|

|

市場調査レポート

商品コード

1494347

北米の本人確認市場 - 2030年までの予測、地域別分析:コンポーネント別、展開別、組織規模別、タイプ別、業界別North America Identity Verification Market Forecast to 2030 - Regional Analysis - Component, Deployment, Organization Size, Type, and Industry Vertical |

||||||

|

|||||||

| 北米の本人確認市場 - 2030年までの予測、地域別分析:コンポーネント別、展開別、組織規模別、タイプ別、業界別 |

|

出版日: 2024年03月14日

発行: The Insight Partners

ページ情報: 英文 99 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

北米の本人確認市場は2022年に34億3,155万米ドルと評価され、2030年には111億1,949万米ドルに達し、2022年から2030年までのCAGRは15.8%と予測されます。

本人確認詐欺事例の増加が北米の本人確認市場を押し上げる

デジタル化は、あらゆる産業分野で大流行しています。人々は実店舗モデルよりもeコマースにシフトしています。取引や重要な情報交換の大半はデジタルプラットフォームを通じて行われており、これが詐欺師によるID詐欺の門戸を開いています。セキュリティー情報プラットフォームやITセキュリティーベースのツールやソリューションの高度化は、企業のセキュリティーエコシステム全体の管理に大きな影響を与えると予想されます。サイバー攻撃の前例のない増加により、企業全体で堅牢なセキュリティソリューションに対するニーズがさらに高まっています。Regulaによると、2022年には企業の95%、中小企業の約90%がID詐欺を経験しています。平均すると、1つの企業が2022年に経験した件数は30件に上ります。このような詐欺は、事業の中断、法的支出、既存および潜在的な顧客の損失につながります。そのため、企業が機密性の高い取引や相互作用に正常にアクセスできるよう、個人の身元確認を支援する複数のセキュリティソリューションの導入が進んでいます。本人確認の主な利点には、リアルタイムの本人確認、摩擦を伴わないIDからの直接データ抽出、効果的な文書認証および検証、なりすましリスクの軽減などがあります。本人確認、データ識別、不正検出などの本人確認ソリューションの機能は、複数の市場企業がID詐欺を防止するのに役立っています。本人確認が提供するこれらすべての利点と機能は、企業に長期的な利益をもたらし、セキュリティの強化に役立ちます。これらの利点が本人確認市場を牽引しています。

北米の本人確認市場の概要

北米は、技術革新と先進技術の採用の両面で最も急成長している地域の1つです。また、この地域はITとクラウドのインフラが確立されています。過去3年間で、この地域は、人工知能やブロックチェーンなどの新興技術のすべての主要産業分野での大幅な採用を示してきました。さまざまな業界でデジタル化の浸透が進む中、本人確認は、特に金融機関やオンライン小売業において、ビジネス取引のエコシステムに不可欠な要素となっています。これらのソリューションによって企業がさまざまな規則や規制に準拠できるようになるため、企業における本人確認ソリューションの需要は急速に高まっています。こうした規制のいくつかには、マネーロンダリング防止(AML)、顧客情報(KYC)、デジタル詐欺防止などが含まれます。北米の本人確認市場の成長は、主にBFSI、政府、防衛、ヘルスケアなどの産業部門からの需要の高まりによってもたらされます。そこでは、ユーザーと顧客の正確な識別が事業を成功させるための重要なビジネス要件となっています。2018年、北米は世界の本人確認市場全体の収益において最大の市場シェアを占めており、予測期間中もその優位性が続くと推計されます。

北米の本人確認市場の収益と2030年までの予測

北米の本人確認市場のセグメンテーション

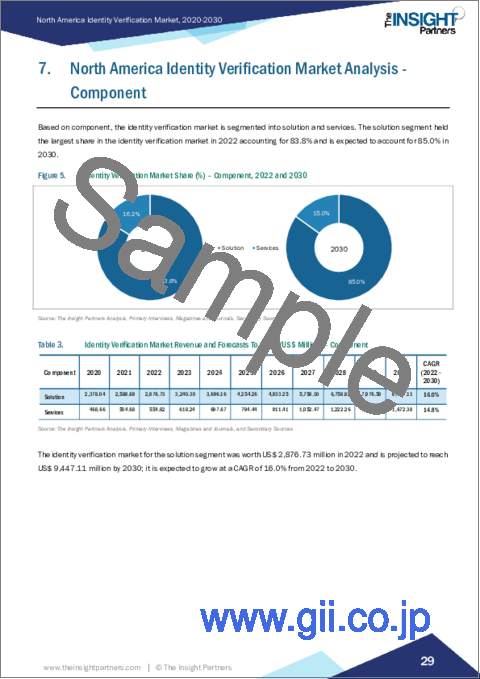

北米の本人確認市場は、コンポーネント、展開、組織規模、タイプ、業界別、国別に区分されます。コンポーネントに基づいて、北米の本人確認市場はソリューションとサービスに二分されます。2022年にはソリューションセグメントがより大きな市場シェアを占めました。

展開別では、クラウドとオンプレミスに二分されます。2022年にはクラウドセグメントがより大きな市場シェアを占めています。

組織規模別では、大企業と中小企業に二分されます。2022年には大企業セグメントがより大きな市場シェアを占めました。

タイプ別では、バイオメトリクス認証、オンライン認証、知識ベース認証、その他に区分されます。バイオメトリクス認証セグメントは2022年に最大の市場シェアを占めました。

業界別では、BFSI、政府・防衛、ヘルスケア、IT・通信、小売、その他に区分されます。BFSIセグメントが2022年に最大の市場シェアを占めました。

国別では、米国、カナダ、メキシコに区分されます。米国が2022年の北米の本人確認市場シェアを独占しました。

Trulioo、Onfido、Mitek Systems, Inc、IDology、Authenteq、Experian Plc、Thales SA、IDEMIA、Jumio Corporation、LexisNexis Risk Solutions Groupは、北米の本人確認市場で事業を展開する大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の本人確認市場情勢

- エコシステム分析

- バリューチェーンのベンダー一覧

第5章 北米の本人確認市場:主要産業力学

- 本人確認市場- 主要産業力学

- 市場促進要因

- 本人確認詐欺事例の増加

- BFSIセクターからの需要の増加

- BYOD(Bring Your Own Device)概念の採用増加

- 市場抑制要因

- データプライバシーとセキュリティへの懸念

- 市場機会

- 中小企業におけるデジタル化ニーズの高まり

- 政府による規制への取り組みと投資の増加

- 今後の動向

- 人工知能とその他の先端技術の統合

- 促進要因と抑制要因の影響

第6章 本人確認市場:北米市場分析

- 北米の本人確認市場の売上高(2022年~2030年)

- 本人確認市場の予測と分析

第7章 北米の本人確認市場分析:コンポーネント別

- ソリューション

- ソリューション市場の収益と2030年までの予測

- サービス

- サービス市場の収益と2030年までの予測

第8章 北米の本人確認市場分析:デプロイメント

- クラウド

- クラウド市場の収益と2030年までの予測

- オンプレミス

- オンプレミス市場の収益と2030年までの予測

第9章 北米の本人確認市場分析:組織規模別

- 大企業

- 大企業市場の収益と2030年までの予測

- 中小企業

- 中小企業市場の収益と2030年までの予測

第10章 北米の本人確認市場分析:タイプ別

- バイオメトリクス認証

- バイオメトリクス認証市場の収益と2030年までの予測

- オンライン認証

- オンライン認証市場の収益と2030年までの予測

- 知識ベース認証

- 知識ベース認証市場の収益と2030年までの予測

- その他

- その他の市場の収益と2030年までの予測

第11章 北米の本人確認市場分析:業界別

- BFSI

- BFSI市場の収益と2030年までの予測

- 政府・防衛

- 政府・防衛市場の収益と2030年までの予測

- ヘルスケア

- ヘルスケア市場の収益と2030年までの予測

- IT・通信

- IT・通信市場の収益と2030年までの予測

- 小売

- 小売市場の収益と2030年までの予測

- その他

- その他の市場の収益と2030年までの予測

第12章 北米の本人確認市場:国別分析

- 北米

第13章 競合情勢

- 主要企業によるヒートマップ分析

第14章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第15章 企業プロファイル

- Trulioo

- Onfido

- Mitek Systems, Inc

- IDology

- Authenteq

- Experian Plc

- Thales SA

- IDEMIA

- Jumio Corporation

- LexisNexis Risk Solutions Group

第16章 付録

List Of Tables

- Table 1. Identity Verification Market Segmentation

- Table 2. Identity Verification Market Revenue and Forecasts To 2030 (US$ Million)

- Table 3. Identity Verification Market Revenue and Forecasts To 2030 (US$ Million) - Component

- Table 4. Identity Verification Market Revenue and Forecasts To 2030 (US$ Million) -Deployment

- Table 5. Identity Verification Market Revenue and Forecasts To 2030 (US$ Million) - Organization Size

- Table 6. Identity Verification Market Revenue and Forecasts To 2030 (US$ Million) - Type

- Table 7. Identity Verification Market Revenue and Forecasts To 2030 (US$ Million) - Industry Vertical

- Table 8. North America: Identity Verification Market Revenue Share, by Key Country (2022 and 2030)

- Table 9. US: Identity Verification Market, by Component - Revenue and Forecast to 2030 (US$ Million)

- Table 10. US: Identity Verification Market, by Deployment - Revenue and Forecast to 2030 (US$ Million)

- Table 11. US: Identity Verification Market, by Organization Size - Revenue and Forecast to 2030 (US$ Million)

- Table 12. US: Identity Verification Market, by Type - Revenue and Forecast to 2030 (US$ Million)

- Table 13. US: Identity Verification Market, by Industry Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 14. Canada: Identity Verification Market, by Component - Revenue and Forecast to 2030 (US$ Million)

- Table 15. Canada: Identity Verification Market, by Deployment - Revenue and Forecast to 2030 (US$ Million)

- Table 16. Canada: Identity Verification Market, by Organization Size - Revenue and Forecast to 2030 (US$ Million)

- Table 17. Canada: Identity Verification Market, by Type - Revenue and Forecast to 2030 (US$ Million)

- Table 18. Canada: Identity Verification Market, by Industry Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 19. Mexico: Identity Verification Market, by Component - Revenue and Forecast to 2030 (US$ Million)

- Table 20. Mexico: Identity Verification Market, by Deployment - Revenue and Forecast to 2030 (US$ Million)

- Table 21. Mexico: Identity Verification Market, by Organization Size - Revenue and Forecast to 2030 (US$ Million)

- Table 22. Mexico: Identity Verification Market, by Type - Revenue and Forecast to 2030 (US$ Million)

- Table 23. Mexico: Identity Verification Market, by Industry Vertical - Revenue and Forecast to 2030 (US$ Million)

- Table 24. Heat Map Analysis By Key Players

- Table 25. List of Abbreviation

List Of Figures

- Figure 1. Identity Verification Market Segmentation, By Country

- Figure 2. Ecosystem: Identity Verification Market

- Figure 3. Impact Analysis of Drivers and Restraints

- Figure 4. North America Identity Verification Market Revenue (US$ Million), 2022 - 2030

- Figure 5. Identity Verification Market Share (%) - Component, 2022 and 2030

- Figure 6. Solution Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 7. Services Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 8. Identity Verification Market Share (%) - Deployment, 2022 and 2030

- Figure 9. Cloud Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. On-Premise Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 11. Identity Verification Market Share (%) - Organization Size, 2022 and 2030

- Figure 12. Large Enterprises Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 13. SMEs Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Identity Verification Market Share (%) - Type, 2022 and 2030

- Figure 15. Biometric Verification Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Online Verification Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 17. Knowledge Based Authentication Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 19. Identity Verification Market Share (%) - Industry Vertical, 2022 and 2030

- Figure 20. BFSI Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 21. Government and Defense Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Healthcare Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. IT and Telecom Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Retail Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. North America: Identity Verification Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 27. North America: Identity Verification Market Revenue Share, by Key Country (2022 and 2030)

- Figure 28. US: Identity Verification Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 29. Canada: Identity Verification Market - Revenue, and Forecast to 2030 (US$ Million)

- Figure 30. Mexico: Identity Verification Market - Revenue, and Forecast to 2030 (US$ Million)

The North America identity verification market was valued at US$ 3,431.55 million in 2022 and is expected to reach US$ 11,119.49 million by 2030; it is estimated to grow at a CAGR of 15.8% from 2022 to 2030.

Increase in Cases of Identity Fraud Boost North America Identity Verification Market

The digitalization has gained traction in the pandemic period across all industry verticals. People has shifted towards the e-commerce over the brick-and-mortar model. Majority of the transactions and exchange of critical information is taking place via digital platforms which has opened gates for the fraudsters to carry out identity fraud. The growing sophistication of security information platforms and IT security-based tools and solutions is anticipated to have a profound impact on the overall management of the security ecosystem of an enterprise. The unprecedented growth in the number of cyberattacks has further led to an increased need for robust security solutions across enterprises. According to Regula, ~95% of enterprises and approximately 90 percent of small businesses experienced identity fraud in 2022. On average, a company experienced ~30 cases in 2022. Such frauds result in business disruption, legal expenditures, and loss of existing and potential clients. Hence, companies are increasingly adopting several security solutions to help businesses confirm the identity of individuals to access sensitive transactions and interactions successfully. The prominent benefits of identity verification include real-time ID verification, extracting data directly from IDs without any friction, effective document authentication and verification, and mitigation of the risk of spoofing. The capabilities of identity verification solutions, such as identity verification, data identification, and fraud detection help the several market players to prevent identity frauds. All these benefits and capabilities offered by identity verification provide long-term benefits to enterprises and helps them to enhance their security. These benefits drive the identity verification market.

North America Identity Verification Market Overview

North America is one of the fastest-growing regions in terms of both technological innovations and the adoption of advanced technologies. The region also has a well-established IT & cloud infrastructure. In the past three years, the region has witnessed significant adoption of emerging technologies such as artificial intelligence and blockchain across all the major industry verticals. With the increasing penetration of digitization in various industries, identity verification has become a vital component of business transaction ecosystems, especially in financial institutions and online retail. The demand for identity verification solutions in companies is increasing rapidly as these solutions allow companies to comply with various rules and regulations. A few of these regulations include anti-money laundering (AML), know your customer (KYC), and digital fraud prevention. The North America identity verification market growth is primarily driven by rising demand from industrial sectors such as BFSI, government, defense, and healthcare, where correct identification of users and customers is a crucial business requirement for successful operations. In 2018, North America contributed the largest market share in terms of overall revenue of the global identity verification market, and it is estimated to continue its dominance during the forecast period.

North America Identity Verification Market Revenue and Forecast to 2030 (US$ Million)

North America Identity Verification Market Segmentation

The North America identity verification market is segmented based on component, deployment, organization size, type, industry vertical, and country. Based on component, the North America identity verification market is bifurcated into solution and services. The solution segment held a larger market share in 2022.

Based on deployment, the North America identity verification market is bifurcated into cloud and on-premise. The cloud segment held a larger market share in 2022.

In terms of organization size, the North America identity verification market is bifurcated into large enterprises and SMEs. The large enterprises segment held a larger market share in 2022.

By type, the North America identity verification market is segmented into biometric verification, online verification, knowledge based authentication, and others. The biometric verification segment held the largest market share in 2022.

Based on industry vertical, the North America identity verification market is segmented into BFSI, government & defense, healthcare, IT & telecom, retail, and others. The BFSI segment held the largest market share in 2022.

Based on country, the North America identity verification market is segmented into the US, Canada, and Mexico. The US dominated the North America identity verification market share in 2022.

Trulioo, Onfido, Mitek Systems, Inc, IDology, Authenteq, Experian Plc, Thales SA, IDEMIA, Jumio Corporation, and LexisNexis Risk Solutions Group are some of the leading companies operating in the North America identity verification market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Identity Verification Market Landscape

- 4.1 Overview

- 4.2 Ecosystem Analysis

- 4.2.1 List of Vendors in Value Chain

5. North America Identity Verification Market - Key Industry Dynamics

- 5.1 Identity Verification Market - Key Industry Dynamics

- 5.2 Market Drivers

- 5.2.1 Increase in Cases of Identity Fraud

- 5.2.2 Rise in Demand from BFSI Sector

- 5.2.3 Increase in Adoption of Bring Your Own Device (BYOD) Concept

- 5.3 Market Restraints

- 5.3.1 Data Privacy and Security Concerns

- 5.4 Market Opportunities

- 5.4.1 Rising Need for Digitization in Small and Medium Enterprises

- 5.4.2 Increasing Regulatory Initiatives and Investments by Governments

- 5.5 Future Trends

- 5.5.1 Integration of Artificial Intelligence and Other Advanced Technologies

- 5.6 Impact of Drivers and Restraints:

6. Identity Verification Market - North America Market Analysis

- 6.1 North America Identity Verification Market Revenue (US$ Million), 2022 - 2030

- 6.2 Identity Verification Market Forecast and Analysis

7. North America Identity Verification Market Analysis - Component

- 7.1 Solution

- 7.1.1 Overview

- 7.1.2 Solution Market, Revenue and Forecast to 2030 (US$ Million)

- 7.2 Services

- 7.2.1 Overview

- 7.2.2 Services Market, Revenue and Forecast to 2030 (US$ Million)

8. North America Identity Verification Market Analysis - Deployment

- 8.1 Cloud

- 8.1.1 Overview

- 8.1.2 Cloud Market, Revenue and Forecast to 2030 (US$ Million)

- 8.2 On-Premise

- 8.2.1 Overview

- 8.2.2 On-Premise Market, Revenue and Forecast to 2030 (US$ Million)

9. North America Identity Verification Market Analysis - Organization Size

- 9.1 Large Enterprises

- 9.1.1 Overview

- 9.1.2 Large Enterprises Market, Revenue and Forecast to 2030 (US$ Million)

- 9.2 SMEs

- 9.2.1 Overview

- 9.2.2 SMEs Market, Revenue and Forecast to 2030 (US$ Million)

10. North America Identity Verification Market Analysis - Type

- 10.1 Biometric Verification

- 10.1.1 Overview

- 10.1.2 Biometric Verification Market, Revenue and Forecast to 2030 (US$ Million)

- 10.2 Online Verification

- 10.2.1 Overview

- 10.2.2 Online Verification Market, Revenue and Forecast to 2030 (US$ Million)

- 10.3 Knowledge Based Authentication

- 10.3.1 Overview

- 10.3.2 Knowledge Based Authentication Market, Revenue and Forecast to 2030 (US$ Million)

- 10.4 Others

- 10.4.1 Overview

- 10.4.2 Others Market Revenue, and Forecast to 2030 (US$ Million)

11. North America Identity Verification Market Analysis - Industry Vertical

- 11.1 BFSI

- 11.1.1 Overview

- 11.1.2 BFSI Market, Revenue and Forecast to 2030 (US$ Million)

- 11.2 Government and Defense

- 11.2.1 Overview

- 11.2.2 Government and Defense Market, Revenue and Forecast to 2030 (US$ Million)

- 11.3 Healthcare

- 11.3.1 Overview

- 11.3.2 Healthcare Market, Revenue and Forecast to 2030 (US$ Million)

- 11.4 IT and Telecom

- 11.4.1 Overview

- 11.4.2 IT and Telecom Market, Revenue and Forecast to 2030 (US$ Million)

- 11.5 Retail

- 11.5.1 Overview

- 11.5.2 Retail Market, Revenue and Forecast to 2030 (US$ Million)

- 11.6 Others

- 11.6.1 Overview

- 11.6.2 Others Market Revenue, and Forecast to 2030 (US$ Million)

12. North America Identity Verification Market - by Country Analysis

- 12.1 North America: Identity Verification Market

- 12.1.1 North America: Identity Verification Market, by Key Country

- 12.1.1.1 US: Identity Verification Market - Revenue, and Forecast to 2030 (US$ Million)

- 12.1.1.1.1 US DNS Security Software Market Breakdown by Component

- 12.1.1.1.2 US: Identity Verification Market, by Deployment

- 12.1.1.1.3 US: Identity Verification Market, by Organization Size

- 12.1.1.1.4 US: Identity Verification Market, by Type

- 12.1.1.1.5 US: Identity Verification Market, by Industry Vertical

- 12.1.1.2 Canada: Identity Verification Market - Revenue, and Forecast to 2030 (US$ Million)

- 12.1.1.2.1 Canada DNS Security Software Market Breakdown by Component

- 12.1.1.2.2 Canada: Identity Verification Market, by Deployment

- 12.1.1.2.3 Canada: Identity Verification Market, by Organization Size

- 12.1.1.2.4 Canada: Identity Verification Market, by Type

- 12.1.1.2.5 Canada: Identity Verification Market, by Industry Vertical

- 12.1.1.3 Mexico: Identity Verification Market - Revenue, and Forecast to 2030 (US$ Million)

- 12.1.1.3.1 Mexico DNS Security Software Market Breakdown by Component

- 12.1.1.3.2 Mexico: Identity Verification Market, by Deployment

- 12.1.1.3.3 Mexico: Identity Verification Market, by Organization Size

- 12.1.1.3.4 Mexico: Identity Verification Market, by Type

- 12.1.1.3.5 Mexico: Identity Verification Market, by Industry Vertical

- 12.1.1.1 US: Identity Verification Market - Revenue, and Forecast to 2030 (US$ Million)

- 12.1.1 North America: Identity Verification Market, by Key Country

13. Competitive Landscape

- 13.1 Heat Map Analysis by Key Players

14. Industry Landscape

- 14.1 Overview

- 14.2 Market Initiative

- 14.3 New Product Development

- 14.4 Merger and Acquisition

15. Company Profiles

- 15.1 Trulioo

- 15.1.1 Key Facts

- 15.1.2 Business Description

- 15.1.3 Products and Services

- 15.1.4 Financial Overview

- 15.1.5 SWOT Analysis

- 15.1.6 Key Developments

- 15.2 Onfido

- 15.2.1 Key Facts

- 15.2.2 Business Description

- 15.2.3 Products and Services

- 15.2.4 Financial Overview

- 15.2.5 SWOT Analysis

- 15.2.6 Key Developments

- 15.3 Mitek Systems, Inc

- 15.3.1 Key Facts

- 15.3.2 Business Description

- 15.3.3 Products and Services

- 15.3.4 Financial Overview

- 15.3.5 SWOT Analysis

- 15.3.6 Key Developments

- 15.4 IDology

- 15.4.1 Key Facts

- 15.4.2 Business Description

- 15.4.3 Products and Services

- 15.4.4 Financial Overview

- 15.4.5 SWOT Analysis

- 15.4.6 Key Developments

- 15.5 Authenteq

- 15.5.1 Key Facts

- 15.5.2 Business Description

- 15.5.3 Products and Services

- 15.5.4 Financial Overview

- 15.5.5 SWOT Analysis

- 15.5.6 Key Developments

- 15.6 Experian Plc

- 15.6.1 Key Facts

- 15.6.2 Business Description

- 15.6.3 Products and Services

- 15.6.4 Financial Overview

- 15.6.5 SWOT Analysis

- 15.6.6 Key Developments

- 15.7 Thales SA

- 15.7.1 Key Facts

- 15.7.2 Business Description

- 15.7.3 Products and Services

- 15.7.4 Financial Overview

- 15.7.5 SWOT Analysis

- 15.7.6 Key Developments

- 15.8 IDEMIA

- 15.8.1 Key Facts

- 15.8.2 Business Description

- 15.8.3 Products and Services

- 15.8.4 Financial Overview

- 15.8.5 SWOT Analysis

- 15.8.6 Key Developments

- 15.9 Jumio Corporation

- 15.9.1 Key Facts

- 15.9.2 Business Description

- 15.9.3 Products and Services

- 15.9.4 Financial Overview

- 15.9.5 SWOT Analysis

- 15.9.6 Key Developments

- 15.10 LexisNexis Risk Solutions Group

- 15.10.1 Key Facts

- 15.10.2 Business Description

- 15.10.3 Products and Services

- 15.10.4 Financial Overview

- 15.10.5 SWOT Analysis

- 15.10.6 Key Developments

16. Appendix

- 16.1 About The Insight Partners

- 16.2 Word Index