|

|

市場調査レポート

商品コード

1535281

静止衛星市場:規模・予測、世界・地域シェア、動向、成長機会分析レポート:コンポーネント別、用途別、地域別Geostationary Satellites Market Size and Forecast, Global and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component, Application, and Geography |

||||||

|

|||||||

| 静止衛星市場:規模・予測、世界・地域シェア、動向、成長機会分析レポート:コンポーネント別、用途別、地域別 |

|

出版日: 2024年07月22日

発行: The Insight Partners

ページ情報: 英文 150 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

静止衛星市場は、2023年の61億9,000万米ドルから2031年には82億8,000万米ドルに達すると予測されており、2023~2031年のCAGRは3.7%と予測されています。

2023年、米国政府の宇宙予算は1,170億米ドルに達し、2022年比で15%の増加を記録しました。この投資のうち590億米ドル近くは、衛星打ち上げを含む防衛費に充てられています。米国が静止衛星市場をリードしているのは、複数の静止衛星システムメーカーが存在感を示していることと、宇宙分野への政府投資によるものです。ムーグ社、ノースロップ・グラマン社、ロッキード・マーチン社、AQSTカナダ社などが北米の静止衛星ソリューションの主要メーカーです。カナダ政府は宇宙分野に多大な投資を行っています。2023年、政府は国内の民間ロケット打ち上げ構想を支援する複数年計画を発表しました。このように、政府による宇宙産業への投資の急増と、宇宙分野における新製品の革新が、北米の静止衛星市場の成長を促進すると予想される要因です。

米国の宇宙部門では、衛星打ち上げに多額の投資が行われています。例えば、2024年1月、米国政府は米国ペンタゴンで100億米ドル相当の衛星コンステレーション賞を立ち上げました。この契約には、静止軌道(GEO)や地球低軌道(LEO)を含む400以上の衛星の打ち上げが含まれています。この契約は、ノースロップ・グラマン、ロッキード・マーチン、L3ハリスなどの大手メーカーが受注しました。2023年の衛星打ち上げでは米国が市場をリードしました。2023年に米国が打上げを試みた衛星109基のうち98基をSpaceX社が独自に打上げ、米国製衛星2234基のうち1937基が軌道投入に成功しました。衛星打上げ数の新興国市場の拡大は、衛星産業における製品開発の活発化とともに、米国の静止衛星市場の進展を後押ししています。2024年1月、静止運用環境衛星U(GOES-U)が米国フロリダで打ち上げ準備が整った。この衛星はNASAと米国海洋大気庁(NOAA)が気象観測と環境監視のためにGOES-Rシリーズに引き続き開発したものです。着陸したGOES-Rシリーズ衛星により、予報担当者は、公共の安全のために、雷雨、山火事、ハリケーン、太陽嵐などの局地的な気象現象を観測、予測、追跡することができます。このように、衛星打ち上げの重視と宇宙分野への政府予算配分の増加が静止衛星市場の成長を後押ししています。

2024年5月、欧州防衛機構は地球静止軌道に自律型ボディガード衛星を打ち上げるために700万米ドルの資金を拠出すると発表しました。地球観測やその他の研究活動のための衛星打ち上げに重点を置く欧州諸国は、静止衛星技術を進歩させる重要なプレーヤーとして台頭してきました。エアバス社やタレス・アレニア・スペース社など、最先端の静止衛星システム開発の専門知識で知られる航空宇宙・宇宙分野の大手企業は、欧州の宇宙分野の主要な貢献企業です。欧州では、新たな衛星を打ち上げるための宇宙研究や地球観測計画がいくつか導入されています。2022年には、欧州の宇宙分野を強化するため、衛星航法、コネクティビティ、地球観測、宇宙研究などの分野に特に重点を置き、~140億米ドルの予算で欧州宇宙計画が発足しました。欧州宇宙計画は、新しい衛星の打ち上げを促進し、それによってこの地域の静止衛星市場に大きなチャンスをもたらすと期待されています。

COPERNICUS(コペルニクス)は、欧州全域の環境管理、気候変動の影響緩和、市民安全保障を支援することを目的とした欧州の地球観測システムです。さらにGALILEOは、輸送、農業、国境管理、捜索救助など、欧州連合(EU)経済のさまざまな分野を支援するために欧州で開始された全地球衛星航法・測位システム(GNSS)です。2022年2月、欧州委員会は、衛星を利用した接続性を高め、宇宙トラフィックを管理するための2つの新たな旗艦イニシアティブを立ち上げました。こうした取り組みと宇宙分野への投資の急増が、欧州の静止衛星市場を後押しする主な要因となっています。

世界の静止衛星市場は、コンポーネント、用途、地域に区分されます。コンポーネント別では、静止衛星市場は通信システム、電力システム、推進システム、その他に区分されます。用途別では、静止衛星市場は通信、宇宙探査、ナビゲーション、地球観測、その他に分類されます。地域別では、静止衛星市場は北米、欧州、アジア太平洋地域、その他の地域に分類されます。

コンポーネント別では、推進システムセグメントは、主要企業や政府組織によるシステムの進歩の増加に伴い、急速なペースで成長しています。例えば、2024年3月、インド宇宙研究機関(ISRO)は、衛星に電気推進システムを使用する実証を計画しています。このシステムは300ミリニュートン(mN)のスラスターで構成されています。先進推進システムの採用拡大が静止衛星市場の成長を牽引します。静止衛星は、地球との間で無線信号を増幅、受信、再送信する中継器を備えています。これらの信号は、放送、通信、リモートセンシング、ナビゲーションなど幅広い用途に使用されます。

静止衛星の最も一般的な用途は、効果的な通信サービスを提供することです。静止衛星は、地球との間で無線信号を受信、増幅、再送信する中継器を備えています。これらの信号は、放送、通信、リモートセンシング、航法など幅広い用途に利用されています。通信分野が2023年に最大のシェアを占めたのは、通信衛星を宇宙に打ち上げるためにいくつかの国の政府機関が投資を増やしているためです。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 静止衛星市場情勢

- ポーターのファイブフォース分析

- エコシステム分析

- 衛星コンポーネントメーカー

- 静止衛星メーカー

- エンドユーザー

- 静止衛星システムプロバイダー一覧

第5章 静止衛星市場:主要市場力学

- 静止衛星市場- 主な市場力学

- 市場促進要因

- 衛星ネットワークによる長距離通信への需要の高まり

- 衛星ベースの軍事通信に対するニーズの高まり

- 市場抑制要因

- 静止衛星の故障事故と受注量の減少

- 市場機会

- 静止軌道向け小型衛星の開発

- 今後の動向

- ソフトウェア定義電気システムの展開

- 促進要因と抑制要因の影響

第6章 静止衛星市場:世界市場分析

- 地理的概観

- 静止衛星市場の売上高、2021年~2031年

- 静止衛星市場の予測分析

第7章 静止衛星市場分析:コンポーネント別

- 通信システム

- 電力システム

- 推進システム

- その他

第8章 静止衛星市場の分析:用途別

- 通信

- 宇宙探査

- ナビゲーション

- 地球観測

- その他

第9章 静止衛星市場:地域別分析

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- アジア太平洋地域のその他諸国

- 世界のその他の地域

- 中東・アフリカ

- 南米

第10章 競合情勢

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 製品開発

第12章 企業プロファイル

- Airbus SE

- The Boeing Co

- Ball Corp

- Korea Aerospace Industries Ltd.

- Lockheed Martin Corp

- Maxar Technologies Inc

- Northrop Grumman Corp

- Thales SA

- Israel Aerospace Industries Ltd

- OHB SE

第13章 付録

List Of Tables

- Table 1. Geostationary Satellites Market Segmentation

- Table 2. List of Vendors in Value Chain

- Table 3. Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million) - by Component

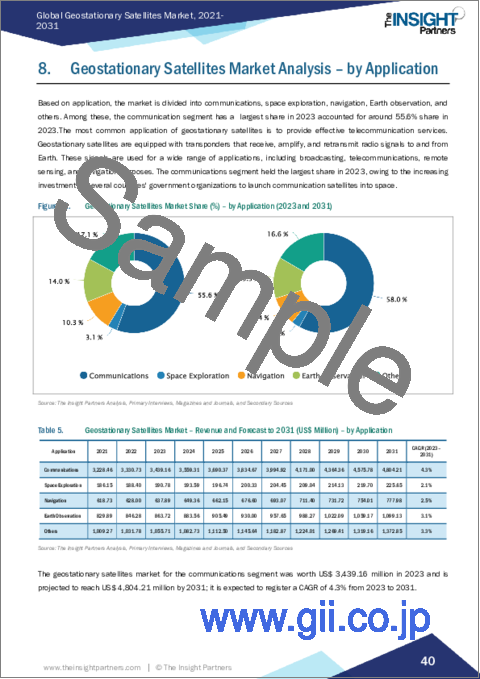

- Table 5. Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million) - by Application

- Table 6. North America: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 7. North America: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 8. North America: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 9. United States: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 10. United States: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 11. Canada: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 12. Canada: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 13. Mexico: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 14. Mexico: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 15. Europe: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 16. Europe: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 17. Europe: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 18. Germany: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 19. Germany: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 20. France: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 21. France: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 22. Italy: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 23. Italy: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 24. United Kingdom: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 25. United Kingdom: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 26. Russia: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 27. Russia: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 28. Rest of Europe: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 29. Rest of Europe: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 30. Asia Pacific: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 31. Asia Pacific: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 32. Asia Pacific: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 33. China: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 34. China: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 35. India: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 36. India: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 37. Japan: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 38. Japan: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 39. South Korea: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 40. South Korea: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 41. Rest of APAC: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 42. Rest of APAC: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 43. Rest of the World: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 44. Rest of the World: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 45. Rest of the World: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Country

- Table 46. Middle East and Africa: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 47. Middle East and Africa: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

- Table 48. South America: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Component

- Table 49. South America: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million) - by Application

List Of Figures

- Figure 1. Geostationary Satellites Market Segmentation, by Geography

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. Geographic Overview

- Figure 5. Geostationary Satellites Market Revenue (US$ Million), 2021-2031

- Figure 6. Geostationary Satellites Market Share (%) - by Component (2023 and 2031)

- Figure 7. Communication System: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Power System: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Propulsion System: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Others: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Geostationary Satellites Market Share (%) - by Application (2023 and 2031)

- Figure 12. Communications: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Space Exploration: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Navigation: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Earth Observation: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Others: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Geostationary Satellites Market Breakdown by Region, 2023 and 2031 (%)

- Figure 18. North America: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 19. North America: Geostationary Satellites Market Breakdown, by Component (2023 and 2031)

- Figure 20. North America: Geostationary Satellites Market Breakdown, by Application (2023 and 2031)

- Figure 21. North America: Geostationary Satellites Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 22. United States: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 23. Canada: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 24. Mexico: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 25. Europe: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 26. Europe: Geostationary Satellites Market Breakdown, by Component (2023 and 2031)

- Figure 27. Europe: Geostationary Satellites Market Breakdown, by Application (2023 and 2031)

- Figure 28. Europe: Geostationary Satellites Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 29. Germany: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 30. France: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 31. Italy: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 32. United Kingdom: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 33. Russia: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 34. Rest of Europe: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 35. Asia Pacific: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 36. Asia Pacific: Geostationary Satellites Market Breakdown, by Component (2023 and 2031)

- Figure 37. Asia Pacific: Geostationary Satellites Market Breakdown, by Application (2023 and 2031)

- Figure 38. Asia Pacific: Geostationary Satellites Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 39. China: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 40. India: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 41. Japan: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 42. South Korea: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 43. Rest of APAC: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 44. Rest of the World: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 45. Rest of the World: Geostationary Satellites Market Breakdown, by Component (2023 and 2031)

- Figure 46. Rest of the World: Geostationary Satellites Market Breakdown, by Application (2023 and 2031)

- Figure 47. Rest of the World: Geostationary Satellites Market Breakdown, by Key Countries, 2023 and 2031 (%)

- Figure 48. Middle East and Africa: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 49. South America: Geostationary Satellites Market - Revenue and Forecast to 2031(US$ Million)

- Figure 50. Company Positioning & Concentration

The geostationary satellites market is projected to reach US$ 8.28 billion by 2031 from US$ 6.19 billion in 2023; the market is expected to register a CAGR of 3.7% during 2023-2031.

In 2023, the US government's space budget reached ~US$ 117 billion, recording an upsurge of 15% compared to 2022. Nearly US$ 59 billion of this investment was made in defense expenditures, including satellite launches. The US leads the geostationary satellite market owing to the prominent presence of several geostationary satellite system manufacturers and government investments in the space sector. Moog Inc., Northrop Grumman Corporation, Lockheed Martin, and AQST Canada Inc. are among the major manufacturers of geostationary satellite solutions in North America. The Government of Canada invests significant resources in the space sector. In 2023, the government announced a multi-year plan to support the privately built rocket launching initiatives in the country. Thus, a surge in investments by governments in the space industry and new product innovations in the space sector are the factors anticipated to propel the geostationary satellite market growth in North America.

The space sector in the US has witnessed significant investments in satellite launches. For instance, in January 2024, the US government launched a satellite constellation award worth US$ 10 billion in the Pentagon, US. The scope of this award includes the launch of more than 400 satellites in space, including the geostationary orbit (GEO) as well as lower earth orbit (LEO). This contract was awarded to some of the major manufacturers, including Northrop Grumman, Lockheed Martin, and L3Harris. The US led the market in terms of satellite launches in 2023. SpaceX independently launched 98 of the 109 satellite launch attempts made by the US in 2023, and 1,937 of the 2,234 US-built satellites were successfully orbited. The growing number of satellite launches, along with a rise in product development in the satellite industry, is fueling the geostationary satellite market progress in the US. In January 2024, the Geostationary Operational Environmental Satellite U (GOES-U) was ready to launch in Florida, US. The satellite was developed by NASA and the National Oceanic and Atmospheric Administration (NOAA) in continuation of the GOES-R Series for weather observation and environmental monitoring. The GOES-R Series satellite landed enables forecasters to observe, predict, and track local weather events such as thunderstorms, wildfires, hurricanes, and solar storms for public safety. Thus, the emphasis on satellite launches and an upsurge in government budget allocations for the space sector drive the geostationary satellite market growth.

In May 2024, the European Defense Organization announced the funds of US$ 7 million to launch an autonomous Bodyguard satellite in the geosynchronous earth orbit. With a strong emphasis on satellite launches for earth observation and other research activities, European countries have emerged as key players in advancing geostationary satellite technologies. Leading aerospace and space companies such as Airbus and Thales Alenia Space, which are renowned for their expertise in developing cutting-edge geostationary satellite systems, are the prime contributors to the space sector in Europe. Several space research and earth observation programs are being introduced to launch new satellites in Europe. In 2022, the European Space Programme was launched to bolster the European space sector with a budget of ~US$ 14 billion, with a particular focus on fields such as satellite navigation, connectivity, earth observation, and space research. The European Space Programme is expected to promote the launch of new satellites, thereby creating significant opportunities for the geostationary satellite market in the region.

COPERNICUS is the European Earth observation system aimed to provide support in the management of the environment, mitigation of climate change impact, and ensuring civil security across Europe. Further, GALILEO is a global satellite navigation and positioning system (GNSS) launched in Europe to support various sectors of the European Union's economy, including transport, agriculture, border management, and search and rescue. In February 2022, the European Commission launched two new flagship initiatives to boost satellite-based connectivity and manage space traffic. Such initiatives and a surge in investments in the space sector are the major factors propelling the geostationary satellite market in Europe.

The global geostationary satellites market is segmented into component, application, and region. On the basis of component, the geostationary satellites market is segmented into communication system, power system, propulsion system, and others. Based on application, the geostationary satellites market is categorized into communications, space exploration, navigation, earth observation, and others. On the basis of region, the geostationary satellites market is categorized into North America, Europe, Asia Pacific, and Rest of the World.

Based on component type, the propulsion system segment is growing at a rapid pace with the increasing advancement in the system by key players and government organizations. For instance, in March 2024, the Indian Space Research Organization (ISRO) planned to demonstrate the use of electric propulsion systems on its satellites. The system consists of a thruster of 300 millinewtons (mN). Growing adoption of advanced propulsion systems drives the geostationary satellite market growth. Geostationary satellites are equipped with transponders that amplify, receive, and retransmit radio signals to and from Earth. These signals are used for a wide range of applications, including broadcasting, telecommunications, remote sensing, and navigation.

Based on application, communication segment has a largest share in 2023.The most common application of geostationary satellites is to provide effective telecommunication services. Geostationary satellites are equipped with transponders that receive, amplify, and retransmit radio signals to and from Earth. These signals are used for a wide range of applications, including broadcasting, telecommunications, remote sensing, and navigation purposes. The communications segment held the largest share in 2023, owing to the increasing investment by several countries' government organizations to launch communication satellites into space.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. Geostationary Satellites Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Satellite Component Manufacturers:

- 4.3.2 Geostationary Satellite Manufacturers:

- 4.3.3 End Users:

- 4.3.4 List of Geostationary Satellite System Providers

5. Geostationary Satellites Market - Key Market Dynamics

- 5.1 Geostationary Satellites Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Demand for Long-Range Communication Coverage Through Satellite Network

- 5.2.2 Growing Need for Satellite-Based Military Communications

- 5.3 Market Restraints

- 5.3.1 Incidents of Geostationary Satellite Failures and Decline in Orders of Geostationary Satellites

- 5.4 Market Opportunities

- 5.4.1 Development of Small Satellites for Geostationary Orbit

- 5.5 Future Trends

- 5.5.1 Deployment of Software-Defined Electric Systems

- 5.6 Impact of Drivers and Restraints:

6. Geostationary Satellites Market - Global Market Analysis

- 6.1 Geographic Overview

- 6.2 Geostationary Satellites Market Revenue (US$ Million), 2021-2031

- 6.3 Geostationary Satellites Market Forecast Analysis

7. Geostationary Satellites Market Analysis - by Component

- 7.1 Communication System

- 7.1.1 Overview

- 7.1.2 Communication System: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Power System

- 7.2.1 Overview

- 7.2.2 Power System: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Propulsion System

- 7.3.1 Overview

- 7.3.2 Propulsion System: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Others

- 7.4.1 Overview

- 7.4.2 Others: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

8. Geostationary Satellites Market Analysis - by Application

- 8.1 Communications

- 8.1.1 Overview

- 8.1.2 Communications: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Space Exploration

- 8.2.1 Overview

- 8.2.2 Space Exploration: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Navigation

- 8.3.1 Overview

- 8.3.2 Navigation: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Earth Observation

- 8.4.1 Overview

- 8.4.2 Earth Observation: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

9. Geostationary Satellites Market - Geographical Analysis

- 9.1 Overview

- 9.2 North America

- 9.2.1 North America Geostationary Satellites Market Overview

- 9.2.2 North America: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.3 North America: Geostationary Satellites Market Breakdown, by Component

- 9.2.3.1 North America: Geostationary Satellites Market - Revenue and Forecast Analysis - by Component

- 9.2.4 North America: Geostationary Satellites Market Breakdown, by Application

- 9.2.4.1 North America: Geostationary Satellites Market - Revenue and Forecast Analysis - by Application

- 9.2.5 North America: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.2.5.1 North America: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.2.5.2 United States: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.5.2.1 United States: Geostationary Satellites Market Breakdown, by Component

- 9.2.5.2.2 United States: Geostationary Satellites Market Breakdown, by Application

- 9.2.5.3 Canada: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.5.3.1 Canada: Geostationary Satellites Market Breakdown, by Component

- 9.2.5.3.2 Canada: Geostationary Satellites Market Breakdown, by Application

- 9.2.5.4 Mexico: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2.5.4.1 Mexico: Geostationary Satellites Market Breakdown, by Component

- 9.2.5.4.2 Mexico: Geostationary Satellites Market Breakdown, by Application

- 9.3 Europe

- 9.3.1 Europe Geostationary Satellites Market Overview

- 9.3.2 Europe: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.3 Europe: Geostationary Satellites Market Breakdown, by Component

- 9.3.3.1 Europe: Geostationary Satellites Market - Revenue and Forecast Analysis - by Component

- 9.3.4 Europe: Geostationary Satellites Market Breakdown, by Application

- 9.3.4.1 Europe: Geostationary Satellites Market - Revenue and Forecast Analysis - by Application

- 9.3.5 Europe: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.3.5.1 Europe: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.3.5.2 Germany: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.5.2.1 Germany: Geostationary Satellites Market Breakdown, by Component

- 9.3.5.2.2 Germany: Geostationary Satellites Market Breakdown, by Application

- 9.3.5.3 France: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.5.3.1 France: Geostationary Satellites Market Breakdown, by Component

- 9.3.5.3.2 France: Geostationary Satellites Market Breakdown, by Application

- 9.3.5.4 Italy: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.5.4.1 Italy: Geostationary Satellites Market Breakdown, by Component

- 9.3.5.4.2 Italy: Geostationary Satellites Market Breakdown, by Application

- 9.3.5.5 United Kingdom: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.5.5.1 United Kingdom: Geostationary Satellites Market Breakdown, by Component

- 9.3.5.5.2 United Kingdom: Geostationary Satellites Market Breakdown, by Application

- 9.3.5.6 Russia: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.5.6.1 Russia: Geostationary Satellites Market Breakdown, by Component

- 9.3.5.6.2 Russia: Geostationary Satellites Market Breakdown, by Application

- 9.3.5.7 Rest of Europe: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3.5.7.1 Rest of Europe: Geostationary Satellites Market Breakdown, by Component

- 9.3.5.7.2 Rest of Europe: Geostationary Satellites Market Breakdown, by Application

- 9.4 Asia Pacific

- 9.4.1 Asia Pacific Geostationary Satellites Market Overview

- 9.4.2 Asia Pacific: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.3 Asia Pacific: Geostationary Satellites Market Breakdown, by Component

- 9.4.3.1 Asia Pacific: Geostationary Satellites Market - Revenue and Forecast Analysis - by Component

- 9.4.4 Asia Pacific: Geostationary Satellites Market Breakdown, by Application

- 9.4.4.1 Asia Pacific: Geostationary Satellites Market - Revenue and Forecast Analysis - by Application

- 9.4.5 Asia Pacific: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.4.5.1 Asia Pacific: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.4.5.2 China: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.5.2.1 China: Geostationary Satellites Market Breakdown, by Component

- 9.4.5.2.2 China: Geostationary Satellites Market Breakdown, by Application

- 9.4.5.3 India: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.5.3.1 India: Geostationary Satellites Market Breakdown, by Component

- 9.4.5.3.2 India: Geostationary Satellites Market Breakdown, by Application

- 9.4.5.4 Japan: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.5.4.1 Japan: Geostationary Satellites Market Breakdown, by Component

- 9.4.5.4.2 Japan: Geostationary Satellites Market Breakdown, by Application

- 9.4.5.5 South Korea: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.5.5.1 South Korea: Geostationary Satellites Market Breakdown, by Component

- 9.4.5.5.2 South Korea: Geostationary Satellites Market Breakdown, by Application

- 9.4.5.6 Rest of APAC: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4.5.6.1 Rest of APAC: Geostationary Satellites Market Breakdown, by Component

- 9.4.5.6.2 Rest of APAC: Geostationary Satellites Market Breakdown, by Application

- 9.5 Rest of the World

- 9.5.1 Rest of the World Geostationary Satellites Market Overview

- 9.5.2 Rest of the World: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.3 Rest of the World: Geostationary Satellites Market Breakdown, by Component

- 9.5.3.1 Rest of the World: Geostationary Satellites Market - Revenue and Forecast Analysis - by Component

- 9.5.4 Rest of the World: Geostationary Satellites Market Breakdown, by Application

- 9.5.4.1 Rest of the World: Geostationary Satellites Market - Revenue and Forecast Analysis - by Application

- 9.5.5 Rest of the World: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.5.5.1 Rest of the World: Geostationary Satellites Market - Revenue and Forecast Analysis - by Country

- 9.5.5.2 Middle East and Africa: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.5.2.1 Middle East and Africa: Geostationary Satellites Market Breakdown, by Component

- 9.5.5.2.2 Middle East and Africa: Geostationary Satellites Market Breakdown, by Application

- 9.5.5.3 South America: Geostationary Satellites Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5.5.3.1 South America: Geostationary Satellites Market Breakdown, by Component

- 9.5.5.3.2 South America: Geostationary Satellites Market Breakdown, by Application

10. Competitive Landscape

- 10.1 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 Product Development

12. Company Profiles

- 12.1 Airbus SE

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 The Boeing Co

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Ball Corp

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Korea Aerospace Industries Ltd.

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Lockheed Martin Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Maxar Technologies Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Northrop Grumman Corp

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Thales SA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Israel Aerospace Industries Ltd

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 OHB SE

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About The Insight Partners