らかにするために利用される研磨剤の需要も並行して増加しています。また、国際エネルギー機関によると、2021年の電気自動車販売台数は63万台です。また、国際エネルギー機関(IEA)によると、インフレ抑制法が成立した2022年8月から2023年3月までの間に、主要な電気自動車メーカーとバッテリーメーカーは北米の電気自動車サプライチェーンに総額最低520億米ドルの投資を発表しました。技術の進歩により、エレクトロニクス、航空宇宙、ヘルスケアなどさまざまな分野で研磨工具の採用が増加しています。北米各国の政府は、航空宇宙・防衛分野の技術と研究プログラムに多額の投資を行っています。この地域は、Raytheon Technologies Corporation、Boeing、GE Aviation、Bombardier Inc.、Lockheed Martin Corporationなど、主要な航空機、航空機部品、防衛機器製造企業の拠点となっています。研磨剤は、精度と品質が最優先される航空宇宙・防衛部品の製造工程で重要な役割を果たしています。航空機や防衛システムには軽量で高強度な素材が必要なため、高度な機械加工と仕上げ技術が必要となり、特殊な研磨剤の需要をさらに押し上げています。

北米の研磨剤市場の収益と2030年までの予測(金額)

北米の研磨剤市場セグメンテーション

北米の研磨剤市場は素材、タイプ、用途、販売チャネル、国に分類されます。

材質別では、北米の研磨剤市場は天然と合成に二分されます。2022年の北米の研磨剤市場は合成セグメントが大きなシェアを占めています。

タイプ別では、北米の研磨剤市場はボンド研磨剤とコーティング研磨剤に二分されます。2022年の北米の研磨剤市場は、ボンド研磨剤セグメントが大きなシェアを占めています。さらに、ボンド砥粒セグメントはディスク、ホイール、その他に細分化されます。さらに、コーティング研磨材セグメントは、フラップディスク、ファイバーディスク、フックアループディスク、ベルト、ロール、その他に細分化されます。

用途別では、北米の研磨剤市場は自動車、航空宇宙、海洋、金属加工、木工、電気・電子、その他に区分されます。2022年の北米の研磨剤市場では、自動車分野が最大のシェアを占めています。

販売チャネル別では、北米の研磨剤市場は直接と間接に二分されます。2022年の北米の研磨剤市場は間接セグメントが大きなシェアを占めています。

国別では、北米の研磨剤市場は米国、カナダ、メキシコに区分されます。米国が2022年の北米の研磨剤市場シェアを独占しました。

Deerfos Co.Ltd.、CUMI AWUKO Abrasives GmbH、Robert Bosch GmbH、Tyrolit Schleifmittelwerke Swarovski AG &Co KG、Sun Abrasives Co Ltd、Compagnie de Saint-Gobain S.A.、sia Abrasives Industries AG、RHODIUS Abrasives GmbH、3M Co.などが北米の研磨剤市場で事業を展開する主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 研磨剤市場情勢

- ポーターズ分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 各種研磨メディアの特性

- バリューチェーンのベンダー一覧

第5章 北米の研磨剤市場:主要市場力学

- 市場促進要因

- 自動車産業と金属加工産業の成長

- 電気・電子産業からの研磨剤需要の増加

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- 自動化・ロボット用途での研磨材の採用

- 今後の動向

- 持続可能な研磨剤の開発

- 促進要因と抑制要因の影響

第6章 研磨材市場:北米分析

- 研磨剤市場の売上高、2020-2030年

- 研磨剤市場の予測分析

第7章 北米の研磨剤市場分析:材質別

- 天然

- 合成

第8章 北米の研磨剤市場の分析:タイプ別

- ボンド砥粒

- コーティング砥粒

第9章 北米の研磨剤市場の分析:用途別

- 自動車

- 航空宇宙

- 海洋

- 金属加工

- 木工

- 電気・電子

- その他

第10章 北米の研磨剤市場分析:販売チャネル別

- 直接

- 間接販売

第11章 北米の研磨剤市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第13章 業界情勢

- 製品発売

- 合併と買収

- 事業拡大

- その他の戦略と展開

第14章 企業プロファイル

- Deerfos Co., Ltd.

- CUMI AWUKO Abrasives GmbH

- Robert Bosch GmbH

- Tyrolit Schleifmittelwerke Swarovski AG & Co KG

- Sun Abrasives Co Ltd

- Compagnie de Saint-Gobain S.A.

- sia Abrasives Industries AG

- RHODIUS Abrasives GmbH

- 3M Co

- Ekamant AB

第15章 付録

List Of Tables

- Table 1. North America Abrasive Market Segmentation

- Table 2. List of Vendors

- Table 3. Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 5. Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 6. Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 7. Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Sales Channel

- Table 8. United States: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 9. United States: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 10. United States: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 11. United States: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Sales Channel

- Table 12. Canada: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 13. Canada: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 14. Canada: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 15. Canada: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Sales Channel

- Table 16. Mexico: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Material

- Table 17. Mexico: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 18. Mexico: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 19. Mexico: Abrasive Market - Revenue and Forecast to 2030 (US$ Million) - by Sales Channel

List Of Figures

- Figure 1. North America Abrasive Market Segmentation, by Country

- Figure 2. Abrasive Market - Porter's Analysis

- Figure 3. Ecosystem: Abrasive Market

- Figure 4. Abrasive Grain Processing

- Figure 5. Bonded Abrasive Product Manufacturing Process

- Figure 6. Coated Abrasive Product Manufacturing Process

- Figure 7. Abrasive Market - Key Market Dynamics

- Figure 8. Motor Vehicle Production, By Region (2019-2022)

- Figure 9. Production Value by the Global Electronics and IT Industries (2015-2023)

- Figure 10. Impact Analysis of Drivers and Restraints

- Figure 11. Abrasive Market Revenue (US$ Million), 2020-2030

- Figure 12. Abrasive Market Share (%) - by Material (2022 and 2030)

- Figure 13. Natural: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Synthetic: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Abrasive Market Share (%) - by Type (2022 and 2030)

- Figure 16. Bonded Abrasives: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Wheels: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Others: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Coated Abrasives: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Flap Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Fiber Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Hook and Loop Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Belts: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Rolls: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Others: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Abrasive Market Share (%) - by Application (2022 and 2030)

- Figure 28. Automotive: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 29. Aerospace: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 30. Marine: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 31. Metal Fabrication: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 32. Woodworking: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Electrical & Electronics: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 34. Others: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 35. Abrasive Market Share (%) - by Sales Channel (2022 and 2030)

- Figure 36. Direct: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 37. Indirect: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 38. North America: Abrasive Market, By Key Country - Revenue 2022 (US$ Million)

- Figure 39. North America: Abrasive Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 40. United States: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 41. Canada: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 42. Mexico: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 43. Heat Map Analysis by Key Players

- Figure 44. Company Positioning & Concentration

The North America abrasive market was valued at US$ 4,350.77 million in 2022 and is expected to reach US$ 6,375.03 million by 2030; it is estimated to register a CAGR of 4.9% from 2022 to 2030.

Development of Sustainable Abrasives Fuels North America Abrasive Market

Governments of various countries have imposed a few regulations on using sustainable materials to manufacture products in processing industries, including chemicals & materials, to ensure better protection of human health and the environment. These regulations are set to reduce greenhouse emissions and have compelled manufacturing companies to increase investments in developing naturally derived raw materials. Rising awareness regarding greenhouse gas (GHG) emissions and environmental pollution is projected to surge the demand for bio-based and sustainable products. Governments of various countries are adopting several initiatives to increase the awareness and development of sustainable materials. Emerging trends in sustainability have spurred innovation in the abrasive market. Advancements in abrasive manufacturing techniques, such as precision engineering and surface modification, are leveraged to enhance efficiency and reduce waste generation. Several manufacturers are also focused on minimizing energy consumption and emissions caused during the production and usage of abrasives. Therefore, the development of sustainable abrasives is expected to drive the abrasive market during the forecast period.

North America Abrasive Market Overview

North America holds extensive growth opportunities for abrasive manufacturers owing to the increasing demand from end-use industries such as construction, automotive, aerospace, electrical & electronics, energy, semiconductor, and metalworking. The manufacturing sector plays a pivotal role, as abrasives are essential in various industrial processes such as metal fabrication, automotive production, and machinery manufacturing. The region's robust manufacturing industry, driven by technological advancements and innovation, contributes significantly to the demand for abrasives. In addition, the construction and infrastructure development in North America contributes to the demand for abrasives. The construction sector in North America is rapidly developing due to a robust economy and increased federal and state financing for public works and institutional structures. Rapid development and urbanization are also driving the North American abrasive market. According to a report released by the US Census Bureau, the value of total construction (private and public) investment in 2023 was US$ 1,978.7 billion, a 7% increase from investments in 2022 of US$ 1,848.7 billion. The use of abrasive in applications involving surface preparation, concrete polishing, and stone cutting is crucial in the construction sector. As the region experiences continuous growth and urbanization, the demand for abrasives in construction activities is likely to remain high. In North America, passenger vehicles are the most common mode of transportation, and their use is increasing with the rise in per capita income. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), vehicle production in North America increased by 10%, from ~13.5 million in 2021 to 14.8 million vehicles in 2022. As the automotive sector expands, there is a parallel increase in the demand for abrasives, which are utilized to remove paint and rust and polish or smooth surfaces. In addition, according to the International Energy Agency, electric car sales accounted for 630,000 in 2021. In addition, according to the International Energy Agency, between August 2022 (when the Inflation Reduction Act was passed) and March 2023, major electric vehicle and battery makers announced investments totaling a minimum of US$ 52 billion in electric vehicle supply chains in North America. Technological advancements are increasing the adoption of abrasive tools in various sectors, including electronics, aerospace, and healthcare. Governments of countries in North America have significantly invested in technology and research programs in the aerospace & defense sector. The region is a hub for major aircraft, aircraft components, and defense equipment manufacturing companies such as Raytheon Technologies Corporation, Boeing, GE Aviation, Bombardier Inc., and Lockheed Martin Corporation. Abrasives play a crucial role in the manufacturing process of aerospace and defense components, where precision and quality are paramount. The need for lightweight, high-strength materials in aircraft and defense systems necessitates advanced machining and finishing techniques, further driving the demand for specialized abrasives.

North America Abrasive Market Revenue and Forecast to 2030 (US$ Million)

North America Abrasive Market Segmentation

The North America abrasive market is categorized into material, type, application, sales channel, and country.

By material, the North America abrasive market is bifurcated into natural and synthetic. The synthetic segment held a larger share of North America abrasive market in 2022.

In terms of type, the North America abrasive market is bifurcated into bonded abrasives and coated abrasives. The bonded abrasives segment held a larger share of North America abrasive market in 2022. Furthermore, the bonded abrasives segment is subcategorized into discs, wheels, and others. Additionally, the coated abrasives segment is subcategorized into flap discs, fiber discs, hook a loop discs, belts, rolls, and others.

By application, the North America abrasive market is segmented into automotive, aerospace, marine, metal fabrication, woodworking, electrical & electronics, and others. The automotive segment held the largest share of North America abrasive market in 2022.

Based on sales channel of hearing loss, the North America abrasive market is bifurcated into direct and indirect. The indirect segment held a larger share of North America abrasive market in 2022.

By country, the North America abrasive market is segmented into the US, Canada, and Mexico. The US dominated the North America abrasive market share in 2022.

Deerfos Co., Ltd; CUMI AWUKO Abrasives GmbH; Robert Bosch GmbH; Tyrolit Schleifmittelwerke Swarovski AG & Co KG; Sun Abrasives Co Ltd; Compagnie de Saint-Gobain S.A.; sia Abrasives Industries AG; RHODIUS Abrasives GmbH; and 3M Co are some of the leading companies operating in the North America abrasive market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Abrasive Market Landscape

- 4.1 Overview

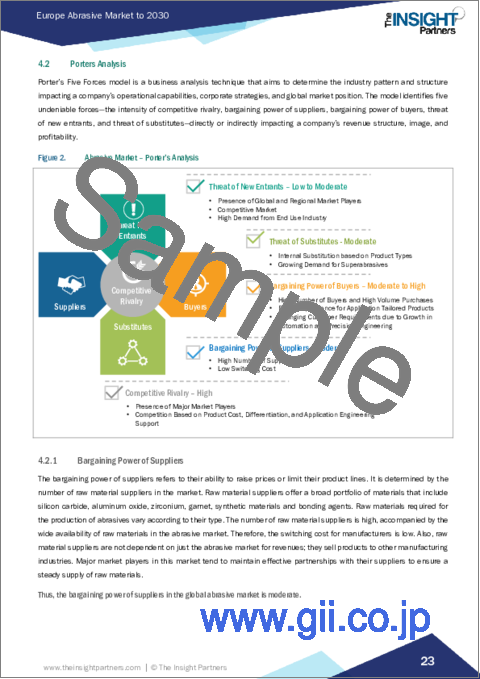

- 4.2 Porters Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Properties of Different Abrasive Media Types

- 4.3.2 List of Vendors in the Value Chain

5. North America Abrasive Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Automotive and Metal Fabrication Industry

- 5.1.2 Rising Demand for Abrasives from Electrical and Electronics Industry

- 5.2 Market Restraints

- 5.2.1 Fluctuations in Raw Material Prices

- 5.3 Market Opportunities

- 5.3.1 Adoption of Abrasives in Automation and Robotic Applications

- 5.4 Future Trends

- 5.4.1 Development of Sustainable Abrasives

- 5.5 Impact of Drivers and Restraints:

6. Abrasive Market - North America Analysis

- 6.1 Overview

- 6.2 Abrasive Market Revenue (US$ Million), 2020-2030

- 6.3 Abrasive Market Forecast Analysis

7. North America Abrasive Market Analysis - by Material

- 7.1 Natural

- 7.1.1 Overview

- 7.1.2 Natural: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Synthetic

- 7.2.1 Overview

- 7.2.2 Synthetic: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Abrasive Market Analysis - by Type

- 8.1 Bonded Abrasives

- 8.1.1 Overview

- 8.1.2 Bonded Abrasives: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.3 Discs

- 8.1.3.1 Overview

- 8.1.3.2 Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.4 Wheels

- 8.1.4.1 Overview

- 8.1.4.2 Wheels: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.1.5 Others

- 8.1.5.1 Overview

- 8.1.5.2 Others: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Coated Abrasives

- 8.2.1 Overview

- 8.2.1.1 Coated Abrasives: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

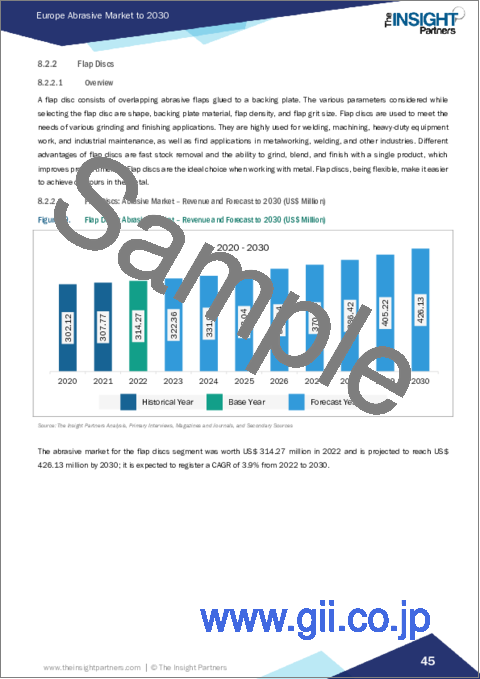

- 8.2.2 Flap Discs

- 8.2.2.1 Overview

- 8.2.2.2 Flap Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.3 Fiber Discs

- 8.2.3.1 Overview

- 8.2.3.2 Fiber Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.4 Hook and Loop Discs

- 8.2.4.1 Overview

- 8.2.4.2 Hook and Loop Discs: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.5 Belts

- 8.2.5.1 Overview

- 8.2.5.2 Belts: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.6 Rolls

- 8.2.6.1 Overview

- 8.2.6.2 Rolls: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.7 Others

- 8.2.7.1 Overview

- 8.2.7.2 Others: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2.1 Overview

9. North America Abrasive Market Analysis - by Application

- 9.1 Automotive

- 9.1.1 Overview

- 9.1.2 Automotive: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Aerospace

- 9.2.1 Overview

- 9.2.2 Aerospace: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Marine

- 9.3.1 Overview

- 9.3.2 Marine: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Metal Fabrication

- 9.4.1 Overview

- 9.4.2 Metal Fabrication: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Woodworking

- 9.5.1 Overview

- 9.5.2 Woodworking: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 9.6 Electrical & Electronics

- 9.6.1 Overview

- 9.6.2 Electrical & Electronics: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Abrasive Market Analysis - by Sales Channel

- 10.1 Direct

- 10.1.1 Overview

- 10.1.2 Direct: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 10.2 Indirect

- 10.2.1 Overview

- 10.2.2 Indirect: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

11. North America Abrasive Market - Country Analysis

- 11.1 North America

- 11.1.1 North America: Abrasive Market - Revenue and Forecast Analysis - by Country

- 11.1.1.1 United States: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.1.1 United States: Abrasive Market Breakdown, by Material

- 11.1.1.1.2 United States: Abrasive Market Breakdown, by Type

- 11.1.1.1.3 United States: Abrasive Market Breakdown, by Application

- 11.1.1.1.4 United States: Abrasive Market Breakdown, by Sales Channel

- 11.1.1.2 Canada: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.2.1 Canada: Abrasive Market Breakdown, by Material

- 11.1.1.2.2 Canada: Abrasive Market Breakdown, by Type

- 11.1.1.2.3 Canada: Abrasive Market Breakdown, by Application

- 11.1.1.2.4 Canada: Abrasive Market Breakdown, by Sales Channel

- 11.1.1.3 Mexico: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1.3.1 Mexico: Abrasive Market Breakdown, by Material

- 11.1.1.3.2 Mexico: Abrasive Market Breakdown, by Type

- 11.1.1.3.3 Mexico: Abrasive Market Breakdown, by Application

- 11.1.1.3.4 Mexico: Abrasive Market Breakdown, by Sales Channel

- 11.1.1.1 United States: Abrasive Market - Revenue and Forecast to 2030 (US$ Million)

- 11.1.1 North America: Abrasive Market - Revenue and Forecast Analysis - by Country

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Product launch

- 13.3 Mergers and Acquisitions

- 13.4 Expansion

- 13.5 Other Strategies and Developments

14. Company Profiles

- 14.1 Deerfos Co., Ltd.

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 CUMI AWUKO Abrasives GmbH

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Robert Bosch GmbH

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Tyrolit Schleifmittelwerke Swarovski AG & Co KG

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Sun Abrasives Co Ltd

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Compagnie de Saint-Gobain S.A.

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 sia Abrasives Industries AG

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 RHODIUS Abrasives GmbH

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 3M Co

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Ekamant AB

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

15. Appendix

- 15.1 About the Insight Partners