|

|

市場調査レポート

商品コード

1510706

欧州の飼料用プレミックス市場:2030年までの予測、地域別分析 - タイプ別、形態別、家畜別Europe Feed Premix Market Forecast to 2030 - Regional Analysis - by Type (Vitamins, Minerals, Amino Acids, Antibiotics, Antioxidants, Blends, and Others), Form (Dry and Liquid), and Livestock (Poultry, Ruminants, Swine, Aquaculture, and Others) |

||||||

|

|||||||

| 欧州の飼料用プレミックス市場:2030年までの予測、地域別分析 - タイプ別、形態別、家畜別 |

|

出版日: 2024年05月07日

発行: The Insight Partners

ページ情報: 英文 113 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の飼料用プレミックス市場は、2022年には25億3,422万米ドルとなり、2030年には35億229万米ドルに達すると予測され、2022年から2030年までのCAGRは4.1%で成長すると予測されています。

家畜生産の増加が欧州の飼料用プレミックス市場を牽引

工業的畜産は、食肉製品や乳製品への需要の増加により、大きな変貌を遂げています。動物性タンパク質は、人間の食事に含まれるエネルギーの16%、タンパク質の34%を占めています。また、畜産は食料生産額の19%、世界の農業額の30%を占めています。畜産物の需要は、ライフスタイルや食の嗜好の変化、都市化の進展、所得の増加、世界人口の急増によって牽引されています。家畜需要の急増に伴い、タンパク質が豊富な肉製品の消費が急増しています。国連食糧農業機関(FAO)によると、世界の肉タンパク質消費量は2030年までに14%増加すると予測されています。さらに、経済協力開発機構(OECD)とFAOの報告書によると、世界の牛乳生産量は2020年から2029年にかけて毎年1.6%増加し、2029年には9億9,700万トンに達すると予想されています。このように、食肉などの畜産物の消費の増加と生乳生産の増加は、メーカーが家畜に良質で栄養豊富な飼料を提供することに注力するよう促しています。このことが、飼料メーカーの間で添加物としての飼料用プレミックスの需要を牽引しています。家畜生産の増加は、人々が消費する食肉の品質に高い関心を寄せていることから、飼料の栄養的品質を高めるための飼料用プレミックスに対する需要を生み出す可能性が高いです。家畜の栄養不足は、家畜の成長率、健康、幸福を維持する栄養価の高い飼料を与えることで解決できます。このように、需要の急増に伴い、健康な家畜の生産は地域全体で増加しており、欧州の飼料用プレミックス市場をさらに牽引しています。

欧州の飼料用プレミックス市場概要

欧州の飼料用プレミックス市場は、食肉生産の工業化の急増と栄養価の高い動物飼料の需要の増加により、力強い成長を目の当たりにしています。家畜の所有者は、健康的で高品質な栄養価の高い食肉製品を生産するために、健康的な飼料原料を採用しています。さらに、欧州は動物の種類が多く、食肉需要が高いことでも知られています。Eurostat(欧州連合)の発表によると、2020年、欧州には約1億4,600万頭の豚、7,600万頭のウシ、7,500万頭のヒツジとヤギの家畜がいた。このような膨大な畜産動物は十分な飼料を必要とするため、飼料用プレミックスの需要が高まっています。

この地域は2020年に最高の鶏肉生産量を記録し、~1,360万羽の鶏肉生産量を記録しました。さらに、欧州飼料製造業者連盟(FEFAC)によると、この地域ではアフリカ豚コレラ熱(ASF)の蔓延が続いており、養豚への影響があるにもかかわらず、豚飼料の生産量は2020年に2.9%増加しました。高い畜産生産量と家畜飼養頭数の増加は、欧州の飼料用プレミックス市場にとって良好な事業環境を生み出しています。このように、家畜の増加による飼料の大量生産とその消費が、飼料用プレミックスのような栄養価の高い飼料添加物の需要を押し上げています。したがって、上記のすべての要因のおかげで、欧州の飼料用プレミックス市場は、2022年から2030年の間に欧州で大幅に成長すると予想されます。しかし、欧州では一部の飼料原料に対して厳しい政策がとられており、動物性食品中の飼料含有比率が制限されています。例えば、欧州食品安全機関(EFSA)、欧州医薬品庁(EMA)、欧州疾病予防管理センター(ECDC)は、動物飼料中の抗生物質の使用を減らすガイドラインを発表しています。このような政策が欧州の飼料用プレミックス市場の成長を阻害しています。

欧州の飼料用プレミックス市場の収益と2030年までの予測(金額)

欧州の飼料用プレミックス市場セグメンテーション

欧州の飼料用プレミックス市場は、タイプ、形態、家畜、国によって区分されます。

タイプ別では、欧州の飼料用プレミックス市場はビタミン、ミネラル、アミノ酸、抗生物質、酸化防止剤、ブレンド、その他に区分されます。2022年にはブレンドセグメントが最大のシェアを占めています。

形態別では、欧州の飼料用プレミックス市場は乾燥と液体に二分されます。2022年には乾燥セグメントが大きなシェアを占めています。

家畜別では、欧州の飼料用プレミックス市場は調査用家禽、反芻動物、豚、養殖、その他に分類されます。家禽セグメントが2022年に最大のシェアを占めました。

国別では、欧州飼料用プレミックス市場はドイツ、フランス、イタリア、英国、スペイン、その他欧州に区分されます。その他欧州が2022年の欧州飼料用プレミックス市場を独占しました。

Agrifirm Group BV、Archer-Daniels-Midland Co、Cargill Inc、Danish Agro AMBA、Dansk Landbrugs Grovareselskab amba、De Heus Voeders BV、Kemin Industries Inc、Koninklijke DSM NV、NuSana BV、Nutreco NVは、欧州の飼料用プレミックス市場で事業展開している大手企業の一部です。

目次

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 欧州の飼料用プレミックス市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 製造プロセス

- ディストリビューターまたはサプライヤー

- エンドユーザー

- ベンダー一覧

第5章 欧州の飼料用プレミックス市場:主要市場力学

- 市場促進要因

- 家畜生産の増加

- 飼料の強化

- 市場抑制要因

- 飼料添加物としての抗生物質の禁止

- 市場機会

- 新興諸国からの飼料用プレミックス需要の増加

- 今後の動向

- 有機飼料への嗜好の高まり

- 促進要因と抑制要因の影響分析

第6章 飼料用プレミックス市場:欧州市場分析

- 欧州の飼料用プレミックス市場の収益

- 欧州の飼料用プレミックス市場の予測と分析(2020年~2030年)

第7章 欧州の飼料用プレミックス分析:タイプ別

- ビタミン

- ビタミン類欧州の飼料用プレミックス市場の収益と2030年までの予測

- ミネラル

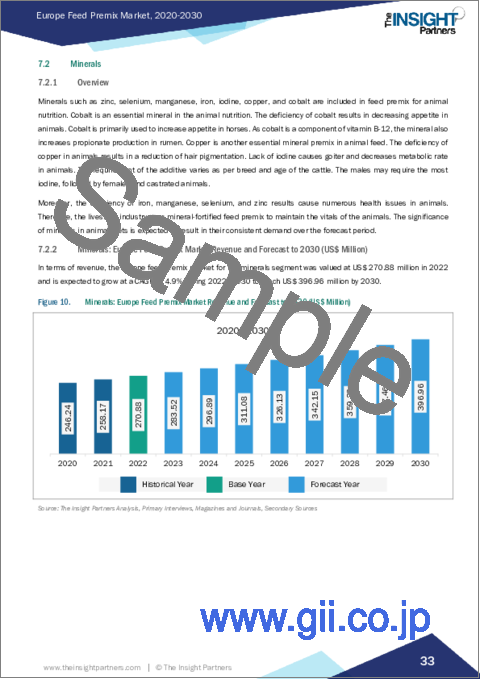

- ミネラル:欧州の飼料用プレミックス市場の収益と2030年までの予測

- アミノ酸

- アミノ酸:欧州の飼料用プレミックス市場の収益と2030年までの予測

- 抗生物質

- 抗生物質:欧州の飼料用プレミックス市場の収益と2030年までの予測

- 酸化防止剤

- 酸化防止剤:欧州の飼料用プレミックス市場の収益と2030年までの予測

- ブレンド

- ブレンド:欧州の飼料用プレミックス市場の収益と2030年までの予測

- その他

- その他:欧州の飼料用プレミックス市場の収益と2030年までの予測

第8章 欧州の飼料用プレミックス市場の収益分析:形態別

- 乾燥

- 液体

第9章 欧州の飼料用プレミックス市場の収益分析:家畜別

- 家禽

- 反芻動物

- 豚

- 水産養殖

- その他

第10章 欧州の飼料用プレミックス市場:国別分析

- ドイツ

- フランス

- イタリア

- 英国

- スペイン

- その他欧州

第11章 競合情勢

- 主要企業別のヒートマップ分析

- 企業のポジショニングと集中度

第12章 企業プロファイル

- Danish Agro AMBA

- Agrifirm Group BV

- Nutreco NV

- Archer-Daniels-Midland Co

- Cargill Inc

- Koninklijke DSM NV

- Dansk Landbrugs Grovvareselskab amba

- NuSana BV

- De Heus Voeders BV

- Kemin Industries Inc

第13章 付録

List Of Tables

- Table 1. Europe Feed Premix Market Segmentation

- Table 2. List of Vendors in Value Chain

- Table 3. Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- Table 4. Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - Type

- Table 5. Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - Form

- Table 6. Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - Livestock

- Table 7. Germany: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 8. Germany: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Form

- Table 9. Germany: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

- Table 10. France: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 11. France: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Form

- Table 12. France: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

- Table 13. Italy: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 14. Italy: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Form

- Table 15. Italy: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

- Table 16. UK: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 17. UK: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Form

- Table 18. UK: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

- Table 19. Spain: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 20. Spain: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Form

- Table 21. Spain: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

- Table 22. Rest of Europe: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 23. Rest of Europe: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Form

- Table 24. Rest of Europe: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million) - By Livestock

List Of Figures

- Figure 1. Europe Feed Premix Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis: Europe Feed Premix Market

- Figure 3. Ecosystem: Europe Feed Premix Market

- Figure 4. Europe Feed Premix Market - Key Industry Dynamics

- Figure 5. Global Meat Production by Livestock Type (2001-2021)

- Figure 6. Europe Feed Premix Market Impact Analysis of Drivers and Restraints

- Figure 7. Europe Feed Premix Market Revenue (US$ Million), 2020 - 2030

- Figure 8. Europe Feed Premix Market Share (%) - Type, 2022 and 2030

- Figure 9. Vitamins: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Minerals: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Amino Acids: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Antibiotics: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 13. Antioxidants: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Blends: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Others: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Europe Feed Premix Market Revenue Share, By Form (2022 and 2030)

- Figure 17. Dry: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Liquid: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Europe Feed Premix Market Revenue Share, By Livestock (2022 and 2030)

- Figure 20. Poultry: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Ruminants: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Swine: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Aquaculture: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Others: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Europe Feed Premix Market Breakdown by Key Countries - Revenue (2022) (US$ Million)

- Figure 26. Europe Feed Premix Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 27. Germany: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 28. France: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 29. Italy: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 30. UK: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 31. Spain: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 32. Rest of Europe: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 33. Company Positioning & Concentration

- Figure 34. Heat Map Analysis by Key Players

The Europe feed premix market was valued at US$ 2,534.22 million in 2022 and is expected to reach US$ 3,502.29 million by 2030; it is estimated to grow at a CAGR of 4.1% from 2022 to 2030.

Increase in Livestock Production Drives Europe Feed Premix Market

Industrial livestock production has undergone a significant transformation owing to increasing demand for meat-based products and dairy products. Animal protein account for 16% of energy and 34% of the protein in human diets. Livestock production also accounts for ~19% of the value of food production and 30% of the global value of agriculture. The demand for livestock products is driven by changing lifestyles and food preferences, increasing urbanization, growing income, and the rapidly rising world population. With burgeoning livestock demand, the consumption of protein-rich meat products is surging. According to the Food and Agriculture Organization (FAO), worldwide meat protein consumption is predicted to increase by 14% by 2030. Additionally, world milk production is expected to rise by 1.6% annually between 2020 and 2029 and reach 997 million metric tons in 2029, according to a report by the Organization for Economic Co-operation and Development (OECD) and FAO. Thus, the increasing consumption of livestock products such as meat and increasing milk production has encouraged manufacturers to focus on providing good quality and nutrient rich feed for livestock. This drives the demand for feed premix as an additive among the feed manufacturers. The growth in livestock production is likely to create a demand for feed premixes to enhance the nutritional quality of feed, as people are highly concerned about the quality of meat they consume. Nutrient deficiencies in livestock can be resolved by providing them with nutritional feed that maintains the growth rate of livestock, their health, and well-being. Thus, with the surging demand, the production of healthy livestock is increasing across the region, further driving the Europe feed premix market.

Europe Feed Premix Market Overview

The Europe feed premix market in Europe is witnessing strong growth due to the surging industrialization of meat production and the increasing demand for nutritional animal feed. Livestock owners are adopting healthy feed ingredients to produce healthy, quality, and nutritious animal meat products. Furthermore, Europe is known for its large variety of animal stocks and high demand for meat. As per the Eurostat (European Union), in 2020, Europe had nearly 146 million pigs, 76 million bovine animals, and 75 million sheep and goat stock. Such a huge stock of livestock animals requires enough animal feed, which is increasing the demand for feed premix.

The region witnessed its highest poultry meat production in 2020, recording ~13.6 million poultry meat production. Additionally, according to the European Feed Manufacturers' Federation (FEFAC), pig feed production rose by 2.9% in 2020 despite the continued spread of African Swine Fever (ASF) in the region and its impact on pig farming. The high livestock production and the rise in animal stock are creating a favorable business environment for the Europe feed premix market in Europe. Thus, the mass production of animal feed and its consumption due to growing livestock are boosting the demand for nutritious feed additives such as feed premix. Thus, owing to all the factors mentioned above, the Europe feed premix market is expected to grow significantly in Europe during 2022-2030. However, Europe has stringent policies for some feed ingredients and limits the ratios of feed contents in animal food. For instance, European Food Safety Authority (EFSA), the European Medicines Agency (EMA), and the European Centre for Disease Prevention and Control (ECDC) have issued guidelines to decrease the use of antibiotics in animal feed. Such policies impede the Europe feed premix market growth in the region.

Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

Europe Feed Premix Market Segmentation

The Europe feed premix market is segmented based on type, form, livestock, and country.

Based on type, the Europe feed premix market is segmented into vitamins, minerals, amino acids, antibiotics, antioxidants, blends, and others. The blends segment held the largest share in 2022.

By form, the Europe feed premix market is bifurcated into dry and liquid. The dry segment held a larger share in 2022.

By livestock, the Europe feed premix market is categorized into research poultry, ruminants, swine, aquaculture, and others. The poultry segment held the largest share in 2022.

Based on country, the Europe feed premix market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. The Rest of Europe dominated the Europe feed premix market in 2022.

Agrifirm Group BV, Archer-Daniels-Midland Co, Cargill Inc, Danish Agro AMBA, Dansk Landbrugs Grovvareselskab amba, De Heus Voeders BV, Kemin Industries Inc, Koninklijke DSM NV, NuSana BV, and Nutreco NV are some of the leading companies operating in the Europe feed premix market.

Table Of Contents

Table of Content

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Feed Premix Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturing Process

- 4.3.2.1 Raw Material

- 4.3.2.2 Formulation

- 4.3.2.3 Weighing

- 4.3.2.4 Mixing

- 4.3.2.5 Packaging

- 4.3.3 Distributors or Suppliers

- 4.3.4 End User

- 4.4 List of Vendors

5. Europe Feed Premix Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increase in Livestock Production

- 5.1.2 Feed Fortification

- 5.2 Market Restraints

- 5.2.1 Bans on Antibiotics as Feed Additives

- 5.3 Market Opportunities

- 5.3.1 Growing Demand for Feed Premix from Developing Countries

- 5.4 Future Trends

- 5.4.1 Rising Preference for Organic Feed

- 5.5 Impact Analysis of Drivers and Restraints

6. Feed Premix Market - Europe Market Analysis

- 6.1 Europe Feed Premix Market Revenue (US$ Million)

- 6.2 Europe Feed Premix Market Forecast and Analysis (2020-2030)

7. Europe Feed Premix Market Analysis - Type

- 7.1 Vitamins

- 7.1.1 Overview

- 7.1.2 Vitamins: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 7.2 Minerals

- 7.2.1 Overview

- 7.2.2 Minerals: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 7.3 Amino Acids

- 7.3.1 Overview

- 7.3.2 Amino Acids: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 7.4 Antibiotics

- 7.4.1 Overview

- 7.4.2 Antibiotics: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 7.5 Antioxidants

- 7.5.1 Overview

- 7.5.2 Antioxidants: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 7.6 Blends

- 7.6.1 Overview

- 7.6.2 Blends: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 7.7 Others

- 7.7.1 Overview

- 7.7.2 Others: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

8. Europe Feed Premix Market Revenue Analysis - By Form

- 8.1 Overview

- 8.2 Dry

- 8.2.1 Overview

- 8.2.2 Dry: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 8.3 Liquid

- 8.3.1 Overview

- 8.3.2 Liquid: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

9. Europe Feed Premix Market Revenue Analysis - By Livestock

- 9.1 Overview

- 9.2 Poultry

- 9.2.1 Overview

- 9.2.2 Poultry: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 9.3 Ruminants

- 9.3.1 Overview

- 9.3.2 Ruminants: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 9.4 Swine

- 9.4.1 Overview

- 9.4.2 Swine: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 9.5 Aquaculture

- 9.5.1 Overview

- 9.5.2 Aquaculture: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: Europe Feed Premix Market Revenue and Forecast to 2030 (US$ Million)

10. Europe Feed Premix Market - Country Analysis

- 10.1 Europe Feed Premix Market - Country Analysis

- 10.1.1 Europe Feed Premix Market Revenue and Forecasts and Analysis - By Countries

- 10.1.1.1 Europe Feed Premix Market Breakdown by Country

- 10.1.1.2 Germany: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.2.1 Germany: Europe Feed Premix Market Breakdown by Type

- 10.1.1.2.2 Germany: Europe Feed Premix Market Breakdown by Form

- 10.1.1.2.3 Germany: Europe Feed Premix Market Breakdown by Livestock

- 10.1.1.3 France: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.3.1 France: Europe Feed Premix Market Breakdown by Type

- 10.1.1.3.2 France: Europe Feed Premix Market Breakdown by Form

- 10.1.1.3.3 France: Europe Feed Premix Market Breakdown by Livestock

- 10.1.1.4 Italy: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.4.1 Italy: Europe Feed Premix Market Breakdown by Type

- 10.1.1.4.2 Italy: Europe Feed Premix Market Breakdown by Form

- 10.1.1.4.3 Italy: Europe Feed Premix Market Breakdown by Livestock

- 10.1.1.5 UK: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.5.1 UK: Europe Feed Premix Market Breakdown by Type

- 10.1.1.5.2 UK: Europe Feed Premix Market Breakdown by Form

- 10.1.1.5.3 UK: Europe Feed Premix Market Breakdown by Livestock

- 10.1.1.6 Spain: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.6.1 Spain: Europe Feed Premix Market Breakdown by Type

- 10.1.1.6.2 Spain: Europe Feed Premix Market Breakdown by Form

- 10.1.1.6.3 Spain: Europe Feed Premix Market Breakdown by Livestock

- 10.1.1.7 Rest of Europe: Europe Feed Premix Market Revenue and Forecasts to 2030 (US$ Million)

- 10.1.1.7.1 Rest of Europe: Europe Feed Premix Market Breakdown by Type

- 10.1.1.7.2 Rest of Europe: Europe Feed Premix Market Breakdown by Form

- 10.1.1.7.3 Rest of Europe: Europe Feed Premix Market Breakdown by Livestock

- 10.1.1 Europe Feed Premix Market Revenue and Forecasts and Analysis - By Countries

11. Competitive Landscape

- 11.1 Heat Map Analysis By Key Players

- 11.2 Company Positioning & Concentration

12. Company Profiles

- 12.1 Danish Agro AMBA

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 Agrifirm Group BV

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Nutreco NV

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Archer-Daniels-Midland Co

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Cargill Inc

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Koninklijke DSM NV

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Dansk Landbrugs Grovvareselskab amba

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 NuSana BV

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 De Heus Voeders BV

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Kemin Industries Inc

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments