|

|

市場調査レポート

商品コード

1498570

北米の心臓マーカー市場規模および予測、地域シェア、動向、成長機会分析レポート:製品タイプ別、バイオマーカータイプ別、適応症別、エンドユーザー別、国別North America Cardiac Markers Market Size and Forecast, Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Product Type, Biomarker Type, Indication, End User, and Country |

||||||

|

|||||||

| 北米の心臓マーカー市場規模および予測、地域シェア、動向、成長機会分析レポート:製品タイプ別、バイオマーカータイプ別、適応症別、エンドユーザー別、国別 |

|

出版日: 2024年05月24日

発行: The Insight Partners

ページ情報: 英文 106 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の心臓マーカー世界市場は、2023年の11億7,000万米ドルから2031年には28億7,000万米ドルに達すると予測されています。2023年から2031年までのCAGRは11.8%で成長すると推定されます。

本レポートで紹介する北米の心臓マーカー市場予測は、同マーケットプレースの利害関係者が成長戦略を立案するのに役立ちます。心血管疾患の有病率の上昇と、ポイントオブケア心臓検査キットの需要の急増が、北米の心臓マーカー市場の成長を促進する主な要因です。

CVDバイオマーカーとしてのエクソソーム利用に関する進行中の調査

低酸素はエクソソームカーゴに大きな影響を与え、さまざまなシグナル伝達経路を通じて血管新生、成長、CVDの進行を示すさまざまなタンパク質やmiRNAを産生します。エクソソームは、生理学的および病理学的条件下での細胞間コミュニケーションに関連するため、研究者の注目を集めています。エクソソームのmiRNAであるmiR-133a、miR-208a、miR-1、miR-499-5p、およびmiR-30aは、急性心筋梗塞(AMI)のタイムリーな診断に有用であるとされています。さらに、エクソソーム由来のmiR-192、miR-146a、miR-194、miR-92b-5pは、心不全の潜在的なバイオマーカーと考えられています。

冠動脈疾患(CAD)患者において、フィブリノゲンβ/γ鎖、α-1-アンチキモトリプシン、インターα-トリプシンインヒビター重鎖などのエクソソームタンパク質の発現上昇が、タンパク質バイオマーカーとして評価されました。多様な細胞間情報伝達機構を介したCVD発症におけるエクソソームの機能は、大きく認識されつつあります。最近のいくつかの動向から、エクソソームが正常な生理機能(心臓の発育、網状赤血球の成熟、心筋血管新生)や虚血再灌流(IR)傷害、動脈硬化、心臓リモデリングなどの病態生理学的過程と関連することを支持するエビデンスが得られています。低酸素症や炎症などのストレス状態は、生物学的エクソソーム含量や標的細胞を調節する可能性があり、それによって心機能の改善や障害に寄与します。体液中のエクソソームに基づくmiRNAとタンパク質を統合することにより、心血管疾患におけるこれらの成分の潜在的なバイオマーカーとしての役割を総合的に分析することが可能になります。したがって、エクソソームバイオマーカーの利用は、CVDの診断のための新たなアプローチとして浮上しています。

北米の心臓マーカー市場を阻害する要因

企業は特定の用途の心臓マーカーについて、FDAのバイオマーカー認定プログラムに規制当局の認定申請を提出することができます。適格とされたマーカーだけが、マーカーの適合性を再確認するための医薬品評価研究センター(CDER)の承認を必要とすることなく、複数の医薬品開発プログラムで使用することができます。

心臓マーカーは、CVDの多くの段階の調査を完了するための疫学調査において広く使用されています。その過程では、詳細な情報を得るために、貴重な生物学的サンプルをより慎重に取り扱い、保管する必要があります。データの損失を避けるために、これらのサンプルが適切な保存条件で取り扱われるようにするためには、正確な品質管理対策が必要です。心臓マーカー研究では、保存試料が使用されるため、試料の完全性と採取、処理、保存の方法に依存します。取扱い、ラベリング、処理、分注、保管、輸送は、研究結果に影響を及ぼす可能性があります。サンプルはドライアイスに入れ、その日のうちに発送しなければならないです。この工程が適切に行われないと、サンプルの品質に影響を与え、その後の結果を妨げる可能性があります。そのため、米国FDAが定めた厳格なバリデーションプロトコルや、サンプル採取と保管に関連する技術的な問題が、北米の心臓マーカー市場の成長を妨げています。

疾患別に見ると、北米の心臓マーカー市場は、HIV検査、インフルエンザ検査、性感染症検査、C型肝炎ウイルス検査、熱帯病検査、呼吸器感染症検査、院内感染症検査、溶連菌検査、その他に分けられます。市場はさらに分子診断学に基づいて、ポリメラーゼ連鎖反応(PCR)、等温核酸増幅技術(INAAT)、その他に分けられます。2023年には呼吸器感染症検査セグメントが最大の市場シェアを占めました。

製品タイプ別に見ると、北米の心臓マーカー市場は試薬・キットと分析装置に区分されます。2023年には分析装置セグメントが大きなシェアを占めました。試薬・キットセグメントは、2023~2031年に高いCAGRを記録すると予測されています。

バイオマーカーの種類に基づき、北米の心臓マーカー市場は、トロポニン、クレアチンキナーゼ-MB、ミオグロビン、B型ナトリウム利尿ペプチド、その他に分けられます。2023年にはトロポニンセグメントが最大の市場シェアを占め、2023~2031年の市場CAGRは最高を記録すると推定されます。

適応症別では、市場はうっ血性心不全、心筋梗塞、急性冠症候群、その他に区分されます。うっ血性心不全セグメントが2023年の市場で最大のシェアを占めています。急性冠症候群セグメントは、2023~2031年に最も高いCAGRを記録すると推定されています。

エンドユーザー別では、北米の心臓マーカー市場は病院、診断ラボ、ポイントオブケア検査施設、その他に分けられます。病院セグメントが2023年に最大の市場シェアを占めています。診断検査施設セグメントは、2023-2031年の間に市場で最も高いCAGRを記録すると推定されています。

北米の感染症向けポイントオブケア分子検査市場地域別概要

ヘルスケアシステムが発達し、疾患の診断と予測に心臓マーカーが広く受け入れられています。高齢者人口の増加により、急性心筋梗塞などの病態を検出するためのバイオマーカー検査が必要となり、検査製品への需要が高まっています。Quidel CorporationやDanaher Corporationといった主要企業がこの地域に存在することも、この市場の成長に寄与しています。世界保健機関(WHO)によると、18歳以上の成人のうち7,700万人が2型糖尿病を患っており、うち2,500万人が糖尿病予備軍です。さらに、革新的な心臓バイオマーカー検査を開発するためにこの地域の市場プレーヤーが採用する戦略が増加しており、この地域の市場成長に寄与すると期待されています。

北米の心臓マーカー市場に関するレポートを作成する際に参照した主な一次情報および二次情報には、世界銀行データ、国民保健サービス(NHS)、米国保健福祉省(HHS)、WHO(世界保健機関)などがあります。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

第4章 北米心臓マーカー市場情勢

- PEST分析

第5章 北米心臓マーカー市場:主要市場力学

- 北米の心臓マーカー市場:主要市場力学

- 市場促進要因

- 心血管疾患の有病率の上昇

- ポイントオブケア心臓検査キットの需要急増

- 市場抑制要因

- 検体採取と保存に関する厳しいバリデーションと技術的問題

- 市場機会

- 心血管分野への投資

- 今後の動向

- CVDバイオマーカーとしてのエクソソーム利用に関する進行中の調査

- 影響分析

第6章 北米心臓マーカー市場分析

- 北米の心臓マーカー市場収益、2021年~2031年

第7章 北米の心臓マーカー市場分析:製品タイプ別

- 分析装置

- 試薬およびキット

第8章 北米の心臓マーカー市場の分析:バイオマーカータイプ別

- トロポニン

- クレアチンキナーゼ-MB

- ミオグロビン

- B型ナトリウム利尿ペプチド

- その他

第9章 北米の心臓マーカー市場分析:適応症別

- うっ血性心不全

- 心筋梗塞

- 急性冠症候群

- その他

第10章 北米心臓マーカー市場分析-エンドユーザー別

- 病院

- 診断研究所

- ポイントオブケア検査施設

- その他

第11章 北米の心臓マーカー市場:国別分析

- 北米

- 米国

- カナダ

- メキシコ

第12章 業界情勢

- 最近の動向

第13章 心臓マーカー市場-業界情勢

- 有機的成長戦略

第14章 企業プロファイル

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Thermo Fisher Scientific Inc

- Beckman Coulter Inc

- Bio-Rad Laboratories Inc

- Creative Diagnostics

- Diazyme Laboratories, Inc.

- bioMerieux SA

- HyTest Ltd.

- QuidelOrtho Corp

第15章 付録

List Of Tables

- Table 1. North America Cardiac Marker Market Segmentation

- Table 2. Available POC Products in the US

- Table 3. Exosomes as CVD Biomarkers

- Table 4. United States: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 5. United States: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Biomarker Type

- Table 6. United States: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Indication

- Table 7. United States: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 8. Canada: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 9. Canada: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Biomarker Type

- Table 10. Canada: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Indication

- Table 11. Canada: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 12. Mexico: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 13. Mexico: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Biomarker Type

- Table 14. Mexico: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by Indication

- Table 15. Mexico: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million) - by End User

- Table 16. Recent Development Activities in the Cardiac Marker Market

- Table 17. Recent Organic Growth Strategies in the Cardiac Marker Market

- Table 18. Glossary of Terms, North America Cardiac Marker Market

List Of Figures

- Figure 1. North America Cardiac Marker Market Segmentation, by Country

- Figure 2. PEST Analysis

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Cardiac Marker Market Revenue (US$ Million), 2021-2031

- Figure 5. North America Cardiac Marker Market Share (%) - by Product Type, 2023 and 2031

- Figure 6. Analyzers: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 7. Reagents and Kits: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 8. North America Cardiac Marker Market Share (%) - by Biomarker Type, 2023 and 2031

- Figure 9. Troponin: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 10. Creatine Kinase-MB: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 11. Myoglobin: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 12. B-Type Natriuretic Peptide: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 13. Others: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 14. North America Cardiac Marker Market Share (%) - by Indication, 2023 and 2031

- Figure 15. Congestive Heart Failure: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 16. Myocardial Infraction: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 17. Acute Coronary Syndrome: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 18. Others: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 19. North America Cardiac Marker Market Share (%) - by End User, 2023 and 2031

- Figure 20. Hospitals: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 21. Diagnostic Laboratories: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 22. Point-of-Care Testing Facilities: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 23. Others: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 24. North America Cardiac Marker Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 25. United States: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 26. Canada: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 27. Mexico: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

The global North America cardiac marker market is expected to reach US$ 2.87 billion by 2031 from US$ 1.17 billion in 2023. The market is estimated to grow with a CAGR of 11.8% from 2023 to 2031.

The North America cardiac marker market forecast presented in this report can help stakeholders in this marketplace plan their growth strategies. The rising prevalence of cardiovascular diseases and a surge in the demand for point-of-care cardiac testing kits are the key factors propelling the North America cardiac marker market growth.

Ongoing Research in Use of Exosomes as CVD Biomarkers

Hypoxia significantly affects exosome cargo and produces various proteins and miRNAs that indicate angiogenesis, growth, and progression for CVD through different signaling pathways. Exosomes has gathered the attention of researchers because they are relevant to intercellular communication under both physiological and pathological conditions. The upregulated exosome miRNAs miR-133a, miR-208a, miR-1, miR-499-5p, and miR-30a have been designated for the timely diagnosis of acute myocardial infarction (AMI). Further, derived exosomes namely, miR-192, miR-146a, miR-194, and miR-92b-5p are considered as potential biomarkers for HF.

- Table 1. Exosomes as CVD Biomarkers

Biomarker Disease Function

miRNA-126, miRNA-223, and miRNA-320b Acute myocardial infarction Platelet activation and thrombus formation, endothelial damage, myocardial apoptosis, and fibroblast proliferation

miRNA-1, miRNA-21a/b, and miRNA-29b Acute myocardial infraction Myocardial apoptosis, fibroblast proliferation, and cardiac hypertrophy

miRNA-208a Acute myocardial infarction Cardiac hypertrophy and electrical conduction

miRNA-499 Acute myocardial infarction Myocardial apoptosis

miRNA-486 Acute myocardial infarction Myocardial apoptosis (protective)

miRNA-223-5p Acute myocardial infarction, atherosclerosis, and heart failure Cell proliferation, migration, apoptosis, and polarization; cardiomyocyte hypertrophy; and electrical conduction

miRNA-941 Acute coronary syndrome Cell proliferation and inflammation

miRNA-216a and miRNA-451 Coronary artery disease Endothelial damage and monocyte recruitment

miRNA-223-3p, miRNA-122-5p, and miRNA-93-5p Coronary artery disease Inflammation, migration and apoptosis, cardiomyocyte hypertrophy, electrical conduction, and cardiomyocyte apoptosis

miRNA-142-3p, miRNA-17-5p, and miRNA-126 Acute myocardial infarction and coronary artery disease Inflammation; cardiomyocyte hypertrophy; and cell proliferation, migration, and apoptosis

miRNA-133a Coronary artery disease Cell proliferation and differentiation, cardiac hypertrophy, and electrical conduction (arrhythmia)

Serpin G1, Serpin F2, and Cystatin C CD14 Heart failure and acute coronary syndrome Inflammation, decrease in kidney function, decrease in fibrinolysis, and thrombotic process

Source: Allen Press

In coronary artery disease (CAD) patients, upregulated exosome proteins-including fibrinogen beta/gamma chain, alpha-1-antichymotrypsin, and inter-alpha-trypsin inhibitor heavy chain-were evaluated as putative protein biomarkers. The function of exosomes in CVD pathogenesis through diverse intercellular communication mechanisms is gaining significant recognition. Several studies conducted in recent years have generated evidence supporting the association of exosomes with normal physiology (cardiac development, reticulocyte maturation, and myocardial angiogenesis) and pathophysiological processes, including ischemia/reperfusion (IR) injury, atherosclerosis, and cardiac remodeling. Stressful conditions such as hypoxia and inflammation can modulate biological exosome content and target cells, thereby contributing to improving or impairing cardiac function. The integration of exosome-based miRNAs and proteins in body fluids enables a comprehensive analysis of the potential biomarker role of these components in cardiovascular diseases. Therefore, the use of exosome biomarkers is emerging as a new approach for the diagnosis of CVDs.

Factor Hampering North American Cardiac Marker Market

Companies can submit an application for regulatory qualification for a cardiac marker to the FDA Biomarker Qualification Program for a specific application. Only the qualified marker can be used in multiple drug development programs without the need for the Center for Drug Evaluation and Research (CDER) approval to reconfirm the suitability of the markers.

Cardiac markers are widely used in epidemiological studies for completing the investigation of numerous stages of CVD. The process requires more careful handling and storage of valuable biological samples to obtain detailed information. Precise quality control measures are required to ensure that these samples are handled in appropriate storage conditions to avoid data loss. Cardiac marker studies depend on the integrity of samples and the manner of collection, processing, and storage, as archived samples are used in these studies. Handling, labeling, processing, aliquoting, storage, and transportation may affect study results. The sample must be placed on dry ice and shipped the same day. If the process is not carried out properly, it can impact the quality of the sample, subsequently hampering the outcomes. Therefore, strict validation protocols established by the US FDA and technical issues associated with sample collection and storage hamper the growth of the North America cardiac markers market.

Based on disease, the North America cardiac marker market is divided into HIV testing, influenza testing, sexually transmitted diseases testing, hepatitis C virus testing, tropical diseases testing, respiratory infection testing, hospital-acquired infections, strep, and others. The market is further divided on the basis of molecular diagnostics into polymerase chain reactions (PCR), isothermal nucleic acid amplification technology (INAAT), and others. The respiratory infection testing segment held the largest market share in 2023.

Based on product type, the North America cardiac markers market is segmented into reagents and kits, and analyzers. The analyzers segment held a larger share in 2023. The reagents and kits segment is expected to register a higher CAGR during 2023-2031.

Based on biomarker type, the North America cardiac markers market is divided into troponin, creatine kinase-MB, myoglobin, B-type natriuretic peptide, and others. The troponin segment held the largest market share in 2023 and is estimated to register the highest CAGR in the market during 2023-2031.

By indication, the market is segmented into congestive heart failure, myocardial infraction, acute coronary syndrome, and others. The congestive heart failure segment held the largest share of the market in 2023. The acute coronary syndrome segment is estimated to register the highest CAGR during 2023-2031.

In terms of end user, the North America cardiac markers market is divided into hospitals, diagnostic laboratories, point-of-care testing facilities, and others. The hospitals segment held the largest market share in 2023. The diagnostic laboratories segment is estimated to register the highest CAGR in the market during 2023-2031.

North America Point-Of-Care Molecular Testing for Infectious Diseases Market: Regional Overview

The the developed healthcare system and the high acceptance of cardiac markers for diagnosing and predicting diseases. The growing geriatric population needs biomarker testing for detecting conditions such as acute myocardial infarction, thereby driving demand for testing products. The existence of key players such as Quidel Corporation and Danaher Corporation in the region is another factor contributing to the growth of this market. According to the World Health Organization (WHO), ~77 million adults over the age of 18 have type 2 diabetes, including 25 million prediabetes, which increases the possibility of cardiovascular diseases (CVDs) and puts additional pressure on the healthcare system. Furthermore, increasing strategies adopted by market players in this region to develop innovative cardiac biomarker tests are expected to contribute to the market growth in this region.

A few of the major primary and secondary sources referred to while preparing the report on the North America cardiac marker market are the World Bank Data, National Health Service (NHS), US Department of Health and Human Services (HHS), and WHO (World Health Organization).

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

4. North America Cardiac Marker Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

5. North America Cardiac Marker Market - Key Market Dynamics

- 5.1 North America Cardiac Marker Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Rising Prevalence of Cardiovascular Diseases

- 5.2.2 Surge in Demand for Point-of-Care Cardiac Testing Kits

- 5.3 Market Restraints

- 5.3.1 Strict Validation and Technical Issues Related to Sample Collection and Storage

- 5.4 Market Opportunities

- 5.4.1 Investments in Cardiovascular Sector

- 5.5 Future Trends

- 5.5.1 Ongoing Research in Use of Exosomes as CVD Biomarkers

- 5.6 Impact analysis

6. North America Cardiac Marker Market Analysis

- 6.1 North America Cardiac Marker Market Revenue (US$ Million), 2021-2031

7. North America Cardiac Marker Market Analysis - by Product Type

- 7.1 Analyzers

- 7.1.1 Overview

- 7.1.2 Analyzers: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Reagents and Kits

- 7.2.1 Overview

- 7.2.2 Reagents and Kits: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

8. North America Cardiac Marker Market Analysis - by Biomarker Type

- 8.1 Troponin

- 8.1.1 Overview

- 8.1.2 Troponin: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Creatine Kinase-MB

- 8.2.1 Overview

- 8.2.2 Creatine Kinase-MB: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

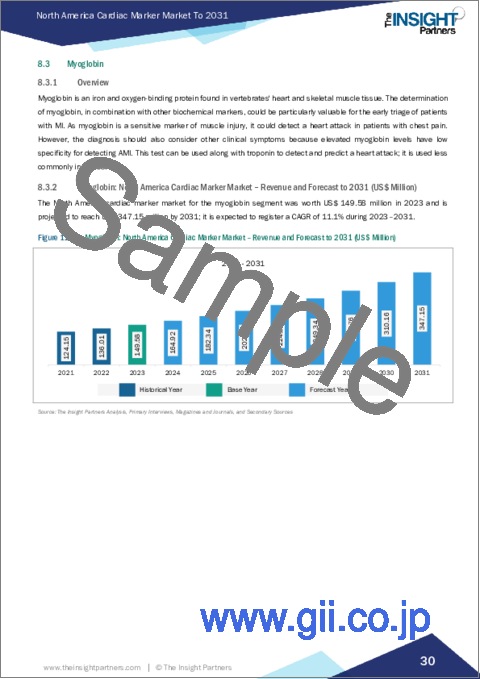

- 8.3 Myoglobin

- 8.3.1 Overview

- 8.3.2 Myoglobin: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 B-Type Natriuretic Peptide

- 8.4.1 Overview

- 8.4.2 B-Type Natriuretic Peptide: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Others

- 8.5.1 Overview

- 8.5.2 Others: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

9. North America Cardiac Marker Market Analysis - by Indication

- 9.1 Congestive Heart Failure

- 9.1.1 Overview

- 9.1.2 Congestive Heart Failure: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Myocardial Infraction

- 9.2.1 Overview

- 9.2.2 Myocardial Infraction: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Acute Coronary Syndrome

- 9.3.1 Overview

- 9.3.2 Acute Coronary Syndrome: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Others

- 9.4.1 Overview

- 9.4.2 Others: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

10. North America Cardiac Marker Market Analysis - by End User

- 10.1 Hospitals

- 10.1.1 Overview

- 10.1.2 Hospitals: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 10.2 Diagnostic Laboratories

- 10.2.1 Overview

- 10.2.2 Diagnostic Laboratories: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 10.3 Point-of-Care Testing Facilities

- 10.3.1 Overview

- 10.3.2 Point-of-Care Testing Facilities: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 10.4 Others

- 10.4.1 Overview

- 10.4.2 Others: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

11. North America Cardiac Marker Market - Country Analysis

- 11.1 North America

- 11.1.1 North America Cardiac Marker Market Breakdown by Countries

- 11.1.2 North America Cardiac Marker Market Revenue and Forecast and Analysis - by Country

- 11.1.2.1 United States: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.1.1 United States: North America Cardiac Marker Market Breakdown by Product Type

- 11.1.2.1.2 United States: North America Cardiac Marker Market Breakdown by Biomarker Type

- 11.1.2.1.3 United States: North America Cardiac Marker Market Breakdown by Indication

- 11.1.2.1.4 United States: North America Cardiac Marker Market Breakdown by End User

- 11.1.2.2 Canada: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.2.1 Canada: North America Cardiac Marker Market Breakdown by Product Type

- 11.1.2.2.2 Canada: North America Cardiac Marker Market Breakdown by Biomarker Type

- 11.1.2.2.3 Canada: North America Cardiac Marker Market Breakdown by Indication

- 11.1.2.2.4 Canada: North America Cardiac Marker Market Breakdown by End User

- 11.1.2.3 Mexico: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

- 11.1.2.3.1 Mexico: North America Cardiac Marker Market Breakdown by Product Type

- 11.1.2.3.2 Mexico: North America Cardiac Marker Market Breakdown by Biomarker Type

- 11.1.2.3.3 Mexico: North America Cardiac Marker Market Breakdown by Indication

- 11.1.2.3.4 Mexico: North America Cardiac Marker Market Breakdown by End User

- 11.1.2.1 United States: North America Cardiac Marker Market - Revenue and Forecast to 2031 (US$ Million)

12. Industry Landscape

- 12.1 Overview

- 12.2 Recent Development Strategies

- 12.2.1 Overview

13. Cardiac Marker Market-Industry Landscape

- 13.1 Overview

- 13.2 Organic Growth Strategies

- 13.2.1 Overview

14. Company Profiles

- 14.1 Abbott Laboratories

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 F. Hoffmann-La Roche Ltd

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 Thermo Fisher Scientific Inc

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 Beckman Coulter Inc

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Bio-Rad Laboratories Inc

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Creative Diagnostics

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Diazyme Laboratories, Inc.

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 bioMerieux SA

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 HyTest Ltd.

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 QuidelOrtho Corp

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners

- 15.2 Glossary of Terms