|

|

市場調査レポート

商品コード

1558386

北米の仮想パイプライン設備の市場規模・予測、国別シェア、動向、成長機会分析:タイプ別、ガス別、用途別、国別North America Virtual Pipeline Equipment Market Size and Forecast, Country Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type, Gas, and Application, and Country |

||||||

|

|||||||

| 北米の仮想パイプライン設備の市場規模・予測、国別シェア、動向、成長機会分析:タイプ別、ガス別、用途別、国別 |

|

出版日: 2024年08月13日

発行: The Insight Partners

ページ情報: 英文 112 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の仮想パイプライン設備の市場規模は、2023年の4億6,334万米ドルから2031年には8億6,792万米ドルに達すると予測されています。同市場は2023~2031年の間にCAGR8.2%を記録すると予測されています。

北米の仮想パイプライン設備市場は、タイプ、ガス、用途に区分されます。タイプでは、市場は減圧ユニット、圧縮ユニット、輸送ユニット、ディスペンシングユニットに分けられます。ガス別では、CNG、水素、RNG、その他に分類されます。用途別では、ユーティリティパイプライン/パイプライン補修、産業、輸送、商業・住宅、フラッキングに分けられます。

Chesapeake Utilities Corp、Stabilis Solutions Inc、Algas-SDI International LLC、ANGI Energy Systems LLC、Broadwind Inc、Cobey Inc、Cryopeak LNG Solutions Corp、Galileo Technologies SA、Quantum Fuel Systems LLC、Hexagon Composites ASA、Kinder Morgan Inc、Xpress Natural Gas, LLC、Aggreko Ltd、Fiba Technologies Inc、CMD Alternative Energy Solutions、Plum Gas Solutions LLC、Chart Industries Incなどが北米の仮想パイプライン設備市場を運営する主要企業です。

米国エネルギー情報局のAnnual Energy Outlook 2023によると、米国におけるあらゆる形態のエネルギー消費は、人口急増と経済成長により、2022年~2050年の間に0~15%まで増加すると予測されています。米国のエネルギー部門は、産業、運輸、住宅、商業の4つの最終用途部門に大別されます。産業部門におけるエネルギー消費は、2022年~2050年に5~32%増加すると予想されています。運輸部門では、エネルギー消費量は2022年~2050年の間に10%減少するか、8%増加すると予想されています。経済成長予測は両部門に大きな影響を与えます。経済が拡大すれば、より多くのエネルギーが消費されます。そのため、さまざまな市場関係者が石油・ガスを供給するために、仮想パイプライン設備プロバイダーに手を伸ばしています。例えば、2022年5月、総合代替エネルギー企業であるクァンタム・フュエル・システムズ(クァンタム)は、Certarus Ltd.(以下Certarus)から、総額2,200万米ドルの業界最高水準の天然ガス用仮想パイプライントレーラーを受注しました。トレーラーは2022年第3四半期と第4四半期に納入されました。

ガス別では、北米の仮想パイプライン設備市場はCNG、水素、RNG、その他に区分されます。2023年の北米の仮想パイプライン設備市場では、CNGセグメントが最大のシェアを占めています。水素ガスは仮想パイプライン設備を通じて輸送できます。既存のパイプラインを通じて気体水素を輸送することは、大量の水素を供給するための低コストなオプションです。さらに、純水素を供給する水素輸送インフラを急速に拡大するには、天然ガスインフラの強化が必要です。世界は脱炭素化に注力しており、それが水素の生産と供給への投資と集中につながっています。水素の継続的な研究開発と、水素燃料電池車などの用途のための水素需要の増加は、今後数年間における水素の取引活動の増加の機会を生み出すと思われます。この要因は、水素輸送のための仮想パイプライン設備に対する需要を生み出します。北米の仮想パイプライン設備市場は、同地域が水素生産のリーダー的存在であることから成長を遂げています。Invest in Canadaによると、カナダは世界でも有数のクリーンな水素施設を有しており、世界の水素生産国トップ10に入っています。水素生産への投資の増加は、予測期間中、同セグメントに大きな機会をもたらすと思われます。水素を最終消費者に供給するために、仮想パイプライン設備に対する需要が高まると思われます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

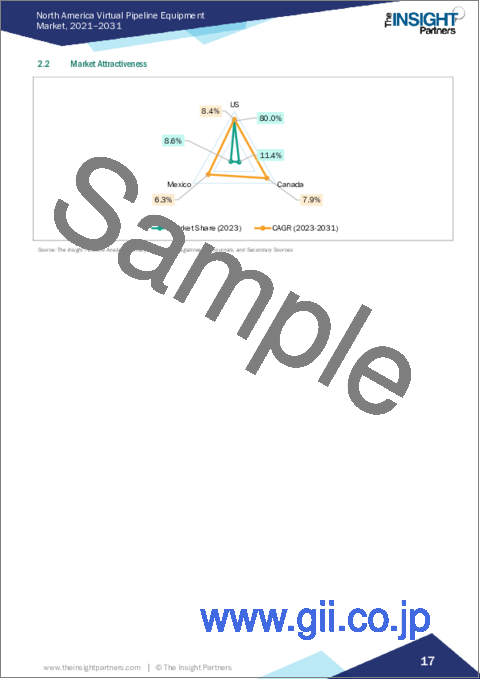

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 北米の仮想パイプライン設備市場情勢

- PEST分析

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の仮想パイプライン設備市場:主要市場力学

- 北米の仮想パイプライン設備市場:主要市場力学

- 市場促進要因

- エネルギー需要の増加

- シェールガス探査・採掘プロジェクトの増加

- 市場抑制要因

- 従来型パイプラインインフラの大幅な優位性

- 市場機会

- 天然ガス消費への傾斜の高まり

- 今後の動向

- 仮想パイプライン技術の進展

- 促進要因と抑制要因の影響

第6章 北米の仮想パイプライン設備市場分析

- 北米の仮想パイプライン設備市場の売上実績(2021年~2031年)

- 北米の仮想パイプライン設備市場の予測と分析

第7章 北米の仮想パイプライン設備市場分析:タイプ別

- 減圧ユニット

- 圧縮ユニット

- 輸送ユニット

- ディスペンシングユニット

第8章 北米の仮想パイプライン設備市場分析:ガス別

- CNGガス

- 水素

- RNG

- その他

第9章 北米の仮想パイプライン設備市場分析:用途別

- ユーティリティパイプライン/パイプライン補修

- 産業

- 輸送

- 商業・住宅

- フラッキング

第10章 北米の仮想パイプライン設備市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場への取り組み

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Chesapeake Utilities Corp

- Stabilis Solutions Inc

- Algas-SDI International LLC

- ANGI Energy Systems LLC

- Broadwind Inc

- Cobey Inc

- Cryopeak LNG Solutions Corp

- Galileo Technologies SA

- Quantum Fuel Systems LLC.

- Hexagon Composites ASA

- Kinder Morgan Inc

- Xpress Natural Gas, LLC

- Aggreko Ltd

- Fiba Technologies Inc

- CMD Alternative Energy Solutions

- Plum Gas Solutions LLC

- Chart Industries Inc

第14章 付録

List Of Tables

- Table 1. North America Virtual Pipeline Equipment Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 5. North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Gas

- Table 6. North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 7. North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 8. United States: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 9. United States: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Gas

- Table 10. United States: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 11. Canada: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 12. Canada: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Gas

- Table 13. Canada: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 14. Mexico: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 15. Mexico: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Gas

- Table 16. Mexico: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million) - by Application

List Of Figures

- Figure 1. North America Virtual Pipeline Equipment Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Virtual Pipeline Equipment Market - Ecosystem Analysis

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. North America Virtual Pipeline Equipment Market Revenue (US$ Million), 2021-2031

- Figure 6. North America Virtual Pipeline Equipment Market Share (%) - by Type, 2023 and 2031

- Figure 7. Decompression Units: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Compression Units: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Transportation Units: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Dispensing Units: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 11. North America Virtual Pipeline Equipment Market Share (%) - by Gas, 2023 and 2031

- Figure 12. CNG: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Hydrogen: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 14. RNG: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Others: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 16. North America Virtual Pipeline Equipment Market Share (%) - by Application, 2023 and 2031

- Figure 17. Utility Pipeline/Pipeline Repair: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Industrial: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Transportation: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Commercial and Residential: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Fracking: North America Virtual Pipeline Equipment Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 22. North America Virtual Pipeline Equipment Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 23. United States: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Canada: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Mexico: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Company Positioning and Concentration

The North America virtual pipeline equipment market size is projected to reach US$ 867.92 million by 2031 from US$ 463.34 million in 2023. The market is expected to register a CAGR of 8.2% during 2023-2031.

The North America virtual pipeline equipment market is segmented into equipment type, gas, and application. Based on equipment type, the market is divided into decompression units, compression units, transportation units, and dispensing units. In terms of gas, the market is categorized into CNG, hydrogen, RNG, and others. By application, the market is divided into utility pipeline/pipeline repair, industrial, transportation, commercial & residential, and fracking.

Chesapeake Utilities Corp, Stabilis Solutions Inc, Algas-SDI International LLC, ANGI Energy Systems LLC, Broadwind Inc, Cobey Inc, Cryopeak LNG Solutions Corp, Galileo Technologies SA, Quantum Fuel Systems LLC, Hexagon Composites ASA, Kinder Morgan Inc, Xpress Natural Gas, LLC, Aggreko Ltd, Fiba Technologies Inc, CMD Alternative Energy Solutions, Plum Gas Solutions LLC, and Chart Industries Inc are among the key players operating the North America virtual pipeline equipment market.

According to the US Energy Information Administration Annual Energy Outlook 2023, all forms of energy consumption in the US are projected to increase from 0% to 15% between 2022 and 2050 due to population outbursts and economic growth. The energy sector in the US is majorly divided into four major end-use sectors-industrial, transportation, residential, and commercial. Energy consumption in the industrial sector is expected to rise by 5% to 32% from 2022 to 2050. In the transportation sector, energy consumption is expected to fall by 10% between 2022 and 2050 or increase by 8%. Economic growth projections heavily influence both sectors; as the economy expands, more energy is consumed. Therefore, various market players are reaching out to virtual pipeline equipment providers to deliver oil and gas. For example, in May 2022, Quantum Fuel Systems (Quantum), a fully integrated alternative energy company, was selected by Certarus Ltd. ("Certarus") to deliver industry-leading virtual pipeline trailers for natural gas with a total value of ~US$ 22 million. The trailers were delivered in Q3 and Q4 2022.

Based on gas, the North America virtual pipeline equipment market has been segmented into CNG, hydrogen, RNG, and others. The CNG segment held the largest share in the North America virtual pipeline equipment market in 2023. Hydrogen gas can be transported through a virtual pipeline equipment. Transporting gaseous hydrogen through existing pipelines is a low-cost option to deliver large volumes of hydrogen. Further, rapidly expanding hydrogen delivery infrastructure to deliver pure hydrogen requires the reinforcement of natural gas infrastructure. The world is focused on decarbonization, which has led to the investment and focus on the production and supply of hydrogen. The continuous R&D in hydrogen and the rise in demand for hydrogen for applications such as hydrogen fuel cell vehicles would create opportunities for the increased trading activities of hydrogen in the coming years. This factor generates the demand for virtual pipeline equipment for the transportation of hydrogen. The North America virtual pipeline equipment market is experiencing growth as the region is one of the leaders in hydrogen production. According to Invest in Canada, Canada has one of the clean hydrogen facilities across the world, and the country is among the top 10 hydrogen producers worldwide. Increasing investments in hydrogen production is likely to create substantial opportunity for the segment during the forecast period. As to deliver the hydrogen to end consumers, there will be substantial demand for virtual pipeline equipment.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Virtual Pipeline Equipment Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Vendors in the Value Chain

5. North America Virtual Pipeline Equipment Market - Key Market Dynamics

- 5.1 North America Virtual Pipeline Equipment Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Energy Demand

- 5.2.2 Rising Shale Gas Exploration and Extraction Projects

- 5.3 Market Restraints

- 5.3.1 Significant Dominance of Conventional Pipeline Infrastructure

- 5.4 Market Opportunities

- 5.4.1 Growing Inclination Toward Natural Gas Consumption

- 5.5 Future Trends

- 5.5.1 Growing Advancements in Virtual Pipeline Technologies

- 5.6 Impact of Drivers and Restraints:

6. North America Virtual Pipeline Equipment Market Analysis

- 6.1 Overview

- 6.2 North America Virtual Pipeline Equipment Market Revenue (US$ Million), 2021-2031

- 6.3 North America Virtual Pipeline Equipment Market Forecast and Analysis

7. North America Virtual Pipeline Equipment Market Analysis - by Type

- 7.1 Decompression Units

- 7.1.1 Overview

- 7.1.2 Decompression Units: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Compression Units

- 7.2.1 Overview

- 7.2.2 Compression Units: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Transportation Units

- 7.3.1 Overview

- 7.3.2 Transportation Units: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Dispensing Units

- 7.4.1 Overview

- 7.4.2 Dispensing Units: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Virtual Pipeline Equipment Market Analysis - by Gas

- 8.1 CNG

- 8.1.1 Overview

- 8.1.2 CNG: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Hydrogen

- 8.2.1 Overview

- 8.2.2 Hydrogen: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 RNG

- 8.3.1 Overview

- 8.3.2 RNG: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Virtual Pipeline Equipment Market Analysis by Application

- 9.1 Utility Pipeline/Pipeline Repair

- 9.1.1 Overview

- 9.1.2 Utility Pipeline/Pipeline Repair: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Industrial

- 9.2.1 Overview

- 9.2.2 Industrial: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Transportation

- 9.3.1 Overview

- 9.3.2 Transportation: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Commercial and Residential

- 9.4.1 Overview

- 9.4.2 Commercial and Residential: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Fracking

- 9.5.1 Overview

- 9.5.2 Fracking: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Virtual Pipeline Equipment Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Virtual Pipeline Equipment Market Revenue and Forecast and Analysis - by Country

- 10.1.1.1 North America Virtual Pipeline Equipment Market Revenue and Forecast and Analysis - by Country

- 10.1.1.2 United States: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.2.1 United States: North America Virtual Pipeline Equipment Market Breakdown by Type

- 10.1.1.2.2 United States: North America Virtual Pipeline Equipment Market Breakdown by Gas

- 10.1.1.2.3 United States: North America Virtual Pipeline Equipment Market Breakdown by Application

- 10.1.1.3 Canada: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.3.1 Canada: North America Virtual Pipeline Equipment Market Breakdown by Type

- 10.1.1.3.2 Canada: North America Virtual Pipeline Equipment Market Breakdown by Gas

- 10.1.1.3.3 Canada: North America Virtual Pipeline Equipment Market Breakdown by Application

- 10.1.1.4 Mexico: North America Virtual Pipeline Equipment Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.1.4.1 Mexico: North America Virtual Pipeline Equipment Market Breakdown by Type

- 10.1.1.4.2 Mexico: North America Virtual Pipeline Equipment Market Breakdown by Gas

- 10.1.1.4.3 Mexico: North America Virtual Pipeline Equipment Market Breakdown by Application

- 10.1.1 North America Virtual Pipeline Equipment Market Revenue and Forecast and Analysis - by Country

11. Competitive Landscape

- 11.1 Company Positioning and Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Chesapeake Utilities Corp

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Stabilis Solutions Inc

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Algas-SDI International LLC

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 ANGI Energy Systems LLC

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Broadwind Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Cobey Inc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Cryopeak LNG Solutions Corp

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Galileo Technologies SA

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Quantum Fuel Systems LLC.

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Hexagon Composites ASA

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Kinder Morgan Inc

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 Xpress Natural Gas, LLC

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Aggreko Ltd

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 Fiba Technologies Inc

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 CMD Alternative Energy Solutions

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

- 13.16 Plum Gas Solutions LLC

- 13.16.1 Key Facts

- 13.16.2 Business Description

- 13.16.3 Products and Services

- 13.16.4 Financial Overview

- 13.16.5 SWOT Analysis

- 13.16.6 Key Developments

- 13.17 Chart Industries Inc

- 13.17.1 Key Facts

- 13.17.2 Business Description

- 13.17.3 Products and Services

- 13.17.4 Financial Overview

- 13.17.5 SWOT Analysis

- 13.17.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners