|

|

市場調査レポート

商品コード

1535253

米国と欧州のペット用スナック・おやつ市場:市場規模・予測、地域シェア、動向、成長機会分析レポート範囲:製品タイプ別、フレーバー別、流通チャネル別、国別US and Europe Pet Snacks and Treats Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type, Flavor, Distribution Channel, and Country |

||||||

|

|||||||

| 米国と欧州のペット用スナック・おやつ市場:市場規模・予測、地域シェア、動向、成長機会分析レポート範囲:製品タイプ別、フレーバー別、流通チャネル別、国別 |

|

出版日: 2024年07月16日

発行: The Insight Partners

ページ情報: 英文 174 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

米国と欧州のペット用スナック・おやつ市場規模は、2023年の330億9,000万米ドルから2031年には202億4,000万米ドルに達すると予測されています。2023年~2031年のCAGRは6.3%と予測されます。

企業は、オーガニック、穀物不使用、高タンパク質といった人間の食生活の嗜好を反映したスナック菓子を開発することで、飼い主がペットの健康とウェルネスを優先する傾向に乗じています。W.F.YoungやPetcureanなどのメーカーは、歯の健康、関節のサポート、消化補助などの機能的な利点を備えたおやつを発売しており、ペットのために嗜好品以上のものを求める健康志向の飼い主に付加価値を与え、アピールしています。例えば、2024年3月、AbsorbineやThe Missing Linkなど複数のペットケアブランドの親会社であるW.F.Youngは、機能的で植物由来の犬用おやつHonest to Goodness Plant Snacksのラインを発売しました。さらに、ペット用スナックやおやつの大手メーカーの中には、革新的な中小企業を買収したり、他の既存企業と合併したりして、ブランドポートフォリオを拡大しているところもあります。こうしたアプローチにより、既存の技術を活用して新製品を開発し、市場での存在感と競争力を高めています。2022年9月、ヴォフプレミアムペットフードはノヴァドッグチューズの買収を発表しました。この買収により、ヴォフ社のナチュラルプレミアムペットフード製品のポートフォリオが拡大しました。同様に、ジャストフードのレポートによると、マースは新しい地理的市場に参入し、様々な顧客の需要に応えるため、フランスの拠点に1億4,000万米ドル(1億3,000万ユーロ)を投資する予定です。同社によると、マースペットケアとロイヤルカナンの2つのペットケア部門、マースフード、菓子類に特化したマースリグリーのフランスの4部門で生産能力を増強します。他の国や地域での製造インフラを強化することで、これらの企業は人気のペットフードやおやつブランドのプレゼンスを拡大し、様々な国の小売業者や消費者への安定した製品供給を確保することができます。

さらに、多くの企業は、ブランドロイヤルティを築き、より多くの人々にリーチするために、ソーシャルメディアキャンペーン、インフルエンサーとの提携、ターゲット広告など、効果的なマーケティング戦略に多額の投資を行っています。例えば、2024年2月、ペットフードメーカーのPets Choice社は、成長中のキャットフードとドッグフードのブランドであるWebbox Naturalsの認知度を高めるため、新たなマルチチャネルキャンペーンに62万1,000米ドル(50万ポンド)を投資しました。このように、主要企業による製品革新、ブランド拡大、マーケティング強化などの戦略的発展が、米国と欧州のペット用スナック・おやつ市場を牽引しています。

製品タイプ別に見ると、米国と欧州のペット用スナック・おやつ市場は犬用スナックと猫用スナックに分けられます。犬用おやつはさらにビスケットとクッキー、ジャーキー、スティック、ストリップ、チューボーン、リングおやつ、その他の犬用おやつに分類されます。犬用スナックセグメントは2023年に大きな市場シェアを占めています。犬用スナック分野は、米国と欧州のペット用スナック・おやつ市場で突出し、急速に拡大しています。近年、入手可能な犬用スナックの種類と洗練度が大幅に増加しています。この市場セグメントには、しつけ用おやつ、デンタル・チュー、関節の健康、消化、皮膚や被毛の状態に関連した特定の健康効果を提供するように設計された機能性おやつなど、幅広い製品が含まれます。犬の飼い主がペットの健康や福祉に気を配るようになるにつれ、栄養価が高く味もおいしいペット用おやつを選ぶ傾向が強まっています。

フレーバー別に、市場はチキン、ビーフ、ラム、シーフード、野菜、果物、その他に分類されます。米国と欧州のペット用スナック・おやつ市場では、フルーツセグメントが最も高いCAGRを記録すると予想されます。果物風味のスナックやおやつは犬や猫の両方にアピールし、さまざまな果物の風味や栄養上の利点を取り入れたおやつを提供します。フルーツに関連する健康効果に対する消費者の意識の高まりが、フルーツフレーバーセグメントの成長に寄与している主な要因です。果物には必須ビタミン、抗酸化物質、食物繊維が豊富に含まれており、健康全般をサポートし、免疫システムを高め、消化を助ける。ペットにバランスの取れた食事を与えようとする飼い主は、こうした有益な栄養素をペットの食事に取り入れるため、フルーツ風味のおやつを購入するケースが増えています。また、果物の自然な甘みは、ペットにとって嗜好性が高く、楽しいおやつとなっています。フルーツ風味のスナックやおやつの採用が増加しているのは、ナチュラルでホリスティックなペットケアの動向と一致しています。消費者は、人工添加物、保存料、充填物を含まない製品を購入するようになっています。りんご、ブルーベリー、いちご、バナナなどの果物は一般的にこれらのおやつに使われ、自然で健康的な原材料を提供しています。加工を最小限に抑えた本物の果物の使用を強調するブランドは、ペットフードの透明性と品質を優先する健康志向のペットオーナーに特にアピールできます。

市場は流通チャネル別に、スーパーマーケットおよびハイパーマーケット、専門店、オンライン小売、その他に区分されます。米国と欧州のペット用スナック・おやつ市場では、オンライン小売セグメントが最も高いCAGRを記録すると予想されます。オンライン小売プラットフォームは、便利で利用しやすいショッピング体験を提供します。顧客は実店舗を訪れることなく、自宅でさまざまなペット用スナックやおやつを閲覧することができます。また、オンライン小売業者は驚くほどの品揃えを提供することが多く、顧客は好みに合わせて希望の商品を選ぶことができます。さらに、オンラインプラットフォームは、詳細な商品説明、カスタマーレビュー、商品画像を提供し、買い物客が十分な情報を得た上で意思決定できるよう支援しています。また、オンライン小売業者が示す競合価格は、顧客が異なるブランドの製品の価格を比較し、予算やその他の好みに合った最良の取引を見つけることができるため、製品流通のための魅力的なチャネルとなっています。

J M Smucker Co、Shameless Pets、LLC、Nestle SA、Nature's Diet、General Mills Inc、Interquell Gmbh、VAFO Group、Purrform Limited、Scrumbles、Mars Inc、Colorado Pet Treats、Mera-The Petfood Family、Schell &Kampeter Inc、United Petfood、RUPP FOOD Austria GmbHは、米国および欧州のペット用スナック・おやつ市場で事業を展開する主要企業の一つです。

米国と欧州のペット用スナックとおやつ市場全体の規模は、一次情報と二次情報を用いて算出しました。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、トピックに関するより詳細な分析的洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスの参入企業には、米国および欧州のペット用スナック・おやつ市場を専門とする副社長、事業開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家、評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 米国と欧州のペット用スナック・おやつ市場情勢

- 市場概要

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- ディストリビューター/サプライヤー

- 小売業者

- バリューチェーンのベンダー一覧

- 平均小売価格帯-製品タイプ別

第5章 米国と欧米のペット用スナック・おやつ市場:主要市場動向

- 米国と欧州のペット用スナック・おやつ市場:主要市場力学

- 市場促進要因

- ペットオーナー数の増加

- 主要企業による戦略的発展の高まり

- 市場抑制要因

- ペットフードの製造、表示、流通に関する政府の厳しい規制

- 市場機会

- eコマースプラットフォームへの嗜好の高まり

- 今後の動向

- 革新的な風味を持つ持続可能なオーガニックプレミアム製品への関心の高まり

- 促進要因と抑制要因の影響

第6章 米国と欧州のペット用スナック・おやつ市場分析

- 米国と欧州のペット用スナック・おやつ市場収益(2021年~2031年)

- 米国と欧州のペット用スナック・おやつ市場の予測と分析

第7章 米国と欧州のペット用スナック・おやつ市場分析:製品タイプ別

- 犬用スナック

- 猫用スナック

第8章 米国と欧州のペット用スナック・おやつの市場分析:フレーバー別

- チキン

- ビーフ

- ラム

- シーフード

- 野菜

- 果物

- その他

第9章 米国と欧州のペット用スナック・おやつ市場分析:流通チャネル別

- スーパーマーケットとハイパーマーケット

- 専門店

- オンライン小売

- その他

第10章 米国と欧州のペット用スナック・おやつ市場:国別分析

- 米国

- 米国

- 欧州

- 欧州のペット用スナック・おやつ市場:国別内訳

- 欧州のペット用スナック・おやつ市場の収益と予測:国別分析

- ドイツ

- フランス

- イタリア

- スペイン

- 英国

- その他欧州

第11章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 有機的成長戦略

- 無機的成長戦略

第13章 企業プロファイル

- J M Smucker Co

- Shameless Pets, LLC

- Nestle SA

- Nature's Diet

- General Mills Inc

- Interquell Gmbh

- VAFO Group

- Purrform Limited

- Scrumbles

- Mars Inc

- Colorado Pet Treats

- mera-The Petfood Family

- Schell & Kampeter, Inc

- United Petfood

- RUPP FOOD Austria GmbH

- Irish Dog Foods Limited

- Rondo Food GmbH & Co. KG

- Inspired Pet Nutrition Ltd

- Ava's Pet Palace

- Butcher's Pet Care Limited

- Scholtus Special Products B.V

- Wellness Pet Company

- Addiction Foods LLC

- Smart Cookie Dog Treats

第14章 付録

List Of Tables

- Table 1. US and Europe Pet Snacks and Treats Market Segmentation

- Table 2. List of Vendors in the Value Chain:

- Table 3. Average Retail Price Range for Dog Snacks and Treats in US, 2023, (US$)

- Table 4. Average Retail Price Range for Cat Snacks and Treats in US, 2023, (US$)

- Table 5. Average Retail Price Range for Dog Snacks and Treats in Europe, 2023, (US$)

- Table 6. Average Retail Price Range for Cat Snacks and Treats in Europe, 2023, (US$)

- Table 7. US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Table 8. US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 9. US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 10. US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 11. United States: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 12. United States: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 13. United States: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 14. Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 15. Germany: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 16. Germany: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 17. Germany: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 18. France: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 19. France: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 20. France: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 21. Italy: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 22. Italy: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 23. Italy: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 24. Spain: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 25. Spain: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 26. Spain: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 27. United Kingdom: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 28. United Kingdom: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 29. United Kingdom: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 30. Rest of Europe: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 31. Rest of Europe: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Flavor

- Table 32. Rest of Europe: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million) - by Distribution Channel

- Table 33. Recent Organic Growth Strategies in US and Europe Pet Snacks and Treats Market

- Table 34. Recent Inorganic Growth Strategies in the US and Europe Pet Snacks and Treats Market

List Of Figures

- Figure 1. US and Europe Pet Snacks and Treats Market Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: US and Europe Pet Snacks and Treats Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. US and Europe Pet Snacks and Treats Market Revenue (US$ Million), 2021-2031

- Figure 6. US and Europe Pet Snacks and Treats Market Share (%) - by Product Type, 2023 and 2031

- Figure 7. Dog Snacks: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 8. Biscuits and Cookies: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 9. Jerky: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Sticks: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Strips: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 12. Chew Bones: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Ring Treats: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

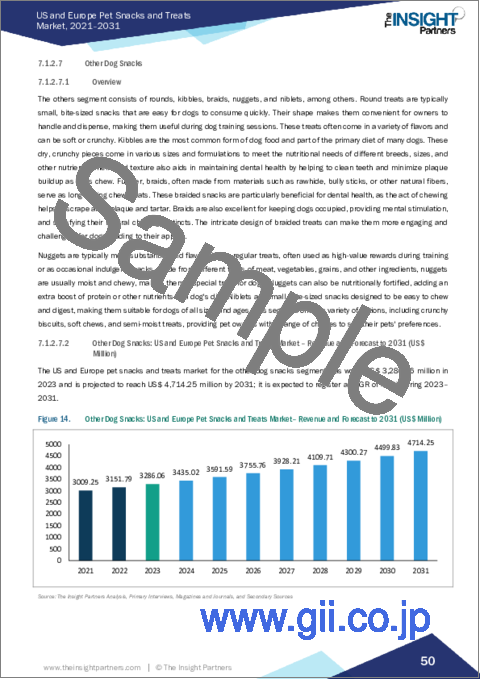

- Figure 14. Other Dog Snacks: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 15. Cat Snacks: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Crunchies: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Lickable Treats: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Jerky: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Pillows: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Other Cat Snacks: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 21. US and Europe Pet Snacks and Treats Market Share (%) - by Flavor, 2023 and 2031

- Figure 22. Chicken: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Beef: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Lamb: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Seafood: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Vegetables: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Fruits: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Others: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 29. US and Europe Pet Snacks and Treats Market Share (%) - by Distribution Channel, 2023 and 2031

- Figure 30. Supermarkets and Hypermarkets: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Specialty Stores: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Online Retail: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 33. Others: US and Europe Pet Snacks and Treats Market- Revenue and Forecast to 2031 (US$ Million)

- Figure 34. PET Snacks and Treats Market Breakdown by Region, 2023 and 2031 (%)

- Figure 35. United States: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 36. Europe Pet Snacks and Treats Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 37. Germany: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 38. France: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 39. Italy: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 40. Spain: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 41. United Kingdom: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 42. Rest of Europe: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 43. Heat Map Analysis by Key Players

- Figure 44. Company Positioning & Concentration

The US and Europe pet snacks and treats market size is projected to reach US$ 20.24 billion by 2031 from US$ 33.09 billion in 2023. The market is expected to register a CAGR of 6.3% during 2023-2031.

Companies are capitalizing on the trend of owners prioritizing pets' health and wellness by developing snacks that mirror human dietary preferences for organic, grain-free, and high-protein products. Manufacturers such as W.F. Young and Petcurean are launching treats with functional benefits such as dental health, joint support, and digestive aids that add value and appeal to health-conscious pet owners seeking more than indulgence for their pets. For instance, in March 2024, W.F. Young, the parent company of several pet care brands like Absorbine and The Missing Link, launched a line of functional, plant-based dog treats Honest to Goodness Plant Snacks. In addition, a few of the major manufacturers of pet snacks and treats are expanding their brand portfolios by acquiring smaller, innovative companies or merging with other established entities. This approach allows them to develop new products with the help of existing technologies, thereby enhancing their market presence and competitiveness. In September 2022, Voff Premium Pet Food announced its acquisition of Nova Dog Chews-a European manufacturer of dog chews, treats, and snacks. The acquisition expands Voff's portfolio of natural, premium pet food products. Similarly, according to a report from Just Food, Mars is planning to invest US$ 140 million (€130 million) in its French sites to enter new geographic markets and cater to different customer demands. According to the company, it will increase production capacity across its four French units-the two pet care arms of Mars Petcare and Royal Canin, as well as Mars Food and the confectionery-focused Mars Wrigley. By enhancing their manufacturing infrastructure in other countries and regions, these players can expand popular pet food and treats brands' presence, ensuring a steady product supply to retailers and consumers across various countries.

Moreover, many companies are investing heavily in effective marketing strategies, including social media campaigns, influencer partnerships, and targeted advertising, to build brand loyalty and reach a wider audience. For instance, in February 2024, Pet food manufacturer Pets Choice invested ~US$ 621 thousand (£500 thousand) in a new multi-channel campaign to generate awareness for its growing cat and dog food brand, Webbox Naturals. Thus, strategic developments, such as product innovation, brand expansion, and enhanced marketing, by key players drive the US and Europe pet snacks and treats market.

Based on product type, the US and Europe pet snacks and treats market is divided into dog snacks and cat snacks. Dog snacks segmented is further categorized into biscuits and cookies, jerky, sticks, strips, chew bones, ring treats, other dog snacks. The dog snacks segment holds a significant market share in 2023. The dog snacks segment is a prominent and rapidly expanding component of the US and Europe pet snacks and treats market. In recent years, there has been a significant increase in the variety and sophistication of available dog snacks. This market segment encompasses a broad range of products, including training treats, dental chews, and functional snacks designed to provide specific health benefits related to joint health, digestion, and skin and coat conditions. As dog owners become more attentive to their pets' health and well-being, they are increasingly opting for pet snacks that offer nutritional value and are delicious to taste.

Based on flavor, the market is categorized into chicken, beef, lamb, seafood, vegetables, fruits, and others. Fruits segment expected to register highest CAGR in the US and Europe pet snacks and treats market. Fruit-flavored snacks and treats appeal to both dogs and cats, offering a range of treats that incorporate the flavors and nutritional benefits of different fruits. The growing consumer awareness about the health benefits associated with fruits is a primary factor contributing to the growth of the fruit flavor segment. Fruits are rich in essential vitamins, antioxidants, and fiber, supporting overall health, boosting the immune system, and aiding digestion. Pet owners seeking to provide a balanced diet for their pets are increasingly purchasing fruit-flavored treats to introduce these beneficial nutrients into their pets' diets. The natural sweetness of fruits also makes these treats highly palatable and enjoyable for pets. The rising adoption of fruit-flavored snacks and treats aligns with the broader natural and holistic pet care trend. Consumers are increasingly purchasing products that are free from artificial additives, preservatives, and fillers. Fruits such as apples, blueberries, strawberries, and bananas are commonly used in these treats, offering a natural and wholesome ingredient profile. Brands that emphasize the use of real, minimally processed fruits can particularly appeal to health-conscious pet owners who prioritize transparency and quality in their pets' food.

Based on distribution channel the market is segmented into supermarkets and hypermarkets, specialty stores, online retail, and others. Online retail segment expected to register the highest CAGR in the US and Europe pet snacks and treats market. Online retail platforms provide a convenient and accessible shopping experience. Customers can browse varieties of pet snacks and treats from their homes without visiting physical stores. Additionally, online retailers often offer an incredible range of products, allowing customers to choose desired products as per their preferences. Moreover, online platforms provide detailed product descriptions, customer reviews, and product images, which assist shoppers in making well-informed decisions. Also, the competitive pricing shown by online retailers makes it an attractive channel for product distribution, as customers are able to compare prices of products from different brands and find best deals that suit their budget and other preferences.

J M Smucker Co, Shameless Pets, LLC, Nestle SA, Nature's Diet, General Mills Inc, Interquell Gmbh, VAFO Group, Purrform Limited, Scrumbles, Mars Inc, Colorado Pet Treats, Mera-The Petfood Family, Schell & Kampeter Inc, United Petfood, and RUPP FOOD Austria GmbH are among the key players operating in the US and European pet snacks and treats market.

The overall US and European pet snacks and treats market size has been derived using primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs; business development managers; market intelligence managers; national sales managers; and external consultants, including valuation experts, research analysts, and key opinion leaders, specializing in the US and European pet snacks and treats market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. US and Europe Pet Snacks and Treats Market Landscape

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 Retailers

- 4.3.5 List of Vendors in the Value Chain

- 4.4 Average Retail Price Range - By Product Type

5. US and Europe Pet Snacks and Treats Market - Key Market Dynamics

- 5.1 US and Europe Pet Snacks and Treats Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Number of Pet Owners

- 5.2.2 Rising Strategic Developments by Key Players

- 5.3 Market Restraints

- 5.3.1 Stringent Government Regulations on Pet Food Manufacturing, Labeling, and Distribution

- 5.4 Market Opportunities

- 5.4.1 Rising Preference for E-Commerce Platforms

- 5.5 Future Trends

- 5.5.1 Growing Interest in Sustainable, Organic, and Premium Products with Innovative Flavors

- 5.6 Impact of Drivers and Restraints:

6. US and Europe Pet Snacks and Treats Market Analysis

- 6.1 US and Europe Pet Snacks and Treats Market Revenue (US$ Million), 2021-2031

- 6.2 US and Europe Pet Snacks and Treats Market Forecast and Analysis

7. US and Europe Pet Snacks and Treats Market Analysis - by Product Type

- 7.1 Dog Snacks

- 7.1.1 Overview

- 7.1.2 Dog Snacks: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.1 Biscuits and Cookies

- 7.1.2.1.1 Overview

- 7.1.2.1.2 Biscuits and Cookies: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.2 Jerky

- 7.1.2.2.1 Overview

- 7.1.2.2.2 Jerky: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.3 Sticks

- 7.1.2.3.1 Overview

- 7.1.2.3.2 Sticks: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.4 Strips

- 7.1.2.4.1 Overview

- 7.1.2.4.2 Strips: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.5 Chew Bones

- 7.1.2.5.1 Overview

- 7.1.2.5.2 Chew Bones: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.6 Ring Treats

- 7.1.2.6.1 Overview

- 7.1.2.6.2 Ring Treats: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.7 Other Dog Snacks

- 7.1.2.7.1 Overview

- 7.1.2.7.2 Other Dog Snacks: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.1.2.1 Biscuits and Cookies

- 7.2 Cat Snacks

- 7.2.1 Overview

- 7.2.2 Cat Snacks: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2.2.1 Crunchies

- 7.2.2.1.1 Overview

- 7.2.2.1.2 Crunchies: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2.2.2 Lickable Treats

- 7.2.2.2.1 Overview

- 7.2.2.2.2 Lickable Treats: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2.2.3 Jerky

- 7.2.2.3.1 Overview

- 7.2.2.3.2 Jerky: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2.2.4 Pillows

- 7.2.2.4.1 Overview

- 7.2.2.4.2 Pillows: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2.2.5 Other Cat Snacks

- 7.2.2.5.1 Overview

- 7.2.2.5.2 Other Cat Snacks: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2.2.1 Crunchies

8. US and Europe Pet Snacks and Treats Market Analysis - by Flavor

- 8.1 Chicken

- 8.1.1 Overview

- 8.1.2 Chicken: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Beef

- 8.2.1 Overview

- 8.2.2 Beef: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Lamb

- 8.3.1 Overview

- 8.3.2 Lamb: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Seafood

- 8.4.1 Overview

- 8.4.2 Seafood: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Vegetables

- 8.5.1 Overview

- 8.5.2 Vegetables: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Fruits

- 8.6.1 Overview

- 8.6.2 Fruits: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

9. US and Europe Pet Snacks and Treats Market Analysis - by Distribution Channel

- 9.1 Supermarkets and Hypermarkets

- 9.1.1 Overview

- 9.1.2 Supermarkets and Hypermarkets: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Specialty Stores

- 9.2.1 Overview

- 9.2.2 Specialty Stores: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Online Retail

- 9.3.1 Overview

- 9.3.2 Online Retail: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

10. US and Europe Pet Snacks and Treats Market - Country Analysis

- 10.1 Overview

- 10.2 US

- 10.2.1 Overview

- 10.2.2 United States: US and Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2.2.1 United States: US and Europe Pet Snacks and Treats Market Breakdown by Product Type

- 10.2.2.2 United States: US and Europe Pet Snacks and Treats Market Breakdown by Flavor

- 10.2.2.3 United States: US and Europe Pet Snacks and Treats Market Breakdown by Distribution Channel

- 10.3 Europe

- 10.3.1 Europe Pet Snacks and Treats Market Breakdown by Countries

- 10.3.2 Europe Pet Snacks and Treats Market Revenue and Forecast and Analysis - by Country

- 10.3.2.1 Europe Pet Snacks and Treats Market Revenue and Forecast and Analysis - by Country

- 10.3.2.2 Germany: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.2.2.1 Germany: Europe Pet Snacks and Treats Market Breakdown by Product Type

- 10.3.2.2.2 Germany: Europe Pet Snacks and Treats Market Breakdown by Flavor

- 10.3.2.2.3 Germany: Europe Pet Snacks and Treats Market Breakdown by Distribution Channel

- 10.3.2.3 France: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.2.3.1 France: Europe Pet Snacks and Treats Market Breakdown by Product Type

- 10.3.2.3.2 France: Europe Pet Snacks and Treats Market Breakdown by Flavor

- 10.3.2.3.3 France: Europe Pet Snacks and Treats Market Breakdown by Distribution Channel

- 10.3.2.4 Italy: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.2.4.1 Italy: Europe Pet Snacks and Treats Market Breakdown by Product Type

- 10.3.2.4.2 Italy: Europe Pet Snacks and Treats Market Breakdown by Flavor

- 10.3.2.4.3 Italy: Europe Pet Snacks and Treats Market Breakdown by Distribution Channel

- 10.3.2.5 Spain: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.2.5.1 Spain: Europe Pet Snacks and Treats Market Breakdown by Product Type

- 10.3.2.5.2 Spain: Europe Pet Snacks and Treats Market Breakdown by Flavor

- 10.3.2.5.3 Spain: Europe Pet Snacks and Treats Market Breakdown by Distribution Channel

- 10.3.2.6 United Kingdom: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.2.6.1 United Kingdom: Europe Pet Snacks and Treats Market Breakdown by Product Type

- 10.3.2.6.2 United Kingdom: Europe Pet Snacks and Treats Market Breakdown by Flavor

- 10.3.2.6.3 United Kingdom: Europe Pet Snacks and Treats Market Breakdown by Distribution Channel

- 10.3.2.7 Rest of Europe: Europe Pet Snacks and Treats Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3.2.7.1 Rest of Europe: Europe Pet Snacks and Treats Market Breakdown by Product Type

- 10.3.2.7.2 Rest of Europe: Europe Pet Snacks and Treats Market Breakdown by Flavor

- 10.3.2.7.3 Rest of Europe: Europe Pet Snacks and Treats Market Breakdown by Distribution Channel

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Organic Growth Strategies

- 12.2.1 Overview

- 12.3 Inorganic Growth Strategies

- 12.3.1 Overview

13. Company Profiles

- 13.1 J M Smucker Co

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Shameless Pets, LLC

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Nestle SA

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Nature's Diet

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 General Mills Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Interquell Gmbh

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 VAFO Group

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Purrform Limited

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Scrumbles

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Mars Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Colorado Pet Treats

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Products and Services

- 13.11.4 Financial Overview

- 13.11.5 SWOT Analysis

- 13.11.6 Key Developments

- 13.12 mera - The Petfood Family

- 13.12.1 Key Facts

- 13.12.2 Business Description

- 13.12.3 Products and Services

- 13.12.4 Financial Overview

- 13.12.5 SWOT Analysis

- 13.12.6 Key Developments

- 13.13 Schell & Kampeter, Inc

- 13.13.1 Key Facts

- 13.13.2 Business Description

- 13.13.3 Products and Services

- 13.13.4 Financial Overview

- 13.13.5 SWOT Analysis

- 13.13.6 Key Developments

- 13.14 United Petfood

- 13.14.1 Key Facts

- 13.14.2 Business Description

- 13.14.3 Products and Services

- 13.14.4 Financial Overview

- 13.14.5 SWOT Analysis

- 13.14.6 Key Developments

- 13.15 RUPP FOOD Austria GmbH

- 13.15.1 Key Facts

- 13.15.2 Business Description

- 13.15.3 Products and Services

- 13.15.4 Financial Overview

- 13.15.5 SWOT Analysis

- 13.15.6 Key Developments

- 13.16 Irish Dog Foods Limited

- 13.16.1 Key Facts

- 13.16.2 Business Description

- 13.16.3 Products and Services

- 13.16.4 Financial Overview

- 13.16.5 SWOT Analysis

- 13.16.6 Key Developments

- 13.17 Rondo Food GmbH & Co. KG

- 13.17.1 Key Facts

- 13.17.2 Business Description

- 13.17.3 Products and Services

- 13.17.4 Financial Overview

- 13.17.5 SWOT Analysis

- 13.17.6 Key Developments

- 13.18 Inspired Pet Nutrition Ltd

- 13.18.1 Key Facts

- 13.18.2 Business Description

- 13.18.3 Products and Services

- 13.18.4 Financial Overview

- 13.18.5 SWOT Analysis

- 13.18.6 Key Developments

- 13.19 Ava's Pet Palace

- 13.19.1 Key Facts

- 13.19.2 Business Description

- 13.19.3 Products and Services

- 13.19.4 Financial Overview

- 13.19.5 SWOT Analysis

- 13.19.6 Key Developments

- 13.20 Butcher's Pet Care Limited

- 13.20.1 Key Facts

- 13.20.2 Business Description

- 13.20.3 Products and Services

- 13.20.4 Financial Overview

- 13.20.5 SWOT Analysis

- 13.20.6 Key Developments

- 13.21 Scholtus Special Products B.V

- 13.21.1 Key Facts

- 13.21.2 Business Description

- 13.21.3 Products and Services

- 13.21.4 Financial Overview

- 13.21.5 SWOT Analysis

- 13.21.6 Key Developments

- 13.22 Wellness Pet Company

- 13.22.1 Key Facts

- 13.22.2 Business Description

- 13.22.3 Products and Services

- 13.22.4 Financial Overview

- 13.22.5 SWOT Analysis

- 13.22.6 Key Developments

- 13.23 Addiction Foods LLC

- 13.23.1 Key Facts

- 13.23.2 Business Description

- 13.23.3 Products and Services

- 13.23.4 Financial Overview

- 13.23.5 SWOT Analysis

- 13.23.6 Key Developments

- 13.24 Smart Cookie Dog Treats

- 13.24.1 Key Facts

- 13.24.2 Business Description

- 13.24.3 Products and Services

- 13.24.4 Financial Overview

- 13.24.5 SWOT Analysis

- 13.24.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners