|

|

市場調査レポート

商品コード

1558388

北米の輸液デバイスの市場規模・予測、地域シェア、動向、成長機会分析:製品タイプ別、用途別、エンドユーザー別、国別North America Infusion Devices Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type, Application, End User, and Country |

||||||

|

|||||||

| 北米の輸液デバイスの市場規模・予測、地域シェア、動向、成長機会分析:製品タイプ別、用途別、エンドユーザー別、国別 |

|

出版日: 2024年08月30日

発行: The Insight Partners

ページ情報: 英文 109 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の輸液デバイス市場規模は、2023年の54億9,415万米ドルから2031年には91億1,647万米ドルに達すると予測されています。2023年~2031年のCAGRは6.5%と予測されています。

米国国勢調査局によると、65歳以上の米国人は2022年の5,800万人から2050年には8,200万人へと47%増加すると予想されています。さらに、65歳以上の人口が総人口に占める割合は、17~23%に上昇すると予測されています。カナダ統計局によると、2022年にはカナダ人口のほぼ20%が65歳以上です。さらに、人口予測によれば、2068年までにカナダ人口の21~29%が65歳以上になる可能性があります。

高齢者集団における輸液療法の主な利点を以下の通りです。

水分補給と電解質バランス:喉の渇きの減少、特定の薬剤、腎機能の変化などの要因により、高齢者にとって脱水はより高いリスクとなり得ます。輸液は、高齢者が全身の健康のために必要な水分補給と電解質レベルを維持するのに役立ちます。

栄養サポートと改善:高齢になると、適切な栄養素を摂取することが難しくなり、慢性疾患のリスクが高まります。輸液療法は、高齢者が必須ミネラル、ビタミン、アミノ酸を効率的に摂取できる直接的な方法を提供します。

免疫機能の強化:高齢者は感染症にかかりやすいため、免疫系に特別なサポートが必要な場合があります。輸液療法は、ビタミンC、亜鉛、グルタチオンなどの免疫力を高める栄養素を直接体内に届けることができます。

疼痛管理:多くの高齢者が慢性的な痛みに毎日悩まされており、生活の質に影響を及ぼしています。輸液療法は、薬物を血流に直接送り込むことで、痛みを素早く効果的に管理し、緩和し、炎症を抑えることができます。

このように、高齢者人口の増加が北米全体の輸液デバイス需要を牽引しています。

市場企業の戦略的取り組み

様々な市場企業が、糖尿病、がん、慢性疼痛などの慢性疾患の治療を容易にする高度な製品を開発するために、製品の発売、合併、買収、提携などの戦略的開発に注力しています。北米の輸液デバイス市場の最近の動向は以下の通りです。

2024年4月、マッケンジー・ヘルスは、静脈内投薬ポンプと患者の電子カルテとの間で双方向の情報フローを可能にする技術をカナダで発売しました。BD Alaris EMR Interoperabilityとして知られるこの技術は、医療従事者が手動でポンプをプログラムする必要性を排除します。輸液の安全性に関する情報をEpic EMRに送り返し、投与ミスのリスクを低減し、EMRに正確な輸液記録を提供します。

2022年11月、Medtronic plcは米国でMedtronic Extended輸液セットを発売すると発表しました。これは、最大7日間の装着が可能な、最初で唯一の輸液セットです。輸液セットは、インスリンポンプから体内にインスリンを供給するチューブで、通常2~3日ごとに交換する必要があります。

2022年5月、フレゼニウス・カビはIvenixとその先進的な輸液ポンプ技術を買収し、先進的な輸液ポンプとヘルスケア専門家向けのソリューションのポートフォリオを拡大し、ケアの連続体全体のヘルスケアニーズに対応しています。フレゼニウス・カビはまた、米国における輸液療法のポートフォリオを急速に拡大し、ノースカロライナ州の製造拠点が米国の顧客に輸液を供給するための資格を取得することを見越して、複数の輸液についてFDAの承認を取得したと発表しました。

2022年3月、フレゼニウス・カビはワイヤレス輸液システム「アジリア・コネクト・インフュージョン・システム」のFDAによる510(k)認可を取得しました。このシステムにはAgilia容量ポンプとAgiliaシリンジポンプが含まれ、Vigilant Software Suite-Vigilant Master Med技術が搭載されています。両ポンプは、2021年にAAMI(Association for the Advancement of Medical Instrumentation)が策定したTIR101規格に従って承認された最初のものです。

製品承認、上市、戦略的提携の急増は、輸液デバイス市場に将来的に有利な機会を創出する可能性が高いです。

エンドユーザー別の洞察

北米の輸液デバイス市場は、エンドユーザー別に、病院・専門クリニック、在宅医療、外来手術センター、その他に分類されます。2023年は、病院と専門クリニックのセグメントが市場を独占しました。2023~2031年のCAGRは、在宅医療部門が最も高いと予測されています。病院や診療所は、患者が診断を受け、治療オプションや代替手段を選択するための主要な接点です。病院や診療所のインフラは、高度な医療機器へのアクセスが可能であるため、どのような疾病状態にある患者にも質の高い治療を提供することができます。病院・診療所セグメントは、新興諸国や先進国の患者の大多数が健康関連の問題で病院を訪れることを好むため、かなりの市場シェアを占めると予測されています。

輸液ポンプは、精密さ、正確さ、使いやすさといったポンプが提供するその他の利点により、病院や診療所で大規模に使用されています。ポンプは、化学療法、疼痛管理、糖尿病管理などの用途に使用することができ、これらの用途は、患者の長期入院や短期入院の主な理由となっています。

ウェルスパンヘルスとBDのケアフュージョンは共同で、ウェルスパンの4病院すべてにアラリスシステムを導入することを発表しました。ウェルスパンヨーク病院は、新しい輸液デバイスと電子カルテ・輸液デバイス間の双方向の相互運用性で本稼働を開始した最初の病院です。

したがって、輸液ポンプの利点と複数の用途が、北米の病院・診療所セグメントの輸液デバイス市場の成長を後押ししています。

用途別では、糖尿病、腫瘍、疼痛管理、血液、小児科、消化器内科、その他に区分されます。 糖尿病セグメントは2023年に市場で最大のシェアを占め、2023~2031年の間に市場で最も高いCAGRを記録すると予測されています。

エンドユーザー別に見ると、北米の輸液デバイス市場は、病院・専門クリニック、在宅医療環境、外来手術センター、その他に分けられます。2023年は、病院・専門クリニックセグメントが市場を独占しました。2023~2031年のCAGRは、在宅医療セグメントが最も高いと予測されています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 北米の輸液デバイス市場情勢

- PEST分析

- 米国における輸液ポンプの主流システムの概要

- シリンジ輸液ポンプ

- 容積式輸液ポンプ

- 輸液ポンプの売れ筋と型番一覧

第5章 北米の輸液デバイス市場:主要市場力学

- 北米の輸液デバイス市場:主要市場力学

- 市場促進要因

- がんの有病率の増加

- 高齢者人口の拡大

- 市場抑制要因

- 輸液デバイスの頻繁な製品回収

- 市場機会

- 市場企業の戦略的取り組み

- 今後の動向

- 高まる技術進歩

- 促進要因と抑制要因の影響

第6章 北米の輸液デバイス市場分析

- 北米の輸液デバイス市場の売上実績(2021年~2031年)

- 北米の輸液デバイス市場の予測・分析

第7章 北米の輸液デバイス市場分析-製品タイプ別

- 輸液ポンプ

- 輸液セット

第8章 北米の輸液デバイス市場分析-用途別

- 糖尿病

- 腫瘍

- 疼痛管理

- 血液

- 小児科

- 消化器内科

- その他

第9章 北米の輸液デバイス市場分析-エンドユーザー別

- 病院・専門クリニック

- 在宅医療環境

- 外来手術センター

- その他

第10章 北米の輸液デバイス市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 北米の輸液デバイス市場:業界情勢

- 北米の輸液デバイス市場の成長戦略

- 有機的成長戦略

- 無機的成長戦略

- 企業のポジショニング

第12章 企業プロファイル

- Becton Dickinson and Co

- Fresenius Kabi AG

- B Braun SE

- CODAN US Corp

- Baxter International Inc

- Elimedical Inc

- ICU Medical Inc

- BPL Medical Technologies Pvt Ltd

- Nipro Corp

- KD Scientific Inc

- Medtronic Plc

- Zimed Healthcare Ltd

- Terumo Corp

- Eitan Medical Ltd

- Polymedicure

- Moog Inc

第13章 付録

List Of Tables

- Table 1. North America Infusion Devices Market Segmentation

- Table 2. North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Table 3. North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

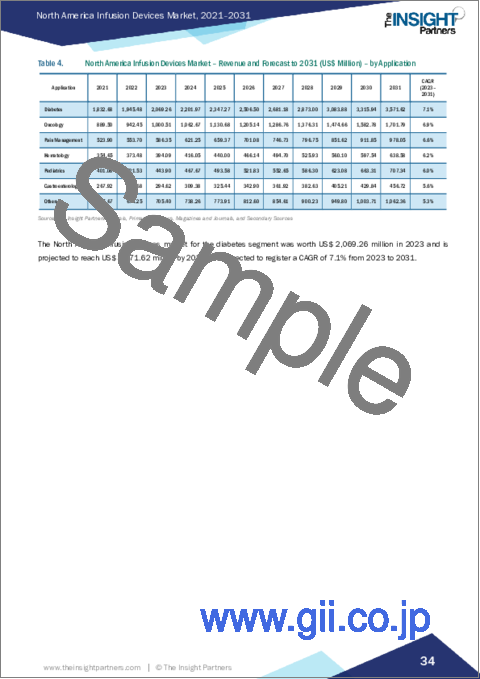

- Table 4. North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 5. North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 6. North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 7. United States: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 8. United States: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Infusion Pumps

- Table 9. United States: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Infusion Sets

- Table 10. United States: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 11. United States: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 12. Canada: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 13. Canada: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Infusion Pumps

- Table 14. Canada: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Infusion Sets

- Table 15. Canada: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 16. Canada: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 17. Mexico: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 18. Mexico: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Infusion Pumps

- Table 19. Mexico: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Infusion Sets

- Table 20. Mexico: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 21. Mexico: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 22. Recent Organic Growth Strategies in North America Infusion Devices Market

- Table 23. Recent Inorganic Growth Strategies in the North America Infusion Devices Market

- Table 24. Glossary of Terms, North America Infusion Devices Market

List Of Figures

- Figure 1. North America Infusion Devices Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Estimated Number of New Cancer Cases, US, 2024

- Figure 4. Statistics of Incidence of Cancer at Glance, Canada, 2022

- Figure 5. Impact Analysis of Drivers and Restraints

- Figure 6. North America Infusion Devices Market Revenue (US$ Million), 2021-2031

- Figure 7. North America Infusion Devices Market Share (%) - by Product Type, 2023 and 2031

- Figure 8. Infusion Pumps: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Infusion Sets: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 10. North America Infusion Devices Market Share (%) - by Application, 2023 and 2031

- Figure 11. Diabetes: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Oncology: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Pain Management: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Hematology: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Pediatrics: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Gastroenterology: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 18. North America Infusion Devices Market Share (%) - by End User, 2023 and 2031

- Figure 19. Hospitals and Specialty Clinics: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Homecare Settings: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Ambulatory Surgical Centers: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Others: North America Infusion Devices Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 23. North America Infusion Devices Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 24. United States: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Canada: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Mexico: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Growth Strategies in North America Infusion Devices Market

The North America infusion devices market size is projected to reach US$ 9,116.47 million by 2031 from US$ 5,494.15 million in 2023. The market is expected to register a CAGR of 6.5% during 2023-2031.

According to the US Census Bureau, the number of Americans aged 65 and above is expected to rise from 58 million in 2022 to 82 million by 2050, which is a 47% increase. Additionally, the share of the total population for the 65-and-older age group is projected to rise from 17% to 23%. According to Statistics Canada, in 2022, almost ~18.8% of Canadians were aged 65 years. Almost 20% of the Canadian population is aged 65 years and above. Furthermore, population projections suggest that 21% to 29% of Canadians could be aged 65 or above by 2068.

A few key benefits of infusion therapy administered in senior populations are listed below.

Rehydration and electrolyte balance: Dehydration can be a higher risk for seniors due to factors such as decreased thirst, certain medications, and changes in kidney function. IV fluids can help seniors maintain the necessary hydration and electrolyte levels for overall health.

Nutrition support and improvement: Aging makes it harder for human bodies to consume the right nutrients, increasing the risk of chronic illnesses. Infusion therapy provides a direct way for seniors to get essential minerals, vitamins, and amino acids efficiently.

Immune function reinforcement: Immune systems of elderly people may need extra support, as they are more vulnerable to infections. Infusion therapy can deliver immune-boosting nutrients such as vitamin C, zinc, and glutathione directly to the body.

Pain management: Many seniors deal with chronic pain daily, affecting their quality of life. Infusion therapy can quickly and effectively manage pain by delivering medication directly into the bloodstream, providing relief and reducing inflammation.

Thus, the increasing geriatric population drives the demand for infusion devices across North America.

Strategic Initiatives by Market Players

Various market players focus on strategic developments such as product launches, mergers, acquisitions, and collaborations to develop advanced products that help ease the treatment of chronic disorders such as diabetes, cancer, chronic pain among others. Following are a few recent developments in the North America infusion devices market.

In April 2024, Mackenzie Health launched a technology in Canada that allows for two-way information flow between an intravenous (IV) medication pump and a patient's electronic medical record. The technology, known as BD Alaris EMR Interoperability, eliminates the need for healthcare professionals to manually program pumps. It sends infusion safety information back to Epic EMR, reducing the risk of administration errors and providing an accurate infusion record in the EMR.

In November 2022, Medtronic plc announced the launch of Medtronic Extended infusion set in the US. It is the first and only infusion set labeled for up to seven-day wear. An infusion set is tubing that delivers insulin from an insulin pump to the body and usually needs to be changed every two to three days.

In May 2022, Fresenius Kabi acquired Ivenix and its advanced infusion pump technology, expanding its portfolio of advanced infusion pumps and solutions for healthcare professionals to address healthcare needs across the care continuum. Fresenius Kabi also announced that it has rapidly expanded its infusion therapy portfolio in the US, obtaining FDA approvals for multiple IV solutions in anticipation of qualifying its North Carolina manufacturing site to supply the US customers with IV solutions.

In March 2022, Fresenius Kabi received 510(k) regulatory clearance from the FDA for its wireless Agilia Connect Infusion System. The system includes the Agilia Volumetric Pump and the Agilia Syringe Pump with Vigilant Software Suite-Vigilant Master Med technology. Both pumps are the first to be cleared following TIR101 standards, which were developed by the Association for the Advancement of Medical Instrumentation (AAMI) in 2021.

An upsurge in the number of product approvals, launches, and strategic collaborations is likely to create lucrative opportunities for the infusion devices market in the future.

End User-Based Insights

Based on end user, the North America infusion devices market is divided into hospitals and specialty clinics, homecare settings, ambulatory surgical centers, and others. The hospitals and specialty clinics segment dominated the market in 2023. The homecare settings segment is anticipated to register the highest CAGR during 2023-2031. Hospitals and clinics are primary contact points for patients to get their diagnosis done and opt for treatment options and alternatives. Available infrastructure in hospitals and clinics can provide high-quality care for patients suffering from any disease condition as they have access to advanced medical devices. The hospitals and clinics segment is projected to hold a considerable market share as a majority of patients in emerging nations and developed countries prefer visiting hospitals for health-related problems.

Infusion pumps are being used on a large scale in hospitals and clinics, owing to the additional benefits offered by the pumps such as precision, accuracy, and ease of use. The pumps can be used for applications such as chemotherapy, pain management, and diabetes management, which are the major reasons for patients being admitted for longer and shorter duration.

WellSpan Health and CareFusion, a BD company, jointly announced the implementation of the Alaris System across all four WellSpan hospitals. WellSpan York Hospital is the first hospital to go live with new infusion devices and bi-directional interoperability between the electronic health record and infusion device.

Hence, the benefits and the multiple applications of infusion pumps fuel the North America infusion devices market growth for the hospitals and clinics segment.

By application, the market is segmented into diabetes, oncology, pain management, hematology, pediatrics, gastroenterology, and others. The diabetes segment held the largest share of the market in 2023, and it is projected to register the highest CAGR in the market during 2023-2031.

Based on end user, the North America infusion devices market is divided into hospitals and specialty clinics, homecare settings, ambulatory surgical centers, and others. The hospitals and specialty clinics segment dominated the market in 2023. The homecare settings segment is anticipated to register the highest CAGR during 2023-2031.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Infusion Devices Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Overview of Mainstream System for infusion Pumps by US

- 4.3.1 Syringe Infusion Pumps:

- 4.3.2 Volumetric Infusion Pumps:

- 4.4 List of Best-Selling infusion Pumps along with the Model Number

5. North America Infusion Devices Market - Key Market Dynamics

- 5.1 North America Infusion Devices Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Prevalence of Cancer

- 5.2.2 Growing Geriatric Population

- 5.3 Market Restraints

- 5.3.1 Frequent Product Recalls of Infusion Devices

- 5.4 Market Opportunities

- 5.4.1 Strategic Initiatives by Market Players

- 5.5 Future Trends

- 5.5.1 Growing Technological Advancements

- 5.6 Impact of Drivers and Restraints:

6. North America Infusion Devices Market Analysis

- 6.1 North America Infusion Devices Market Revenue (US$ Million), 2021-2031

- 6.2 North America Infusion Devices Market Forecast and Analysis

7. North America Infusion Devices Market Analysis - by Product Type

- 7.1 Infusion Pumps

- 7.1.1 Overview

- 7.1.2 Infusion Pumps: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Infusion Sets

- 7.2.1 Overview

- 7.2.2 Infusion Sets: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Infusion Devices Market Analysis - by Application

- 8.1 Diabetes

- 8.1.1 Overview

- 8.1.2 Diabetes: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Oncology

- 8.2.1 Overview

- 8.2.2 Oncology: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Pain Management

- 8.3.1 Overview

- 8.3.2 Pain Management: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Hematology

- 8.4.1 Overview

- 8.4.2 Hematology: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Pediatrics

- 8.5.1 Overview

- 8.5.2 Pediatrics: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Gastroenterology

- 8.6.1 Overview

- 8.6.2 Gastroenterology: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Infusion Devices Market Analysis - by End User

- 9.1 Hospitals and Specialty Clinics

- 9.1.1 Overview

- 9.1.2 Hospitals and Specialty Clinics: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Homecare Settings

- 9.2.1 Overview

- 9.2.2 Homecare Settings: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Ambulatory Surgical Centers

- 9.3.1 Overview

- 9.3.2 Ambulatory Surgical Centers: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Infusion Devices Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Infusion Devices Market Breakdown by Countries

- 10.1.2 North America Infusion Devices Market Revenue and Forecast and Analysis - by Country

- 10.1.2.1 North America Infusion Devices Market Revenue and Forecast and Analysis - by Country

- 10.1.2.2 United States: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.2.1 United States: North America Infusion Devices Market Breakdown by Product Type

- 10.1.2.2.2 United States: North America Infusion Devices Market Breakdown by Infusion Pumps

- 10.1.2.2.3 United States: North America Infusion Devices Market Breakdown by Infusion Sets

- 10.1.2.2.4 United States: North America Infusion Devices Market Breakdown by Application

- 10.1.2.2.5 United States: North America Infusion Devices Market Breakdown by End User

- 10.1.2.3 Canada: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.3.1 Canada: North America Infusion Devices Market Breakdown by Product Type

- 10.1.2.3.2 Canada: North America Infusion Devices Market Breakdown by Infusion Pumps

- 10.1.2.3.3 Canada: North America Infusion Devices Market Breakdown by Infusion Sets

- 10.1.2.3.4 Canada: North America Infusion Devices Market Breakdown by Application

- 10.1.2.3.5 Canada: North America Infusion Devices Market Breakdown by End User

- 10.1.2.4 Mexico: North America Infusion Devices Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.4.1 Mexico: North America Infusion Devices Market Breakdown by Product Type

- 10.1.2.4.2 Mexico: North America Infusion Devices Market Breakdown by Infusion Pumps

- 10.1.2.4.3 Mexico: North America Infusion Devices Market Breakdown by Infusion Sets

- 10.1.2.4.4 Mexico: North America Infusion Devices Market Breakdown by Application

- 10.1.2.4.5 Mexico: North America Infusion Devices Market Breakdown by End User

11. North America Infusion Devices Market - Industry Landscape

- 11.1 Overview

- 11.2 Growth Strategies in North America Infusion Devices Market

- 11.3 Organic Growth Strategies

- 11.3.1 Overview

- 11.4 Inorganic Growth Strategies

- 11.4.1 Overview

- 11.5 Company Positioning:

12. Company Profiles

- 12.1 Becton Dickinson and Co

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Fresenius Kabi AG

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 B Braun SE

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 CODAN US Corp

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Baxter International Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Elimedical Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 ICU Medical Inc

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 BPL Medical Technologies Pvt Ltd

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Nipro Corp

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 KD Scientific Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

- 12.11 Medtronic Plc

- 12.11.1 Key Facts

- 12.11.2 Business Description

- 12.11.3 Products and Services

- 12.11.4 Financial Overview

- 12.11.5 SWOT Analysis

- 12.11.6 Key Developments

- 12.12 Zimed Healthcare Ltd

- 12.12.1 Key Facts

- 12.12.2 Business Description

- 12.12.3 Products and Services

- 12.12.4 Financial Overview

- 12.12.5 SWOT Analysis

- 12.12.6 Key Developments

- 12.13 Terumo Corp

- 12.13.1 Key Facts

- 12.13.2 Business Description

- 12.13.3 Products and Services

- 12.13.4 Financial Overview

- 12.13.5 SWOT Analysis

- 12.13.6 Key Developments

- 12.14 Eitan Medical Ltd

- 12.14.1 Key Facts

- 12.14.2 Business Description

- 12.14.3 Products and Services

- 12.14.4 Financial Overview

- 12.14.5 SWOT Analysis

- 12.14.6 Key Developments

- 12.15 Polymedicure

- 12.15.1 Key Facts

- 12.15.2 Business Description

- 12.15.3 Products and Services

- 12.15.4 Financial Overview

- 12.15.5 SWOT Analysis

- 12.15.6 Key Developments

- 12.16 Moog Inc

- 12.16.1 Key Facts

- 12.16.2 Business Description

- 12.16.3 Products and Services

- 12.16.4 Financial Overview

- 12.16.5 SWOT Analysis

- 12.16.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners

- 13.2 Glossary of Terms