|

|

市場調査レポート

商品コード

1498573

北米の鋳鉄市場規模・予測、地域シェア、動向、成長機会分析レポート:タイプ別、プロセス別、最終用途別、国別North America Iron Casting Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Type, Process, End Use, and Country |

||||||

|

|||||||

| 北米の鋳鉄市場規模・予測、地域シェア、動向、成長機会分析レポート:タイプ別、プロセス別、最終用途別、国別 |

|

出版日: 2024年05月27日

発行: The Insight Partners

ページ情報: 英文 128 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の鋳鉄市場は、2023年の334億米ドルから2031年には501億9,000万米ドルに成長すると予測されており、2023年から2031年までのCAGRは5.2%と予想されています。

北米は主要な自動車、航空宇宙、インフラ・建設、機械産業で構成されています。米国鋳造協会によると、高度な技術を要する鋳鉄は、ほとんどの製造品や機械の生産に使用されています。北米には1,900以上の金属鋳造施設があります。さらに、鋳物工場は米国、カナダ、メキシコの自動車、建設、農業、重工業機械、航空機・航空宇宙、鉄道、パイプラインなどの産業にサービスを提供しています。いくつかの最終用途産業からの鋳鉄に対する需要の高まりは、この地域での事業拡大を計画するメーカーを促しています。例えば2020年、レイセオン・テクノロジーズ社の一部門であるプラット&ホイットニーは、米国ノースカロライナ州のタービン翼生産施設に2027年までに6億5,000万米ドルを投資する計画を発表しました。この生産施設には、タービン翼製造用の先進的な鋳造工場が設置される予定でした。2021年、三井金属ダイカスト・テクノロジー・アメリカはジョージア州に2,000万米ドルの施設を建設しました。自動車用製品はこの施設で開発されます。2021年、IBCアドバンスト・アロイは500万米ドル以上を投資して銅鋳造施設を建設する計画を発表しました。このように、北米における最終用途産業の拡大と鋳鉄メーカーによる戦略的開発が、予測期間中の鋳鉄需要を押し上げるとみられます。

産業機械は製造業の生産性を高め、産業競争力にプラスの影響を与えます。国際貿易局によると、2021年に米国は440億米ドル相当の機械と240億米ドル相当の電気機械を輸出しました。米国国勢調査局によると、米国における金属加工機械の売上高は2019年に318億米ドルを占めました。Parker Hannifin Corporationの報告書によると、コンピュータ数値制御(CNC)工作機械の世界市場は2026年までに1,290億米ドルに達すると予測されています。米国プラスチック工業協会によると、射出成形機と押出成形機の出荷台数は、北米では2020年第4四半期に2019年同期比で19.3%増加しました。2022年の国際ロボット連盟のプレスリリースによると、2022年第1四半期の北米におけるロボット受注の47%を自動車および自動車部品メーカーが占め、前年同期比15%増となった。産業用機械は、マテリアルハンドリング、組立、溶接から仕上げ、パレタイジング用途まで、多様な作業を行う。鋳鉄は、ベアリングハウジング、工作機械部品、機械のフレームやベースの製造に広く使用されています。また、構造支持にも使用されます。このように、産業機械に対する需要の高まりが北米の鋳鉄市場を後押ししています。

北米の鋳鉄市場では自動車産業が重要な役割を果たしており、自動車製造に不可欠な部品を提供しています。鋳鉄は、その強度、耐久性、費用対効果により、様々な自動車用途で広く使用されています。エンジンブロックやシリンダーヘッドからブレーキ部品やサスペンション部品に至るまで、鋳鉄は自動車の製造に不可欠なものです。自動車業界では最近、燃費の向上と排出ガスの削減を目的に、軽量材料の需要が高まっています。アルミニウムやコンポジットといった素材が一部の用途で人気を博している一方で、鋳鉄は優れた機械的特性と手頃な価格により、多くの重要部品に欠かせない存在であり続けています。メーカー各社は、鋳鉄の性能を高めると同時に、高度な設計技術やエンジニアリング技術によって軽量化を図るための研究開発に投資を続けています。さらに、自動車業界の電気自動車やハイブリッド車へのシフトは、鋳鉄市場に新たな課題と機会をもたらしました。これらの自動車は、エンジンブロックのような従来の部品をあまり必要としないが、電気モーターのハウジング、バッテリーケーシング、構造部品などの重要な部品は依然として鋳鉄に依存しています。電気自動車の需要が伸び続ける中、鋳鉄市場は自動車業界の進化するニーズに即座に適応し、電気自動車やハイブリッド車の生産をサポートする革新的なソリューションを模索しています。

北米の鋳鉄市場で事業を展開している主な企業は、Aarrowcast Inc.、Cadillac Casting Inc.、Calmet Inc.、Fusium Inc.、Decatur Foundry Inc.、Grupo Industrial Saltillo SAB de CV、Willman Industries Inc.、OSCO Industries Inc.、Mesa Castings Inc.、Waupaca Foundry Inc.などです。同市場で事業を展開するプレーヤーは、顧客の要求を満たすため、高品質で革新的な製品の開発に非常に注力しています。

北米の鋳鉄市場全体の規模は、一次情報と二次情報の両方を用いて算出されています。北米の鋳鉄市場に関連する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、より分析的な洞察を得るために、業界関係者との複数の一次インタビューを実施しました。この調査プロセスには、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家や、北米の鋳鉄市場を専門とする評価専門家、調査アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参入しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要市場洞察

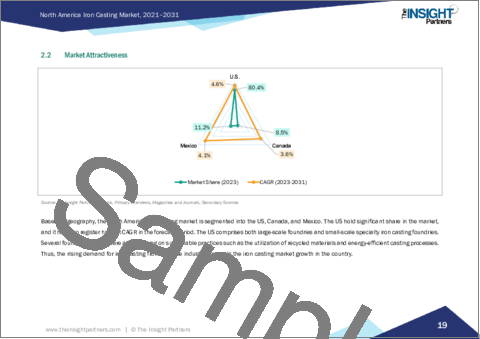

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 北米の鋳鉄市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- 流通業者または供給業者

- 最終用途産業

- バリューチェーンのベンダー一覧

第5章 北米の鋳鉄市場:主要市場力学

- 北米の鋳鉄市場:主要市場力学

- 市場促進要因

- 自動車産業と建設産業の成長

- 産業機械需要の増加

- 市場抑制要因

- 原材料価格の変動

- 市場機会

- 戦略的拡大活動

- 今後の動向

- リサイクルへの取り組み

- 影響分析

第6章 北米の鋳鉄市場分析

- 北米の鋳鉄市場数量(キロトン)、2021年~2031年

- 北米の鋳鉄市場数量、予測・分析(キロトン)

- 北米の鋳鉄市場収益、2023年~2031年

- 北米の鋳鉄市場予測・分析

第7章 北米の鋳鉄市場数量・収益分析:タイプ別

- ねずみ鋳鉄

- ダクタイル鋳鉄

- その他

第8章 北米の鋳鉄市場収益分析:プロセス別

- ダイカスト

- 遠心鋳造

- 砂型鋳造

- インベストメント鋳造

- その他

第9章 北米の鋳鉄市場収益分析:最終用途別

- 自動車

- 産業機械

- 航空宇宙

- 建築・建設

- エネルギー

- 海洋

- その他

第10章 北米の鋳鉄市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第11章 競合情勢

- ヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 合併と買収

- 契約、提携、合弁事業

- 新製品の上市

- 事業拡大とその他の戦略的展開

第13章 企業プロファイル

- Aarrowcast Inc

- Cadillac Casting Inc

- Calmet Inc

- Fusium Inc

- Decatur Foundry Inc

- Grupo Industrial Saltillo SAB de CV

- Willman Industries Inc

- OSCO Industries Inc

- Mesa Castings Inc

- Waupaca Foundry Inc

第14章 付録

List Of Tables

- Table 1. North America Iron Casting Market Segmentation

- Table 2. List of Vendors

- Table 3. North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons)

- Table 4. North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Table 5. North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 6. North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 7. North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 8. North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 9. North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons) - by Country

- Table 10. North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 11. United States: North America Iron Casting Market -Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 12. United States: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 13. United States: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 14. United States: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 15. Canada: North America Iron Casting Market -Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 16. Canada: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 17. Canada: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 18. Canada: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 19. Mexico: North America Iron Casting Market -Volume and Forecast to 2031 (Kilo Tons) - by Type

- Table 20. Mexico: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Type

- Table 21. Mexico: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by Process

- Table 22. Mexico: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

List Of Figures

- Figure 1. North America Iron Casting Market Segmentation, by Geography

- Figure 2. North America Iron Casting Market - Porter's Analysis

- Figure 3. Ecosystem: Iron Casting Market

- Figure 4. Fluctuations in Iron Ore Prices from January 2019 to April 2023

- Figure 5. North America Iron Casting Market Impact Analysis of Drivers and Restraints

- Figure 6. North America Iron Casting Market Volume (Kilo Tons), 2021-2031

- Figure 7. North America Iron Casting Market Revenue (US$ Million), 2023-2031

- Figure 8. North America Iron Casting Market Share (%) - Type, 2023 and 2031

- Figure 9. Grey Iron: North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 10. Grey Iron: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Ductile Iron: North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 12. Ductile Iron: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Others: North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons)

- Figure 14. Others: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 15. North America Iron Casting Market Share (%) - Process, 2023 and 2031

- Figure 16. Die Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Centrifugal Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Sand Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. Investment Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 20. Others: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. North America Iron Casting Market Share (%) - End Use, 2023 and 2031

- Figure 22. Automotive: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Industrial Machinery: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. Aerospace: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 25. Building and Construction: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Energy: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Marine: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 28. Others: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 29. North America Iron Casting Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 30. United States: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 31. Canada: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 32. Mexico: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 33. Heat Map Analysis

- Figure 34. Company Positioning & Concentration

The North America iron casting market is anticipated to grow from US$ 33.40 billion in 2023 to US$ 50.19 billion by 2031; it is expected to register a CAGR of 5.2% from 2023 to 2031.

North America consists of major automotive, aerospace, infrastructure & construction, and machinery industries. According to the American Foundry Society, highly engineered iron casting are used to produce most of the manufactured goods and machinery. North America consists of more than 1,900 metal casting facilities. Further, foundries serve industries such as automotive, construction, agriculture, heavy industrial machinery, aircraft & aerospace, railways, and pipelines in the US, Canada, and Mexico. The rising demand for iron casting from several end-use industries is prompting manufacturers to plan expansion in the region. For instance, in 2020, a division of Raytheon Technologies Corp, Pratt & Whitney, announced its plan to invest US$ 650 million through 2027 in a turbine airfoil production facility in North Carolina, US. The production facility was planned to have an advanced casting foundry for the production of turbine airfoils. In 2021, Mitsui Kinzoku Die-Casting Technology America built a US$ 20 million facility in Georgia. Automotive products will be developed in this facility. In 2021, IBC Advanced Alloys announced its plans to invest over US$ 5 million to build a copper casting facility. Thus, the expansion of end-use industries and strategic developments by iron casting manufacturers in North America are likely to boost the demand for iron casting during the forecast period.

Industrial machinery enhances the productivity of manufacturing operations and positively impacts industrial competitiveness. According to the International Trade Administration, in 2021, the US exported machinery worth US$ 44 billion and electrical machinery worth US$ 24 billion. According to the US Census Bureau, the sales of metalworking machinery in the US accounted for US$ 31.8 billion in 2019. As per the Parker Hannifin Corporation report, the global market for computer numerically controlled (CNC) machine tools is projected to reach US$ 129 billion by 2026. According to the US Plastics Industry Association, injection molding and extrusion machinery shipments rose by 19.3% in the fourth quarter of 2020 compared to the same period in 2019 in North America. A press release by the International Federation of Robotics in 2022 stated that car and car component manufacturers accounted for 47% of robot orders in North America in Q1 2022, a rise of 15% year-on-year. Industrial machineries perform diverse operations, from material handling, assembly, and welding to finishing and palletizing applications. Iron castings are widely used in the production of bearing housing, machine tool components, and machinery frames and bases. Also, they are used for structural support. Thus, the rising demand for industrial machinery propels the North America iron casting market.

The automotive industry plays a vital role in the North America iron casting market, providing essential components for vehicle manufacturing. Iron castings are widely used in various automotive applications due to their strength, durability, and cost-effectiveness. From engine blocks and cylinder heads to brake components and suspension parts, iron casting is integral in the construction of automobiles. The automotive industry has recently witnessed a growing demand for lightweight materials to improve fuel efficiency and reduce emissions. While materials such as aluminum and composites have gained popularity for a few applications, iron casting remain indispensable for many critical components due to their superior mechanical properties and affordability. Manufacturers continue to invest in research and development to enhance the performance of iron casting while reducing their weight through advanced design and engineering techniques. Furthermore, the automotive industry's shift toward electric and hybrid vehicles has presented new challenges and opportunities for the iron casting market. While these vehicles require fewer traditional components, such as engine blocks, they still rely on iron casting for essential parts, such as electric motor housings, battery casings, and structural components. As the demand for electric vehicles continues to grow, the iron casting market instantly adapts to meet the evolving needs of the automotive industry, exploring innovative solutions to support the production of electric and hybrid vehicles.

A few key players operating in the North America iron casting market are Aarrowcast Inc., Cadillac Casting Inc., Calmet Inc., Fusium Inc., Decatur Foundry Inc., Grupo Industrial Saltillo SAB de CV, Willman Industries Inc., OSCO Industries Inc., Mesa Castings Inc., and Waupaca Foundry Inc. Players operating in the market are highly focused on developing high-quality and innovative product offerings to fulfill customers' requirements.

The overall North America iron casting market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the North America iron casting market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants, such as valuation experts, research analysts, and key opinion leaders-specializing in the North America iron casting market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Market Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Iron Casting Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors or Suppliers:

- 4.3.4 End-Use Industry:

- 4.3.5 List of Vendors in the Value Chain

5. North America Iron Casting Market - Key Market Dynamics

- 5.1 North America Iron Casting Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Automotive and Construction Industry

- 5.2.2 Rising Demand for Industrial Machinery

- 5.3 Market Restraints

- 5.3.1 Fluctuations in Raw Material Prices

- 5.4 Market Opportunities

- 5.4.1 Strategic Expansion Activities

- 5.5 Future Trends

- 5.5.1 Recycling Initiatives

- 5.6 Impact Analysis

6. North America Iron Casting Market Analysis

- 6.1 North America Iron Casting Market Volume (Kilo Tons), 2021-2031

- 6.2 North America Iron Casting Market Volume Forecast and Analysis (Kilo Tons)

- 6.3 North America Iron Casting Market Revenue (US$ Million), 2023-2031

- 6.4 North America Iron Casting Market Forecast and Analysis

7. North America Iron Casting Market Volume and Revenue Analysis - by Type

- 7.1 Grey Iron

- 7.1.1 Overview

- 7.1.2 Grey Iron: North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.1.3 Grey Iron: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Ductile Iron

- 7.2.1 Overview

- 7.2.2 Ductile Iron: North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.2.3 Ductile Iron: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Others

- 7.3.1 Overview

- 7.3.2 Others: North America Iron Casting Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.3.3 Others: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Iron Casting Market Revenue Analysis - by Process

- 8.1 Die Casting

- 8.1.1 Overview

- 8.1.2 Die Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Centrifugal Casting

- 8.2.1 Overview

- 8.2.2 Centrifugal Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Sand Casting

- 8.3.1 Overview

- 8.3.2 Sand Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Investment Casting

- 8.4.1 Overview

- 8.4.2 Investment Casting: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Iron Casting Market Revenue Analysis - by End Use

- 9.1 Automotive

- 9.1.1 Overview

- 9.1.2 Automotive: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Industrial Machinery

- 9.2.1 Overview

- 9.2.2 Industrial Machinery: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Aerospace

- 9.3.1 Overview

- 9.3.2 Aerospace: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Building and Construction

- 9.4.1 Overview

- 9.4.2 Building and Construction: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Energy

- 9.5.1 Overview

- 9.5.2 Energy: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Marine

- 9.6.1 Overview

- 9.6.2 Marine: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Iron Casting Market - Country Analysis

- 10.1 North America

- 10.1.1 North America Iron Casting Market Breakdown by Countries

- 10.1.2 North America Iron Casting Market Revenue and Forecast and Analysis - by Country

- 10.1.2.1 North America Iron Casting Market Volume and Forecast and Analysis - by Country

- 10.1.2.2 North America Iron Casting Market Revenue and Forecast and Analysis -by Country

- 10.1.2.3 United States: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.3.1 United States: North America Iron Casting Market Breakdown by Type

- 10.1.2.3.2 United States: North America Iron Casting Market Breakdown by Process

- 10.1.2.3.3 United States: North America Iron Casting Market Breakdown by End Use

- 10.1.2.4 Canada: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.4.1 Canada: North America Iron Casting Market Breakdown by Type

- 10.1.2.4.2 Canada: North America Iron Casting Market Breakdown by Process

- 10.1.2.4.3 Canada: North America Iron Casting Market Breakdown by End Use

- 10.1.2.5 Mexico: North America Iron Casting Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.5.1 Mexico: North America Iron Casting Market Breakdown by Type

- 10.1.2.5.2 Mexico: North America Iron Casting Market Breakdown by Process

- 10.1.2.5.3 Mexico: North America Iron Casting Market Breakdown by End Use

11. Competitive Landscape

- 11.1 Heat Map Analysis

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Mergers And Acquisitions

- 12.3 Agreements, Collaborations, And Joint Ventures

- 12.4 New Product Launches

- 12.5 Expansions And Other Strategic Developments

13. Company Profiles

- 13.1 Aarrowcast Inc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Cadillac Casting Inc

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Calmet Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Fusium Inc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Decatur Foundry Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Grupo Industrial Saltillo SAB de CV

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Willman Industries Inc

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 OSCO Industries Inc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Mesa Castings Inc

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Waupaca Foundry Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners