|

|

市場調査レポート

商品コード

1535272

北米鉱業用再製造部品市場:規模・予測、地域別シェア、動向、成長機会分析レポート概要コンポーネント別、装置別、産業別、地域別North America Mining Remanufacturing Components Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Component, Equipment, and Industry, and Region |

||||||

|

|||||||

| 北米鉱業用再製造部品市場:規模・予測、地域別シェア、動向、成長機会分析レポート概要コンポーネント別、装置別、産業別、地域別 |

|

出版日: 2024年07月03日

発行: The Insight Partners

ページ情報: 英文 150 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の鉱業用再製造部品市場は、2023年に9億1,537万米ドルと評価され、2031年には13億643万米ドルに達すると予測され、2023年から2031年の間に4.5%のCAGRを記録すると予測されています。

部品別に見ると、世界の鉱業用再製造部品市場はエンジン、アクスル、トランスミッション、油圧シリンダー、その他に区分されます。エンジン、トランスミッション、油圧シリンダーセグメントは、鉱業再製造コンポーネント市場で大きなシェアを占めると思われます。採掘車両の状態は、その扱い方や周囲の環境に大きく影響されるため、継続的な交換が必要となります。エンジン、アクスル、トランスミッション、油圧シリンダーの故障など、何らかの機器が故障した場合、鉱山会社の収益性に影響が出る。そのため、ほとんどの鉱山会社は、費用対効果と信頼性の高さから、機器のコンポーネントを再生部品に交換することを好んでいます。

機器別では、世界の鉱業用再製造部品市場は、ホイールローダー、ホイールドーザー、クローラードーザー、運搬トラック、掘削機、その他に区分されます。予測期間中、掘削機セグメントは、探査、発見、開発、生産、埋め立てなどの採掘作業で幅広く使用されているため、最大の市場シェアを占めると予想されます。発展途上国における鉱物・金属需要の増加は、探査活動を活発化させ、鉱山機械の採用率上昇につながっています。さらに、発展途上国の政府は、鉱業活動の増加と拡大に注力しています。インド政府が2023年3月に発表したデータによると、政府は2026年から2027年までに鉱業部門のGDPへの寄与度を2.5%に高めるという目標を掲げています。また、同部門に投資家や業界に優しい基準を導入する意向です。鉱業部門を拡大するためのこのような取り組みは、今後数年間で鉱業機器への要求を高め、最終的に鉱業用再製造部品市場を牽引することになります。

さらに、効率的なドーザーの製造における主要企業の努力も市場を牽引する要因の一つです。同社が2023年2月に発表したニュースによると、コマツは顧客からの多くのフィードバックに基づき、世界最大の生産台数を誇るドーザーであるD475A-8を再設計し、前世代よりも大幅に進化させました。リバース時の馬力を11%向上させたことで、より幅広い実用的な利点が生まれました。リバース時の馬力が向上したことで、対地速度が向上し、リターンサイクルタイムが短縮されたことで、生産性は前モデルより最大10%向上しました。また、作業機、メインフレーム、トラックフレーム、イコライザーバー、ピボットシャフトの耐久性が向上したため、総所有コストも6万時間以上減少しました。このような活動により、鉱業におけるクローラドーザーの再製造部品の需要が高まっています。

AB Volvo、Atlas Copco AB、Caterpillar, Inc.、Epiroc AB、J C Bamford Excavators Ltd.、Liebherr Group、Komatsu Ltd.、SRC Holding Corporation、Hitachi Construction Machinery Co.Ltd.、Swanson Industriesなどが北米で鉱業用再製造部品を提供している主要企業です。新たな技術開発のための研究開発活動や、M&A、パートナーシップ、コラボレーションを通じたその他の企業との提携は、北米の鉱業用再製造部品市場で事業を展開する企業の主要なビジネス戦略の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 北米鉱業用再製造部品市場情勢

- PEST分析

- エコシステム分析

- 鉱業用再製造部品サプライヤー一覧

第5章 北米鉱業用再製造部品市場-主要市場力学

- 北米の鉱業用再製造部品市場- 主な市場力学

- 市場促進要因

- 北米全域での鉱業・鉱物生産の増加

- 鉱物生産を促進するための政府奨励金と資金の増加

- 鉱物探査活動に対する政府発表

- 市場抑制要因

- 品質問題と技術的障壁

- 市場機会

- 鉱業における電気自動車と自律走行車の採用増加

- 今後の動向

- 再製造産業における積層造形

- 促進要因と抑制要因の影響

第6章 北米鉱業用再製造部品市場分析

- 北米の鉱業用再製造部品市場の売上高とCAGR(%)、2021-2031年

- 北米の鉱業用再製造部品市場売上高:2021年~2031年

- 北米鉱業用再製造部品市場の予測および分析

第7章 北米鉱業用再製造部品市場の分析-部品別

- エンジン

- アクスル

- トランスミッション

- 油圧シリンダー

- その他

第8章 北米鉱業用再製造部品市場分析:装置別

- 掘削機

- ホイールローダー

- ホイールドーザー

- クローラドーザー

- 運搬トラック

- その他

第9章 北米鉱業用再製造部品市場分析-産業別

- 石炭

- 金属

- その他

第10章 北米鉱業用再製造部品市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

- 以下のグラフは、メキシコの鉱業生産と鉱業市場規模(2019年~2023年)を示しています。

第11章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Atlas Copco AB

- J C Bamford Excavators Ltd

- Caterpillar Inc

- Epiroc AB

- Swanson Industries Inc

- Komatsu Ltd

- Liebherr-International AG

- SRC Holdings Corp

- AB Volvo

- Hitachi Construction Machinery Co Ltd

第14章 付録

List Of Tables

- Table 1. North America Mining Remanufacturing Components Market Segmentation

- Table 2. List of Suppliers

- Table 3. North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- Table 4. North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 5. North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Equipment

- Table 6. North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Industry

- Table 7. North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 8. United States: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 9. United States: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Equipment

- Table 10. United States: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Industry

- Table 11. Canada: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 12. Canada: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Equipment

- Table 13. Canada: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Industry

- Table 14. Mexico: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Component

- Table 15. Mexico: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Equipment

- Table 16. Mexico: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million) - by Industry

- Table 17. Heat Map Analysis by Key Players

List Of Figures

- Figure 1. North America Mining Remanufacturing Components Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Mining Remanufacturing Components Market Revenue (US$ Million), 2021-2031

- Figure 5. North America Mining Remanufacturing Components Market Share (%) - by Component, 2023 and 2031

- Figure 6. Engine: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Axle: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Transmission: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

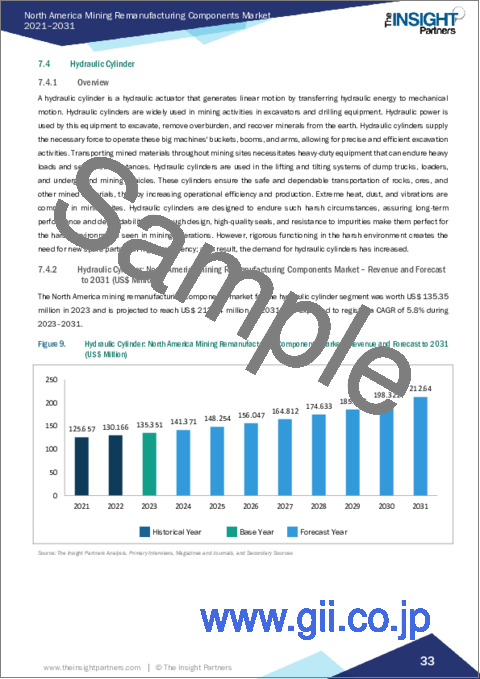

- Figure 9. Hydraulic Cylinder: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Others: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 11. North America Mining Remanufacturing Components Market Share (%) - by Equipment, 2023 and 2031

- Figure 12. Excavators: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Wheel Loader: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 14. Wheel Doser: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Crawler Dosers: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Haul Trucks: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Others: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 18. North America Mining Remanufacturing Components Market Share (%) - by Industry, 2023 and 2031

- Figure 19. Coal: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Metal: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Others: North America Mining Remanufacturing Components Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 22. North America Mining Remanufacturing Components Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 23. United States: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Canada: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Mexico: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Company Positioning & Concentration

The North America mining remanufacturing components market was valued at US$ 915.37 million in 2023 and is projected to reach US$ 1,306.43 million by 2031; it is expected to register a CAGR of 4.5% during 2023-2031.

On the basis of component, the global mining remanufacturing component market is segmented into engine, axle, transmission, hydraulic cylinder, and others. The engine, transmission, and hydraulic cylinder segments are likely to account for significant shares of the mining remanufacturing component market. The state of a mining vehicle is highly influenced by the way it is handled and the environment around it, necessitating continuous replacements. If any equipment breaks down in case of engine, axle, transmission, or hydraulic cylinder failure, the profitability of mining companies is affected. Thus, most of the mining companies prefer to replace the equipment components with remanufactured components owing to their cost-effective and reliability factors.

On the basis of equipment, the global mining remanufacturing component market is segmented into wheel loaders, wheel dozers, crawler dozers, haul trucks, excavators, and others. During the forecast period, the excavators segment is anticipated to hold the largest market share due to their wide usage in mining operations such as exploration, discovery, development, production, and reclamation. Increased demand for minerals and metals in developing nations has increased exploration activities, leading to higher adoption of mining equipment. Further, governments of developing nations are focusing on increasing and expanding their mining activities. As per the data published by the Indian government in March 2023, the government has set an objective of boosting the mining sector's contribution to GDP to 2.5% by 2026-2027. It intends to introduce investor- and industry-friendly standards for the sector. Such initiatives to expand the mining sector will increase the requirement for mining equipment in the coming years, ultimately driving the mining remanufacturing component market.

In addition, key players' efforts in making efficient dozers are another factor driving the market. As per the news published by the company in February 2023, Komatsu re-engineered the D475A-8, the world's largest production dozer, based on considerable customer feedback, with substantial advancements over the previous generation. The dozer has 11% more power in reverse, which opens the door to a wider variety of practical advantages-the greater horsepower in reverse aids in higher ground speeds, producing shorter return cycle times, allowing the dozer to be up to 10% more productive than the previous model. The total cost of ownership has also decreased by over 60,000 hours due to improvements in the durability of the work equipment, mainframe, track frames, equalizer bars, and pivot shafts. Such activities have driven the demand for crawler dozer remanufacturing components in the mining industry.

AB Volvo; Atlas Copco AB; Caterpillar, Inc.; Epiroc AB; J C Bamford Excavators Ltd.; Liebherr Group; Komatsu Ltd; SRC Holding Corporation; Hitachi Construction Machinery Co. Ltd.; and Swanson Industries are among the key players offering mining remanufacturing components in North America. Research and development activities for new technological development and alliances with other companies through mergers and acquisitions, partnerships, and collaborations are a few of the key business strategies of companies operating in the North America mining remanufacturing components market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Mining Remanufacturing Components Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 List of Mining Remanufacturing Component Suppliers

5. North America Mining Remanufacturing Components Market - Key Market Dynamics

- 5.1 North America Mining Remanufacturing Components Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Mining and Mineral Production Across North America:

- 5.2.2 Rising Government Incentives and Funding to Promote Mineral Production:

- 5.2.2.1 Government Announcements for the Minerals Exploration Activities

- 5.3 Market Restraints

- 5.3.1 Quality Issues and Technological Barriers:

- 5.4 Market Opportunities

- 5.4.1 Rising Adoption of Electric and Autonomous Vehicles in Mining Industry:

- 5.5 Future Trends

- 5.5.1 Additive Manufacturing in Remanufacturing Industry:

- 5.6 Impact of Drivers and Restraints:

6. North America Mining Remanufacturing Components Market Analysis

- 6.1 North America Mining Remanufacturing Components Market Revenue and CAGR (%) (US$ Million), 2021-2031

- 6.2 North America Mining Remanufacturing Components Market Revenue (US$ Million), 2021-2031

- 6.3 North America Mining Remanufacturing Components Market Forecast and Analysis

7. North America Mining Remanufacturing Components Market Analysis - by Component

- 7.1 Engine

- 7.1.1 Overview

- 7.1.2 Engine: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Axle

- 7.2.1 Overview

- 7.2.2 Axle: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Transmission

- 7.3.1 Overview

- 7.3.2 Transmission: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 7.4 Hydraulic Cylinder

- 7.4.1 Overview

- 7.4.2 Hydraulic Cylinder: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Mining Remanufacturing Components Market Analysis - by Equipment

- 8.1 Excavators

- 8.1.1 Overview

- 8.1.2 Excavators: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Wheel Loader

- 8.2.1 Overview

- 8.2.2 Wheel Loader: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Wheel Doser

- 8.3.1 Overview

- 8.3.2 Wheel Doser: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Crawler Dosers

- 8.4.1 Overview

- 8.4.2 Crawler Dosers: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Haul Trucks

- 8.5.1 Overview

- 8.5.2 Haul Trucks: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Others

- 8.6.1 Overview

- 8.6.2 Others: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Mining Remanufacturing Components Market Analysis - by Industry

- 9.1 Coal

- 9.1.1 Overview

- 9.1.2 Coal: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Metal

- 9.2.1 Overview

- 9.2.2 Metal: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Others

- 9.3.1 Overview

- 9.3.2 Others: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Mining Remanufacturing Components Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Mining Remanufacturing Components Market Breakdown by Countries

- 10.1.2 North America Mining Remanufacturing Components Market Revenue and Forecast and Analysis - by Country

- 10.1.2.1 North America Mining Remanufacturing Components Market Revenue and Forecast and Analysis - by Country

- 10.1.2.2 United States: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.2.1 United States: North America Mining Remanufacturing Components Market Breakdown by Component

- 10.1.2.2.2 United States: North America Mining Remanufacturing Components Market Breakdown by Equipment

- 10.1.2.2.3 United States: North America Mining Remanufacturing Components Market Breakdown by Industry

- 10.1.2.3 Canada: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.3.1 Canada: North America Mining Remanufacturing Components Market Breakdown by Component

- 10.1.2.3.2 Canada: North America Mining Remanufacturing Components Market Breakdown by Equipment

- 10.1.2.3.3 Canada: North America Mining Remanufacturing Components Market Breakdown by Industry

- 10.1.2.4 Mexico: North America Mining Remanufacturing Components Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.3 Following Chart Shows Mexico's Mining Production and Mining Market Size, 2019-2023

- 10.1.3.1.1 Mexico: North America Mining Remanufacturing Components Market Breakdown by Component

- 10.1.3.1.2 Mexico: North America Mining Remanufacturing Components Market Breakdown by Equipment

- 10.1.3.1.3 Mexico: North America Mining Remanufacturing Components Market Breakdown by Industry

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Atlas Copco AB

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 J C Bamford Excavators Ltd

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Caterpillar Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Epiroc AB

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Swanson Industries Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Komatsu Ltd

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Liebherr-International AG

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 SRC Holdings Corp

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 AB Volvo

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Hitachi Construction Machinery Co Ltd

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners