|

|

市場調査レポート

商品コード

1562353

北米の鉱業再製造部品:2030年までの市場予測 - 地域分析 - 部品、装置、産業別North America Mining Remanufacturing Components Market Forecast to 2030 - Regional Analysis - by Component, Equipment, and Industry |

||||||

|

|||||||

| 北米の鉱業再製造部品:2030年までの市場予測 - 地域分析 - 部品、装置、産業別 |

|

出版日: 2024年07月04日

発行: The Insight Partners

ページ情報: 英文 109 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の鉱業再製造部品市場は、2022年に8億8,758万米ドルと評価され、2030年には11億8,493万米ドルに達すると予測され、2022年から2030年までのCAGRは3.7%と推定されます。

新品部品に比べコスト削減が北米の鉱業再製造部品市場を促進

リマニュファクチャリング産業協議会(RIC)は、米国を拠点とするリマニュファクチャリング産業部門と学術機関の団体です。RICは再製造を、過去に販売され、摩耗し、機能しなくなった製品や部品を「新品同様」または「新品以上」の状態に修復し、最高の性能レベルと品質を保証する包括的で厳格な産業プロセスと定義しています。再製造は、新しい部品の製造工程におけるエネルギー集約的な多くの工程を削減または排除するため、同じ部品を新たに製造するよりもはるかに少ないエネルギーしか使用しないです。再製造は、新製品開発よりも少ない原材料資源、少ないエネルギー消費、少ない廃棄物しか生み出さないです。これらの分野における削減効果は大きく、その結果、再製造業者とエンドユーザーの双方にとって、同等の品質の製品がより安価に手に入ることになります。Liebherr鉱業再製造部門の責任者によれば、再製造された部品のコストは、新しい部品よりも最大60%低く、コスト削減のほとんどは、材料費とエネルギーコストの削減によるものです。

鉱業は資本集約型の産業です。露天掘りや地下鉱山の開発・建設にかかる費用は、鉱業における建設資本の主要な先行投資です。道路、鉄道、橋、発電所、港湾など、企業が建設するその他のインフラは、鉱石や精鉱の採掘や出荷を支援するために頻繁に存在します。また、実際の採掘プロセスには日々の経費がかかります。上記のすべての段階で、ホイールドーザー、ホイールローダー、クローラードーザー、運搬トラックなどの機器が重要な役割を果たし、鉱業コストの顕著な割合を占めています。これらの車両は、鉱業運営費全体の約10~15%を占めています。このような機器の継続的な摩耗や損傷は、部品交換の必要性につながり、その結果、設備投資が必要となります。そのため、多くの鉱山機械OEM企業は、鉱業全体の操業コストを削減するため、部品の再製造に目を向けています。大手鉱山機械メーカーのひとつであるキャタピラー社は、ホイールドーザーの再製造・再生プログラムにより、新規製造に比べて40~70%のコスト削減が可能だと主張しています。Liebherr、Caterpillar、コマツ、日立製作所など、他の大手再製造メーカーが実施しているこのような再製造プログラムは、鉱山会社に利益をもたらし、最終的に鉱業における部品の再製造の需要を促進しています。

北米の鉱業再製造部品市場概要

北米の鉱業再製造部品市場は米国、カナダ、メキシコに区分されます。北米、特に米国、カナダ、メキシコなどの国々の鉱業部門が鉱業再製造部品の需要を大きく牽引しています。北米の鉱業再製造部品市場は、様々な最終用途産業の着実な拡大とインフラ整備への継続的な投資により、成長軌道を継続すると予想されます。例えば、カナダ政府が発表したデータによると、119の主要鉱業関連プロジェクトに890億米ドルの資本支出が行われ、同産業は鉱山の建設、再開発、拡張、処理施設への継続的な関心を示しています。同国の資本支出は、2020年の820億米ドル、120プロジェクトから、2021年の890億米ドル、119プロジェクトへと増加しており、パンデミック(世界的大流行)による課題にもかかわらず、鉱山関連プロジェクトへの関心が継続していることを示しています。建設プロジェクト、港湾、ターミナルを含むインフラ整備への継続的な注力も、この地域における鉱業再製造部品の需要に寄与しています。鉱物や金属に対する需要の増加は、この地域における採掘活動の成長を促進し、採掘機器用の再製造部品のニーズを生み出しています。

北米の鉱業再製造部品市場の収益と2030年までの予測(金額)

北米の鉱業再製造部品市場のセグメンテーション

北米の鉱業再製造部品市場は、部品、装置、産業、国に分類されます。

部品に基づき、北米の鉱業再製造部品市場はエンジン、アクスル、トランスミッション、油圧シリンダー、その他にセグメント化されます。エンジンセグメントは2022年に北米の鉱業再製造部品市場で最大のシェアを占めました。

機器では、北米の鉱業再製造部品市場は掘削機、ホイールローダー、ホイールドーザー、クローラドーザー、運搬トラック、その他にセグメント化されます。クローラドーザーセグメントが2022年の北米の鉱業再製造部品市場シェアで最大を占めています。

産業別では、北米の鉱業再製造部品市場は石炭、金属、その他に分けられます。金属セグメントは2022年に北米の鉱業再製造部品市場で最大のシェアを占めました。

国別では、北米の鉱業再製造部品市場は米国、カナダ、メキシコに区分されます。2022年の北米鉱山用再製造部品市場シェアは米国が独占しました。

Atlas Copco AB、J C Bamford Excavators Ltd、Caterpillar Inc、Epiroc AB、Swanson Industries Inc、Komatsu Ltd、Liebherr-International AG、SRC Holdings Corp、AB Volvo、Hitachi Construction Machinery Co Ltdは、北米鉱業再製造部品市場で事業を展開している主要企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の鉱業再製造部品市場情勢

- エコシステム分析

- 鉱業再製造部品サプライヤー一覧

第5章 北米の鉱業再製造部品市場:主要市場力学

- 市場促進要因

- 新品部品と比較したコスト削減

- 鉱業における成長

- 市場抑制要因

- 品質問題と技術的障壁

- 市場機会

- 鉱業における電気自動車と自律走行車の採用増加

- 今後の動向

- 再製造産業における積層造形

- 促進要因と抑制要因の影響

第6章 鉱業再製造部品市場:北米市場分析

- 鉱業再製造部品市場の収益、2020年~2030年

- 鉱業再製造部品市場の予測分析

第7章 北米の鉱業再製造部品市場分析:部品別

- エンジン

- アクスル

- トランスミッション

- 油圧シリンダー

- その他

第8章 北米の鉱業再製造部品市場分析:装置別

- 掘削機

- ホイールローダー

- ホイールドーザー

- クローラドーザー

- 運搬トラック

- その他

第9章 北米の鉱業再製造部品市場分析:産業別

- 石炭

- 金属

- その他

第10章 北米の鉱業再製造部品市場:国別分析

- 北米市場概要

- 北米

- 米国

- カナダ

- メキシコ

- 北米

第11章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Atlas Copco AB

- J C Bamford Excavators Ltd

- Caterpillar Inc

- Epiroc AB

- Swanson Industries Inc

- Komatsu Ltd

- Liebherr-International AG

- SRC Holdings Corp

- AB Volvo

- Hitachi Construction Machinery Co Ltd

第14章 付録

List Of Tables

- Table 1. Mining Remanufacturing Components Market Segmentation

- Table 2. List of Suppliers

- Table 3. Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Table 4. Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 5. Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Equipment

- Table 6. Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 7. North America: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Country

- Table 8. United States: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 9. United States: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Equipment

- Table 10. United States: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 11. Canada: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 12. Canada: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Equipment

- Table 13. Canada: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 14. Mexico: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Component

- Table 15. Mexico: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Equipment

- Table 16. Mexico: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million) - by Industry

- Table 17. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. Mining Remanufacturing Components Market Segmentation, by Country

- Figure 2. Mining Remanufacturing Components Market - Key Market Dynamics

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Mining Remanufacturing Components Market Revenue (US$ Million), 2020-2030

- Figure 5. Mining Remanufacturing Components Market Share (%) - by Component (2022 and 2030)

- Figure 6. Engine: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. Axle: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Transmission: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Hydraulic Cylinder: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

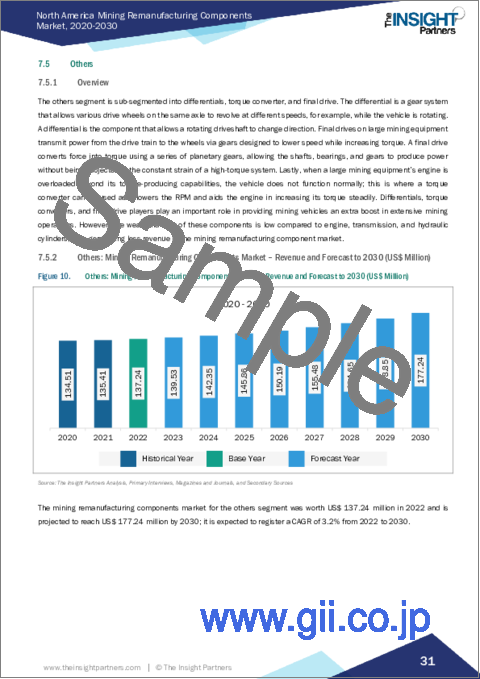

- Figure 10. Others: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Mining Remanufacturing Components Market Share (%) - by Equipment (2022 and 2030)

- Figure 12. Excavators: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Wheel Loader: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Wheel Dozer: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Crawler Dozer: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Haul Truck: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Others: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Mining Remanufacturing Components Market Share (%) - by Industry (2022 and 2030)

- Figure 19. Coal: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Metal: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Others: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. North America Mining Remanufacturing Components Market, by Key Countries - Revenue (2022) (US$ Million)

- Figure 23. North America: Mining Remanufacturing Components Market Breakdown, by Key Countries, 2022 and 2030 (%)

- Figure 24. United States: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Canada: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Mexico: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. Company Positioning & Concentration

The North America mining remanufacturing components market was valued at US$ 887.58 million in 2022 and is expected to reach US$ 1,184.93 million by 2030; it is estimated to register a CAGR of 3.7% from 2022 to 2030.

Reduced Cost Compared to New Components Fuels North America Mining Remanufacturing Components Market

The Remanufacturing Industries Council (RIC) is an association of remanufacturing industry sectors and academic institutions based in the US. RIC defines remanufacturing as a comprehensive and rigorous industrial process that restores a previously sold, worn, or non-functional product or component to a "like-new" or "better-than-new" condition and ensures the highest performance level and quality. Remanufacturing a product uses much less energy than new manufacturing of the same component as it reduces or eliminates numerous energy-intensive processes in the new component manufacturing process. Remanufacturing uses fewer raw resources, consumes less energy, and generates less waste than new product development. The reductions in these areas are substantial, resulting in a product of comparable quality that costs less for both the remanufacturer and the end user. As per the head of Liebherr Mining Remanufacturing division, remanufactured components cost up to 60% less than new components, and most cost savings come from lower material and energy costs.

Mining is a capital-intensive industry. The costs involved with the development and construction of open-pit and underground mines are a major upfront layout of construction capital in mining. Other company-built infrastructure, such as roads, railways, bridges, power plants, and seaports, are frequently present to assist ore and concentrate extraction and shipping. Also, there is day to day expenses in the actual mining process. In all the phases mentioned above, equipment such as wheel dozers, wheel loaders, crawler dozers, and haul trucks play an important role and account for a notable share of the mining industry costs. These vehicles cost approximately 10-15% of the total mining operating expenditure. Continuous wear and tear of such equipment leads to the requirement for component replacement, which results in capital investment. Thus, many mining and equipment OEM companies have turned towards remanufacturing components to reduce overall mining operating costs. Caterpillar, one of the leading mining equipment manufacturers, claims that its remanufacturing and rebuilding program for wheel dozers reduces 40-70% costs compared to new manufacturing. Such remanufacturing programs carried out by other top remanufacturers such as Liebherr, Caterpillar, Komatsu, and Hitachi have benefitted the mining companies, ultimately driving the demand for remanufacturing of components in the mining industry.

North America Mining Remanufacturing Components Market Overview

The North America mining remanufacturing components market is segmented into the US, Canada, and Mexico. The mining sector in North America, particularly in countries such as the US, Canada, and Mexico, majorly drives the demand for mining remanufacturing components. The mining remanufacturing components market in North America is expected to continue its growth trajectory due to the steady expansion of various end-use industries and continuous investments in infrastructure development. For instance, according to the data published by the government of Canada, with US$ 89 billion in capital expenditures spread across 119 major mining-related projects, the industry demonstrated continued interest in mine constructions, redevelopments, expansions, and processing facilities. The country witnessed increase in capital expenditures from US$ 82 billion and 120 projects in 2020 to US$ 89 billion and 119 projects in 2021 signifies continuing interest in mining-related projects despite the challenges posed by the pandemic. The continued focus on infrastructure development, including construction projects, ports, and terminals, also contributes to the demand for mining remanufacturing components in the region. The increased demand for minerals and metals is propelling the growth of mining activities in the region, creating a need for remanufactured components for mining equipment.

North America Mining Remanufacturing Components Market Revenue and Forecast to 2030 (US$ Million)

North America Mining Remanufacturing Components Market Segmentation

The North America mining remanufacturing components market is categorized into component, equipment, industry, and country.

Based on component, the North America mining remanufacturing components market is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine segment held the largest North America mining remanufacturing components market share in 2022.

In terms of equipment, the North America mining remanufacturing components market is segmented into excavator, wheel loader, wheel dozer, crawler dozer, haul truck, and others. The crawler dozers segment held the largest North America mining remanufacturing components market share in 2022.

By industry, the North America mining remanufacturing components market is divided into coal, metal, and others. The metal segment held the largest North America mining remanufacturing components market share in 2022.

By country, the North America mining remanufacturing components market is segmented into the US, Canada, and Mexico. The US dominated the North America mining remanufacturing components market share in 2022.

Atlas Copco AB, J C Bamford Excavators Ltd, Caterpillar Inc, Epiroc AB, Swanson Industries Inc, Komatsu Ltd, Liebherr-International AG, SRC Holdings Corp, AB Volvo, and Hitachi Construction Machinery Co Ltd are some of the leading companies operating in the North America mining remanufacturing components market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Mining Remanufacturing Components Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Mining Remanufacturing Component Suppliers

5. North America Mining Remanufacturing Components Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Reduced Cost Compared to New Components

- 5.1.2 Growth in in Mining Industry

- 5.2 Market Restraints

- 5.2.1 Quality Issues and Technological Barriers

- 5.3 Market Opportunities

- 5.3.1 Rising Adoption of Electric and Autonomous Vehicles in Mining Industry

- 5.4 Future Trends

- 5.4.1 Additive Manufacturing in Remanufacturing Industry

- 5.5 Impact of Drivers and Restraints:

6. Mining Remanufacturing Components Market - North America Market Analysis

- 6.1 Mining Remanufacturing Components Market Revenue (US$ Million), 2020-2030

- 6.2 Mining Remanufacturing Components Market Forecast Analysis

7. North America Mining Remanufacturing Components Market Analysis - by Component

- 7.1 Engine

- 7.1.1 Overview

- 7.1.2 Engine: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 7.2 Axle

- 7.2.1 Overview

- 7.2.2 Axle: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 7.3 Transmission

- 7.3.1 Overview

- 7.3.2 Transmission: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Hydraulic Cylinder

- 7.4.1 Overview

- 7.4.2 Hydraulic Cylinder: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

8. North America Mining Remanufacturing Components Market Analysis - by Equipment

- 8.1 Excavators

- 8.1.1 Overview

- 8.1.2 Excavators: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 8.2 Wheel Loader

- 8.2.1 Overview

- 8.2.2 Wheel Loader: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 8.3 Wheel Dozer

- 8.3.1 Overview

- 8.3.2 Wheel Dozer: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Crawler Dozer

- 8.4.1 Overview

- 8.4.2 Crawler Dozer: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Haul Truck

- 8.5.1 Overview

- 8.5.2 Haul Truck: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

9. North America Mining Remanufacturing Components Market Analysis - by Industry

- 9.1 Coal

- 9.1.1 Overview

- 9.1.2 Coal: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 9.2 Metal

- 9.2.1 Overview

- 9.2.2 Metal: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 9.3 Others

- 9.3.1 Overview

- 9.3.2 Others: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

10. North America Mining Remanufacturing Components Market - Country Analysis

- 10.1 North America Market Overview

- 10.1.1 North America: Mining Remanufacturing Components Market - Revenue and Forecast Analysis - by Country (2022 & 2030)

- 10.1.1.1 North America: Mining Remanufacturing Components Market - Revenue and Forecast Analysis - by Country

- 10.1.1.2 United States: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.2.1 United States: Mining Remanufacturing Components Market Breakdown, by Component

- 10.1.1.2.2 United States: Mining Remanufacturing Components Market Breakdown, by Equipment

- 10.1.1.2.3 United States: Mining Remanufacturing Components Market Breakdown, by Industry

- 10.1.1.3 Canada: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.3.1 Canada: Mining Remanufacturing Components Market Breakdown, by Component

- 10.1.1.3.2 Canada: Mining Remanufacturing Components Market Breakdown, by Equipment

- 10.1.1.3.3 Canada: Mining Remanufacturing Components Market Breakdown, by Industry

- 10.1.1.4 Mexico: Mining Remanufacturing Components Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.1.4.1 Mexico: Mining Remanufacturing Components Market Breakdown, by Component

- 10.1.1.4.2 Mexico: Mining Remanufacturing Components Market Breakdown, by Equipment

- 10.1.1.4.3 Mexico: Mining Remanufacturing Components Market Breakdown, by Industry

- 10.1.1 North America: Mining Remanufacturing Components Market - Revenue and Forecast Analysis - by Country (2022 & 2030)

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Atlas Copco AB

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 J C Bamford Excavators Ltd

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Caterpillar Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Epiroc AB

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Swanson Industries Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Komatsu Ltd

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Liebherr-International AG

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 SRC Holdings Corp

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 AB Volvo

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Hitachi Construction Machinery Co Ltd

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners