|

|

市場調査レポート

商品コード

1510615

アジア太平洋の鉄粉市場:2030年予測-タイプ別、製造プロセス別、グレード別、最終用途産業別、国別Asia Pacific Iron Powder Market Forecast to 2030 - Regional Analysis - by Type (Reduced, Atomized, and Electrolytic), Manufacturing Process, Grade ( 99.0% and 99.1%), and End-Use Industry |

||||||

|

|||||||

| アジア太平洋の鉄粉市場:2030年予測-タイプ別、製造プロセス別、グレード別、最終用途産業別、国別 |

|

出版日: 2024年05月07日

発行: The Insight Partners

ページ情報: 英文 126 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

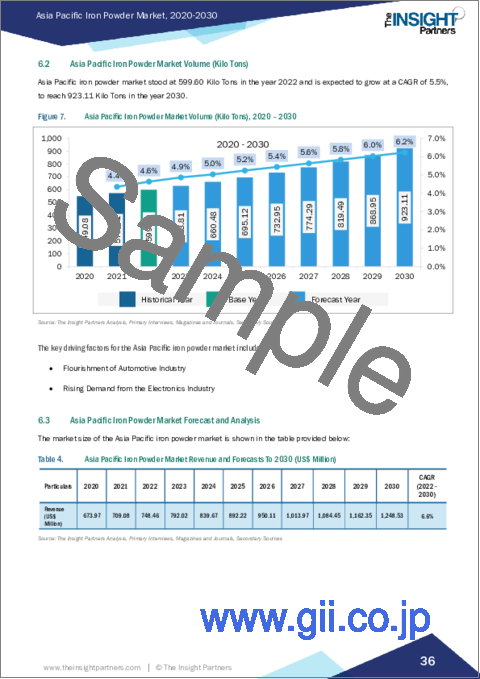

アジア太平洋の鉄粉市場は2022年に7億4,846万米ドルと評価され、2030年には12億4,853万米ドルに達すると予測され、2022年から2030年までのCAGRは6.6%と予測されています。

自動車産業の繁栄がアジア太平洋の鉄粉市場を牽引

自動車産業は、粉末冶金分野の基本原料である鉄粉に大きく依存しています。この製造プロセスでは、金属粉末を成形・焼結して複雑な部品を作る。自動車メーカーは、ギア、ベアリング、ブッシュなどの部品の製造に粉末冶金を採用することが増えています。これは、費用効率が高く、精密で、資源効率の高い製造ソリューションが得られるからです。さらに近年、自動車部門は燃費向上と排出ガス削減のため、車両の軽量化に多額の投資を行っています。鉄粉を金属基複合材料やその他の先端材料に組み込むことで、構造的完全性を維持した軽量部品の開発に貢献することができます。これらの部品は、業界の軽量化目標の達成に不可欠であり、その結果、より燃費の良い自動車と二酸化炭素排出量の削減を実現します。現代自動車は2022年3月、インドネシア・チカラン近郊のデルタマス工業団地に、東南アジアで初の工場となるヒュンダイ・モーター・マニュファクチャリング・インドネシアを設立しました。現代自動車は同工場に約15億5,000万米ドルを投資し、生産能力を25万台に引き上げる計画です。また、マルチ・スズキ・インディアは2021年7月、インドのハリヤナ州にある新製造施設に24億2,000万米ドルを投資すると発表しました。この施設では年間100万台の生産が見込まれています。このような自動車の生産と需要の拡大が、鉄粉の需要を牽引しています。自動車産業が電気自動車(EV)へと変貌を遂げる中、鉄粉の役割はさらに重要になっています。EVに使用される電気モーターは、モーターの効率と性能に不可欠な軟磁性コアの製造に鉄粉を使用することが多いです。国際エネルギー機関(IEA)が毎年発表している「世界電気自動車見通し」によると、2022年には世界で1,000万台以上の電気自動車が販売され、2023年にはさらに35%増加して1,400万台に達すると予測されています。自動車部品セクターが進化と革新を続ける中、鉄粉は高品質で効率的、かつ環境に配慮した自動車部品を生産するための基本材料であり続ける構えです。

アジア太平洋の鉄粉市場概要

アジア太平洋の鉄粉市場は、オーストラリア、中国、インド、日本、韓国、その他アジア太平洋地域に区分されます。アジア太平洋諸国は、都市化の進展、工業化の進展に伴う製造業の増加により急成長を遂げており、アジア太平洋の鉄粉市場の主要企業に十分な機会を提供しています。同地域には鉄粉の成長機会が豊富にあります。外国直接投資の増加もこの地域の経済成長につながります。冶金、コーティング、装飾、電子材料、焼結部品、ダイヤモンド切削工具など、多くの用途で鉄粉の使用が増加しており、アジア太平洋の鉄粉需要が増加すると予想されています。アジア太平洋におけるエレクトロニクス産業の成長と相まって、電化分野におけるプロジェクトの増加は、アジア太平洋の鉄粉市場の成長に有利な機会を提供しています。東南アジア諸国連合(ASEAN)によると、エレクトロニクス産業はアジア太平洋のほとんどの国の輸出総額の20~50%を占めています。さらに、インドや中国を含むアジア太平洋諸国における自動車販売の増加は、近年のアジア太平洋の鉄粉市場にとって最も心強い成長要因の一つとなっています。加えて、中産階級の人口増加、新興国交通インフラの開拓、可処分所得の増加、大都市近郊の衛星都市開発による移動性の向上、自家用車所有への憧れの高まりが、アジア太平洋の鉄粉市場に拍車をかけています。さらに、人口の増加とアジア太平洋地域の経済の高騰が工業化をもたらし、製品需要を促進することで、予測期間中にアジア太平洋の鉄粉市場を拡大させるでしょう。

アジア太平洋の鉄粉市場の収益と2030年までの予測(金額)

アジア太平洋の鉄粉市場のセグメンテーション

アジア太平洋の鉄粉市場は、タイプ、グレード、製造プロセス、最終用途産業、国に分類されます。

タイプ別では、アジア太平洋の鉄粉市場は還元、アトマイズ、電解に区分されます。アトマイズセグメントは2022年に最大の市場シェアを占めました。

グレード別では、アジア太平洋の鉄粉市場は<=99.0% and>=99.1%に二分されます。<=99.0%セグメントが2022年に大きな市場シェアを占めました。

製造プロセス別では、アジア太平洋の鉄粉市場は物理的、化学的、機械的に分類されます。2022年には物理的セグメントが最大の市場シェアを占めました。さらに、物理的セグメントはアトマイズと電着に細分化されます。さらに、化学セグメントは還元と分解にさらに細分化されます。

最終用途産業に基づいて、アジア太平洋の鉄粉市場は塗料・コーティング、添加剤製造、医療、軟磁性製品、冶金、その他に区分されます。冶金セグメントは2022年に最大の市場シェアを占めました。さらに、冶金セグメントは複合ろう付け、複合焼結、複合溶接、その他に細分化されます。

国別では、アジア太平洋の鉄粉市場はオーストラリア、中国、インド、日本、韓国、その他アジア太平洋地域に区分されます。2022年のアジア太平洋の鉄粉市場シェアは中国が独占。

Rio Tinto Metal Powders、American Elements Inc、Industrial Metal Powders(India)Pvt Ltd、CNPC Powder North America Inc、Ashland Inc、BASF SE、Hoganas AB、JFE Steel Corp、Reade International Corp、Kobe Steel Ltdなどがアジア太平洋の鉄粉市場の大手企業です。

目次

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 アジア太平洋の鉄粉市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係の強さ

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- ディストリビューター/サプライヤー

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 アジア太平洋の鉄粉市場:主要市場力学

- 市場促進要因

- 自動車産業の繁栄

- エレクトロニクス産業からの需要増加

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- 積層造形への需要の高まり

- 今後の動向

- 持続可能で環境に優しい製造方法

- 影響分析

第6章 アジア太平洋の鉄粉市場-アジア太平洋市場分析

- アジア太平洋の鉄粉市場の売上高

- アジア太平洋の鉄粉市場規模

- アジア太平洋の鉄粉市場の予測・分析

第7章 アジア太平洋の鉄粉市場分析-タイプ別

- 還元

- 還元鉄粉市場の収益と2030年までの予測

- 還元鉄粉市場の数量と2030年までの予測

- アトマイズ

- アトマイズ市場の収益と2030年までの予測

- アトマイズ市場の数量と2030年までの予測

- 電解

- 電解市場の収益と2030年までの予測

- 電解市場の数量と2030年までの予測

第8章 アジア太平洋の鉄粉市場分析-製造プロセス別

- 物理的

- 物理的市場の収益と2030年までの予測

- 粉末化

- 電着

- 化学的

- 化学的市場の収益と2030年までの予測

- 還元

- 分解

- 機械的

- 機械的市場の収益と2030年までの予測

第9章 アジア太平洋の鉄粉市場分析-グレード別

- 99.0%

- 99.0%市場の収益と2030年までの予測

- 99.1%

- 99.1%市場の収益と2030年までの予測

第10章 アジア太平洋の鉄粉市場分析-用途別産業

- 塗料・コーティング

- 塗料・コーティング市場の収益と2030年までの予測

- 積層造形

- 積層造形市場の収益と2030年までの予測

- 医療

- 医療市場の収益と2030年までの予測

- 軟磁性製品

- 軟磁性製品市場の収益と2030年までの予測

- 冶金

- 冶金市場の収益と2030年までの予測

- 複合ろう付け

- 複合焼結

- 複合溶接

- その他

- その他

- その他市場の収益と2030年までの予測

第11章 アジア太平洋の鉄粉市場:国別分析

- オーストラリア

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

第12章 競合情勢

- 主要企業別ヒートマップ分析

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第14章 企業プロファイル

- Rio Tinto Metal Powders

- American Elements Inc

- Industrial Metal Powders(India)Pvt Ltd

- CNPC Powder North America Inc

- Ashland Inc

- BASF SE

- Hoganas AB

- JFE Steel Corp

- Reade International Corp

- Kobe Steel Ltd

第15章 付録

List Of Tables

- Table 1. Asia Pacific Iron Powder Market Segmentation

- Table 2. List of Raw Material Suppliers in Value Chain

- Table 3. List of Manufacturers in Value Chain

- Table 4. Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- Table 5. Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- Table 6. Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - Type

- Table 7. Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons) - Type

- Table 8. Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - Manufacturing Process

- Table 9. Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - Grade

- Table 10. Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - End-Use Industry

- Table 11. Australia: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 12. Australia: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons) - By Type

- Table 13. Australia: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Manufacturing Process

- Table 14. Australia: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Grade

- Table 15. Australia: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By End-Use Industry

- Table 16. China: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 17. China: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons) - By Type

- Table 18. China: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Manufacturing Process

- Table 19. China: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Grade

- Table 20. China: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By End-Use Industry

- Table 21. India: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 22. India: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons) - By Type

- Table 23. India: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Manufacturing Process

- Table 24. India: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Grade

- Table 25. India: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By End-Use Industry

- Table 26. Japan: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 27. Japan: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons) - By Type

- Table 28. Japan: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Manufacturing Process

- Table 29. Japan: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Grade

- Table 30. Japan: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By End-Use Industry

- Table 31. South Korea: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 32. South Korea: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons) - By Type

- Table 33. South Korea: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Manufacturing Process

- Table 34. South Korea: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Grade

- Table 35. South Korea: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By End-Use Industry

- Table 36. Rest of Asia Pacific: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Type

- Table 37. Rest of Asia Pacific: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons) - By Type

- Table 38. Rest of Asia Pacific: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Manufacturing Process

- Table 39. Rest of Asia Pacific: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By Grade

- Table 40. Rest of Asia Pacific: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million) - By End-Use Industry

- Table 41. Company Positioning & Concentration

List Of Figures

- Figure 1. Asia Pacific Iron Powder Market Segmentation, By Country

- Figure 2. Asia Pacific Iron Powder Market - Porter's Analysis

- Figure 3. Ecosystem: Asia Pacific Iron Powder Market

- Figure 4. Market Dynamics: Asia Pacific Iron Powder Market

- Figure 5. Asia Pacific Iron Powder Market Impact Analysis of Drivers and Restraints

- Figure 6. Asia Pacific Iron Powder Market Revenue (US$ Million), 2020 - 2030

- Figure 7. Asia Pacific Iron Powder Market Volume (Kilo Tons), 2020 - 2030

- Figure 8. Asia Pacific Iron Powder Market Share (%) - Type, 2022 and 2030

- Figure 9. Reduced Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 10. Reduced Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 11. Atomized Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 12. Atomized Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 13. Electrolytic Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 14. Electrolytic Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 15. Asia Pacific Iron Powder Market Share (%) -Manufacturing Process, 2022 and 2030

- Figure 16. Physical Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 17. Atomization Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 18. Electro Deposition Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 19. Chemical Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 20. Reduction Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 21. Decomposition Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 22. Mechanical Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 23. Asia Pacific Iron Powder Market Share (%) -Grade, 2022 and 2030

- Figure 24. 99.0% Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 25. 99.1% Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 26. Asia Pacific Iron Powder Market Share (%) -End-Use Industry, 2022 and 2030

- Figure 27. Paints and Coatings Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 28. Additive Manufacturing Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 29. Medical Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 30. Soft Magnetic Products Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 31. Metallurgy Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 32. Compound Brazing Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 33. Compound Sintering Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 34. Compound Welding Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 35. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 36. Others Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 37. Asia Pacific Iron Powder Market Breakdown By Key Countries - Revenue (2022) (US$ Million)

- Figure 38. Asia Pacific Iron Powder Market Breakdown By Key Countries, 2022 And 2030 (%)

- Figure 39. Australia: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 40. Australia: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 41. China: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 42. China: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 43. India: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 44. India: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 45. Japan: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 46. Japan: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 47. South Korea: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 48. South Korea: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 49. Rest of Asia Pacific: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- Figure 50. Rest of Asia Pacific: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- Figure 51. Heat Map Analysis By Key Players

The Asia Pacific iron powder market was valued at US$ 748.46 million in 2022 and is expected to reach US$ 1,248.53 million by 2030; it is estimated to register a CAGR of 6.6% from 2022 to 2030.

Flourishment of Automotive Industry Drives Asia Pacific Iron Powder Market

The automotive industry heavily relies on iron powder as it is a fundamental raw material in the field of powder metallurgy. This manufacturing process involves shaping and sintering metal powders to create intricate parts. Automotive manufacturers increasingly turn to powder metallurgy for the production of components such as gears, bearings, and bushings, as it offers cost-effective, precise, and resource-efficient manufacturing solutions. In addition, in recent years, the automotive sector has heavily invested in reducing the weight of vehicles to enhance fuel efficiency and reduce emissions. Iron powder, when integrated into metal matrix composites and other advanced materials, can contribute to the development of lightweight components that maintain structural integrity. These components are integral to achieving the industry's lightweight objectives, resulting in more fuel-efficient vehicles and a reduced carbon footprint. Hyundai Motor Company inaugurated Hyundai Motor Manufacturing Indonesia, its first factory in Southeast Asia, located in the Deltamas industrial complex near Cikarang, Indonesia, with an initial production capacity of 150,000 units in March 2022. Hyundai plans to invest around US$ 1.55 billion in the plant, and the production capacity will be increased to 250,000 units. In addition, in July 2021, Maruti Suzuki India Ltd. announced an investment worth US$ 2.42 billion in a new manufacturing facility in Haryana, India. The facility is expected to manufacture one million units annually. This growing production and demand for vehicles is driving the demand for iron powder. As the automotive industry experiences a transformative shift toward electric vehicles (EVs), iron powder's role becomes even more crucial. Electric motors used in EVs often rely on iron powder for the production of soft magnetic cores, which are essential for the motors' efficiency and performance. According to the International Energy Agency's annual Global Electric Vehicle Outlook, over 10 million electric cars were sold worldwide in 2022, and sales are projected to grow by another 35% in 2023 to reach 14 million. As the automotive parts sector continues to evolve and innovate, iron powder is poised to remain a fundamental material for the production of high-quality, efficient, and environmentally responsible automotive components.

Asia Pacific Iron Powder Market Overview

The Asia Pacific iron powder market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. These countries are witnessing an upsurge due to growth in urbanization, increasing manufacturing industries coupled with growing industrialization, which offers ample opportunities for key market players in the Asia Pacific iron powder market. The region encompasses an ample number of opportunities for the growth of iron powder. Rising foreign direct investments also lead to economic growth in the region. The growing use of iron powders in numerous applications, including metallurgy, coating and decorations, electronic materials, sintered parts, diamond cutting tools, and others, is anticipated to increase the iron powder demand in Asia Pacific. The increasing projects in the field of electrification, coupled with the growth of the electronics industry in the Asia Pacific, provide lucrative opportunities for the growth of the Asia Pacific iron powder market. According to The Association of Southeast Asian Nations (ASEAN), the electronics industry accounts for 20-50% of the total value of exports of most countries in Asia Pacific. Moreover, the rising automotive sales in the Asia Pacific countries, including India and China, have been one of the most encouraging growth factors for the Asia Pacific iron powder market in recent years. Besides, the growing middle-class population, developing surface transportation infrastructure, rising disposable income, increasing mobility due to the development of satellite townships near megacities, and increasing aspiration of owning private vehicles fuel the market for iron powder in Asia Pacific. Further, the increasing population, along with the soaring economy in the Asia Pacific, has led to industrialization, which will propel product demand, thereby expanding the Asia Pacific iron powder market in Asia Pacific during the forecast period.

Asia Pacific Iron Powder Market Revenue and Forecast to 2030 (US$ Million)

Asia Pacific Iron Powder Market Segmentation

The Asia Pacific iron powder market is categorized into type, grade, manufacturing process, end-use industry, and country.

Based on type, the Asia Pacific iron powder market is segmented into reduced, atomized, and electrolytic. The atomized segment held the largest market share in 2022.

In terms of grade, the Asia Pacific iron powder market is bifurcated into <= 99.0% and >= 99.1%. The <= 99.0% segment held a larger market share in 2022.

By manufacturing process, the Asia Pacific iron powder market is categorized into physical, chemical, and mechanical. The physical segment held the largest market share in 2022. Furthermore, the physical segment is further subsegmented into atomization and electro deposition. Additionally, the chemical segment is further subsegmented into reduction and decomposition.

Based on end-use industry, the Asia Pacific iron powder market is segmented into paints and coatings, additive manufacturing, medical, soft magnetic products, metallurgy, and others. The metallurgy segment held the largest market share in 2022. Furthermore, the metallurgy segment is further subsegmented into compound brazing, compound sintering, compound welding, and others.

By country, the Asia Pacific iron powder market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific iron powder market share in 2022.

Rio Tinto Metal Powders, American Elements Inc, Industrial Metal Powders (India) Pvt Ltd, CNPC Powder North America Inc, Ashland Inc, BASF SE, Hoganas AB, JFE Steel Corp, Reade International Corp, and Kobe Steel Ltd are among the leading companies operating in the Asia Pacific iron powder market.

Table Of Contents

Table of Content

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Asia Pacific Iron Powder Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End Users

- 4.3.5 List of Vendors in the Value Chain:

5. Asia Pacific Iron Powder Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Flourishment of Automotive Industry

- 5.1.2 Rising Demand from the Electronics Industry

- 5.2 Market Restraints

- 5.2.1 Volatility in Raw Material Prices

- 5.3 Market Opportunities

- 5.3.1 Growing Demand for Additive Manufacturing

- 5.4 Future Trends

- 5.4.1 Sustainable and Eco-Friendly Manufacturing Practices

- 5.5 Impact Analysis

6. Asia Pacific Iron Powder Market - Asia Pacific Market Analysis

- 6.1 Asia Pacific Iron Powder Market Revenue (US$ Million)

- 6.2 Asia Pacific Iron Powder Market Volume (Kilo Tons)

- 6.3 Asia Pacific Iron Powder Market Forecast and Analysis

7. Asia Pacific Iron Powder Market Analysis - Type

- 7.1 Reduced

- 7.1.1 Overview

- 7.1.2 Reduced Market Revenue and Forecast to 2030 (US$ Million)

- 7.1.3 Reduced Market Volume and Forecast to 2030 (Kilo Tons)

- 7.2 Atomized

- 7.2.1 Overview

- 7.2.2 Atomized Market Revenue and Forecast to 2030 (US$ Million)

- 7.2.3 Atomized Market Volume and Forecast to 2030 (Kilo Tons)

- 7.3 Electrolytic

- 7.3.1 Overview

- 7.3.2 Electrolytic Market Revenue and Forecast to 2030 (US$ Million)

- 7.3.3 Electrolytic Market Volume and Forecast to 2030 (Kilo Tons)

8. Asia Pacific Iron Powder Market Analysis - Manufacturing Process

- 8.1 Physical

- 8.1.1 Overview

- 8.1.2 Physical Market Revenue and Forecast to 2030 (US$ Million)

- 8.1.3 Atomization

- 8.1.3.1.1 Atomization : Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 8.1.4 Electro Deposition

- 8.1.4.1.1 Electro Deposition : Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 8.2 Chemical

- 8.2.1 Overview

- 8.2.2 Chemical Market Revenue and Forecast to 2030 (US$ Million)

- 8.2.3 Reduction

- 8.2.3.1.1 Reduction : Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 8.2.4 Decomposition

- 8.2.4.1.1 Decomposition: Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 8.3 Mechanical

- 8.3.1 Overview

- 8.3.2 Mechanical Market Revenue and Forecast to 2030 (US$ Million)

9. Asia Pacific Iron Powder Market Analysis - Grade

- 9.1 99.0%

- 9.1.1 Overview

- 9.1.2 99.0% Market Revenue and Forecast to 2030 (US$ Million)

- 9.2 99.1%

- 9.2.1 Overview

- 9.2.2 99.1% Market Revenue and Forecast to 2030 (US$ Million)

10. Asia Pacific Iron Powder Market Analysis - End-Use Industry

- 10.1 Paints and Coatings

- 10.1.1 Overview

- 10.1.2 Paints and Coatings Market Revenue and Forecast to 2030 (US$ Million)

- 10.2 Additive Manufacturing

- 10.2.1 Overview

- 10.2.2 Additive Manufacturing Market Revenue and Forecast to 2030 (US$ Million)

- 10.3 Medical

- 10.3.1 Overview

- 10.3.2 Medical Market Revenue and Forecast to 2030 (US$ Million)

- 10.4 Soft Magnetic Products

- 10.4.1 Overview

- 10.4.2 Soft Magnetic Products Market Revenue and Forecast to 2030 (US$ Million)

- 10.5 Metallurgy

- 10.5.1 Overview

- 10.5.2 Metallurgy Market Revenue and Forecast to 2030 (US$ Million)

- 10.5.3 Compound Brazing

- 10.5.3.1.1 Compound Brazing: Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.4 Compound Sintering

- 10.5.4.1.1 Compound Sintering: Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.5 Compound Welding

- 10.5.5.1.1 Compound Welding: Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 10.5.6 Others

- 10.5.6.1.1 Others: Asia Pacific Iron Powder Market - Revenue and Forecast to 2028 (US$ Million)

- 10.6 Others

- 10.6.1 Overview

- 10.6.2 Others Market Revenue and Forecast to 2030 (US$ Million)

11. Asia Pacific Iron Powder Market - Country Analysis

- 11.1 Asia Pacific Iron Powder Market Breakdown by Country

- 11.1.1 Asia Pacific Iron Powder Market Breakdown by Country

- 11.1.2 Australia: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.3 Australia: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.3.1 Australia: Asia Pacific Iron Powder Market Breakdown by Type

- 11.1.3.2 Australia: Asia Pacific Iron Powder Market Breakdown by Manufacturing Process

- 11.1.3.3 Australia: Asia Pacific Iron Powder Market Breakdown by Grade

- 11.1.3.4 Australia: Asia Pacific Iron Powder Market Breakdown by End-Use Industry

- 11.1.4 China: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.5 China: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.5.1 China: Asia Pacific Iron Powder Market Breakdown by Type

- 11.1.5.2 China: Asia Pacific Iron Powder Market Breakdown by Manufacturing Process

- 11.1.5.3 China: Asia Pacific Iron Powder Market Breakdown by Grade

- 11.1.5.4 China: Asia Pacific Iron Powder Market Breakdown by End-Use Industry

- 11.1.6 India: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.7 India: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.7.1 India: Asia Pacific Iron Powder Market Breakdown by Type

- 11.1.7.2 India: Asia Pacific Iron Powder Market Breakdown by Manufacturing Process

- 11.1.7.3 India: Asia Pacific Iron Powder Market Breakdown by Grade

- 11.1.7.4 India: Asia Pacific Iron Powder Market Breakdown by End-Use Industry

- 11.1.8 Japan: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.9 Japan: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.9.1 Japan: Asia Pacific Iron Powder Market Breakdown by Type

- 11.1.9.2 Japan: Asia Pacific Iron Powder Market Breakdown by Manufacturing Process

- 11.1.9.3 Japan: Asia Pacific Iron Powder Market Breakdown by Grade

- 11.1.9.4 Japan: Asia Pacific Iron Powder Market Breakdown by End-Use Industry

- 11.1.10 South Korea: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.11 South Korea: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.11.1 South Korea: Asia Pacific Iron Powder Market Breakdown by Type

- 11.1.11.2 South Korea: Asia Pacific Iron Powder Market Breakdown by Manufacturing Process

- 11.1.11.3 South Korea: Asia Pacific Iron Powder Market Breakdown by Grade

- 11.1.11.4 South Korea: Asia Pacific Iron Powder Market Breakdown by End-Use Industry

- 11.1.12 Rest of Asia Pacific: Asia Pacific Iron Powder Market Revenue and Forecasts to 2030 (US$ Million)

- 11.1.13 Rest of Asia Pacific: Asia Pacific Iron Powder Market Volume and Forecasts to 2030 (Kilo Tons)

- 11.1.13.1 Rest of Asia Pacific: Asia Pacific Iron Powder Market Breakdown by Type

- 11.1.13.2 Rest of Asia Pacific: Asia Pacific Iron Powder Market Breakdown by Manufacturing Process

- 11.1.13.3 Rest of Asia Pacific: Asia Pacific Iron Powder Market Breakdown by Grade

- 11.1.13.4 Rest of Asia Pacific: Asia Pacific Iron Powder Market Breakdown by End-Use Industry

12. Competitive Landscape

- 12.1 Heat Map Analysis By Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 New Product Development

- 13.4 Merger and Acquisition

14. Company Profiles

- 14.1 Rio Tinto Metal Powders

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 American Elements Inc

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Industrial Metal Powders (India) Pvt Ltd

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 CNPC Powder North America Inc

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Ashland Inc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 BASF SE

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Hoganas AB

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 JFE Steel Corp

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Reade International Corp

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 Kobe Steel Ltd

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments