|

|

市場調査レポート

商品コード

1819710

北米の遺伝子検査サービス市場レポート(2021年~2031年):範囲、セグメント、力学、競合分析North America Genetic Testing Services Market Report 2021-2031 by Scope, Segmentation, Dynamics, and Competitive Analysis |

||||||

|

|||||||

| 北米の遺伝子検査サービス市場レポート(2021年~2031年):範囲、セグメント、力学、競合分析 |

|

出版日: 2025年07月10日

発行: The Insight Partners

ページ情報: 英文 176 Pages

納期: 即納可能

|

概要

北米の遺伝子検査サービス市場は著しい成長を遂げ、2023年の18億802万米ドルから2031年までには約58億9,293万米ドルに達すると予測されています。この成長軌道は、2023年から2031年までのCAGRが15.9%であることを示しています。

エグゼクティブサマリーと市場分析

北米の遺伝子検査サービス分野は、主に技術の進歩、個別化医療に対する需要の高まり、予防ヘルスケア重視の高まりに後押しされ、大幅な拡大を目の当たりにしています。米国は、がん診断、出生前スクリーニング、遺伝性疾患の特定など、さまざまな用途で遺伝子検査が広く利用されていることが特徴で、この市場の主要プレーヤーとして際立っています。23andMe、Illumina、LabCorpといった著名企業の存在が、検査技術の継続的な革新と強化を通じて市場の成長をさらに後押ししています。さらに、ゲノム研究を支援する政府の取り組みやヘルスケア資金の増加が市場の成長に大きく寄与し、遺伝子検査サービスの世界的リーダーとしての北米の地位が確固たるものになると期待されています。

市場セグメンテーション分析

遺伝子検査サービス市場は、サービスタイプ、疾患、サービスプロバイダーに基づいてセグメント化できます。

- サービスタイプ:市場は、予測検査、キャリア検査、出生前検査、新生児スクリーニング、診断用遺伝子検査、その他を含むいくつかのカテゴリーに分けられます。2023年には、予測検査分野が市場最大の貢献者に浮上しました。

- 疾患:市場は、がん、心血管疾患、代謝性疾患、その他の疾患を含む疾患別にも区分されます。がんのリスク評価と管理における遺伝子検査の重要な役割を反映して、2023年にはがん分野が最大の市場シェアを占めました。

- サービスプロバイダー:市場は、病院ベースの検査室、診断検査室、その他のサービスプロバイダーに分類されます。病院ベースの検査施設が2023年に最大のシェアを占め、遺伝子検査サービスの提供における重要な役割を強調しています。

市場の展望

遺伝性疾患の世界的な有病率の増加は、遺伝子検査サービスの需要を促進する主な要因です。遺伝性疾患は稀で非典型的な症状を呈することが多く、その多くは現在治癒不能です。2021年の世界保健機関(WHO)によると、1,000人中約10人が単一遺伝子疾患に罹患しており、これは世界中で推定7,000万から8,000万人に相当します。世界遺伝子機構(Global Genes)の報告によると、約7,000の希少疾患や障害が特定されており、定期的に新たな疾患が発見されています。

シェフィールド大学の調査によると、全世界で約3億人が遺伝性疾患を抱えて生活しているといいます。例えば、MJH Life Sciencesの2022年の報告書によると、毎年約30万人の新生児が鎌状赤血球症と診断されており、これは世界人口の約5%に相当します。さらに、2023年8月に発表された研究では、アフリカ系アメリカ人の500人に1人が鎌状赤血球症に罹患しており、約12人に1人が常染色体劣性突然変異を持っていることが強調されています。

このような遺伝性疾患の罹患率の増加は、遺伝子検査サービス市場の成長にとって重要な促進要因です。

各国の洞察

北米の遺伝子検査サービス市場には米国、カナダ、メキシコが含まれ、2023年には米国が最大の市場シェアを占めました。米国疾病予防管理センター(CDC)によると、米国では2020年に約160万3,844人が新たにがんと診断され、60万2,347人ががんに関連して死亡しました。2023年の予測では、約195万8,310人が新たにがんと診断され、60万9,820人が死亡しています。国際がん研究機関は、新たながん罹患者は2040年までに3,020万人に達すると予測しています。多くのがんには遺伝的要素があるため、がんの家族歴を持つ人の危険因子を評価するためには遺伝子検査が不可欠です。

米国政府説明責任局は2021年10月、2,500万人から3,000万人の米国人が希少疾病に罹患しており、その半数近くが小児患者であると報告しました。希少疾患の80%は遺伝に起因すると推定されています。

遺伝子検査は、過去数十年にわたって米国のヘルスケアシステムに不可欠なものとなっています。遺伝子検査の普及が進むにつれ、全国で実施される検査の質を保証する必要性が高まっています。臨床検査施設改善法(CLIA)は遺伝子検査施設を規制し、品質管理と保証基準の遵守を保証しています。さらに、米国食品医薬品局(FDA)は、臨床検査室で使用される遺伝子検査キットの品質を監督しています。

米国における遺伝子検査の需要は、がん、自己免疫疾患、感染症への応用に牽引され、今後も伸び続けると予想されます。Avellino LabsのAvaGen遺伝子眼検査やFDAによる脆弱X症候群の遺伝子検査の承認など、遺伝子検査製品における革新は、この分野における継続的な進歩を物語っています。

企業プロファイル

北米の遺伝子検査サービス市場の主要企業には、Eurofins Scientific SE、Exact Sciences Corp、Laboratory Corp of America Holdings、23andMe Holding Co、Ambry Genetics Corp、Quest Diagnostics Inc、Illumina Inc、F. Hoffmann-La Roche Ltd、NeoGenomics Inc、Centogene NV、Ancestry Genomics Inc、Gene By Gene Ltd、SIVOTEC BioInformatics LLC、Progenesis、Fulgent Genetics, Inc、VERITAS INTERCONTINENTAL、GeneDx, LLCなどがあります。これらの企業は、市場での存在感を高め、消費者に革新的なソリューションを提供するために、事業拡大、製品革新、M&Aなど様々な戦略を採用しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の開発

- データの三角測量

- 国レベルのデータ

第4章 北米の遺伝子検査サービス市場情勢

- PEST分析

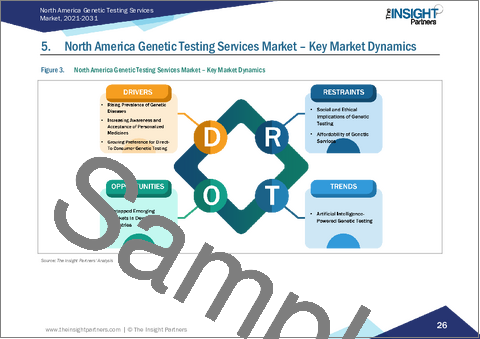

第5章 北米の遺伝子検査サービス市場:主要市場力学

- 市場促進要因

- 遺伝性疾患の有病率の上昇

- 個別化医療に対する認識と受容の高まり

- 消費者直接検査(DTC)に対する選好の高まり

- 市場抑制要因

- 遺伝子検査の社会的・倫理的意味合い

- 遺伝学的サービスの手頃な価格

- 市場機会

- 開発途上国における未開拓の新興市場

- 今後の動向

- 人工知能による遺伝子検査

- 影響分析

第6章 遺伝子検査サービス市場:北米分析

- 北米の遺伝子検査サービス市場収益、2021年~2031年

- 北米の遺伝子検査サービス市場予測分析

第7章 北米の遺伝子検査サービス市場分析-サービスタイプ別

- 予測検査

- キャリア検査

- 出生前検査

- 新生児スクリーニング

- 診断用遺伝子検査

- その他

第8章 北米の遺伝子検査サービス市場分析-疾患別

- がん

- 心血管疾患

- 代謝性疾患

- その他の疾患

第9章 北米の遺伝子検査サービス市場分析-サービスプロバイダー別

- 病院ベースの研究所

- 診断ラボ

- その他のサービスプロバイダー

第10章 北米の遺伝子検査サービス市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 遺伝子検査サービス市場:業界情勢

- 遺伝子検査サービス市場における成長戦略

- 有機的成長戦略

- 無機的成長戦略

第12章 企業プロファイル

- Eurofins Scientific SE

- Exact Sciences Corp

- Laboratory Corp of America Holdings

- 23andMe Holding Co

- Ambry Genetics Corp

- Quest Diagnostics Inc

- Illumina Inc

- F. Hoffmann-La Roche Ltd

- NeoGenomics Inc

- Centogene NV

- Ancestry Genomics Inc

- Gene By Gene Ltd

- SIVOTEC BioInformatics LLC

- Progenesis

- Fulgent Genetics, Inc

- VERITAS INTERCONTINENTAL

- GeneDx, LLC